Thanks that's really useful advice about running! I do feel I do the "running" bit a lot, but maybe not the others, whether it's strength, eating the right things etc.

09.12.2025 16:47 — 👍 0 🔁 0 💬 1 📌 0

Cycling is a definitely an option. Hopefully will get back to running soon, although this time will be working on my technique a lot more.. maybe need to mix it up with more gym too.

09.12.2025 16:15 — 👍 0 🔁 0 💬 1 📌 0

Probabilistic intraday electricity price forecasting using generative machine learning papers.ssrn.com/sol3/papers.... #QuantLinkADay

09.12.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

What's a good exercise to do, if you can't run for the time being (and love running!)? I'm trying swimming, but I just can't get into it!

09.12.2025 10:48 — 👍 0 🔁 0 💬 1 📌 0

Exchange Rate Regime Flexibility and Firms' Employment papers.ssrn.com/sol3/papers.... #QuantLinkADay

08.12.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

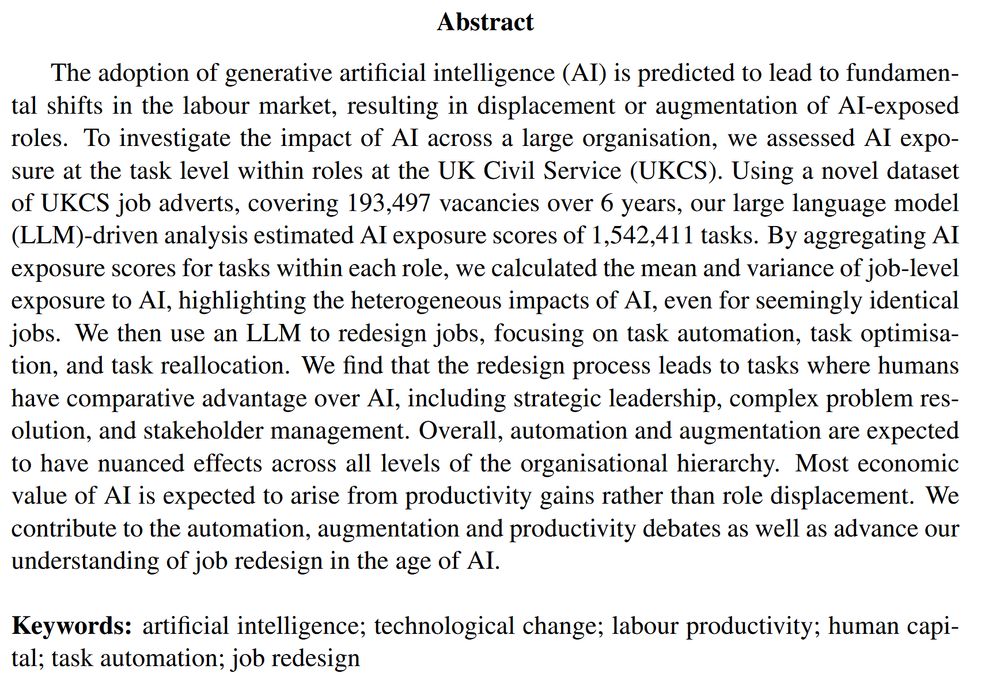

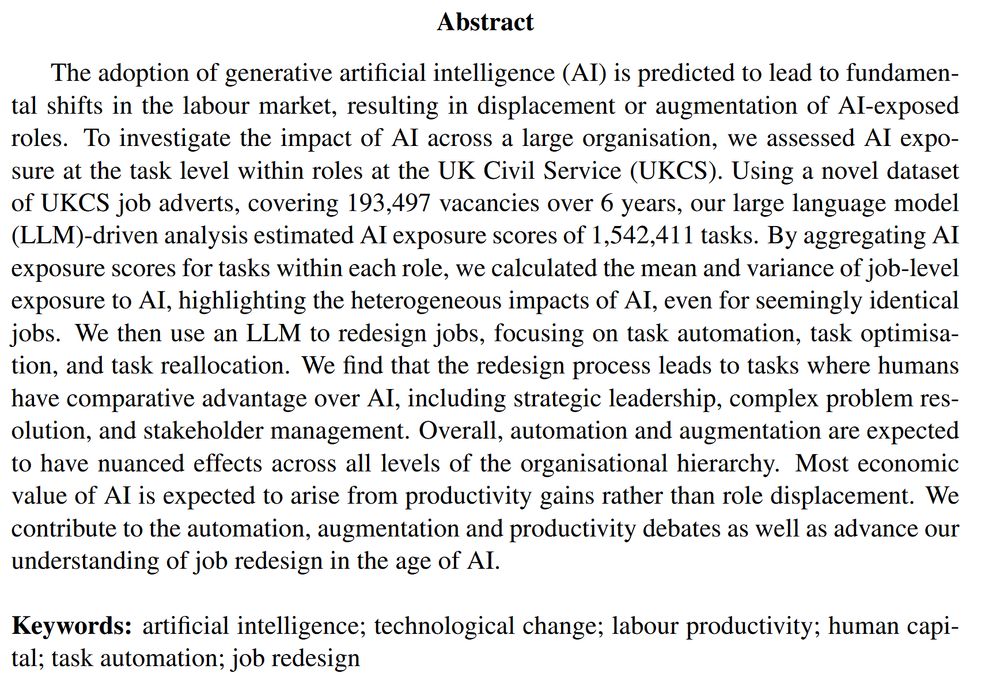

Beyond Automation: Redesigning Jobs with LLMs to Enhance Productivity arxiv.org/pdf/2512.05659 #QuantLinkADay

08.12.2025 09:39 — 👍 1 🔁 0 💬 0 📌 0

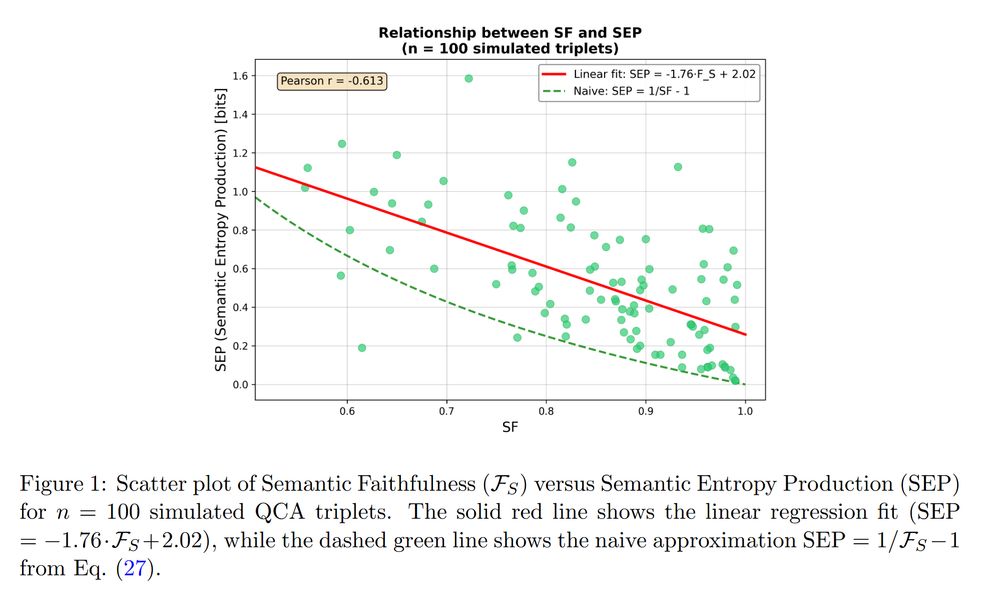

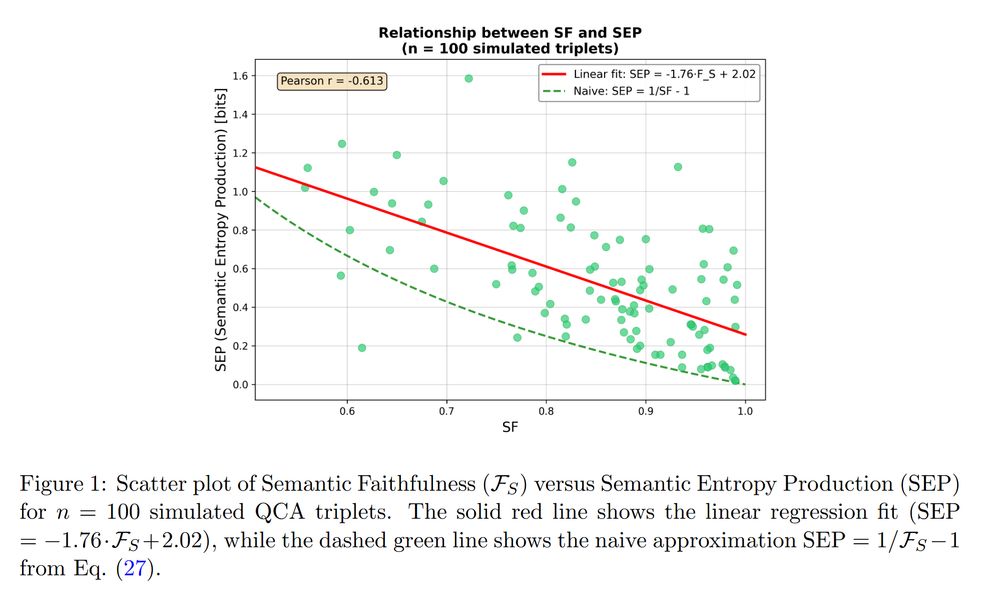

Semantic Faithfulness and Entropy Production Measures to Tame Your LLM Demons and Manage Hallucinations arxiv.org/abs/2512.05156 #QuantLinkADay

