Just go post wherever you are happier.

But of course X is more relevant. Bluesky only has about 1 million users any given day, according to this dashboard bsky.jazco.dev/stats

12.10.2025 11:10 — 👍 1 🔁 0 💬 1 📌 0

For me it is difficult to lever stuff even a bit because I started looking at investing by reading value investors with a bit of an Austrian bend (not that I agree with them re:macro).

With the language and community around crypto... not surprised these cases exist.

12.10.2025 07:04 — 👍 1 🔁 0 💬 0 📌 0

No Trails in the Sky SC in the list?

06.10.2025 19:01 — 👍 0 🔁 0 💬 0 📌 0

Physical sales in Japan are slightly down overall vs last entry, and down a lot in the PlayStation ecosystem, though. Had expected a bit more there, but seems like having the game in Switch and PC at the same time has taken a toll.

04.10.2025 11:32 — 👍 1 🔁 0 💬 0 📌 0

I think Falcom's Trails in the Sky remake might be pretty transformative.

- Peak CCU in Steam about 6x prior one

- Leading Switch 2 digital sales in JP, showing up in the ranking elsewhere

- Playstation store number of reviews already above all post 2020 entries in the series

04.10.2025 11:31 — 👍 3 🔁 0 💬 1 📌 0

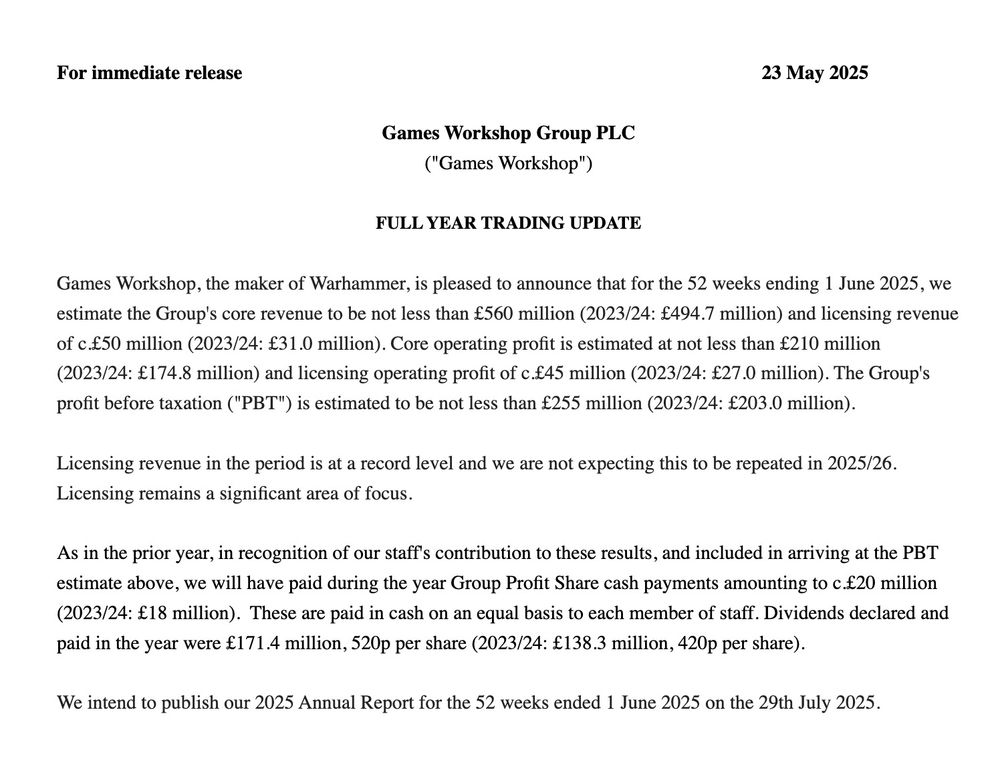

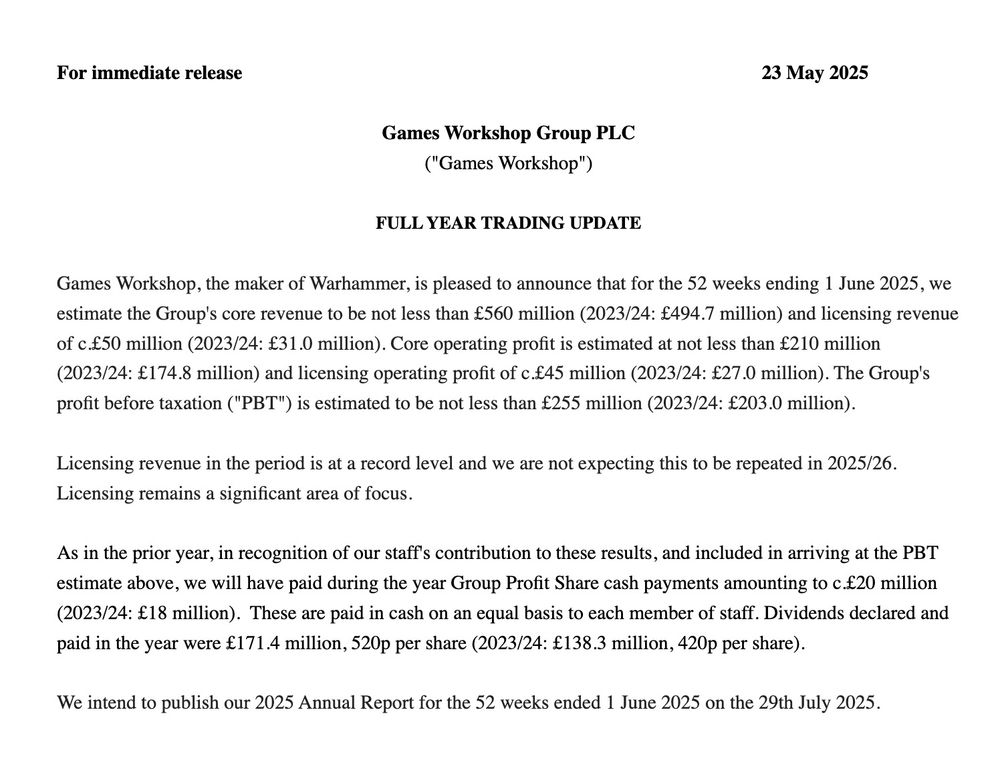

I mean, in dividends

01.08.2025 10:51 — 👍 1 🔁 0 💬 0 📌 0

And paying £5.20 per share too :D

01.08.2025 10:51 — 👍 0 🔁 0 💬 1 📌 0

Yes, I know of late it is not at its best. But the name does a lot.

27.07.2025 08:05 — 👍 1 🔁 0 💬 0 📌 0

Not surprised. An institution

