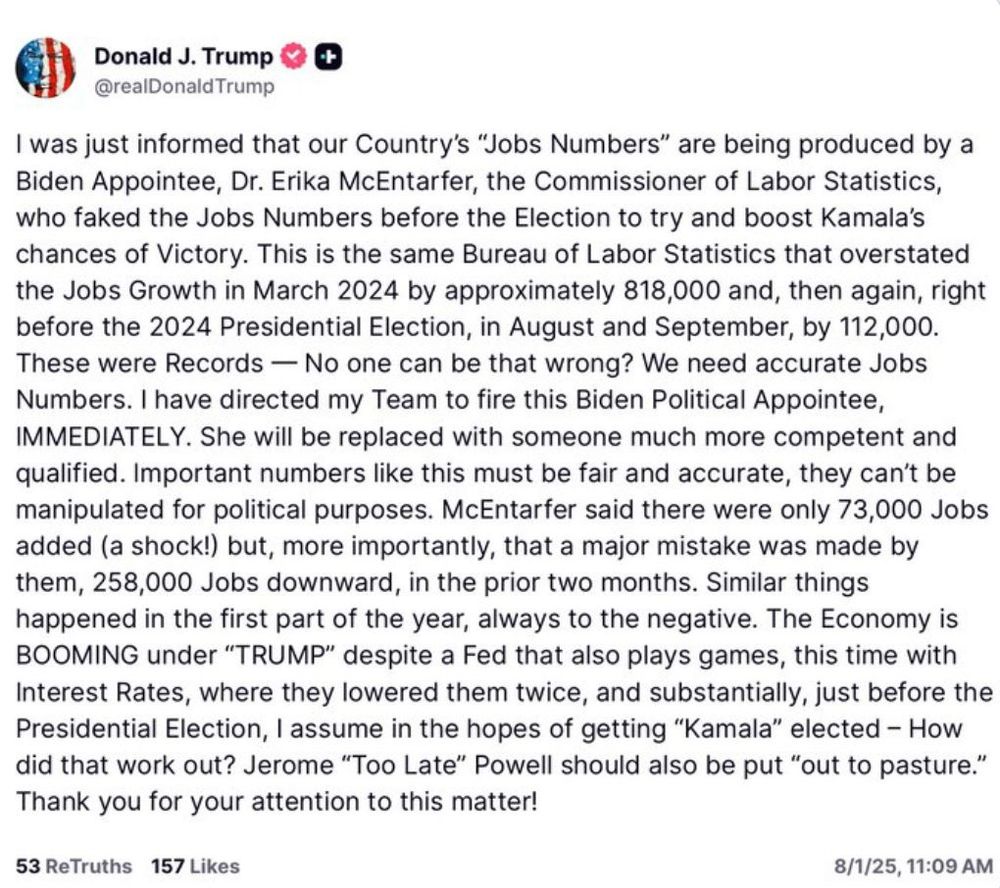

This is awful. Reliable economic data is a key strength of the US economy.

When Argentina and Greece faked economic data it contributed to major crises.

I don't think Trump will be able to fake the data given the procedures. But there is now a risk plus an awful appearance.

01.08.2025 18:40 — 👍 1088 🔁 282 💬 56 📌 25

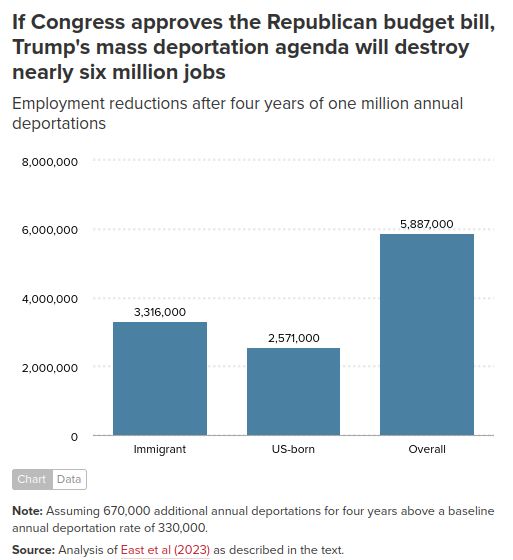

The funding increase for arrests, detentions, deportations will cause widespread harm to the labor market and destroy millions of jobs held by immigrant and US-born workers

www.epi.org/blog/the-rep...

01.07.2025 20:16 — 👍 7 🔁 4 💬 1 📌 0

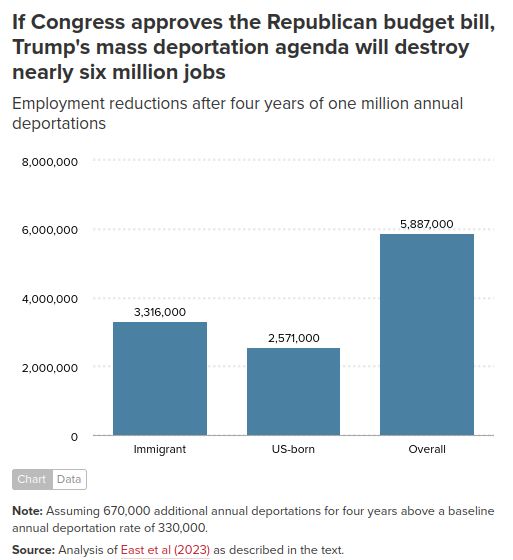

A bar chart titled "If Congress approves the Republican budget bill, Trump's mass deportation agenda will destroy nearly six million jobs."

The chart displays the "Employment reductions after four years of one million annual deportations" across three categories:

Immigrant: 3,316,000 jobs lost

US-born: 2,571,000 jobs lost

Overall: 5,887,000 jobs lost

A note at the bottom states: "Assuming 670,000 additional annual deportations for four years above a baseline annual deportation rate of 330,000." The source is cited as "Analysis of East et al (2023) as described in the text."

