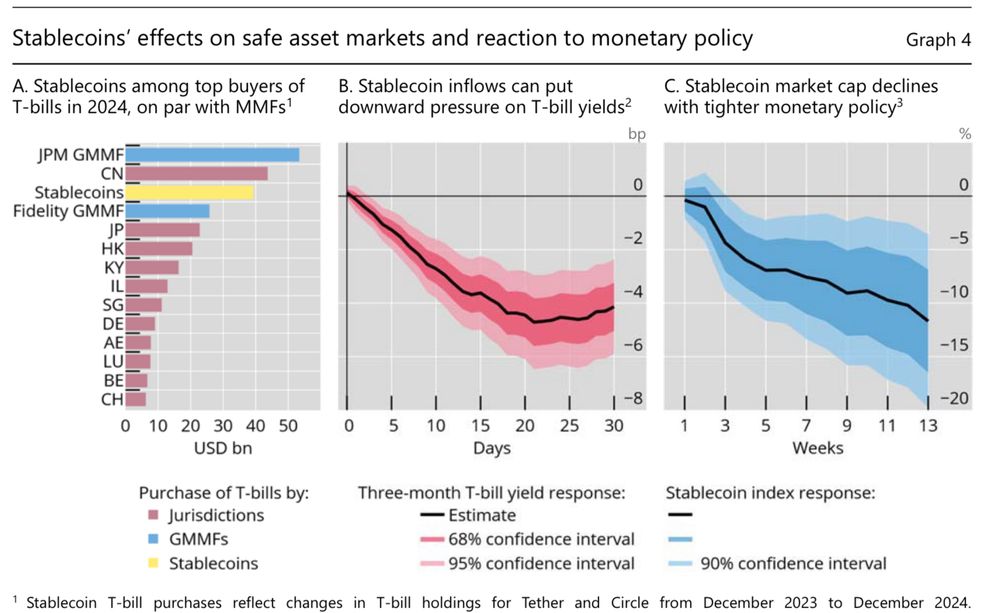

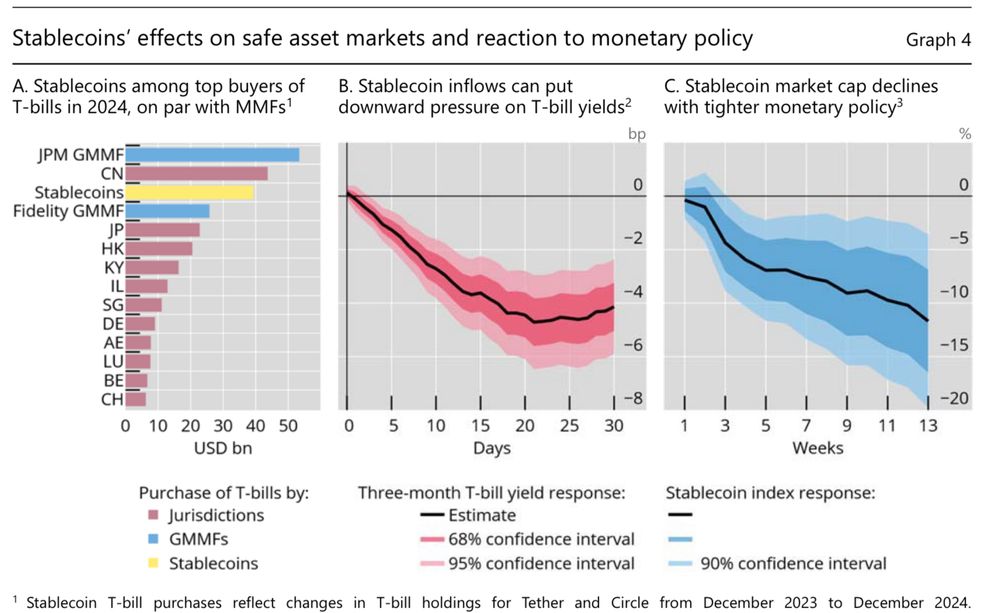

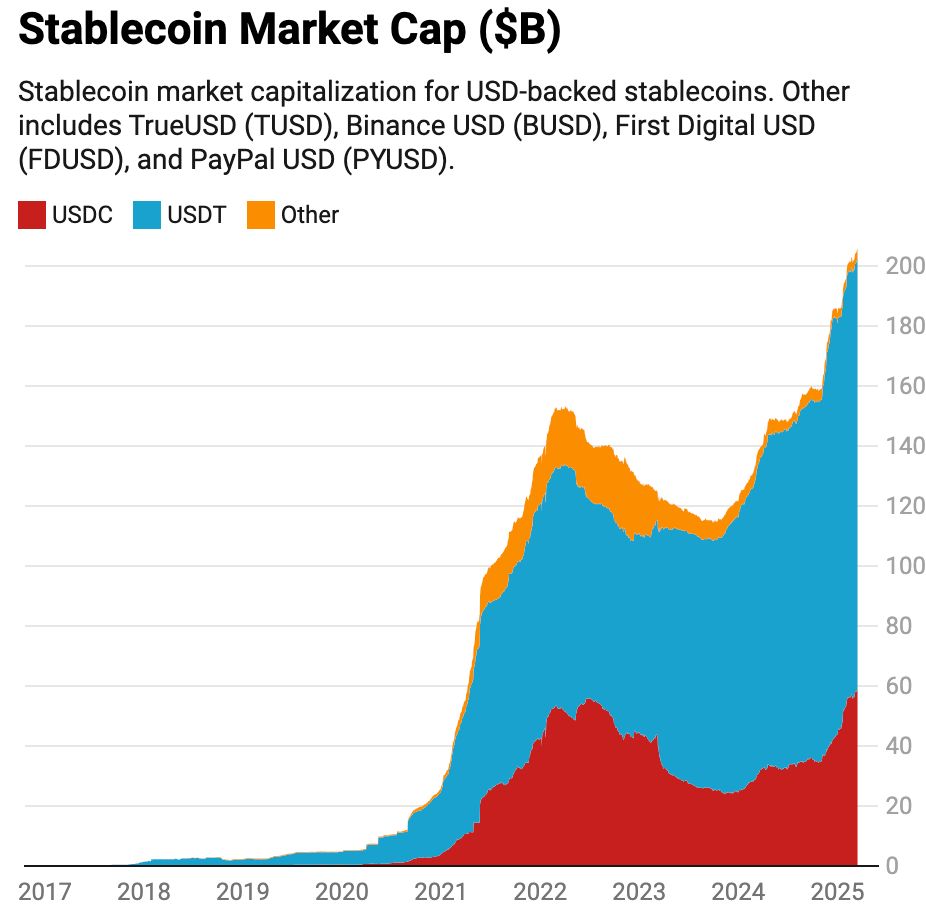

Stablecoins are already meaningful players in the Treasury market, as we show in more detail in a recent paper with @rashad-ahmed.bsky.social

www.bis.org/publ/work127...

@rashad-ahmed.bsky.social

Economist at the Andersen Institute | global macro | stablecoins | views are my own https://sites.google.com/view/rashad-ahmed

