Photo of Spirit Halloween, which has a tariff aisle including a sign that says “Tariff-ied,” t-shirts that say “once I was afraid now I’m tariffied,” and costumes of Trump’s tariff chart

Spirit Halloween now has a section devoted to Trump’s economic policies

24.10.2025 19:57 — 👍 463 🔁 88 💬 12 📌 6

Does France need a wealth tax? on.ft.com/4onIDYn

18.10.2025 09:00 — 👍 49 🔁 6 💬 6 📌 3

How a Legislative Fix Could Bolster IDA’s Financing Firepower (at No Cost to the Taxpayer)

The International Development Association (IDA), the World Bank’s concessional lending arm for the world’s poorest countries, is facing an uphill climb to maintain its $100 billion replenishment, fina...

The World Bank's IDA is facing an uphill climb ⛰️ to maintain its $100bn replenishment, as the tight global interest rate environment drives up borrowing costs.

Nico Martinez & @clemencelanders.bsky.social explain how recent legislation could offer relief:

https://bit.ly/4698A6z

09.09.2025 18:45 — 👍 0 🔁 1 💬 0 📌 0

Emerging market borrowing premium over US falls to nearly lowest since 2007

Yields for investment-grade EM borrowers fall relative to developed markets amid concerns over traditional havens

Investors have become less worried about the potential fallout for emerging markets from Trump’s erratic trade war, and are instead focusing on EMs’ improving economic health. It also reflects wariness among some investors over US government bonds...

www.ft.com/content/c939...

