11.04.2025 01:50 — 👍 110 🔁 13 💬 4 📌 1

11.04.2025 01:50 — 👍 110 🔁 13 💬 4 📌 1

How to handle the stock market dropping

07.04.2025 17:55 — 👍 88 🔁 13 💬 10 📌 2

It’s actually a good thing that so many Trump supporters are losing their money in crypto scams. Republicans have been insulated from their poor decisions for too long. They vote against their own interests, only to be saved by Democrats (e.g., Obamacare). When you face real consequences, you learn

20.01.2025 23:17 — 👍 204 🔁 16 💬 5 📌 3

Why are egg prices so high under Trump?

Why isn't the war in Ukraine over under Trump?

Why is it so hard to afford housing under Trump?

Why do we have so much government waste under Trump?

Why do we have a geriatric president under Trump?

20.01.2025 20:40 — 👍 169 🔁 15 💬 5 📌 0

Startling how people make major financial decisions without ever running a single calculation

In my experience, 90%+ of people buying a house NEVER run basic calculations (buy vs. rent, amortization)

Same for buying a car & investing fees

Meanwhile, they agonize over coffee

18.01.2025 17:03 — 👍 50 🔁 3 💬 3 📌 0

ANNOUNCING MY NEW BOOK!

Money For Couples shows you how to build a Rich Life together. Use the word-for-word scripts to stop fighting and build a shared vision. Set your accounts up to make it all flow smoothly

Best of all, use money to bring you both closer together

iwt.com/moneyforcouples

01.01.2025 20:11 — 👍 43 🔁 3 💬 4 📌 1

Good Q. Depends on income and expenses, but the big thing to consider:

If maxing out your 401K achieves your investing goals (e.g., will you have enough for retirement?), then it can make sense to back off investing. In FIRE terms, this is "CoastFIRE"

29.12.2024 20:23 — 👍 1 🔁 0 💬 2 📌 0

In a marriage:

- Venmo'ing each other for expenses: No

- Each person having their own no-questions-asked account: Yes

- One person being the "Money Person": No

- Secret accounts: No

- Talking about money every month with an agenda that starts with a compliment: Yes

29.12.2024 19:53 — 👍 52 🔁 2 💬 3 📌 1

Here are the 4 Key Financial Numbers you should know

- Fixed Costs: 50-60% of net income (take-home)

- Investments: 5-10% (the more, the better)

- Savings: 5-10%

- Guilt-Free Spending: 20-35%

Within those ranges? GREAT! If not, make a change. No need to track the price of pickles

29.12.2024 18:49 — 👍 45 🔁 3 💬 4 📌 0

When couples fight about spending at Target or energy drinks at the gas station, it’s never about those expenses

It’s almost always about how much they spend on (1) housing, (2) cars, & (3) their values

But they don’t know they’re overspending, so they fight about $20 expenses

28.12.2024 19:35 — 👍 26 🔁 3 💬 1 📌 0

More from my simple financial system

- No private equity, no leverage. No need!

- Spend a lot of time building the skill of spending meaningfully and making money FUN

- Do this together with my wife

28.12.2024 16:00 — 👍 11 🔁 2 💬 1 📌 0

My simple financial system:

