Since 2021, Intel's purchase commitments have declined by 46%, while Nvidia's have grown by 7x. NVIDIA's supply backlog is now 8 times larger than Intel's. While Nvidia and AMD have more substantial HBM backlogs than Intel, they all compete for the same wafers.

lnkd.in/egtzn82v

31.01.2026 16:13 — 👍 2 🔁 0 💬 0 📌 0

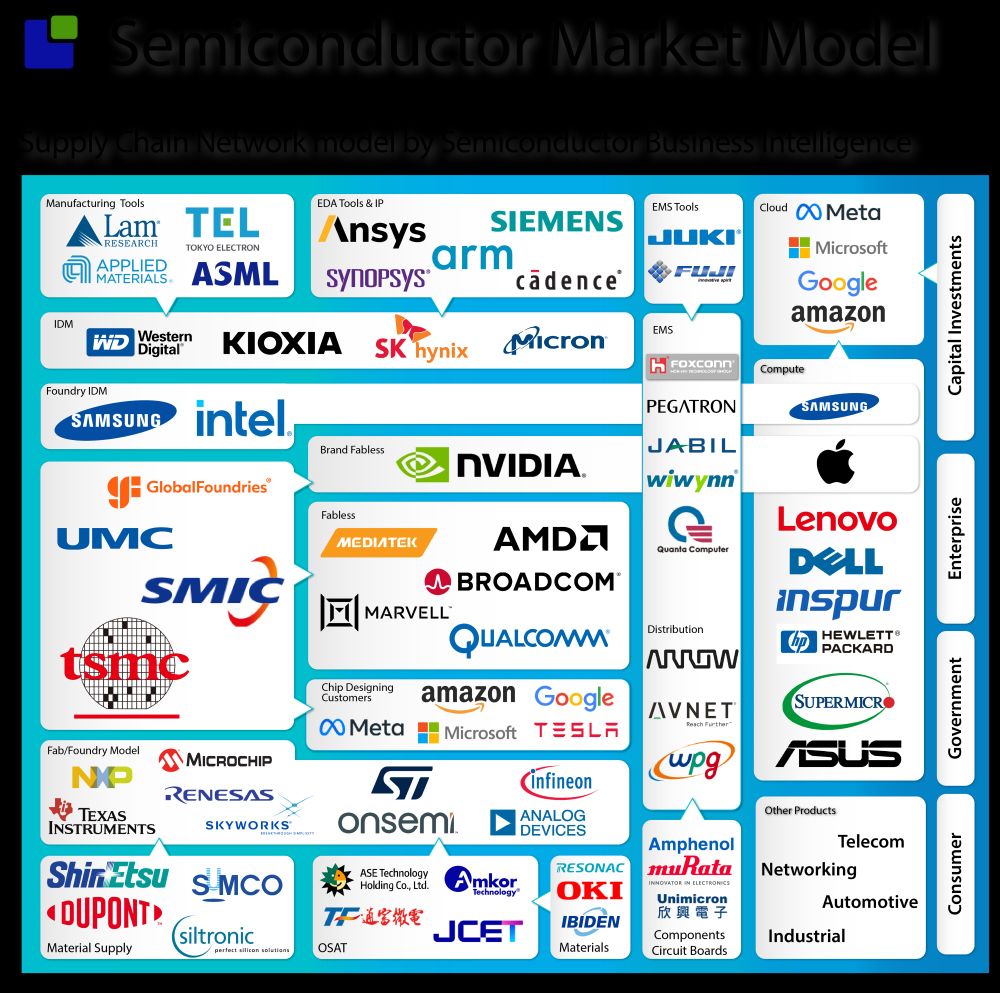

With Intel and Samsung discussing organisational structures, the US semiconductor leadership is in the hands of the Taiwanese, as usual.

If you are dependent on the semiconductor industry, you can sign up to my blog here: lnkd.in/d2ZXMHjw

16.07.2025 13:52 — 👍 3 🔁 0 💬 0 📌 0

Nvidia's quarterly capital expenditure (CapEx) has surpassed that of the largest semiconductor company using the hybrid manufacturing model, Texas Instruments.

