AEA Statement on Dismissal of BLS Comm.

"The independence of the federal statistical agencies is essential to the proper functioning of a modern economy. Accurate, timely, and impartial statistics are the foundation upon which households, businesses, and policymakers make critical decisions."

02.08.2025 13:50 —

👍 198

🔁 107

💬 3

📌 15

Can private insurance fill gaps from public disability insurance (DI) cuts? Studying a German reform, Seibold, @sseitzecon.bsky.social & @sigginho.bsky.social find modest private DI take-up, no adverse selection & efficiency gains, but an equity case for public DI. buff.ly/A0x8RSu

21.07.2025 13:04 —

👍 4

🔁 1

💬 0

📌 1

🚨 New #Publication: We tracked how policy and parenthood reshaped gender inequality in Germany from the 1960s to today. In early decades, only 14% of the gender gap was due to kids—now it's 64%.

How did children become the biggest factor? Thread🧵

🧑🤝🧑 with Hansen, @dominiksachs.bsky.social & Lüthen

10.04.2025 14:21 —

👍 47

🔁 15

💬 3

📌 2

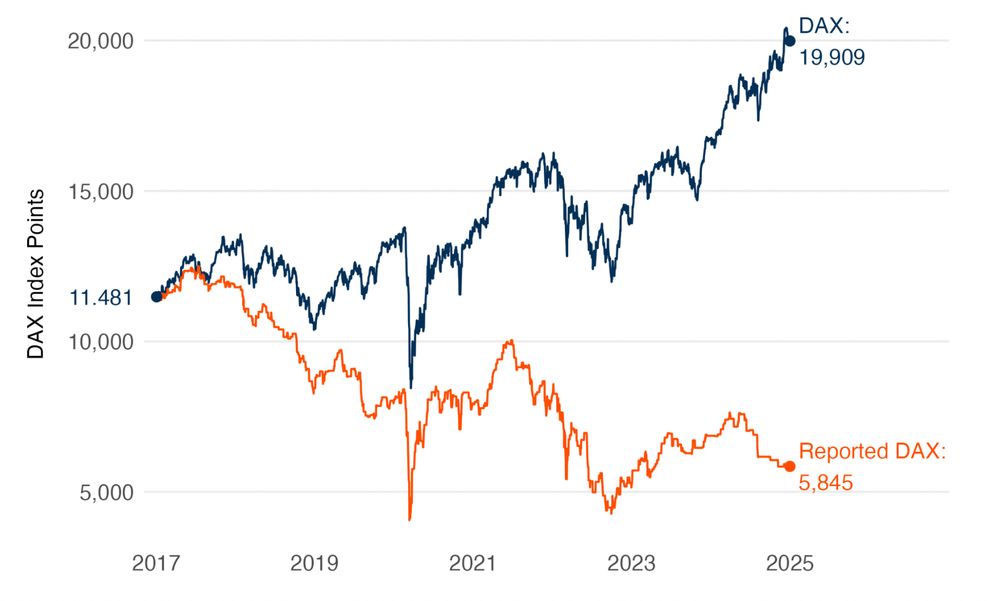

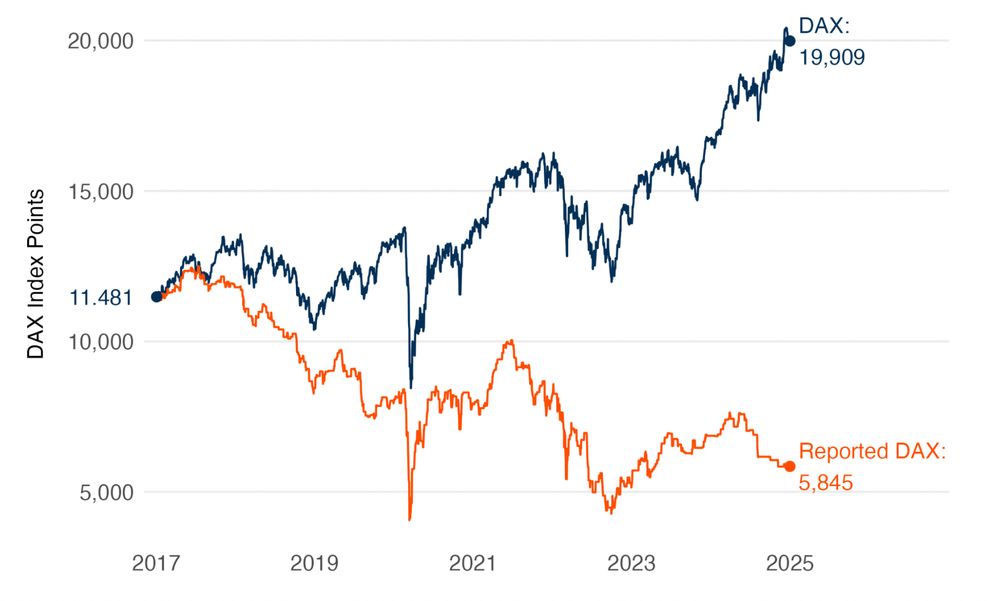