27.07.2025 08:04 — 👍 1 🔁 0 💬 1 📌 0

IG group is also in the same business, in case you want to have a look

23.06.2025 07:52 — 👍 0 🔁 0 💬 0 📌 0

Money printing machine. While I own both, I do prefer XTB, I think they are doing well reinvesting the CFD proceeds in becoming an all-purpose broker with enough scale.

23.06.2025 07:41 — 👍 0 🔁 0 💬 1 📌 0

I know, I know, Spanish.

But my god, Nacho Cano did some pretty horrible things.

15.06.2025 13:08 — 👍 0 🔁 0 💬 0 📌 0

No hay marcha en Nueva York

Ni aunque lo jure Henry Ford

No hay marcha en Nueva York

Y los jamones son de York

15.06.2025 13:08 — 👍 0 🔁 0 💬 1 📌 0

I get where this thread comes from, but IMHO this would result in more layoffs.

Remember how prevalent piracy was, and how many games you and your friends used to have back in those days.

23.05.2025 22:01 — 👍 2 🔁 0 💬 0 📌 0

So right and yet... we should also remember the piracy rates back then and that we did get a lot less games released (and bought).

23.05.2025 21:56 — 👍 2 🔁 0 💬 0 📌 0

You can find some info in the usual places, or by talking to anyone at the stores for those roles. Studio roles (sculptors, writers...) used to be fairly low pay (think below 30k pound for most) a few years back, AFAIK they haven't moved a lot... but the market for that area is bad in general.

23.05.2025 21:38 — 👍 1 🔁 0 💬 1 📌 0

On the other hand... Salaries at GAW are not exactly the stuff of legend 😅

23.05.2025 14:05 — 👍 0 🔁 0 💬 1 📌 0

You mean the profit bonus? Yeah, they have been doing it that way for a long time.