TI is spending capital expenditures on Semiconductor Fabs, but what about Nvidia?

14.06.2025 13:21 — 👍 2 🔁 0 💬 0 📌 0

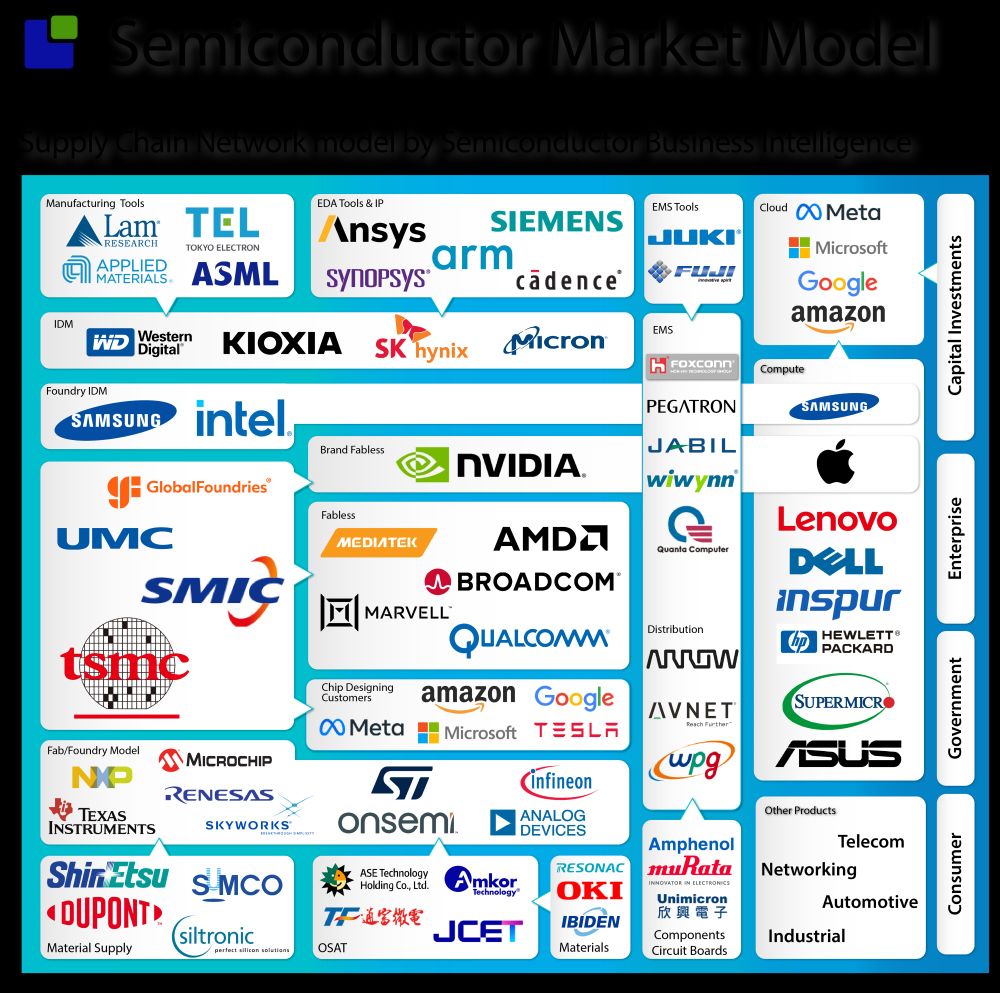

My research model comprises a supply network that spans more than 50 subsegments, encompassing over 400 companies.

