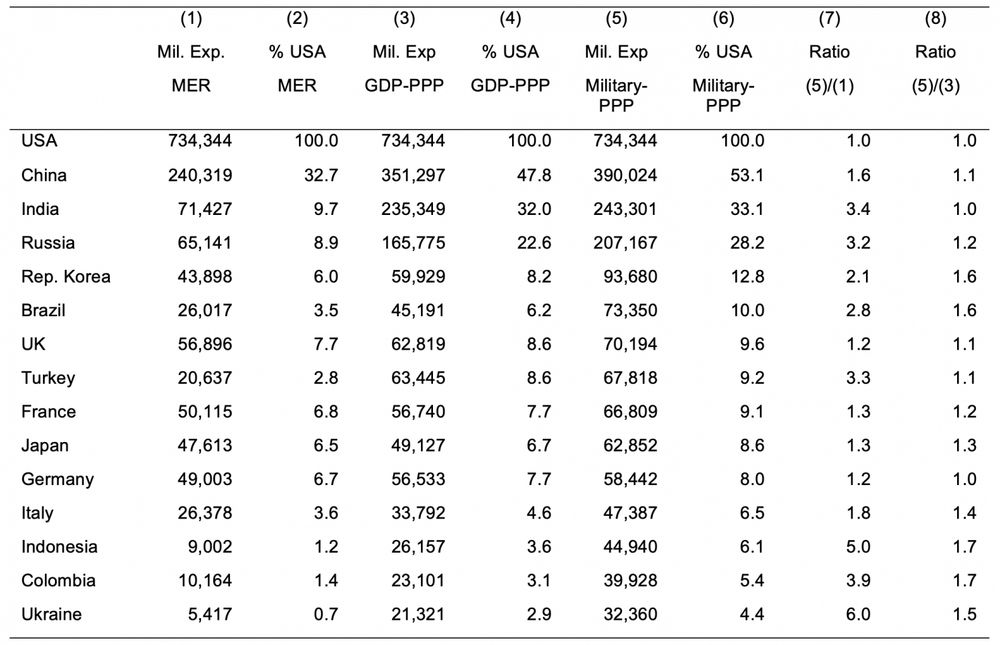

Click on the link, it's military PPP

14.01.2025 12:08 — 👍 0 🔁 0 💬 1 📌 0Rüdiger Weber

@rdgrwbr.bsky.social

Financial economist www.rudigerweber.com

@rdgrwbr.bsky.social

Financial economist www.rudigerweber.com

Click on the link, it's military PPP

14.01.2025 12:08 — 👍 0 🔁 0 💬 1 📌 0Also, do you habe any idea how much you have to pay for retired NVA officers?

14.01.2025 11:54 — 👍 0 🔁 0 💬 0 📌 0

PPP adjusted military expenses, https://cepr.org/voxeu/columns/debating-defence-budgets-why-military-purchasing-power-parity-matters

You need to adjust for how much the spending buys.

cepr.org/voxeu/column...

Even more interesting would be PP adjustment.

20.12.2024 17:55 — 👍 6 🔁 0 💬 0 📌 0forgot to add a 😉

19.12.2024 12:20 — 👍 1 🔁 0 💬 0 📌 0It can be both. Rigor is a necessary but not sufficient condition for success. In addition to beimg rigorous, it helps to be senior.

See, it's that kind of sharp reasoning economists mean.

The sloppiness of the map is very Zeit-y (see also the post Nazi greater Hamburg act circumference of Hamburg). 2 yrs go or so they argued that building more housing doesnt help against rising rents bc in cities w more construction rents rose more.

17.12.2024 19:37 — 👍 0 🔁 0 💬 0 📌 0You mean Further Austria, right?

17.12.2024 19:32 — 👍 0 🔁 0 💬 1 📌 0Probably not sth a country profits from long-term. Exporting at low exchange rates also means exporting capital so you lack necessary investment at home. Borrowing at lower rates otoh is a clear advantage.

17.12.2024 16:08 — 👍 1 🔁 0 💬 0 📌 0Bc of low exchange rates?

17.12.2024 12:18 — 👍 0 🔁 0 💬 1 📌 0

There's also this whole thing about Homer's wine-like sea (that's not actually red but just dark) e.g., here: www.laphamsquarterly.org/sea/winelike...

15.12.2024 14:19 — 👍 1 🔁 0 💬 0 📌 0Welcome @alexchinco.bsky.social to BlueSky! Alex is one of the best writers in finance academia. I don't know if he'll post regularly, but I'd encourage everyone to follow him.

11.12.2024 23:13 — 👍 8 🔁 3 💬 2 📌 0Sure! Publishing such a paper (by non-famous authors) is hard enough when you don't claim findings are wrong.

That said, some of the comments under or above your post (not yours) essentially were "it's all wrong" which I guess would be too much to claim.

where the problem is bigger than in the other specifications where much of the correlation is accounted for.

Not an expert on this topic but we should be careful to judge too much (based on one critique paper that most of us haven't read).

I remember a reply by @jvoth.bsky.social, I think, arguing that it's not as big a problem as the paper argues. E.g. the Kelly paper tends to looks at the "rawest" tables in the original paper (no controls, etc),

07.12.2024 18:00 — 👍 1 🔁 0 💬 1 📌 0Tbf 2/3 of the shown answers could be `evolution'

29.11.2024 12:17 — 👍 0 🔁 0 💬 0 📌 0sth about a paper on equity duration at the 2020 ASSA

28.11.2024 09:36 — 👍 0 🔁 0 💬 0 📌 0Unfortunately, the link isn't working for me.. Was it the Goncalves paper?

27.11.2024 13:38 — 👍 0 🔁 0 💬 1 📌 0Reminder: you don't get omitted-variable bias in your coefficient of interest because some variable that you can't/don't control for may also affect the outcome.

20.10.2023 09:29 — 👍 4 🔁 0 💬 0 📌 0Bier trinken?

04.10.2023 19:56 — 👍 1 🔁 0 💬 1 📌 0