Stablecoins are already meaningful players in the Treasury market, as we show in more detail in a recent paper with @rashad-ahmed.bsky.social

www.bis.org/publ/work127...

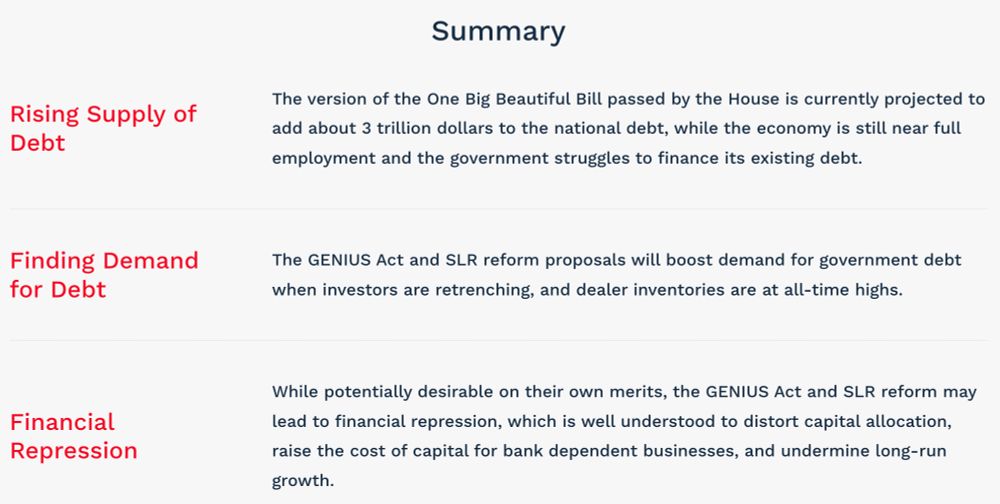

New @anderseninstitute.bsky.social Note: "When financial regulation becomes financial repression" (link below)

We take a macro view on the interactions between:

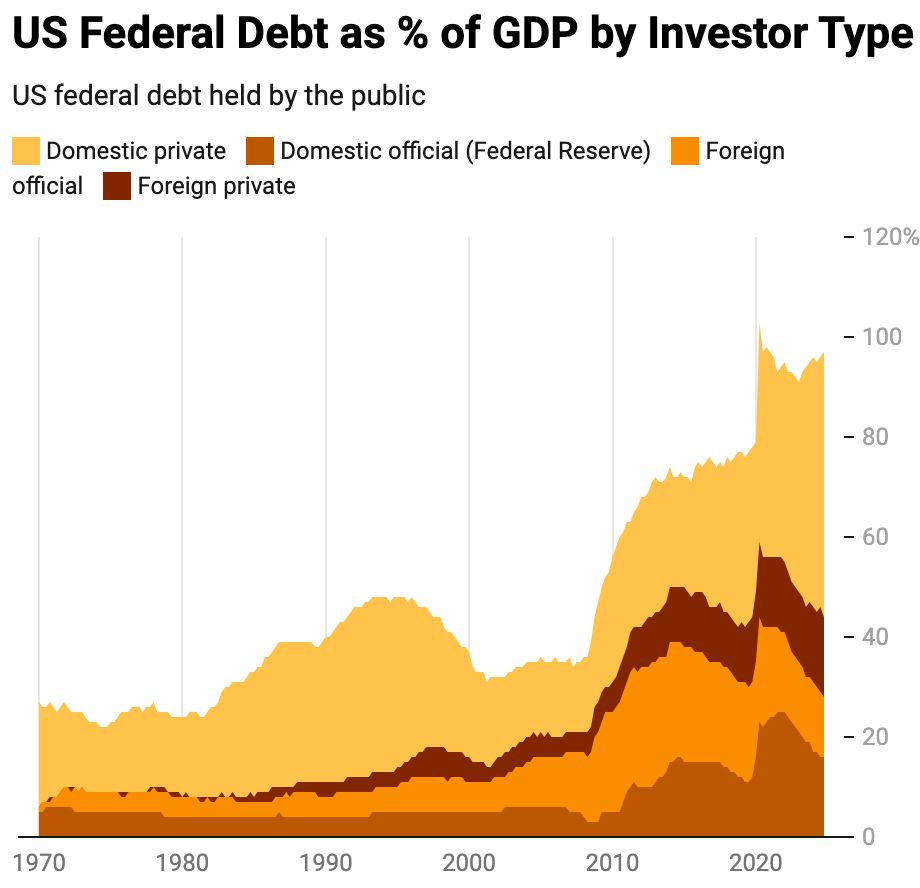

(i) high and rising debt

(ii) OBBB expansionary spending

(iii) GENIUS Act stablecoin legislation

(iv) SLR bank capital reform

Nice Big Read by @staffordphilip.bsky.social on stablecoins, featuring our paper with @rashad-ahmed.bsky.social on the impact of SCs on the Treasury market

on.ft.com/3ZvMDw5

Great Long Read by @katie0martin.ft.com featuring our recent paper with @rashad-ahmed.bsky.social

06.06.2025 19:48 — 👍 11 🔁 3 💬 0 📌 0Aaaand new paper is out!

“Stablecoins and safe asset prices” with the awesome @rashad-ahmed.bsky.social

Quantifying the effects pf stablecoin flows on Tsy yields with instrumented linear projections, documenting asymmetric effects of inflows vs outflows

www.bis.org/publ/work127...

If tariffs are going to improve US debt sustainability then why is US default risk going up?

#Finsky #Econsky

Join us at the 2025 Johns Hopkins Geoeconomics Conference Keynote Presentation and Panel Discussion

🗓️ Friday, May 2 | 2:00–7:00 PM

📍 Hopkins Bloomberg Center, Washington, DC

🔗 Register here: lnkd.in/eEzhX_PQ.