If you are interested in my latest analysis of the industry, you can read more here: lnkd.in/d-m5AiFR

21.05.2025 10:25 — 👍 3 🔁 0 💬 0 📌 0

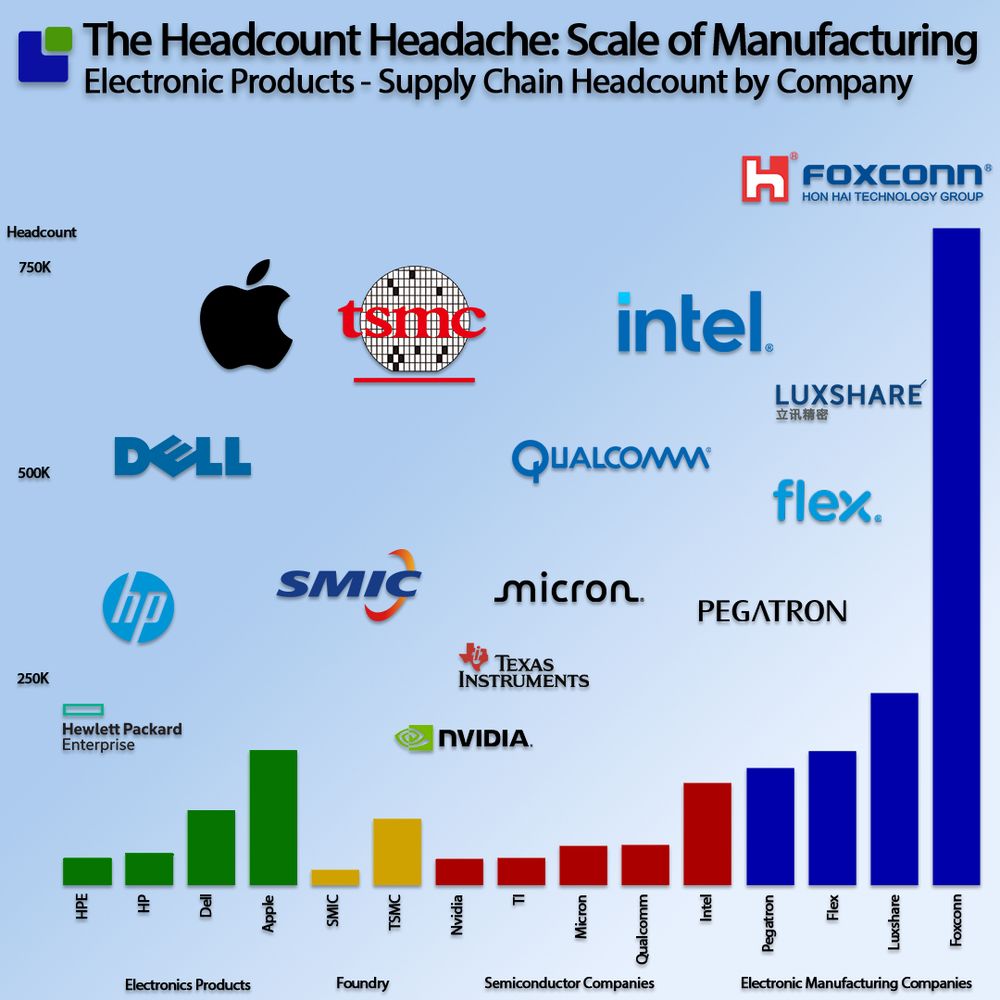

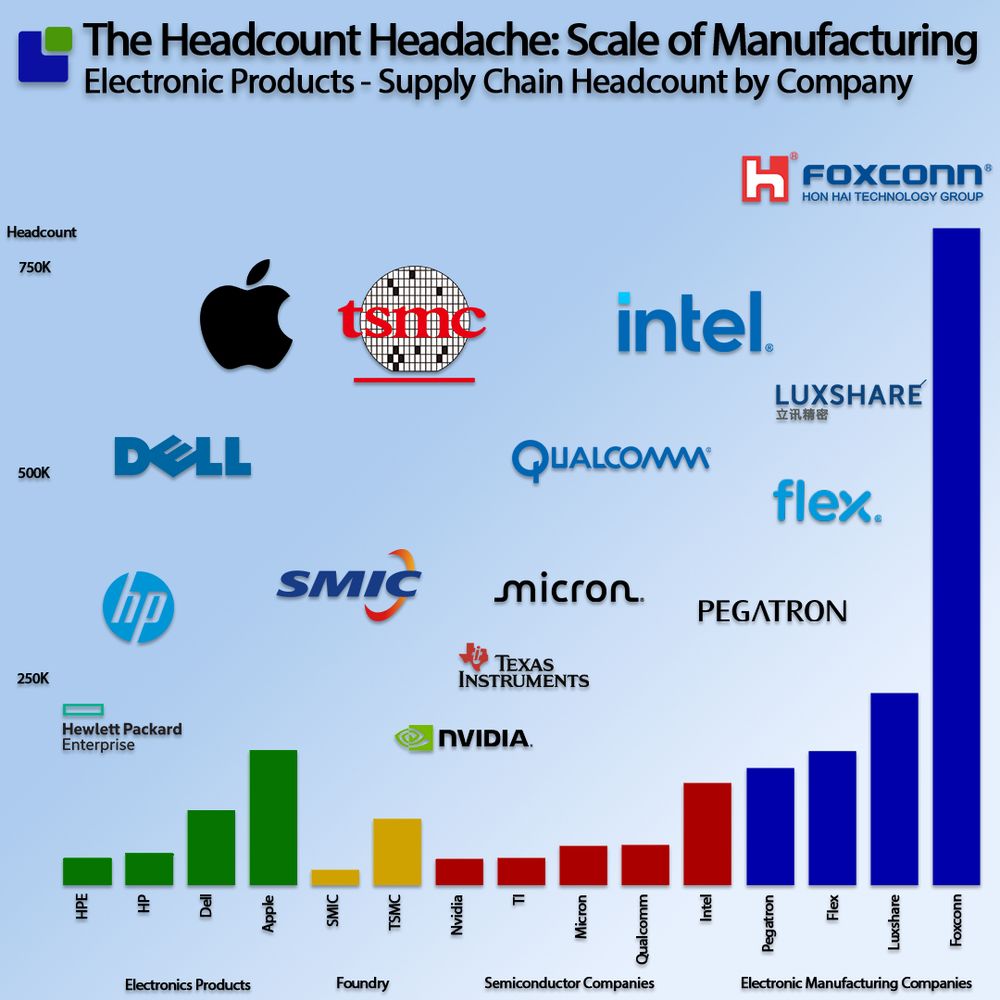

If you think reshoring some Semiconductor manufacturing to the US is expensive, you better prepare for reshoring electronic manufacturing.

Read more about electronic manufacturing here: lnkd.in/dv3amq7k

14.04.2025 15:30 — 👍 1 🔁 0 💬 0 📌 0

In the post-fact era, where strategies and trade policies are made by instinct, using data and statistics to uncover the foundation for decision-making feels a bit old-school. But old school I am.

lnkd.in/d2ZXMHjw

11.04.2025 13:37 — 👍 0 🔁 0 💬 0 📌 0

What was supposed to be a Bull in a China Shop has turned out to be a Dragon in a Pottery Barn.

China has been preparing for the inevitable trade war since the last Trump administration, while US electronics companies have been caught completely unprepared.

lnkd.in/d2ZXMHjw

10.04.2025 12:35 — 👍 0 🔁 0 💬 0 📌 0

You must place a significant bet years in advance to win in Semiconductors.

The best way to identify the bet is to track the development of semiconductor companies' headcounts.

If you want to know more about the New Intel and the 2025 Vision: lnkd.in/dhtyY3_b

08.04.2025 14:15 — 👍 0 🔁 0 💬 0 📌 0

Only a year ago, Pat Gelsinger intended for Intel to compete with Nvidia, but the new CEO, Lip-Bu Tan, is burying that ambition.

If the New Intel and the 2025 Vision are important to you, read more here: lnkd.in/drXUPZXJ

06.04.2025 13:28 — 👍 0 🔁 0 💬 0 📌 0

With 19% growth in the "Semiconductor Device" market and massive investments in new Semiconductor capacity, you would expect the Semiconductor foundries to run at close to maximum capacity and struggle to follow demand.