23.07.2025 22:11 — 👍 0 🔁 0 💬 0 📌 0

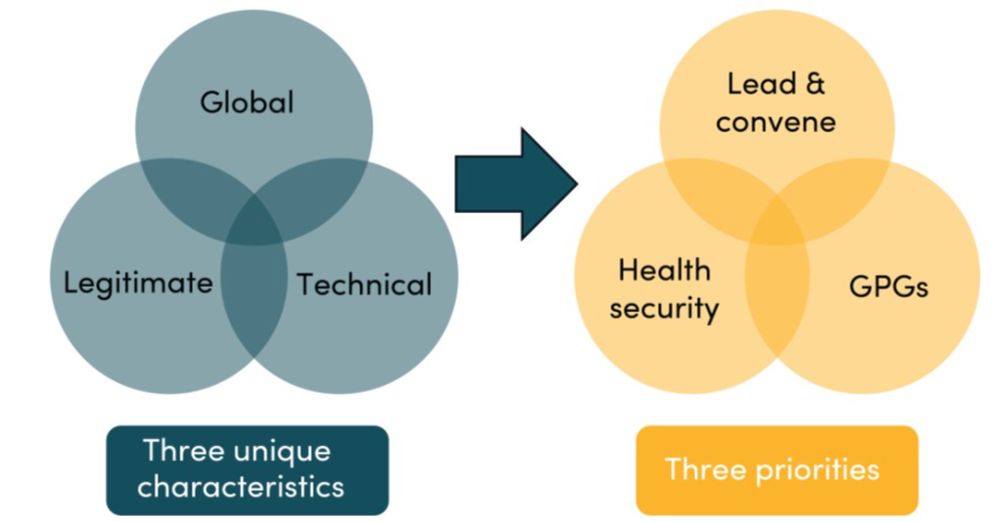

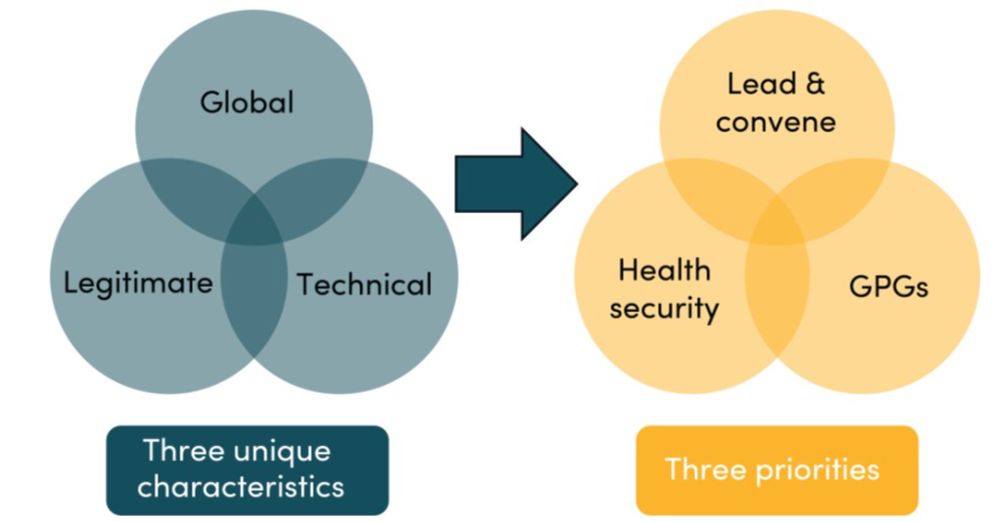

A Lean World Health Organization for the Global Good

In this brief—the first in the Tough Times, Tough Choices series that will target the major global health and development institutions and their funders—we propose a different approach: radically stre...

1st edition of our @cgdev.org series "Tough Times, Tough Choices" is hot off the press

Facing budget cuts, we argue WHO's leadership must chart a path of retrenchment to a lean @who.int for the global good

w/ @peterbaker17.bsky.social & @rachelbonnifield.bsky.social

www.cgdev.org/publication/...

