Our article "Operational Uncertainty and the Missing Money Problem" is now in Energy Economics (authors.elsevier.com/c/1lxeFW3fd1v69). The paper investigates capacity markets and operations, finding that current configurations in the US slightly undercompensate baseload plants relative to peakers.

16.10.2025 10:52 —

👍 5

🔁 1

💬 0

📌 0

Did not see that coming!

10.09.2025 13:41 —

👍 2

🔁 0

💬 1

📌 0

💡 New Transmission Paper alert 💡

“Electric transmission value and its drivers in United States power markets” just went live in Nature Communications! Kudos especially to Julie Mulvaney Kemp for getting this work to the finish line.

doi.org/10.1038/s414...

02.09.2025 19:19 —

👍 17

🔁 7

💬 1

📌 1

That should say "Revisiting" instead of "Rethinking"

20.08.2025 09:52 —

👍 1

🔁 0

💬 0

📌 0

Our paper "Rethinking capacity market fundamentals," about several issues in accreditation and non-performance penalties in capacity markets, is now published in Energy Economics and is open access for the next 50 days at this link: authors.elsevier.com/c/1ldcmW3fd1...

19.08.2025 15:06 —

👍 10

🔁 5

💬 2

📌 2

Can you expand on this?

16.07.2025 05:39 —

👍 1

🔁 0

💬 1

📌 1

If years left pre-tenure are greater than years of eligibility remaining, seems better to wait?

31.05.2025 22:42 —

👍 0

🔁 0

💬 0

📌 0

Due to the lower wholesale prices, seems like it would slightly increase the cost of other procurement. So the effect on the mix depends if you think the additional cost would change the quantity procured in those auctions.

29.05.2025 21:17 —

👍 1

🔁 0

💬 1

📌 0

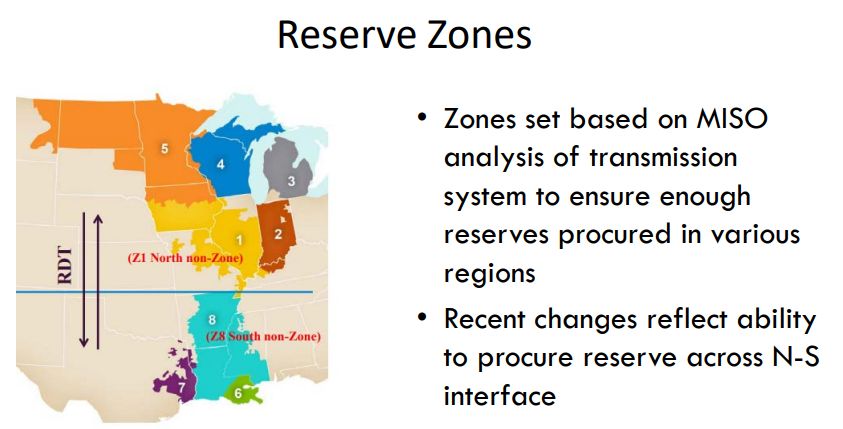

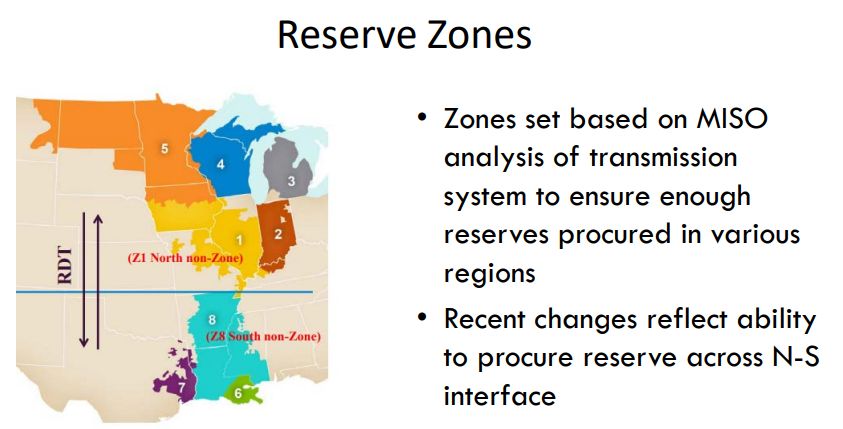

Map of MISO reserve zones

I think the 6 GW is probably irrelevant in this case--need to know what was available specifically in zone 6 on this map. I agree that the system should be planned in a way that enables operation without both nuclear plants, but I think we'll need to wait for the MISO report to learn more.