You would expect wrong. lnkd.in/dPqG8s7P

29.03.2025 10:35 — 👍 0 🔁 0 💬 0 📌 0

While you easily could be led to believe that the 12" Semiconductor Wafer is the most common size in the foundry market, you would be wrong. 8" is still the most common size, although a systemic shift is underway: lnkd.in/dPqG8s7P

27.03.2025 15:07 — 👍 1 🔁 0 💬 0 📌 0

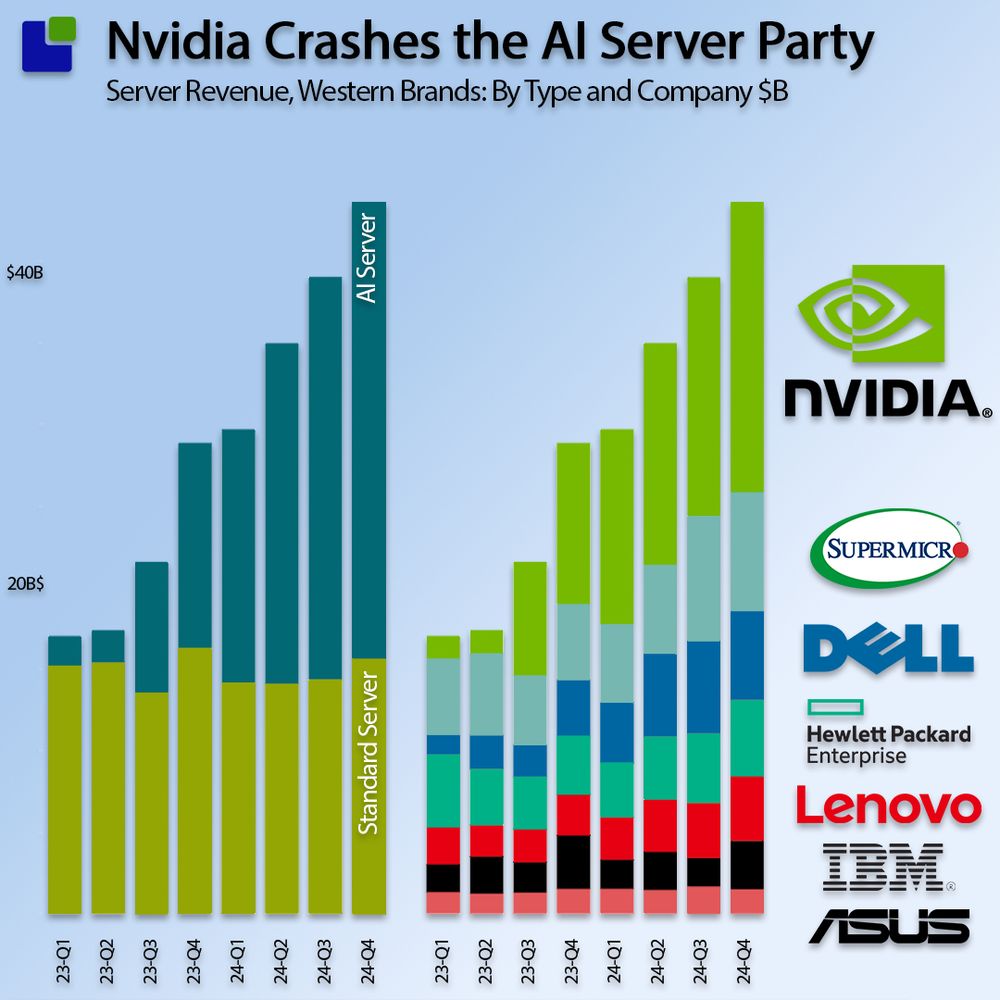

While all the Hyperscalers are Nvidia customers, they also desperately try to displace Nvidia while the AI leader's profit margins taunt them.

