My new casebook is the bestseller in corporate law on Amazon -->

19.08.2025 15:44 — 👍 6 🔁 0 💬 1 📌 0

My new casebook is the bestseller in corporate law on Amazon -->

19.08.2025 15:44 — 👍 6 🔁 0 💬 1 📌 0

Available at fine bookstores everywhere. Actually just Amazon: amazon.com/dp/B0FGQFW18W

09.07.2025 19:14 — 👍 3 🔁 0 💬 0 📌 0

I have aimed to make it modern, accessible, practical, and affordable. It's priced at $85. A statutes & rules supplement is available for $25.

The book includes up-to-date treatment of corporate law, which has changed quite a bit lately.

I published a new business organizations casebook.

09.07.2025 19:14 — 👍 6 🔁 0 💬 1 📌 0There is no need to be maximalist anti-tariff, which can be a useful tool to allow infant industries to thrive. That's especially true when praising an industrial policy that used tariffs!

14.04.2025 13:10 — 👍 26 🔁 2 💬 2 📌 0

"We spent the last 30 years coming to a new understanding as a country about what we need to do. And sometimes that means tariffs." -- Buttigieg

11.04.2025 11:51 — 👍 4 🔁 0 💬 0 📌 1me this morning www.nytimes.com/2025/04/09/o...

09.04.2025 13:16 — 👍 9903 🔁 2673 💬 396 📌 239Yep. The system is completely indefensible.

09.04.2025 10:13 — 👍 4 🔁 0 💬 0 📌 0What @jomichell.bsky.social says.

09.04.2025 09:49 — 👍 12 🔁 2 💬 0 📌 0

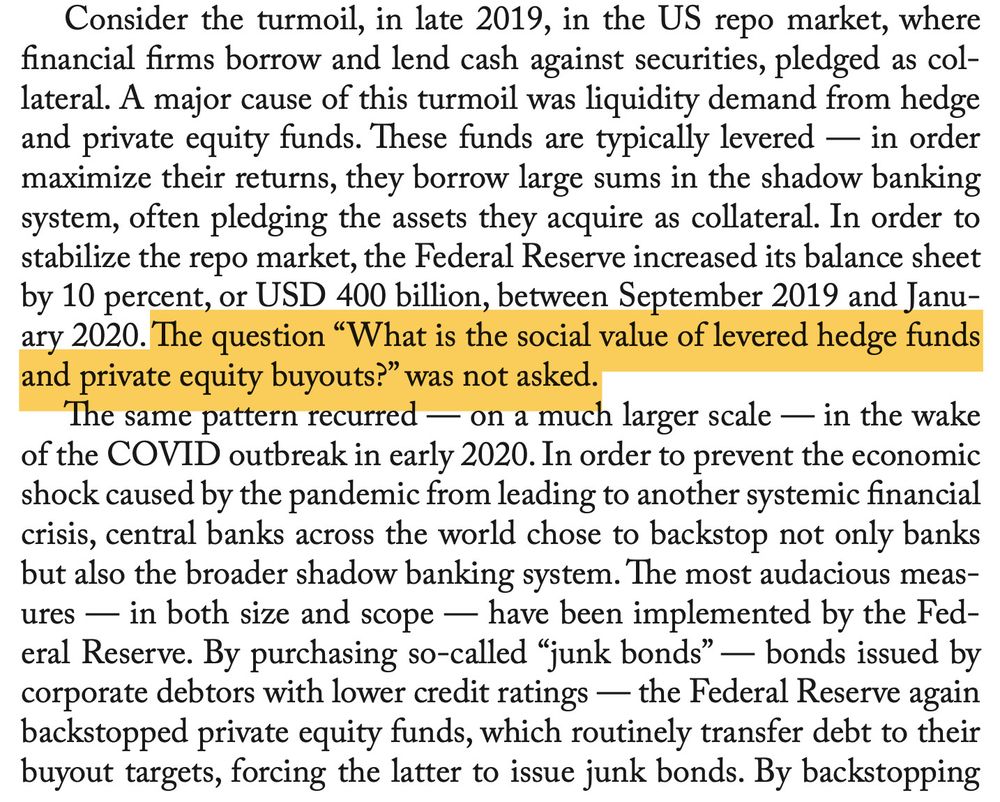

Consider the turmoil, in late 2019, in the US repo market, wherefinancial firms borrow and lend cash against securities, pledged as col-lateral. A major cause of this turmoil was liquidity demand from hedgeand private equity funds. These funds are typically levered — in ordermaximize their returns, they borrow large sums in the shadow bankingsystem, often pledging the assets they acquire as collateral. In order tostabilize the repo market, the Federal Reserve increased its balance sheetby 10 percent, or USD 400 billion, between September 2019 and Janu-ary 2020. The question “What is the social value of levered hedge fundsand private equity buyouts?” was not asked.The same pattern recurred — on a much larger scale — in the wakeof the COVID outbreak in early 2020. In order to prevent the economicshock caused by the pandemic from leading to another systemic financialcrisis, central banks across the world chose to backstop not only banksbut also the broader shadow banking system. The most audacious meas-ures — in both size and scope — have been implemented by the Fed-eral Reserve. By purchasing so-called “junk bonds” — bonds issued bycorporate debtors with lower credit ratings — the Federal Reserve againbackstopped private equity funds, which routinely transfer debt to theirbuyout targets, forcing the latter to issue junk bonds. By backstopping