Do the media focus on the negative? If so, why? We study this in the context of stock market reporting and identify and quantify an overlooked bias. A thread:

10.04.2025 12:20 —

👍 22

🔁 6

💬 2

📌 0

(c) Nadine Jakobs

Guten Morgen aus #Frankfurt!

Wir begrüßen Sie auf unserem offiziellen Bluesky-Kanal!👋

Ab heute halten wir Sie hier über alles Wissenswerte rund um die #Geldpolitik, #Bankenaufsicht und #Finanzstabilität sowie über viele weitere Aufgaben der #Bundesbank auf dem Laufenden.

#HerzlichWillkommen

09.04.2025 08:14 —

👍 65

🔁 4

💬 3

📌 0

1/19: Seems timely to share a paper which explores how people perceive & understand trade and trade policies. Which factors shape the support for different trade policies? Thread below with the key takeaways #EconTwitter 🧵, and full paper here: socialeconomicslab.org/understandin...

04.04.2025 15:18 —

👍 103

🔁 36

💬 2

📌 2

⚠️Join us at the Spring Conference on Expectations of Households and Firms hosted by the @bundesbank.de on 24–25 April 2025 at our Conference Centre in Eltville/Rhein.

Only few more seats available

👉Click here for details on programme and registration:

www.bundesbank.de/de/bundesban...

