How Will the Trump Megabill Change Americans’ Taxes in 2026?

The megabill will raise taxes on the poorest 40 percent of Americans, barely cut them for the middle 20 percent, and cut them tremendously for the wealthiest Americans next year.

How will your taxes change next year now that the megabill has been signed into law?

People making less than $53,000 could see their taxes increase.

The richest 1% alone will benefit more from Trump’s tax plan than the bottom 80% of Americans.

itep.org/how-will-tru...

05.08.2025 17:55 — 👍 0 🔁 3 💬 0 📌 1

"Just one more tax cut for the rich please bro it'll trickle down this time it's good for the economy"

11.07.2025 16:42 — 👍 1 🔁 0 💬 1 📌 0

This is what Congress approved today.

03.07.2025 19:03 — 👍 0 🔁 1 💬 0 📌 0

graph showing debt/gdp from 2001 to present. it breaks out the effect of the bush tax cuts, the trump tax cuts, and our one-time responses to the great recession and to covid. without the bush and trump tax cuts, debt/gdp would be stable.

I updated this old graph of mine. It shows that, if not for the Bush and Trump tax cuts, debt/GDP would be stable rather than rising forever.

I've updated the methodology to first assume an AMT patch at Clinton levels, so I'm only attributing to the Bush tax cuts their portion of the AMT patch.

30.05.2025 17:00 — 👍 478 🔁 203 💬 19 📌 5

Federal Tax Debate 2025

The tax cuts in the House bill mostly flow to those who have the most. Roughly 68% of the tax cuts go to the richest 20% in the U.S. Some other notable changes would support private school voucher pro...

The tax cuts in the House bill are mostly for the wealthy. 68% of the cuts go to the richest 20%.

On top of that, the bill also includes a new way for rich people to avoid taxes by donating to school vouchers and a harsher tax code for immigrants and their families.

itep.org/federal-tax-...

29.05.2025 18:04 — 👍 0 🔁 0 💬 0 📌 0

Here's what's in the GOP megabill that's just passed the House

At the center of the sweeping bill is trillions in tax cuts, which Republicans aim to partially offset through changes to safety net programs like Medicaid and SNAP.

In the middle of the night, the House of Representatives pushed through a bill that rips health insurance and food assistance from millions, leaves the poorest households worse off, and sends massive tax cuts to the rich - all while increasing the deficit by trillions. www.npr.org/2025/05/21/n...

22.05.2025 13:05 — 👍 1 🔁 0 💬 0 📌 0

.@RonWyden: Billy Long made his money by "steering clients to firms that sold fake tax shelters and pushed small businesses to unknowingly commit tax fraud."

Is that the type of experience that qualifies you to lead the IRS? 🤔

20.05.2025 14:42 — 👍 8 🔁 5 💬 1 📌 0

The Republican Tax Bill Screws the Working Class

Alas, if history is any guide, they’ll love it anyway.

If you’re working class, this tax bill has very little for you and quite a lot for people much richer than you. newrepublic.com/article/1952...

14.05.2025 17:22 — 👍 2 🔁 2 💬 0 📌 0

America's 19 richest households gained $1 trillion in wealth last year. That increase is greater than Switzerland’s entire economy.

The ultra-rich can afford to pay more in taxes.

08.05.2025 14:36 — 👍 0 🔁 0 💬 0 📌 0

States that raise taxes on their wealthiest residents don't see hordes of them leave, our director @amyhanauer.bsky.social explains.

Instead, they raise money needed to improve their communities.

Out of all income groups, the richest 1% pay the smallest share of income on taxes in 41 states.

29.04.2025 14:44 — 👍 7 🔁 4 💬 0 📌 0

#TaxDay reminder

15.04.2025 22:56 — 👍 3 🔁 1 💬 0 📌 0

Senate Republicans Rig Congressional Rules to Make Their Tax Cuts Appear Cost-Free

What the "current policy baseline" really means

Congressional Republicans are attempting to make the $4.6 trillion cost of their tax plan disappear with an accounting gimmick.

Don’t be fooled. open.substack.com/pub/itep/p/s...

11.04.2025 15:16 — 👍 57 🔁 33 💬 2 📌 1

Trump’s Address to Congress Obscures His Actual Tax Agenda

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking…

During his speech to Congress this week, Trump failed to mention his goal of giving huge tax cuts to rich people, his goal of giving huge tax cuts to corporations, or how his tariffs will raise most Americans’ taxes. itep.org/trump-addres...

