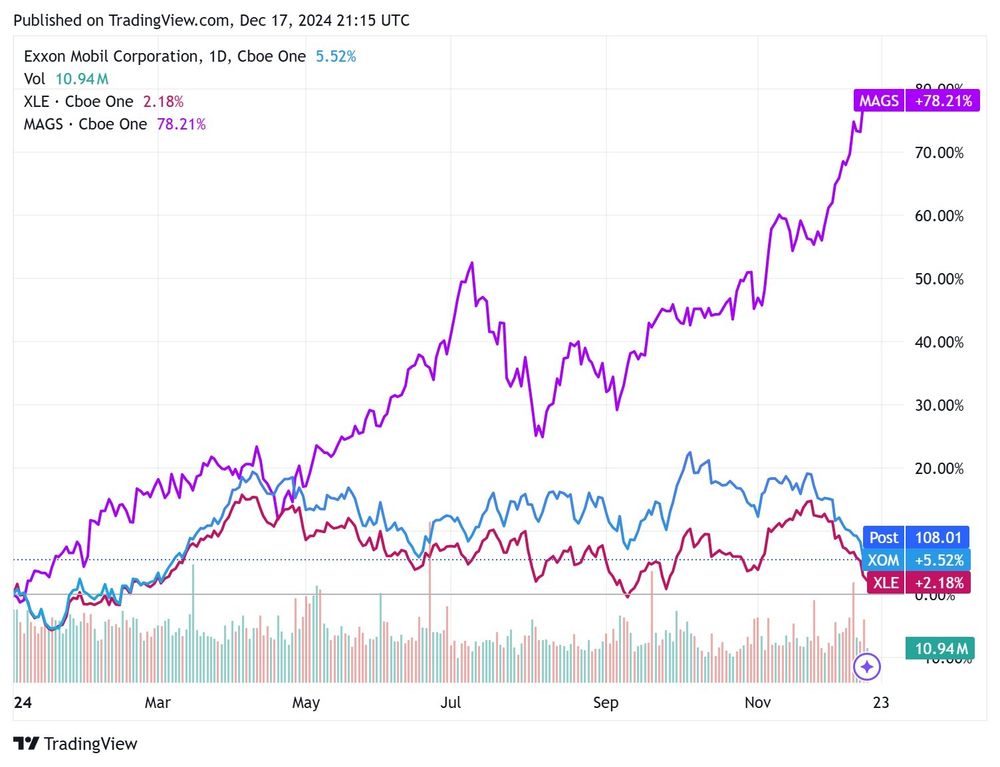

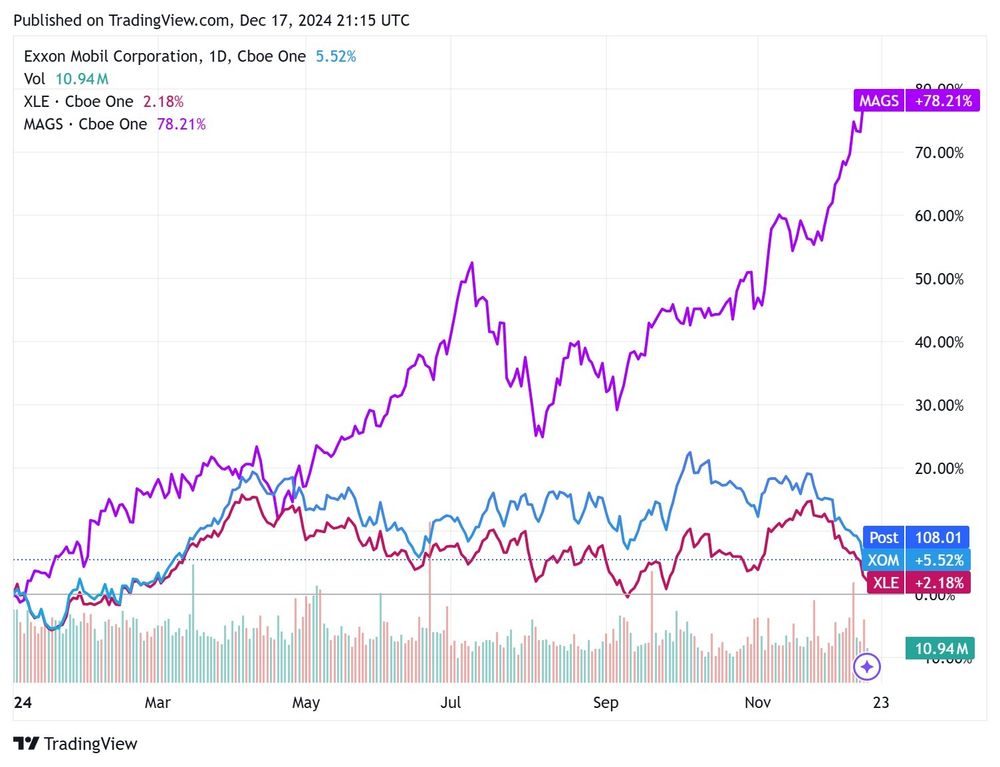

Street value analyst: don't buy oil stocks

Those that get it: bottoms in

#energysky #oott #com

@energytrader.bsky.social

Physical Energy Trader, senior management at major trading house. I talk about Oil, Gas & Energy commodities

Street value analyst: don't buy oil stocks

Those that get it: bottoms in

#energysky #oott #com

Draws sizeable, expectations of big downsides if you listen to the street. But inventories not what they seem and maintenance seems... thin.

18.12.2024 00:50 — 👍 0 🔁 0 💬 0 📌 0#crude - Setting up for a melt up. Many not positioned for this. Flows flat now, but China is the sleeper here. Q1 going to catch a lot of people off guard. HF net short. Demand brewing. China in stimulus mode. OPEC protecting 7 handle #energysky #oott #com

12.12.2024 01:15 — 👍 1 🔁 0 💬 0 📌 1#LNG Asain rates going to slide further - Kansai offering out Feb. Even Indians Petronet offered but didn't award a Dec cgo. PCI sold to Trafi a Jan cgo & Shell sold two, Vitol + BP at discount to JKM. All mid 14's #oott #energysky

10.12.2024 00:34 — 👍 1 🔁 0 💬 0 📌 0#LNG Asian rates declining. Chinese offering out. Warm winter and high inventory. Trucked LNG prices well below import level. #oott #energysky

09.12.2024 05:04 — 👍 4 🔁 2 💬 0 📌 0There is a geo-arb here. The wise will be taking advantage of backwaration, sending bbls east for cal25 and benefitting from the switch to contago and Chinese bids #oott #energysky

