A professional announcement: Oli Coibion,

@ygorodnichenko.bsky.social and I are starting a new conference on Expectations and Behavior, with a special focus on giving junior researchers the opportunity to interact with more senior researchers in the field.

21.10.2025 19:05 —

👍 16

🔁 3

💬 1

📌 1

Call for papers:

sites.lsa.umich.edu/rudib/wp-con...

Submit your work

#EconSky

22.10.2025 02:35 —

👍 8

🔁 3

💬 0

📌 0

US consumer inflation heats up; weekly jobless claims near four-year high

U.S. consumer prices increased by the most in seven months in August amid higher costs for housing and food, but a surge in first-time applications for unemployment aid last week kept the Federal Reserve on track to cut interest rates next Wednesday.

Inflation ⬆️ & Employment ⬇️ → Stagflation

A difficult situation for the Fed. Cut interest rates now → risk of rising inflation ⬆️

More here: "Inflation, Expectations and Monetary Policy: What Have We Learned and to What End?" with Oli Coibion @empctmacrotx.bsky.social, shorturl.at/2fmOD

#EconSky

11.09.2025 15:18 —

👍 6

🔁 2

💬 1

📌 0

Read the full blog post here: sites.utexas.edu/macro/2025/0...

29.08.2025 15:22 —

👍 0

🔁 0

💬 0

📌 0

The authors emphasize that although America is further away from the battlegrounds, history shows that American consumers do react to wars overseas, calling for stabilization by policymakers and central banks, especially by anchoring expectations.

29.08.2025 15:22 —

👍 0

🔁 0

💬 1

📌 0

Importantly, these views also concern people's personal situation and not just their general economic outlook.

29.08.2025 15:22 —

👍 0

🔁 0

💬 1

📌 0

Though apparently far away, wars still transcend into the expectations of households and consumers, progressively worsening their outlook as wars drag on as shows European survey data.

29.08.2025 15:22 —

👍 0

🔁 0

💬 1

📌 0

How Wars in Foreign Countries Influence Inflation and Expectations

That is what Olivier Coibion and Yuriy Gorodnichenko explore in our most recent blog post "When Foreign Wars Abroad Hit Wallets at Home".

29.08.2025 15:22 —

👍 6

🔁 2

💬 1

📌 0

New working paper:

The Dynamics of Technology Transfer: Multinational Investment in China and Rising Global Competition

by @jaedochoi.bsky.social, George Cui, Younghun Shim & Yongseok Shin.

Link to the paper as well as other working papers of our center: sites.utexas.edu/macro/resear...

25.08.2025 14:36 —

👍 2

🔁 1

💬 0

📌 0

New (updated) working paper:

The Inflation Attention Threshold and Inflation Surges by

@pfaeutiecon.bsky.social

.

Link to the paper as well as other working papers of our center:

sites.utexas.edu/macro/resear...

