Whether and how this virtuous cycle can be triggered in the EU is a first order issue. IMO, this is one of the most interesting research and policy questions of our times.

11.11.2025 14:38 — 👍 1 🔁 0 💬 0 📌 0

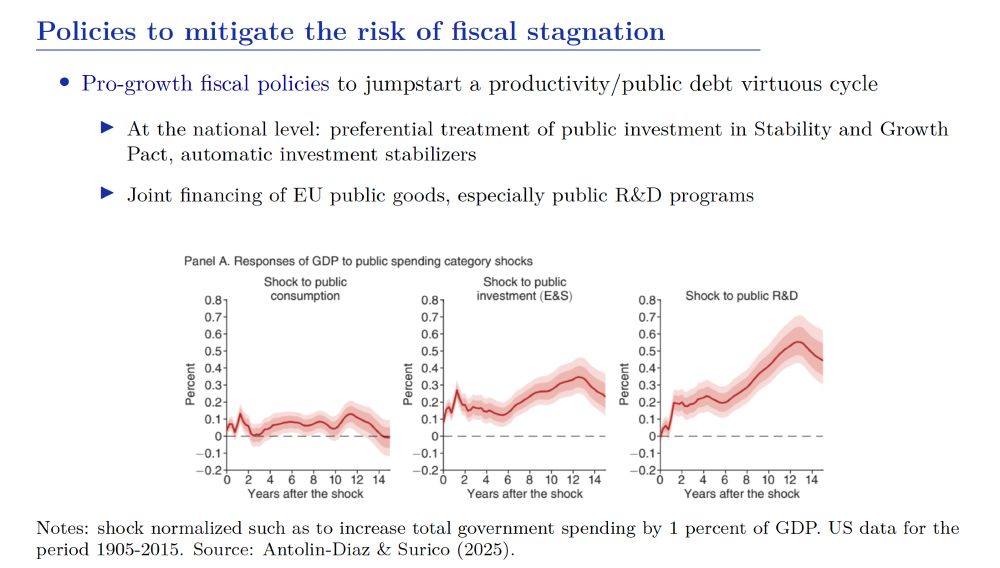

This amplification effect could also go in reverse. A 'pro-growth' fiscal reform could raise productivity growth, making public debt easier to sustain, in turn freeing fiscal space for even more pro-growth policies.