The conference Website is here: lnkd.in/eGbz-s_j

#Geoeconomics #JohnsHopkins

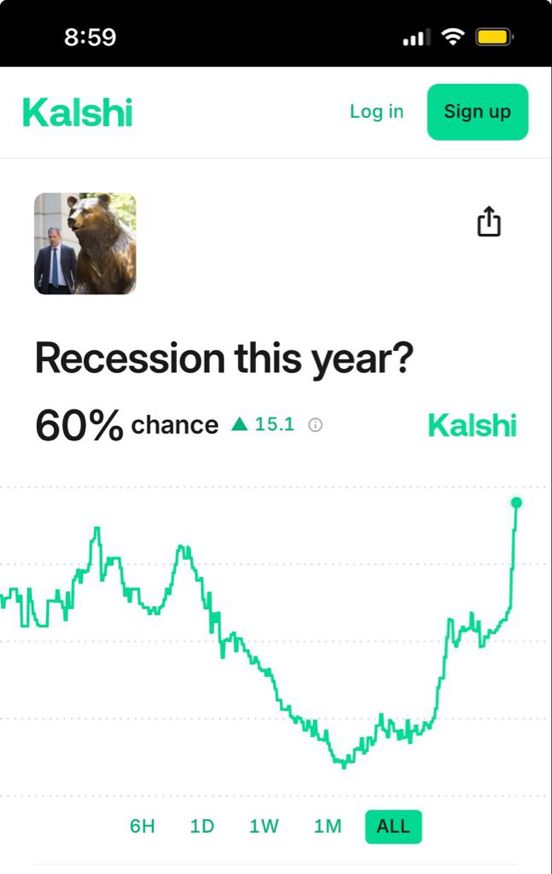

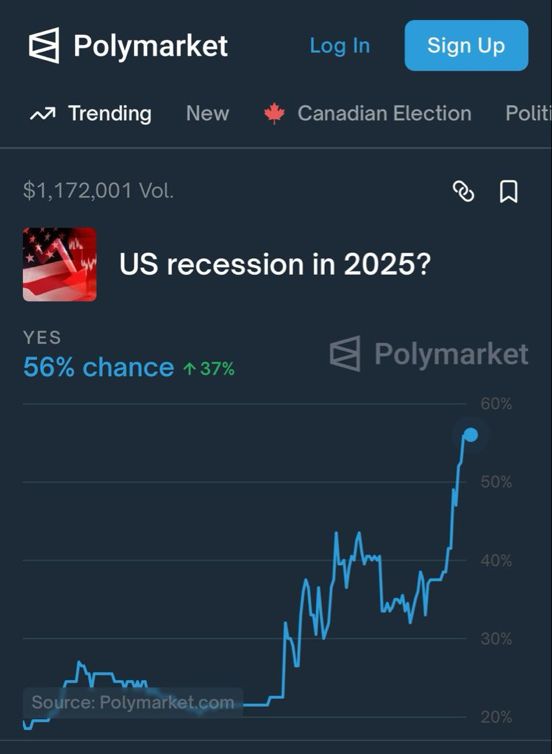

The idea that these tarriffs will be recessionary is consistent with cross asset market moves and even more directly, rising recession odds in prediction markets

equities (-)

mid/long rates (-)

STIR fwds (-)

inflation fwds beyond 1-year (-)

crude oil (-)

Thanks!

20.03.2025 09:25 — 👍 1 🔁 0 💬 0 📌 0

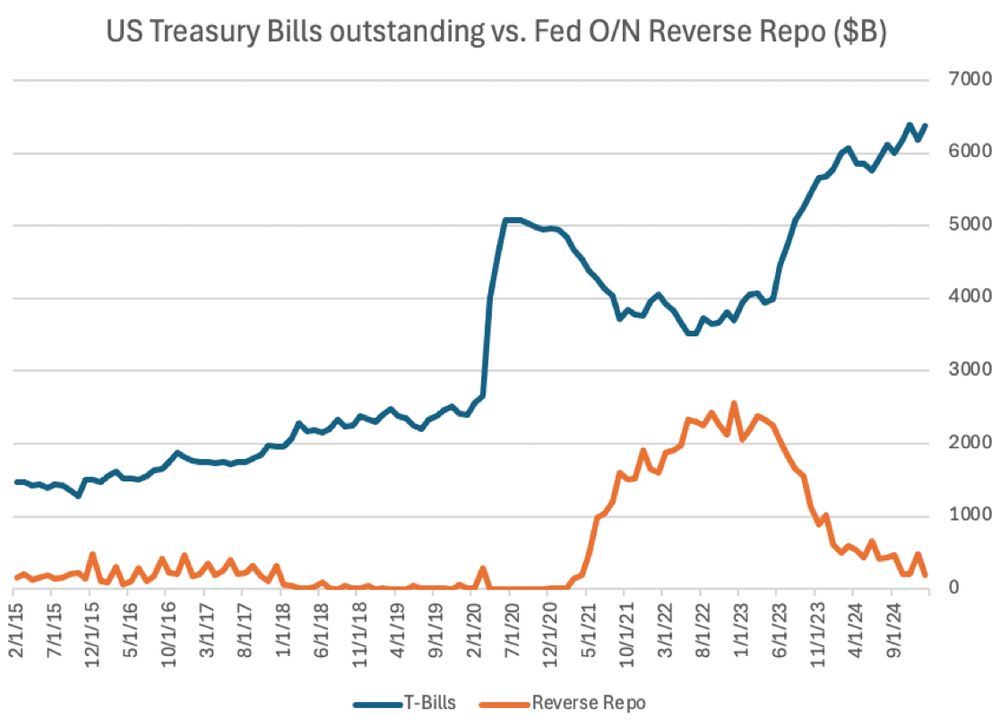

Turns out that RRP drainage was highly responsive to T-bill supply

12.02.2025 17:42 — 👍 10 🔁 1 💬 0 📌 0

@katie0martin.ft.com notes that the US Treasury market reflects the inconsistencies in the administration's policy goals