both the money market and the (high-risk) capital market, the FederalReserve effectively protects both the liability side and the asset side oflevered investors’ balance sheets.In other words, the Federal Reserve ensures that the arsenal of themost predatory actors in the financial system is fully stocked and readyto be deployed — for further financializing currently distressed sectorsof the economy, such as elderly care. Shareholders understand — thestock price of firms such as Blackstone and Apollo bounced back spec-tacularly after the Federal Reserve announced its measures. Unless gov-ernments take swift and decisive action to curb the ability of hedge andprivate equity funds to gobble up assets, COVID will become a majormilestone in the long history of central bank-facilitated financialization.The upshot is that while central bank planning already exists, it iscurrently geared toward propping up a system in which the planning ofinvestment is in private hands. This system is both unfair and inefficient.Central banks have become the lenders of last resort for a manifestly un-sustainable status quo (Fontan, Claveau, and Dietsch 2016; Jacobs andKing 2016; Streeck 2014).

Time really is a circle. Leveraged hedge funds make billions; bets blow up; dash for cash; the Fed steps in; repeat. Here's what I wrote four years ago about central banks as guarantors of this unjust and inefficient (some might say: stupid) system.

benjaminbraun.org/assets/pubs/...

You may see care for the intellectually and developmentally disabled as a moral imperative. Private equity has been consolidating the field for the last decade because, well, because of money. Dan Boguslaw reports on a new study of PE's lucrative rollup, and the consequences:

18.03.2025 14:15 — 👍 91 🔁 47 💬 6 📌 2

Anyway here's how to do it

scholarship.law.columbia.edu/faculty_scho...

. @matt-levine.bsky.social unwittingly making the case for rate regulation in banking.

21.01.2025 13:53 — 👍 3 🔁 2 💬 1 📌 0

3/3:

20.01.2025 15:47 — 👍 2 🔁 0 💬 0 📌 0

2/3:

20.01.2025 15:47 — 👍 1 🔁 0 💬 1 📌 0

Austrian business cycle theory (1/3):

20.01.2025 15:47 — 👍 0 🔁 0 💬 1 📌 0

Interesting

20.01.2025 15:47 — 👍 3 🔁 1 💬 2 📌 0This should have been the central organizing question during the post-2008 financial reform process, but it wasn't. No real theory of the case.

17.01.2025 16:52 — 👍 3 🔁 0 💬 0 📌 0

.@matt-levine.bsky.social on Eurodollars.

The most fundamental question in all of finance is -- and for hundreds of years has been -- "who gets to issue money [dollars in this case] and subject to what constraints."

I haven't listened to part 3 yet but you absolutely cannot miss parts 1 and 2 of this podcast. Incredible stuff.

podcasts.apple.com/us/podcast/t...

OK, I'm already hooked.

15.01.2025 19:45 — 👍 8 🔁 3 💬 0 📌 0

Just arrived, excited to read this. @mkonings.bsky.social

15.01.2025 19:44 — 👍 12 🔁 1 💬 2 📌 0

My grandfather's 100th birthday!

29.12.2024 00:04 — 👍 10 🔁 0 💬 1 📌 0

Musk's apparent flouting of Exchange Act § 13(d) in 2022 without any legal repercussions tells you a lot about elite impunity in America.

(clip from recent @matt-levine.bsky.social newsletter)

Up next, @stefeich.bsky.social's contribution.

13.12.2024 23:25 — 👍 0 🔁 0 💬 0 📌 0Konings's introductory essay here is deep and has given me a lot to think about. I highly recommend it to anyone interested in finance and economic policy. Parts of it relate to what Lev Menand and I have called "the monetary-financial complex."

13.12.2024 23:25 — 👍 14 🔁 5 💬 2 📌 0

If we're going to be overhauling bank regulatory structure then may I humbly suggest:

13.12.2024 19:56 — 👍 14 🔁 6 💬 1 📌 0

It's amazing that the mainstream retail payment system is controlled by a duopoly, basically free from meaningful economic regulation.

It would be nice to see some leadership from the Fed in this area.

t.co/2qGESBLwBy

I'm looking for readings re: whether changes in US equity market structure from ~1997 to 2005 (order handling rules, regulation ATS, regulation NMS, etc.) contributed to the near-demise of the IPO market -- would be very grateful for any suggestions.

12.12.2024 20:04 — 👍 4 🔁 2 💬 1 📌 0

Great event here last month with Jonathan Kanter.

10.12.2024 16:33 — 👍 6 🔁 0 💬 0 📌 0