08.12.2025 09:35 — 👍 1 🔁 0 💬 0 📌 0

Yes I’d make an exception for an Ethernet cable.. although guess there’s a higher return for the seller than the buyer there 😀

07.12.2025 19:46 — 👍 1 🔁 0 💬 1 📌 0

Like he says in the article there’s an element of diminishing returns to actually noting the difference.. but maybe sound quality is overrated anyway? Music you like is a lot better at a concert played live, even if it’s being pumped out too loud for you to hear the details 😀

07.12.2025 18:55 — 👍 0 🔁 0 💬 1 📌 0

When does Monetary Policy Matter? Policy Stance vs. Term Premium News papers.ssrn.com/sol3/papers.... #QuantLinkADay

05.12.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

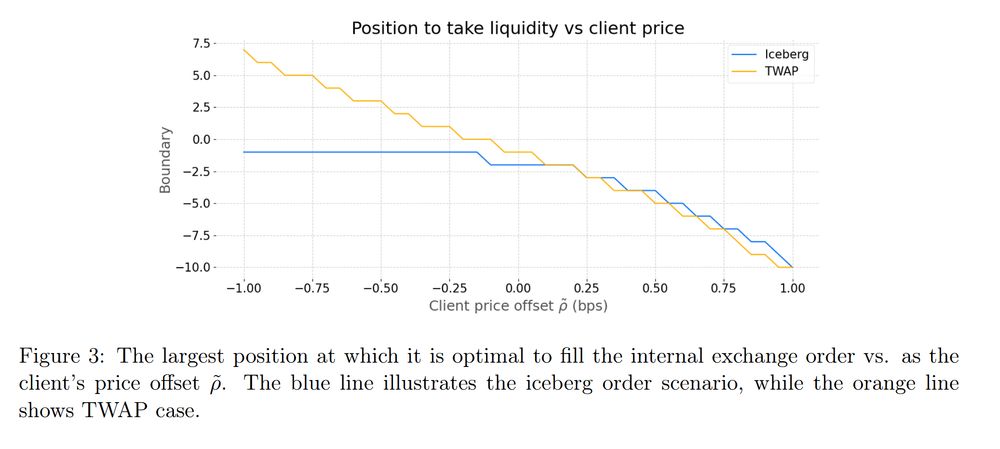

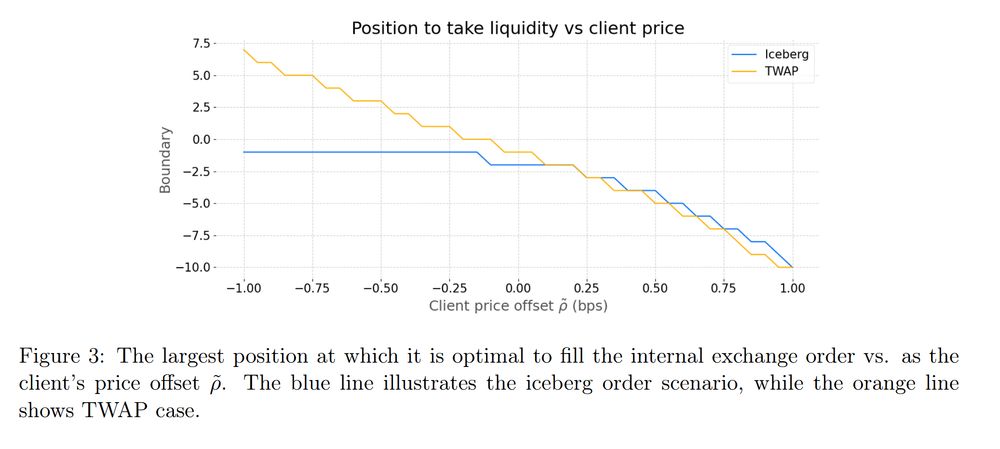

FX Market Making with Internal Liquidity arxiv.org/abs/2512.04603 #QuantLinkADay

05.12.2025 10:16 — 👍 0 🔁 0 💬 0 📌 0

The Predictability of Global Monetary Policy Surprises www.bostonfed.org/publications... #QuantLinkADay

03.12.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

Inflation narratives and expectations www.ecb.europa.eu/pub/pdf/scpw... #QuantLinkADay

02.12.2025 13:00 — 👍 1 🔁 0 💬 0 📌 0

More Is More: Leveraging Missing Data in Commercial Real Estate with Machine Learning papers.ssrn.com/sol3/papers.... #QuantLinkADay

01.12.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

Credit-Market Sentiment: Estimation and Macroeconomic Implications papers.ssrn.com/sol3/papers.... #QuantLinkADay

