This probably isn't weak enough to short, or even sell, going into 2025. I'm still long, but cognizant of valuations. My ears are up for more.

12.12.2024 17:07 — 👍 0 🔁 0 💬 0 📌 0

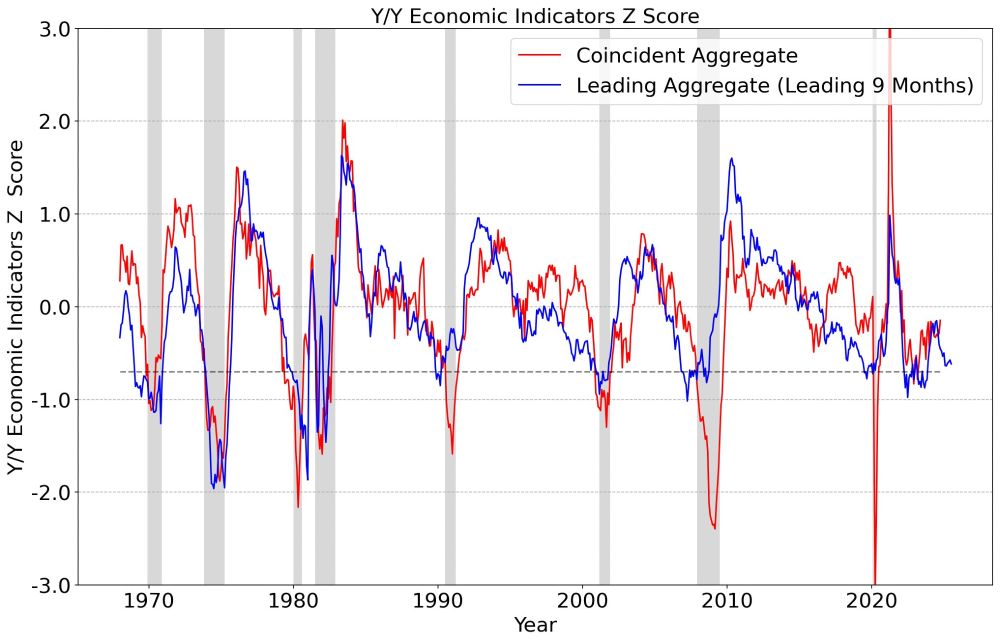

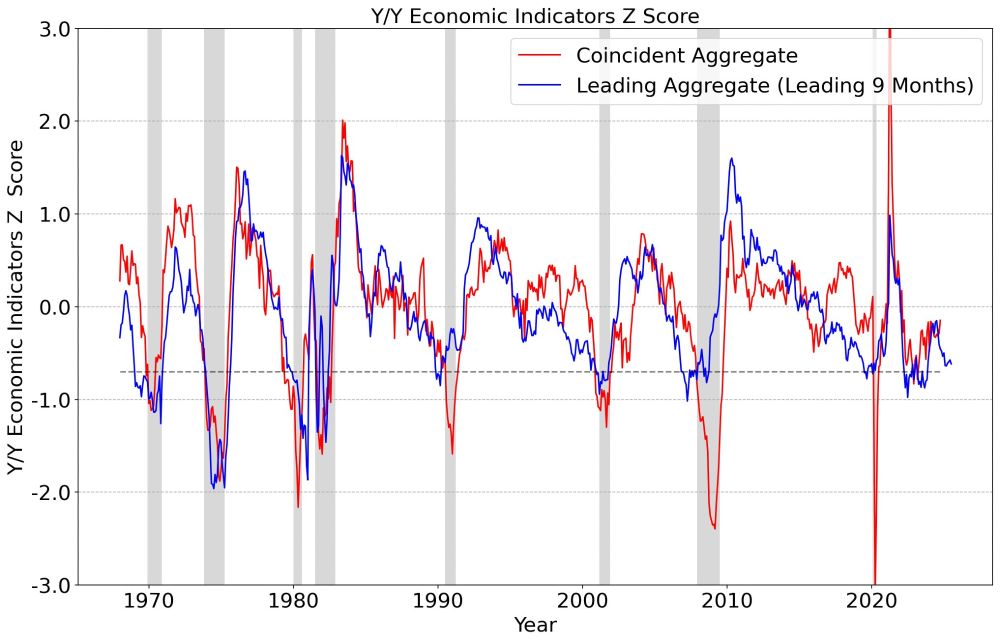

Leading data need help and they've needed help since Q1. Housing data has poured cold water on the idea of easing. Seems like the Fed wants to help but can't. 2025 could be a 🥒-zone!