07.03.2025 17:38 — 👍 0 🔁 0 💬 0 📌 0

Jeff Bezos' revamp of 'Washington Post' opinions leads editor to quit

Billionaire Jeff Bezos, who owns the Post, says the newspaper's editorial section will publish columns only "in support and defense of two pillars: personal liberties and free markets."

RE Jeff Bezos' planned weekly homages to "free markets": I can't think of another business whose success has so transparently relied on short-circuiting the workings of free markets. From the very beginning, Amazon's competitive advantage was built on tax avoidance. (1/x)

www.npr.org/2025/02/26/n...

27.02.2025 12:54 — 👍 10 🔁 6 💬 1 📌 0

House Budget Resolution Tees Up Damaging Trump Tax Agenda

The budget resolution passed by House Republicans will enrich the richest, blow up the deficit, and decimate vital public services. The budget resolution allows Congress to pass reconciliation legisla...

The budget resolution passed yesterday now tees up a dangerous tax agenda.

Congressional Republicans have no way to pay for the massive tax cuts promised by Trump other than to dismantle fundamental parts of the government and increase the federal budget deficit. itep.org/house-budget...

26.02.2025 20:17 — 👍 7 🔁 5 💬 0 📌 0

A reminder that this has been the plan all along.

26.02.2025 16:34 — 👍 4 🔁 2 💬 0 📌 0

Opinion | Trump Just Fired 6,700 I.R.S. Workers in the Middle of Tax Season. That’s a Huge Mistake.

The Trump administration’s decision to fire over 6,000 I.R.S. workers will make the government less effective and less efficient, not more.

IRS commissioners appointed by Reagan, H.W. Bush, Clinton, W. Bush, Obama, Trump, and Biden agree that Trump is making a huge mistake firing 6,700 IRS workers in the middle of tax season: www.nytimes.com/2025/02/24/o...

24.02.2025 14:35 — 👍 87 🔁 34 💬 3 📌 0

#TaxValentines

14.02.2025 20:29 — 👍 1 🔁 1 💬 0 📌 0

There are plenty of reasons why we're better off without more tax cuts for the rich.

Here's a few of them.

itep.org/federal-tax-...

31.01.2025 15:44 — 👍 1 🔁 0 💬 0 📌 0

Trump wants to cut the corporate tax rate down to 15%.

The benefits will mostly go to foreign investors and the richest 20% of households.

Corporate tax breaks worsen income inequality.

28.01.2025 15:37 — 👍 11 🔁 11 💬 1 📌 0

Charles Koch’s network launches $20m campaign backing Trump tax breaks

Revealed: fossil fuel billionaire’s Americans for Prosperity vows ‘herculean undertaking’ to renew and deepen tax cuts

In a fundraising letter, Americans for Prosperity just said the quiet part out loud:

"We will work to counter the class-warfare argument that tax cuts are for the 'rich.'"

Not debunk or disprove. Their goal is to counter.

www.theguardian.com/us-news/2025...

27.01.2025 17:29 — 👍 1 🔁 0 💬 0 📌 0

Trump is already carving out tariff exemptions for huge corporations like Apple and Tesla.

The new trade agenda is to advantage the largest tech firms over small manufacturers.

18.12.2024 20:02 — 👍 1 🔁 0 💬 0 📌 1

An unsurprising news day.