28.05.2025 08:58 —

👍 2

🔁 0

💬 0

📌 0

Still accurate to say they “played a role,” since their absence almost certainly contributed to reserve shortage in that zone.

28.05.2025 00:06 —

👍 2

🔁 0

💬 1

📌 0

Do you have data on LCOE for balcony solar? Seems like it might be competitive.

07.05.2025 15:58 —

👍 1

🔁 0

💬 2

📌 0

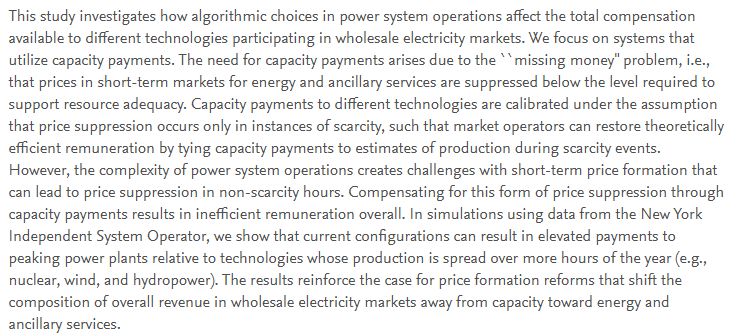

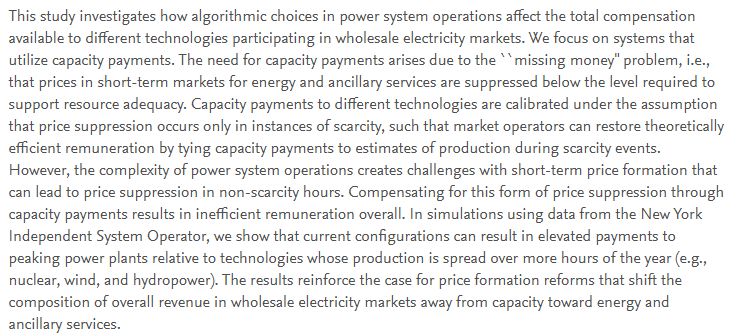

This study investigates how algorithmic choices in power system operations affect the total compensation available to different technologies participating in wholesale electricity markets. We focus on systems that utilize capacity payments. The need for capacity payments arises due to the "missing money" problem, i.e., that prices in short-term markets for energy and ancillary services are suppressed below the level required to support resource adequacy. Capacity payments to different technologies are calibrated under the assumption that price suppression occurs only in instances of scarcity, such that market operators can restore theoretically efficient remuneration by tying capacity payments to estimates of production during scarcity events. However, the complexity of power system operations creates challenges with short-term price formation that can lead to price suppression in non-scarcity hours. Compensating for this form of price suppression through capacity payments results in inefficient remuneration overall. In simulations using data from the New York Independent System Operator, we show that current configurations can result in elevated payments to peaking power plants relative to technologies whose production is spread over more hours of the year (e.g., nuclear, wind, and hydropower). The results reinforce the case for price formation reforms that shift the composition of overall revenue in wholesale electricity markets away from capacity toward energy and ancillary services.

The basic idea is summarized in the abstract here:

03.04.2025 18:01 —

👍 2

🔁 0

💬 1

📌 0

Operational Uncertainty and the Missing Money Problem

This study investigates how algorithmic choices in power system operations affect the total compensation available to different technologies participating in wh

New working paper, "Operational Uncertainty and the Missing Money." Here we argue that competitive electricity markets probably overcompensate peaking resources relative to those whose production is spread over more hours of the year (e.g., nuclear and hydro) papers.ssrn.com/sol3/papers....

03.04.2025 18:01 —

👍 15

🔁 3

💬 2

📌 1

I think it makes sense for the dual to be zero if non-binding or the penalty if binding. If that doesn’t accurately reflect the nature of the penalty, could model piecewise constant or piecewise linear slacks to get a smoother price outcome.

23.01.2025 00:48 —

👍 1

🔁 0

💬 1

📌 0

Yep, the tax is embedded in the offers of emitting suppliers.