www.ft.com/content/5d69...

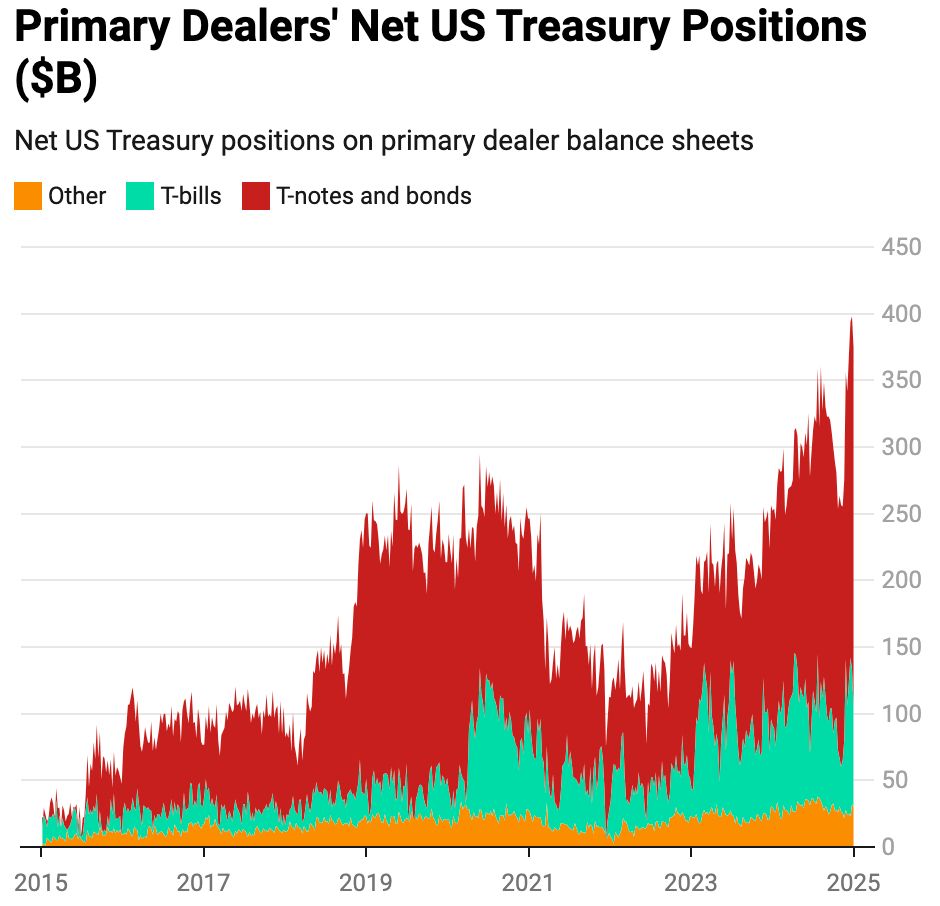

@rashad-ahmed.bsky.social and I find that dealers' constraints are a geopolitical vulnerability

cepr.org/voxeu/column...

#Econsky #AcademicSky

What was meant as a quick n dirty weekend analysis by @arebucci.bsky.social and I.. now catching the attn of @reuters.com and @financialtimes.com. Grateful to see interest in our work

Our piece: cepr.org/voxeu/column...

FT: on.ft.com/3QaAVCc

Reuters: www.reuters.com/markets/rate...

Video interviews are not my favorite, and I don't like to rewatch myself, but you might find this discussion of our paper with @rashad-ahmed.bsky.social on the price impact of foreign official sales of treasuries on their yileds informative: www.youtube.com/watch?v=FGGQ... #Econsky

07.02.2025 18:59 — 👍 5 🔁 6 💬 0 📌 0

New semester, here are data sources for students... #econsky

econbrowser.com/archives/202...

#FT and #Reuters covering our analysis of foreign official flows and US yileds:

@

www.ft.com/content/7201...

www.reuters.com/markets/rate...