If you want to know more about the business case of the Hyperscalers Accelerators attempting to dislodge Nvidia, read more here: lnkd.in/dNK2Xknz

20.03.2025 14:55 — 👍 0 🔁 0 💬 0 📌 0

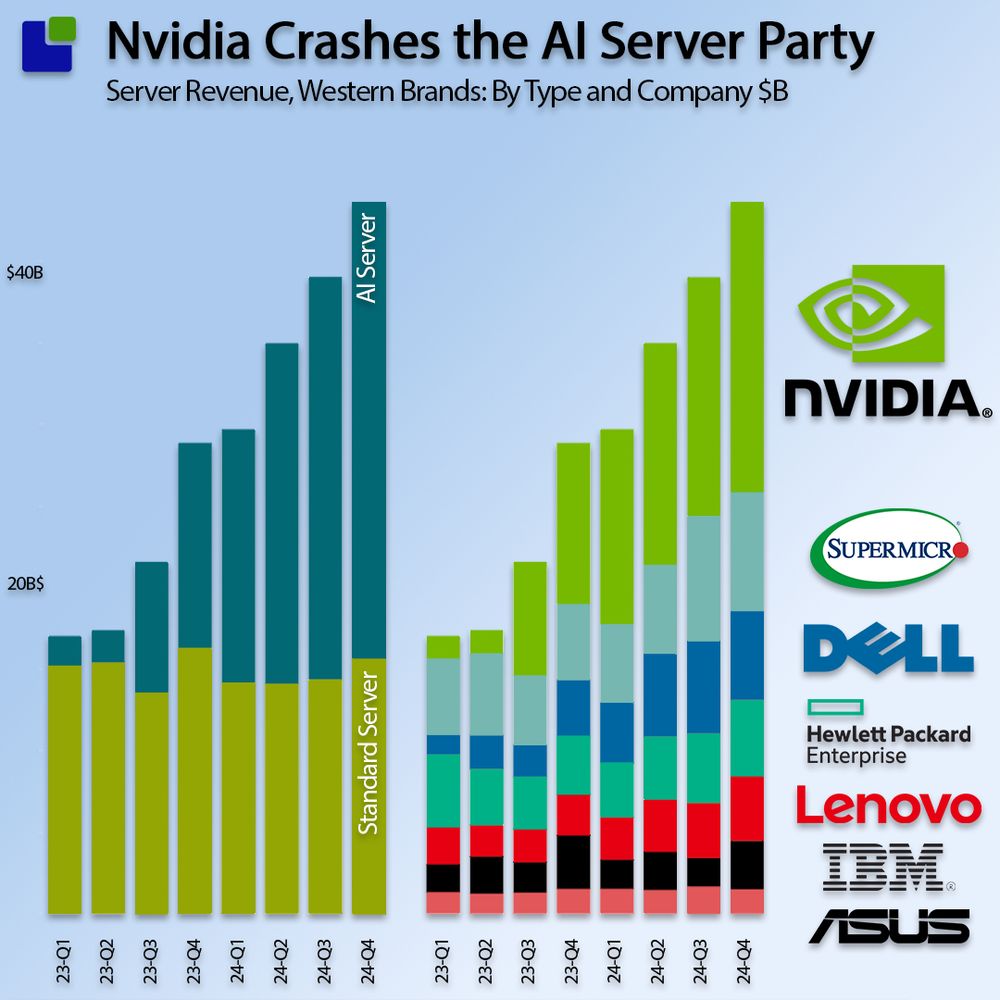

One of Nvidia's masterstrokes is creating Nvidia-branded servers. Not only is Nvidia profiting from the silicon but also from the whole hodge-podge of components that make up a server. lnkd.in/dNK2Xknz

18.03.2025 14:18 — 👍 2 🔁 0 💬 0 📌 0

While Cloud companies can choose to buy AI servers from Nvidia or one of their partners, Nvidia's control is absolute.

