Przychodzimy z kolejnym postem z naszej serii o edukacji.

Dziś przyglądamy się systemowi finansowania szkół prywatnych – i temu, jak wpływa on na sytuację szkół publicznych.

@monikasadkowska.bsky.social

Climate risk advisory in Deloitte - climate transition & adaptation planning

Przychodzimy z kolejnym postem z naszej serii o edukacji.

Dziś przyglądamy się systemowi finansowania szkół prywatnych – i temu, jak wpływa on na sytuację szkół publicznych.

🇪🇺 The EU’s omnibus proposal could increase financial risk and make it harder for the bloc to transition to a green economy, regulators and experts warn.

greencb.co/43jZ6nD

I don't think it's unreasonable to assume the OpenAI / Jony Ive thing was timed very specifically to draw attention away from @karenhao.bsky.social's book out today....

www.penguinrandomhouse.com/books/743569...

“Generative AI tools are getting practically shoved down our throats and it’s getting harder and harder to opt out, or to make informed choices when it comes to energy and climate"

- @sashamtl.bsky.social

Awesome! ❤️

08.05.2025 07:00 — 👍 1 🔁 0 💬 0 📌 0

Read more about mission-oriented approaches to climate and innovation ➡️ www.ucl.ac.uk/bartlett/pub... 2/2

29.04.2025 06:30 — 👍 4 🔁 4 💬 0 📌 0

The real drivers of future inflation are not just tariffs, but the climate crisis and states backing off their decarbonization efforts.

www.theguardian.com/commentisfre...

Here's bit of an explainer I was involved in on how the NEM works, and the energy transition unfolding within it.

(..including why it's a tough gig for 'baseload' technologies .. like nuclear)

🔌💡

www.abc.net.au/news/2025-04...

fantastic piece and it's very cute

27.04.2025 08:49 — 👍 57 🔁 5 💬 1 📌 0

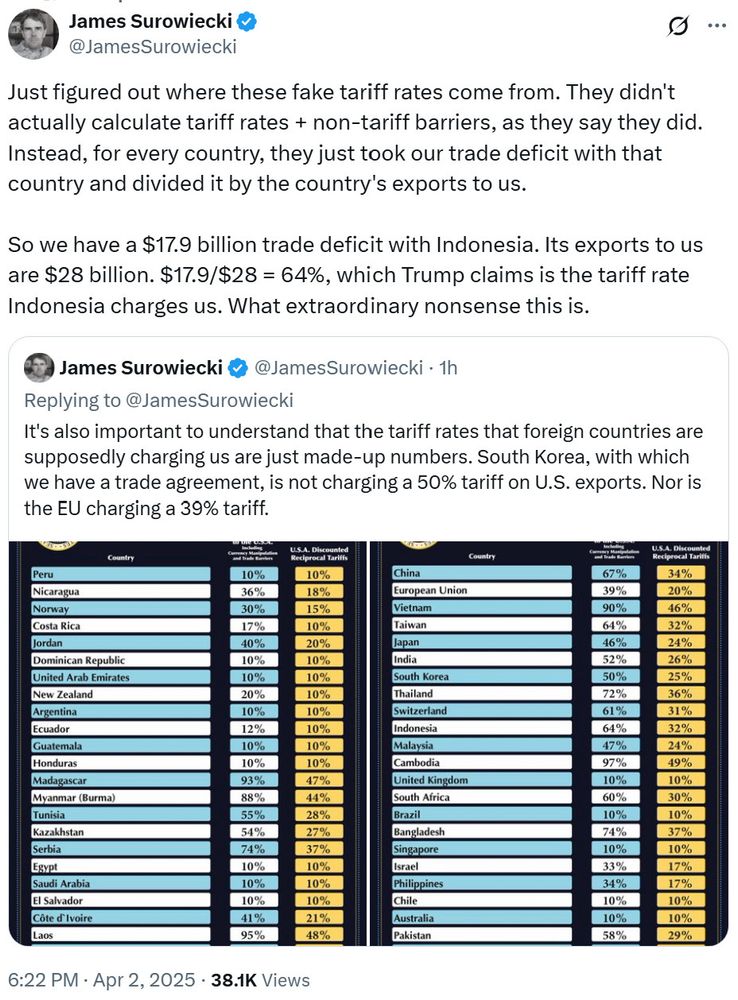

Donald Trump’s attempts to overturn the global trade regime are chaotic and uncoordinated.

