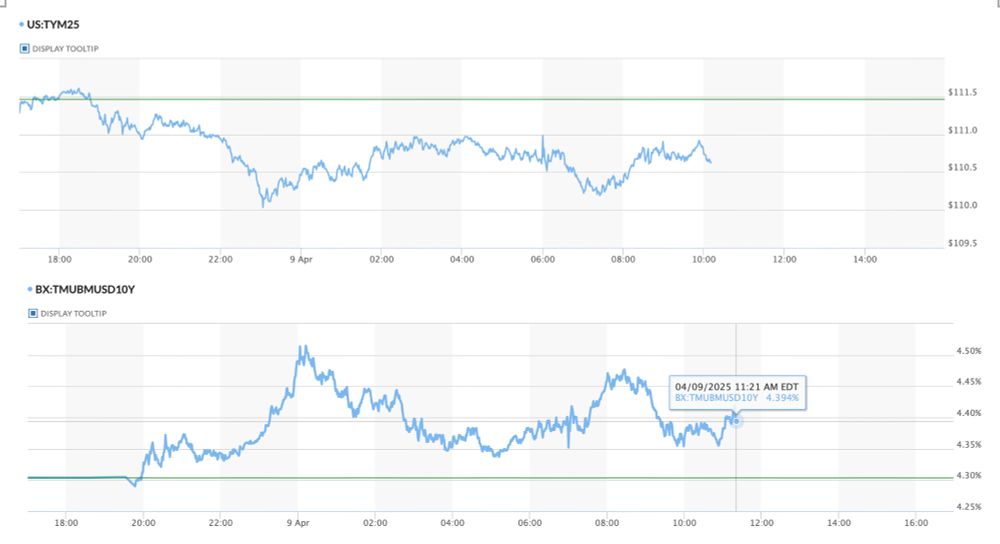

This makes the basis trade unwinding explanation really unsatisfying to me...can anyone with more institutional knowledge explain to me why this may also happen due to basis trade unwinding?

09.04.2025 16:15 — 👍 1 🔁 0 💬 0 📌 0

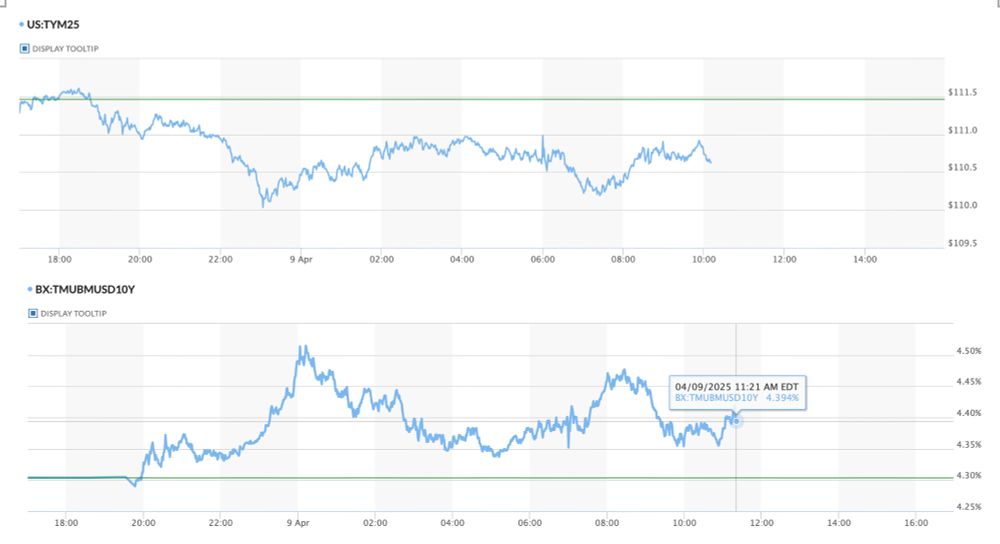

Traders all say the 10yr yield hike is due to basis trade unwinding. But unwinding has two legs: selling spot and buying future, so future should appreciate. But what we saw is that Treasury future price dropped as well (upper panel), actually pretty much in sync with the spot price (lower panel)

09.04.2025 16:15 — 👍 2 🔁 0 💬 1 📌 0

Sent it to JMCs

10.01.2025 17:30 — 👍 0 🔁 0 💬 0 📌 0

7 years ago when I just came to the US I was appalled by the perfunctory attitude people hold towards the lunch. A lunch should be a bowl of hot ramen followed by a refreshing nap.

