😆😆😆

21.05.2025 13:24 — 👍 1 🔁 0 💬 0 📌 0@pythonfintech.com.bsky.social

PhD in Computer Science by day, Python-powered amateur hedge fund operator by night. Send help. https://pythonfintech.com/

😆😆😆

21.05.2025 13:24 — 👍 1 🔁 0 💬 0 📌 0

Implementing TradingView's Stochastic RSI indicator in Python

The implementation I cover here tries to mimic the output you see in TradingView (as much as possible).

👉 pythonfintech.com/articles/tra...

#Python #DataScience #Quant #AlgoTrading #Finance

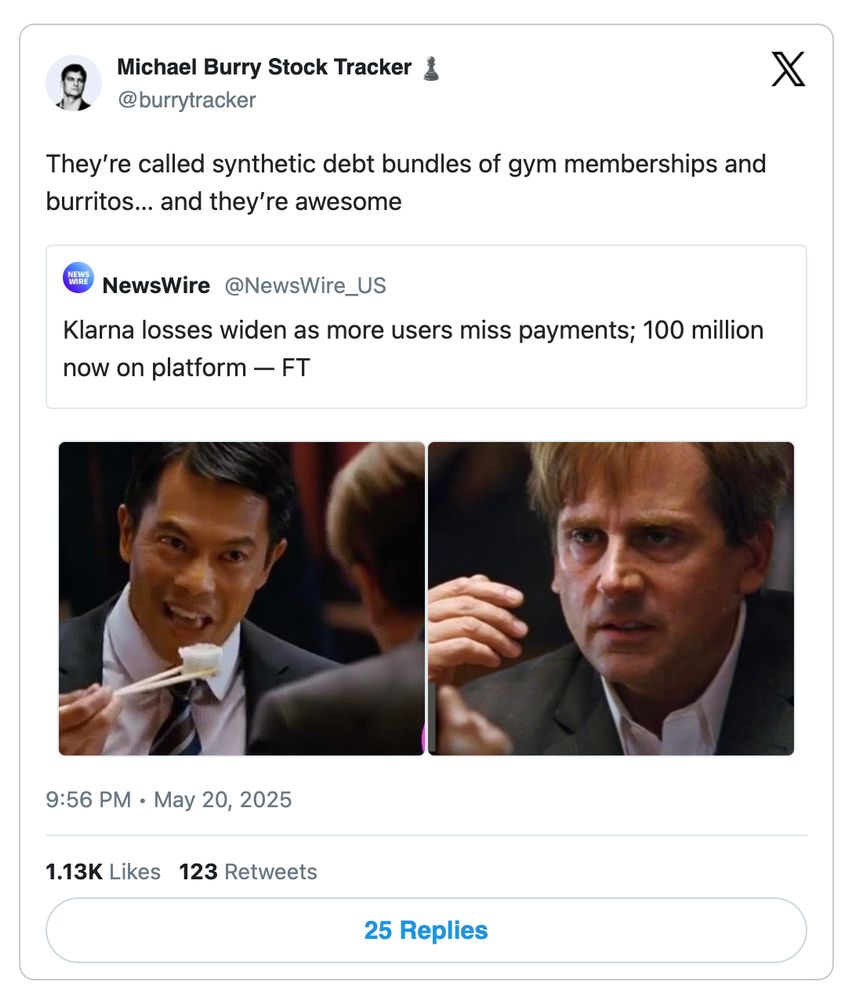

Market stage detection with Python and Pandas

👉 pythonfintech.com/articles/mar...

