NEW REPORT📢 Critical minerals offer a huge economic opportunity for 🇨🇦 in the global energy transition—but current investments are not keeping pace with demand. Smart policies can accelerate investment, uphold Indigenous rights & protect the environment⬇️

climateinstitute.ca/reports/crit...

12.06.2025 12:04 — 👍 7 🔁 7 💬 1 📌 1

I had to do a double take on this graph. Despite the doom, clean investment is still booming in the US.

It's almost as if the US is re-shoring manufacturing...

shorturl.at/c6FrS

24.04.2025 17:15 — 👍 1 🔁 0 💬 0 📌 0

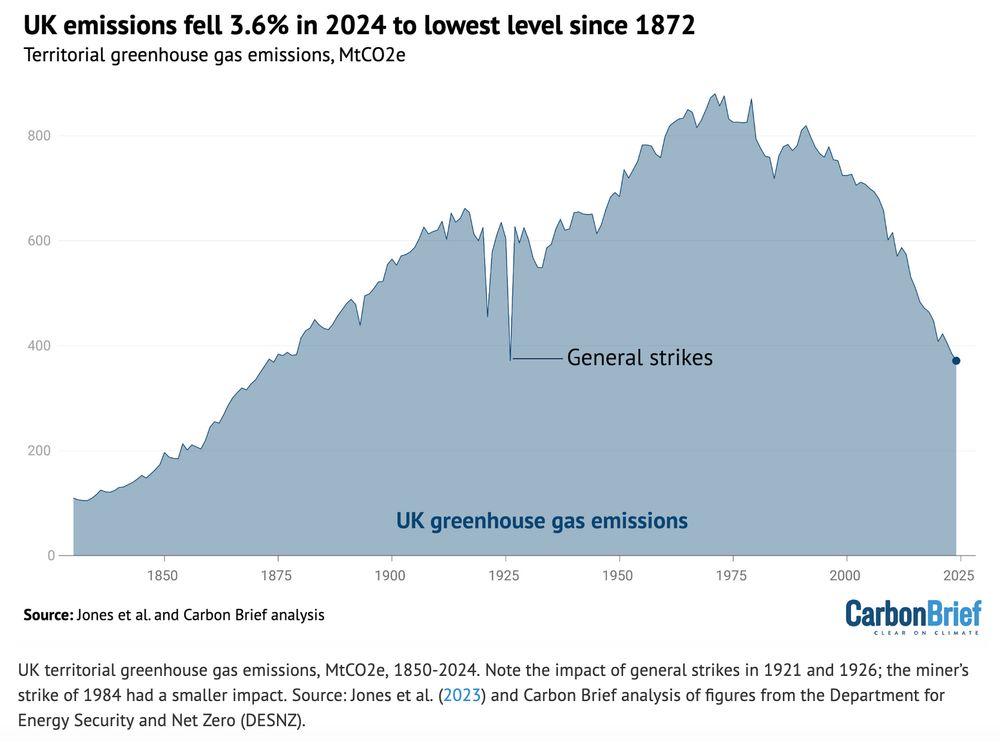

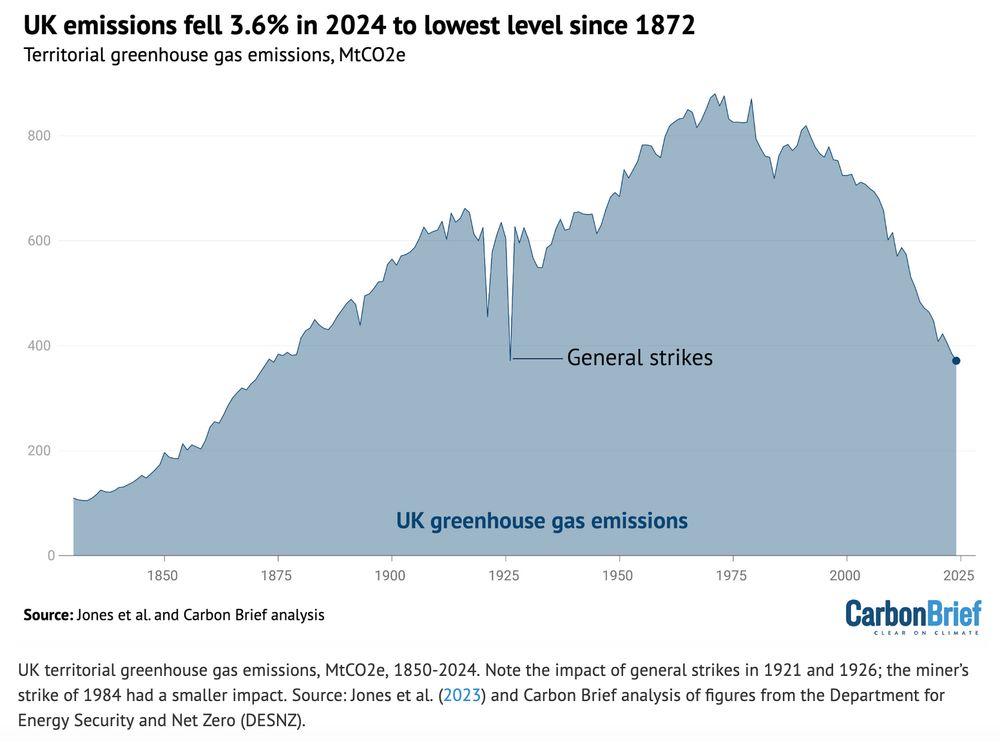

The news has been more than a bit grim of late, so hooray for @carbonbrief.org providing some genuine and really meaningful **good** news: the UK's carbon emissions in 2024 were the lowest since 1872, because demand for fossil fuels just keeps decreasing.

www.carbonbrief.org/analysis-uk-...

12.03.2025 22:47 — 👍 3257 🔁 773 💬 53 📌 58

Curious about Canadian electricity trade with the US?

Here are import and exports: volumes, value, and avg price, for the 4 largest traders.

Canadian hydro reservoirs showcasing their flexibility! (Ontario just pushing out surplus...)

04.03.2025 18:15 — 👍 28 🔁 13 💬 2 📌 4

Minor earthquake in North Van just now

21.02.2025 21:30 — 👍 0 🔁 0 💬 0 📌 0

Another piece of hard-hitting research from @climateinstitute.bsky.social. New housing developments in BC will be particularly exposed to flood/fire risk. Better land-use policies + disclosure are key to reducing future costs for homeowners and taxpayers.

The data viz is ✨🤤✨

06.02.2025 17:34 — 👍 2 🔁 1 💬 0 📌 0

Full picture is helpful here, including important calcs on cost and impact of IRA incentives

04.02.2025 23:48 — 👍 1 🔁 0 💬 0 📌 0

BlackRock should listen to its CEO from 2020: climate risk is still investment risk

