Put simply: the central banks are not in charge. Waltraud Schelkle once compared it to Asterix and the Romans: anarchy, aided by the occasional dose of magic (financial innovation), withstands the imposition of order.

8/n

18.01.2026 21:15 — 👍 1 🔁 1 💬 1 📌 0

Geoeconomic | Substack

Cornel Ban, associate prof at Copenhagen Business School and fellow at Boston University's China Initiative at the Global Development Program. Click to read Geoeconomic, a Substack publication with hu...

The best new Substack you're (probably) not reading yet. @cornelban.bsky.social covers everything from ruling the winds and green central banking to kinky investments, China as the revisionist terminator, and what it takes to scale technology on geoeconomic.substack.com

22.12.2025 15:40 — 👍 3 🔁 1 💬 0 📌 0

Public Investment Quality and Sovering Risk (with Amat Adarov) is now out in JIMF @gvagrad.bsky.social

15.12.2025 13:12 — 👍 6 🔁 2 💬 0 📌 0

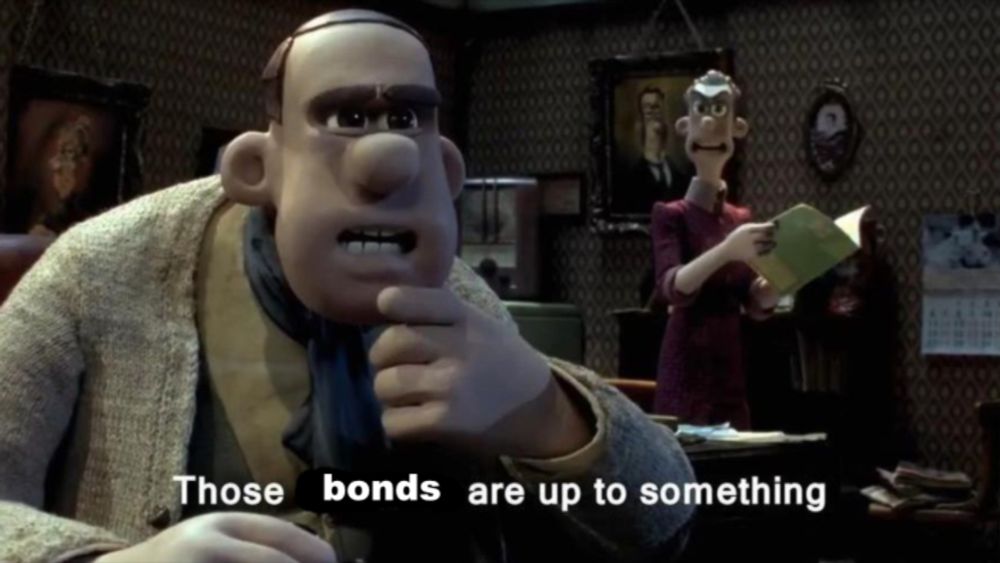

A needless rebranding -- historically and contemporarily a central bank purchasing bonds is normal! You are right, this can then be used as a justification for shelving.

06.11.2025 13:54 — 👍 0 🔁 0 💬 1 📌 0

What do you make of the section on the bond portfolios, is this "we're definitely stopping... unless we need to start again"? Why not just acknowledge that market-stabilisation runs on bonds?

06.11.2025 12:05 — 👍 2 🔁 0 💬 1 📌 0

IMF: "only about half of fiscal consolidations achieve their fiscal targets, including debt reduction. A broad range of econometric methods, based on well-established methods in the empirical literature, confirm that fiscal consolidations do not reduce debt ratios, on average."

04.11.2025 11:53 — 👍 19 🔁 7 💬 1 📌 1

Congratulations! and look, @fabianpape.bsky.social fresh figures for you nice dollar hegemony lecture.

30.10.2025 13:26 — 👍 3 🔁 1 💬 1 📌 0

Bang: "A truly healthy economy will come from a government taking responsibility for delivering meaningful change, not evoking the bond markets to avoid it."

30.10.2025 09:47 — 👍 2 🔁 0 💬 0 📌 0

It's only a matter of time before Weidmann's 'getting out of town' gets a different coat of paint too.

