There is nothing unusual about the current level of US interest rates or their recent movement.

If anything, this is a yawningly normal interest rate environment.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

@nirkaissar.bsky.social

There is nothing unusual about the current level of US interest rates or their recent movement.

If anything, this is a yawningly normal interest rate environment.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

Institutional investors are looking to sell illiquid private assets.

Meanwhile, fund companies are looking for new ways to justify high fees.

The solution? Sell private asset funds to unsuspecting individual investors.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

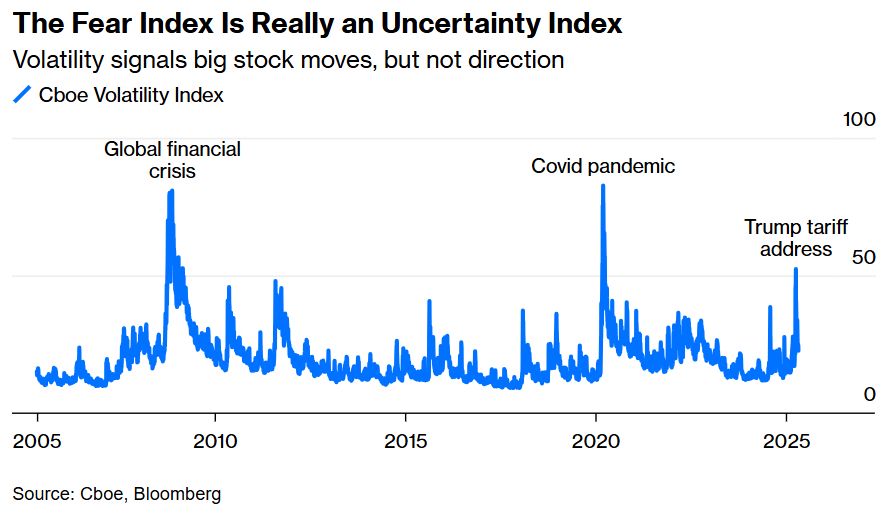

The VIX is misunderstood.

It forecasts the degree of S&P 500 price changes, not directionality.

When it spiked after Trump's tariff announcement, it signaled big gains or losses are likely to follow, and big gains are what we got.

@opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

My tribute to Warren Buffett, the philosopher king of investing.

🐐

www.bloomberg.com/opinion/arti... via @opinion.bloomberg.com

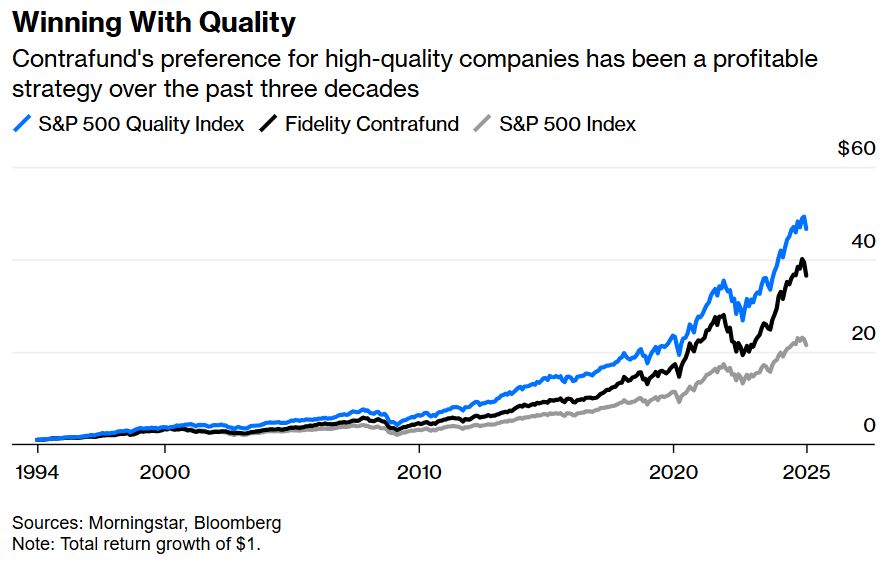

The measure of a professional stock picker used to be whether they can beat the market.

