If you're looking for new investment ideas, worth checking what these funds hold

25.11.2025 21:46 — 👍 2 🔁 0 💬 1 📌 0@mginvestor.bsky.social

Concentrated Investor in UK markets. Looking for management who under-promise and over-deliver. DM to discuss shares. Family office

If you're looking for new investment ideas, worth checking what these funds hold

25.11.2025 21:46 — 👍 2 🔁 0 💬 1 📌 0

For £19m mcap you're on track getting £3m EBITDA for FY25 & £4M for next. #EAAS

www.investegate.co.uk/announcement...

Although it's high risk, today's aftermarket news by #EAAS looks v significant despite Harwood taking a chunk more of eEnergy from warrants and possible future raise.

Was building a position below 5p before Harwood turned up. It's the order book I'm interested in for FY26 now

I think short term traders are getting out whilst the RSI is at overbought levels.

Ive read ppl concerned about cash flow but broker mentions 2H is stronger. I think #ELIX took advantage of low price for EBT purchase (obv for staff benefit)

Generally pleased here and I continue to hold it for LT

I don't know how many of you are still active on here? I don't think bsky will last long...

For those not on X I just posted:

Phenomenal HY results from #ELIX today which IMO were well ahead of expectations (look at those margins):

Broker TP increased to 1240p (from 1100p)

Been quiet here but active elsewhere - #RWS worth a look. Market has been way too pessimistic over AI's impact on RWS. Latest HY results presentation worth a watch. New CEO with good background. Fundamentally looks very cheap even if you take into account adjustments. Ignore the divi yield

I hold

We have had some good ones listing in 2020/2021. Namely #ELIX which I conveniently hold.

Im sure there's others but yes worst time to buy IPOs is when we have a bull market going

Limit order set just below the 200SMA & above a round number for a potential top up of one of my core positions.

Already a v sig position so this will be a short term trade for next month or so I think.

No, not gonna say what it is until I (if!) get filled

Recent IPO #MHA trading update shows its performing strongly & ahead of market expectations! Expects to report:

• FY25 rev ~£224m +45.4%

▪︎ Adj EBITDA £41m +32.3%

Market cap of ~£300m. Won't be long before market works it out.

I hold. Did alert investors to potential 🙃

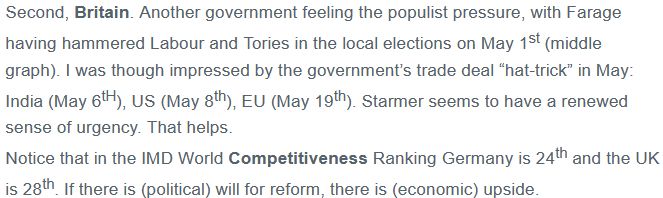

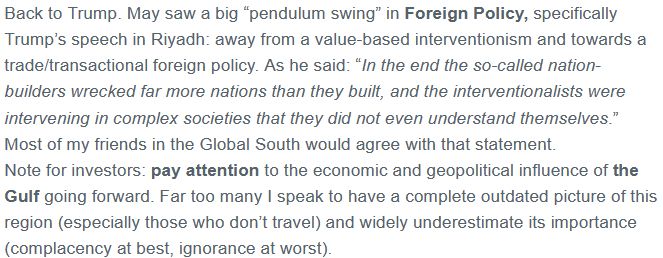

and for those who get triggered, but again I agree:

04.06.2025 16:40 — 👍 0 🔁 0 💬 0 📌 0

And this. Politics aside - UK has a good opportunity to finally wake up:

04.06.2025 16:35 — 👍 0 🔁 0 💬 0 📌 0

Agree with this. Most people I speak to about the Gulf are woefully ignorant for a variety of reasons

04.06.2025 16:28 — 👍 0 🔁 0 💬 0 📌 0

The kind of stuff I like my companies to be involved in

#Elixirr #ELIX

Will be keeping a close eye on this in June:

www.britishcycling.org.uk/tourofbritai...

Have a look at the Chairman's track record 🤯

03.06.2025 07:10 — 👍 1 🔁 0 💬 1 📌 0Contracts keep coming in for Made Tech with 2 announced yesterday/today:

>£8 for MoJ

and £2m for Dept of Culture, Media & Sports.

Momentum really building here now.

I hold #MTEC

We all look like geniuses in an uptrending market regardless of our stock picks.

Let's see if we agree on being clowns on the way down too 😆

The quote escapes me...market sentiment is majority of the move and stock picking is 10-20%? something like that?