15.10.2025 13:43 — 👍 0 🔁 0 💬 0 📌 0

It’s goodnight Vienna as Paris sleeper train to Austria and Berlin hit by cuts

Some Nightjet services suspended from mid-December after French withdrawal amid public budget crisis

Paris-Berlin sleeper: low carbon, 2 years old, constantly full, but currently losing SNCF a few million EUR/yr

Intl Jet fuel tax exemptions are 80 years old and cost the EU 22 million EUR/yr for the Paris-Berlin route alone.

And you're cutting... the sleeper?

www.theguardian.com/travel/2025/...

29.09.2025 21:31 — 👍 493 🔁 273 💬 12 📌 11

We have a great job opportunity for an economic analyst focused on fiscal in our Brussels office BUT so far hardly any women have applied. Pls help us changed that and spread the word! Job posting: dezernatzukunft-my.sharepoint.com/:b:/g/person...

07.07.2025 06:27 — 👍 62 🔁 64 💬 3 📌 0

For a data collection we want to launch soon, we're looking for a German speaker who could translate our survey instrument to German. This should only take a few hours of work. Of course we are remunerating! Interested? Please reach out to @alexjabbour.bsky.social !

03.07.2025 09:24 — 👍 18 🔁 27 💬 0 📌 2

Domestic bond vigilantes - the unsung 'heroes' of market discipline; congratulations on this fine piece!

24.06.2025 07:08 — 👍 3 🔁 0 💬 0 📌 0

It’s time for yet another UK fiscal event. Will the OBR fix its BoE bond-sale projections?

MaPS, they don’t love you like we love you

read @alphaville.ft.com series on the crazy 'fiscal headroom' games played by the OBR and the Bank of England with QT, games with real consequences, like the two-child benefit cap, and weep for Labour's toothless governing

www.ft.com/content/d593...

03.06.2025 07:41 — 👍 11 🔁 4 💬 1 📌 0

scrapping it would add GBP 2.5bn yearly to government spending. That is 25bn over ten years.

Only last year, the Treasury paid the Bank of England around 40bn for its 'losses' on the QE gilt portfolio.

It didnt have to. No other central bank expects to be compensated.

22.04.2025 07:50 — 👍 56 🔁 22 💬 3 📌 2

28.03.2025 17:12 — 👍 2 🔁 0 💬 1 📌 0

28.03.2025 17:12 — 👍 2 🔁 0 💬 1 📌 0

A case of ‘A poor craftsman blames his tools’ fiscal rules edition? Since '05, the Stability and Growth Pact could discount spending which fostered international solidarity (‘French defense spending loophole’) or which was thought to promote the unification of Europe (German unification loophole).

12.03.2025 09:11 — 👍 0 🔁 0 💬 0 📌 0

Highly recommended and eminently quotable on coercive decarbonisation, credit policy, and capital controls! - looking forward to the rest of the @ripejournal.bsky.social special issue on derisking.

11.03.2025 16:46 — 👍 2 🔁 0 💬 0 📌 0

Blown away by this erudite book by @valentimvicente.bsky.social 🤯 An exceptional combination of theoretical sophistication and empirical breadth and depth.

His theory of normalization not just helps explain recent rise of far right but also warns for overestimating strength of democracy.

11.03.2025 14:32 — 👍 633 🔁 174 💬 9 📌 12

Is the model for this Nixon goes to China, Schröder's sledgehammer and Steinbrück's 'proudest political achievement' (from his memoir)?

24.02.2025 17:02 — 👍 1 🔁 0 💬 0 📌 0

@excubs.bsky.social is on the (book) case!

05.02.2025 14:00 — 👍 2 🔁 1 💬 0 📌 0

Agreed, and 'discipline' is a useful porthole for historically minded scholarship wanting to use your work as a starting point working backwards.