#econsky

24.03.2025 13:56 —

👍 4

🔁 3

💬 0

📌 0

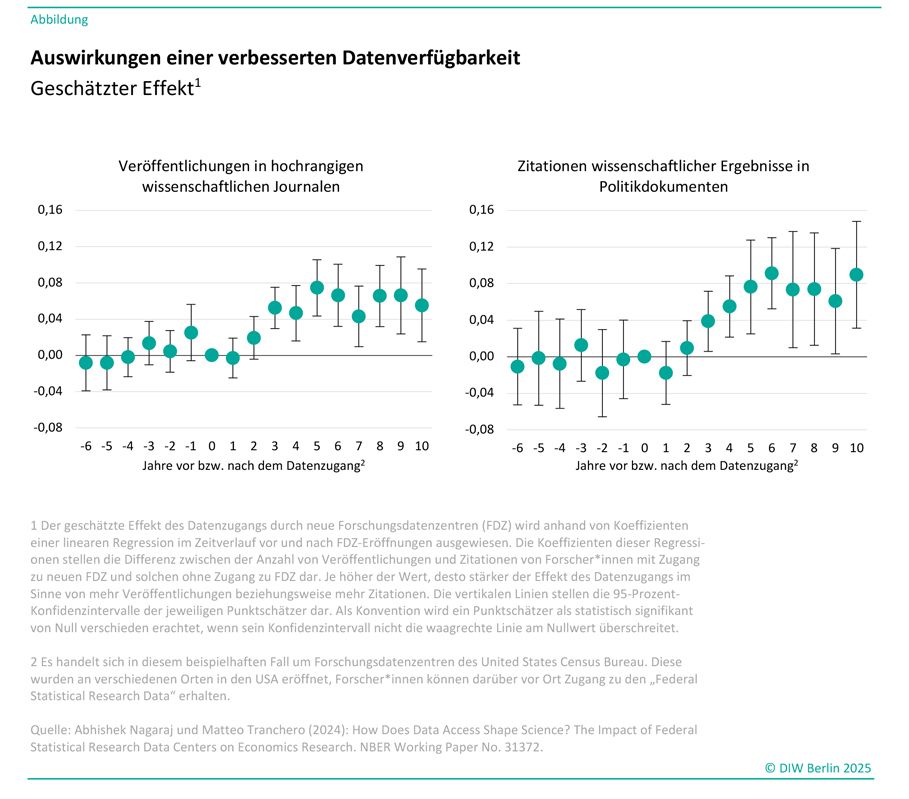

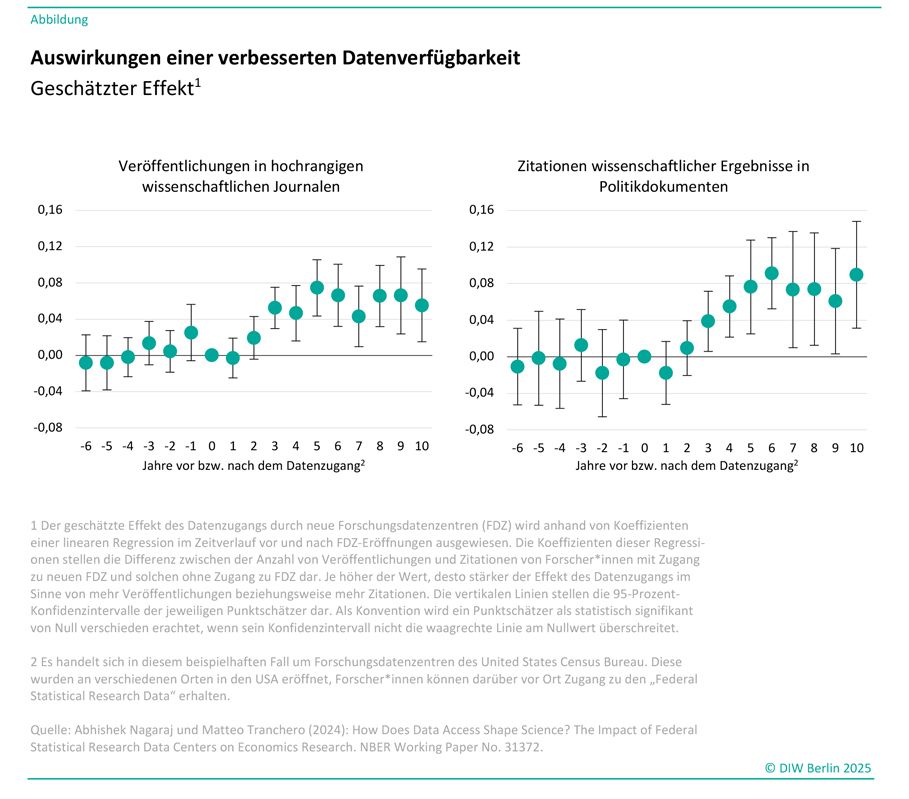

Deutschland braucht ein modernes #Forschungsdatengesetz. Eine bessere Verfügbarkeit von Daten führt zu hochwertigeren Publikationen, die öfter bei politischen Entscheidungen genutzt werden. Die Vorarbeit für ein solches Gesetz hat die #Ampel bereits geleistet. Mehr dazu:

www.diw.de/de/diw_01.c....

21.03.2025 13:11 —

👍 20

🔁 7

💬 1

📌 1

Just published in @jpube.bsky.social:

"The Big Sell: Privatizing East Germany's Economy"

By @lukasmergele.bsky.social, Moritz Hennecke, & @mlubczyk.bsky.social

12.02.2025 14:06 —

👍 82

🔁 25

💬 4

📌 3

American Economic Journal: Economic Policy

Vol. 17 No. 1 February 2025

The February 2025 issue of AEJ: Economic Policy (17, 1) is now available online at aeaweb.org/issues/792.

31.01.2025 13:28 —

👍 9

🔁 3

💬 0

📌 2

New paper: "Unintended Effects of Transparency: The Consequences of Income Disclosure by Politicians," (www.econtribute.de/RePEc/ajk/aj... ) co-authored with @nilswehrhoefer.bsky.social. THREAD 1/n