- Small # of credit cards

- Automatic investing into low-cost index funds

- Healthy margin of error

- Long time horizon

- Focus on $300,000 questions including increasing income

28.12.2024 16:00 — 👍 30 🔁 4 💬 4 📌 2

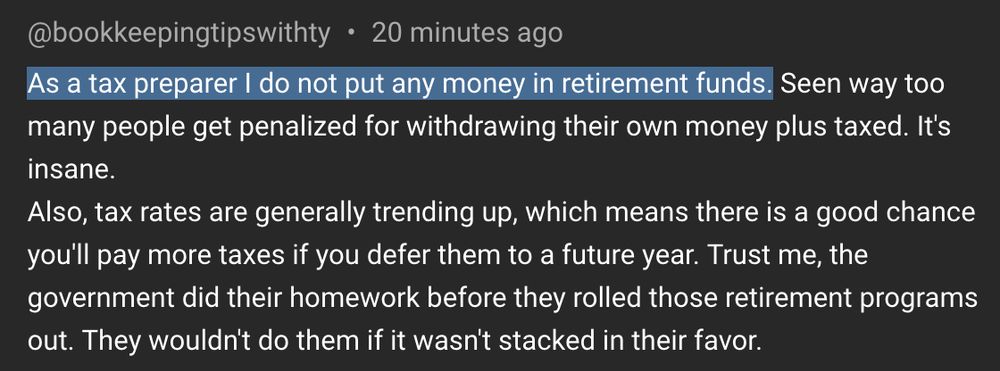

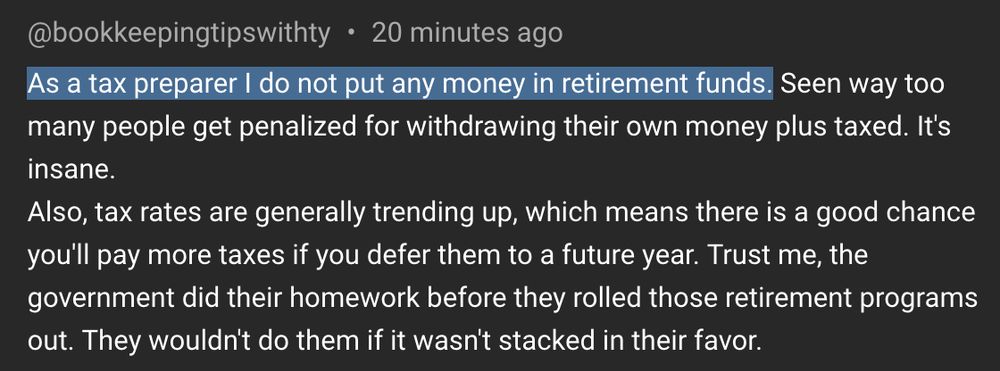

uh what

28.12.2024 02:56 — 👍 27 🔁 1 💬 4 📌 0

5. Know each other's Money Type: Avoider, Worrier, Optimizer, or Dreamer. Then act accordingly (see my new book, Money For Couples)

27.12.2024 22:56 — 👍 10 🔁 2 💬 0 📌 0

3. Have a monthly money meeting where you always start with a compliment. This helps you both stay on track

4. There is no "money person" in a relationship. You're both teammates and each of you should "own a number," meaning you're each in charge of at least one critical part of your finances

27.12.2024 22:56 — 👍 11 🔁 2 💬 1 📌 0

5 rules for money in your relationship

1. Ask: What's our Rich Life? How are we using our money to live it?

2. Set up accounts so your money goes into a joint account, but each of you gets a separate, no-questions-asked account that only you have access to

27.12.2024 22:56 — 👍 18 🔁 1 💬 3 📌 0

wut

26.12.2024 22:56 — 👍 32 🔁 1 💬 7 📌 1

I have talked to multiple people on my podcast who complained about the “unaffordable” economy — specifically, inflation at the grocery store — while they had a car payment of over $1,400/month

They did not see a connection

23.12.2024 14:12 — 👍 84 🔁 8 💬 4 📌 0

It can be done! Have a conversation where you recalibrate your relationship with money

- NO numbers

- No talking about debt or budgets

- Talk about how you feel, how you want to feel, and ask your partner how they feel

I cover this in my book, including what to do next

22.12.2024 20:09 — 👍 0 🔁 0 💬 0 📌 0

Sure, one partner might be more skilled/interested in a certain topic. That's OK! I'm more experienced with investing but my wife and I discuss our investment rate, returns, & we discuss what it means for us together

You can build a Rich Life vision together

That's why I wrote my new book

22.12.2024 17:01 — 👍 9 🔁 1 💬 0 📌 0

It would have been easy for me to be the "money guy" in my relationship, but I wanted us to BOTH do it together

1. If I get hit by a bus, the last thing I want is some Wells Fargo 1.25% shithead calling my grieving wife

2. It's good to have a 2nd set of eyes on major decisions

3. It's more FUN

22.12.2024 17:01 — 👍 12 🔁 1 💬 1 📌 0

In couples, one partner might take on the role of emptying the dishwasher. Another might take out the trash

