Thanks for sharing!

27.06.2025 17:10 — 👍 0 🔁 0 💬 0 📌 0

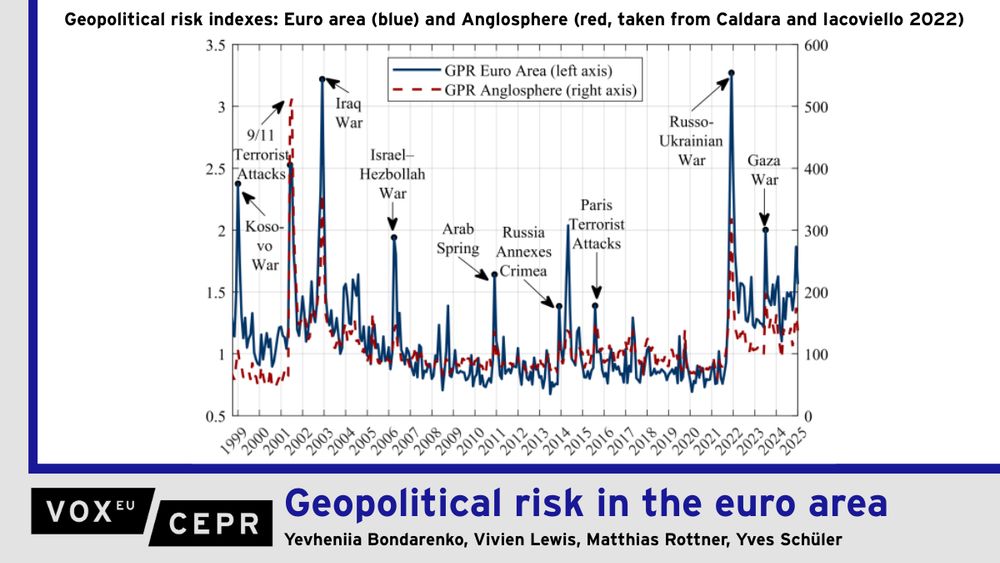

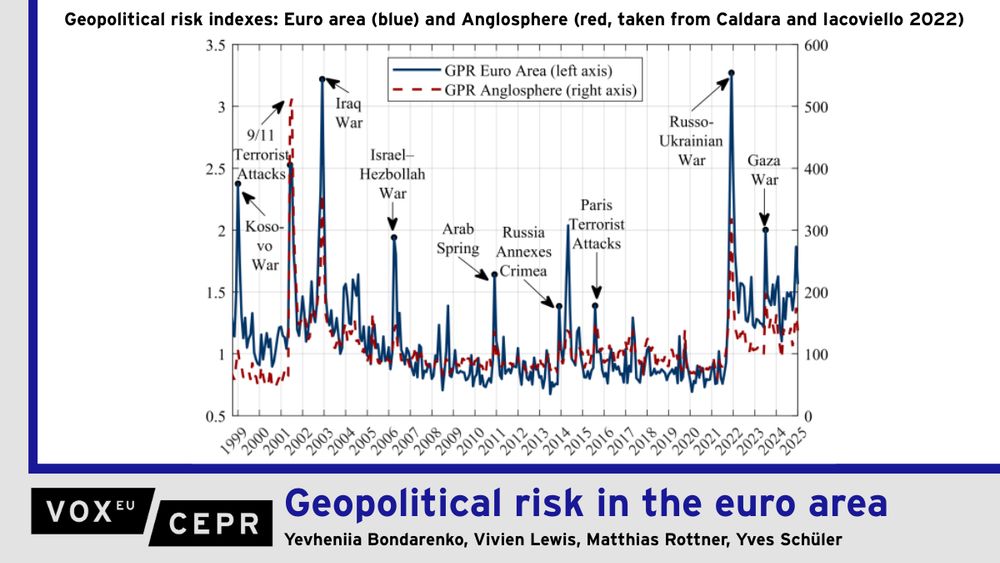

This is important. Many of the existing geopolitical and other risk measures are too Anglo-centric. Here the authors use European newspapers, hence e.g. Russia’s invasion of Ukraine has much larger and lasting effect on perceived risks in Europe. This increase is basically adverse supply shock=bad.