Now they must also beat indexes that mimic their style of stock picking and are probably tracked by a low-cost ETF.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

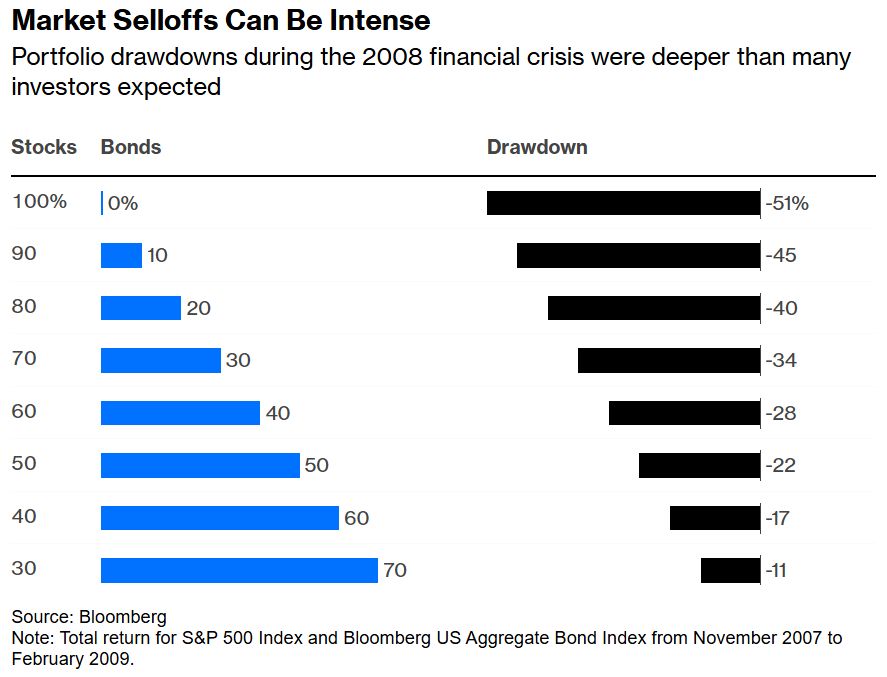

The best protection in a bumpy market is to know your drawdown tolerance: How much pain can you stomach?

Diversified portfolios can dip lower than people expect before they recover.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

.

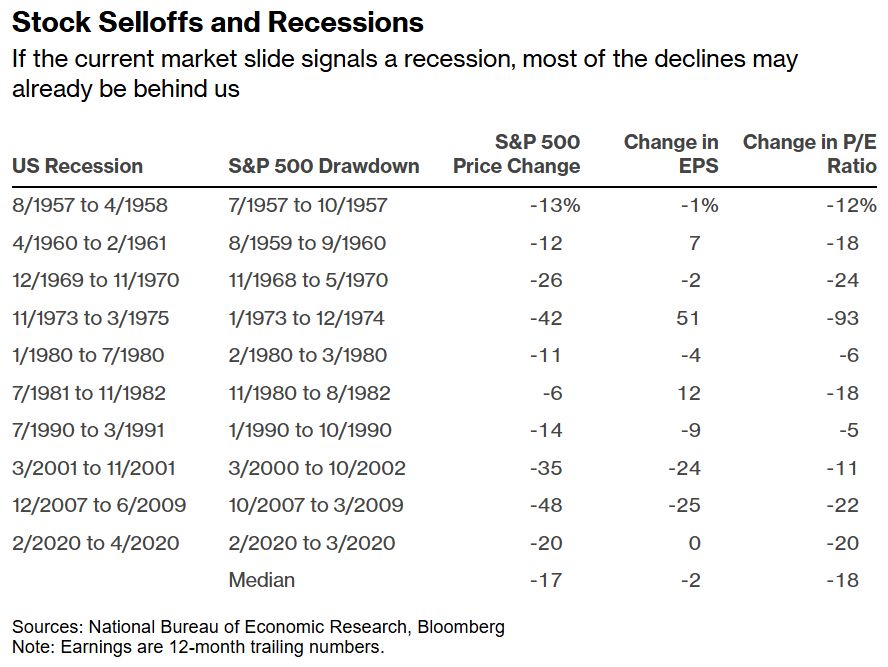

Markets are signaling a slowdown and possible recession, not a crisis.

