We can get a bounce based on technicals but I do think Trump sees chaos as a ladder, and that he wants chaos to consolidate power and have more bargaining power

10.03.2025 16:56 — 👍 0 🔁 0 💬 0 📌 0

APOLLO: “There are more data centers in the US than in all other major countries combined.” 🇺🇸

05.12.2024 17:51 — 👍 138 🔁 27 💬 10 📌 3

Since Nov 28, 1900, gold has underperformed the S&P 500 by 21,365% (1st chart).

Between Jan 21, 1980 and June 30, 2008, gold underperformed the S&P 500 by 1,033% (2nd chart).

I am cherry picking dates, but this is so you are aware that gold isn't the safe haven you think it is. Cash flows win.

27.11.2024 13:47 — 👍 1 🔁 0 💬 0 📌 0

buy

26.11.2024 15:03 — 👍 0 🔁 0 💬 0 📌 0

Do you think Bessent the better pick?

22.11.2024 15:16 — 👍 0 🔁 0 💬 1 📌 0

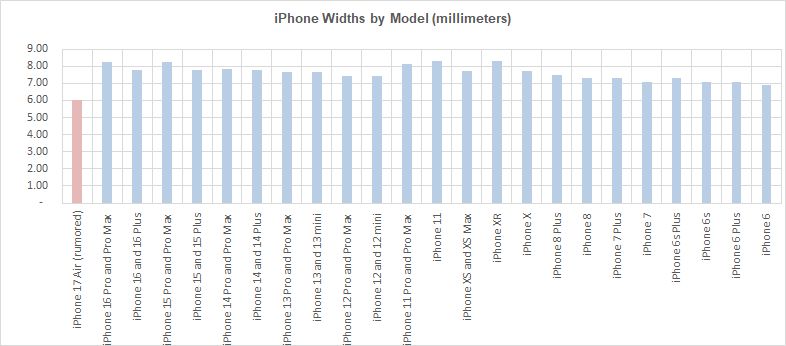

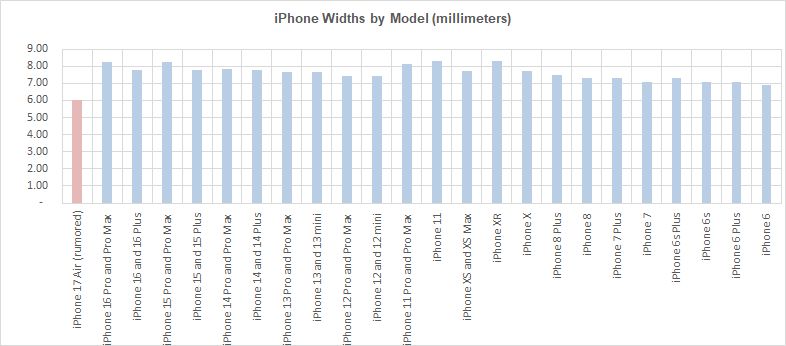

We will finally get a thinner iPhone next year

The rumored iPhone 17 "Air" will be 6.00mm thin. Not quite as thin as the new iPad Pro (5.1mm) or the last iPod Nano (5.4mm) but a welcome change after seeing the width increase to 8.0mm in the latest models

$AAPL

21.11.2024 22:30 — 👍 1 🔁 0 💬 0 📌 0

Thoughts on bad $GOOGL news being a positive for $META?

21.11.2024 16:05 — 👍 0 🔁 0 💬 0 📌 0

The fact that this doesn't seem farfetched really speaks to the times we are living in. This would have been insane to say 5 years ago

15.11.2024 23:25 — 👍 1 🔁 0 💬 0 📌 0

Agree

13.11.2024 14:16 — 👍 1 🔁 0 💬 0 📌 0

Genuine replies and less spam imo. Look at the replies to this post vs what you would get on Twitter

Agree with other comments that search feature has to improve

12.11.2024 21:50 — 👍 2 🔁 0 💬 0 📌 0

14/

I just don't see the short thesis on GOOS at these levels.

Curious to hear any other takes and I hope you learned something!

NTM EBITDA 9.2x

CY23 EBITDA 9.9x

C24 EBITDA 8.2x

Will do a thread on brand surveys/buzz later (which are healthy)

02.08.2023 02:46 — 👍 0 🔁 0 💬 0 📌 0

13/

To summarize:

1) GOOS is gaining market share globally

2) GOOS sales are growing

3) GOOS is skewed to China

4) GOOS expectations have been revised downward many times

5) GOOS CQ2 credit card data looks ok

6) GOOS already down 75% from recent high

7) SI is at 1-yr highs

02.08.2023 02:45 — 👍 0 🔁 0 💬 1 📌 0

12/

Lastly, short interest has always been high for GOOS because people pair trade it with MONC. Seeing as how the SI is high for the US float but not the Canadian float, this is likely true. However, the squeeze risk is very high now per S3 data (SQ + CS >85 is no bueno)

02.08.2023 02:45 — 👍 0 🔁 0 💬 1 📌 0

11/

Operating Profit expectations have been revised lower many times already. Maybe they get revised lower yet again (this is $GOOS afterall lol), but it does feel like we are reaching trough expectations. We also have winter season just around the corner.

