We discuss it some more here www.financialresearch.gov/briefs/files...

04.03.2025 20:27 — 👍 3 🔁 0 💬 1 📌 0Jay Kahn

@jstatistic.bsky.social

Economist working on repo, Treasuries and money markets. Views are my own.

@jstatistic.bsky.social

Economist working on repo, Treasuries and money markets. Views are my own.

We discuss it some more here www.financialresearch.gov/briefs/files...

04.03.2025 20:27 — 👍 3 🔁 0 💬 1 📌 0

Note here: www.federalreserve.gov/econres/note...

18.02.2025 14:32 — 👍 0 🔁 0 💬 0 📌 0

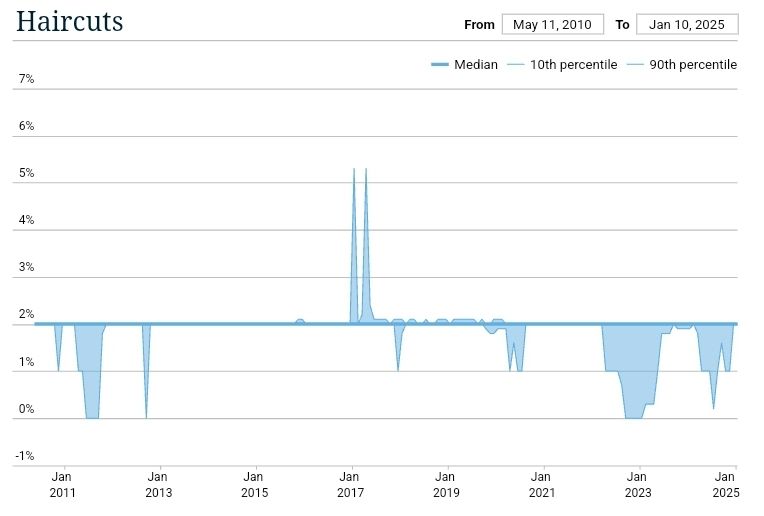

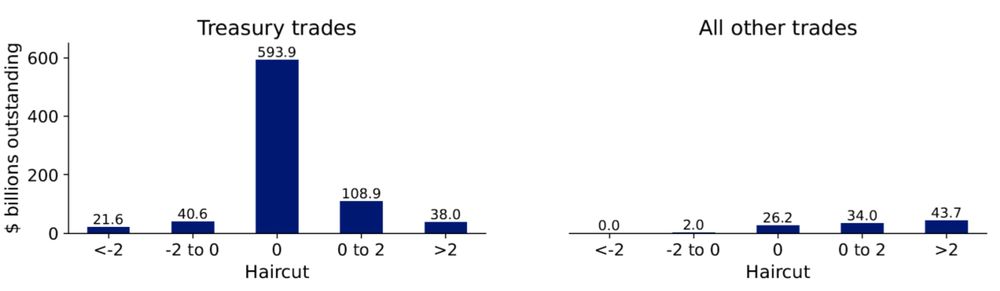

Even with these reasons in hand, that triparty haircuts are so uniformly at or near 2% regardless of market conditions suggests this may be a useful convention for traders trying to pack a lot of transactions into very little time, rather than carefully calibrated protection.