26.06.2025 06:59 — 👍 8 🔁 3 💬 2 📌 0

Graph of geopolitical risk indexes of the euro area and the Anglosphere.

Geopolitical risk is a key concern for the euro area, yet most available measures reflect a US perspective. This column introduces a new indicator of geopolitical risk tailored specifically to the euro area, based entirely on newspaper coverage from local sources. The authors show that shocks to this index have significant recessionary and inflationary effects, even when controlling for ‘global’ geopolitical risk. For anyone seeking to assess geopolitical risk in Europe, this euro area indicator offers a missing regional lens.

Yevheniia Bondarenko, Vivien Lewis, @matthiasrottner.bsky.social, & Yves Schüler introduce a new indicator of geopolitical #risk tailored specifically to the euro area, based entirely on newspaper coverage from local sources.

cepr.org/voxeu/column...

#EconSky

24.06.2025 07:36 — 👍 11 🔁 4 💬 0 📌 2

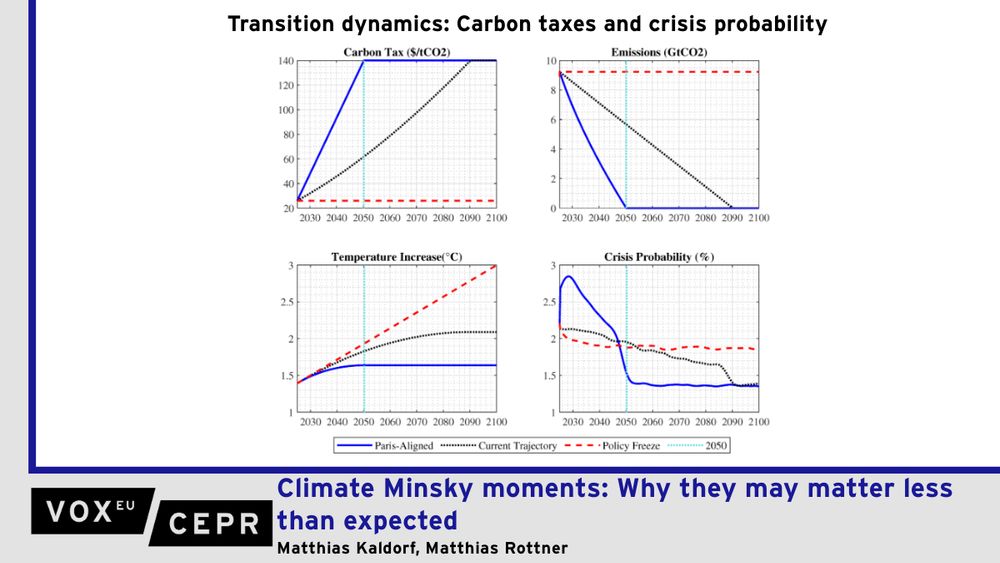

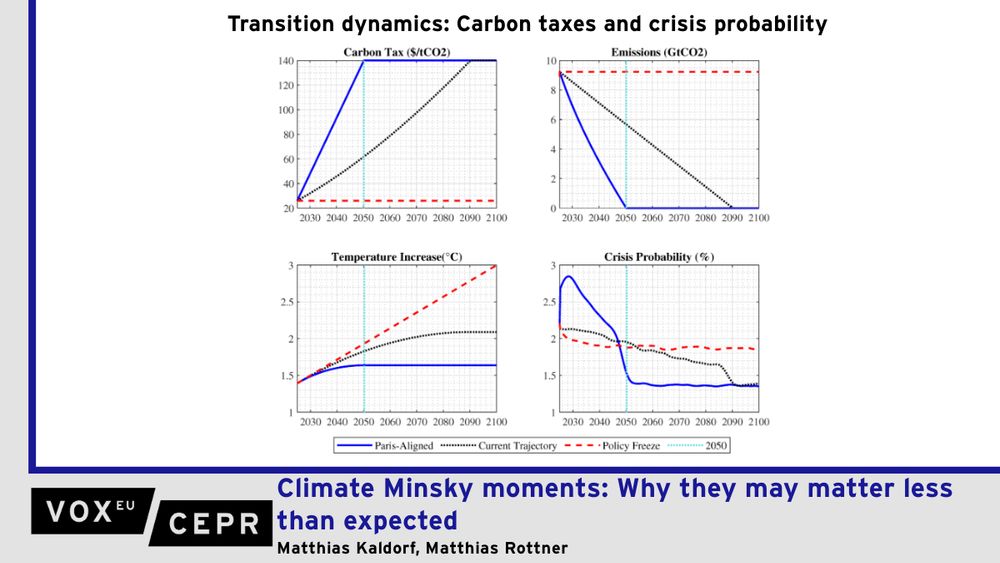

Climate policies could affect financial stability if they lead to large changes in asset returns. This column studies the financial stability and welfare effects of such ‘climate Minsky moments’ using a novel quantitative macroeconomic model with carbon taxes and endogenous financial crises. An accelerated net zero transition aligned with the Paris Agreement temporarily increases the probability of a financial crisis, before resulting in a lower long-run crisis probability. However, the welfare losses are small relative to the real costs and benefits of the net zero transition. Therefore, ‘climate Minsky moments’ do not warrant delaying ambitious climate policy.

An accelerated #net-zero transition temporarily increases the probability of a financial crisis. However, the welfare losses are small relative to the real costs and benefits of the net zero transition.

Matthias Kaldorf @bundesbank.de, @matthiasrottner.bsky.social

cepr.org/voxeu/column...