23.05.2025 14:05 — 👍 1 🔁 0 💬 2 📌 0

That will do. #GAW

23.05.2025 07:11 — 👍 3 🔁 0 💬 1 📌 0

Up on those results says a lot about the expectations. Then again, might be the seemingly excessive guidance 😅

13.05.2025 08:53 — 👍 2 🔁 0 💬 3 📌 0

Balatro has 104 people credited on mobygames. Initial reddit post is dishonest and plain wrong on several aspects. Having seen in early 2021 what Guillaume, Tom & François did with a couple of friends (game was called « We Lost » then and was already stunning)…

11.05.2025 18:06 — 👍 9 🔁 5 💬 2 📌 0

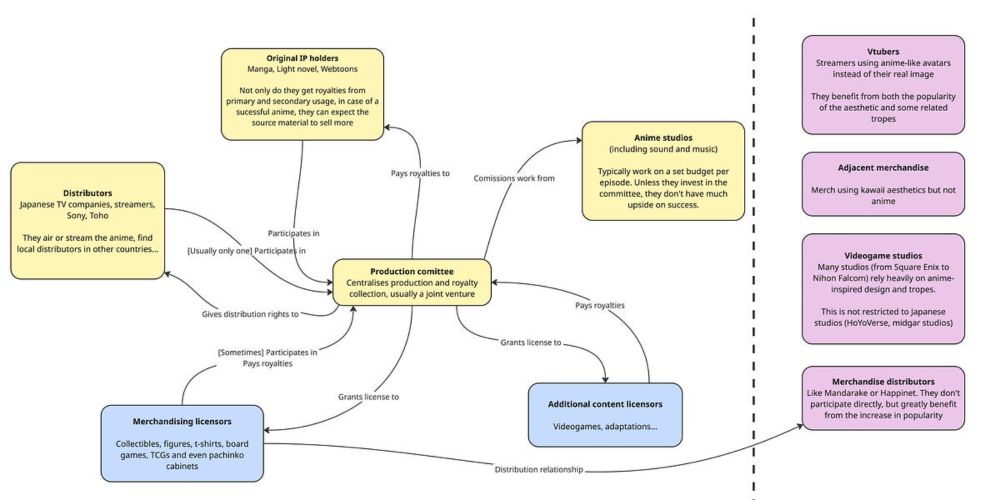

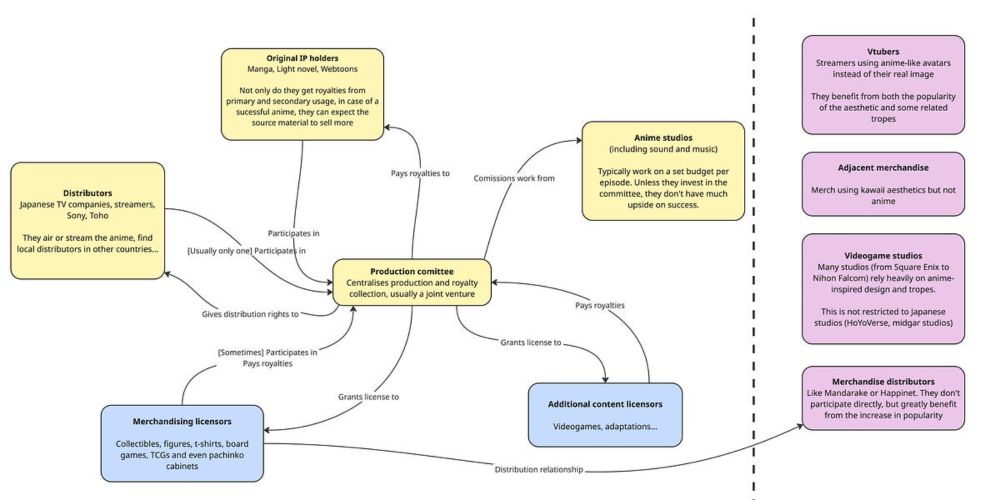

A hitchhiker's guide to the Anime Galaxy

An investor's primer for Japan's most important export: aesthetics

A few weeks ago I published an anime sector guide for investors. If you are new to the space and are interested, have a look!