30.11.2025 22:21 — 👍 0 🔁 0 💬 0 📌 0

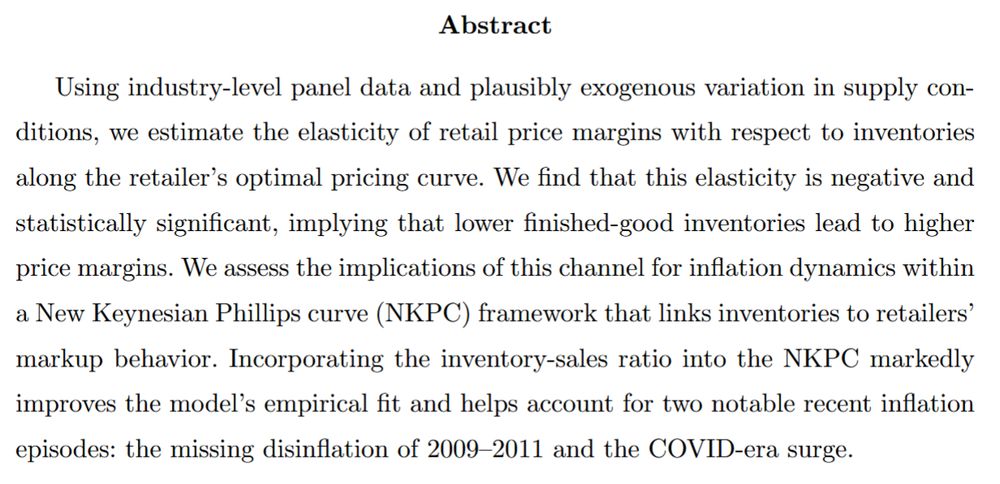

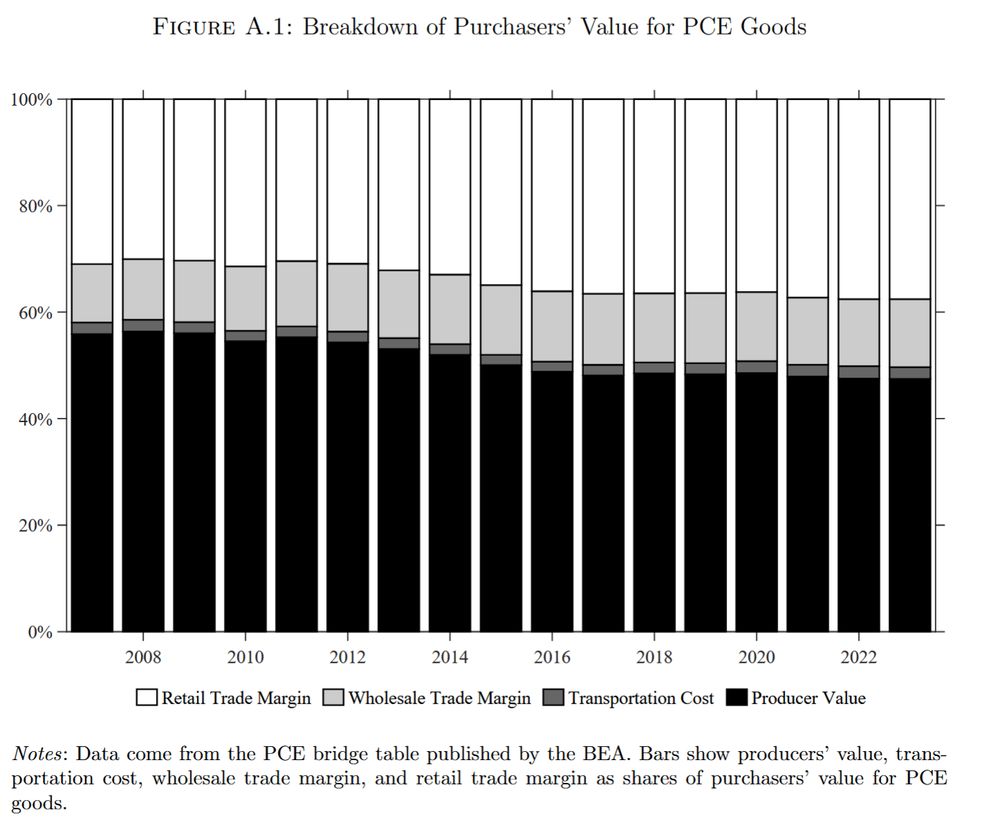

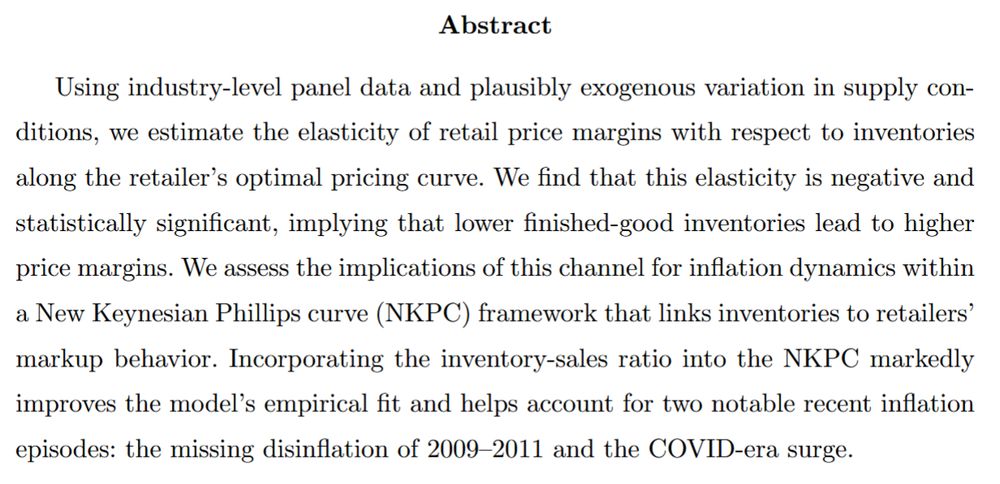