Now that Congress has passed the Republican spending bill, "[if] Trump succeeds in carrying out his deportation goals...5.9 million workers will lose their jobs over the next 4 years"--3.3 million immigrants and 2.6 million US-born workers.

-@benzipperer.org @epi.org

www.epi.org/blog/the-rep...

01.07.2025 19:08 — 👍 9 🔁 5 💬 1 📌 0

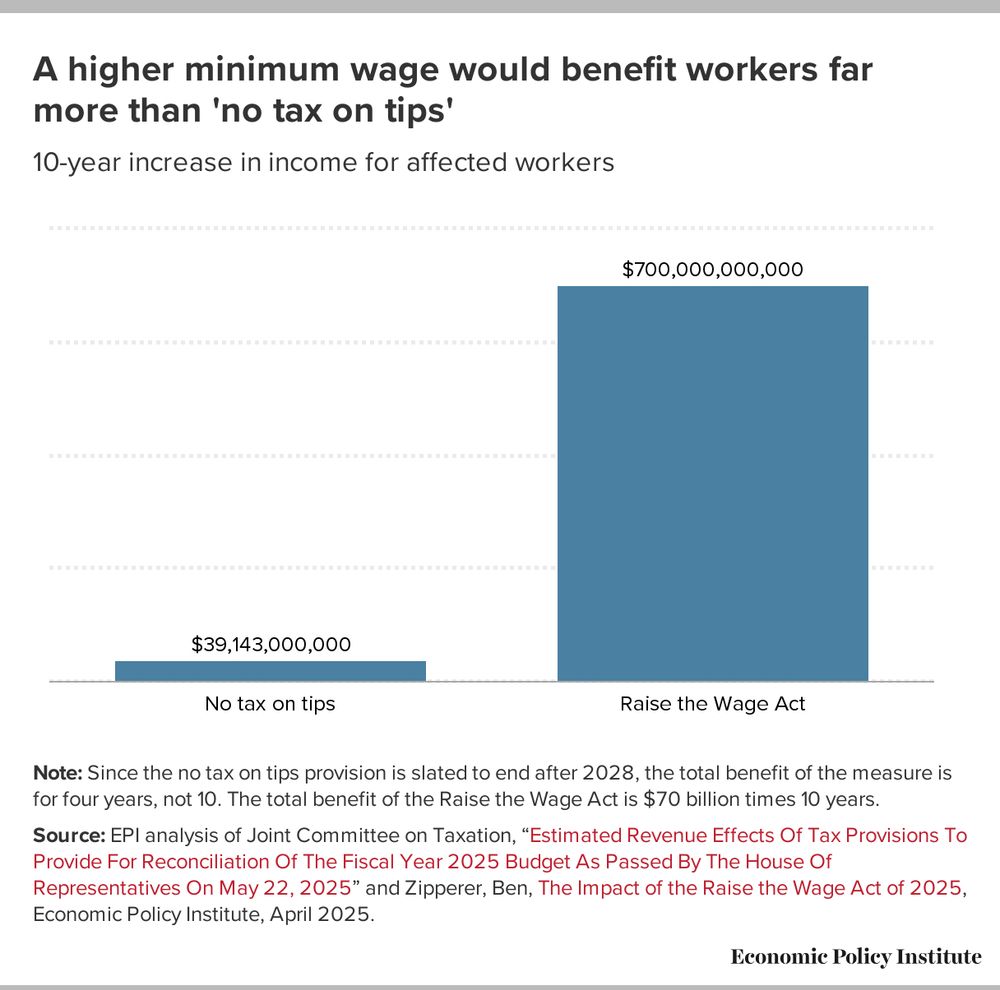

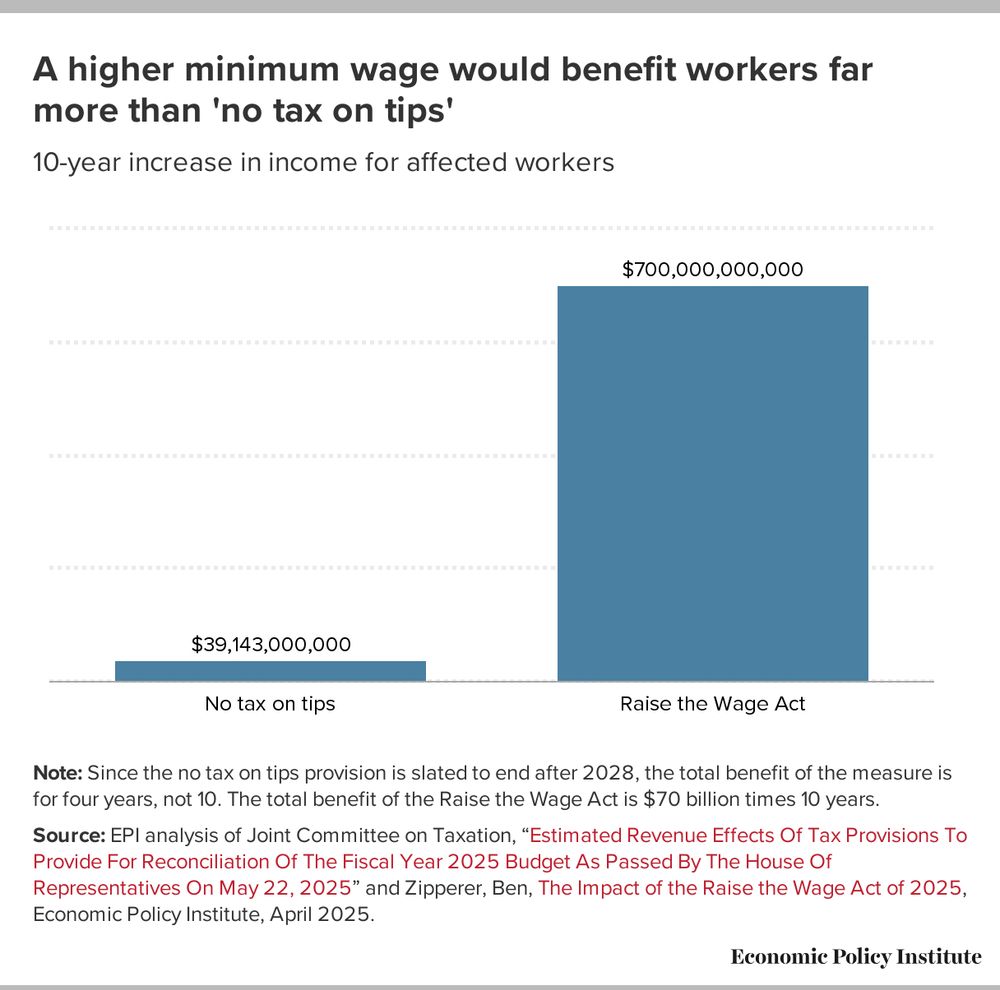

Chart showing that raising the federal minimum wage to $17 would provide $700 bn to workers, compared with only $39 bn from no tax on tips policy.