#Python #DataScience #Quant #AlgoTrading #Finance

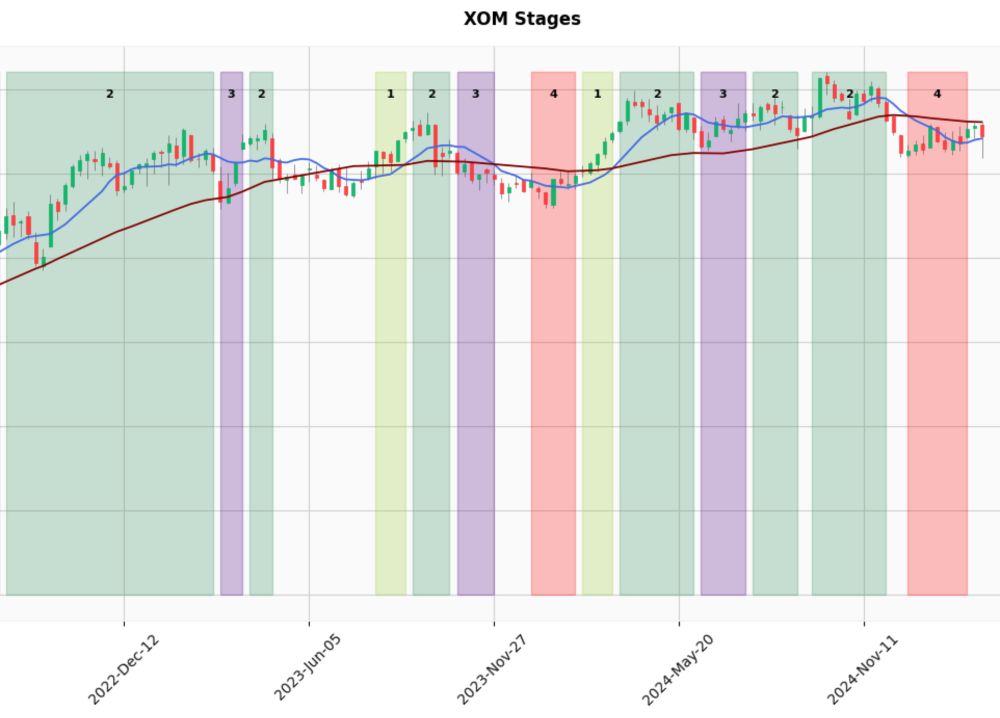

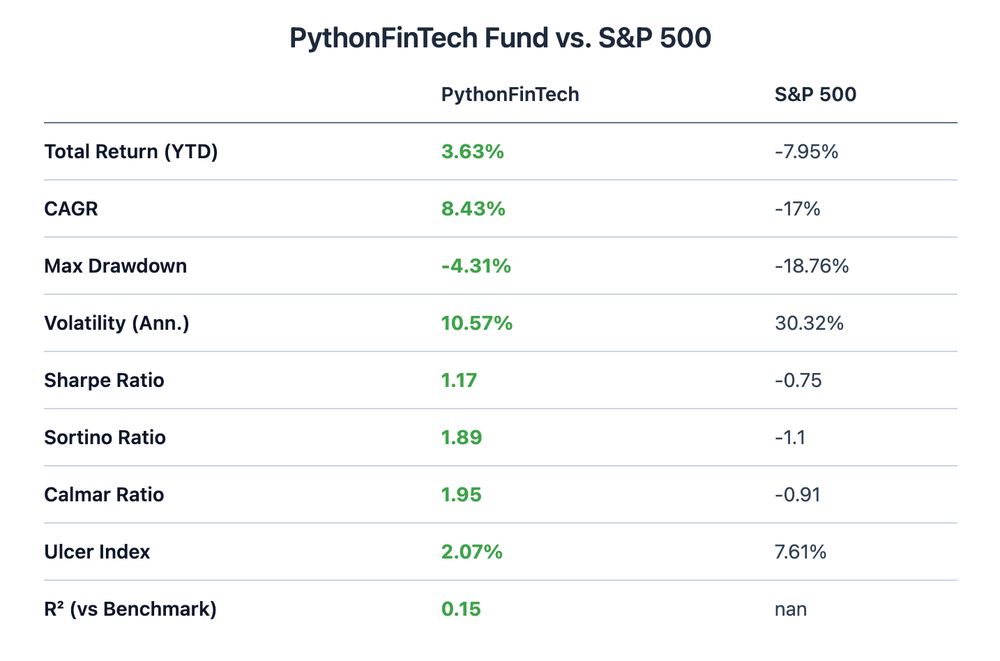

PythonFinTech – April 2025 Recap

✅ +3.8% YTD (vs. S&P -4.86%)

🛡️ Max Drawdown: -4.3%

⚖️ Sharpe 1.18 | Sortino 1.91 | Calmar 1.92

🌀 Volatility: 10.25% vs. 29.86%

📉 R² = 0.15

Staying patient and tactical.