Now I'm the one bringing a bottle of Soylent to the faculty lounge drinking it under derision.

This is the way 🌝

21.12.2024 04:57 — 👍 2 🔁 0 💬 0 📌 0

Most curious about 4 and in particular on how to use Git with different type of co-authors: who I can't force to use Git and who can use it minimally.

19.12.2024 22:19 — 👍 4 🔁 0 💬 0 📌 0

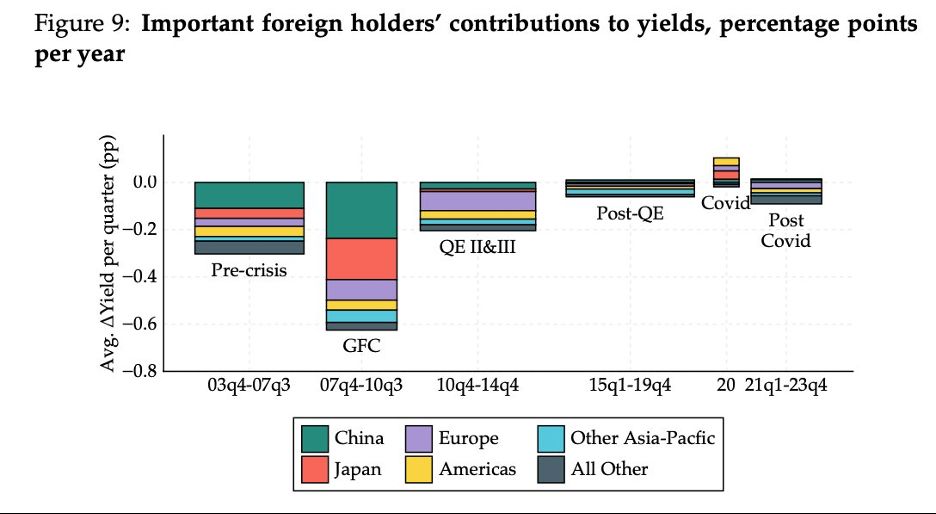

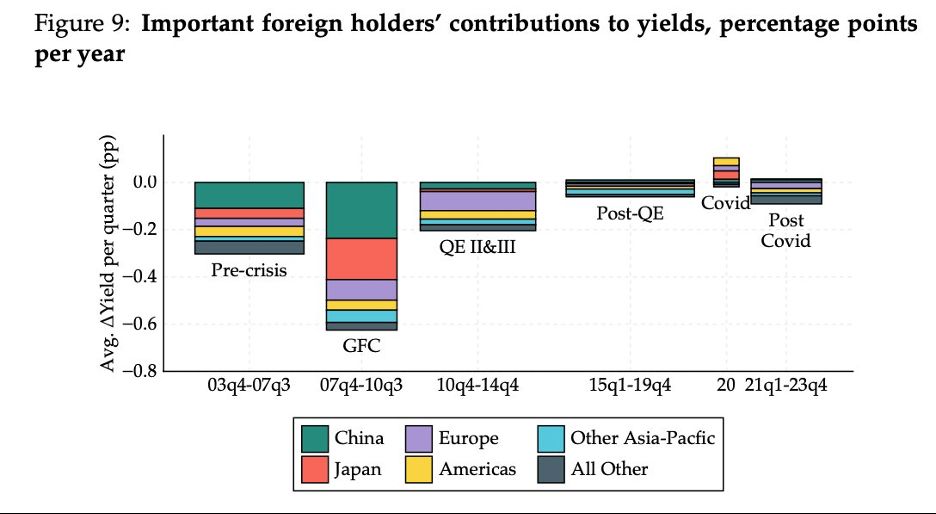

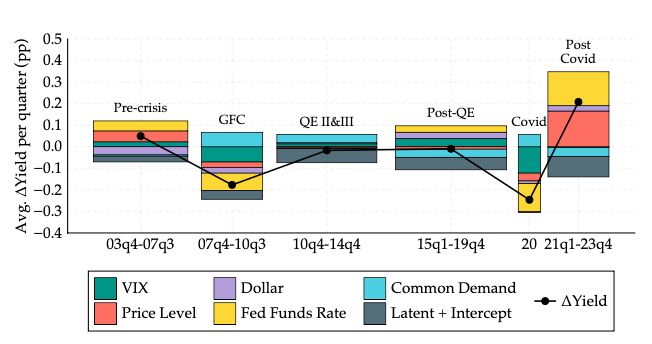

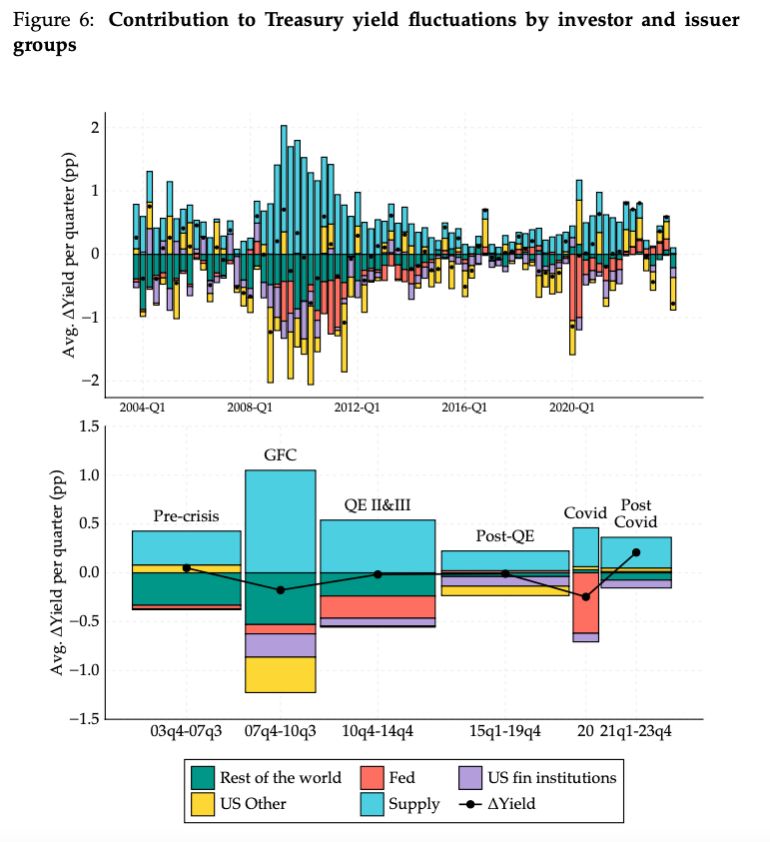

4.3/ Finally, the idea that a Treasury sell-off by major foreign investors such as China may have strong yield-increasing effect is quite correct in the first decade of the 2000s but less so in recent years -- foreign investors do not contribute much to yield movements since 2015.

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

4.2/ U.S. banks and foreign investors become substantially more price inelastic after the GFC, while the Fed has stepped up to the game as a state-contingent liquidity provider in the Treasury market. We discuss factors contributing to these regime shifts in detail in the paper.