As Congress debates no tax on tips, important to recognize just how unserious an effort to help working people it is. Raising the federal minimum wage would deliver nearly 18x as much income to workers. www.epi.org/blog/increas...

12.06.2025 13:36 — 👍 243 🔁 75 💬 12 📌 5

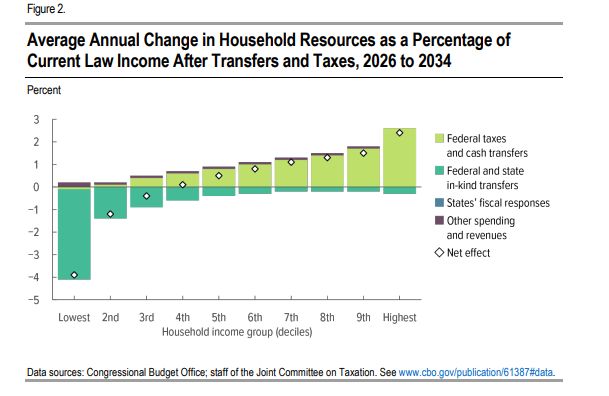

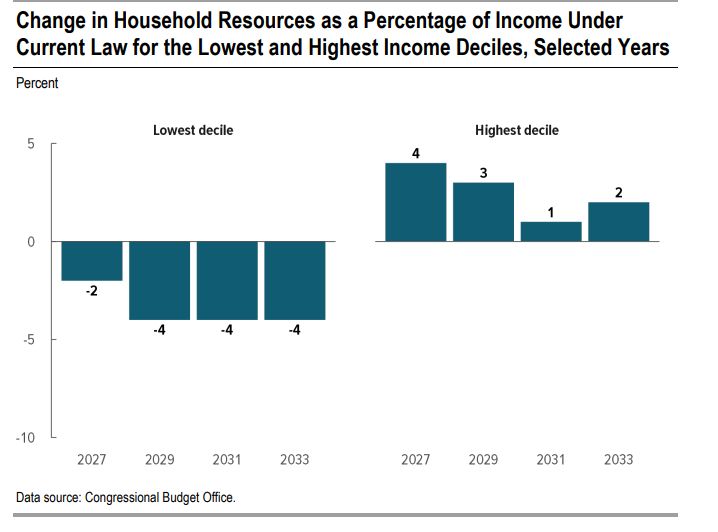

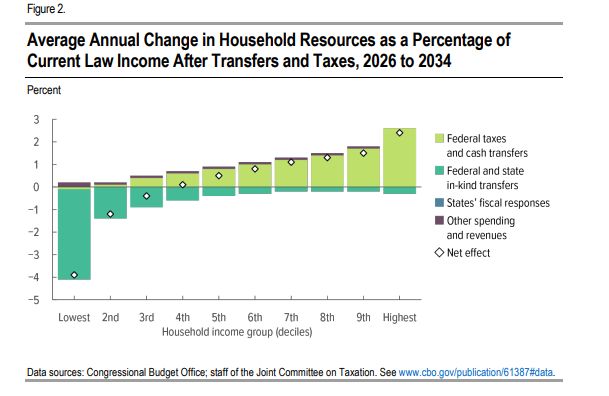

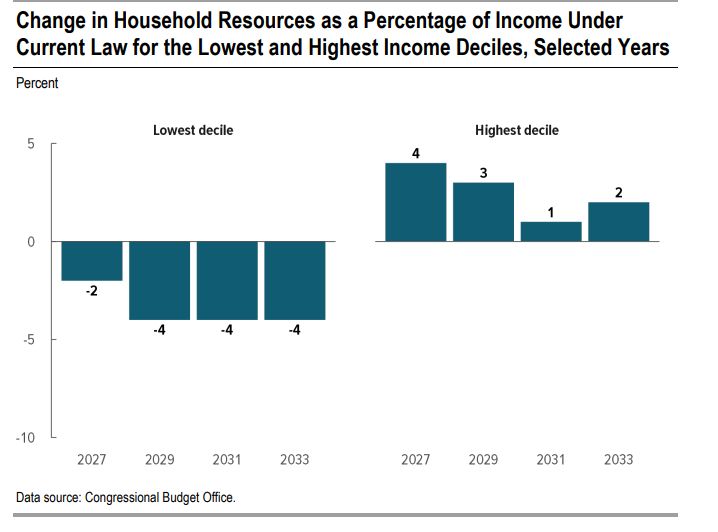

NEW analysis by the Congressional Budget Office shows the "One Big Beautiful Bill"

1.) Makes the bottom 30% worse off

2.) Finances tax cuts that make the top 10% in particular better off.