It covers:

• Diferent roles in the sector

• Economical characteristics of each

• Examples of companies

www.dungeoninvesting.com/p/a-hitchhik...

10.05.2025 08:01 — 👍 2 🔁 1 💬 0 📌 0

A hitchhiker's guide to the Anime Galaxy

An investor's primer for Japan's most important export: aesthetics

A few weeks ago I published an anime sector guide for investors. If you are new to the space and are interested, have a look!

It covers:

• Diferent roles in the sector

• Economical characteristics of each

• Examples of companies

www.dungeoninvesting.com/p/a-hitchhik...

10.05.2025 08:01 — 👍 2 🔁 1 💬 0 📌 0

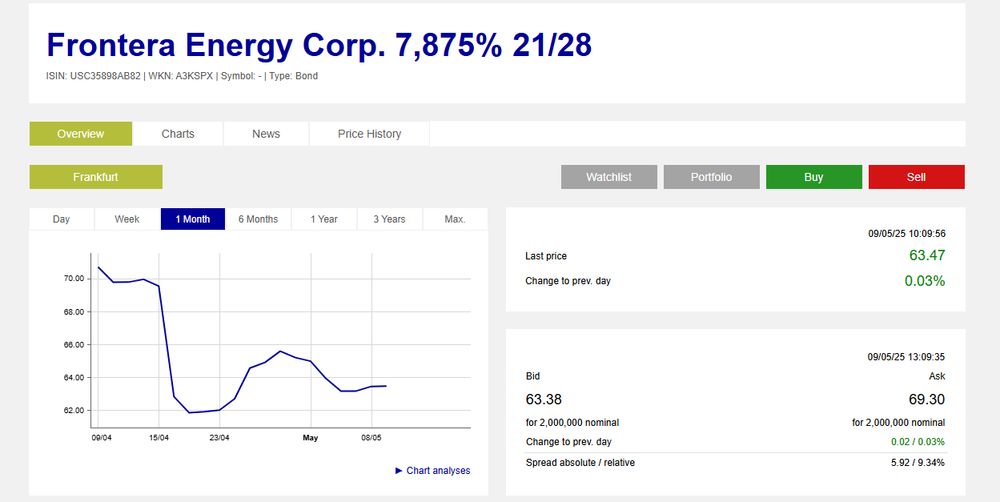

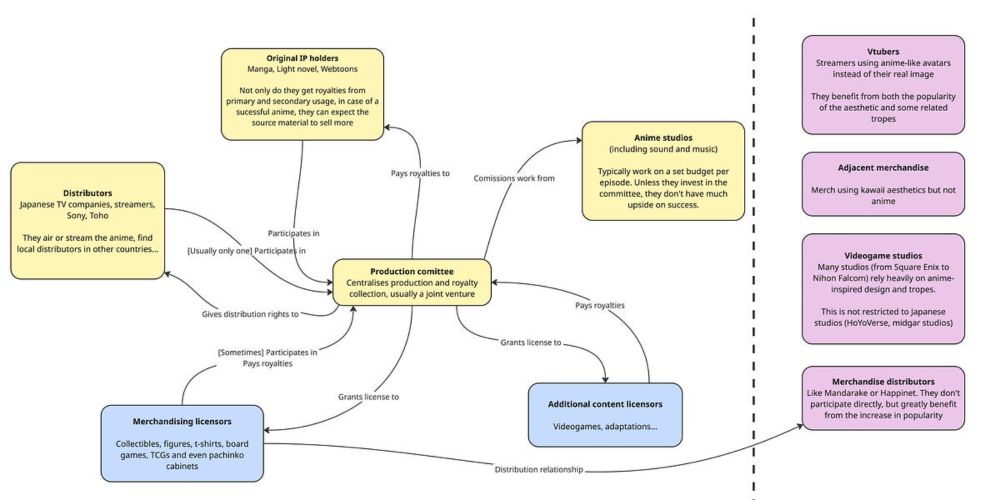

Picture displaying the graph and that a bond for Frontera Energy corp with a 7,875 yield until 2028 is trading at 64 cents on the dolar.

@specialsitinvestor.bsky.social since you have been talking about FEC... the bond seems quite interesting to me as well.

