Applications are open for the Finance Summer School 2026. Last two have been at Brown. This one is at LSE thanks to LSE European Institute and Huth Initiative, plus the Berkeley Program on Finance and Democracy. Stellar Line up. Apps open: forms.gle/WsEVk4Yy52Dn...

03.02.2026 21:21 — 👍 20 🔁 14 💬 0 📌 2

River or sankey diagram showing the allocation of profits from global oil and gas companies to quantiles of the US wealth size distribution via financial system intermediaries, such as asset managers, and categories of ultimate beneficiaries, such as business owners, pension funds and shareholders in listed companies. The scale is hundreds of billions of US dollars, and ultimately 50.4% of profits reaching the US personal wealth distribution go to the richest 1% of households.

🚨NEW PAPER🚨

We all know the 2022 energy price shock fueled the cost of living crisis. It also caused a profit bonanza for the very rich. We show the US reaped the largest profits ($377bn) of any country. 50% went to the richest 1%, only 1% to the bottom 50%. A🧵 www.sciencedirect.com/science/arti...

08.10.2025 16:50 — 👍 438 🔁 248 💬 10 📌 31

this is fascinating!

18.09.2025 08:02 — 👍 4 🔁 2 💬 0 📌 0

Thrilled that my first article is out in @jeppjournal.bsky.social ☺️

It looks at why renewable energy buildout in Europe has been *so* unsteady - tracing the evolution of/conflict over the regime for RE derisking over the last two+ decades...

It's open access! 👉 doi.org/10.1080/1350...

Short 🧵 ...

10.09.2025 09:58 — 👍 50 🔁 19 💬 2 📌 3

A highly recommended read, and folllow. Congrats, @maxwillems.bsky.social!

10.09.2025 12:58 — 👍 12 🔁 5 💬 1 📌 0

Thanks, Dan

11.09.2025 07:44 — 👍 0 🔁 0 💬 0 📌 0

Thanks, Philipp :)

10.09.2025 20:38 — 👍 1 🔁 0 💬 0 📌 0

Thanks, Mark!

(&: not as much as one might think, in this case)

10.09.2025 19:58 — 👍 0 🔁 0 💬 0 📌 0

Thanks, Ben!

10.09.2025 19:48 — 👍 1 🔁 0 💬 0 📌 0

Indebted to many colleagues for great help - special thanks to issue/lead editor @danmertens.bsky.social and to @benbraun.bsky.social for early advice [5/5]

10.09.2025 09:58 — 👍 2 🔁 0 💬 1 📌 0

Then asks why the European regime shifted - first (post-GFC) from a robust (though politically contested) technology-development to a market-based approach, and later (since ~2017) partly reverted to a hybrid model [3/5]

10.09.2025 09:58 — 👍 2 🔁 0 💬 1 📌 0

The article introduces a simple typology of RE derisking instruments, drawing on @danielagabor.bsky.social @benbraun.bsky.social @brettchristophers.bsky.social and others, to make sense of policy support of renewable energy investments in Europe [2/5]

10.09.2025 09:58 — 👍 6 🔁 1 💬 1 📌 0

Thrilled that my first article is out in @jeppjournal.bsky.social ☺️

It looks at why renewable energy buildout in Europe has been *so* unsteady - tracing the evolution of/conflict over the regime for RE derisking over the last two+ decades...

It's open access! 👉 doi.org/10.1080/1350...

Short 🧵 ...

10.09.2025 09:58 — 👍 50 🔁 19 💬 2 📌 3

Indebted to many colleagues for great help - special thanks to issue/lead editor @danmertens.bsky.social and to @benbraun.bsky.social for early advice [5/5]

10.09.2025 09:23 — 👍 0 🔁 0 💬 0 📌 0

Then asks why the European regime shifted - first (post-GFC) from a robust (though politically contested) technology-development to a market-based approach, and later (since ~2017) partly reverted to a hybrid model [3/5]

10.09.2025 09:23 — 👍 1 🔁 0 💬 1 📌 0

The article introduces a simple typology of RE derisking instruments, drawing on @danielagabor.bsky.social/@benbraun.bsky.social and others, to make sense of policy support of renewable energy investments in Europe [2/5]