11.11.2025 14:38 — 👍 1 🔁 0 💬 1 📌 0

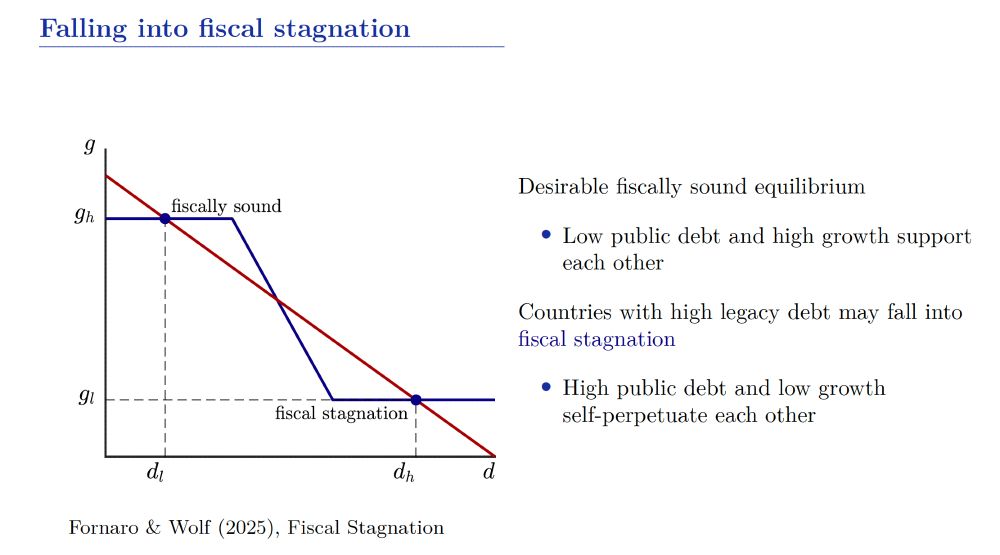

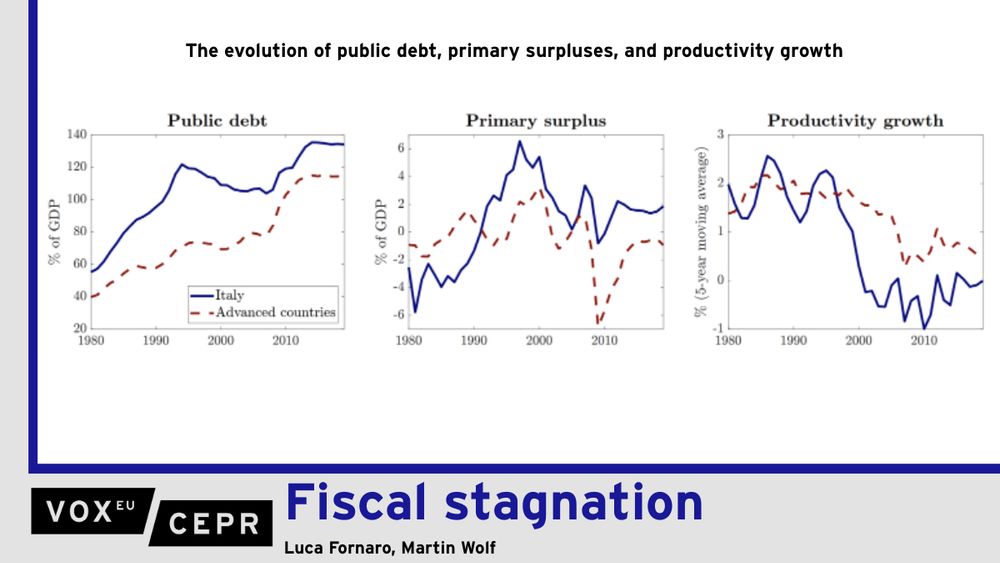

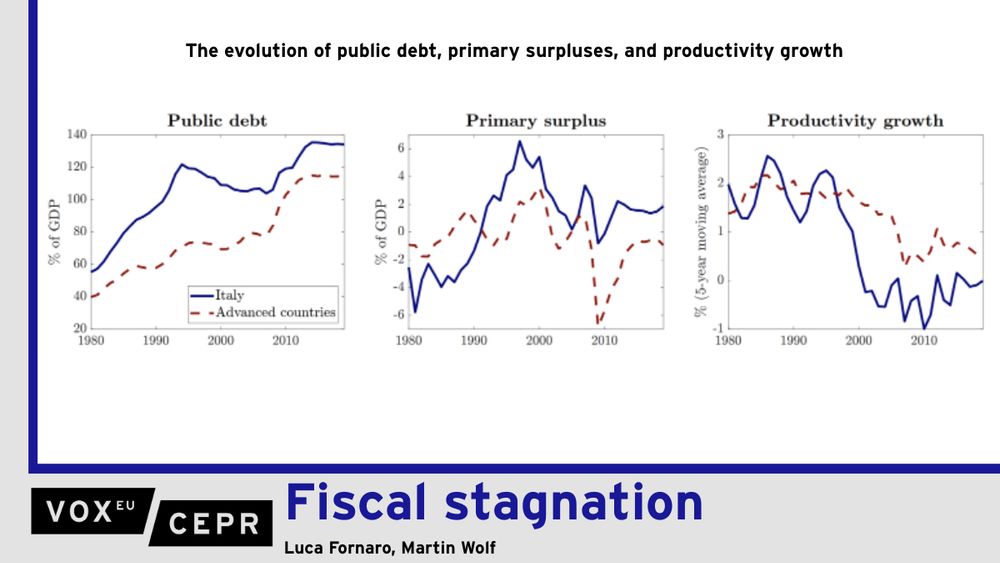

Martin Wolf and I have studied this amplification effect in a recent paper, and show that it may lead to a state of fiscal stagnation, characterized by a self-sustained vicious cycle of high debt, high fiscal distortions and low productivity growth. Italy may be an example of it.