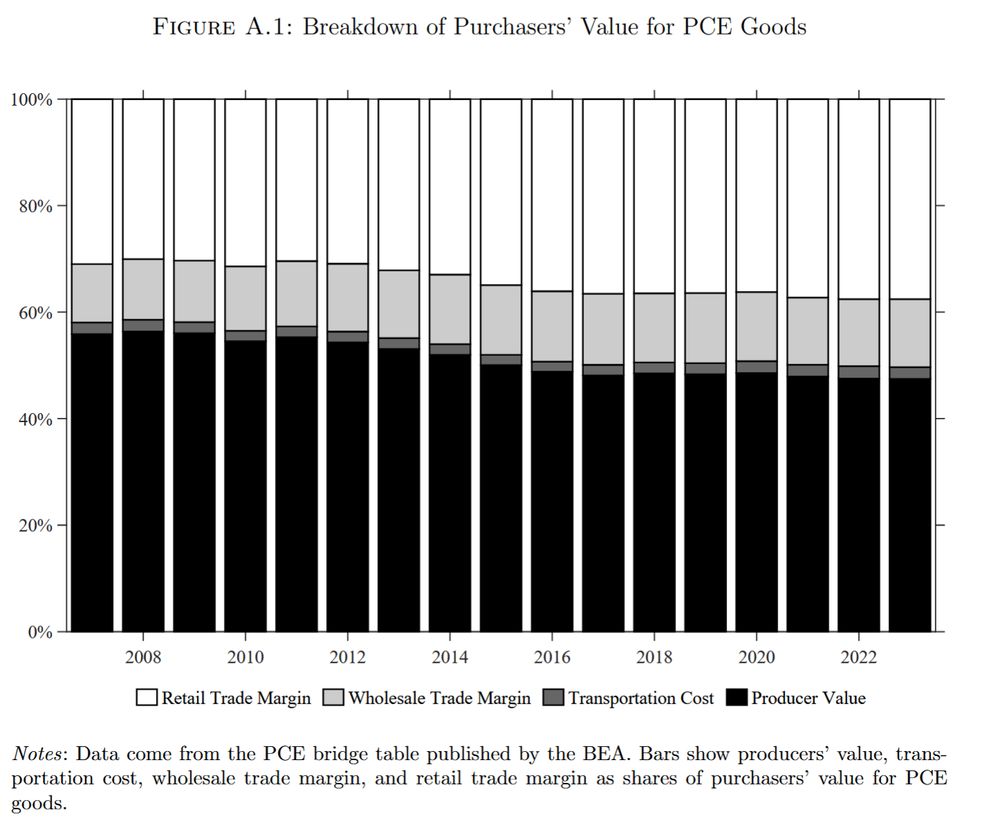

Retail inventories and inflation dynamics: The price margin channel www.federalreserve.gov/econres/ifdp... #QuantLinkADay