This is not shared sacrifice--it's a fiscal transfer from the bottom to the top

www.cbo.gov/system/files...

12.06.2025 15:02 — 👍 94 🔁 34 💬 2 📌 2

No, not directly. The deduction is only against their federal income tax liability, not their FICA (social security/medicare) tax.

12.06.2025 16:06 — 👍 0 🔁 0 💬 1 📌 0

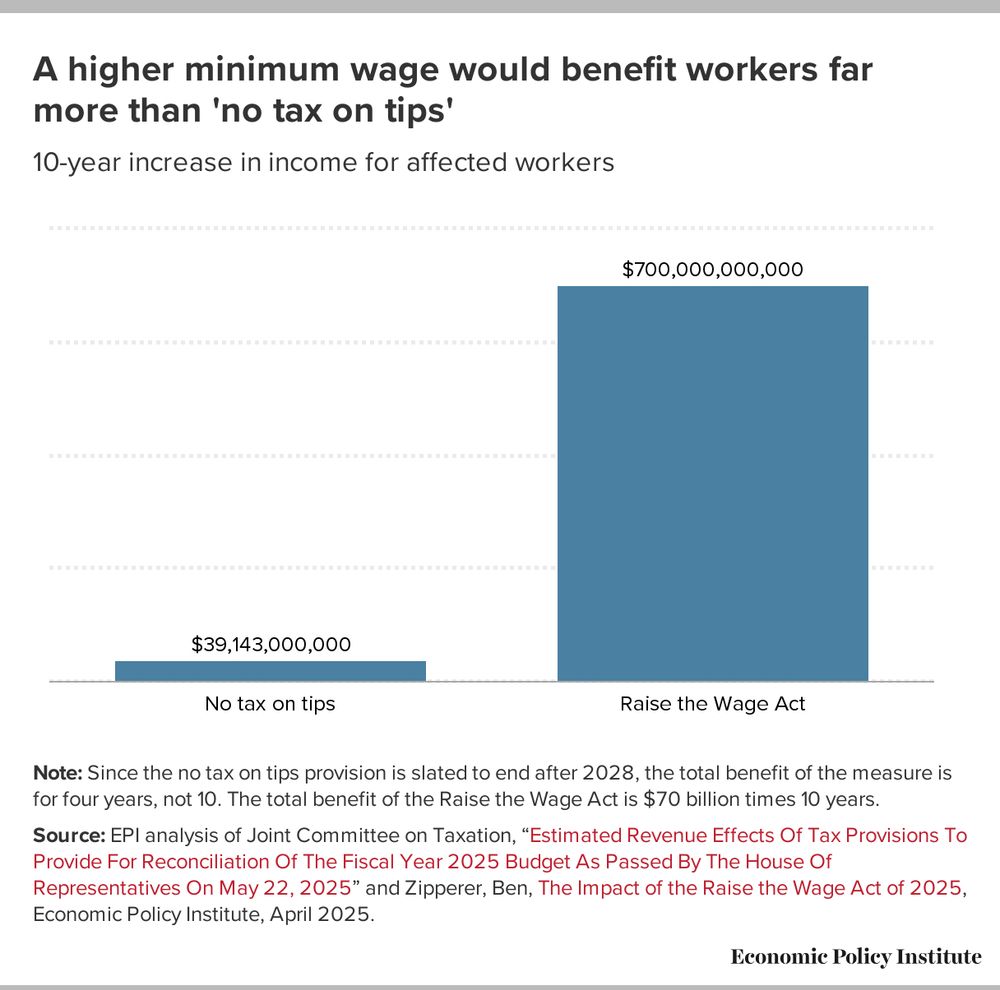

Chart showing that raising the federal minimum wage to $17 would provide $700 bn to workers, compared with only $39 bn from no tax on tips policy.

As Congress debates no tax on tips, important to recognize just how unserious an effort to help working people it is. Raising the federal minimum wage would deliver nearly 18x as much income to workers. www.epi.org/blog/increas...

12.06.2025 13:36 — 👍 243 🔁 75 💬 12 📌 5

The craziest thing about this fight between Trump and Elon Musk is that Republicans are trying to take away health care from 16 million people to pay for tax cuts for billionaires.

05.06.2025 20:32 — 👍 5782 🔁 1578 💬 160 📌 96

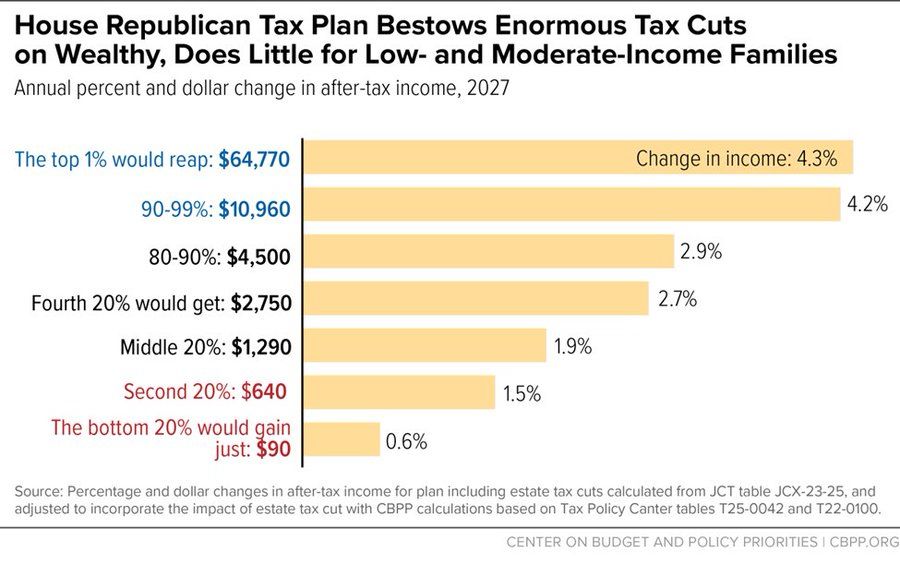

In DC an average of $44k will go to the top 1% (those w/inc over ~$1.3m) while the bottom 20% (inc under $26k) get $90 (until the tax cuts for lower inc folks expire). Paid for in part by the biggest ever cuts to health coverage and food assistance. Some serious reverse Robin Hood 💩.