15.08.2025 14:51 —

👍 2

🔁 0

💬 0

📌 1

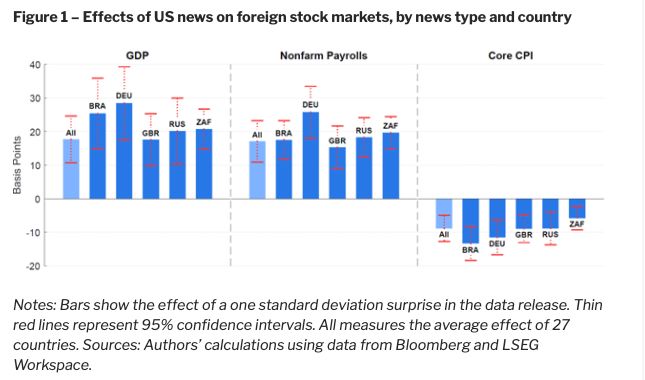

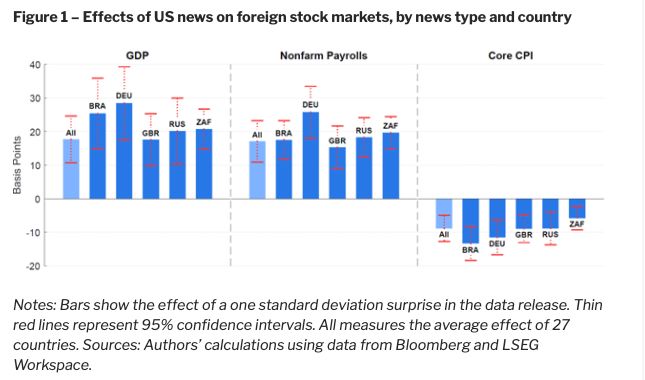

How News about the US Economy Drives Global Financial Conditions

More details in the blog post: sites.utexas.edu/macro/2025/0...

and even more details in the paper: academic.oup.com/restud/advan...

15.07.2025 20:19 —

👍 0

🔁 0

💬 0

📌 0

While US macroeconomic announcements have large effects on foreign stock markets, the reverse is not true. Foreign economic news releases have little to no effects on US markets.

15.07.2025 20:19 —

👍 0

🔁 0

💬 1

📌 0

US monetary policy has a stabilizing role after US macroeconomic news releases.

When bad news about the US economy becomes available, markets expect Fed to lower interest rates, which partially offsets the decline in stock markets and thus stabilizes asset markets and economy.

15.07.2025 20:19 —

👍 0

🔁 0

💬 1

📌 0

These findings suggest that investors are more confident in holding riskier assets when the US economy is doing well.

Flip side: bad news about the US economy can lead to a global stock market panic

15.07.2025 20:19 —

👍 0

🔁 0

💬 1

📌 0

Why is it that global stock prices respond so much to surprises about US macroeconomic data releases?

➡️ global stock prices rise after US macroeconomic news releases

➡️investors’ perceived risk and uncertainty falls

➡️ prices of relatively safe assets also fall

15.07.2025 20:19 —

👍 0

🔁 0

💬 1

📌 0

How does news about the US economy affect the rest of the world?

➡️ after US macroeconomic news releases, global stock prices respond immediately and in a synchronized way.

➡️ effects are large: Foreign countries’ stock prices respond with magnitudes similar to US stock market.

15.07.2025 20:19 —

👍 0

🔁 0

💬 1

📌 0

How News about the US Economy Drives Global Financial Conditions

New blog post by Chris Boehm and @kronerniklas.bsky.social (UT graduate @utaustinecon.bsky.social 🤟) based on paper recently published in @reveconstudies.bsky.social.

Short summary below ⬇️

15.07.2025 20:19 —

👍 4

🔁 3

💬 1

📌 0

How French Firms Navigated the Inflation Surge: Lessons for Expectations and Decision-MakingBlueskyEmailTwitter

Much more details, including a discussion of the policy implications can be found in the blog post:

sites.utexas.edu/macro/2025/0...

Or in the full working paper: utexas.app.box.com/s/ht0ddytxfx...

Thank you for reading!