05.02.2025 11:15 — 👍 0 🔁 0 💬 0 📌 0

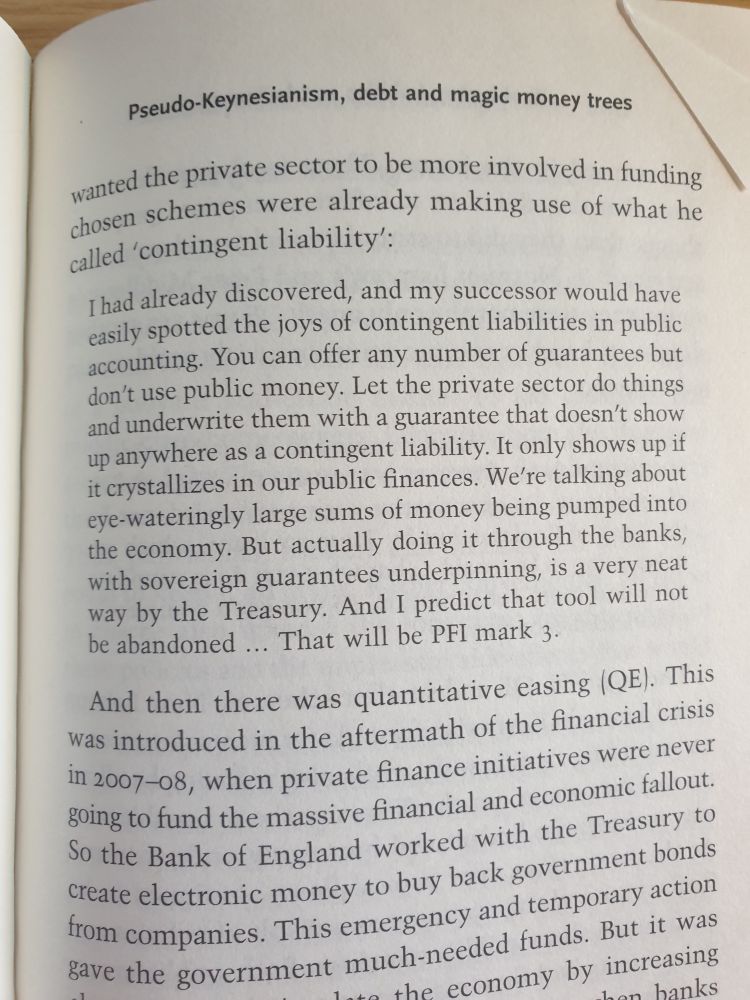

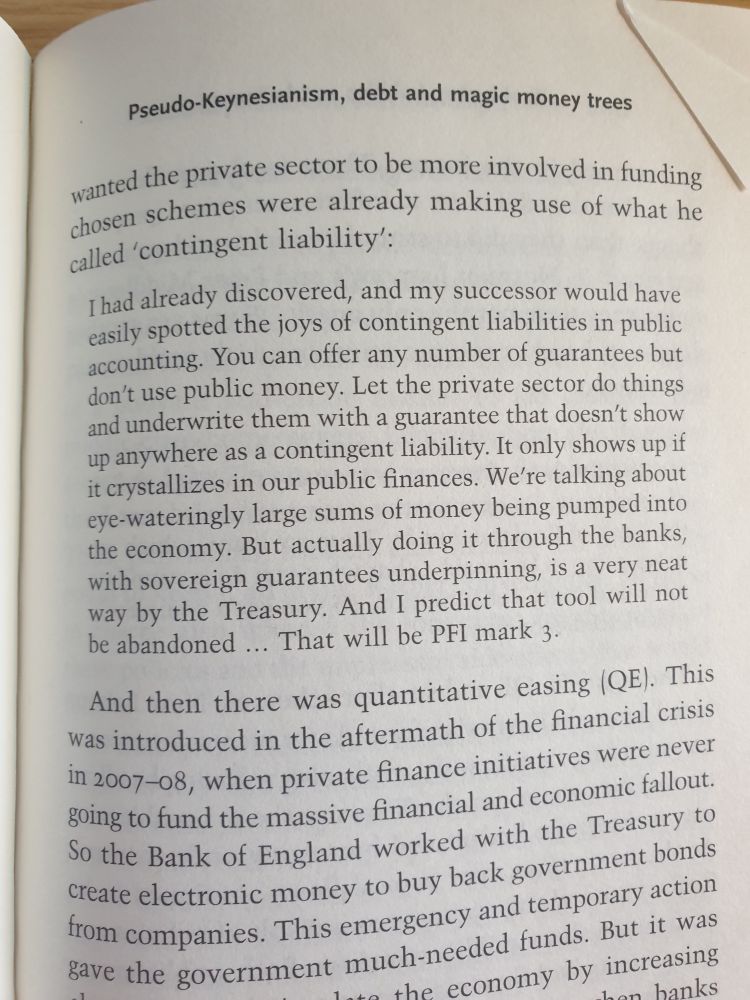

What a quote; the former UK Chancellor Hammond on the joys of contingent liabilities and why the model is not going anywhere (👋 de-risking), from Aeron Davis excellent history of the UK Treasury since 1976 (@manchesterup.bsky.social).