30.11.2025 22:20 — 👍 3 🔁 0 💬 0 📌 0

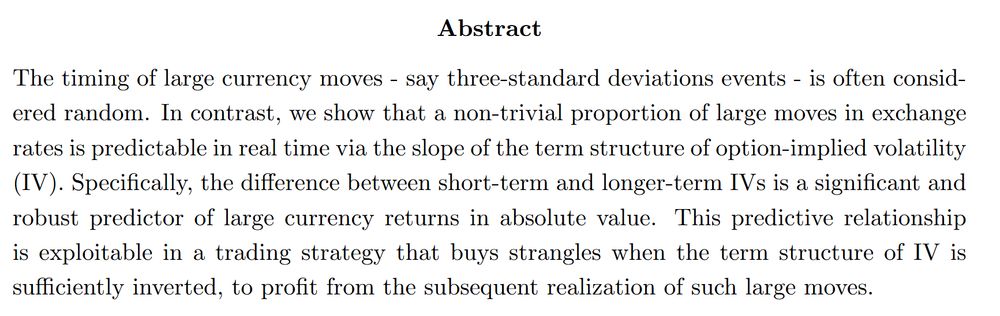

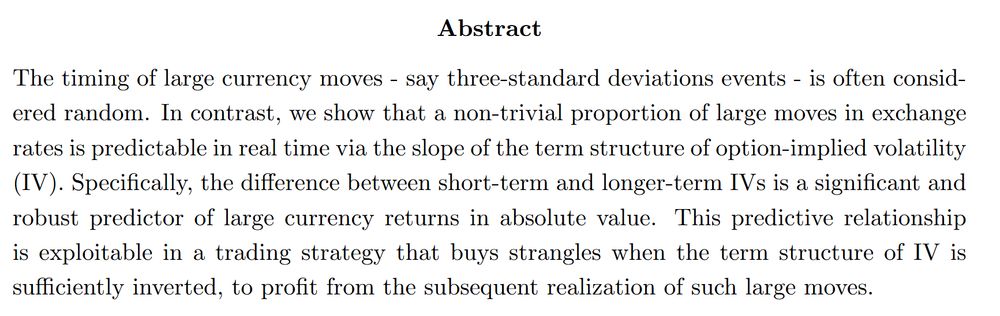

Large Moves in the Foreign Exchange Market papers.ssrn.com/sol3/papers.... #QuantLinkADay

28.11.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

Some people are not cool enough.