12.12.2024 18:15 — 👍 3 🔁 3 💬 0 📌 0

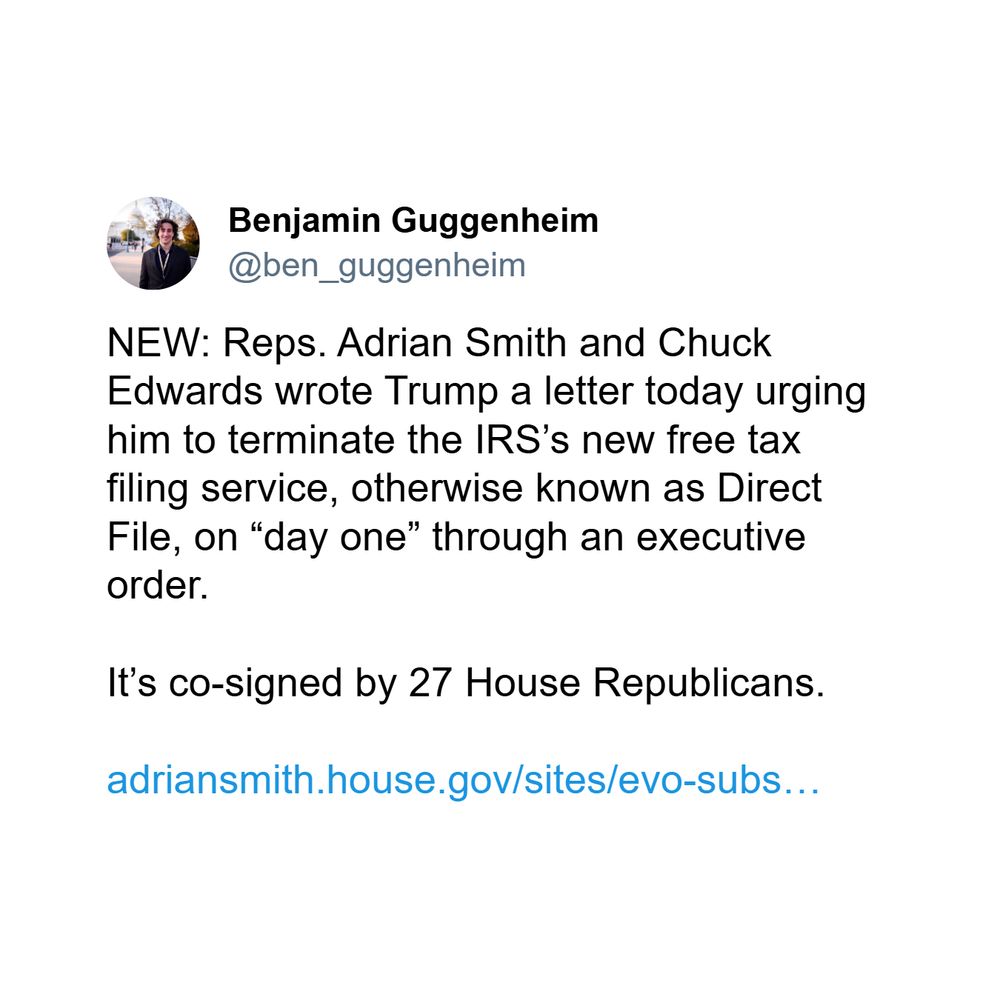

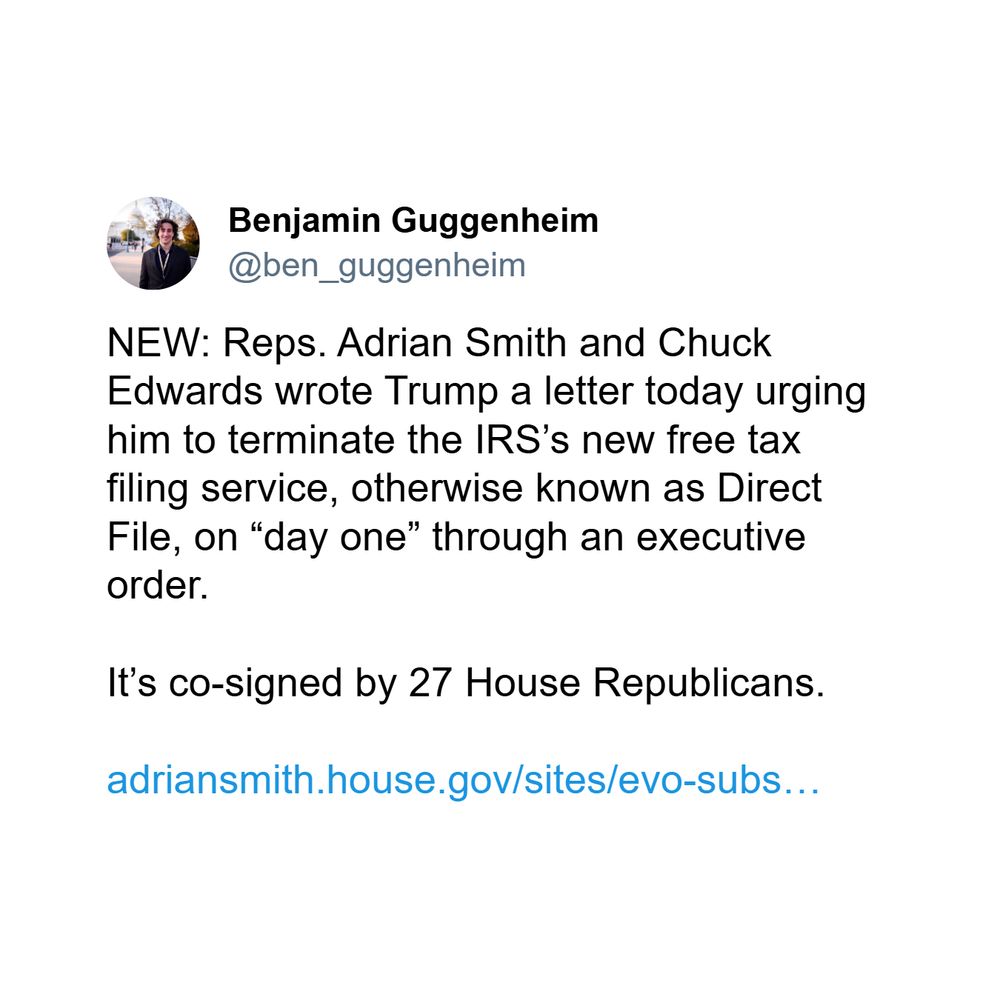

A tweet from Benjamin Guggenheim that explains House Republicans are pushing to eliminate Direct File, the free tax filing service offered by the IRS.

Making it more expensive and more difficult to file your taxes is apparently a “day one” priority.

11.12.2024 16:30 — 👍 8 🔁 2 💬 1 📌 1

Fix the tax code.

Turn justice into reality.

Don't blame my employer for stuff I say here.

We dig deep to expose corporations, extremist megadonors, and special interests who rig the system against everyday Americans.

Stay in the know ➡️ https://accountable.us

We’re fighting to put hardworking families first, standing against tax giveaways to the rich and corporations, and holding our leaders accountable.

Join us: familiesoverbillionaires.org

We are a non-profit organization founded by

@RBReich.bsky.social to inform and engage the public about the realities and impacts of inequality. | linktr.ee/inequalitymedia

We’ve been fighting for ten years to build an economy that works for all of us by making the wealthy and corporations pay their fair share in taxes.

Follow us on all socials to boost tax fairness ➡️ @4taxfairness

she/her, views my own

Join the tax fight: Fair Share America https://www.fairshareusa.org/join-our-email-list

Comedy writer, Onion contributor, mcsweeneys column, etc

Currently in bed. Email nice things only: quintmaura@ gmail

state tax policy @itep.bsky.social

📍tacoma, wa

#GoBills

Good Jobs First has since 1998 been a leading watchdog on economic development subsidies. We also expose corporate crimes.