#EconSky

05.02.2025 09:01 — 👍 6 🔁 3 💬 1 📌 0

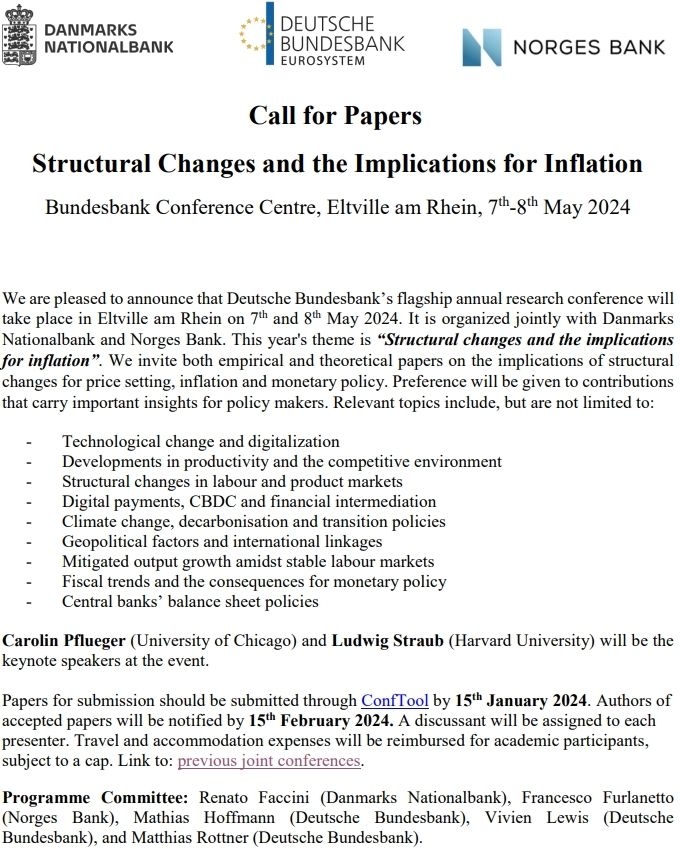

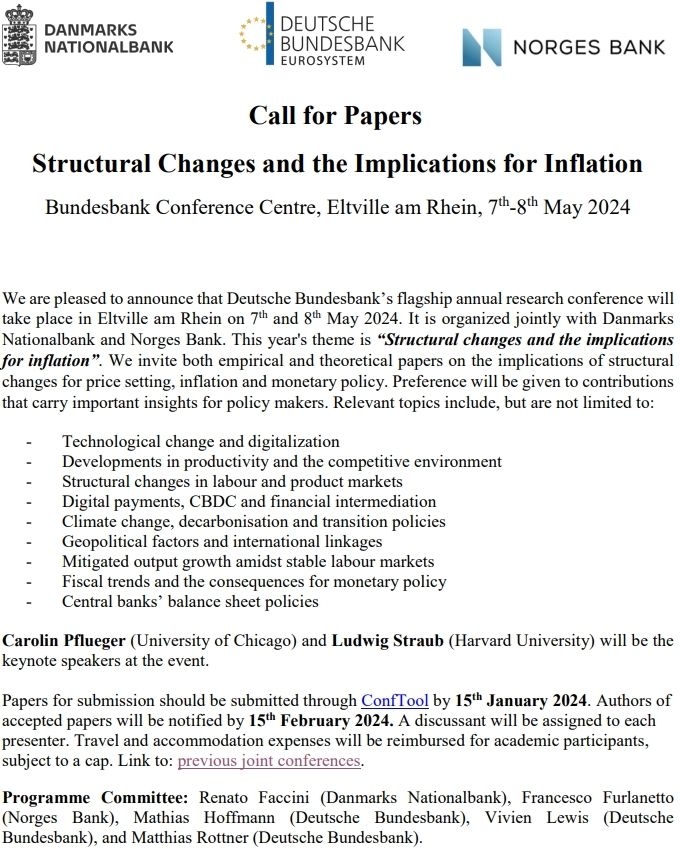

Please submit to our conference on "Structural Changes and the Implications for Inflation" organized jointly Danmarks Nationalbank, Deutsche Bundesbank, and Norges Bank.

On a private note: Looking forward to being part of the organization of a conference for the first time!

30.10.2023 13:15 — 👍 4 🔁 2 💬 0 📌 0

New call for papers. Conference on:

"Structural Changes and the Implications for Inflation"

Eltville (near Frankfurt), 7-8 May 2024.

PDF of call: matthias-rottner.github.io/Files/Confer...

Submission link: www.conftool.pro/business-cyc...

Please submit!

28.10.2023 22:51 — 👍 14 🔁 10 💬 0 📌 1

PhD researcher @eui-eco.bsky.social | Previously @ecb.europa.eu & @econmunich.bsky.social | Central banks, Political Economy and Public Economics | Believes in parallel trends

PhD candidate in economics @EUI - find my website here: https://www.laurakuitunen.nl/

Mostly Macro

Open to RAships!

Mphil_Econ & fmr Researcher @NKUA; fmr @BankofGreece

GitHub: github.com/AineiasGV

Linkedin: linkedin.com/in/aeneas-vafiadakis

Head of BOFIT (Bank of Finland Institute for Emerging Economies), not representing the official views of my employer, RTs not endorsements

https://t.co/E0YqzEKBp7

Labor Economist at Institute for Employment Research (IAB) @iabnews.bsky.social

Macroeconomist École Polytechnique, i-MIP

https://vermandel.fr/the-author/

Assistant Prof @UniGroningenFEB, monetary policy, central bank communication, learning & expectations in macroeconomics. Former @OxfordEconDept and @EUI_ECO #EconSky