10.07.2025 08:01 — 👍 2 🔁 4 💬 0 📌 0

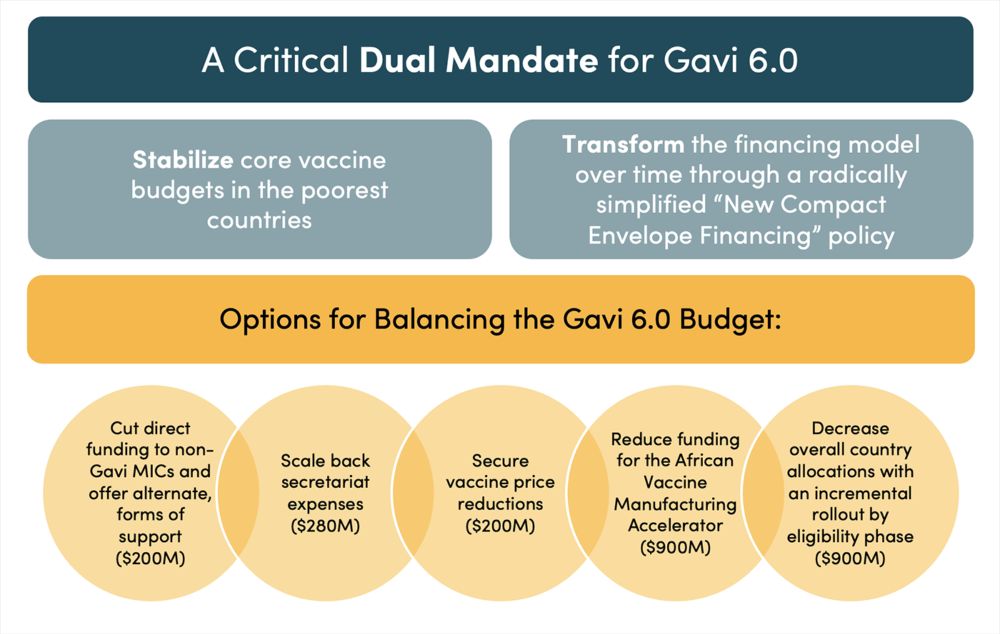

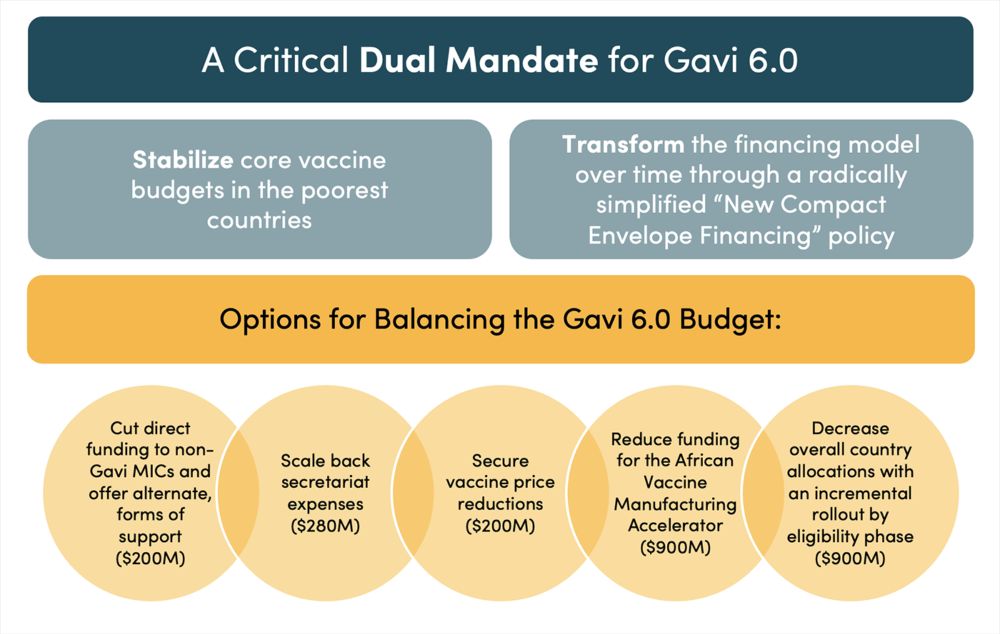

How Gavi 6.0 Can Take a Bigger Leap

Gavi’s board and leadership must stretch scarce resources to fulfill a challenging double mandate: (1) stabilizing immunization outcomes and fiscal solvency in Gavi-eligible countries facing severe he...

Amid a broader global health financing crisis, @gavi.org faces a $2.5B budget shortfall

Read our new @cgdev.org brief on how Gavi 6.0 can take a bigger leap w @rachelbonnifield.bsky.social @peterbaker17.bsky.social @tomldrake.bsky.social & @orinlevine.bsky.social

www.cgdev.org/publication/...

18.07.2025 14:39 — 👍 3 🔁 3 💬 1 📌 1

#FfD4 kicks off next week against the backdrop of aid cuts & a traffic jam of replenishments among health & other concessional funds

But it's clear these funds need a major overhaul. Our new

@cgdev.org blog highlights 3 action items:

www.cgdev.org/blog/concess...

cc: @clemencelanders.bsky.social

27.06.2025 15:11 — 👍 1 🔁 1 💬 0 📌 0

Steel yourself and then read. WaPo went to Khartoum to meet the moms who, thanks to Trump and Musk’s brutal actions, are now watching their little children starve to death or die of cholera

30.06.2025 13:34 — 👍 295 🔁 111 💬 16 📌 3

Trump Targets Key Lifeline for Africa: Money Sent Home by Immigrants

Excited to see our @cgdev.org research featured in this excellent @nytimes.com article about the devastating effect of the US' remittance tax on Africa, especially coming after extensive aid cuts.

www.nytimes.com/2025/06/03/w...

05.06.2025 06:50 — 👍 8 🔁 9 💬 0 📌 0

Can IDA Weather the Development Finance Storm?

The 21st replenishment of the International Development Association (IDA), the concessional lending arm of the World Bank, concluded last December, with donors pledging $23.7 billion for a…

Despite an uncertain development landscape, IDA is on track for a record replenishment—but challenges remain.

Nico Martinez & @clemencelanders.bsky.social detail the headwinds facing IDA, from low growth to rising debt levels:

28.05.2025 16:03 — 👍 1 🔁 1 💬 0 📌 0

We’re only smiling because it’s not a real goodbye to @justsand.bsky.social

28.05.2025 00:06 — 👍 6 🔁 1 💬 0 📌 0

This clearly lays out the problem of declaring the 'biggest ever IDA' by borrowing a lot (rather than getting actual new donor resources) when it is expensive to borrow.