11.11.2025 14:38 — 👍 1 🔁 0 💬 1 📌 0

If the drop in public investment has a strong negative impact on productivity growth, the future public debt to GDP ratio may end up raising. This will call for another round of fiscal adjustment through cuts in public investments, and so on.

11.11.2025 14:38 — 👍 2 🔁 0 💬 1 📌 0

Moreover, there may be an amplification effect at play. Imagine that a government cuts public investments to increase its surplus and stabilize its debt (pretty much what happened during the euro area sovereign debt crisis).

11.11.2025 14:38 — 👍 1 🔁 0 💬 1 📌 0

There is also evidence suggesting that taxes on investment in intangibles tend to slow down innovation and productivity growth.

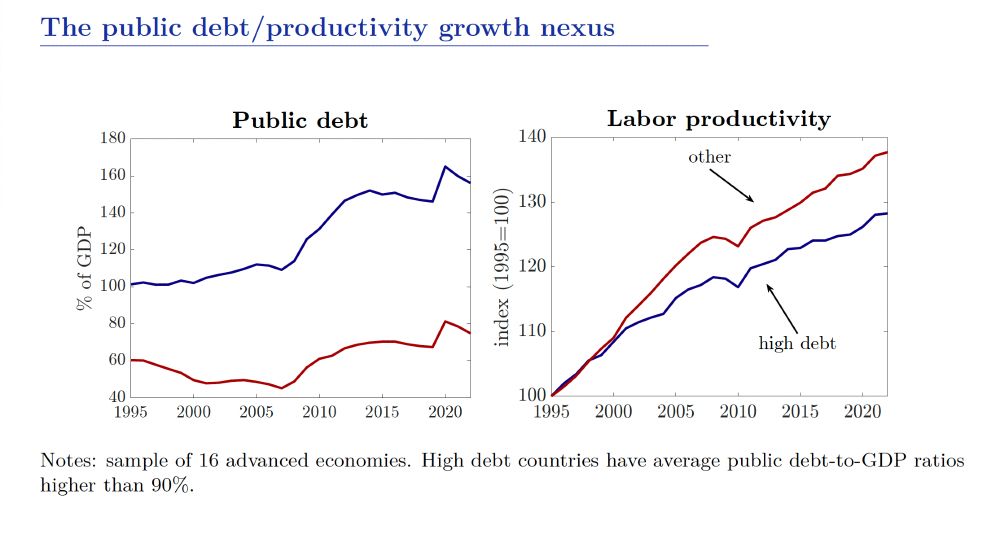

While this evidence is preliminary, it thus does look like fiscal policy affects productivity growth.

11.11.2025 14:38 — 👍 1 🔁 0 💬 1 📌 0

My feeling is that this may be a big miss, and that integrating endogenous productivity dynamics in debt sustainability analyses could be an important area for future research.

Let me explain by citing a few recent works.

11.11.2025 14:38 — 👍 2 🔁 0 💬 1 📌 0

Are public debts in the European Union sustainable? This recent article is a great introduction to this topic, I learned a lot by reading it.

One thing that struck me is that debt sustainability analyses typically abstract from the impact of fiscal policy on productivity growth.

11.11.2025 14:38 — 👍 9 🔁 4 💬 1 📌 0

If you're interested, you can find the full paper here crei.cat/wp-content/u....