While the foundations of managing climate risk remain strong, BlackRock’s exit from the global coalition could slow the pace and scale of ...

Remember *all* the way back to last week when prominent financial orgs like BlackRock exited global climate alliances?

This is a huge reversal that could slow investment in climate solutions. But it also doesn't change the fundamentals of climate finance.

My latest:

shorturl.at/Ew4a6

20.01.2025 23:56 — 👍 0 🔁 0 💬 0 📌 0

For combustion GHGs: as consumers shift to cleaner/better technologies, demand diminishes and growth is no longer possible (unless the company moves into other lines of business). This is fundamentally a different and more potent type of investment risk.

13.01.2025 15:37 — 👍 0 🔁 0 💬 0 📌 0

The lack of agency around Scope 3 is often used as an excuse not to report or do something about it. Yet this lack of agency is *exactly why* these GHGs carry higher investor risk -- particularly for combustion GHGs (known as Category 11).

13.01.2025 15:37 — 👍 0 🔁 0 💬 1 📌 0

New report by NZAOA shows how to overcome challenges with incorporating Scope 3 GHGs for asset owners. But it could have gone farther with explaining why Scope 3 matters for investors, especially combustion GHGs from fossil fuels.

see next

shorturl.at/fSuhm

13.01.2025 15:37 — 👍 2 🔁 1 💬 1 📌 0

BC has made big strides in reducing childcare fees, but parents in other provs are shocked when I tell them how much we pay here. Our 2 part-time spots for one kid(!) total $2,000/month or ~$85/day.

$10/day seems like a pretty far-off fantasy for many in this province.

11.01.2025 19:24 — 👍 0 🔁 0 💬 0 📌 0

Getting heat pumps right | Latitude Media

How do we fix the sometimes frustrating customer experience of getting a heat pump?

This Catalyst pod on modernizing the #heatpump customer experience really resonated. We went through 3 crappy HVAC companies before finally landing on Aquatech Vancouver, who did an incredible job.