28.11.2025 09:15 — 👍 1 🔁 0 💬 0 📌 0

The Macroeconomics of Media Slant papers.ssrn.com/sol3/papers.... #QuantLinkADay

27.11.2025 17:16 — 👍 1 🔁 0 💬 0 📌 0

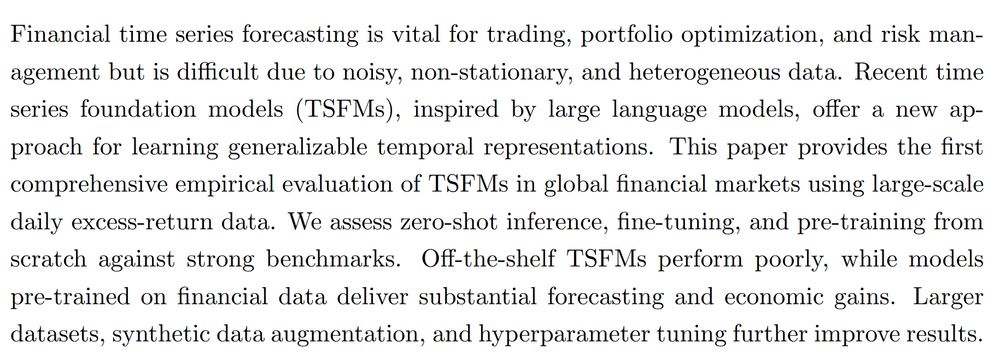

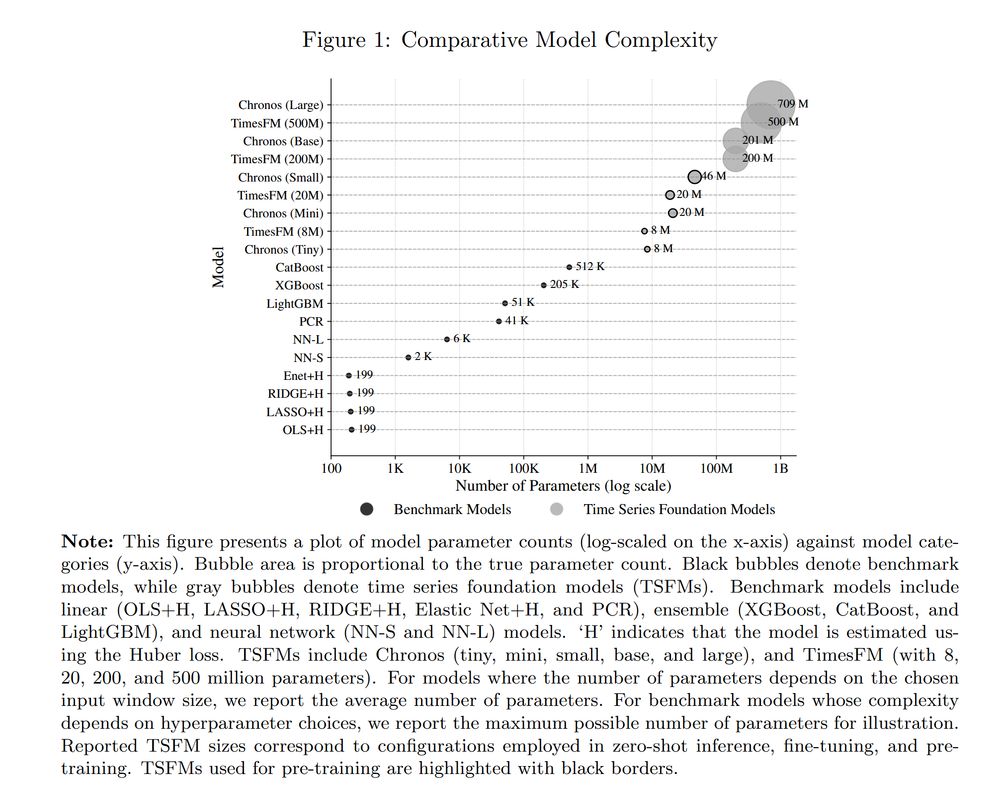

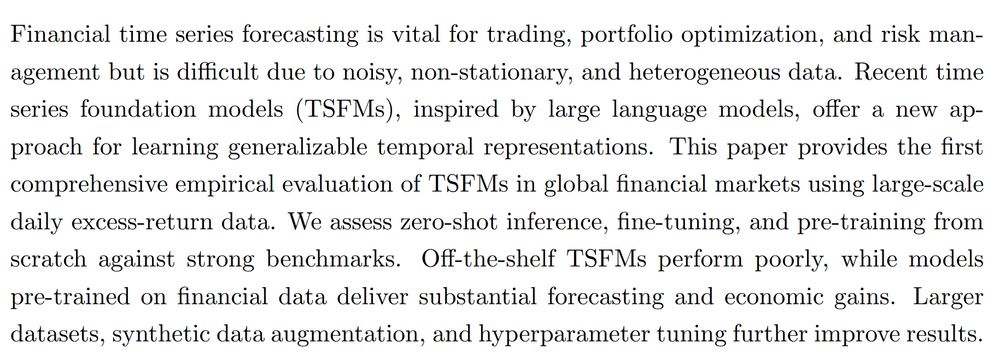

Re(Visiting) Time Series Foundation Models in Finance arxiv.org/abs/2511.18578 #QuantLinkADay

26.11.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

Narratives to Numbers: Large Language Models and Economic Policy Uncertainty arxiv.org/abs/2511.17866 #QuantLinkADay

25.11.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

Thanks for the shoutout!

24.11.2025 15:54 — 👍 1 🔁 0 💬 0 📌 0

Link to the full article at turnleafanalytics.com/quantminds-l...

24.11.2025 15:54 — 👍 1 🔁 0 💬 0 📌 0

I wrote about my takeaways from the recent @QuantMinds conference.. a lot on AI! Link to the full article is in the next tweet..