18.02.2025 14:32 — 👍 0 🔁 0 💬 1 📌 0

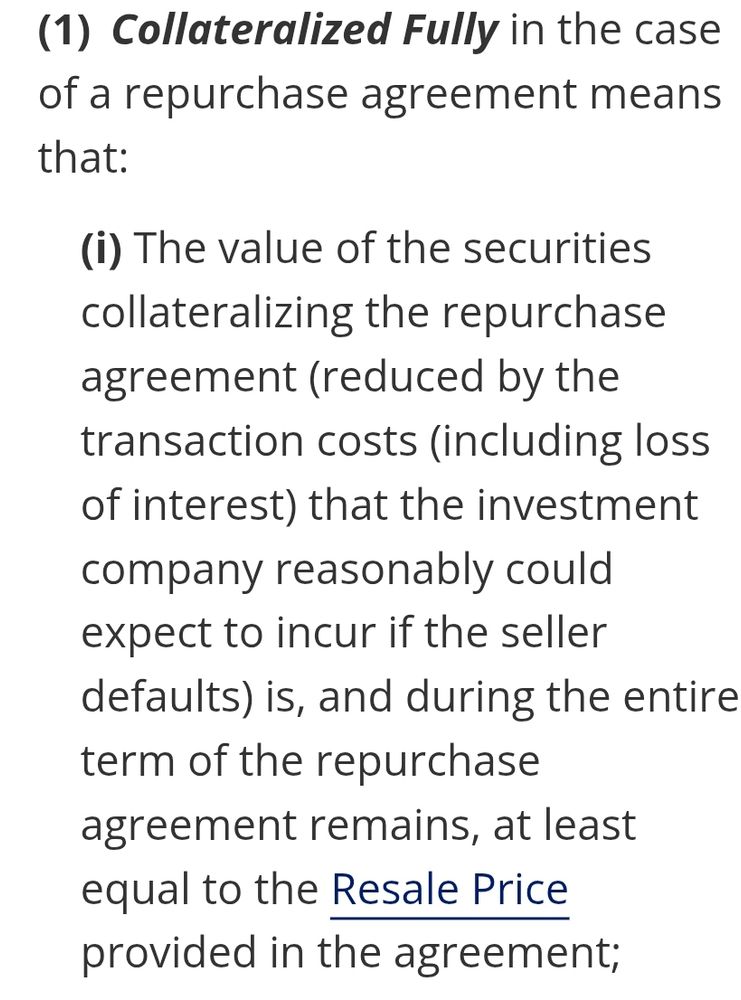

Reason 3: Many tri-party lenders are money market funds bound by 2a-7.

They are allowed to treat repo as an investment in the underlying security only if it is "collateralized fully," which may be interpreted as requiring a strictly positive haircut under the definition below.

Reason 2: Triparty is a general collateral market meaning that dealers have an incentive to use their worst collateral. So they aren't concerned about losing collateral.

Bilateral is specific collateral and may be used to source securities the borrower doesn't want to lose.