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

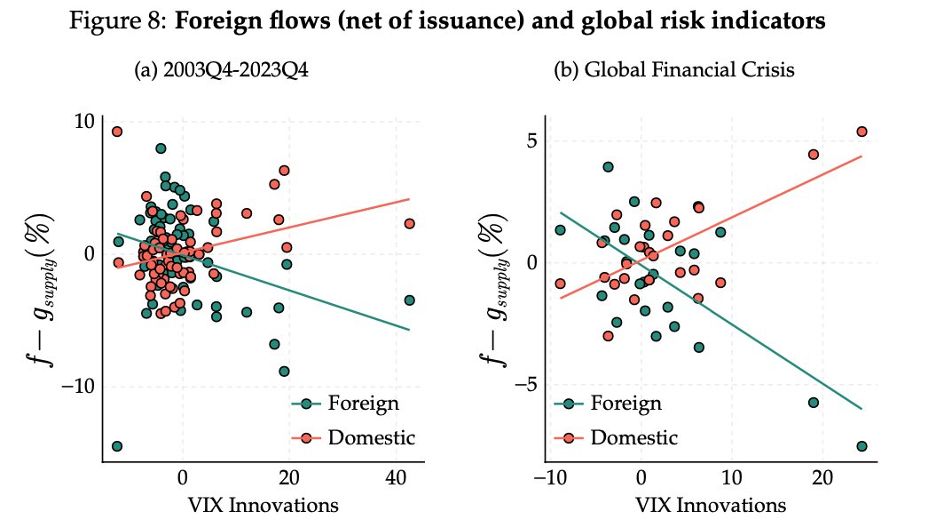

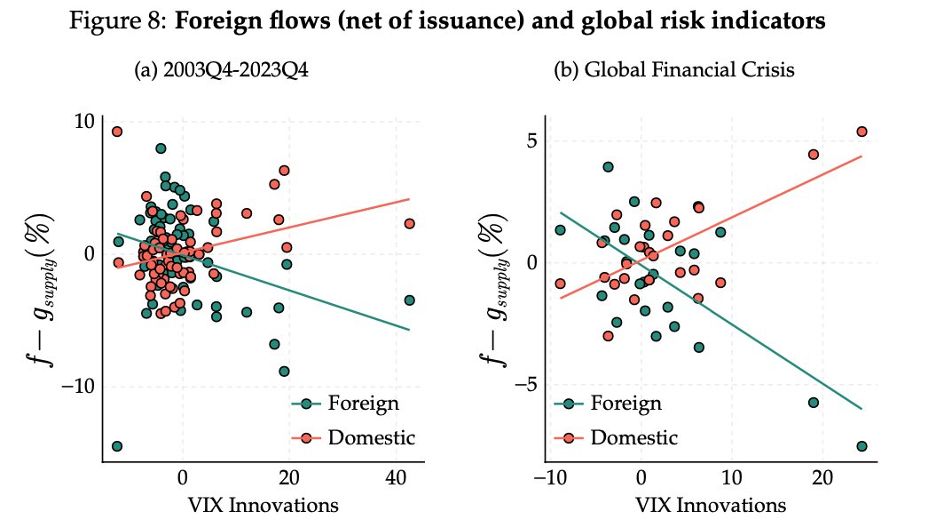

4.1/ We find little evidence supporting the conventional wisdom that foreigners are the major driver of "flight-to-Treasuries" during risk-off episodes. The pattern is evident even in the raw data, and with our model we can quantify the respective role of foreign & domestic investors.

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

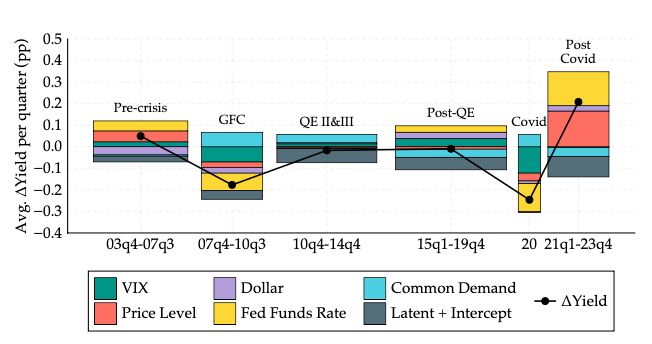

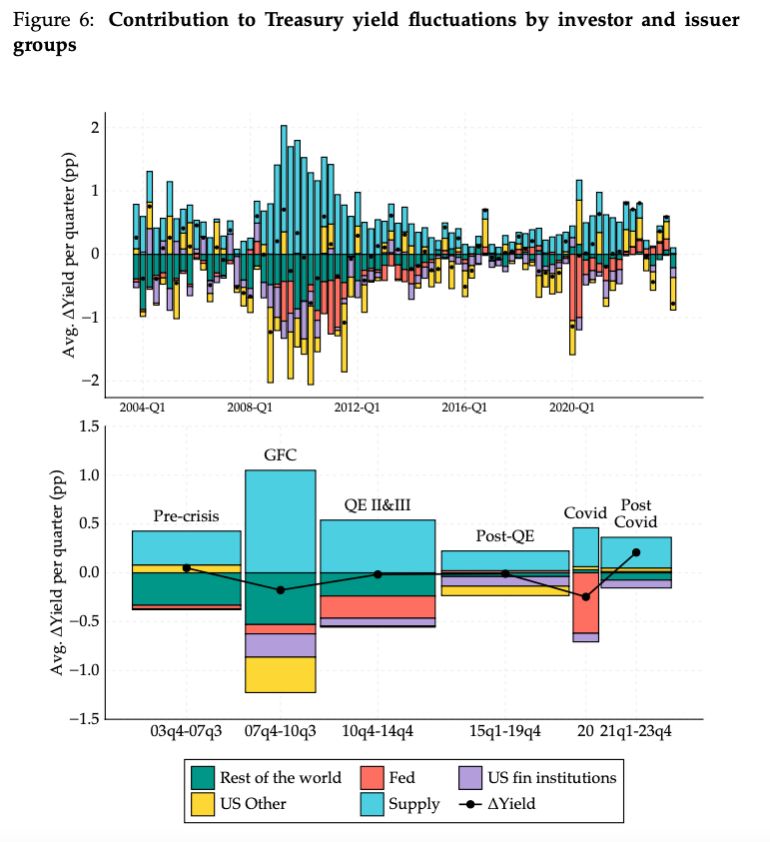

4/ We can use the estimated system to decompose yield movements and study who and what factors move yields. Then we focus on several important investor groups and discuss three main findings:

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

3/ The estimated "macro" multiplier is 1 -- 1% positive demand shocks push down yields on a 10-year note by 10bps. This aligns well with estimates in the literature: larger than "micro" multipliers for govt bonds but smaller than the macro multiplier for stocks.