09.05.2025 11:10 — 👍 1 🔁 0 💬 0 📌 0

I don't see it going away completely with the complete epidemic of computer illiteracy I see around me.

07.05.2025 08:22 — 👍 1 🔁 0 💬 0 📌 0

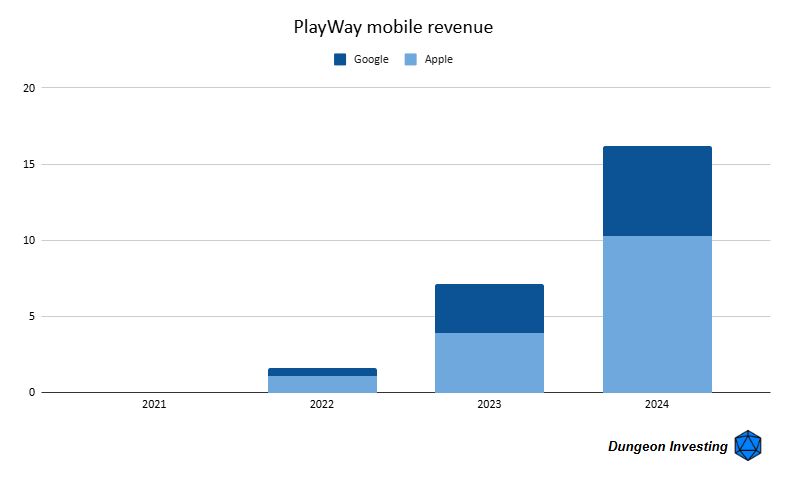

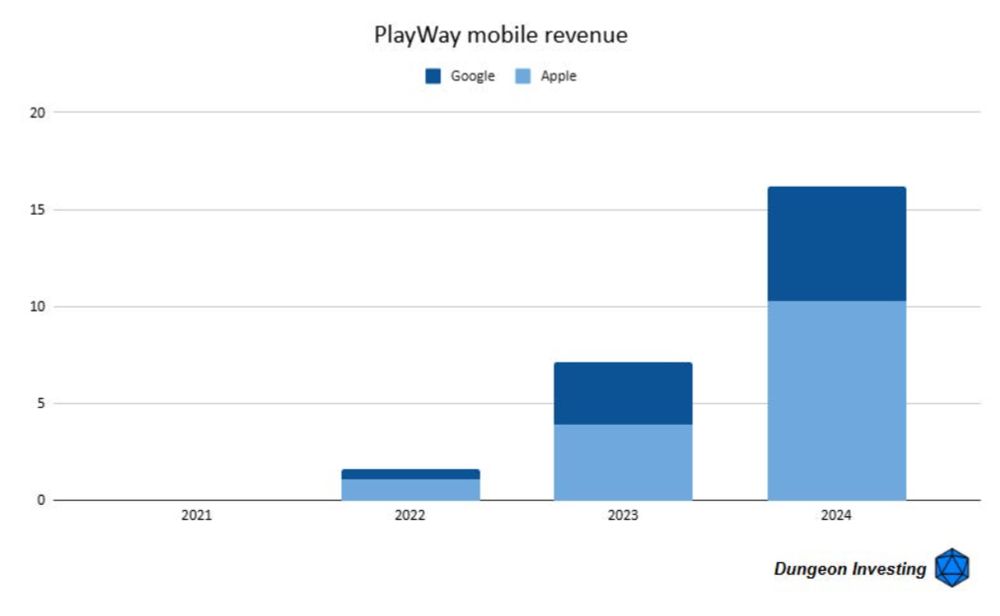

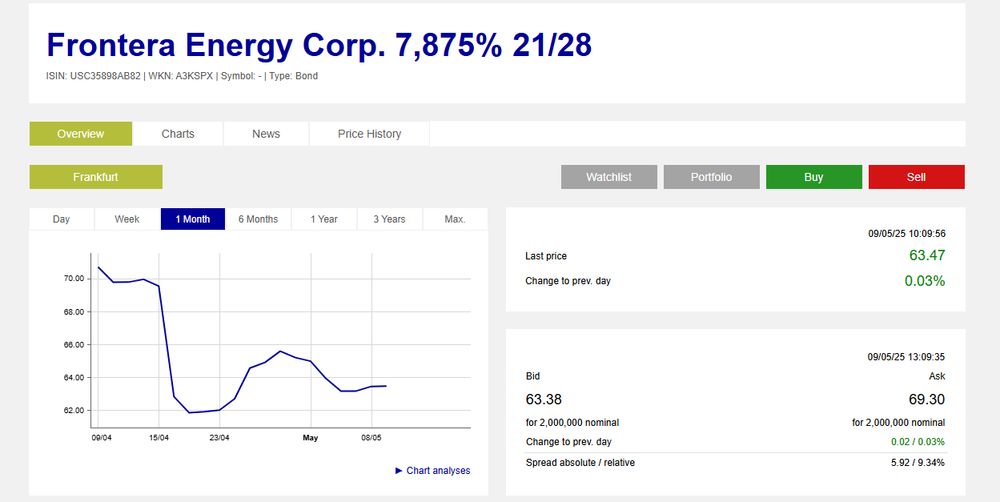