Nvidia's revenue model is complex, but the result is simple. Margins and market shares are decided at internal Nvidia planning meetings.

lnkd.in/dNK2Xknz

17.03.2025 15:49 — 👍 2 🔁 0 💬 0 📌 0

While the possible end of the Chips Act can help the industry return to normalcy, we are still in the post-Logic era. Withdrawing the Chips Act funding will hurt US companies more than foreign companies.

lnkd.in/d2ZXMHjw

14.03.2025 07:22 — 👍 1 🔁 0 💬 0 📌 0

The average monthly revenue showed that TSMC entered the year of the Snake easily.

The average monthly growth was 2.6%, which confirms that TSMC's annual growth rate is currently above 30%.

lnkd.in/d2ZXMHjw

11.03.2025 12:45 — 👍 1 🔁 0 💬 0 📌 0

Nvidia was only invited to the Server supplier party but decided to crash the entire AI Server celebration.

In the quarter that the Hopper architecture was introduced, Nvidia became the largest server supplier, and its market share continued to grow. lnkd.in/dEbAmc9y

10.03.2025 09:19 — 👍 1 🔁 0 💬 0 📌 0

With QoQ growth of 69% in Q3-24, Inspur of China had the highest growth of all companies in the server market.

Although the Nvidia and Inspur Quarter is one month skewed, there is good reason to expect a good result.

lnkd.in/dEbAmc9y

08.03.2025 16:55 — 👍 0 🔁 0 💬 0 📌 0

I use the Taiwanese Electronics Manufacturers' monthly revenues to take the server market's temperature.

Read more about the server market here: lnkd.in/dEbAmc9y

06.03.2025 15:49 — 👍 0 🔁 0 💬 0 📌 0

The server market is becoming increasingly complex, and every quarter, a new business model is introduced as everybody wants a piece of the action.

lnkd.in/dEbAmc9y

06.03.2025 12:44 — 👍 1 🔁 0 💬 0 📌 0

Nvidia delivered again. With $39.3 billion in revenue, the now predominantly server company had 12% QoQ revenue growth and beat the guidance by 4.8%.

Subscribe to my blog to get the update: lnkd.in/d2ZXMHjw

26.02.2025 22:02 — 👍 0 🔁 0 💬 0 📌 0

While embargoes rarely have the intended consequences, they impact the market as it adjusts to the new situation and "Business" finds a new way to support the demand.

Read more about the Semiconductor tool market here: lnkd.in/dYa3aK_H

25.02.2025 15:23 — 👍 0 🔁 0 💬 0 📌 0

ASML might not be captured in Lithography, but rival technologies are being developed that could eventually disrupt the sector.

Read more about the Semiconductor Tool Market here: lnkd.in/dSKimZgV

24.02.2025 18:42 — 👍 0 🔁 0 💬 0 📌 0

Just two years ago, the semiconductor companies using the hybrid manufacturing model were the best-performing sector in the semiconductor supply chain.

In the first three years of the twenties, combined revenue grew 70%, and solid business models almost tripled operating profits. lnkd.in/dQ5nU2ya

20.02.2025 15:54 — 👍 0 🔁 0 💬 0 📌 0

Despite easily beating the guidance with 3.1%, it was a hellish quarter for sales.

The guidance for the next quarter is 3.2% up with healthy-looking profit targets despite one-time charges.

lnkd.in/ddYueXeZ

19.02.2025 19:00 — 👍 0 🔁 0 💬 0 📌 0

Nine quarters into the downturn, you would expect Semiconductor companies with hybrid manufacturing models to have right-sized the manufacturing capacity.

But the fabs keep running at too high a capacity, and the inventories keep growing.

lnkd.in/ddYueXeZ

16.02.2025 16:34 — 👍 1 🔁 0 💬 0 📌 0

Investigating Intel's purchasing and CapEx commitments by year reveals this was not your average investment cycle.

Read more about Intel here: lnkd.in/dDmdgR-K

12.02.2025 16:37 — 👍 0 🔁 0 💬 0 📌 0

While Intel is synonymous with the US semiconductor heritage, it is also Europe's most valuable semiconductor company in terms of property, plant, and equipment.

lnkd.in/dDmdgR-K

11.02.2025 15:56 — 👍 1 🔁 0 💬 0 📌 0

The main problem with Intel's 3-bucket market strategy is that the Data Center AI bucket is empty, and the Data Center CPU bucket is leaking.