#FinTech #Quant #Finance #AlgoTrading #PortfolioManagement

Just put together a visualization of each sector's relative performance against the S&P 500 over the past 5 years.

As a trader, keeping an eye on sector rotation can help you spot market shifts and trends before the rest of the market.

#Python #DataScience #Quant #AlgoTrading #Finance

Computing slope of series with Pandas and SciPy

Here's another little tutorial I put together.

Hope you enjoy it ✌️

pythonfintech.com/articles/com...

#Python #DataScience #Pandas

Sharing my risk-adjusted returns YTD. Here are the takeaways:

📈 Outperforming S&P 500 by ~11%

🧠 Low drawdown

⚖️ High risk-adjusted return

🔍 Very little correlation to S&P 500 (strategy is hunting idiosyncratic alpha, not riding the market beta wave)

#FinTech #Quant #AlgoTrading #Finance

Sharing a simple helper method of mine to compute groups of consecutive integers in an array with Python.

pythonfintech.com/articles/con...

#Python #Programming

If you think I'm not for real or a shyster just unfollow me. It's *genuinely* that simple.

14.04.2025 17:44 — 👍 0 🔁 0 💬 0 📌 0Buddy, I'm offering all this for free. This is my *hobby*, not my *job* — I'm under no obligation to you. It's a fun, "build in public" hedge fund or sorts. It's for fun. Period. I made enough money off my last business, I don't *need*, by any means, to sell anything.

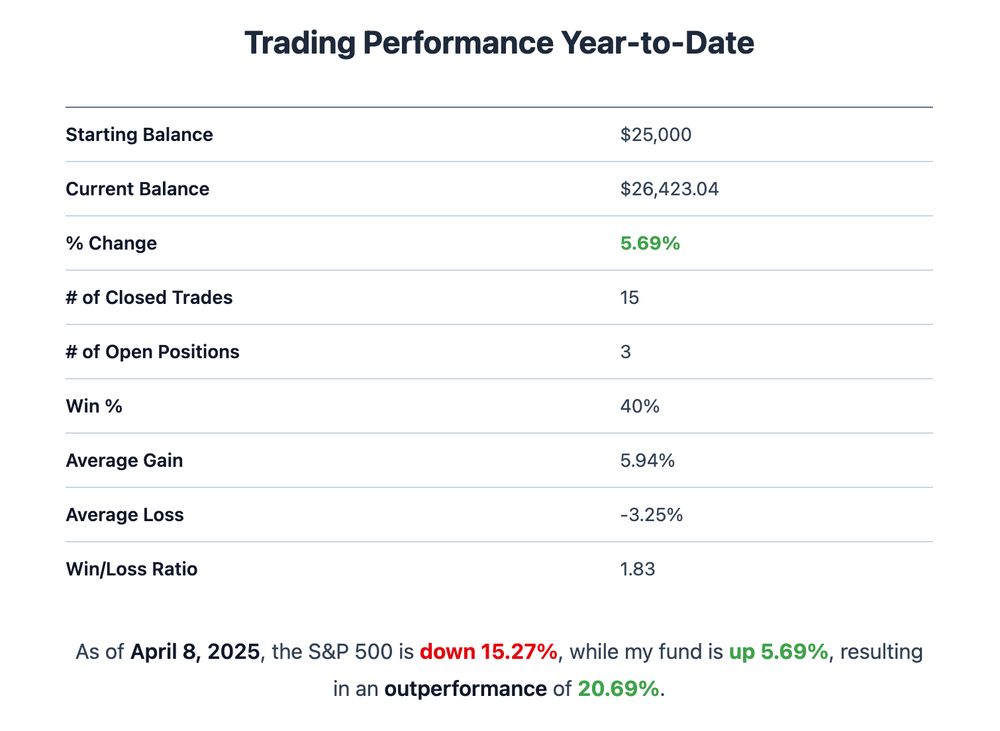

14.04.2025 17:44 — 👍 1 🔁 0 💬 0 📌 0Here's the full article on my March/early-April fund performance:

pythonfintech.com/articles/cas...

(All metrics as of 8 April 2025, the day I drafted this article)

#fintech #quant #finance #algotrading #markets

And, again, I'm not charging you anything to follow along, nor selling you anything. If you don't currently trust me, no worries. I get it. Perhaps in the future.