10.09.2025 09:23 — 👍 0 🔁 0 💬 1 📌 0

Since the start of von der Leyen's second mandate, EU sustainable finance norms face intense dismantling pressures. My new @JEPP article shows this started years ago when the fossil fuel industry “woke up” to the EU Taxonomy. 🧵 #EUTaxonomy #SustainableFinance👇 1/10

01.09.2025 14:48 — 👍 30 🔁 16 💬 1 📌 2

America’s Braudelian Autumn | Benjamin Braun & Cédric Durand

Factions of capital in the second Trump administration

We wrote about the US ruling class taking the reins to manage its own decline. What do the Trumpist factions of capital want? Can that be squared with the interests of the MAGA base? Capable state managers could potentially thread the needle, but that's all gone. With @cedricdurand.bsky.social.

30.05.2025 12:07 — 👍 131 🔁 57 💬 4 📌 17

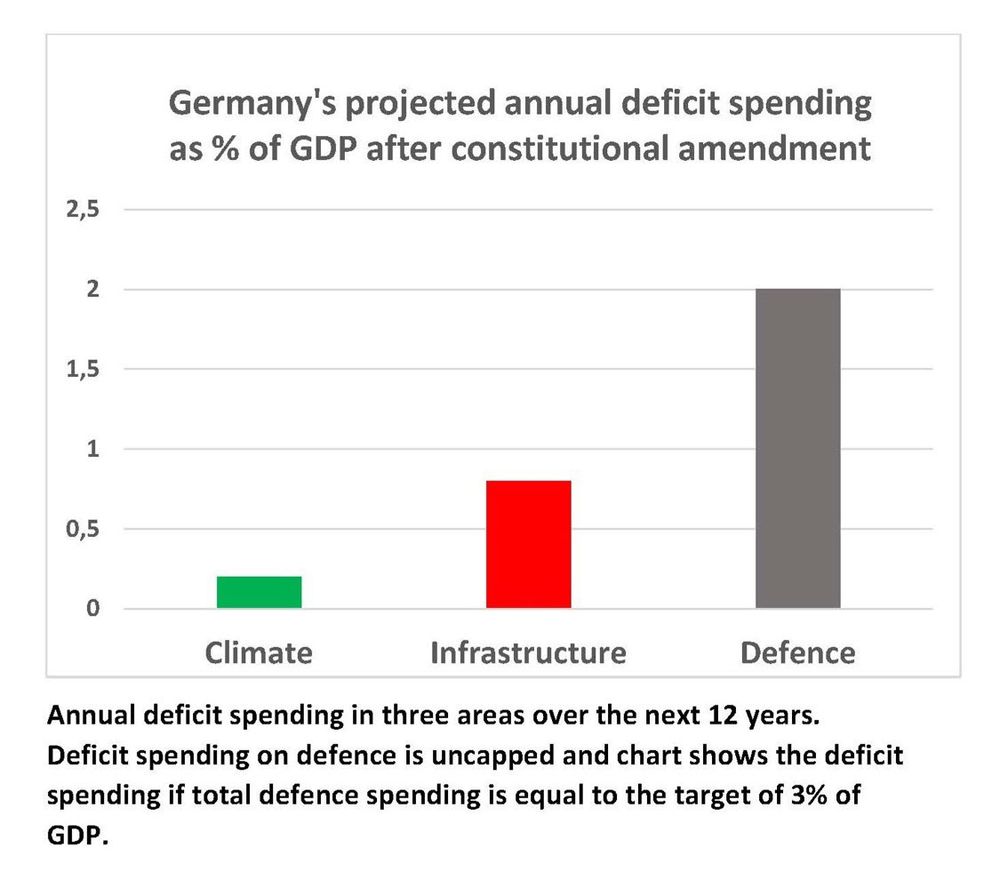

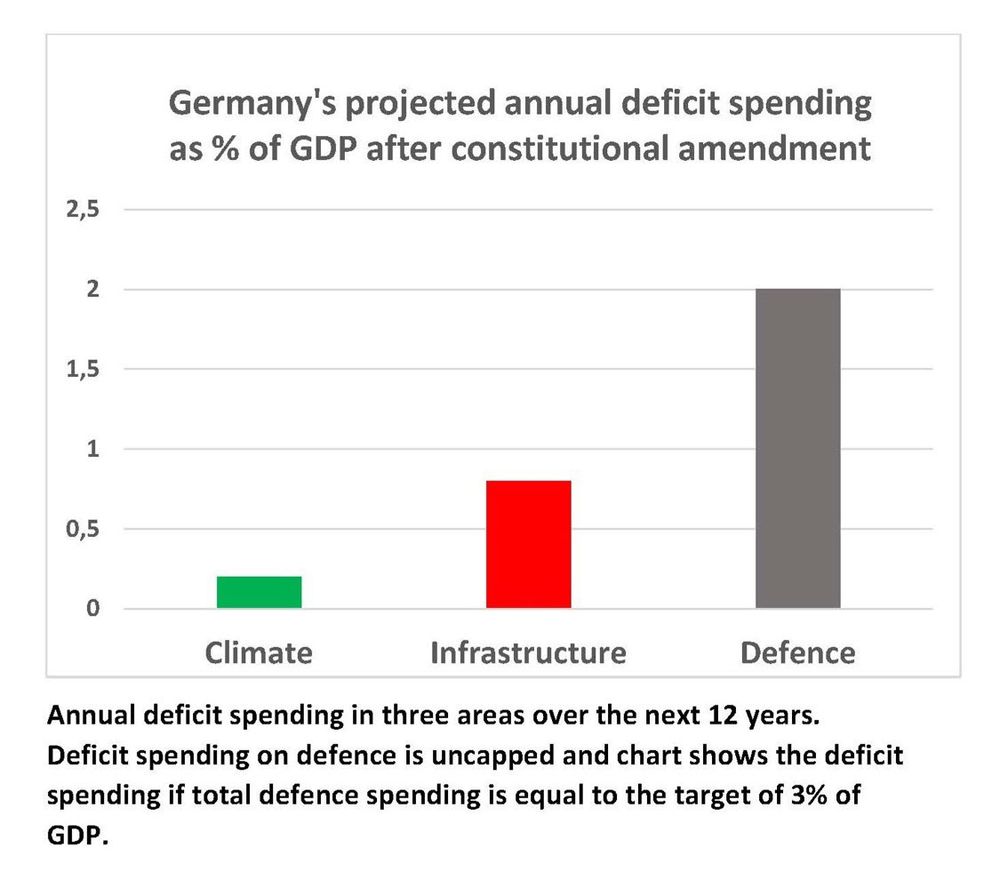

The fiscal breakthrough in Germany is setting a clear direction: Military deficit spending has priority above everything else, the only budget with no limit. The defence spending goal dwarfs the deficit spending available for climate.

20.03.2025 15:53 — 👍 102 🔁 34 💬 5 📌 7

“No one should simply blame the current regime. They announced their intentions. Rather, it’s the rapid capitulation that we have to confront.”

-Jodi Dean

22.03.2025 21:00 — 👍 4 🔁 4 💬 0 📌 1

Unfortunately cancelled due to (very) bad weather/potential flooding! 😬

21.03.2025 11:51 — 👍 0 🔁 0 💬 0 📌 0

Looking forward to presenting some of my dissertation research at ICEI’s Comparative Political Economy seminar tomorrow. Swing by!

20.03.2025 18:31 — 👍 7 🔁 1 💬 1 📌 0

We’re beyond thrilled to launch the 2nd Max Planck Summer School for Women in Political Economy

If you’re a fellow political economist annoyed by all-male rooms & gendered comments— join us & share!

🗓️ 22-25 Sept, 2025 in Cologne

🚨 Apply by 25 Apr, 2025

www.mpifg.de/1343511/2025...

14.03.2025 11:37 — 👍 67 🔁 53 💬 1 📌 5

Planning the green transition is not only about creating new industries, but also about phasing-out old ones.

