How financial incentives shape fertility in Australia – e61 INSTITUTE

Australia's fertility decline: Evidence and policy experience e61.in/how-financia...

12.10.2025 22:32 —

👍 0

🔁 1

💬 1

📌 0

Poverty in Australia 2025: Overview – Poverty and Inequality

The latest report from the ACOSS/UNSW Poverty and Inequality Partnership shows that 3.7m people are experiencing poverty. That number represents 1 in 7 people. Read the report at bit.ly/povertyoverv...

12.10.2025 22:23 —

👍 3

🔁 1

💬 0

📌 0

Screenshot of the public hearing program

Draft program for the Senate Community Affairs Committee public hearing on the Social Security and Other Legislation Amendment (Technical Changes No. 2) Bill 2025 tomorrow from 9am - www.aph.gov.au/Parliamentar...

In Canberra but will be streamed: www.aph.gov.au/News_and_Eve...

02.10.2025 00:32 —

👍 5

🔁 3

💬 1

📌 2

And if you’d like the whole ebook (or any of the 27 chapters) completely free, it’s always just a one-click download from @LSEPress here press.lse.ac.uk/books/e/10.3...

18.09.2025 08:35 —

👍 5

🔁 5

💬 0

📌 0

Happy to say that the paperback book edition of “Australia’s Evolving Democracy” can be purchased for less than £11 from Amazon UK. Great value for 600 pages. www.amazon.co.uk/Australias-E...

18.09.2025 08:29 —

👍 2

🔁 3

💬 1

📌 1

New OECD report shows Australia has the fourth lowest share of revenue from income taxes and social security contributions in the OECD in 2022.

Does Australia rely too much on taxes on incomes?

12.09.2025 00:05 —

👍 1

🔁 1

💬 0

📌 0

Tax Policy Reforms 2025

This is the tenth edition of Tax Policy Reforms: OECD and Selected Partner Economies, an annual publication that provides comparative information on tax reforms across countries and tracks tax policy ...

Rising health expenditures and population ageing prompted OECD governments to increase social security contributions in 2024, reflecting a broader trend towards increasing revenues to strengthen the long-term sustainability of social protection systems. www.oecd.org/en/publicati...

11.09.2025 23:36 —

👍 2

🔁 0

💬 1

📌 0

And one on housing policy www.aph.gov.au/About_Parlia...

17.07.2025 03:55 —

👍 4

🔁 5

💬 1

📌 0

Research

Research

Brand new publication type from the Parliamentary Library - Policy Brief. Here's the first batch: www.aph.gov.au/About_Parlia...

17.07.2025 03:52 —

👍 4

🔁 4

💬 0

📌 1

DSS statement here: www.dss.gov.au/news/update-...

Ministerial media release: ministers.dss.gov.au/media-releas...

17.07.2025 00:41 —

👍 0

🔁 2

💬 0

📌 0

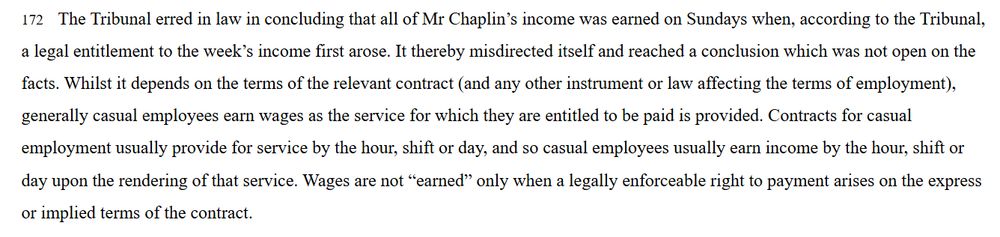

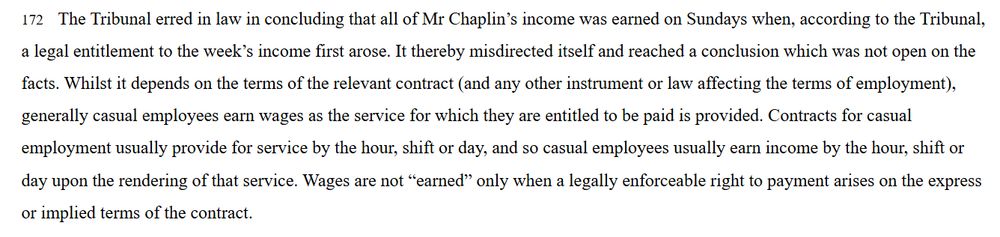

Screenshot of Fed Court decision para 172:

'172 The Tribunal erred in law in concluding that all of Mr Chaplin’s income was earned on Sundays when, according to the Tribunal, a legal entitlement to the week’s income first arose. It thereby misdirected itself and reached a conclusion which was not open on the facts. Whilst it depends on the terms of the relevant contract (and any other instrument or law affecting the terms of employment), generally casual employees earn wages as the service for which they are entitled to be paid is provided. Contracts for casual employment usually provide for service by the hour, shift or day, and so casual employees usually earn income by the hour, shift or day upon the rendering of that service. Wages are not “earned” only when a legally enforceable right to payment arises on the express or implied terms of the contract.'

Importantly, the Fed Court rejected the AAT's interpretation of when income is first 'earned'. The AAT's interpretation overturned how DSS/Centrelink had assessed earnings for decades and would have created a lot of issues for calculating pre-December 2020 debts

17.07.2025 00:35 —

👍 2

🔁 2

💬 1

📌 0

Chaplin v Secretary, Department of Social Services [2025] FCAFC 89

Federal Court decision in Chaplin v DSS Secretary (test case relating to method used to recalculate unlawful income apportionment debts) - accepts DSS' preferred method for assessing income where there is insufficient info on when the income was earned. www.judgments.fedcourt.gov.au/judgments/Ju...

17.07.2025 00:27 —

👍 5

🔁 2

💬 1

📌 0

This appears to be actually legal - but is it good public policy to pursue debts based on calculations in a system that was so complex that the administration got it wrong.

17.07.2025 00:46 —

👍 2

🔁 0

💬 1

📌 0

Jonathan Bradshaw at the symposium on his legacy in Social Policy in the 21st century #York2025 @easp-spa-2025.bsky.social

02.07.2025 13:54 —

👍 8

🔁 3

💬 0

📌 0

13.12.2025 21:14 —

👍 2

🔁 1

💬 1

📌 0

13.12.2025 21:14 —

👍 2

🔁 1

💬 1

📌 0