14.04.2025 13:21 — 👍 1 🔁 0 💬 0 📌 0But I can't give an exact date, because, as you know, the markets are chaos right now and learning how to trade and make this thing profitable for *myself* is my first priority. Education and dissemination is my second priority. I only have so much time in the day.

14.04.2025 13:20 — 👍 1 🔁 0 💬 1 📌 0Hey Michael thanks for following up. This is still very much a WIP. I'm not selling anything to you, so there's literally no risk to you unless you choose to invest your money (which I wouldn't recommend anyway).

I hope to have something more verifiable up and running in the next 1-3 months.

This is my first year, actually!

09.04.2025 20:16 — 👍 0 🔁 0 💬 0 📌 0

How it's going... 📈

• S&P 500: -15.27% 📉

• My Portfolio: +5.69% 📈

• Edge: +20.69% 🚀

#fintech #quant #finance #algotrading #markets

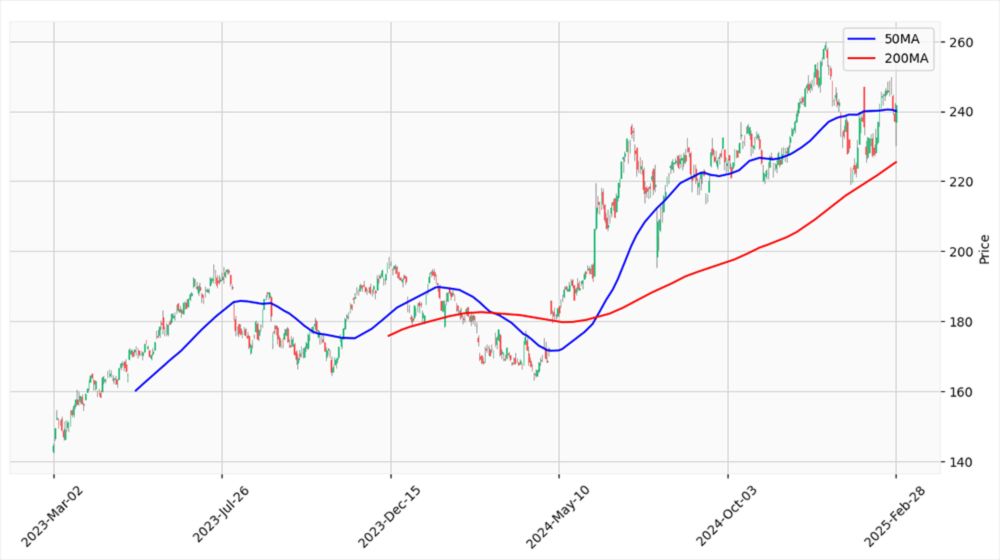

🔥 New tutorial: Computing SMAs for trading with Python

Learn to:

- Calculate SMAs across multiple timeframes

- Visualize MAs with candlestick charts

- Identify golden/death crosses

- Apply to any ticker with clean code

👉 pythonfintech.com/articles/com...

#Python #Trading #AlgoTrading

Plotting stock charts (OHLC) with matplotlib and mplfinance 📈

- Creating proper candlestick charts

- The anatomy of a candlestick

- Adding volume data for deeper market insights

- Focusing analysis on recent price movements

pythonfintech.com/articles/plo...

#Python #Trading #Quant #AlgoTrading

yfinance's default MultiIndex is a nightmare for multiple stocks

2 tickers = 10 columns

100 tickers = 500 columns 🙄

I prefer a row-based index

- Always 5 columns (OHLCV)

- Easier indicator calculations

- Debuggable without eyestrain

pythonfintech.com/articles/ret...

#Python #DataScience #Trading

Thank you for the feedback, Michael.

In general, yes, I'd like to start publishing trades as they happen. Typically I author articles explaining them and/or do a post-mortem but obviously that can't be done in real-time.

I'll look into services to help with the transparency.

After 3 years of silence, I'm writing code tutorials again!! 🎉

Just published my first tutorial since selling PyImageSearch—now it's Python for trading.

Learn how to download market data with yfinance:

pythonfintech.com/articles/how...