24.05.2025 00:53 — 👍 2 🔁 1 💬 1 📌 0

There's a lotta concern about the short run (ie recession or not) implications of Trump's agenda. Dani is right to point to the long run as far far more consequential.

22.05.2025 23:28 — 👍 2715 🔁 607 💬 49 📌 9

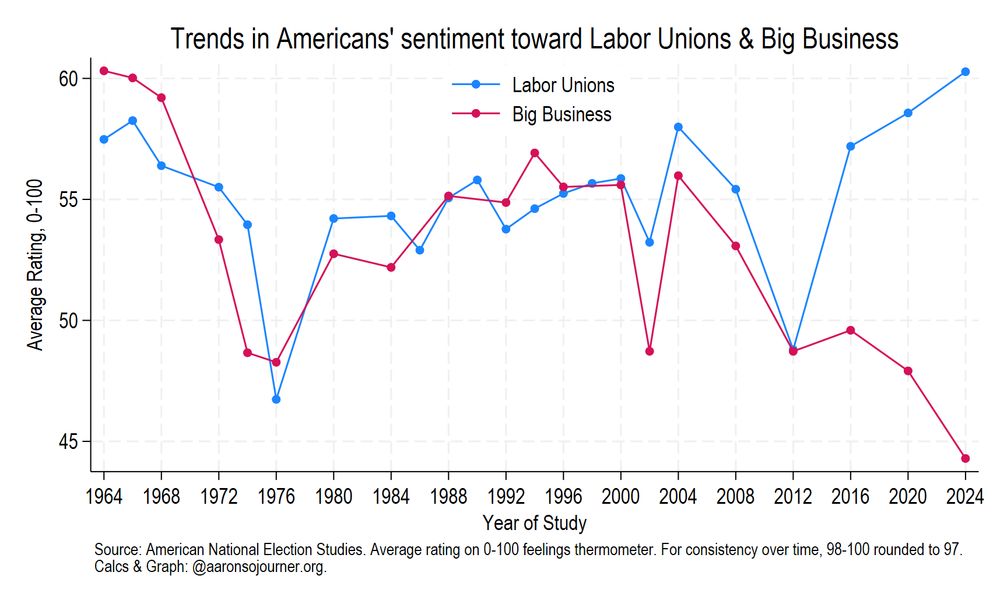

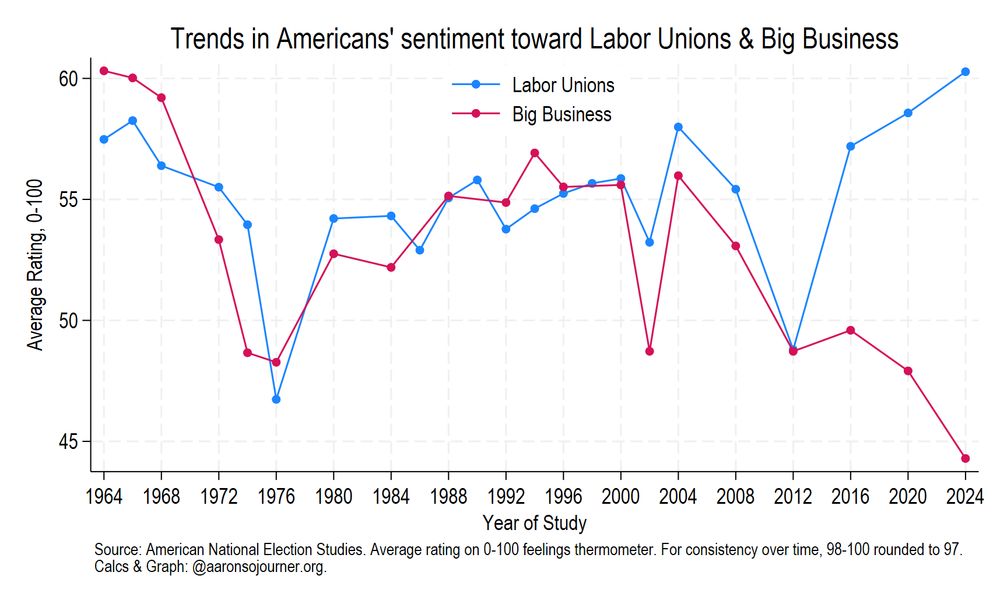

Americans favor labor unions over big business now more than ever, analysis of new data @epi.org from me & Adam Reich of Columbia Labor Lab.

In data back 60 years, Americans' sentiments are both warmer toward unions & cooler towards big business than ever before.

www.epi.org/blog/america...