Read more about Intel's strategy here: lnkd.in/dDmdgR-K

09.02.2025 15:37 — 👍 0 🔁 0 💬 0 📌 0

The company is in complete transformation into a Server-focused company. Server revenue now accounts for more than 71% of the total; three quarters ago, it was 39%.

Read more about SK Hynix here: lnkd.in/dkwTY3dz

26.01.2025 14:55 — 👍 0 🔁 0 💬 0 📌 0

Host & exec prod, "Talking Feds Pod" and "Talking San Diego." FCA Lawyer. Teach con law at UCSD & UCLA. Senior Fellow USC. Former US Atty, Dep Assis AG. Founding Contributor, The Contrarian

Past President of the ACM - acm.org

Past President of ACM SIGGRAPH - https://siggraph.org/

Past Director of Engineering, Maya - https://autodesk.com/products/maya

Believe in yourself! Work hard, never give up & anything's possible! OR: Kick back, relax & aim low: You'll never be disappointed...😜 I IGNORE ALL DMs!

I'm Sarah, seeking ikigai (my reason for being), sharing learning, finding my people and voice. I want to help others get there too. ❤️ 🌍🧠💰

Advocate for tech that makes humans better | Spatial Computing, Holodeck, and AI Futurist | Ex-Microsoft, Rackspace | Co-author, "The Infinite Retina."

🇨🇦A Canadian! Speaks worldwide on trends, disruption, & innovation - NASA, Disney, Pfizer, World Bank, RCMP. Online since ‘82, author, radio host, columnist, tech geek. FDesperately trying not to post things I should not. Failing! https://jimcarroll.social

At the crossroads of technology, spirituality, and deconstruction. Exploring AI, tech, and home automation. Works in temperature metrology. Qualified counsellor, reflective; with a love for poetry, ParkRun, and craft beer, recovering radio amateur.

Programming Languages & Tools, AI, Simulation, Reflection, Debugging.

Director of Research 🚀 Bringing the Future Back !

AuDHD tech leader, ML, data, AI, tech. Chief Architect at climate policy radar (.org). Interested in tech for good, cute animals and neurospicey memes

Expert in Innovation and having people express their talent and Joy at work. We need to reinvent the Democratic Party. Democracy is our sacred right. No one that is not “qualified” for the office of the president should be in the office.

12 year Breast Cancer Survivor 🎀 Mama, HR Extraordinaire, Fibro/Psoriatic Arthritis Warrior, HSP, Cancer Survivorship Advocate. #womensrights #fuckcancer

https://thriveuprising.org

Writing about AI policy at Transformer. Supporting AI journalism with grants at Tarbell. Prev: AI safety and EA comms; journalist at The Economist, Protocol, Finimize. London.

https://transformernews.ai

Product Manager @ Graphcore | My opinions are my own | I talk about AI, LLMs, Engineering, Products and of-course Accelerators

#Rechtsanwalt (#Recht) für #IT, #Cloud, #KI, #Datenschutz (#teamDatenschutz)

Lawyer (#law) in the field of #IT, #cloud, #AI and #privacy.

+a strong interest in #society, #politics, #energy, #intrastructure & creative endeavours

Imprint https://fingolex.de

Head of Data and Digital Preservation at #BFINationalArchive @BFI

#digipres #digitalpreservation #avarchiving

Opinions my own

Books, films, gardens, sport, FS, AI and technology (order to be determined…)

Exploring ethical AI, automation & tech’s impact on society | Making tech accessible to all | Unsponsored & unaffiliated | All views my own

https://ethicsbiastechblog.blogspot.com

#AI #TechForGood #EthicsInTech

Software engineer currently working in AI. Bass player in @knockblockers.com (ska) and @tinkersdamnband.com (grunge/stoner). Part time home and pro-brewer. Recovering Catholic. Originally from Allentown, PA now in Colorado Springs.

Computational Neuroscientist