Turns out I wasn’t the only one who thought this paper was an excellent x-ray of the UK economy.

It features prominently in Martin Wolfs new FT column

24.11.2025 17:55 — 👍 26 🔁 4 💬 1 📌 0

Also try to imagine where things have been if US level of support in the last 3 months of 2024 was there before as well and also not tying Ukraine's hands on what it can use where.

24.11.2025 14:23 — 👍 7 🔁 2 💬 0 📌 0

Indeed!

24.11.2025 07:23 — 👍 14 🔁 2 💬 0 📌 0

The United States is no longer providing any financial support for Ukraine according to Kiel's tracker - and has not been for a few months now (although I do wonder how one counts the intelligence support).

Europe is footing the bill alone.

24.11.2025 01:01 — 👍 82 🔁 46 💬 4 📌 4

A bunch of US firms, including Microsoft, Apple, and Intel, act as Europe’s main intermediaries.

They buy from China and export transformed goods (like semiconductors, precision magnets, chemical inputs) to Europe.

The issue is the upstream I think and the Syndicate piece misses it.

2/2.

23.11.2025 17:46 — 👍 9 🔁 1 💬 0 📌 0

Will cite the ECB paper that @tobiasgehrke.bsky.social immediately thought of.

“Over 80% of large European firms are no more than three intermediaries away from a Chinese rare earth producer.”

It will be similar for US firms - even if some are further ‘upstream’.

1/

23.11.2025 17:46 — 👍 18 🔁 4 💬 1 📌 0

My hunch is that the trade data cited do not go deep enough to capture the dependencies.

The ECB showed nicely that the eurozone for example imports a lot of REE and REE magnets from US subsidiaries who in turn rely on China.

2/2

23.11.2025 17:45 — 👍 9 🔁 2 💬 0 📌 0

China’s Rare-Earth Own Goal

Daniel Gros explains why the country does not have nearly as much leverage in the sector as commonly believed.

piece claims China’s hold on rare earths (REE) is overblown because the US supposedly dominates the high end niches.

A simple challenge: If America had the REE upper hand why did Trump fold?

I think it overlooks China’s monopoly on refining.

1/

www.project-syndicate.org/commentary/b...

23.11.2025 17:45 — 👍 13 🔁 2 💬 1 📌 1

Are you serious? I’ll report this offensive anti semitic slurring. Morally wrong on all levels.

Take a walk and clear your head.

23.11.2025 14:23 — 👍 0 🔁 0 💬 1 📌 0

Sunday Wrap by Erik F. Nielsen | IndependentEconomics | Substack

I write about economics, policies and markets - trying to connect the dots. Click to read Sunday Wrap by Erik F. Nielsen, a Substack publication with thousands of subscribers.

Wonderful write-up by @erikfossingnielsen.bsky.social on a fascinating fiery debate at CERs annual economics conference this weekend (so fast Erik!)

Should Europe use incentives to pull some of our capital exports back home rather than fund Americas deficits?

independenteconomics.substack.com

23.11.2025 14:03 — 👍 15 🔁 8 💬 1 📌 2

Germany Keeps Doors Open in China But Has Nothing to Show for It

Lars Klingbeil’s attempt to reset German ties with China has done little more than showcase the weakness of Europe’s biggest economy in engaging with its Asian counterpart.

There’s little China can offer Germany right now, given that Beijing doesn’t want to rebalance its economy.

Ample supply and a desire to invest in German assets is coming anyway.

Still, good for Klingbeil to dial down tensions - as I told Bloomberg.

www.bloomberg.com/news/article...

22.11.2025 07:33 — 👍 27 🔁 2 💬 1 📌 0

I defer to @paullucas.bsky.social on this obviously, but amazing and wonderful Lufthansa has to have the most diverse fleet of four-holers on the planet. Just in this photo you have B747-400, B747-8 and A340-600. They also have A340-300 but I don’t think there’s one in this photo…

20.11.2025 09:03 — 👍 9 🔁 1 💬 0 📌 0

In Beijing's vision, Europe's role remains that of a supplier of foodstuffs that keeps its markets open to Chinese products & investments. Premier Li Qiang already fobbed off Olaf Scholz in 2024 with trade concessions for apples and beef, saying: “Moderate overcapacity promotes competition & ensures

20.11.2025 11:47 — 👍 13 🔁 3 💬 1 📌 0

Great rundown by @martinsandbu.ft.com on the complex roots of Germany’s economic malaise - plus a very welcome shout-out to our proposal with @sandertordoir.bsky.social and @lucasguttenberg.bsky.social for coordinated Buy European EV clauses as part of the fix.

on.ft.com/4plaPvt

20.11.2025 19:40 — 👍 20 🔁 7 💬 2 📌 1

The Economists new cover.