28.01.2025 14:06 — 👍 2 🔁 1 💬 0 📌 0

The Guardian view on development’s paradox: the rich benefit more than the poor | Editorial

Editorial: The global south needs a fairer deal than this one, in which it funds the lifestyle and wealth of the global north

The World Bank calculated that the rich world earned more than $1.4tn in loan repayments from the global south world in 2023

"Colonial patterns of extraction plainly did not disappear with the withdrawal of troops, flags and bureaucrats."

www.theguardian.com/commentisfre...

20.01.2025 15:22 — 👍 6 🔁 3 💬 0 📌 0

Wow, fantastic material. Whenever I read about new developments in pension land, I remember your tweet that the military was allowed to opt out alone and stayed in the public system.

14.01.2025 20:20 — 👍 3 🔁 0 💬 0 📌 0

What’s up with bond yields?

From borrowers to sorrowers

Perhaps even not that large ? -- main character energy from the FED as per usual: www.ft.com/content/0397...

10.01.2025 10:06 — 👍 0 🔁 0 💬 0 📌 0

“In the years since 1982, developing countries have transferred an estimated $4200 billion in interest payments to their creditors in Europe & North America, far outstripping the official-sector development aid these countries received during the same period“

www.phenomenalworld.org/analysis/new...

08.01.2025 10:12 — 👍 24 🔁 11 💬 1 📌 0

WZB Berlin, Humboldt University, TCD

https://macartan.github.io/

Politics, conflict, inequality, political economy of development, causal inference

Author of 'Silicon Empires: The Fight for the Future of AI': https://amzn.eu/d/aZKYWsA

The Society for the Advancement of Socio-Economics (SASE), founded by Amitai Etzioni in 1989, is an international, interdisciplinary organization with members across 50 countries.

2026 Conference in Bordeaux 🇫🇷

Gründerin von @sanktionsfrei.bsky.social

Social data scientist with too many questions | Postdoc & data scientist | PhD @EUI

https://laurenleek.eu/

https://laurenleek.substack.com

political theory @BarnardCollege: climate, Marxism, feminism. A Planet to Win at Verso; Free Gifts out now at Princeton UP https://tinyurl.com/fa8868a5

www.alyssabattistoni.com

Professor of Political Arithmetic at Uni of Amsterdam | Political economy of AI governance | Leader of the RegulAite project (https://www.regulaite.eu)

Data/AI Governance and Ethics

Food Systems and Decolonial Futures

Currently: Senior Policy Analyst @openfuture.bsky.social

A think tank that develops strategies and policies for cultivating #DigitalCommons.

https://openfuture.eu/

Political Sociology of Money | Stories | Football | Member of RG "Monetary Sovereignty" | @HIS Hamburg

EM doc. Politics nerd 🇷🇴🇬🇧🇫🇷

European at core

Into military stuff nowadays, out of necessity

Labour and Capital: stewardship, labour rights, unions, pensions, corporate governance, workforce engagement

FT Alphaville reporter. Ex-“veteran” fund manager. Resolution Foundation Assoc. Baring Foundation Trustee.

Econ prof at Oxford.

Machine learning, politics, econometrics, inequality, random reading recs.

maxkasy.github.io/home/

Author of many books, Salvage editorial collective. Find my writings at Guardian, New Statesman, NYT, Jacobin, TLS, LRB, etc. Patreon: https://www.patreon.com/richardseymourwtf

I work @lrb.co.uk, most of my opinions are other people’s

Professor of History, sometimes administrator at big public university in Midwest. Writes about money, French Revolution, restaurants. Friend to vert paleo.

ex UCL History; Yale SOM Visiting Fellow; Guggenheim and New America Fellow.

once/future Mainer

PhD candidate in the history of finance at Princeton. Working on early-modern Atlantic currencies. Writing a trade-press history of the dollar and a dissertation about the guinea. I used to be a journalist. I used to be a lot of things.

PhD student in Political Science at UCLouvain (ISPOLE)

Political Economy, Monetary Policy, Central Banks (ECB & Federal Reserve // monetary politics, accountability, expertise)

https://uclouvain.academia.edu/AntoinedeCabanes

The European Political Science Society: the not-for-profit professional association for political science in Europe and beyond

https://epssnet.org/

28.03.2025 17:12 — 👍 2 🔁 0 💬 1 📌 0

28.03.2025 17:12 — 👍 2 🔁 0 💬 1 📌 0