NEW: Four big decisions for the 2025 Spending Review

@beeboileau.bsky.social, @maxwarner.bsky.social and @benzaranko.bsky.social explain why tough choices will be unavoidable at the upcoming Spending Review in our new briefing:

NEW: Four big decisions for the 2025 Spending Review

@beeboileau.bsky.social, @maxwarner.bsky.social and @benzaranko.bsky.social explain why tough choices will be unavoidable at the upcoming Spending Review in our new briefing:

EVENT: A look ahead to the 2025 Spending Review

Join us at 11am on Monday 2 June for analysis of the key choices at next month's Spending Review, with speakers @beeboileau.bsky.social and @instituteforgovernment.org.uk's @stuarthoddinott.bsky.social.

Sign up here: ifs.org.uk/events/look-...

New blog from @theifs.bsky.social suggesting that women who worked longer (because of higher state pension age) generally benefited from lower levels of cognitive decline. Those who did more physical jobs also benefited in terms of physical health, but the opposite was true for more sedentary jobs:

13.05.2025 10:13 — 👍 8 🔁 2 💬 0 📌 1

Woman looks through files in a cabinet. Image credit: Age Without Limits.

NEW: On average, working helps women in their 60s maintain cognitive function and delay the onset of physical disability.

Not all types of work are beneficial, however.

James Banks, Jonathan Cribb, Carl Emmerson and @david-sturrock.bsky.social summarise their new research:

And here is the underlying research, forthcoming in the journal Labour Economics, authored with James Banks, Jonathan Cribb and Carl Emmerson

www.sciencedirect.com/science/arti...

Here is the @theifs.bsky.social comment:

ifs.org.uk/articles/wor...

Our results mean that longer working has the potential to be positive for at least some health outcomes. The effects depend on the type of work and what people would be doing if they retire. Policymakers should therefore consider encouraging social interactions and physical exercise in retirement 7/

13.05.2025 08:50 — 👍 1 🔁 1 💬 1 📌 0This evidence complements a number of studies in other settings that tends to show work is good for cognition but finds mixed results for other outcomes. Our study is also not the last word- there are other aspects of health and effects could change when looking over longer time horizons. 6/

13.05.2025 08:50 — 👍 0 🔁 0 💬 1 📌 0However, the effects varied by the type of job. Jobs with some physical activity were good for preventing disability but sedentary jobs were actively harmful. We found that work caused women in non-sedentary jobs to do less exercise. 5/

13.05.2025 08:50 — 👍 0 🔁 0 💬 1 📌 0On average, being in work prevented the onset of physical disability. Those in work performed better in a walking speed test and reported fewer difficulties with mobility. 4/

13.05.2025 08:50 — 👍 0 🔁 0 💬 1 📌 0The benefits were larger for single women. This suggests that it’s those who live alone - who are more likely to see a drop of in social interactions upon retirement - who gained the most from work 3/

13.05.2025 08:50 — 👍 0 🔁 0 💬 1 📌 0On average, staying in work in your 60s is good for cognitive functioning of women. This was measured by performance on tests including a word recall test. 2/

13.05.2025 08:50 — 👍 0 🔁 0 💬 1 📌 0

NEW:The government continues to increase the state pension age. Next year it’ll start going up from 66 to 67.

Some people choose to - or need to - work longer as a result. Does it run down their health? Or can work keep you young?

We investigated for women whose pension age rose in the 2010s… 1/

Looking forward to speaking at this event tomorrow morning on the challenges faced by people managing their pension wealth in retirement.

Do come along for some discussion of what one Nobel Prize-winning economist called 'the nastiest, hardest problem in finance' (!)

Read the full report here and come along to our event later!

9/9

ifs.org.uk/publications...

There’s a potential role for government to increase awareness of Sharia compliant options and reduce the hassle cost of switching to them. Also implications for thinking about increasing automatic enrolment default rates. 8/

23.01.2025 08:51 — 👍 1 🔁 0 💬 1 📌 0

Opting out of a pension means forgoing the benefits of an employer pension contribution and tax relief. We estimate that doing this over a whole working life could mean losing out on £16.5k or a 60% increase in retirement income for a typical Pakistani or Bangladeshi employee. That’s a lot! 7/

23.01.2025 08:51 — 👍 0 🔁 0 💬 1 📌 0In the private sector, employees are typically enrolled into DC pension schemes where default asset allocations are not in line with these teachings. However, employees typically have the option to change to a Sharia-compliant fund. 6/

23.01.2025 08:51 — 👍 1 🔁 0 💬 1 📌 0Higher opt-out rates for Pakistani and Bangladeshi employees exist in both the public and private sectors despite the fact that saving in public service pensions is generally understood to be consistent with Islamic teaching. 5/