If they're right, history suggests that the worst of the stock market selloff may already be behind us.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

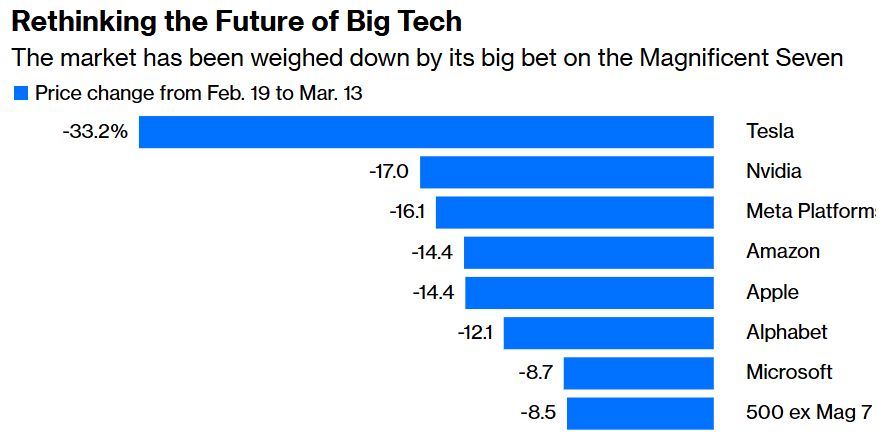

The recent US stock market correction was more about Big Tech's future than trade policy.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

Wowsers, this US growth stock reversal is moving fast.

Here's forward P/E for Russell 1000 Growth/Value back to 1995.

Was 2 SD high less than a month ago. Now nearing average.

📊 Markets

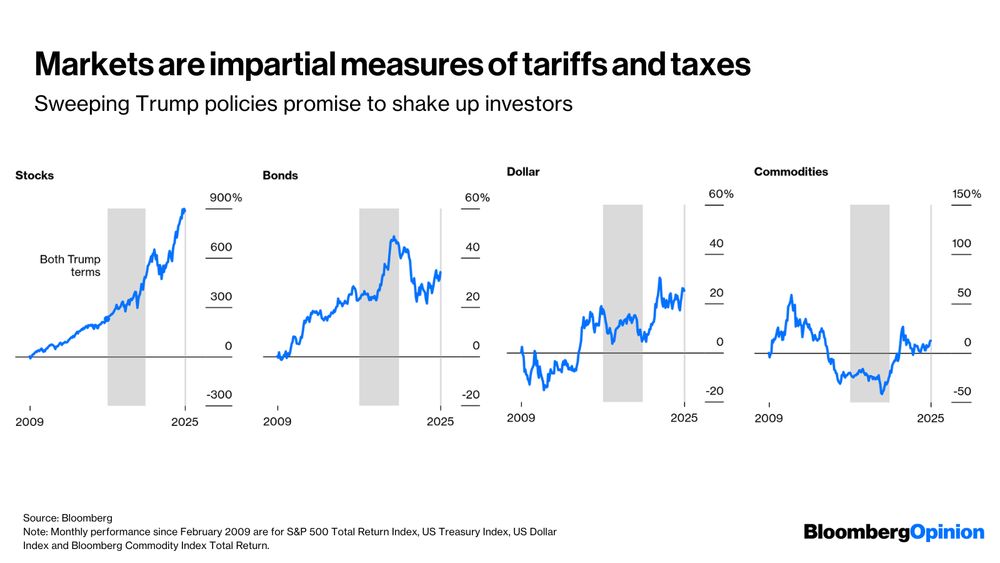

… don’t typically don’t care about presidents, but Trump seems intent on being the exception, says @nirkaissar.bsky.social, with sweeping policies around spending, taxes and tariffs:

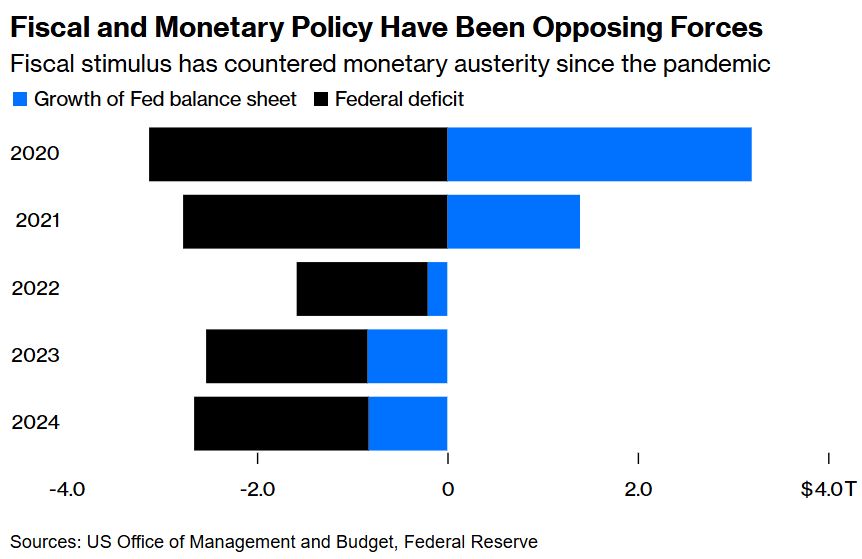

Spending cuts, or even the threat of them, could slow the economy and force the Fed to lower rates as Trump wants.

Fiscal stimulus has supported monetary tightening since the pandemic. Now it may be the other way around.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

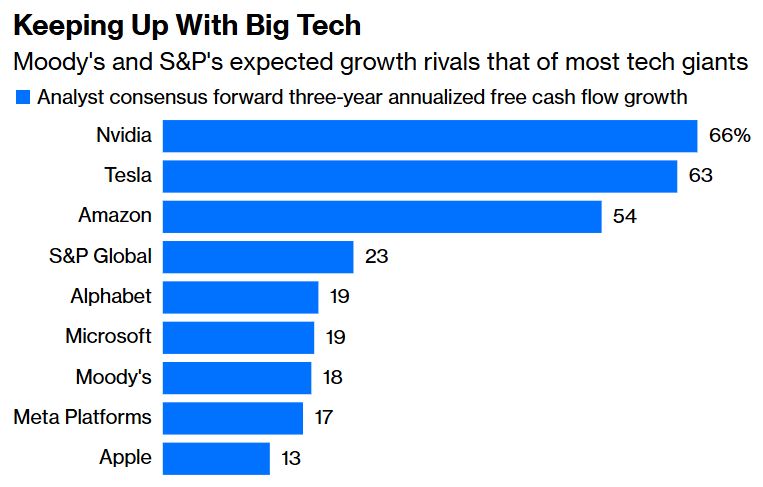

While everyone is watching the Mag 7, S&P and Moody's are building businesses that are just as sturdy and profitable as most of the tech giants.

And they're doing it with a major lift from the Mag 7.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