30.01.2025 09:22 —

👍 6

🔁 2

💬 1

📌 0

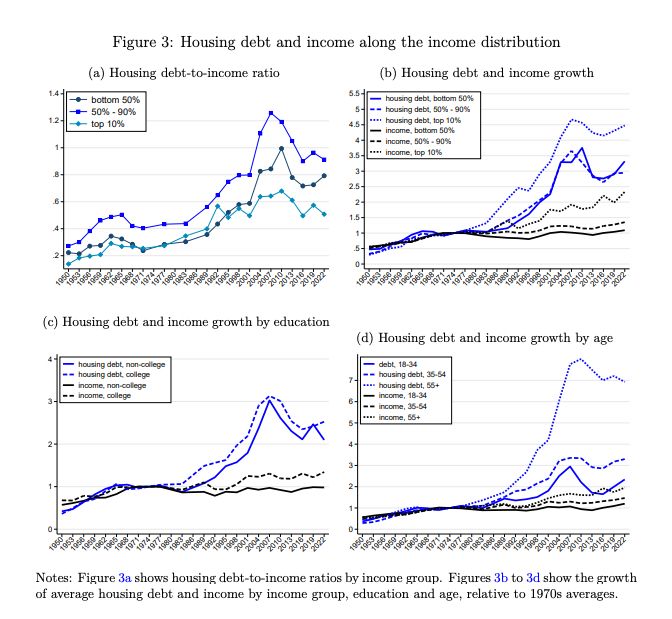

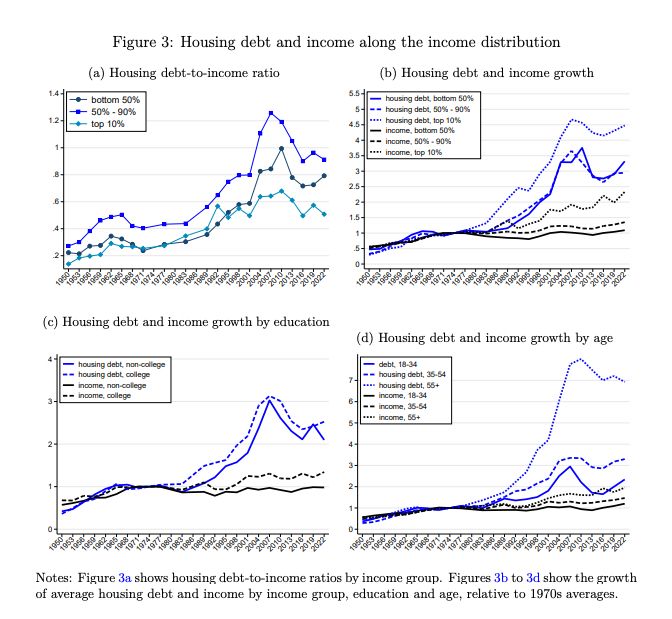

Found a neat new paper by Bartscher, Kuhn, Schularik and Steins!

www.crctr224.de/research/dis...

27.01.2025 16:57 —

👍 24

🔁 3

💬 0

📌 0

A new survey of US households (w/ Michael Weber and Oli Coibion): tinyurl.com/527pnad4

"The Upcoming Trump Tariffs: What Americans Expect and How They Are Responding"

Point 1: Americans expect that the incoming Trump administration will apply heavy tariffs (esp for 🇨🇳).

#Trump #tariff #EconSky

19.01.2025 00:09 —

👍 50

🔁 12

💬 2

📌 2

!!! Submission Deadline: January 19th !!!

For our Spring Conference @bundesbank.de on Expectations of Households and Firms.

April 24th and 25th, 2025 in Eltville am Rhein/Germany.

#econsky

17.01.2025 23:30 —

👍 8

🔁 6

💬 1

📌 0

Research Assistant in the areas of banking and finance / monetary policy implementation and transmission

in Part-time (19,5 hours)

You are pursuing a PhD in economics or finance?

You are particularly interested in banking and finance?

You have strong empirical skills?

You should apply for an RA position in the Research Centre @bundesbank.de !

Deadline: January 12th !!! 👇 #econsky

www.bundesbank.de/en/career/jo...

09.01.2025 12:48 —

👍 12

🔁 7

💬 0

📌 1

JPE Macro logo

Does new housing supply lead to a decrease in rents, even in high-demand markets? Read this Just Accepted article from the Journal of Political Economy Macroeconomics to find out: ow.ly/1eN950UqS1B

08.01.2025 01:28 —

👍 49

🔁 21

💬 0

📌 6

JPE logo

A new paper from the Journal of Political Economy investigates how PhD program ranking, department status, and other author connections impact peer review decisions. Read the full findings here: ow.ly/sfLx50UiGII #EconSky

12.12.2024 14:18 —

👍 43

🔁 9

💬 1

📌 8

New here and happy to share my job market paper!

"Bad Bank, Bad Luck? Evidence from 1 Million Firm-Bank Relationships"

We build a large novel dataset on US firm-bank relationships to ask the question “How do bank failures affect small business survival and employment?”