20.05.2025 17:39 — 👍 1880 🔁 632 💬 39 📌 74

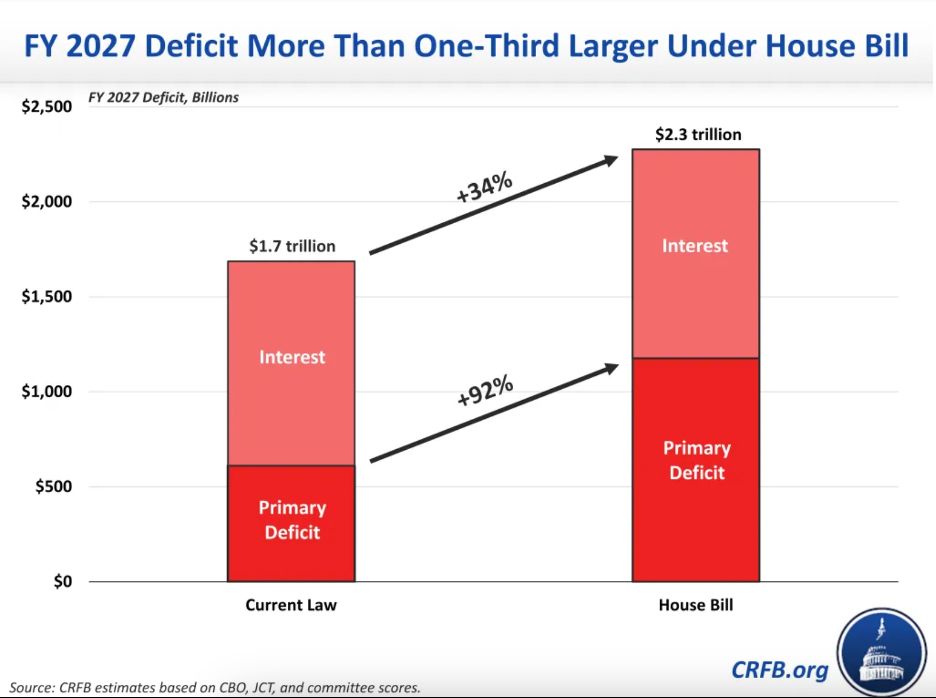

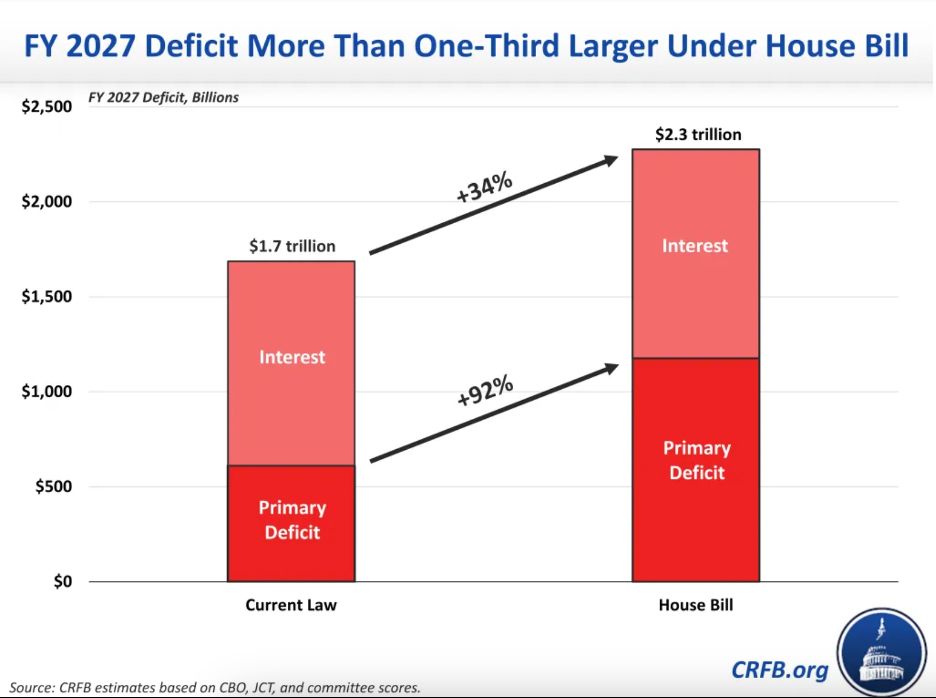

🧵 (1/4) There are four fundamental flaws of the House tax bill.

#1 It is fiscally irresponsible; all reputable sources agree. Bond markets & downgrades show US financial fragility; this is a bad time to take on trillions in additional debt toward no useful policy rationale.

21.05.2025 18:35 — 👍 26 🔁 13 💬 4 📌 1

This reported SALT deal and accelerated Medicaid cuts would make the bill even more effective at transferring resources from low-income to high-income households.

21.05.2025 01:53 — 👍 47 🔁 27 💬 1 📌 2

Official CBO analysis confirms the obvious: House Republican tax and budget bill isn't shared sacrifice.

It makes poor people poorer and rich people richer. It does this by cutting health care & nutrition to help finance tax cuts skewed to the wealthy.

www.cbo.gov/publication/...

21.05.2025 01:45 — 👍 549 🔁 252 💬 16 📌 15

Shame on Gov. Polis for vetoing legislation to restore collective bargaining rights CO workers have been denied for 80 years under arcane anti-union state law.

19.05.2025 14:21 — 👍 26 🔁 7 💬 2 📌 1

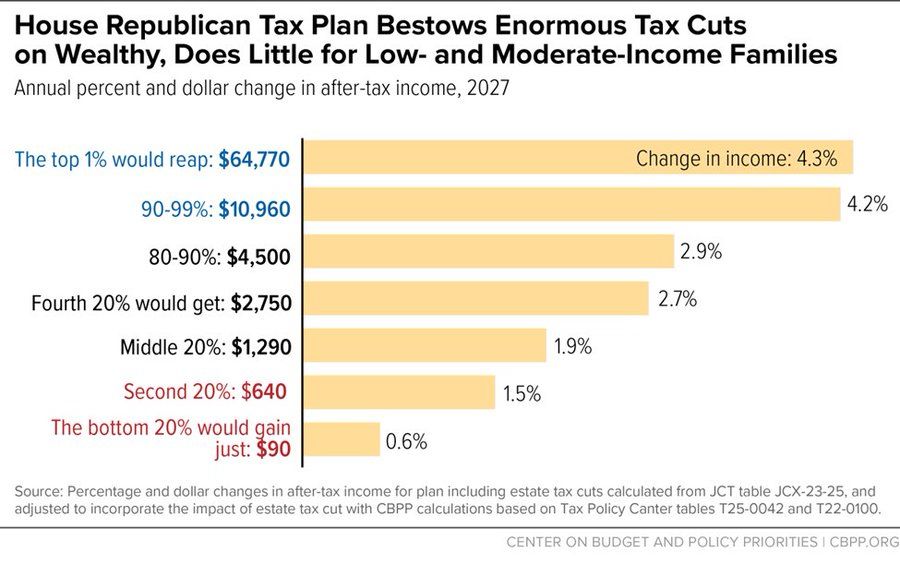

New @centeronbudget.bsky.social analysis of the draft GOP tax plan released yesterday:

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

14.05.2025 00:55 — 👍 614 🔁 256 💬 31 📌 21

D.C. Budget Fix Stalls in the House as Conservative Republicans Balk

It sure would be great if the party that purports to prioritize individual liberty would let the residents of the District of Columbia decide how they want to spend their own money. www.nytimes.com/2025/05/07/u...

07.05.2025 14:52 — 👍 1 🔁 0 💬 0 📌 0

Check out the distribution by income--it's egregious and remember that this will be compounded by plans for cuts to health care, food assistance, education, and every other good thing, to make way for tax cuts for the wealthy.

24.04.2025 14:51 — 👍 7 🔁 6 💬 0 📌 0

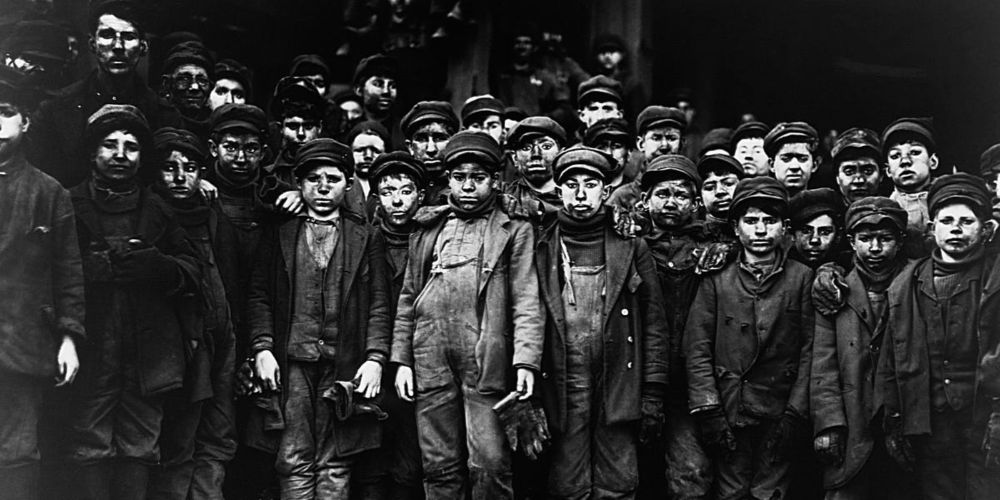

Trump tries to restore a grim era for American workers

Make Black Lung Great Again.

"People look back on the golden age of American manufacturing with fondness because it provided the elusive 'good jobs at good wages.' To the extent that was actually true, it was thanks to an interlocking series of policies that MAGA Republicans happen to hate." -- @snipy.bsky.social