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

a woman says power is power in a gif from gifsec.com

ALT: a woman says power is power in a gif from gifsec.com

2/ this approach yields an estimator that is 1) flexible (each sector has its own residual supply curve shifts that id's the elasticity); 2) intuitive (it has an IV and a bias-corrected OLS interpretation); and 3) powerful (it’s asymptotically efficient), and…

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

1/ we estimate an asset demand/supply system that can handle heterogeneous price elasticities and factor loadings across investors and time regimes. For identification, we propose a simple yet powerful approach exploiting granular idiosyncratic shocks (Gabaix-Koijen).

27.11.2024 21:32 — 👍 0 🔁 0 💬 1 📌 0

First skeet for the first paper as an AP! In *Anatomy of Treasury Market*, we study the drivers of U.S. Treasury yields over the past two decades using a flexible asset demand & supply system (with two amazing coauthors @haonanzhou.bsky.social and @manavchaudhary.bsky.social). Some highlights:

27.11.2024 21:32 — 👍 7 🔁 4 💬 1 📌 1

You are on bluesky! (Pun intended)

22.11.2024 04:15 — 👍 0 🔁 0 💬 0 📌 0

author of Whipping Girl, Sexed Up, Excluded & 99 Erics. also a musician & biologist. more at juliaserano.com. @juliaserano most other platforms. she/her

Truth-Teller | Independent Journalist and Legal Analyst | Trial Lawyer | @katiephang on Substack, Instagram, Threads, & TikTok

https://linktr.ee/katiephang?utm_source=linktree_admin_share

“Though She Be But Little, She Is Fierce”

Dad, husband, President, citizen. barackobama.com

Head of Data Science at Blue Rose Research, based in NYC, originally from Miami.

I try to elect Democrats.

Views are my own. he/him🌹

The fastest growing independent news network in the world. We cover breaking news, politics, law and more. We are unapologetically pro-democracy.

Official Account of Senator Chuck Schumer, New York’s Senator and the Senate Democratic Leader.

schumer.senate.gov

AGI research @DeepMind.

Ex cofounder & CTO Vicarious AI (acqd by Alphabet),

Cofounder Numenta

Triply EE (BTech IIT-Mumbai, MS&PhD Stanford). #AGIComics

blog.dileeplearning.com

A LLN - large language Nathan - (RL, RLHF, society, robotics), athlete, yogi, chef

Writes http://interconnects.ai

At Ai2 via HuggingFace, Berkeley, and normal places

The AI community building the future!

Founding list[float] engineer. LLMs 😬. Information retrieval. Infra. Systems. Normcore code. Nutella. Vectors. Words. Vibes. Bad puns (soon).

https://vickiboykis.com/what_are_embeddings/

https://Answer.AI & https://fast.ai founding CEO; previous: hon professor @ UQ; leader of masks4all; founding CEO Enlitic; founding president Kaggle; various other stuff…

Independent AI researcher, creator of datasette.io and llm.datasette.io, building open source tools for data journalism, writing about a lot of stuff at https://simonwillison.net/

Google Chief Scientist, Gemini Lead. Opinions stated here are my own, not those of Google. Gemini, TensorFlow, MapReduce, Bigtable, Spanner, ML things, ...

Professor at Wharton, studying AI and its implications for education, entrepreneurship, and work. Author of Co-Intelligence.

Book: https://a.co/d/bC2kSj1

Substack: https://www.oneusefulthing.org/

Web: https://mgmt.wharton.upenn.edu/profile/emollick

Taylor Swift. 🫶🏼 Getting updates from other social media apps so you don’t have to 🥳

Endocrinology, endocrine oncology, gender-affirming hormone therapy, functional epigenetics

Exploring the American idea through ambitious, essential reporting and storytelling. Of no party or clique since 1857. http://theatlantic.com

Staff Writer at The Atlantic // Working on a book for Random House // Rep’d by Elyse Cheney // ross@theatlantic.com

programming director at the atlantic | swang@theatlantic.com