20.11.2025 18:38 — 👍 41 🔁 14 💬 2 📌 2

Hear hear

20.11.2025 14:55 — 👍 2 🔁 0 💬 1 📌 0

The let-it-die camp also still has to explain to me why politicians aren’t going to intervene anyway when the pressure mounts further.

The realistic choice in my view is do smart policy or wait for a hot mess of bailouts and crappy policy.

20.11.2025 14:44 — 👍 11 🔁 2 💬 2 📌 0

It’s not obvious to me why with some industrial policy that levels playing field with China a smaller version of European car manufacturing cannot survive.

If that’s true then the rest of the West for sure has no car future. Japan and Korea maybe…

20.11.2025 14:43 — 👍 9 🔁 0 💬 2 📌 0

Why is that the right template? Why is that the right precedent?

20.11.2025 14:42 — 👍 2 🔁 0 💬 2 📌 0

As an aside. I’m the economic geek here but I think the assumption that you can just redeploy hundreds of thousands of workers is shaky at best….looks nice in models for sure. Not in reality.

20.11.2025 14:24 — 👍 7 🔁 0 💬 3 📌 0

I don’t agree - car industry too important, Europe second largest producer in EVs globally. Gotta catch up rather than give up.

20.11.2025 14:22 — 👍 5 🔁 0 💬 1 📌 0

CC @tbenner.bsky.social

20.11.2025 11:43 — 👍 4 🔁 0 💬 0 📌 0

Thorsten Benner not mincing his words. Hard hitting piece on China eating Germanys lunch and the woefully inadequate response.

The Scholz-Li Qiang anecdote is stunning.

www.handelsblatt.com/meinung/kolu...

20.11.2025 11:42 — 👍 30 🔁 19 💬 2 📌 1

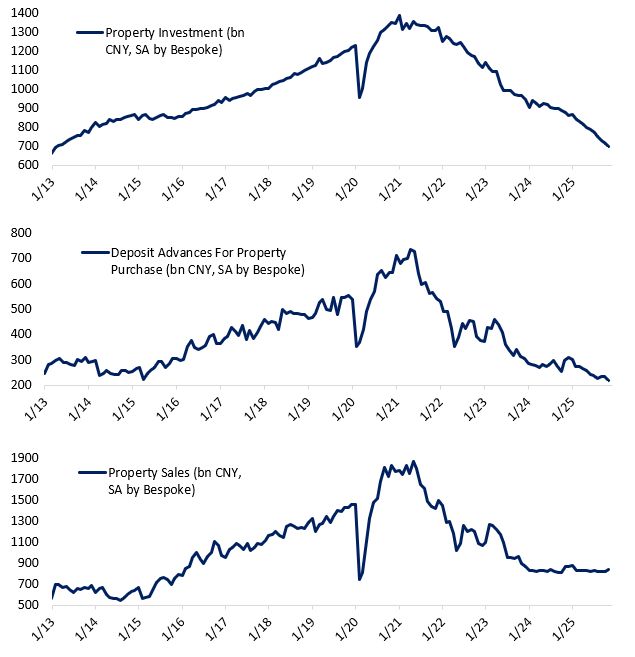

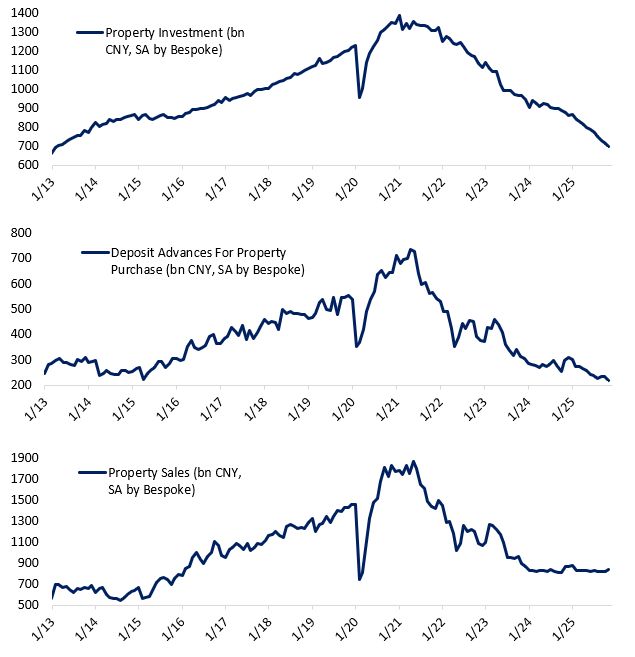

(Bloomberg) -- China is considering new measures to turn around its struggling property market, as concerns mount that a further weakening of the sector will threaten to destabilize its financial system, according to people familiar with the matter.