09.04.2025 16:25 — 👍 1046 🔁 227 💬 46 📌 13

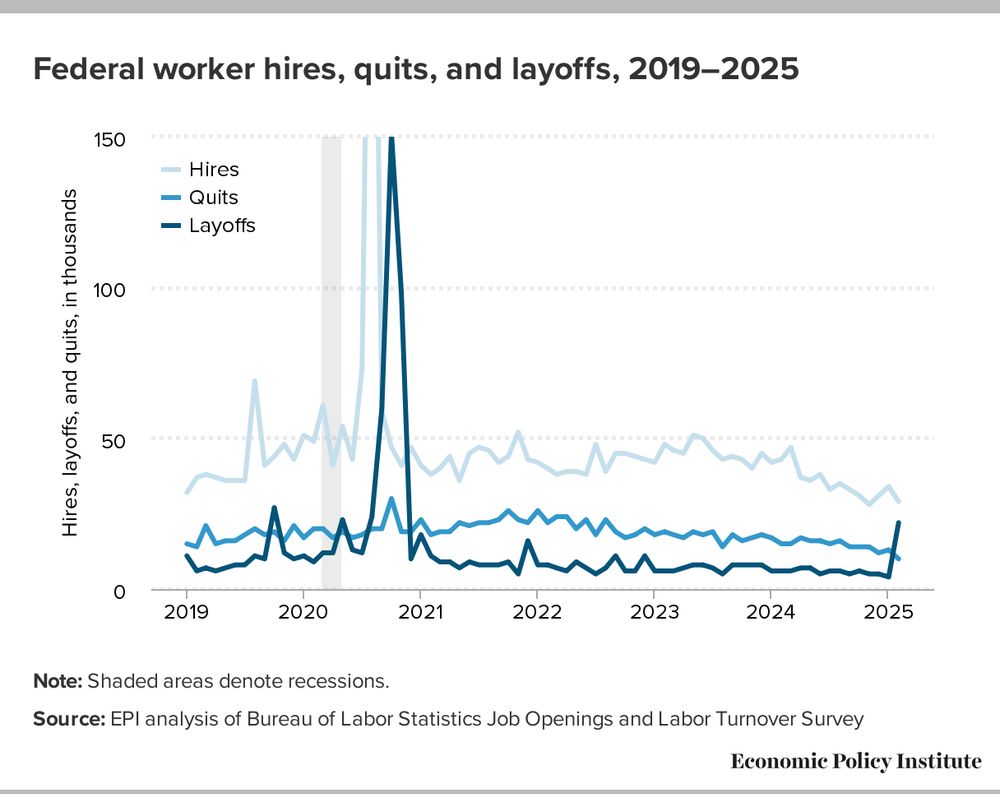

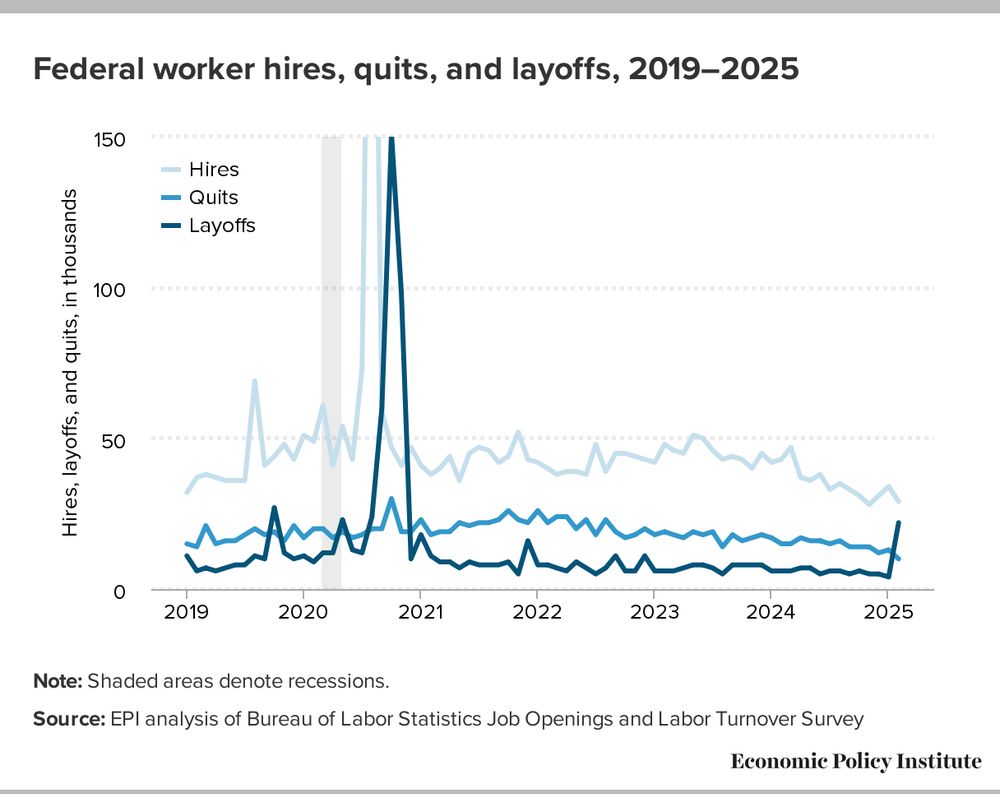

The topline numbers in the latest #NumbersDay report on Job Openings and Labor Turnover for February showed little changed in February, but we can see the fingerprints of recent policy decisions on the federal workforce. The data show 18,000 laid off federal workers in February.

01.04.2025 14:23 — 👍 39 🔁 12 💬 3 📌 0

Researching law and data at the intersection of immigration and labor for EPI.org

Visiting Scholar at UC Davis, Global Migration Center.

[Views expressed are personal]

Stop the wars, respect international law.

Clean the air, wear a mask 😷

Advancing the power of facts, globally 🌎

Investigative journalism in the public interest. Headlines and (sometimes literal) receipts.

Send us tips: propublica.org/tips

Macro-energy systems engineering, optimization & policy. Associate professor at Princeton University. Leads the ZERO Lab. Co-hosts SHIFT KEY podcast. Time100 Next & TIME100 Climate honoree. More at linkedin.com/in/jessedjenkins & zero.lab.princeton.edu

Researcher with @goodjobsfirst.org

I will post interesting, strange, stunning, good and bad things about economic development and business subsidies.

A publication that covers the nuts and bolts of political change: Boltsmag.org

Professional labor photographer. Unions for all. Birds. Whales. Cats. Hydration. Maybe a dash of democratic socialism. Not necessarily in that order. Too much optimism for the current moment.

Cute content skeeted often, not with the news cycle

🇺🇸🇲🇽 in MD. Building power w/ @nonprofitunion.bsky.social and researching @epi.org.

Visit: https://ora-cfo.dc.gov Contact: ora@dc.gov

A division of the DC Office of the Chief Financial Officer, ORA supports the budget and policymaking process with forecasts, estimates, and analyses that ensure the District's financial integrity.

CPSC Commissioner. Consumer advocate. Outdoorsman. Woodworker. Father of 2 young product safety testers👷♂️ 👨👩👧👦🌲 RTs, Follows, Likes ≠ Endorsements

Product safety hazard? Report it on saferproducts.gov

Senior Legal Analyst at the Open Markets Institute.

Newsletter: https://danielhanley.substack.com

Working to change public policy, rollback corporate power, rebuild local communities. Co-Executive Director at the Institute for Local Self-Reliance. Portland, Maine.

We are a group of journalists & scholars in policy & economics working at the vanguard of antimonopoly to achieve victories that empower everyone. Learn more: openmarketsinstitute.org

Founder 350.org and Third Act, author The Crucial Years on substack https://billmckibben.substack.com/

Author of 21 books, beginning with The End of Nature

Director, American Worker Project, Center for American Progress Senior Fellow, Virginia resident, Minnesotan forever

All my opinions are my own

Founder, State Futures; Co-Founder, Sister District. Building power in the states. Lawyer + health policy PhD. Thinking/reading/writing about federalism, state politics, and regulation in the public interest.

statefutures.org