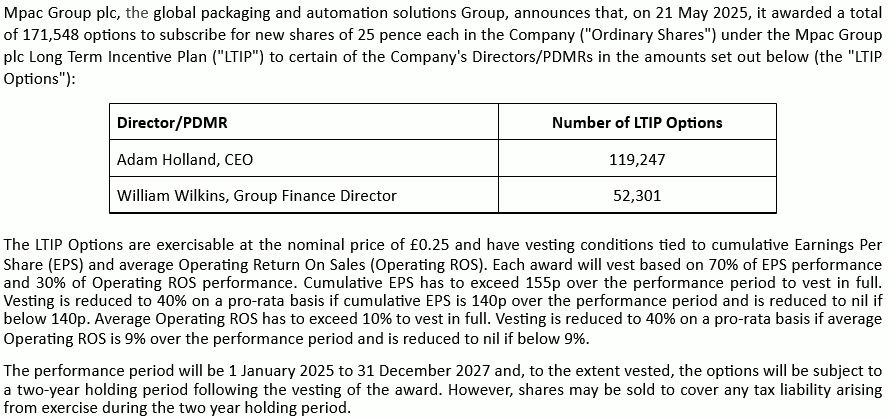

interesting LTIP award announcement by #MPAC today (I hold). I'd be happy if they achieve these targets & I like that they use EPS as a measure but is that adjusted? 🤔

23.05.2025 12:41 — 👍 0 🔁 0 💬 0 📌 0so many companies abandoning the AIM market & moving to the main LSE. Today it's Ashtead Tech's turn (ex-holding).

Who's in charge of AIM now? Have they not noticed? At this rate we'll only have the loss making bio-tech & O, G & M's left.

Probably not a bad thing TBH

DYOR WDIK & #MHA is a core holding for me so could go pear shaped super fast.

Be nice and share this if you want me to go back to sharing ideas again:

bsky.app/profile/mgin...

• The 7th May acq not included in FCs but all I will say is that vendors were ok with taking the majority of the payment in shares. They probably also see value at this level.

Honestly, the whole report is worth a read. Get it from Research Tree or Cavendish own website.

• before someone asks again(!) what about AI - the way to really excel is to use it in your business. #MHA have committed to this. Accountancy services are not going away any time soon.

• Cavendish "believe MHA is fundamentally in a very similar position to Elixirr" #ELIX

• medium-term goal of becoming top 10 UK accountancy, with revs of £500m+ (current FC FY25 of £216m rev)

• rarely loses a client

• Expect strong focus on M&A - #MHA completed 30 transactions since the business was founded (inc 4 in past 18months)

• FC for Rev of £240m & PBT for FY26 at £35m. Check that margin(!)

• High rec revs (85%+)

• strong organic rev growth (~23% avg FY22-24)

• 90%+ cash conversion

• Raised gross proceeds of £98m in Apr 25, -£21.2m was new money to accelerate growth

Enter #MHA - For those that don't get excited about long broker reports on recent IPOs, I've read the 60 pages by Cavendish & tried to give you the juicy bits.

At current market cap of £284m - valued at PE of <10. 12-month price target of 155p implies 50% upside. Here goes:

I was beating the drum for Elixirr #ELIX since I bought in 2020.

Despite the naysayers, nearly 3x in 5yrs, not too shabby. You only get a couple of really good opportunities every few years. Well I think I have another one & I've been buying:

Trifast TU for FY March shows rev below expectations but EBIT in line: "Group expects to report revenues for FY25 of £223.0m, with aEBIT ~£14.8m, which represents an improving margin of c.6.6%."

I sold #TRI during the tariff talk as I think it will struggle. Outlook mentions a pass through of costs

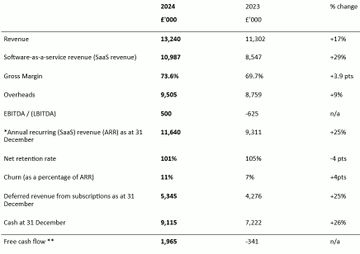

Skillcast #SKL FY24 results continue to show excellent progress:

PBT £0.5m & diluted EPS 0.57p. We should start seeing operational gearing coming through.

Outlook: Solid start to year with ARR up 20% YoY to £12m.

Trading at 2.1x ARR/EV - UK companies usually sell at 3-5x

I'll be keen in seeing if UK had any capital inflows for April. Drop us a msg or mention if you come across anything interesting in this regard

30.04.2025 09:54 — 👍 0 🔁 0 💬 0 📌 0'Been buying a boring business Brickability' bit of a mouthful - Cheap PE ~7.5, cyclical low, interest rates🔽, sector should at least stabilise if not pick up, FCF yield 10%+, Divi 5.6%, gearing down, update yesterday was good if not slightly better than expected #BRCK

25.04.2025 12:23 — 👍 1 🔁 0 💬 0 📌 0#RWS down 38% due to sig profit warning - One of those 'used to be an exceptional business' but now a 'always looks cheap' (for a reason!)

Can't help but think AI took a huge chunk from them.

I've never held. Think it will die a slow death BWDIK