Money isn't like that

Money cuts across everything so deeply -- housing, retirement, vacations, parenting -- that both partners have to be involved

22.12.2024 17:01 — 👍 1 🔁 0 💬 1 📌 0

There should never be a "money person" in a marriage. Both partners should be involved, with each person in charge of at least one aspect of the family finances

22.12.2024 17:01 — 👍 32 🔁 2 💬 4 📌 0

A very generous friend is donating 200 copies of my new book, Money For Couples, to an organization that could use them

If you're part of an organization like this, please email me the name of the org, description, and how you'd use them

ramit.sethi@iwillteachyoutoberich.com

22.12.2024 12:33 — 👍 16 🔁 1 💬 1 📌 1

How it feels to know I have a weekend free of lawn mowing, leaf raking, gutter cleaning, wall painting, lightbulb replacing, Home Depot chasing, backyard maintaining, and pool cleaning

22.12.2024 02:01 — 👍 41 🔁 1 💬 7 📌 0

Great point! Reminds me of how private jet flyers have a net worth 1,000x higher than those flying Southwest, which is why you should buy a private jet to become wealthy

18.12.2024 01:48 — 👍 59 🔁 9 💬 2 📌 0

YouTube video by I Will Teach You To Be Rich

Why You Should Stop Listening to Get-Rich-Quick “Gurus”

This @ramitsethi.bsky.social clip where he calls out scammers moving to florida is making my LIFE

youtu.be/MvLinlXiI_A?...

"I'm not saying everyone who lives in Florida is a scammer, but a lotta scammers sure live in Florida!"

🤣🤣🤣

13.12.2024 10:13 — 👍 28 🔁 5 💬 3 📌 0

Perfect example of what I'm talking about

03.12.2024 05:22 — 👍 3 🔁 0 💬 0 📌 0

American culture applauds this, but I find it sad and pointless

There is no virtue in living a smaller life than you have to

02.12.2024 15:49 — 👍 60 🔁 6 💬 10 📌 1

Honk If You ♥️ SaaS

🥾 I'm the bootstrapped founder of Paperbell (>1m ARR)

🚪 Exited MeetEdgar

✍️ Blogging at https://lauraroeder.com/

🇬🇧 Based in Brighton, UK

New Yorker writer, author Dark Money, The Dark Side, Strange Justice, Landslide, wife & mom.

www.awealthofcommonsense.com

Editor-in-chief of The Verge, host of Decoder, cohost of The Vergecast. I am in love with spectacle.

Liberal talking head (co-host of The Five on Fox News) and excellent mom if I do say so myself. Democracy enthusiast. Perusing the blue skies.

Founder @democracydocket.com. Chair of Elias Law Group. My dog's name is Blue.

CEO of Bluesky, steward of AT Protocol.

dec/acc 🌱 🪴 🌳

Covering online speech, social media and the information wars at @washingtonpost.com. Shitposting about Bluesky on Bluesky.

Signal: willoremus.24

Former US Congressman, Proud RINO, husband, and military man. Fighting the MAGA brain worms daily!

Adamkinzinger.komi.io

Adamkinzinger.substack.com

Law student interested in law and philosophy

CEO/cofounder of Muck Rack and Shorty Awards. Podcasting since 2005 and tweeting since 2007.

Senior Literary Agent representing nonfiction at Writers House

“great story!”— Judith Butler.

Feature writer, @nymag (before that: “propublica, @nytmag).

Learn all about the happenings at America's #1 Pickleball Club from Club President Kevin. We are a 55+ Community with 24 State-Of-The-Art Pickleball Courts in the Desert Southwest.

Questions? Contact Kevin Hillstrom (kevinh@minethatdata.com)

I work for readers as the New York Times money scribe. Author of "The Price You Pay for College," teacher of a course about merit scholarships (meritaidcourse.com), Brooklyn now but forever Chicago. He/We/Abba. Gratitude and rage.

Raised on Vino's Pizza and the triple rims of Miles Park

Wishing for a thing does not make it so.

By @JoeSondow.bsky.social

11.04.2025 01:50 — 👍 110 🔁 13 💬 4 📌 1

11.04.2025 01:50 — 👍 110 🔁 13 💬 4 📌 1