And then I see news that Balenciaga's new $950 Destroyed Jacket sells out within 24 hours. Fascinating!

🤯

Maybe the Fed should not cut rates too quickly...

@marcopabst.bsky.social

@marcopabst.bsky.social

And then I see news that Balenciaga's new $950 Destroyed Jacket sells out within 24 hours. Fascinating!

🤯

Maybe the Fed should not cut rates too quickly...

including unemployment, increased student loan repayment and slower real wage growth" referring to their younger diners. Unemployment amongst 20-24-year olds in the US is 9% and rising in a slow-hire, slow-fire market.

30.10.2025 20:01 — 👍 0 🔁 0 💬 1 📌 0This week we had profit warnings from Chipotle and Shake Shack (two favourite destinations before the kids became health obsessed) with Chipotle CEO Scott Boatwright saying that "this group is facing several headwinds,

30.10.2025 20:01 — 👍 0 🔁 0 💬 1 📌 0Maybe the Fed should not cut rates too quickly...

I find the generation of twenty-somethings fascinating — not only because my own kids are part of that group now, but also because of the way they behave, consume, and think about the world and their future.

👉 Life in the box on the right may be less exciting - but it’s also far less stressful.

Most importantly, the second group is more likely to reach their investment destination with some confidence.

The outcome: lower volatility and the capture of representative long-term asset-class returns.

25.10.2025 13:24 — 👍 0 🔁 0 💬 1 📌 02️⃣ Then there are the long-term investors who simply buy and hold. They also go through rough patches from time to time, but over the years their returns are much smoother, and entry levels become less relevant.

25.10.2025 13:24 — 👍 0 🔁 0 💬 1 📌 0They typically end up with portfolios full of underperforming value traps, missing out on the great long-term compounders. As a result, their returns tend to be volatile and rarely beat any benchmark (that’s the box on the left below).

25.10.2025 13:24 — 👍 0 🔁 0 💬 1 📌 01️⃣ Those who try to time the market by anticipating trend changes and making assumptions about tops and bottoms - often buying assets that continue to fall and selling stocks that continue to rise.

25.10.2025 13:24 — 👍 0 🔁 0 💬 1 📌 0

Time in the market versus timing the market!

👉 A concept most people don't fully appreciate - to their detriment.

There are broadly two investor camps:

👉 The catalyst exposing these weak links is an underlying economy that is bordering on a recession where marginal players increasingly run into trouble.

👀 Watch this space!

On the flip side, I also believe that there will be tremendous opportunities to find value across the distressed space in the future.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0Although I would not expect a major structural issue to come to the surface, I am realistic enough to assume that the poor lending practices of the past few years have led to a substantial misallocation of capital to weak borrowers.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0loans can be off substantially, delaying the repricing and potentially leading to abrupt adjustments.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0The nature of private capital markets obviously makes it difficult to get a good real or near-time picture of the goings-on. In contrast to liquid bond markets where the price finding mechanism is more fluid, marks on private

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0🚨 The swift collapse of relative (and absolute) performance to new lows in 2025 is worrisome, implying that more issues might be lurking underneath the surface which will have an impact on the GPs down the line.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0The sector performed poorly in an environment of rising inflation and interest rates in 2022 but recovered subsequently when risk markets rebounded in 2023 and 2024 as equities rallied and credit spreads collapsed.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0Below I picked an index of listed private equity players (S&P listed private equity index) but the picture is essentially the same for private debt focussed businesses and BDCs.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0👉 The poor relative performance of private equity, private debt and business development companies (BDC) relative to the market was a clear indication that something was wrong.

21.10.2025 13:45 — 👍 1 🔁 0 💬 1 📌 0some time and while it was not clear which domino would fall first, the market has been sensing trouble for quite a while.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0The recent tremors in lending markets, kicked off by the bankruptcies of two auto-related lenders, Tricolor and First Brands are a great example. We have been debating loose lending standards, the massive influx of tourist money into the private lending space and shrinking credit spreads for

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0👉 As a result, the relative strength and weakness of a stock, sector or market is something I pay a lot of attention to as it tells us what the likely direction of travel in the medium term will be and how investors think about a certain area long before it makes any headlines.

21.10.2025 13:45 — 👍 0 🔁 0 💬 1 📌 0

The market saw it coming...

One of my favourite axioms in the world of finance is never to underestimate the ability of markets to sniff out trouble somewhere and price it early.

🚨 Breaking: With only 5% of Twitter's following, Bluesky is driving the SAME traffic to Financial Times! 📈 Is this the future of financial news? Drop your hottest takes below 👇 #FinanceRevolution #BlueskySurge #MediaDisruption

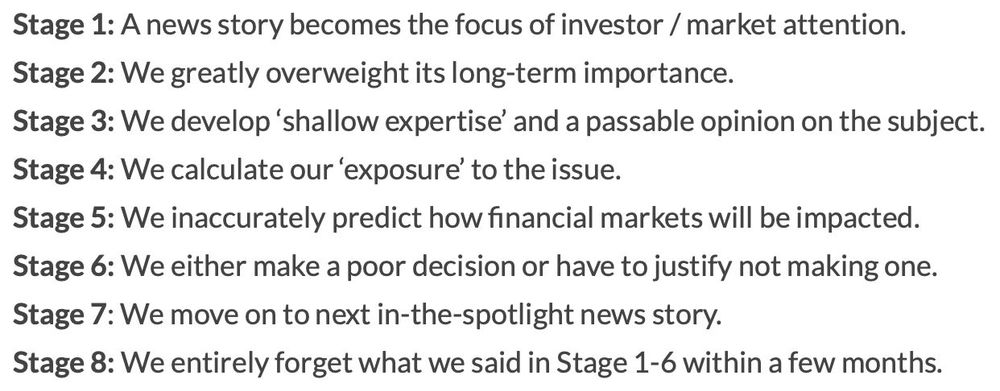

08.02.2025 12:27 — 👍 1 🔁 0 💬 0 📌 0I wondered what is the best way to describe these cycles in more generic terms. Thankfully, Joe Wiggins of behaviouralinvestment.com just published an interesting piece on the topic which hits the nail on the head for me.

Brilliant!

We have seen this before across issues as diverse as 3D printing, Gamestop, the COVID pandemic, Brexit, the London bus bombings, Fukushima, Volmageddon, GLP-1 stocks, etc... The list is endless.

08.02.2025 10:44 — 👍 1 🔁 0 💬 1 📌 0

🚨 Attention news junkies!

The recent DeepSeek news cycle mania just reminded me of how investors just never grow up to absorb news properly.

Trump is a sideshow as this picture is worse in the UK.

08.01.2025 21:29 — 👍 0 🔁 0 💬 0 📌 0

As has happened often in the past, the Dow rel to NASDAQ was a good leading indicator for the current market correction.

20.12.2024 10:57 — 👍 0 🔁 0 💬 0 📌 0

🚨Bitcoin underperforming Lebanon

Everybody these days is talking about Bitcoin and its recent performance.

Nobody, however, has mentioned Lebanese Government bonds which handily outperformed Bitcoin over the last four weeks.

Yes, you read this right!

Old world beats New world…