Follow me if you like having your deep-seated beliefs about monetary and banking history and policy challenged. And help me by challenging mine in turn!

Team Lead Economist at ECB’s Monetary Policy Strategy Team. From the cold North (#visitOulu). PhD from PSE. Tennis player, explorer

Assistant Professor at Zurich, Princeton PhD. Macro, Finance, Machine Learning.

Economics Prof. @HEC Lausanne. Interests in Deep Learning, Machine Learning, Macroeconomics, Climate Change Economics, Finance, Comp. Science, Skiing and Hiking.

https://sites.google.com/site/simonscheidegger

VoxEU – CEPR’s policy portal - promotes "research-based policy analysis and commentary by leading economists". VoxEU columns cover all fields of economics broadly defined and are widely read.

Professor & Pictet Chair @GVAGrad, VP @cepr_org & Director ICMB. Before @UNCTAD @the_IDB @AUB_Lebanon @unito 2 daughters. FVCG ⛷🏍 Twitter handle @upanizza

www.upanizza.com

Economist at Cepremap, Paris

Senior Economist @ Banco de España.

Macro, finance and growth.

Views are my own.

Research economist at the Central Bank of Chile.

Interests: Macroeconomics, Financial Economics and International Economics.

https://www.romero-damian.com

Head of Research at Deutsche Bundesbank &

Professor at Frankfurt School of Finance and Management

PhD student in Economics at the EUI. Interested in quantitative macroeconomics and macro-finance

PhD candidate in economics at Uni Göttingen. Interested in global macro-finance and empirical macro.