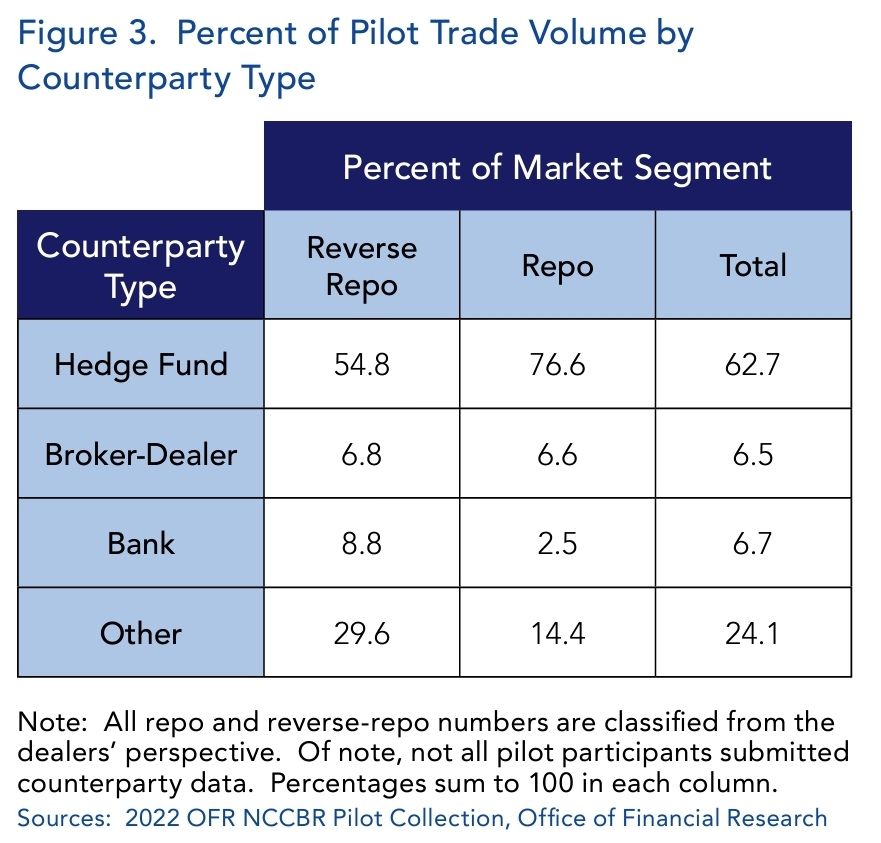

Meanwhile, bilateral features a lot of both borrowing and lending by hedge funds to dealers, so sometimes it may be the dealer-borrower who need protection rather than the lender.

www.financialresearch.gov/briefs/files...

Three big reasons for the gap:

Reason 1: Counterparty risk in triparty is generally lower—triparty is mostly safe banks and money market funds lending to riskier dealers—so lenders generally demand protection.

www.federalreserve.gov/econres/note...

2% haircuts have become a fixation for many thinking about hypothetical minimum margins.

Since we've had the triparty data for a long time, people have gotten used to thinking 2% was "correct," but as we point out in the note triparty is a very different market from bilateral.

In non-centrally cleared bilateral repo, 70% of haircuts are zero, while triparty repo almost always applies a 2% haircut, giving the lender substantially more protection.

Why is there such a big gap?

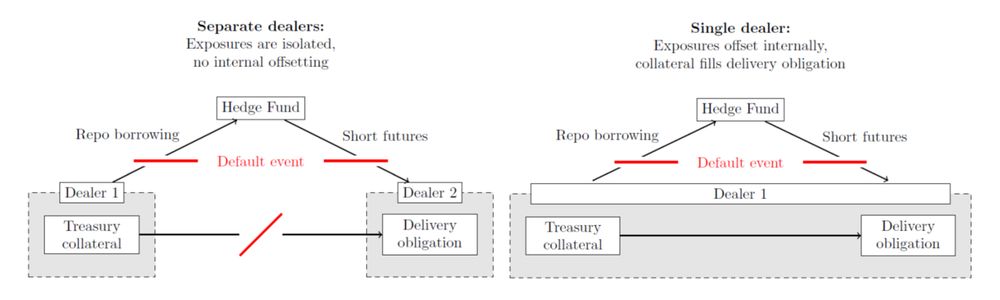

We also argue that cross-margining should be applied where practicable, for instance in cash-futures basis trades.

While cross-margining may allow greater leverage, it also reduces risk of firesales if volatility increases by accounting for correlations between cash and futures

More generally, proportionate margins reflect the full set of risks of exposures and collateral surrounding a transaction.

To the extent exposures offset, as for correlated collateral in a "netted package," that should be reflected in margin collected.