@utaustinecon.bsky.social

04.06.2025 11:41 —

👍 0

🔁 0

💬 0

📌 0

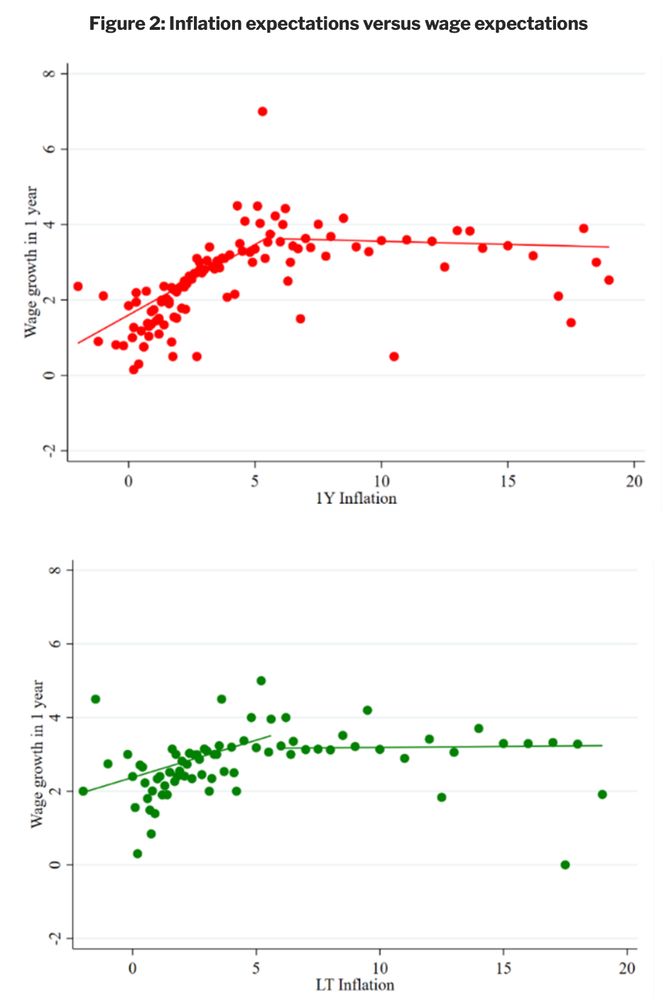

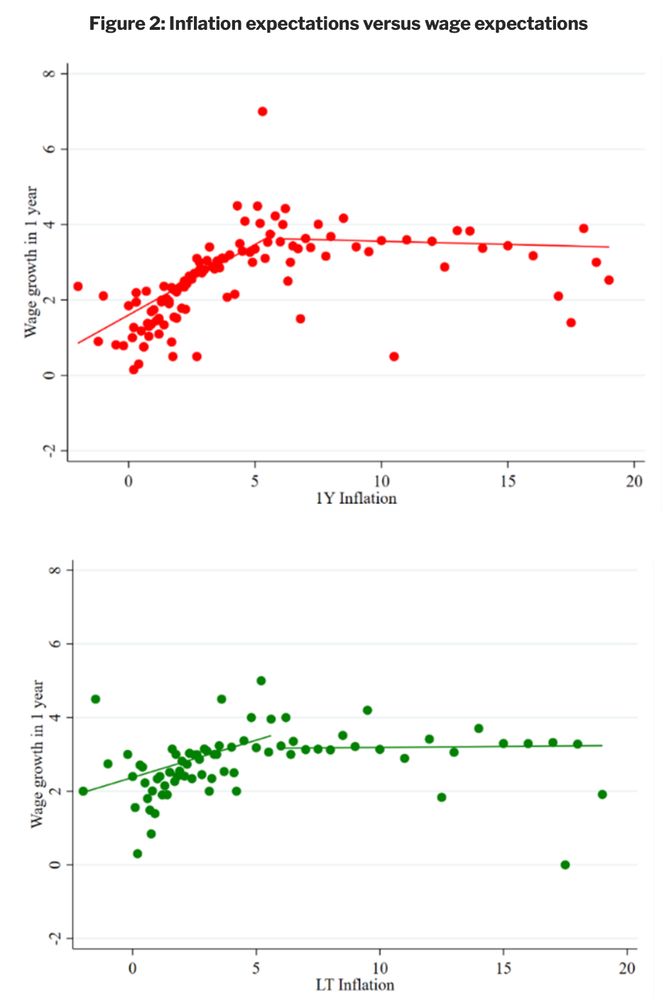

This is consistent with models where wage contracts are short-lived and expectations beyond the contract horizon are irrelevant (as @ivanwerning.bsky.social 's work highlights)

04.06.2025 11:41 —

👍 0

🔁 0

💬 1

📌 0

Only short-term expectations (and inflation perceptions) are meaningfully correlated w/ expected wage growth. Long-run inflation expectations have essentially no predictive power.