20.05.2025 17:44 — 👍 0 🔁 1 💬 0 📌 0

Can IDA Weather the Development Finance Storm?

The 21st replenishment of the International Development Association (IDA), the concessional lending arm of the World Bank, concluded last December, with donors pledging $23.7 billion for a replenishme...

Can IDA sustain its $100B replenishment during this development finance storm? ⛈️

Nico Martinez and @clemencelanders.bsky.social find IDA is on track for a record replenishment—but a tight funding environment, low growth, and rising debt threaten its firepower:

www.cgdev.org/blog/can-ida...

20.05.2025 17:35 — 👍 1 🔁 1 💬 0 📌 1

One of the greatest moments in music history.

05.05.2025 23:10 — 👍 1 🔁 0 💬 0 📌 0

Nearly half of the BofA Global Fund Manager Survey participants now anticipate a global recession within the next 12 months, …For more insights visit today’s Chartbook Top Link!

26.04.2025 17:07 — 👍 50 🔁 13 💬 1 📌 1

The IMF is a fantastic deal for America

If the U.S. steps back from the IMF, there will only be one winner: China.

Huge thanks to THE HILL for running this piece on why the IMF is a fantastic deal for America.

A great joy to be reunited with former colleagues Meg Lundsager and Elizabeth Shortino in support of the Fund.

thehill.com/opinion/fina...

19.04.2025 14:38 — 👍 3 🔁 2 💬 0 📌 2

.@clemencelanders.bsky.social, vice president and senior policy fellow at the @cgdev.org, previews the upcoming IMF and World Bank Spring Meetings.

#IMF #WorldBank #SpringMeetings

18.04.2025 10:47 — 👍 0 🔁 2 💬 1 📌 0

CGD is the place to be for the 2025 Spring Meetings! Please check out our exciting list of events and come say hi.

17.04.2025 18:46 — 👍 4 🔁 6 💬 1 📌 0

The 2025 IMF & World Bank #SpringMeetings are right around the corner!🌸🌍

@cgdev.org is hosting key conversations with leading global development experts and policymakers—explore our schedule of events and sign up below ⬇️

bit.ly/43HcvIn

14.04.2025 17:22 — 👍 2 🔁 5 💬 0 📌 1

In DC for the spring meetings of IMF & World Bank? We have a packed week of events @cgdev.org from the future of foreign assistance to industrial policy to conversations with President of ADB and Finance Min of Pakistan. Come join us. Online options too.

09.04.2025 18:03 — 👍 4 🔁 3 💬 0 📌 0

• The US enjoys a safe harbor investment premium—a value that investors place on

US safety, soundness and stability.

• Even a relatively modest move in risk premia would have profound implications

for the US. If the US country risk premium moved to that of the current UK level,

after 10 years, real equity wealth per household would be $50,000 lower and real

GDP 1% smaller.

• The erosion of safe harbor advantages could include more uncertainty and

discontinuous risk, higher bond yields, and, ultimately, lower growth.

• Country risk analysis is a relative concept. Since the US is conventionally the

benchmark for measuring global risk, by construct, US risk is often assumed to be

0 percent.

• Along several different dimensions, however, US political risk has risen over the

last eight years: we estimate a “shadow” risk premium for the US that implies that

US political and institutional risk is more consistent with a country risk premium

of 25-35 basis points rather than zero. For context, this is roughly half of the UK’s

premium in the immediate aftermath of Brexit.

• US shadow political risk was broadly falling over 2006- 2016 and has risen since by

around 20-25 basis points. Most of this rise occurred from 2016-20.

• There is suggestive evidence that markets are underpricing current US political

risk. A gradual pricing in of 25 basis points of shadow risk implies a modestly

higher unemployment rate (+0.1 percentage points, or about 200,000 more

unemployed workers) and smaller economy (-.25%) after 10 years.