There are enormous opportunities for innovative HVAC companies.

shorturl.at/YRXmO

18.11.2024 17:25 — 👍 0 🔁 1 💬 0 📌 0

ICYMI: this report from the Institute for Sustainable Finance shows how 1,300+ Cdn companies are affected by the EU's new disclosure rules.

It has big implications for Cdn co's operating in EU. But it has even bigger implications for Canada's ability to attract global capital.

shorturl.at/aknz5

09.04.2024 14:46 — 👍 0 🔁 0 💬 0 📌 0

Our clean growth team @climateinstitute.bsky.social has new research on regulatory reform in Canada:

- How to fast-track renewable projects

- How strategic assessments can be better used

- Lessons from reg reform in Cali & NY

- A TLDR blog bringing it all together.

Check it out

shorturl.at/lwyDE

01.12.2023 15:46 — 👍 5 🔁 4 💬 0 📌 0

"In the first half of the year, 68 gas power plant projects were put on hold or cancelled globally..."

"The shift challenges assumptions about long-term gas demand and could mean natural gas has a smaller role in the energy transition than posited by the biggest, listed energy majors."

21.11.2023 22:47 — 👍 0 🔁 0 💬 0 📌 0

It's been a long time coming, but thrilled to see

Min. Freeland commit $1.5M to develop a green/transition #taxonomy for Canada.

There's no more time for delay: Canada can provide global leadership in defining what investments genuinely align with net zero.

shorturl.at/hvX08

21.11.2023 22:43 — 👍 2 🔁 0 💬 0 📌 0

The Smith School of Enterprise and the Environment is a leading interdisciplinary academic hub at the University of Oxford focused upon teaching, research, and engagement with enterprise on climate change and long-term environmental sustainability.

Battcock Professor of Environmental Economics, Smith School, Oxford University, co-founder of Vivid Economics, Climate Bridge, and Aurora Energy Research; investor in early-stage climate ventures.

dad | catalytic climate investing at allied climate partners | phd researcher in climate finance at oxford | nonresident fellow at the payne institute, energy for growth hub, and duke university | fka @solarbenattia

Director of Complexity Economics at INET Oxford; Baillie Gifford Professor of Complex Systems Science at the Smith School of Enterprise and the Environment, University of Oxford; external faculty at the Santa Fe Institute; Chief Scientist, Macrocosm

Post-doc at Oxford (@oxfordsmithschool.bsky.social) in environmental policies, productivity, and inequalities. PhD from CIRED and Univ. Paris Saclay.

Posts in English and French.

https://emilienravigne.netlify.app/

Assistant Professor of Economics and Sustainability at Hertie School, Associate at University of Oxford Smith School & INET Prev: postdoc@University of Oxford, PhD@MCC Berlin, economist@OECD Tax. Environmental economics, carbon pricing, tax.

Nature-based Solutions @ University of Oxford

Focusing on the joint climate change and biodiversity loss crises

🌎🏞️🌐📊☮️

Deputy Director of the Complexity Economics programme, INET, OMS, SSEE, University of Oxford.

Climate investing. UN. Acadia Infrastructure Capital. University of Oxford.

Senior Reporter for Responsible Investor covering fixed income, Germany, UK and US.

Views mine etc.

Labour and Capital: stewardship, responsible investment, labour rights, unions, pensions, corporate governance, workforce engagement

E3G is an independent climate change think tank with offices in London, Brussels, Berlin, and Washington DC, and a global network of associates. We tackle barriers and advance solutions for a safe climate for all.

East Londoner, @E3G Sustainable Finance, generally curious about things/people.

Independent think tank working on sustainable finance, carbon markets and natural capital

ACCR is a shareholder advocacy and research organisation. We use shareholder strategy to enable investors to escalate engagements with heavy-emitting companies in their portfolios. Find us at accr.org.au

Sustainability, responsible investment, communication, corporate governance #Varma

Muutoin Cluedo, tiede, kanttarellit ja suppikset, sähköiset asiat, huumori, Kalevalaseura

Mieluummin katalyytti kuin inhibiitti.

Working in responsible investment and shareholder engagement. Board member access to nutrition initiative. Practicing Aikido and living in Bunnik

Editor, Responsible Investor. Sustainable finance, CEE, sailing.

A Finn with Global Mindset. Sustainable & Impact Investing, Movies, Basketball, Football.