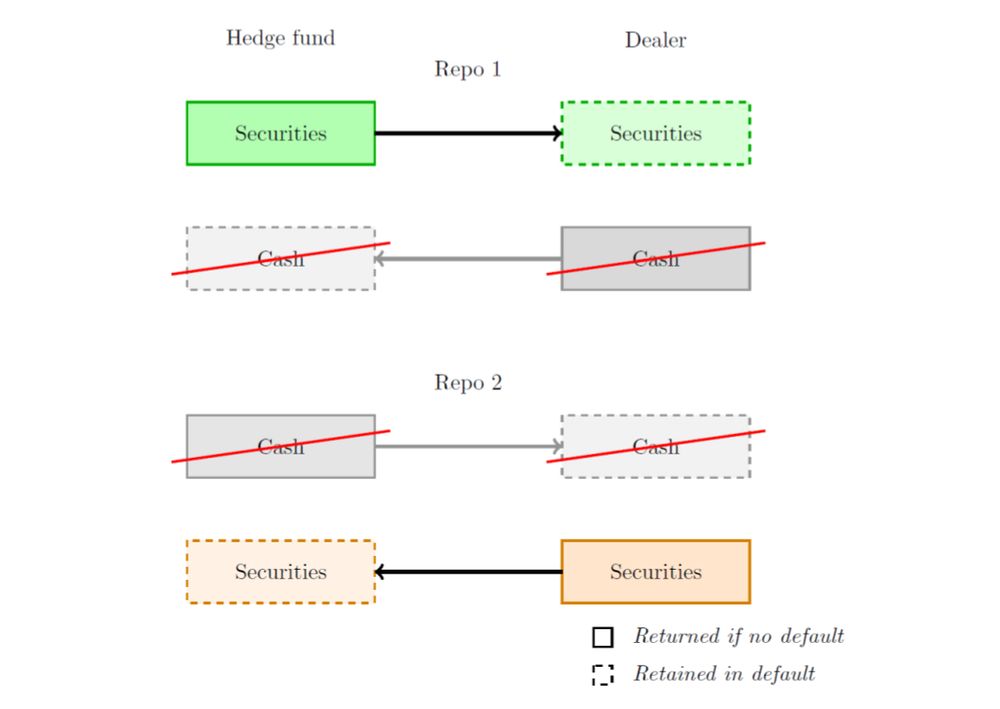

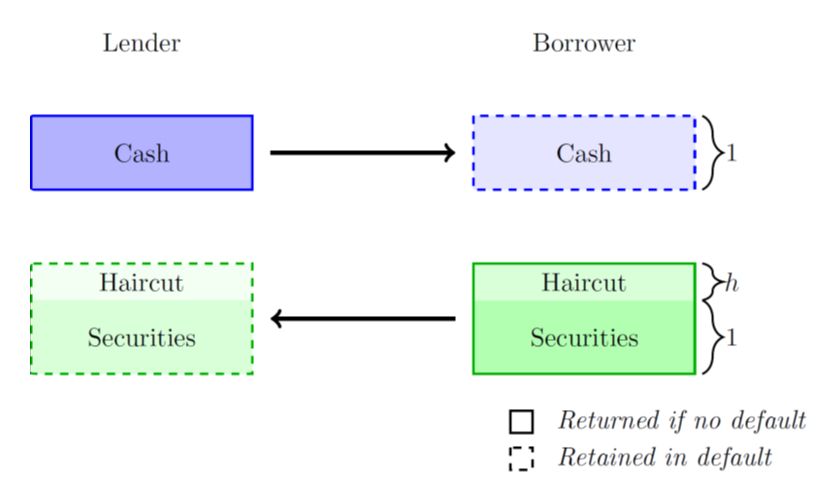

Our previous research showed that in this case, haircuts are often negative, to provide the dealer with protection against the hedge fund.

A consistent minimum haircut would undo this protection, since it would instead require a payment 𝘧𝘳𝘰𝘮 the dealer 𝘵𝘰 the hedge fund.

For example, sometimes hedge funds will source a specific Treasury by lending against it to a dealer.

In this case, even though the hedge fund is the lender, the dealer is the one who needs a cushion to protect against losing a valuable security to the hedge fund's default.

Instead, proportionate margins should:

1) Protect all participants in a transaction (not just one side),

2) Reflect both counterparty and collateral risk,

3) Account for the full portfolio of exposures between counterparties.

Minimum haircuts don't satisfy these properties.

Recent research by my coauthors and me finds that over 70% of haircuts in non-centrally cleared bilateral repo are zero, leaving no cushion for lenders.

www.financialresearch.gov/briefs/files...

This has, in turn, sparked interest in mandatory minimum haircuts in repo.