A🧵summarizing our findings:

06.12.2024 11:09 —

👍 42

🔁 18

💬 3

📌 4

Gender norms are extremely persistent and constrain women's life opportunities, especially so in poor countries. In my Job Market Paper, I show that grassroots media are an effective policy instrument to address gender norms at scale. #EconJMP #EconSky

03.12.2024 13:41 —

👍 71

🔁 16

💬 1

📌 8

Zero-sum thinking is a key mindset that shapes how we view the world. A little thread to highlight our work on its roots with @sahilchinoy.bsky.social,

@nathannunn.bsky.social, Sandra Sequeira.🧵1/23 scholar.harvard.edu/files/stantc...

03.12.2024 15:22 —

👍 108

🔁 32

💬 7

📌 5

🚨 NEW PAPER: When low-income Americans get $1,000/month for 3 years, what happens to their political views & behavior?

The OpenResearch Unconditional income Study reveals surprising findings about the effects of income on politics... 🧵

02.12.2024 19:00 —

👍 206

🔁 70

💬 11

📌 11

Economists love using linear regression to estimate treatment effects — it turns out that there are perils to this method, but also amazing perks

Come with me in this 🧵 if you want to learn about our now-published paper "Contamination Bias in Linear Regressions!"

1/ (Twitter rerun!)

30.11.2024 12:29 —

👍 408

🔁 127

💬 18

📌 15

New paper: benjaminmoll.com/challenge/

29.11.2024 17:59 —

👍 161

🔁 42

💬 3

📌 12

CEPR Public Economics Annual Symposium 2025

PDF document / 207.07 KB

Submit your papers to the next @cepr.org Public Economics Annual Symposium, taking place in Cologne on June 5-6, 2025. Co-organized with @sigginho.bsky.social and Johannes Spinnewijn, keynotes by Cecile Gaubert and @omzidar.bsky.social!

cepr.org/events/cepr-...

29.11.2024 19:37 —

👍 75

🔁 29

💬 6

📌 1

Sarah Gharbi is on the Job Market. Her research is at the intersection of public and labor economics, focusing on policy evaluation w/ large admin data and modern microeconometric methods. Sarah is great! Check out her website and papers and interview her! sarahgharbi.github.io

25.11.2024 08:28 —

👍 5

🔁 3

💬 0

📌 0

I'm delighted to share that our paper 'Who bears the burden of real estate transfer taxes? Evidence from the German housing market' (with @clemensfuest.bsky.social, @ckrolage.bsky.social and Florian Neumeier) has been published in the Journal of Urban Economics. (1/3)

25.11.2024 09:15 —

👍 15

🔁 4

💬 2

📌 0

1/ 🚨 Time to “tweet” about a paper I’ve been working on for a while w/ Alex Savu (University of Cambridge)

How does austerity shape political preferences? We analyze Italy’s 2013 local fiscal rule reform to uncover its effect on support for radical-right parties.

Here’s what we found. 🧵

23.11.2024 14:10 —

👍 15

🔁 6

💬 1

📌 2

To collect income taxes, almost all countries require employers to withhold monthly tax prepayments which are then fully credited against the final income tax liabilities of their employees. Despite being a fundamental component of income taxation systems worldwide, the impact of these withholding taxes on labor supply is poorly understood. We investigate their importance in the context of married couples in Germany where the withholding tax liability can be redistributed between spouses. We exploit a reform that reduced the withholding tax for some married women more than for others, while inducing no differences in income taxes. Using administrative data for the full population of German taxpayers, we estimate an elasticity of labor income with respect to the withholding tax eight years after the reform of 0.14. Additional evidence from a self-conducted survey suggests imperfect understanding of the tax system and limited pooling of resources within the household as the main mechanisms. As the majority of couples shift parts of the withholding tax liability from the husband to the wife, our results suggest that the increased withholding tax liability of married women contributes to their low labor supply. This highlights the need for governments to be aware of the distortion of labor supply incentives when the design of withholding taxes does not match actual income tax incentives.

Hello #EconSky!

📢Excited to share my #JMP 📢

It provides a missing piece to understand how people react to income taxation.

Tldr: By changing tax pre-payments governments can - with almost no costs - increase perceived work incentives of secondary earners and reduce the gender gap.

Thread below👇🧵

23.11.2024 15:54 —

👍 69

🔁 27

💬 2

📌 3