@mw_econ

and I are pretty new to the international trade literature, so comments are welcome.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

Finally, what if a country puts a tariff on innovation inputs, perhaps by taxing researchers moving from abroad? This policy may fail spectacularly, by triggering an outflows of innovation goods, which over time will erode the country's technological rents.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

Moreover, if the rest of the world chooses to retaliate, the result will be a full-blown trade war. In this scenario, tariffs have no impact on the distribution of technological rents across countries, but they cause big efficiency and output losses.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

But this strategy has several drawbacks. First, reducing imports of foreign high-tech goods generates productivity and output losses. Second, even if import tariffs may increase national welfare, this comes at the expense of even larger welfare losses in the rest of the world.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

Tariffs on imports of high-tech goods may be used to steal technological rents from the rest of the world. Intuitively, tariffs reduce the profitability of foreign high-tech firms, causing a flow of innovation inputs and technological rents to the country imposing the tariffs.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

From a national perspective, importing innovation inputs yields technological rents, because of the positive knowledge spillovers that they create. So countries have an incentive to compete for technological hegemony, i.e. to become net importers of innovation inputs.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

To innovate, high-tech firms need specialized 'innovation inputs', such as researchers and venture capital. Building a strong high-tech cluster requires importing innovation inputs from abroad. Think of foreign researchers working for Big Tech firms in the Silicon Valley.

30.10.2025 10:39 — 👍 0 🔁 0 💬 3 📌 0

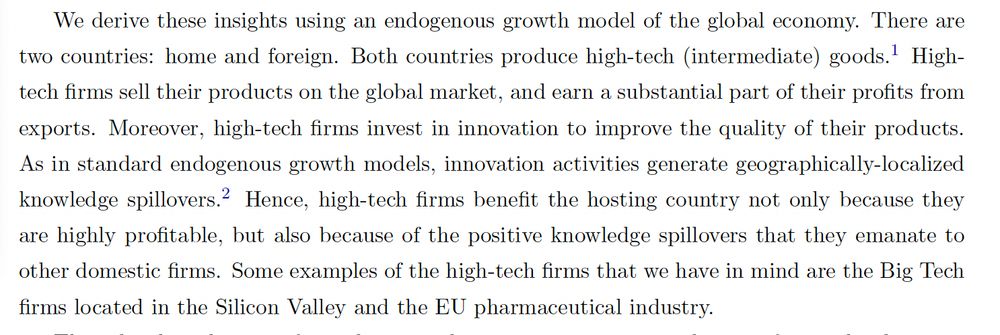

We start from the observation that high-tech clusters generate technological rents for the countries hosting them. Not only high-tech firms are highly profitable, but their innovation activities trigger positive knowledge spillovers to other domestic firms.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

We provide a framework connecting trade policies to innovation and technological hegemony. Our model focuses on high-tech firms that invest heavily in R&D and other intangibles. Nowadays, these firms play a key role in international trade.

30.10.2025 10:39 — 👍 0 🔁 0 💬 1 📌 0

How will tariffs affect innovation in the US and abroad? Shall the EU use tariffs to protect its high-tech industries? Should the rise in Chinese exports of high-tech goods worry the rest of the world?

We tackle these issues in a new paper on Tariffs and Technological Hegemony.