Policymakers including the housing ministry are considering a slew of options, such as providing new homebuyers mortgage subsidies for the first time nationwide, said the people, asking not to be identified discussing a private matter. Other measures being floated include raising income tax rebates for mortgage borrowers and lowering home transaction costs, one of the people said.

China has been trying to put a floor under its four-year real estate downturn, which has weighed on everything from household wealth to consumption and employment. While the housing sector picked up modestly after the government stepped up support about a year ago, the momentum quickly fizzled. Home sales have been falling since the second quarter and fixed-asset investment collapsed last month.

The dim outlook for the property market, coupled with households’ weakened ability to repay mortgages and other personal loans, means that banks’ asset quality could deteriorate next year, Fitch Ratings analysts warned last month. Chinese banks’ bad loans surged to a record 3.5 trillion yuan ($492 billion) at the end of September.

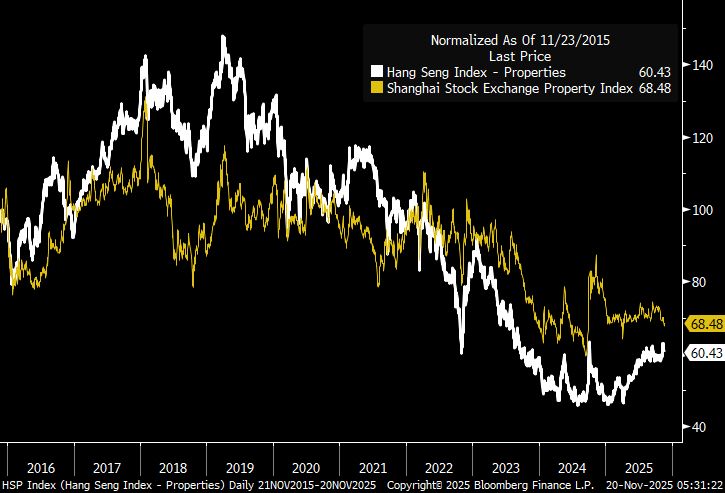

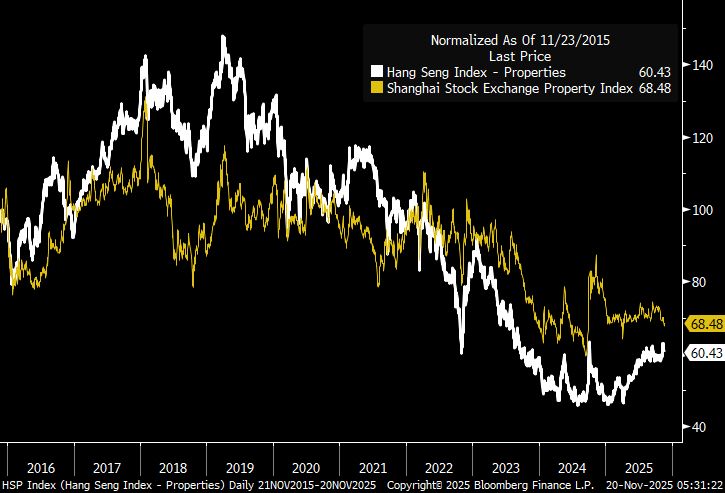

Charts of the Hang Seng Property Index and Shanghai Property Index for the past 10 years. Both are indexed to 100 as of 11/23/2025

Charts of China monthly property investment, deposit advances for property purchases, and property sales since 2013.

Death, taxes, and China property stimulus.

www.bloomberg.com/news/article...

20.11.2025 10:34 — 👍 38 🔁 4 💬 1 📌 2

Was an den Energie-Subventionen falsch ist

Die Wirtschaftspolitik in Deutschland verfolge die falsche Philosophie, schreibt ein Ökonom.

In Kernbereichen der deutschen Wirtschaft, allen voran der Automotive-Sektor, drohen unter einem „zweiten China Schock“ (wie etwa Ökonom @sandertordoir.bsky.social titelte) die Lichter auszugehen.

buff.ly/XfuBRmj

20.11.2025 11:00 — 👍 4 🔁 3 💬 1 📌 0

And what is worse is that PHEV also exploit a tax loophole as their actual emissions are much higher than the emissions used for emissions based motor taxes (stick a small electric motor into a large ICE SUV and reduce the motor tax). The result if a loss to the exchequer and higher emissions.