04.06.2025 11:41 —

👍 0

🔁 0

💬 1

📌 0

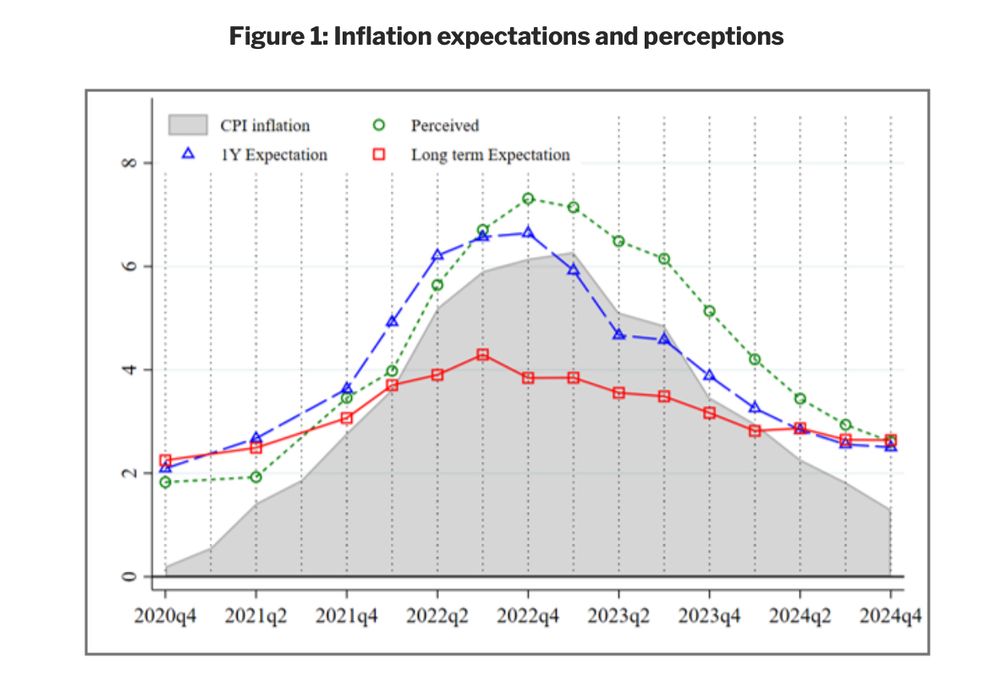

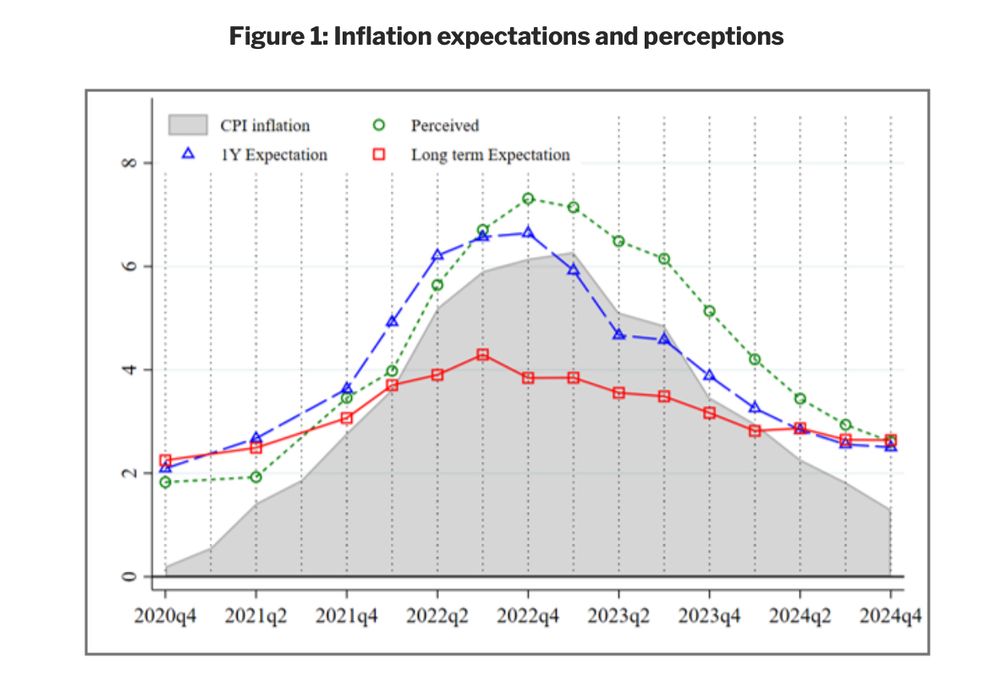

As inflation began rising in 2022, firms initially underreacted: short-term expectations rose more slowly than actual inflation. This gave way to persistent overshooting—firms expected more inflation than actually materialized, especially in the disinflation phase in 2023–2024.