#Python #FinTech #Trading #Quant #FinTech

Beat the S&P 500 for the second month in a row! 📈

• S&P 500: -1.35% 📉

• My Portfolio: +1.53% 📈

• Edge: +2.87% 🚀

How? I went to cash when others bought the dip.

Sometimes the best trade is no trade at all.

Full breakdown: 👇

pythonfintech.com/articles/feb...

#trading #fintech #quant #finance

Just published: "Beginner's Guide to Trading Strategies" 📊

From HFT (where humans need not apply) to Buffett-style investing, I break down which trading style matches different personalities.

My pick? Swing trading with Python automation

pythonfintech.com/articles/typ...

#quant #fintech #trading

This one hit hard today.

#trading #market #quant #fintech

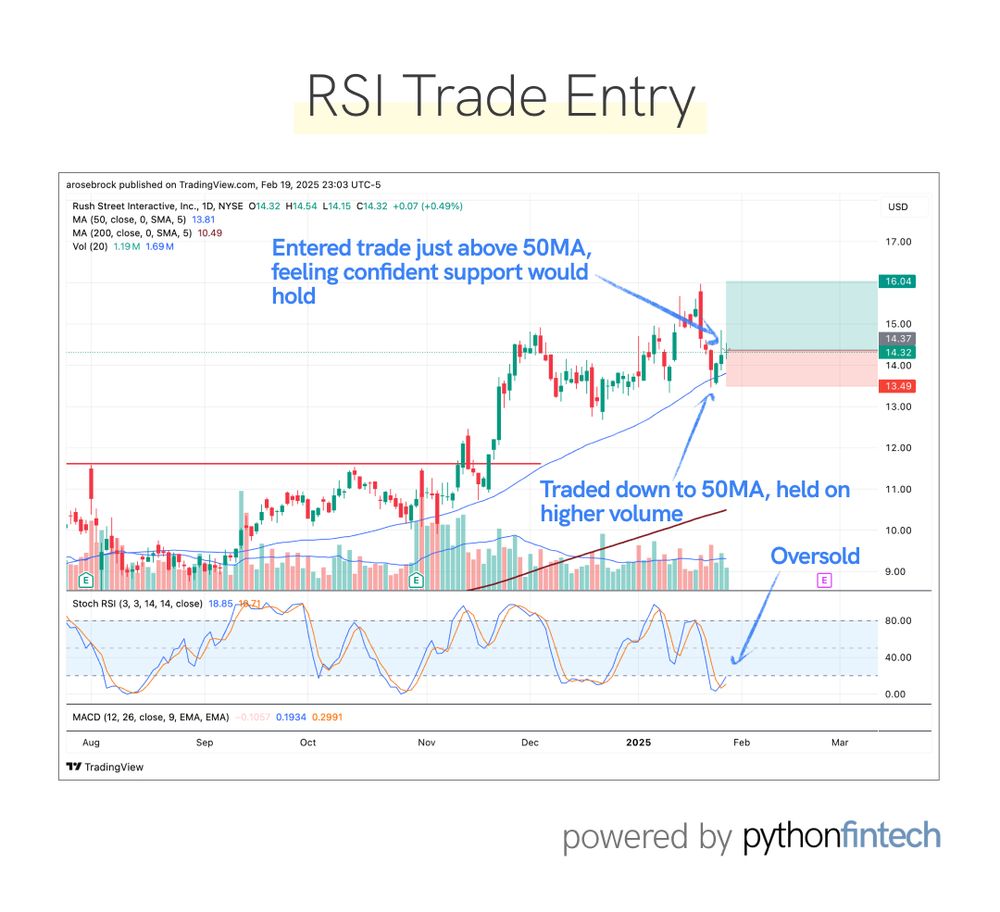

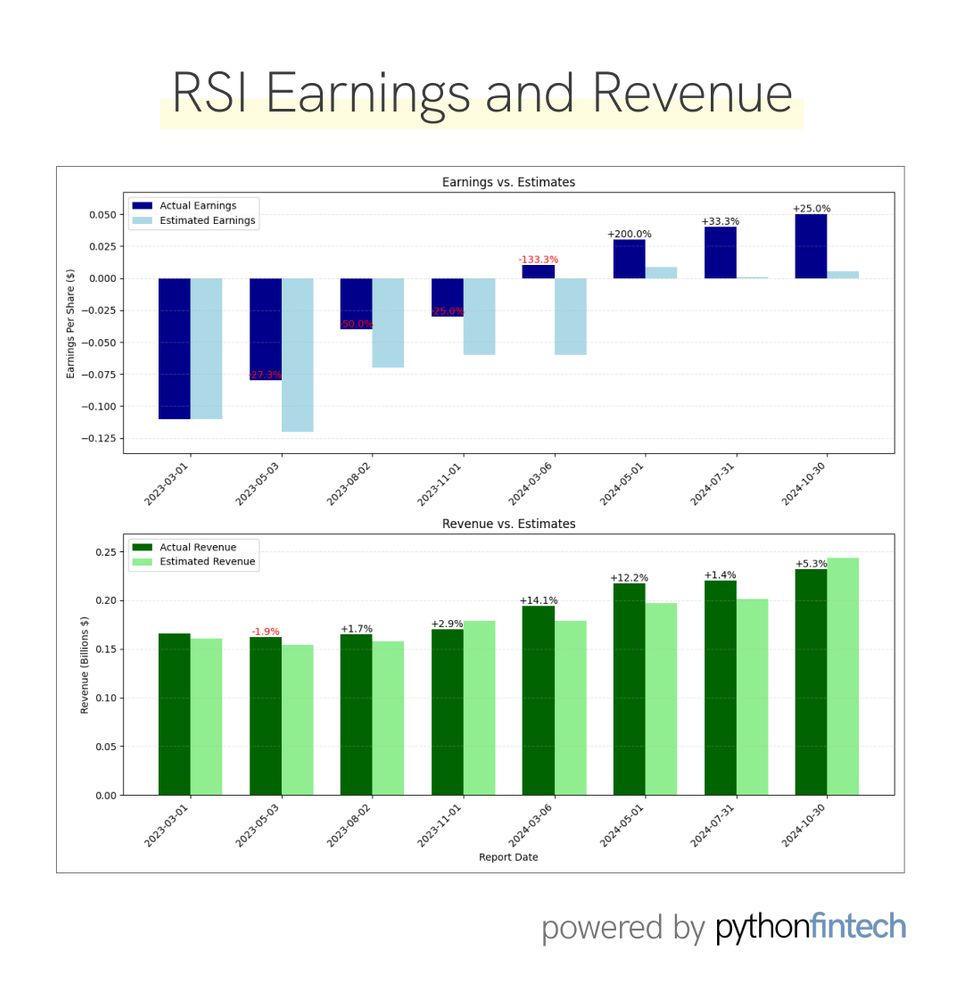

$RSI showing a textbook bullish setup:

- Hammer candle off 50-day MA

- Oversold Stochastics

- Higher volume on advances

- Clear path to $18

- 225% earnings beat average

- 800% earnings growth expected Wednesday

Already up 1.87R, looking to add to position

#fintech #algotrading #quant #trading

You know that moment when you’re absolutely certain you’re about to do something stupid, but you do it anyway? 🤦

Yeah, this is one of those stories.

Learn from my mistakes here:

👉 pythonfintech.com/articles/pro...

#fintech #algotrading #quant #trading #python

Updated my YTD trading metrics this morning:

- Starting Balance: $25,000

- Current Balance: $25,928.09

- % Change: 3.71%

- # of Trades: 2

- Win %: 50%

- Average Gain: 17.38%

- Average Loss: -2.94%

- Win/Loss Ratio: 5.9

#fintech #algotrading #quant #trading #python

Wait. You left the house with the oven on?!

14.02.2025 00:48 — 👍 1 🔁 0 💬 1 📌 0

"Hey ChatGPT, generate an image of a mid-life crisis but replace the Porsche with a TradingView account and add some houseplants for emotional support."

#fintech #algotrading #quant #trading #python

Beat the S&P 500 in January 📈🚀

The numbers (YTD):

- PythonFinTech: +3.37%

- S&P 500: +2.94%

- Outperformance: 0.43%

Full breakdown of my trades (including what worked and what definitely didn't) here:

👉 pythonfintech.com/articles/jan...

#fintech #algotrading #quant #trading #python