site: www.goodjobsfirst.org

trackers: goodjobsfirst.org/databases

newsletter: www.goodjobsfirst.org/subscribe

These days jumping in on things I care about: writing, analyzing, pestering--whatever I can do. Part time Senior Fellow @ITEPtweets. Senior Fellow @CarseySchool. Founding Director of @CarseySchool. Fmr: @pewtrusts @amprog @EconomicPolicy. @napawash fellow.

I work with the fine folks at @itep.org. State/fed tax policy, corporate tax, financial accounting, dogs, surf, go Washington Spirit. Glass half empty but trying to fill it.

Advancing ideas that rebalance power in our economy and democracy. www.rooseveltinstitute.org

Building an economy that works for all of us. #WeAreTheEconomy

Frmr Director, Corporate Power @ RooseveltInst. Tax, corp gov, anti-trust policy and the energy transition. Business financial analyst & watchdog. Post-Boomer, pre-Doomer. Hecho en Califas. Writing new book on the public origins of corporate value.

Comms+ at @goodjobsfirst, the nation's corporate welfare/corporate behavior watchdog. Past: @usatoday @mcall @vcstar @latimes. Bilingüe. Views my own.

Economics and business reporter, Quartz | Contributor: MSNBC | Hablo español 🇵🇪 | jzeballos-roig@qz.com

VP for Research, CAP Action. (~);}

Assignment editor at Washington Post Opinion desk. Send pitches, feedback, etc to Benjy.Sarlin@washpost.com.

President of Center on Budget and Policy Priorities , formerly OMB/HHS, Nats fan, mom.

Reporter at The Washington Post. Listen to my series on John Brown: https://podcasts.apple.com/us/podcast/american-carnage/id1723391781