As economist Ha-Joon Chang tells Jacobin, Trump has failed to see that the cause of the US’s relative decline is its own domestic capitalist class.

HRRR? RRFS? Those models don’t exist without NOAA’s Global Systems Lab.

The physics used in even more models? Not possible without us.

Decision-support tools like DESI and IDSS Engine used throughout the NWS? Also us.

What my lab does is *integral* to weather prediction and keeping people safe.

Challenge accepted, Amy. So here's one bull case for the energy transition.

Chinese economic growth will fall as a result of Trump's tariffs. Its leadership is already discussing injecting a stimulus. Now typically stimulus in a carbon-heavy economy is more emissions, but... 🧵

Absolutely

12.04.2025 06:37 — 👍 1 🔁 0 💬 0 📌 0The fight to be the last man standing in the oil industry

12.04.2025 06:35 — 👍 0 🔁 0 💬 0 📌 0

The return of the chlorinated chicken? Trump administration uses tariffs to push for radical EU deregulation ⚠️

Can a European Commission that has itself embarked on radical #deregulation be trusted to stand firm in defense of high regulatory standards? 🤔

www.corporateeurope.org/en/2025/03/d...

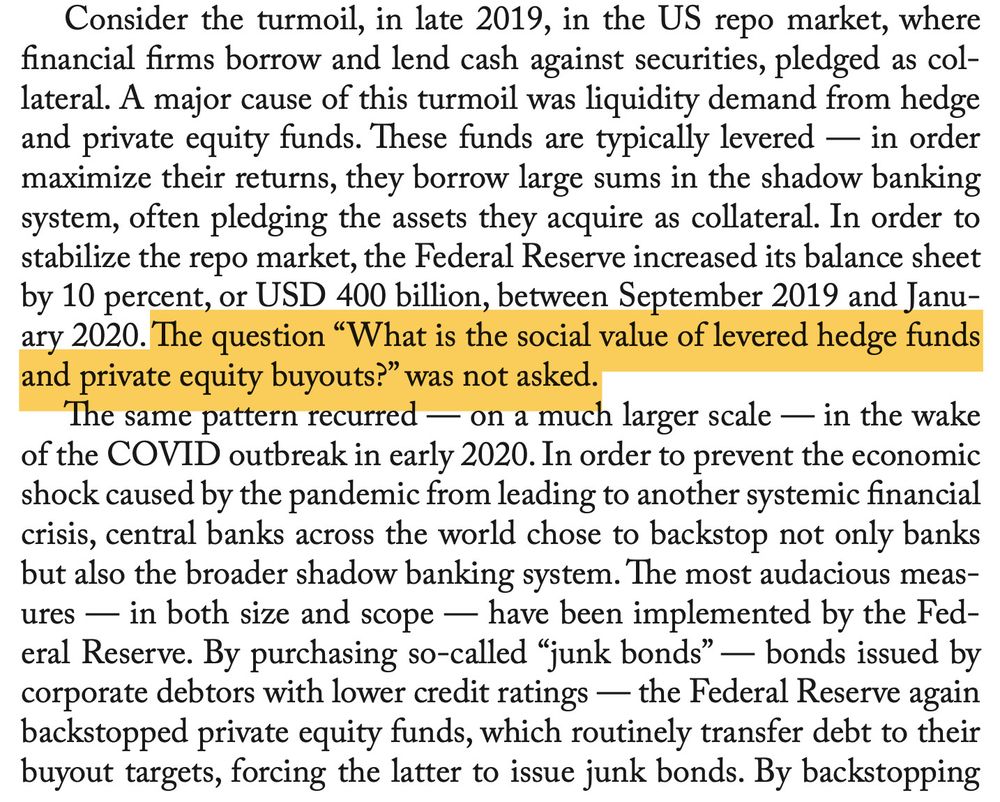

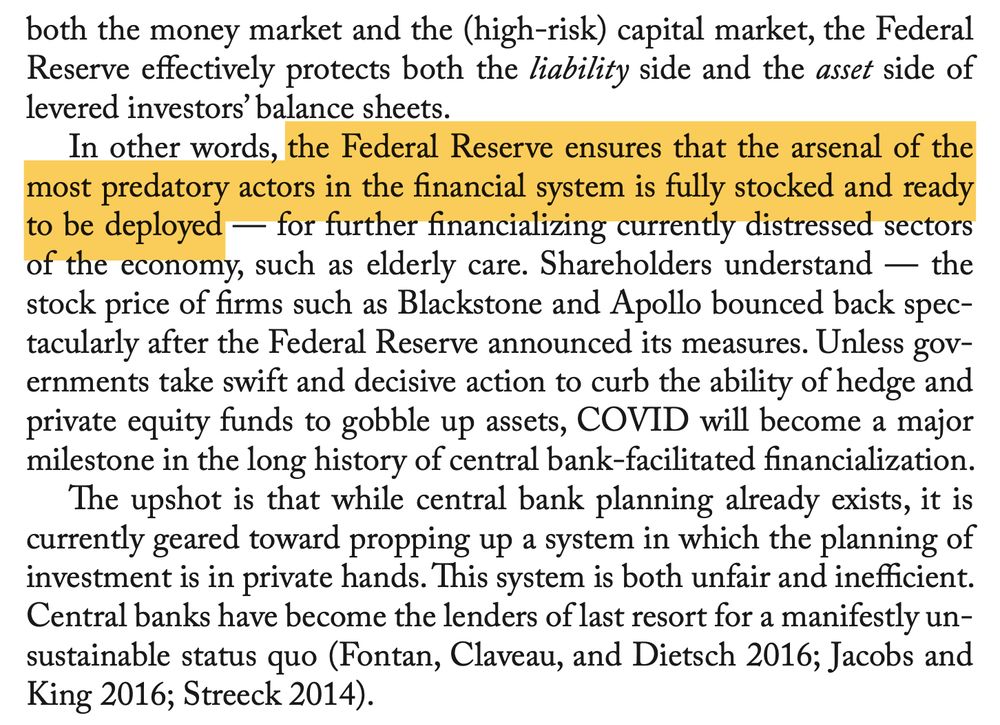

Consider the turmoil, in late 2019, in the US repo market, wherefinancial firms borrow and lend cash against securities, pledged as col-lateral. A major cause of this turmoil was liquidity demand from hedgeand private equity funds. These funds are typically levered — in ordermaximize their returns, they borrow large sums in the shadow bankingsystem, often pledging the assets they acquire as collateral. In order tostabilize the repo market, the Federal Reserve increased its balance sheetby 10 percent, or USD 400 billion, between September 2019 and Janu-ary 2020. The question “What is the social value of levered hedge fundsand private equity buyouts?” was not asked.The same pattern recurred — on a much larger scale — in the wakeof the COVID outbreak in early 2020. In order to prevent the economicshock caused by the pandemic from leading to another systemic financialcrisis, central banks across the world chose to backstop not only banksbut also the broader shadow banking system. The most audacious meas-ures — in both size and scope — have been implemented by the Fed-eral Reserve. By purchasing so-called “junk bonds” — bonds issued bycorporate debtors with lower credit ratings — the Federal Reserve againbackstopped private equity funds, which routinely transfer debt to theirbuyout targets, forcing the latter to issue junk bonds. By backstopping