30.10.2025 10:39 — 👍 5 🔁 0 💬 1 📌 0

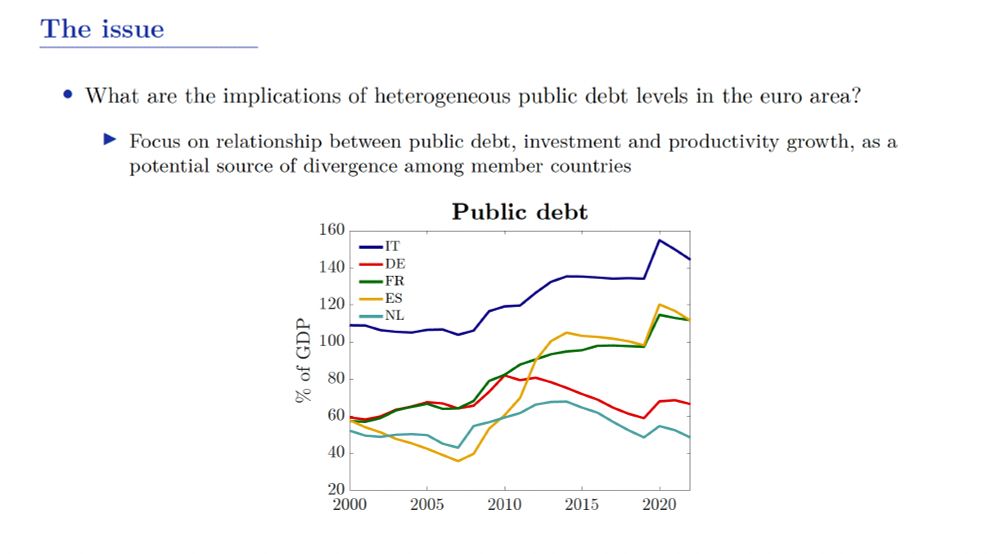

Some thoughts on the interactions between public debt, public investments and productivity growth in the euro area. Key risk is that the union ends up being split between a fiscally sound/high growth block and a fiscally stagnant one.

www.ecb.europa.eu/pub/pdf/sint...