04.06.2025 11:41 —

👍 0

🔁 0

💬 1

📌 0

How French Firms Navigated the Inflation Surge: Lessons for Expectations and Decision-Making

New blog post by Oli Coibion, @erwan-gautier.bsky.social and Frédérique Savignac.

Short summary follows ⬇️

04.06.2025 11:41 —

👍 2

🔁 1

💬 1

📌 0

Now also out as a EMPCT working paper!

Link: sites.utexas.edu/macro/resear...

02.06.2025 20:34 —

👍 2

🔁 1

💬 0

📌 0

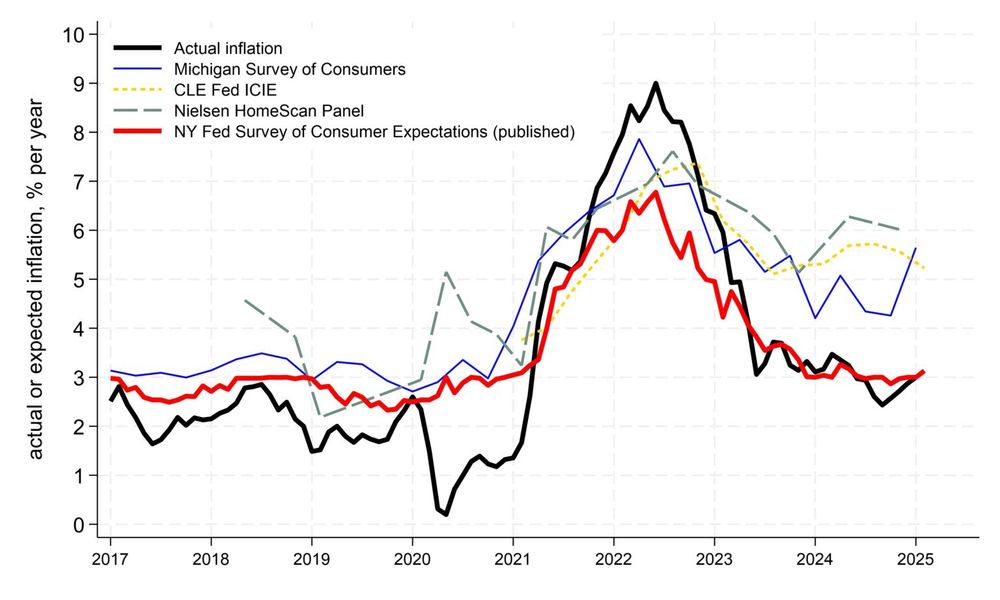

Inflation, Expectations and Monetary Policy: What Have We Learned and to What End?

New paper by Oli Coibion and @ygorodnichenko.bsky.social sheds new light on the recent inflation period and looks ahead.