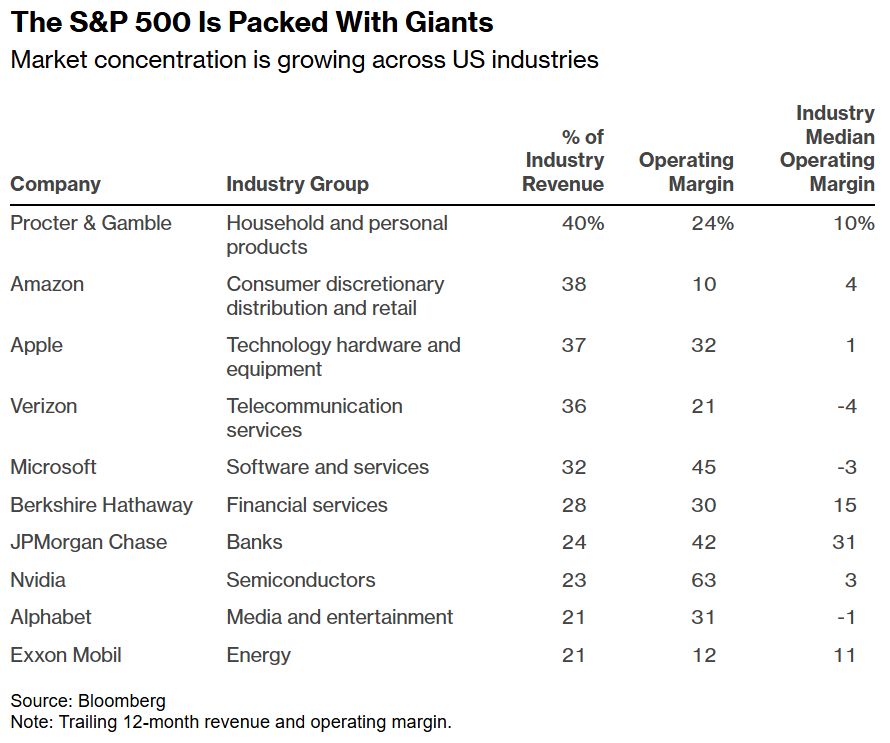

My latest @opinion.bloomberg.com: Don't look to S&P500 for the impact of tariffs.

It's dominated by companies that aren't in the path of tariffs or have the pricing power to pass on higher costs to consumers.

An unfazed S&P500 doesn't mean tariffs aren't biting.

www.bloomberg.com/opinion/arti...

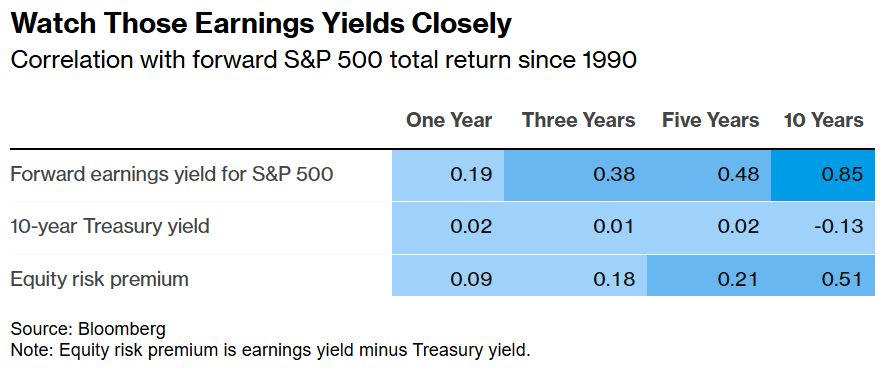

"There's concern rising Treasury yields are an ominous sign for stocks, especially after the 10-year eclipsed the S&P 500's earnings yield. That's the wrong place to look for an investing signal," says @nirkaissar.bsky.social www.bloomberg.com/opinion/arti... @opinion.bloomberg.com

10.01.2025 14:47 — 👍 2 🔁 1 💬 0 📌 0

Stock investors should pay more attention to earnings yields and less to interest rates.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

Get ready for new AI-driven investment products with big promises and high fees.

It'll be a boon for Wall Street. Not so much for investors.

My latest @opinion.bloomberg.com.

www.bloomberg.com/opinion/arti...

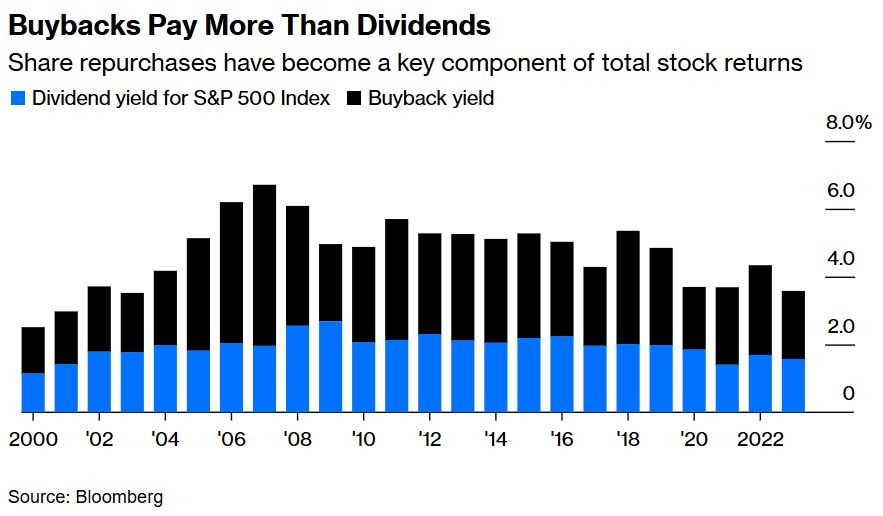

My ode to buybacks @opinion.bloomberg.com.