both the money market and the (high-risk) capital market, the FederalReserve effectively protects both the liability side and the asset side oflevered investors’ balance sheets.In other words, the Federal Reserve ensures that the arsenal of themost predatory actors in the financial system is fully stocked and readyto be deployed — for further financializing currently distressed sectorsof the economy, such as elderly care. Shareholders understand — thestock price of firms such as Blackstone and Apollo bounced back spec-tacularly after the Federal Reserve announced its measures. Unless gov-ernments take swift and decisive action to curb the ability of hedge andprivate equity funds to gobble up assets, COVID will become a majormilestone in the long history of central bank-facilitated financialization.The upshot is that while central bank planning already exists, it iscurrently geared toward propping up a system in which the planning ofinvestment is in private hands. This system is both unfair and inefficient.Central banks have become the lenders of last resort for a manifestly un-sustainable status quo (Fontan, Claveau, and Dietsch 2016; Jacobs andKing 2016; Streeck 2014).

Time really is a circle. Leveraged hedge funds make billions; bets blow up; dash for cash; the Fed steps in; repeat. Here's what I wrote four years ago about central banks as guarantors of this unjust and inefficient (some might say: stupid) system.

benjaminbraun.org/assets/pubs/...

Another brutally hot day in Asia with many stations >45C In India and Pakistan.

46.5 Nawabshah, Pad Idan and Sibbi.

45.6 Barmer,45.4 Jaisalmer

Hundreds of stations are several degrees above their highest temperatures ever recorded in early April in Middle East,Iran,Pakistan,India and Central Asia.

If you limit demand growth from corrosive sources (like Bitcoin and image generators) you get far more room for stuff like 'saving people's lives during heatwaves' and 'moving people from their home to their work without choking them to death with air pollution'

It is WILD how controversial this is

bar chart showing the US oil industry losing money for the first 10 years of the shale boom and only making big profits in the two year after the Russian invasion of Ukraine. In 2024 they lost money again.

Despite all the hype about oil being a great investment compared to renewables, the US industry apparently lost money as a whole LAST year. These prices will do some real damage and reveal a lot of their lies.

04.04.2025 11:21 — 👍 13 🔁 2 💬 1 📌 0

have you seen this - shift from GDP to NDP will make Norway's economy look 10-20% smaller. awks www.climatechangenews.com/2025/04/01/f...

04.04.2025 11:00 — 👍 4 🔁 1 💬 1 📌 1Wow 😳

04.04.2025 12:08 — 👍 0 🔁 0 💬 0 📌 0

Chart showing oil prices dropping to $62 a barrel.

From the latest Dallas Fed survey

"Breakeven prices in the Permian Basin average $65 per barrel, unchanged from last year."

That would indicate the whole Permian Basis is now operating at a loss. Oops.

This enzyme is responsible for life on Earth. It’s a hot mess.

grist.org/video/plant-...

#Climate #GreenSky #Solarpunk #Science #Environment

@vetenskapsradet.bsky.social is opening a new grant to attract researchers from outside Europe to come to Sweden! The call opens in mid-April but some details are already online: www.vr.se/english/just...

03.04.2025 08:28 — 👍 9 🔁 7 💬 0 📌 1Just a quick one on how mad I am about big tech's slimy extractivism

In support of @societyofauthors.bsky.social, who are protesting Meta in London today.

societyofauthors.org/2025/04/01/s...

Sign the petition here: www.change.org/p/protect-au...

#MetaBookThieves #DoTheWriteThing #MakeItFA

BBC: Why don't women use ChatGPT?

Woman: I tried it and it just barfed out useless garbage

BBC: Women don't use ChatGPT because it's too difficult for their pretty little heads

Dinosaurs watching a meteor meme with text that says: https: "First, we construct climate risk indices through textual analysis of newspapers. Second, we present a new approach to compute factor-mimicking portfolios to build climate risk hedge portfolios."

I love the Financial Analysts Journal

www.tandfonline.com/doi/full/10....

I just did the numbers and this assumption looks to be completely right.

Let’s pause for a minute and consider how INSANE this is. 🧵