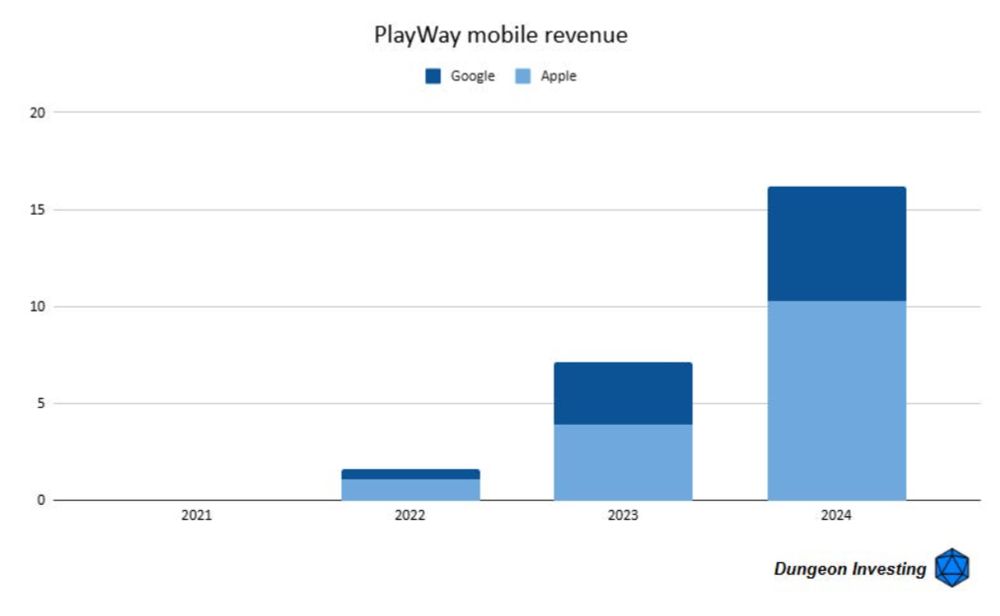

2024 was also an interesting year for their mobile division, though I don't know if that will continue in the future, as it was based on the release of many fast followers to successful simulation games.

The one that really played out was the supermarket management sim.