Only thing I'll say is that I don't think leading data are recessionary, just very low growth.

12.12.2024 17:07 — 👍 0 🔁 0 💬 1 📌 0

This was the chart that finally got me. Explains so much about how/why people stayed too bearish over the past few years.

12.12.2024 15:44 — 👍 0 🔁 0 💬 0 📌 0

Buffett Indicator, Shiller ratio... They just don't work.

www.artificialalphainvestments.com/p/misleading...

12.12.2024 02:06 — 👍 1 🔁 0 💬 0 📌 0

The labor force data were not ideal last Friday

10.12.2024 05:27 — 👍 1 🔁 0 💬 0 📌 0

I like a long-term view on this whenever it turns (5 year timeframe?) so I think a trade could easily turn into an investment on this one

10.12.2024 05:18 — 👍 0 🔁 0 💬 0 📌 0

Coin already launched, funding secured

09.12.2024 21:59 — 👍 4 🔁 0 💬 0 📌 0

Despite a decent setup, valuations don't matter short-term. Need an economic shock before valuations matter. I thought the first China stimulus rhetoric could be that shock, but it wasn't. Bob doesn't seem to think this time will be any different. bsky.app/profile/bobe...

09.12.2024 19:58 — 👍 1 🔁 0 💬 1 📌 0

3) Extended USD

The real dollar is extended, suggesting that valuation gaps and concentration extremes are not fully justified.

09.12.2024 19:58 — 👍 0 🔁 0 💬 1 📌 0

2) USA equity concentration

The ratio between the S&P 500 and the MSCI Emerging Markets index is the highest it has been since the 1960s.

09.12.2024 19:58 — 👍 0 🔁 0 💬 1 📌 0

1) Forward P/Es

1995:

EM 25x

US 13x

US outperforms by 20% per year for 5 years

2001:

EM 10x

US 20x

EM outperforms by 20% per year for 5 years

Now

EM 12x

US 22x

09.12.2024 19:58 — 👍 0 🔁 0 💬 1 📌 0

Like everything else, emerging market equities are at valuation and concentration extremes. I like using valuations and concentration as evidence that investors are mispricing something going forward.

09.12.2024 19:58 — 👍 1 🔁 1 💬 1 📌 0

The economy and markets seem incredibly boring to me right now, which is when short VIX and long mega-caps has done well in recent years. At some point this will stop working, but it's been the cycle lately.

07.12.2024 09:07 — 👍 0 🔁 0 💬 0 📌 0

The Russell 2000 is a bad index and doesn't deserve consideration imo. I'd suggest comparing the S&P 400 vs. the S&P 600. Or here is the CRSP version of VO/VB.

28.11.2024 03:56 — 👍 1 🔁 0 💬 0 📌 0

The MSTR "leverage" seems a lot less productive, which was already a low bar.

28.11.2024 03:40 — 👍 0 🔁 0 💬 0 📌 0

Bitcoin is engineered as a reserve asset. Leverage is being built on top of Bitcoin, that seems obvious without knowing the magnitude. Whether or not Bitcoin acts like a reserve asset when the leverage on top of it cracks is the question. The SBF deleveraging is n = 1.

28.11.2024 03:40 — 👍 0 🔁 0 💬 1 📌 0

Reset your easing clocks

26.11.2024 21:21 — 👍 1 🔁 0 💬 0 📌 0

Aaaaaaaand... 💩

26.11.2024 21:11 — 👍 3 🔁 0 💬 1 📌 0

and retaliatory tariffs stand to kill the dollar more than BRICS currencies because we would be exporting less dollars via lower net imports. Value outperforming growth since the election, seemingly confirming the above. What am I missing?