23.09.2025 08:45 — 👍 6 🔁 3 💬 0 📌 0

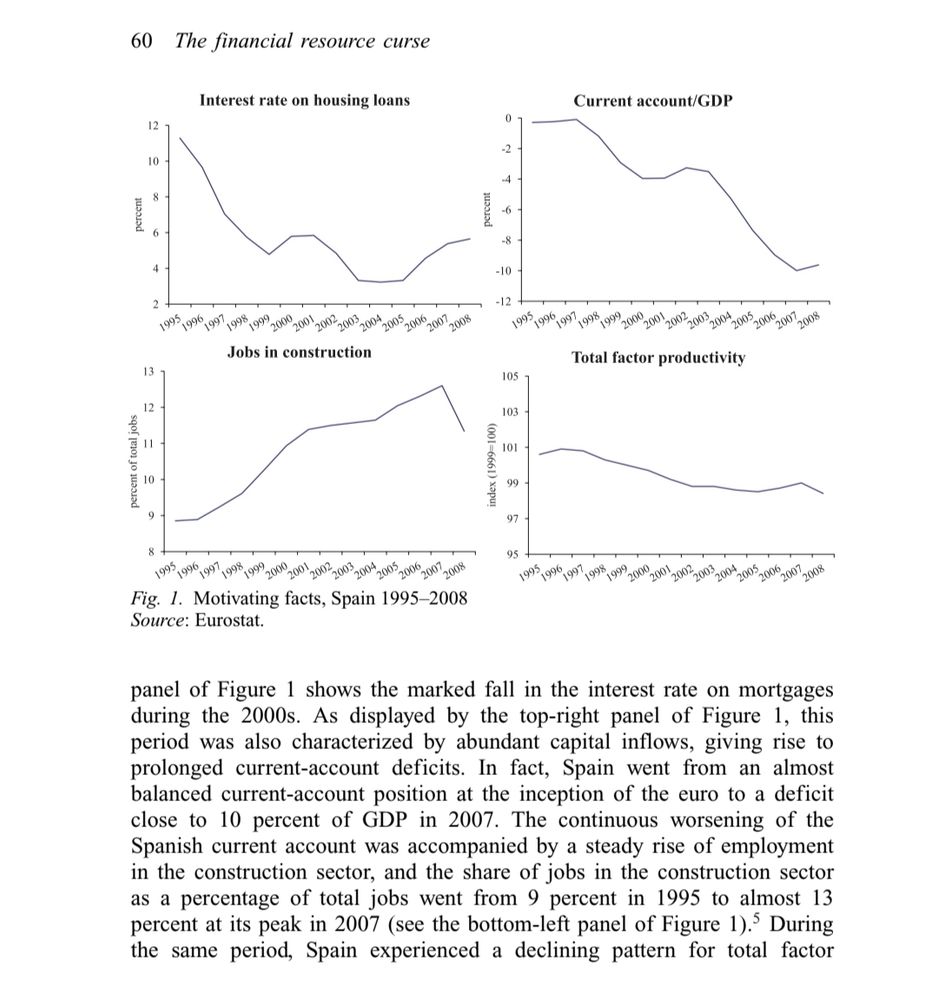

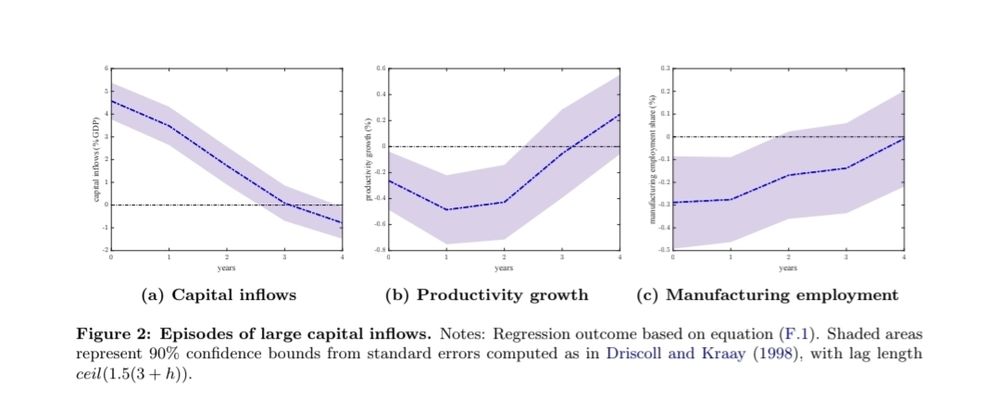

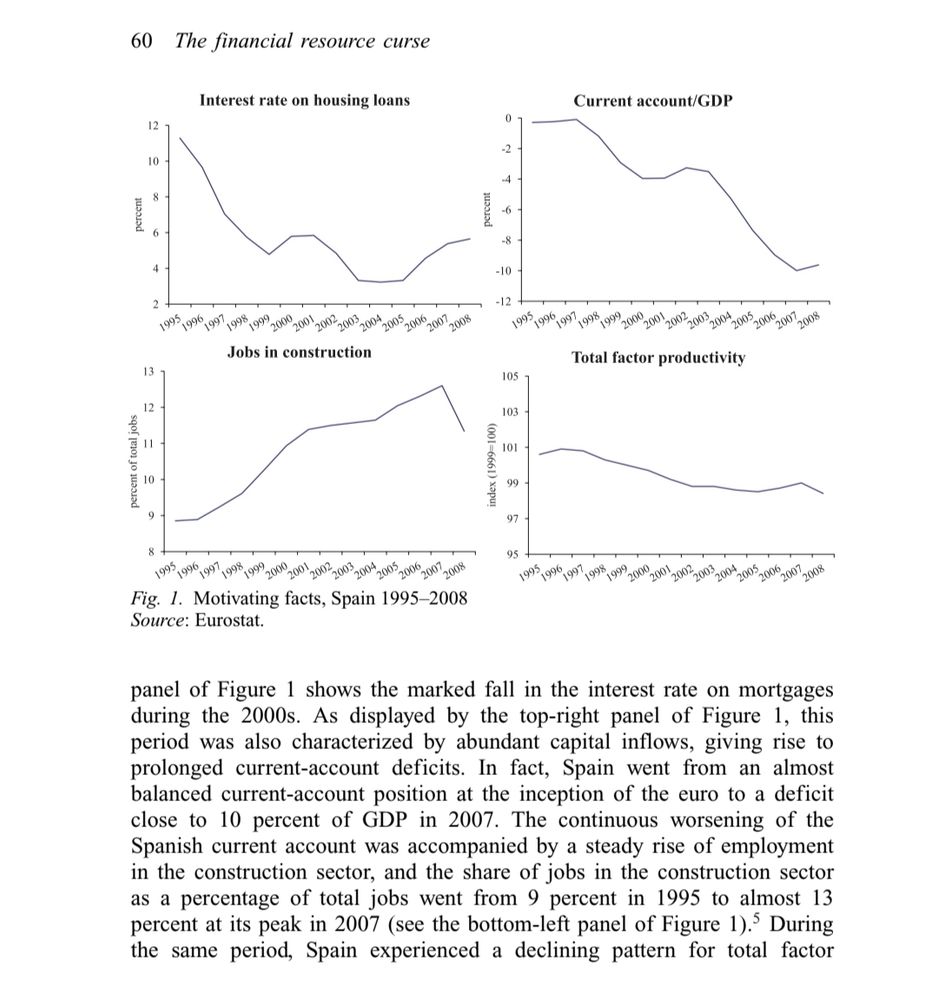

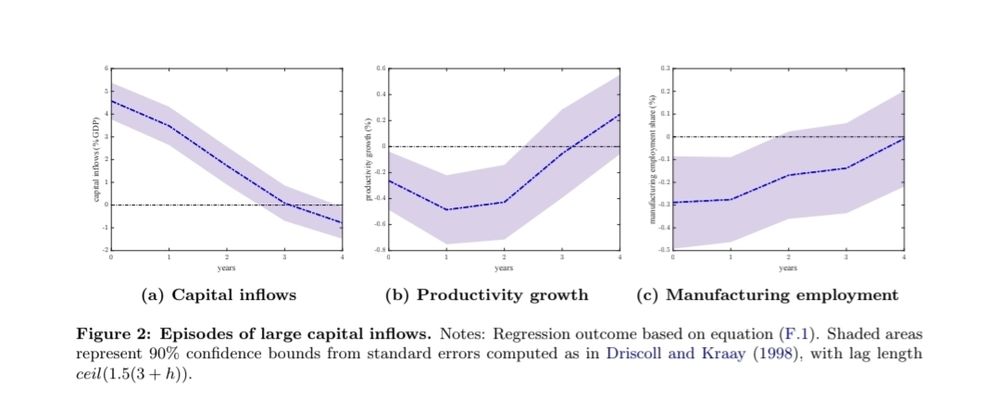

Spain during the 2000s is a good example of these dynamics, but productivity growth slowdowns during large surges in trade deficits are quite common.

31.07.2025 04:35 — 👍 0 🔁 0 💬 0 📌 0

Is the EU heading towards a financial resource curse? Cheap imports (and capital flows) from China could crowd out economic activity in tradable industries in the EU, causing a productivity growth slowdown. crei.cat/wp-content/u...

31.07.2025 04:35 — 👍 6 🔁 2 💬 1 📌 0

Here you can find the full slides ecb.europa.eu/pub/pdf/sint..., while here is the recording of the panel ecb.europa.eu/press/confer..., which features great contributions by

@isabelschnabel.bsky.social, @agnesbq.bsky.social, @pietphc.bsky.social and @refetgurkaynak.bsky.social.

03.07.2025 10:52 — 👍 1 🔁 0 💬 0 📌 0

Luca Fornaro on Hysteresis, Endogenous Growth, and Aggregate Demand Policies

Puntata podcast · Macro Musings with David Beckworth · 19/05/2025 · 1 h

This Macro-Musings episode 🔈

podcasts.apple.com/it/podcast/m...

featuring @lucafornaro.bsky.social provides extremely insightful and clear views on macroeconomic policies to counter hysteresis and stagnation 📈

02.07.2025 06:59 — 👍 3 🔁 1 💬 0 📌 0

YouTube video by Mercatus Center

Luca Fornaro on Hysteresis, Endogenous Growth, and Aggregate Demand Policies

Enjoyed very much this podcast with MacroMusings and @lucafornaro.bsky.social about endogenous growth and aggregate demand policies.

youtu.be/B7aRTPgepok?...

26.06.2025 22:25 — 👍 9 🔁 1 💬 2 📌 0

Powerlifting through Hysteresis

On strength lost, strength regained, and the scars that shape an economy.

What do powerlifting and economic hysteresis have in common? My latest newsletter explores this connection, building on @petercontibrown.bsky.social Conti-Brown's powerlifting journey and @lucafornaro.bsky.social's hysteresis research. macroeconomicpolicynexus.substack.com/p/let-it-fai...

10.06.2025 19:08 — 👍 4 🔁 4 💬 1 📌 0

Three graphs of the evolution of public debt, primary surplus, and productivity growth in Italy compared to other advanced economies.