• Furthermore, worsening political risk and a precipitating market event could have

much more profound implications. For example, a rapid repricing of another 100

basis points of risk—on par with what S&P felt the 2011 debt ceiling crisis equated

to—as well as a pullback in foreign direct investment to the US would raise the

unemployment rate by around 0.5 percentage points even after a decade and

shrink the economy by more than 1%.

"Political Risks to the U.S. Safe Harbor Premium" @ernietedeschi.bsky.social budgetlab.yale.edu/news/240502/...

09.04.2025 17:13 — 👍 18 🔁 8 💬 4 📌 3

In DC for spring meetings? Join me & @clemencelanders.bsky.social on Wed Apr 23 for a @cgdev.org event on how multilateral funds can evolve in the face of shrinking resources and growing needs

RSVP ➡️ www.cgdev.org/event/how-do...

09.04.2025 17:09 — 👍 1 🔁 3 💬 0 📌 0

Excellent observation by @robin-j-brooks.bsky.social. If global markets truly crack, there’ll be less international cooperation — if any.

“The rest of the world wants this sell-off to get worse ..”

06.04.2025 16:26 — 👍 1183 🔁 286 💬 56 📌 31

the art of the deal

31.03.2025 14:51 — 👍 9 🔁 1 💬 0 📌 0

Is the Trump Administration Serious about Merging DFC and MCC?

According to a recently leaked document, the Trump administration is considering reorganizing the US foreign assistance architecture, with an eye to merging MCC, DFC, and USTDA.

The proposal to merge the MCC, DFC, and USTDA (DFC+) has potential—but there's policy objectives that must underpin a merged entity.📌

Mary Svenstrup & @clemencelanders.bsky.social explain what's needed for DFC+ to be a credible and effective development agency:

www.cgdev.org/blog/trump-a...

27.03.2025 21:07 — 👍 1 🔁 1 💬 0 📌 0

CathyDavidson.com. Advocate for active learning, student success. Author “The New Education” etc. Cofounder HASTAC.org ("world's first academic social network"--NSF). Science fiction fan. Lover of oceans. Opinions and typos my own. #SeaScrolling #Breathe

I’ve boldly gone into the clear blue yonder. Follow for more recipes and tips.

DC. political philosopher at Georgetown. rhythm guitarist + vox for @femiandfoundation.bsky.social. Spurs fan #COYS

Visiting Fellow at Center for Global Development. Former foreign policy lead at USAID, former CSIS senior fellow, and aid advocate. Views are my own. Washington, DC girl dad; New Englander at heart.

D.C.-area and worldwide weather news from The Washington Post.

https://cwg.live

Emerging Markets correspondent at the Financial Times.

We're the world’s leading independent news organization covering global development.

Scruffy-looking nerf herder 🦁

she/her

Author of THE DEATH AND LIFE OF AUGUST SWEENEY. NYT-bestselling ghostwriter and screenwriter. Guy at Barrelhouse, professor of Creative Writing at GWU. Swamp Dad. https://bookshop.org/p/books/the-death-and-life-of-august-sweeney-samuel-ashworth/216

EM debt, China, and Climate Finance | CGD, Ex-USAID

Mondays at 9pmET on MSNBC

MaddowBlog.com

Andrew Young: The Dirty Work: MSNBC.com/Andrew-Young-The-Dirty-Work

From Russia with Lev: MSNBC.com/Lev

Ultra podcast: MSNBC.com/Ultra

Prequel: MSNBC.com/Prequel

Research director Ipsos | Lecturer Sciences Po | Author "Les États-Unis au bord de la guerre civile ?" | 🗳️📊🏳️🌈🚲🌼

Economist, political scientist & writer @UChicago @HarrisPolicy. See my book Why We Fight: http://penguinrandomhouse.com/books/636263

Global health, health financing, priority setting. @CGDev Deputy Director & Policy Fellow.

iDSI Deputy Director. NICE Committee Member. Ex DFID. Views are mine.

U.S. Senator fighting for the families and future of Massachusetts. Malden Native, Red Sox Fan, Net Neutrality Defender, co-author of the Green New Deal ( he/him )

United States Senator for Hawaii. Climate hawk. Chief Deputy Whip.