07.12.2024 08:01 — 👍 1 🔁 0 💬 0 📌 0All the analysts crying bearish tones from OPEC+ meeting. They aren't stupid, and this is actually going push numbers once the market realizes its looking at a deficit, sanctions or not. #oott #energysky

06.12.2024 00:12 — 👍 3 🔁 0 💬 0 📌 0#LNG North Asian rates stalling. Curve flattening and none of the Chinese stepping in. Infact they are offering Jan/Feb out. Some majors taking Dec/Jan recently to cover contract deliveries. Europe now premium holder #energysky #oott

05.12.2024 02:04 — 👍 1 🔁 0 💬 0 📌 0OPEC likely to extend cuts for 3-6 months. China recently issued new quotes to teapots. 70's rangebound is what were looking at into q1 #oott #energysky

04.12.2024 13:15 — 👍 1 🔁 0 💬 0 📌 1Shell taking another LT punt on China demand with 3MTPA from QE from cal25, pretty funny given its a mild winter, lackluster Chinese demand and restrictive terms on resale. QE got this right offloading vol to equity partners who will get faded when alt US supply comes online #oott #energysky #LNG

04.12.2024 00:59 — 👍 1 🔁 0 💬 0 📌 0#LNG - Asia is the premium here. Likely start pulling cgos away from Europe. Spot scratching 15s, JKM broken mid 15s. Could see tightening into Feb with a few MOC trades concluded today Shell/Trafi. Less tenders offering out keeping that 15 handle. #energysky

03.12.2024 12:04 — 👍 1 🔁 0 💬 0 📌 0

Hearing some noise on China reducing Iranian bbls. It might look that way from data, but I can assure you, third party traders are stepping in.

#china #oott