Stock investing would be poorer without them.

www.bloomberg.com/opinion/arti...

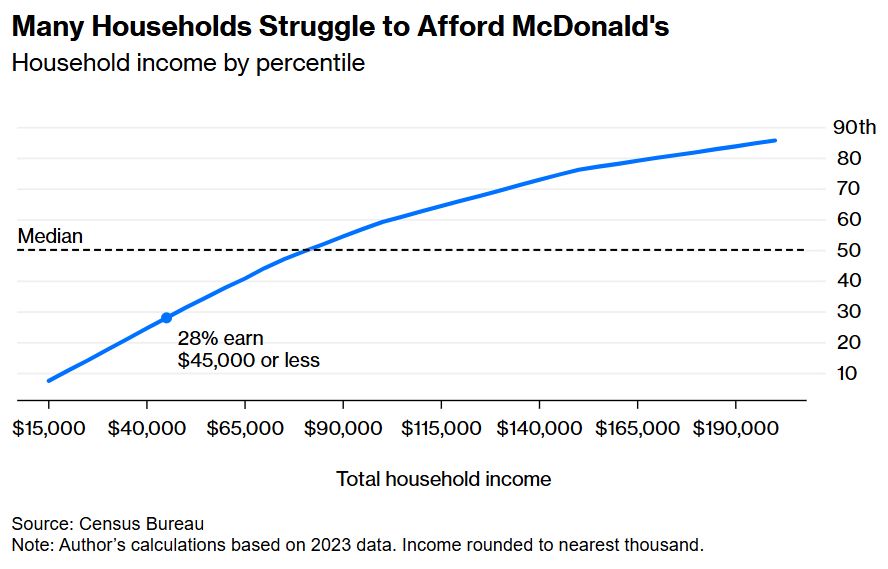

If higher inflation follows deficits or tariffs, companies shouldn't assume consumers will pick up the tab, as McDonald's has discovered.

My latest @opinion.bsky.social.

www.bloomberg.com/opinion/arti...

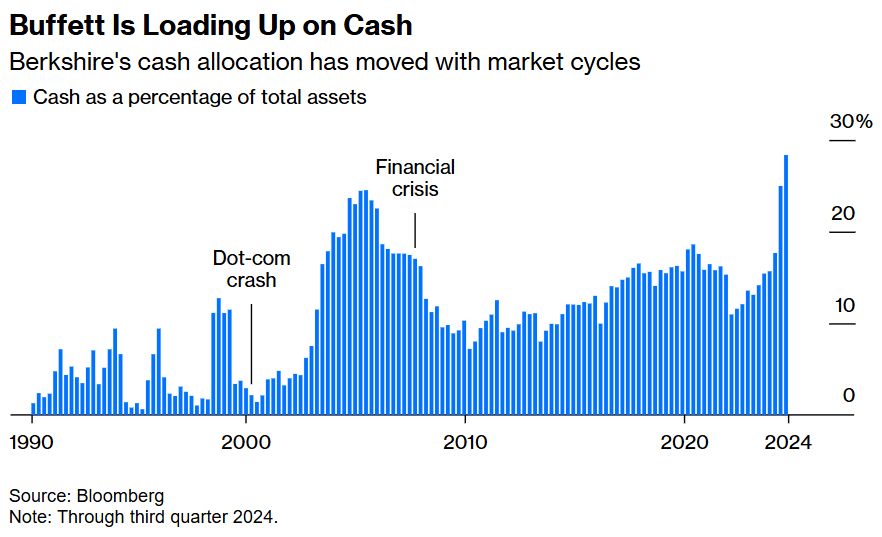

Berkshire Hathaway's cash allocation is a window into what Warren Buffett thinks about future US stock returns.

And the current allocation suggests he's bracing for a slowdown.

My latest @opinion.bsky.social.

www.bloomberg.com/opinion/arti...