02.08.2023 02:44 — 👍 0 🔁 0 💬 1 📌 0

10/

China soft/weak-reopening should help this quarter too at the margin. The company has one of the largest company-owned store mixes in the luxury space.

02.08.2023 02:44 — 👍 0 🔁 0 💬 1 📌 0

9/

$GOOS earnings are out on Thursday.

For all the worries about sales in the US wholesale channel weakening, credit and debit card data points to better than last year sales in DTC (from a small sample set, admittedly). See chart.

02.08.2023 02:43 — 👍 0 🔁 0 💬 1 📌 0

8/

An open letter to the Canada Goose execs:

Hire people that didn't spend almost 15 years at Columbia Sportswear.

That's it. That's the letter.

02.08.2023 02:42 — 👍 0 🔁 0 💬 1 📌 0

7/

I also think that GOOS designers can be a bit boring when compared to other luxury brands.

Where are the collabs? Make this s**t sexy! A few quick prompts in Midjourney can yield great ideas. See example below of a Tiffany-Goose collab.

02.08.2023 02:42 — 👍 0 🔁 0 💬 1 📌 0

6/

The only part where I may agree with the shorts is in mgmt quality when it comes to setting expectations. Really poor forecasting on their part and not cautious enough with guidance given weakening economy. Mgmt also pays themselves too much.

02.08.2023 02:41 — 👍 0 🔁 0 💬 1 📌 0

5/

Look at the charts in the previous tweet again.

You’d need a deterioration in market share in 14 countries in order to justify shorting a growing designer/apparel name trading at 9x NTM EBITDA.

02.08.2023 02:41 — 👍 0 🔁 0 💬 1 📌 0

4/

I think a lot of people see market share in the US, and assume that the same thing is happening in other countries.

But that’s not the case at all.

Here’s market share in every other country in which GOOS is big enough to show up in data.

All up and to the right ↗

02.08.2023 02:40 — 👍 0 🔁 0 💬 1 📌 0

3/

However, sales in the US continue to grow year after year (about 10% annually). They are not skyrocketing, but they're pretty steady and growing. See trend in the chart. Not a sign of a dying brand.

02.08.2023 02:40 — 👍 0 🔁 0 💬 1 📌 0

2/

I think that perhaps people are over-focused on the US market, which indeed has stalled over the last two years.

02.08.2023 02:39 — 👍 0 🔁 0 💬 1 📌 0

1/

Canada Goose $GOOS

Lots of haters on FinTwit on the name but they bring a poor game. I just don't see it. Canada Goose is gaining market share globally and growing (see chart).

Would love to hear more bearish views please!

02.08.2023 02:39 — 👍 5 🔁 0 💬 1 📌 0

Master shape rotator (yes, that Ramp Capital from Twitter)

Not Mads Mikkelsen - In case of emergency

Portfolio Manager at TheStreet, thematics, models, indices, podcasting & dogs

Senior Director & Video Game Industry Thought Leader at Circana. Formerly of Activision and Warner Bros Games. I helped get one of your favorite games greenlit.

Rock and Roll Hall of Fame Inductee

GRAMMYS Lifetime Achievement Award

Questions or complaints,,, harass my management:

FlavorFlavMgmt@gmail.com

tripsnek.com - Europe Travel Itinerary Optimizer

Software architect. Primarily Node/Angular/TypeScript. AI R&D since 2005.

Things I like: Static typing, genetic algorithms, Rick Steves, liberal democracy

📍Atlanta

Professor at Wharton, studying AI and its implications for education, entrepreneurship, and work. Author of Co-Intelligence.

Book: https://a.co/d/bC2kSj1

Substack: https://www.oneusefulthing.org/

Web: https://mgmt.wharton.upenn.edu/profile/emollick

https://icemancapital.substack.com/

HF manager. Views are my own. Not investment advice.

Brussels bureau chief at The New York Times

Open source developer building tools to help journalists, archivists, librarians and others analyze, explore and publish their data. https://datasette.io […]

[bridged from https://fedi.simonwillison.net/@simon on the fediverse by https://fed.brid.gy/ ]

Independent AI researcher, creator of datasette.io and llm.datasette.io, building open source tools for data journalism, writing about a lot of stuff at https://simonwillison.net/

Founder MPP (yeah you know me), UT Austin Prof, former chief economist various financial firms, Fed economist, Prez NABE. Passionate about family, macro, cats and freedom

Economics editor at The Bulwark. MS NOW (formerly MSNBC) anchor.

Previously WaPo op-ed columnist and NYT reporter.

Econ, politics, immigration, tax, etc. + occasional theater nerdery.

I write about the economy for the opinion pages of The New York Times. Verification: https://go.bsky.app/8WhdCDa

independent writer of citationneeded.news and @web3isgoinggreat.com • tech researcher and cryptocurrency industry critic • software engineer • wikipedian

support my work: citationneeded.news/signup

links: mollywhite.net/linktree

💗💜💙

I write Daring Fireball and created Markdown.

Medicine, markets, motion

The fastest growing independent news network in the world. We cover breaking news, politics, law and more. We are unapologetically pro-democracy.