24.11.2025 15:54 — 👍 0 🔁 0 💬 1 📌 0

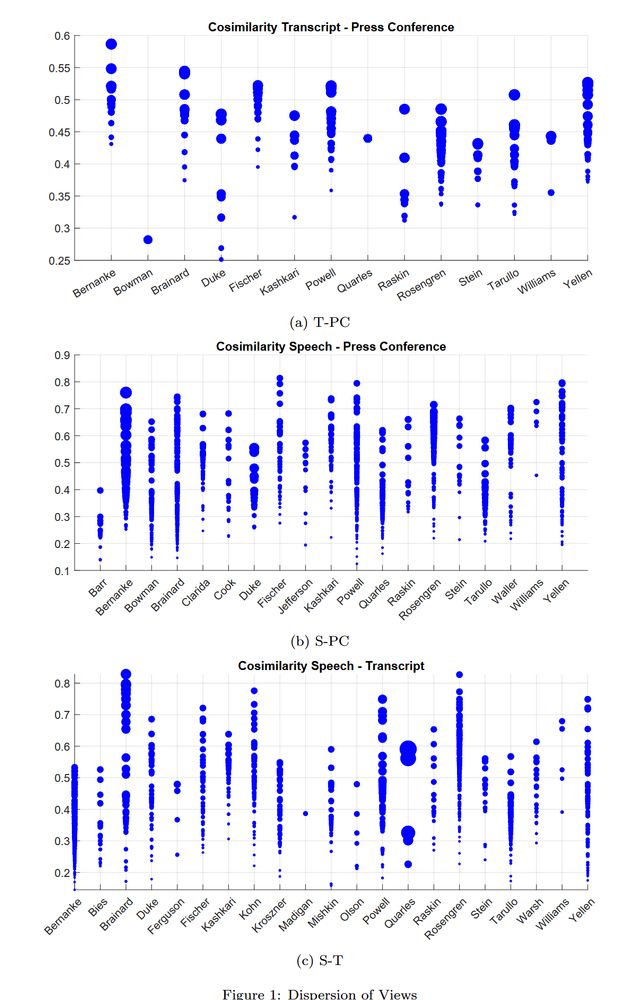

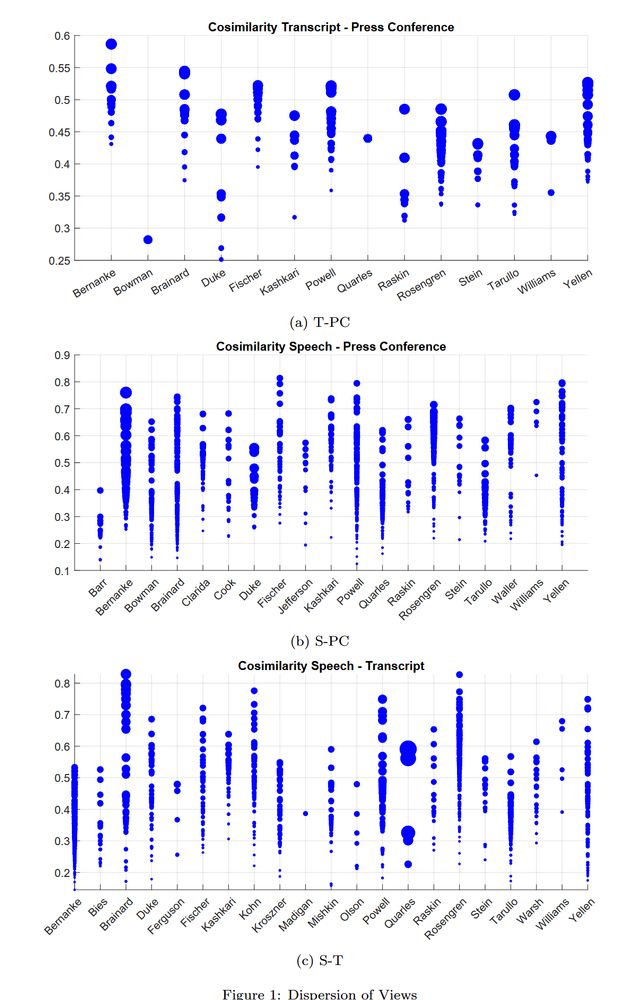

One Fed, Many Voices: Coordinated Communication vs. Transparent Debate papers.ssrn.com/sol3/papers.... #QuantLinkADay

24.11.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

No one says “in the sea” anymore?

23.11.2025 21:55 — 👍 0 🔁 0 💬 0 📌 0

A Millennium of UK Business Cycles: Insights from Structural VAR Analysis arxiv.org/abs/2511.15643 #QuantLinkADay

23.11.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

Financial Information Theory arxiv.org/abs/2511.163... #QuantLinkADay

23.11.2025 13:00 — 👍 1 🔁 0 💬 0 📌 0

The value of trading relationships in FX derivatives: evidence from Credit Suisse's collapse www.bankofengland.co.uk/working-pape... #QuantLinkADay

21.11.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

A New Proposal For Forecasting Inflation In The Eurozone. A Global Model papers.ssrn.com/sol3/papers.... #QuantLinkADay

20.11.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

Tech/Finance, Scala, Python

Curated links from the quantitative trading blogosphere.

https://Quantocracy.com/

ML Eng. and econometrics. Lot more left-posting than normal. Some hobby-level finance

Regrettably degen trading for the next 3 months, im sorry

Views dont reflect my employer

🚵- ⛷️ bum, Chamonix

co-founder of Futureflow, Ex IRO/CDS Trader

Ex “🏆winning” Macro PM / Partner 3bn $ HF

Invented CDS Choice Friday and Liquidity 🎄

Long term views only…

Day job as a VC, here I’m just a bottle of greasy oil and a fintwit refugee

macroeconomist and computer user at http://www.common-wealth.org, editor at www.continuousvariation.com, fellow at stanford, partisan of the republic of letters

Journalist, author, broadcaster. Politics, Middle East

Quant, Economist. I write about the US monetary policy at eightateeight.substack.com and about trade at https://eighttradeeight.substack.com/ 🇨🇭

Roses are red. Violets are blue. I’m not very creative.

Finance/investments for a US utility. Liverpool fan. Occasional baker. Views and sarcasm are my own.

some people call me dick burgers

As the UK's central bank, we work to ensure low inflation, trust in banknotes and a stable financial system.

Scottish historian & art historian; @EmpirePodUK.bsky.social podcaster & Jaipur Lit Fest co-director. Visiting Fellow at All Souls, Oxford. Writes the occasional book.

FT columnist. Also have podcast. Author of three and a half books. Four kids. Two cats. One wife. Numerous friends. Fulham fan.

School of Economics, Tel Aviv University

Department of Economics, New York University

https://arielrubinstein.org/

Blogger.

Mainly law and policy; Aston Villa supporter; sometimes ironic.

Birmingham/London.

Writer, lawyer, Dodger fan, internet dog. nycsouthpaw18 at gmail.

https://www.pinebrookcap.com

Research & code: Research director @inria

►Data, Health, & Computer science

►Python coder, (co)founder of scikit-learn, joblib, & @probabl.bsky.social

►Sometimes does art photography

►Physics PhD