23.01.2025 08:51 — 👍 0 🔁 0 💬 1 📌 0

Islamic teaching is typically seen as prohibiting receiving income from interest and investing in ‘unethical’ industries such as alcohol or tobacco. Muslims who report that their religion makes a greater difference to their life are particularly likely to opt out of workplace pensions. 4/

23.01.2025 08:51 — 👍 0 🔁 0 💬 1 📌 0

There is a wide range of evidence that religious beliefs and/or norms in Islam are important in driving higher opt-out rates, and 90% of Pakistani and Bangladeshi individuals are Muslims. 3/

23.01.2025 08:51 — 👍 0 🔁 0 💬 1 📌 0

The much higher opt-out rates for employees of Pakistani or Bangladeshi origin cannot be explained by differences in earnings, age, education levels, or the characteristics of the job or of their employer 2/

23.01.2025 08:51 — 👍 0 🔁 0 💬 1 📌 0

NEW @theifs.bsky.social report: Employees Pakistani and Bangladeshi background are around twice as likely to opt out of workplace pensions as other employees 1/

23.01.2025 08:51 — 👍 5 🔁 3 💬 2 📌 1

EVENT: Ethnicity gaps in pension participation

Thurs 23 Jan 2025 | 2pm – 3pm | Online

We present new findings on ethnic gaps in pension participation rates, with Taha Choukhmane, Athina Vlachantoni, @laurenceobrien.bsky.social and Carl Emmerson.

Sign up here: ifs.org.uk/events/ethni...

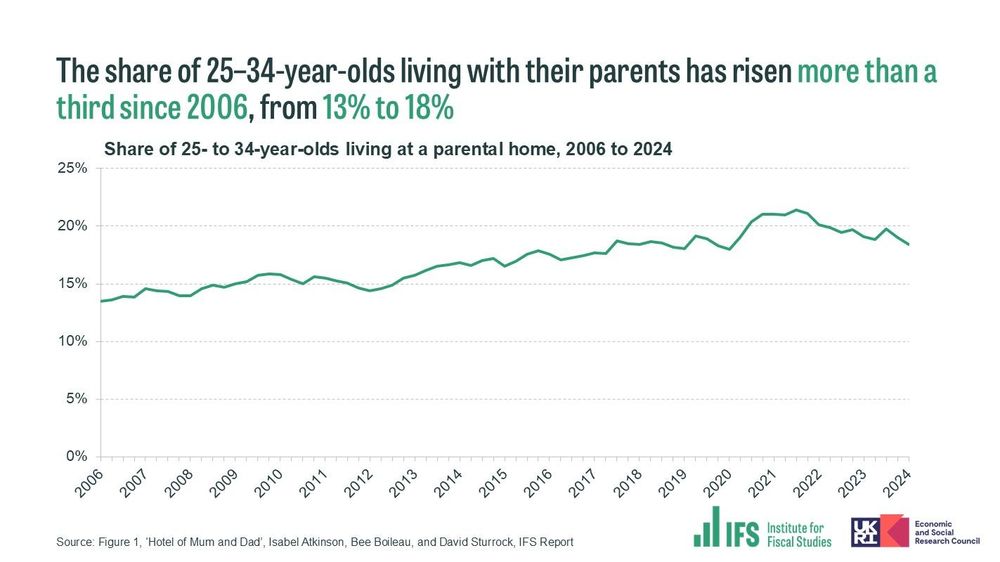

Lots of UK #housing news to digest at a time when nearly one in five 25-34 year olds are living in their parental home; notably, growing reliance on ‘the hotel of mum and dad’ is associated with ‘increased reported experience of ill health’ in this age cohort.

11.01.2025 10:21 — 👍 5 🔁 2 💬 0 📌 0

NEW: 18% of UK 25-34-year-olds are living with their parents, up more than a third since 2006.

@beeboileau.bsky.social, @david-sturrock.bsky.social and Isabel Atkinson's new report the ‘Hotel of Mum and Dad’ looks at who lives with parents, why and the implications for their savings.

[THREAD: 1/9]

This intergenerational support is quite different to direct transfers of wealth. Much more commonly received among lower income people and given by lower wealth parents than direct wealth transfers. More here: ifs.org.uk/publications... 10/10

11.01.2025 08:23 — 👍 1 🔁 0 💬 0 📌 0For some, perhaps particularly if wanting to live in high paying but high housing cost areas like London, having parents willing and able to house you as you start your career could be a welcome opportunity to build savings. For others it can be a safety net in tougher times. 9/

11.01.2025 08:23 — 👍 1 🔁 0 💬 1 📌 0But we also see that those living at home are more likely to see falls in their wealth. This is consistent with some of that group living with parents due to adverse events like job loss or separation from a partner. 8/

11.01.2025 08:23 — 👍 1 🔁 0 💬 1 📌 0

Living with parents can mean saving on rent - about £560 per month typically, rising to £1000 in London.

14% of those living at home built up more than £10k in extra savings over a 2-year period. That was a rate about 30% higher than for an equivalent group of private renters. 7/