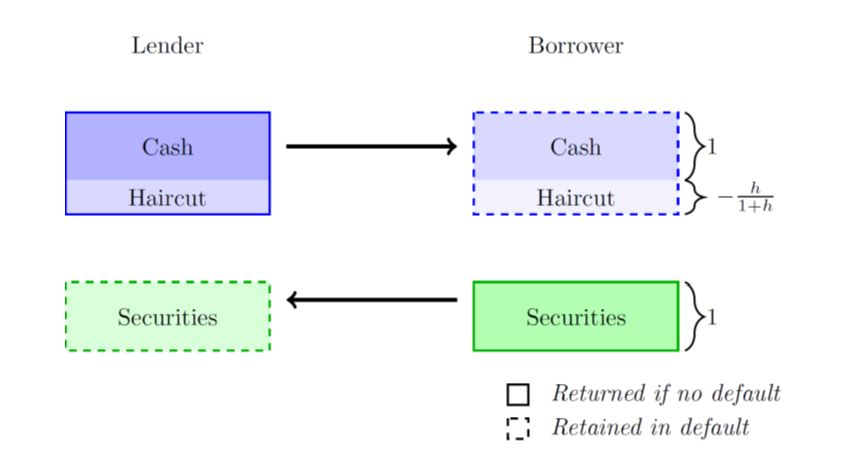

A positive haircut provides a cushion if the borrower defaults, helping the lender recover losses even if the collateral’s value dips or proves costly to liquidate.

14.02.2025 15:03 — 👍 0 🔁 0 💬 1 📌 0Outside of clearing, repo margining is determined by "haircuts": a degree of overcollateralization that guards against default risk.

For instance, if you lend $100 and require $102 of collateral, the haircut is 2%.

Recently, there’s been growing concern about low or zero haircuts in repo markets.

In a new note, we argue that safety and liquidity can both be enhanced by setting repo margins that are 𝘱𝘳𝘰𝘱𝘰𝘳𝘵𝘪𝘰𝘯𝘢𝘵𝘦 to each counterparty’s actual risk.

www.federalreserve.gov/econres/note...

Thread below:

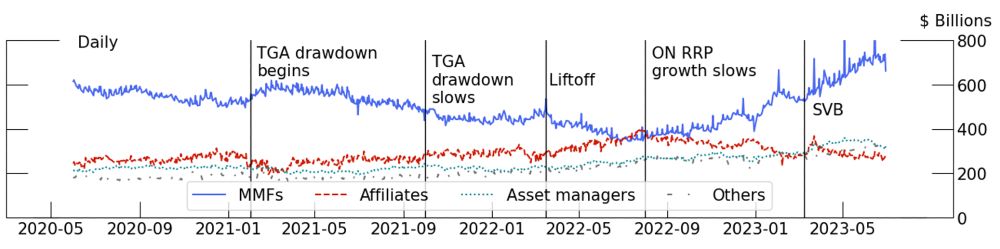

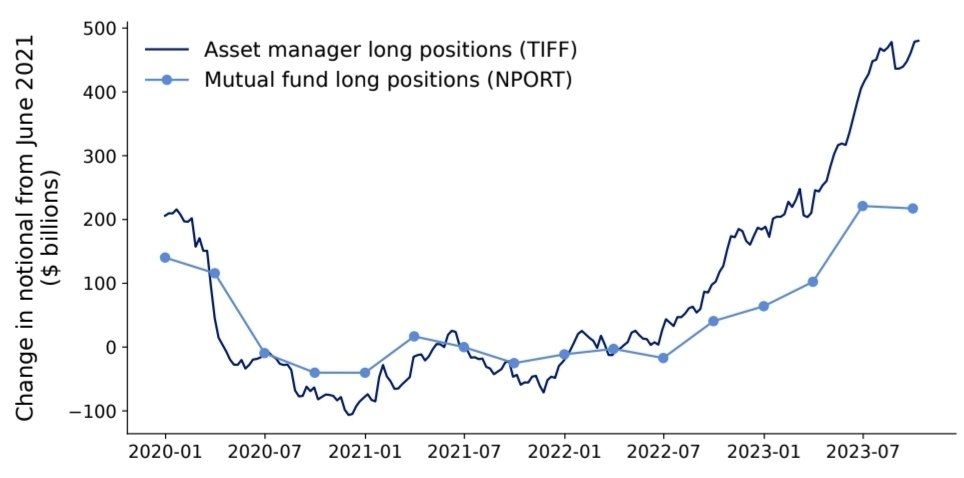

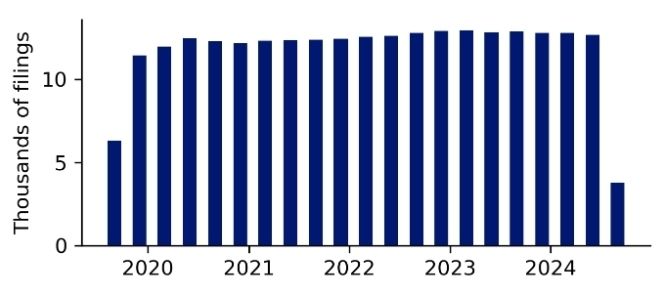

Just released: Update using N-PORT data running through 2024 Q4, live at j-kahn.com/nport/.

11.02.2025 17:19 — 👍 1 🔁 0 💬 0 📌 0I can tell I'm getting old because when I google one of my favorite bands from high school, it sends me to 'warning signs for Strokes.'

25.11.2024 01:23 — 👍 1 🔁 0 💬 0 📌 0In the counterfactual, Tyler is stuck behind me in his car as I take up the *full lane* on my bike.

22.11.2024 00:22 — 👍 0 🔁 0 💬 0 📌 0Going forward I'll be updating this data on a quarterly basis, adding new series and improving the data quality as I go. Any comments or questions are welcome!

17.11.2024 19:13 — 👍 0 🔁 0 💬 0 📌 0

This data was compiled for our paper on mutual funds' use of Treasury futures: papers.ssrn.com/sol3/papers....

It's totally free, but we ask that if you use the data you cite the working paper

Excited to share our N-PORT data release is now live at j-kahn.com/nport/. Over 200K filings from mutual funds, ETFs & more since 2019 Q4.

This preliminary data has fund-level detail on portfolio allocations, maturities, notional derivatives, Treasury futures, and more!