Public debt-to-GDP ratios have climbed to historic highs in most advanced economies. This column studies the connection between productivity growth, fiscal policy, and public debt. Using a theoretical model, it argues that a feedback loop is possible between fiscal policy and growth. Large primary surpluses are associated with fiscal distortions which depress investment and productivity growth, and lead to further pressure on public debt-to-GDP ratios. A fall into fiscal stagnation can result from hysteresis effects or pessimistic animal spirits. Meanwhile, exiting fiscal stagnation requires large policy interventions that reduce the public debt-to-GDP ratio, such as credible pro-growth strategies.

@lucafornaro.bsky.social & Martin Wolf argue that a feedback loop is possible between fiscal policy and #growth. Exiting fiscal stagnation requires large policy interventions that reduce public debt-to-GDP ratio, such as credible pro-growth strategies.

cepr.org/voxeu/column...

#EconSky

02.06.2025 08:33 — 👍 14 🔁 7 💬 0 📌 1

Economist at Banca d’Italia ∙ Labor & Urban ∙ from Trentino ∙ Volleyball, mountains, history, Juventus and Bob Dylan

BCREA Chief Economist, specializing in housing and macro. Seahawks die hard, suffering Mariners fan. Strong for an economist. Work stuff mostly on LinkedIn

Chief Economist & Director of Analysis at FCDO, Professor of Economics at University of Warwick, CEP/LSE, CEPR.

Assistant Professor at Zurich, Princeton PhD. Macro, Finance, Machine Learning.

Doctor in International Political Economy, Ghent University

Scientific researcher @denktankminerva.be

Interests: all things macroeconomy (heterodox & critical vantage point)

Professor of Economics at Warwick University and at University of Bonn. Visiting Fellow LSE, Fellow/Affiliate with NIESR, CESifo, CEPR. European Research Council Grantee. Data Science, Econ, AI, ML, Networks.

IMF Youth Fellow.

Graduate studies in international economics at Barcelona School of Economics/Universitat Pompeu Fabra.

Interested in macro, int’l finance, and political economy, specifically geoeconomics.

Looking for research and PhD opportunities.

https://drafts.interfluidity.com/

https://www.interfluidity.com/

https://tech.interfluidity.com/

https://zirk.us/@interfluidity

Professor of Economics at University of Vienna. Interested in international trade, macroeconomics, industrial policy,labor markets, global value chains,…

Journalist 🗞️ Historian 📚 Writer ✏️ European 🌍 Austrian 🎶 Styrian 🌳 Jedi ☄️ Eldar ✨ Schwoaza ⚽

Associate Prof, Uni Bologna, Economics of climate & natural resources. Tweeting also as citizen, 🇫🇮/🇪🇺 and as resident 🇮🇹. Views are mine, most likely borrowed from somewhere.

Suomeksi @nikoekon.bsky.social

https://sites.google.com/view/jaakkola

Economics PhD student @EUI_ECO | Postdoc. Research Associate @Study Center Gerzensee | (Quantitative) Macro & Public Finance | www.michaelbarczay.com

Chief economist @ Centre for European Reform. Eurozone macroeconomic policies | Role of 🇩🇪 🇳🇱 in EU. Formerly @ECB, @IMF, @Worldbank.

Macroeconomist. Former Deputy Assistant Secretary for Macroeconomics at US Treasury. Views are my own.

Climate economist. Opinions are my own.

· Economist @univlorraine.bsky.social, en français and in English

· I use computers, network theory, and data to study how humans behave at work, in organizations and communities #Rstats

· He/Him 🏳️🌈

🌐 https://o.simardcasanova.net

📍 Nancy, Lorraine, France 🇪🇺

Doctor en economía por la Université Paris Nanterre. Profesor de la Universidad de Alcalá. Director de KREAB Research. Colaborador en Hora 25. | Más en dfuentescastro.com

Researcher at Institute for Advanced Studies, Vienna @ihs.ac.at | Macroeconomics | Member of the IHS business cycle forecasting group | Lecturer @wuvienna.bsky.social