20.11.2025 10:58 — 👍 10 🔁 2 💬 1 📌 0

Of course an alternative or flanking policy is equipping Europes sizeable EV and corporate car subsidies with European preferences.

A symmetric response to Chinas policies.

For more on that see our recent paper: www.cer.eu/publications...

20.11.2025 10:51 — 👍 44 🔁 10 💬 2 📌 1

I’ve been saying this on panels recently.

Europes EV tariffs are starting to fail. China is simply switching to exporting hybrids which weren’t under the duty.

I’m not convinced the EU can fully avoid a broader duty on all Chinese cars (EV Hybrid and ICE) - who all get subsidised anyway.

20.11.2025 10:49 — 👍 23 🔁 7 💬 5 📌 2

This is just such a stunning chart

17.11.2025 23:58 — 👍 44 🔁 14 💬 1 📌 0

Of course the crown jewel of gloriously bad ideas is to leave the euro now.

Crippling German exporters even more with a surging new D-Mark just is what the doctor ordered.

17.11.2025 22:36 — 👍 24 🔁 0 💬 1 📌 1

Chronically ill legal professional |

Occasional expert |

American | British | European

Echter Wiener | Citoyen | Philadelphian

European Federalist | #Renaissance | #Libdems

EM doc. Politics nerd 🇷🇴🇬🇧🇫🇷

European at core

Into military stuff nowadays, out of necessity

Workforce Economist in Residence at Guild; Senior Fellow at the Burning Glass Institute. I tweet a lot about labor markets, macro, and (sorry) music! Tweets represent my own views.

Financial writer. Markets & charts. Open to freelance or full-time work. 2 Corinthians 5:21

My views only. Paris - Berlin, previously in The Hague and Rabat. Still waiting for the ‘edit post’ feature

Actievoerder, Strateeg, Politicus en Ondernemer voor een duurzame toekomst.

Klimaatcolumnist @ Friesch Dagblad.

Ik spin hier analysedraadjes over politiek. Ik ben schaker; ik denk íets strategischer dan de meesten.

”Caeruleum caelum est”

Christen | Papa | CDA Tweede Kamerlid | Reservist | Buza, BuHaOS, Def, J&V, Koninkrijksrelaties, inlichtingendiensten & wonen | Member of Parliament of the Netherlands

Global nomad….the one constant is change.

Looking for ways to reduce cosmetic and food toxicity. Angel investor in clean tech initiatives.

Matteroftrust.org terredecouleur.com

No DMs pls.

Opinions my own.

🌱 Klima- & Biodiversitätskrise lösen

🇪🇺 Europäische Politik

🟢 Goodforces

Senior Research Fellow SuFi Project @UniWH & @UvACorpnet | Global finance, age of passive investing, index providers, ESG, sustainable finance, greenwashing, decarbonization | www.jfichtner.net

Vienna Institute for International Economic Studies (wiiw); macroeconomics, economic policy, public finance, political economy, meta-science.

Contributing editor, Harper's Magazine; Lecturer, Columbia Law School; Attorney

EV Smart Charging | V2G | EV grid integration | Energy 🤝 Mobility | Demand-side Flex | Consumer Flexibility

EN | NL | DE

mastodon.social/@burger_jaap

linkedin.com/in/jaapburger

Energy systems modeling & policy analysis - Associate Research Professor at Center for Global Sustainability, CGS @ctrglobsust.bsky.social at UMD @univofmaryland.bsky.social

German living and biking in DC, and with odd interest in basketball

Views my own

Author - 'THE INVENTION OF AMSTERDAM' out now! (https://amzn.to/2QJx3bh). Writer, aid worker, speechwriter, recovering Tory. Columnist @ADnl; articles NYT, Telegraph, New Statesman, Groene Amsterdammer etc. Buy my new book, it’s good!

digital, social & political transformation; research & policy @ Caribou Digital & fellow @ LSE & Graduate Institute, Geneva; RT ≠ endorsement

X: @emrys_s

Political scientist studying security, conflict, bargaining, US foreign policy, etc. Scored on by Geoff Cameron. Personal account. Opinions mine alone.

https://kyle-haynes.weebly.com/

Commercial lawyer, lifelong engagement with the European project. Newnham, Gray’s Inn, College of Europe. Now, Dutch citizen. Appreciative European. Lifelong choral singer. Mum of three. Now studying legal aspects of the Gascon wine trade 1152-1453

Bosnian in Amsterdam. International development and politics. 🐈 person and 🐶 owner. Antifa, naturally 😉Poguzija&ManUtd. Views and comments my own.