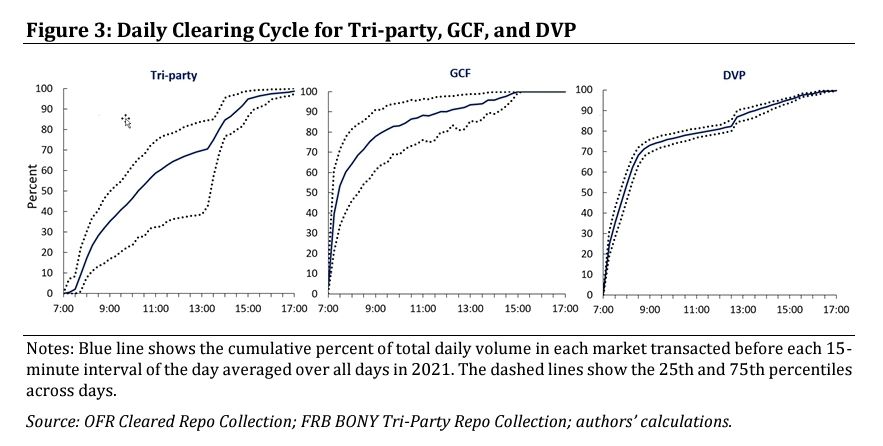

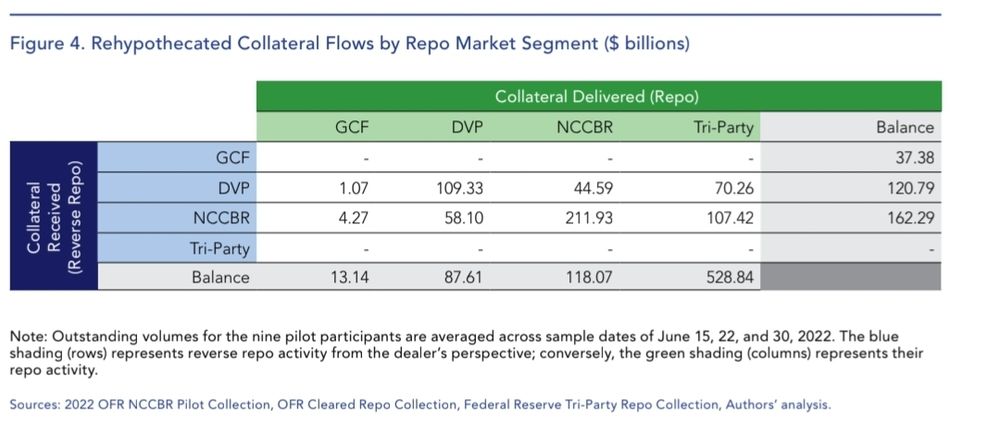

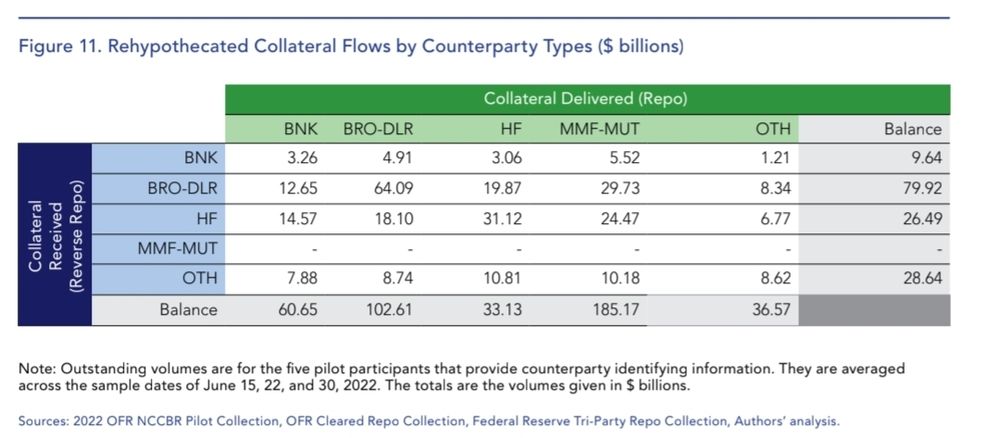

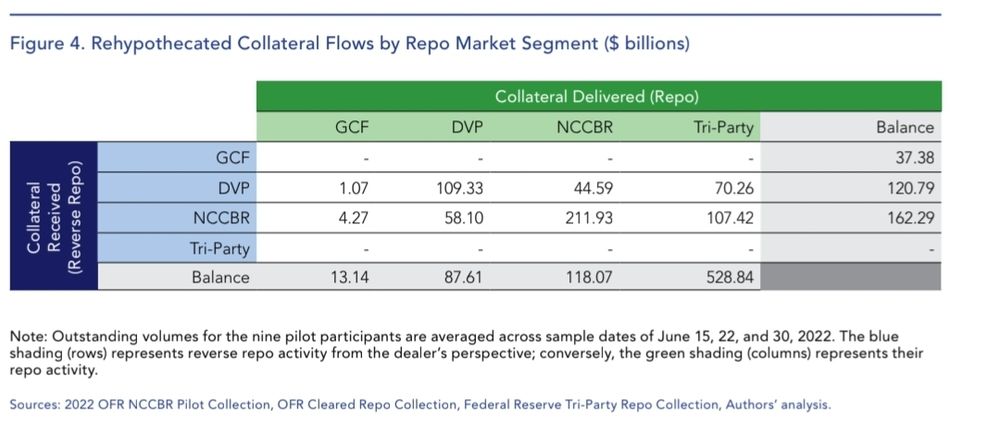

Tracking the flow of collateral across markets allows us to see useful patterns such as the that most tri-party collateral is not sourced from other repo markets (since valuable collateral will be locked up) but bilateral markets are more likely to circulate and reuse collateral.

14.11.2024 17:20 — 👍 0 🔁 0 💬 0 📌 0

We find that dealers rehypothecate about 65% of the collateral they receive, but face a variety of risks in intermediating these flows.

(all credit to Mark and Robert for this novel way of organizing the data which brings out the transfer)

New brief out with Sam Hempel, @markpaddrik and Robert Mann using comprehensive data across all four segments of the U.S. repo market to track collateral flows and repo intermediation.

www.financialresearch.gov/briefs/files...