02.06.2025 05:55 —

👍 4

🔁 1

💬 0

📌 1

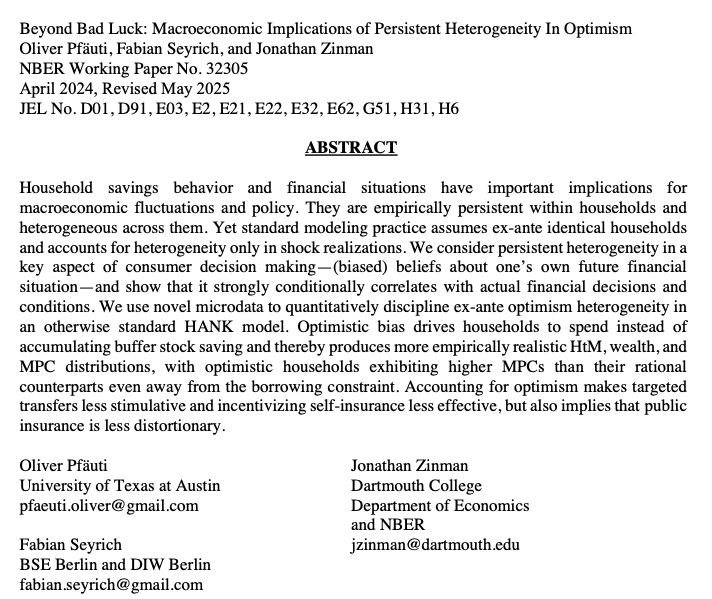

It took a while, but we finally have a new (heavily revised) version out:

nber.org/papers/w32305

23.05.2025 05:57 —

👍 9

🔁 2

💬 0

📌 0

Want to know more about firms' inflation expectations during the recent inflation surge? And how do their expectations correlate w/ wage expectations and firms' price setting?

Check out the new EMPCT working paper by @erwan-gautier.bsky.social, Savignac & Coibion: sites.utexas.edu/macro/resear...

23.05.2025 05:02 —

👍 5

🔁 1

💬 0

📌 0

New working paper on French firms' inflation and wage expectations by Oli Coibion and coauthors!

22.05.2025 04:27 —

👍 1

🔁 2

💬 0

📌 1

New working paper on French firms' inflation and wage expectations by Oli Coibion and coauthors!

22.05.2025 04:27 —

👍 1

🔁 2

💬 0

📌 1

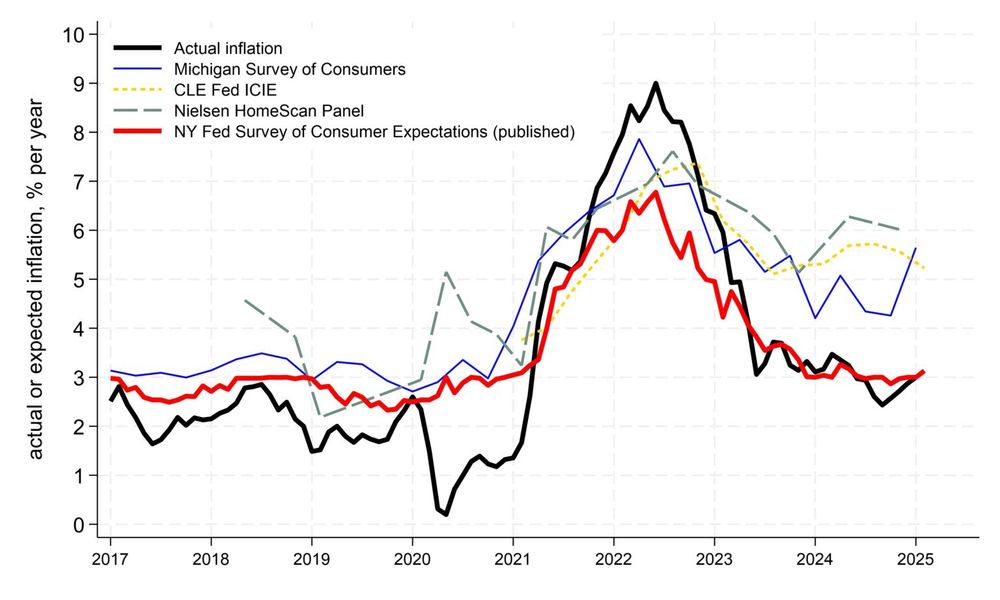

Alarming

17.05.2025 01:47 —

👍 17

🔁 1

💬 0

📌 0

A cautionary take on the rise in inflation expectations in the UMich survey from @ygorodnichenko.bsky.social & Olie Coibion at @empctmacrotx.bsky.social...

The pandemic "inflation surge experience has further unanchored [household & firm] expectations"

sites.utexas.edu/macro/2025/0...

05.05.2025 18:07 —

👍 17

🔁 2

💬 0

📌 0