If you want to know how political backlash against impending economic decline and regional inequalities led to new policies and institutions for transition planning in the EU, have a look👇

06.03.2025 17:31 — 👍 28 🔁 9 💬 2 📌 0

I'm so happy for my friend @pgolka.bsky.social for winning the @ripejournal.bsky.social Best Article Award 2024 for his absolutely brilliant paper on 'Epistemic gerrymandering'! Congratulations Philipp!

05.03.2025 11:48 — 👍 24 🔁 3 💬 1 📌 1

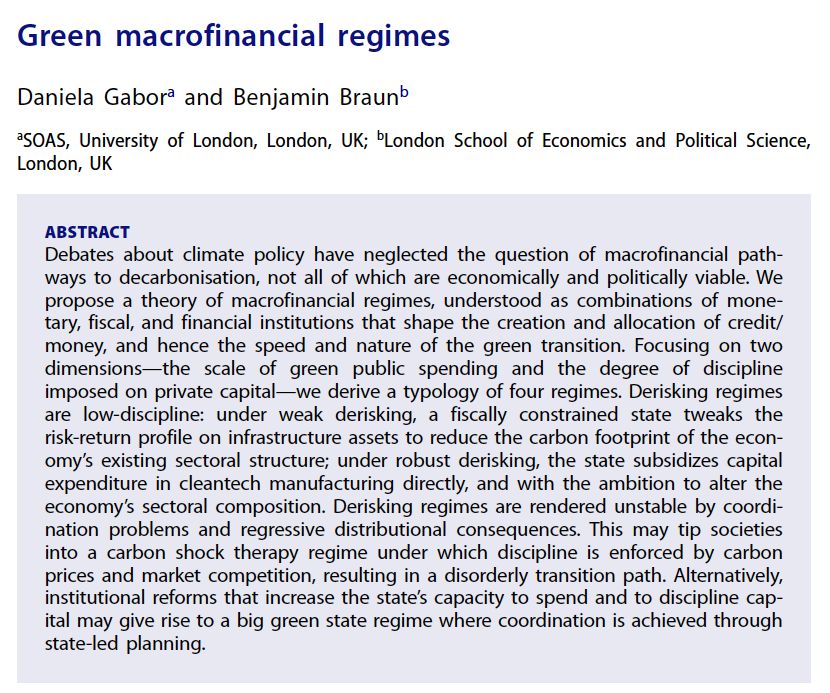

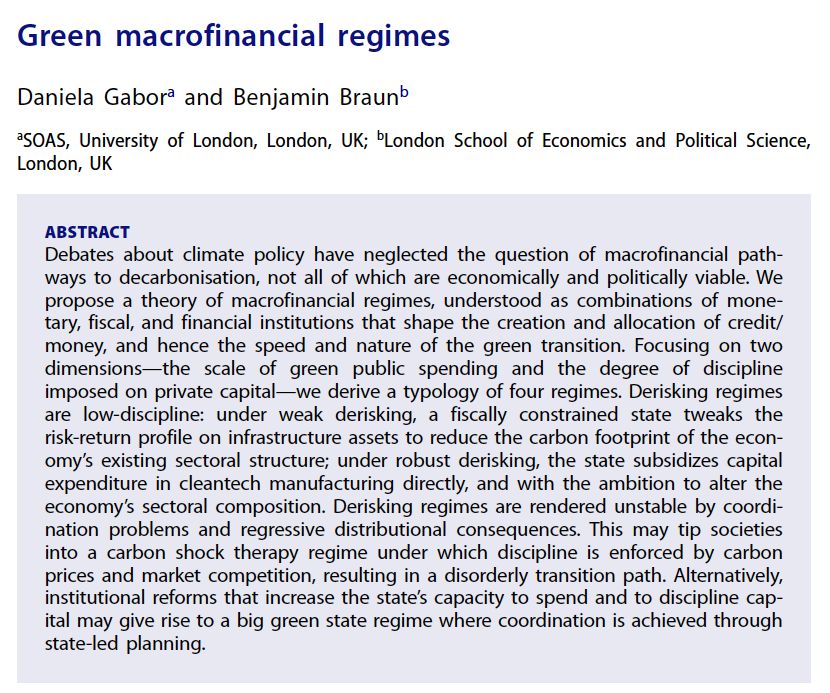

Screenshot of the abstract of the linked paper.