07.05.2025 08:14 — 👍 0 🔁 0 💬 0 📌 0

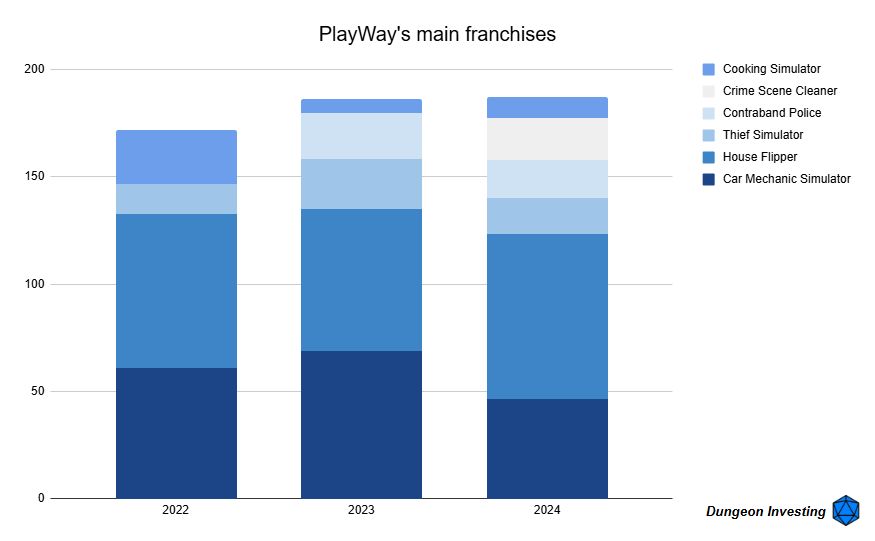

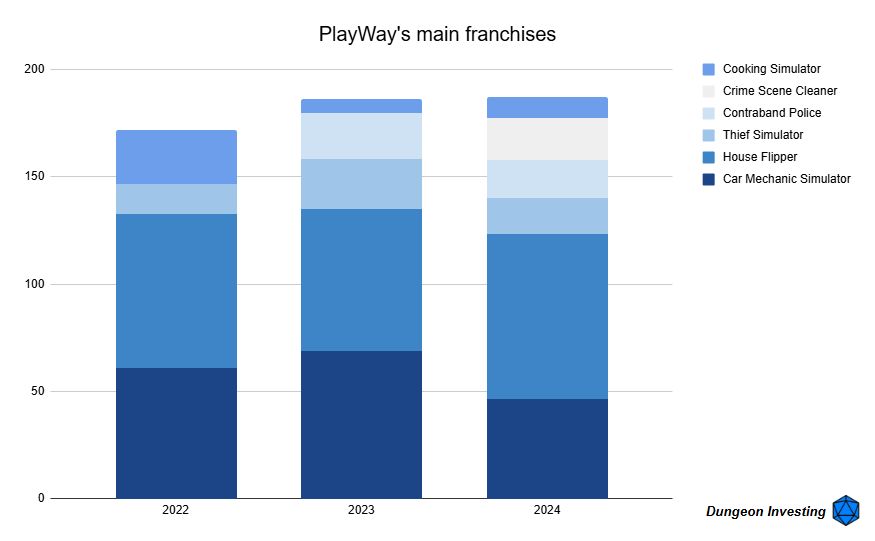

That aside, their main franchises keep showing quite a bit of resiliency, Cooking Simulator aside.

Plus, they are introducing new ones almost annually.

07.05.2025 08:13 — 👍 0 🔁 0 💬 1 📌 0

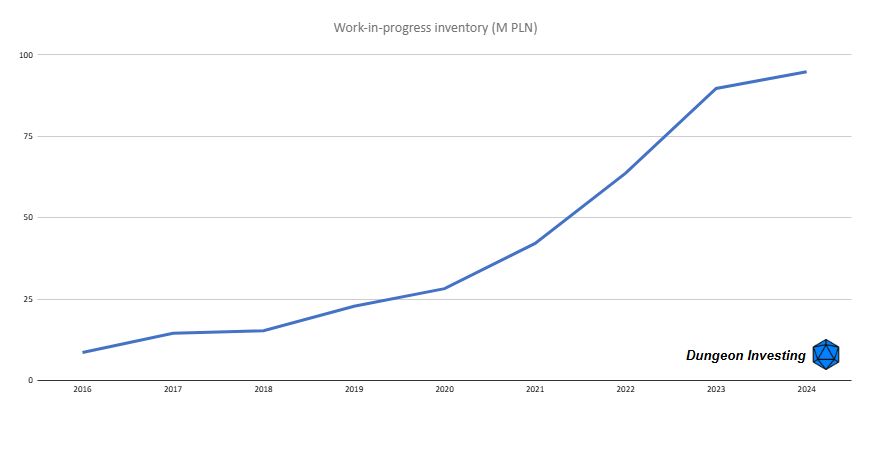

Some nuggets:

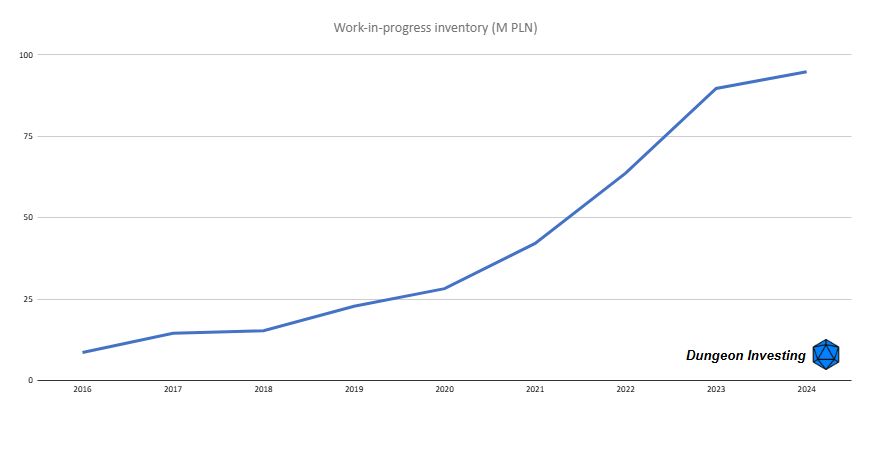

PlayWay seems to have finished their experimenting phase and are now refocusing on simulators while keeping the level of investment, after some failures in the city builder space (and whatever Sherwood Builders was)

07.05.2025 08:13 — 👍 0 🔁 0 💬 1 📌 0

PlayWay annual results update

Record results, but record enough?

PlayWay presented results recently, and there is a lot to breakdown on them. You have the full version on Dungeon Investing. But why is it interesting?

• Record results, both operationally (+15% YoY) and attributable to shareholders (+59% YoY)

• Record dividend (7% yield)

07.05.2025 08:12 — 👍 0 🔁 0 💬 1 📌 0

It hasn't been that amazing and has plenty of debt, though. I would have to see a lot of things improving to make it a normal position.

06.05.2025 21:46 — 👍 0 🔁 0 💬 1 📌 0

@uriondo en el resto de sitios. Intento que no te roben al coger el autobús. Escribo en mis ratos libres para @articulo14.bsky.social y @jotdown.es

Reporter covering video games at Game File (gamefile.news). Previously launched games coverage at Axios and MTV News. Was Kotaku EiC. stephen(at)gamefile(dot)news he/him

Writer, Podcaster, Game Designer | Friends at the Table | A More Civilized Age | Shelved by Genre | Formerly: Possibility Space, Waypoint, Giant Bomb, Paste Games

Over 30 years celebrating the best of games in print and online.

Follow our work: GameInformer.com

Chartbook Substack https://adamtooze.substack.com/

OnesandTooze podcast https://foreignpolicy.com/podcasts/ones-and-tooze/

C******* University historian, Director European Institute, Chair Cttee on Global Thought.

Economics, history, theory, politi

We're in trouble. The canary in the coal mine died. What now?

Blindly plunged like fate into the lone Atlantic.

Bringing Space Marine 2, Toxic Commando, Resonance: A Plague Tale Legacy, SnowRunner, RoadCraft and more to players around the world! 🎮🖤

10 pound brain piloting a slab of meat

Risk manager, quant, physicist, Bayesian. I must study politics and war, that my sons may have liberty to study mathematics and philosophy.

occasional bass player, ex-antique salesman, former ft reporter and l/s equity analyst. rts ≠ opinions. all views my own.

Sovereign Debt “veteran” (retd.) apparently. Finance stuff, opinions and Set Piece FC.

Startups and software

Midwestern transplant to Bay Area and sometimes Tokyo

https://github.com/matthelmer

Currently building:

https://japanfinsight.com

26+ years at @CNBC and @NBCNews / @WSJ alum / Peabody winner

Transforming qualitative public market research through world-class products.

Author of valueandopportunity.com and self proclaimed "King of the Bumsbuden".

Video game enthusiast, follow sales and provide questionable commentary.

Go to https://www.installbaseforum.com/ for dedicated video game sales discussions.

My YouTube: https://www.youtube.com/@JohnWelfare

Small / Micro Caps & GARP Investing ||Searching for Under-Followed-Stocks || No investment advice || http://linktr.ee/mavix_leon || substack: http://www.underfollowedstocks.de ||

Investing stuff from Nordics.