22.11.2024 21:29 — 👍 0 🔁 0 💬 0 📌 0

Can someone explain the stronger dollar post-election? Trump is on record advocating for a weaker dollar, his desired policies carry a higher deficit than Harris's, he's already bullied the Fed into lower rates and intends to do it again,

22.11.2024 21:29 — 👍 0 🔁 0 💬 1 📌 0

On the opposite end, online echo chambers are pretty damaging though imo. I left Reddit back in the day because I couldn't control the echo-chambers on my feed.

22.11.2024 18:05 — 👍 0 🔁 0 💬 0 📌 0

Honestly, Bitcoin

22.11.2024 18:02 — 👍 0 🔁 0 💬 0 📌 0

Clients don't know what a "fiduciary rule" is

22.11.2024 16:57 — 👍 1 🔁 0 💬 1 📌 0

Free DampedSpring report dampedspring.com/wp-content/u...

22.11.2024 16:26 — 👍 42 🔁 3 💬 7 📌 2

My next decision is whether to take a tax hit on S&P 500 capital gains in my brokerage accounts so I can rotate more. That's a much bigger hurdle than what I've done so far. I'll be waiting for sufficient evidence that this is turning into a 5 year story like I suspect.

22.11.2024 16:08 — 👍 1 🔁 0 💬 0 📌 0

I write a daily column for https://pro.thestreet.com/author/helene-meisler on the markets. Worked at Cowen, GS, Cargill. Former Asian Expat: S'pore & Shanghai. Tennis fan. Love to cook.

Woolos Research. $SPX $SPY

National Insider for NFL Network and www.nfl.com. Made seven cameos in the movie Draft Day.

Inquiries: shahob@william-raymond.com

https://link.me/rapsheet

#1 Fantasy Football Podcast — Home of http://UltimateDraftkit.com 🏆 Entertaining, year-round...we help you win.

ESPN Senior NFL Insider. Host of the Adam Schefter Podcast https://www.instagram.com/accounts/login/?next=https%3A%2F%2Fwww.instagram.com%2FAdamSchefter%2F&is_from_rle

The Fantasy Hitman | Co-host of @fantasyfootballers.bsky.social and @spitballerspod | he/him

http://linktr.ee/ffhitman

Football writer and analyst for Yahoo. Creator of #ReceptionPerception methodology for wide receiver evaluation. I did it my way.

Co-host of the award-winning @TheFFBallers and @Spitballerspod podcasts 🏆 3x Top-10 most accurate fantasy football analyst. Lover of Christ, comedy and family.

Host of @fantasyfootballers.bsky.social podcast 🏆 Author http://MyFootballFamily.com — Entrepreneur, ice cream enthusiast, pickleball junkie. Christ follower. Instagram: http://ball.rs/andy Twitter: @andyholloway

Financial writer. Markets & charts. Subscribe to my X for exclusive charts, a Daily Insight blog post, and a follow-back. Open to freelance or full-time work.

https://www.epbresearch.com/

CIO @ Unlimited | Fmr Bridgewater IC | Described as one of the few "sane" voices on #fintwit (or is it #finsky?) | Comments are not investment advice

Editor of TKer.co | Chief evangelist of the stock market usually going up 📈

Investor, CEO, Dad

https://www.downtownjoshbrown.com/

Nom de Post. Not financial, legal, medical, or life advice. Likes & RTs not endorsements.

Chicago diehard. President & CEO of the Chicago Fed, econ prof Chicago Booth School, former Chairman of the Council of Economic Advisers.

I do not speak for the Fed or others on the FOMC

Bloomberg Opinion columnist, Buc-ee’s fan

📍Atlanta, GA

Co-host of the Odd Lots podcast. I like financial crisis hindsight, spurious correlation and puppies. London ➡️New York ➡️Abu Dhabi ➡️Hong Kong ➡️New York