As the Trusk regime is wrecking the state apparatus that brought us the IRA, it's more urgent than ever to understand the politics of green macrofinancial regimes.

Here's a 🧵 on the result of @danielagabor.bsky.social and I wrecking our brains for four years.

www.tandfonline.com/doi/full/10....

12.02.2025 12:28 — 👍 177 🔁 68 💬 6 📌 11

PhD student at @ktbberlin.bsky.social | working on democratisation of energy and socialisation of finance | (she/her)

https://socializationproject.de/

Freelance journalist - climate, renewables, environment & more. Can assist with web content, white papers, copywriting & more (enq robinwhitlock1966 @ gmail.com ). WSM UK. NUJ. Over 10 years experience. Sea shanty singer with The Steepholmers. 🇵🇸🇮🇱

Researching the political economy of electricity, urban and environmental planning.

https://garethfearn.com/

Jean Monnet Fellow at the EUI & Assistant Professor at Leiden University. Political Economy, Crises, Central Banks & the Green and Digital Transitions.

Independent publisher - bringing the best new work in politics, economics, philosophy, geography, and sustainability to readers worldwide.

Sociologist. Post-Doctoral Researcher @mpifg.bsky.social. Labour, culture & elites. Ethnographer of butlers.

Critical Political Economist -- Author: A critical history of poverty finance (http://bit.ly/3pEV7Cf); Fictions of financialization (http://bit.ly/3PUWzdR) -- Reader in Global Sustainable Development, University of Warwick.

Views mine.

Host @CleaningUpPod. CEO Liebreich Associates. Managing Partner Ecopragma Capital. Founder, Contributor @BloombergNEF. Ex Board TfL, Board of Trade. Olympian. Don't message me - I'm not prepared to give away personal data to prove my age. Srsly BlueSky!

Lecturer in International Political Economy @citystgeorges.bsky.social research on central banks, fiscal policy, finance and democracy https://www.city.ac.uk/about/people/academics/inga-rademacher

Professor of Political Science, University of Muenster | passionate about researching democracy, political conflict, radical right parties, EU politics, public policy - and about baking bread

Lecturer in Political Science https://www.sciencespo.fr/centre-etudes-europeennes/en/.

Political Science | Comparative Politics | Political Behaviour & Public Opinion

https://www.dianebolet.com/

Post Doc @goetheuni | prev. @MZESUniMannheim & @PolEconReforms | Interested in Political Economy, Political Conflict, Welfare States & Comparative Methods

https://www.goethe-university-frankfurt.de/135512626/Benedikt_Bender?locale=en

Assoc. prof in STS @uio.no. Oil, climate, finance. RQ: cylinderhatt cylinderhatt var finns du i dag? https://bard.lahn.no

Assistant Professor @univie.ac.at丨Previously @ipz.bsky.social & @eui-sps.bsky.social丨Political Economy: Labor Markets, Fiscal Policy, Green Transition, Technological Change | www.retobuergisser.com

Political Economist; Sciences Po; previously UAlbany; Author of "In the Red: The Politics of Public Debt" (Michigan 2018) and "Rating Politics" (OUP 2023)

Alternately Defiant, Dispirited, and Despondent. Without illusions but not disillusioned. Focus on Climate, Inequality and Development.

I co-edit the Polycrisis project and newsletter https://www.phenomenalworld.org/series/the-polycrisis/

Prof Energy and Climate Change & Director, UCL Centre for Net Zero Market Design. Combines geekiness with policy, esp. economics and political economy of climate and decarbonisation, at home and international. Stubborn optimist, @ profmichaelgrubb.com.

Daniel Denvir’s Jacobin podcast on politics, history, and economics everywhere.

Host: @danieldenvir.bsky.social

Producer: @alexjrlewis.bsky.social

Listen at http://thedigradio.com

Give $$ http://patreon.com/user?u=4839800

The Sussex Energy Group undertakes rigorous, inter-disciplinary research on transitions to sustainable, low carbon energy systems.