21.01.2025 22:10 —

👍 4

🔁 0

💬 1

📌 0

What are they assuming the differences would be between "Public SMR" and "Private SMR"?

20.01.2025 18:59 —

👍 1

🔁 0

💬 1

📌 0

I'm about to start a project on reserve deliverability, reading recommendations are welcome.

16.01.2025 20:00 —

👍 1

🔁 0

💬 1

📌 0

Cornell LSAMP Summer REU

We are recruiting for an undergraduate summer research opportunity in electricity market modeling, through Cornell's Office of Inclusive Excellence (sites.coecis.cornell.edu/lsampreu/). If you or someone you know wants to spend the summer in Ithaca and get into this area, check it out!

16.01.2025 10:12 —

👍 7

🔁 2

💬 0

📌 1

Regional Transmission Organizations as Market Platforms I

What's the origin story of wholesale power markets?

I'm starting off 2025, a year when I'll write a lot about the role of markets and innovation in enabling our future power systems, by writing a series about RTOs as wholesale market platforms. Part I: economic history. 📉📈 and 🔌💡

knowledgeproblem.substack.com/p/regional-t...

09.01.2025 15:50 —

👍 14

🔁 3

💬 1

📌 0

Framing it slightly differently, what’s the cost multiplier for a nuke (or anything, really) sited in downstate New York as opposed to, e.g., Georgia?

05.01.2025 00:14 —

👍 3

🔁 0

💬 1

📌 0

But there are related modeling challenges that are not easy to address, e.g., fuel inventory for dual-fuel units.

31.12.2024 16:42 —

👍 4

🔁 0

💬 1

📌 0

I don't think anyone explicitly separates fuel delivery issues from other causes of generator unavailability. With decent methodology (e.g. PJM after recent reforms) it gets incorporated to the extent it shows up in historical data.

31.12.2024 16:41 —

👍 7

🔁 0

💬 1

📌 0

Agreed that it's hard to argue with in principle, but I am not familiar enough with the details of implementation to say how effective they have been in practice.

23.12.2024 11:26 —

👍 1

🔁 0

💬 0

📌 0

Right--@electronecon.bsky.social is referring to U.S. utilities with fuel adjustment clauses that shield the utility from fuel price volatility, necessitating regulatory intervention if you want to try to restore better incentives for hedging.

23.12.2024 09:24 —

👍 2

🔁 0

💬 1

📌 0

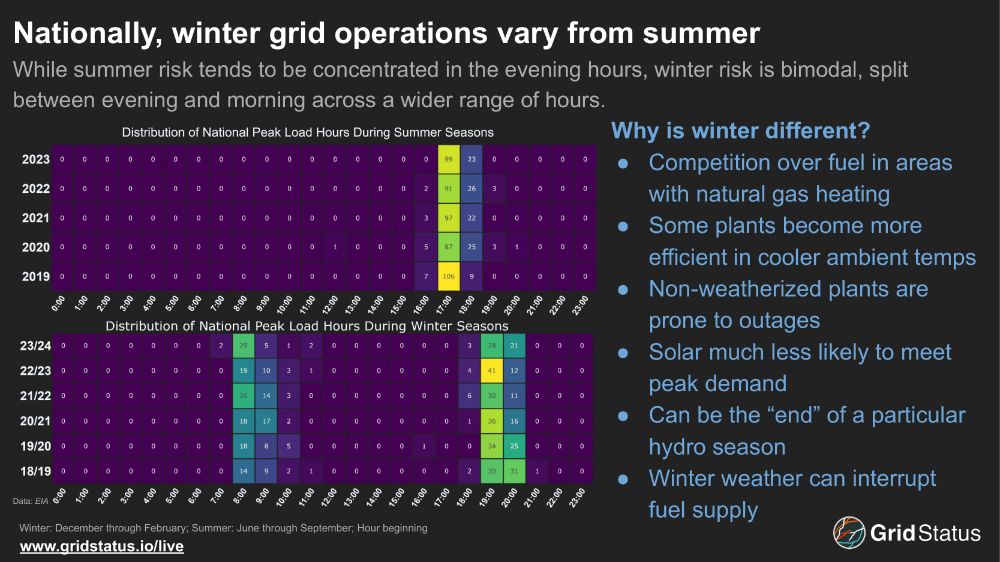

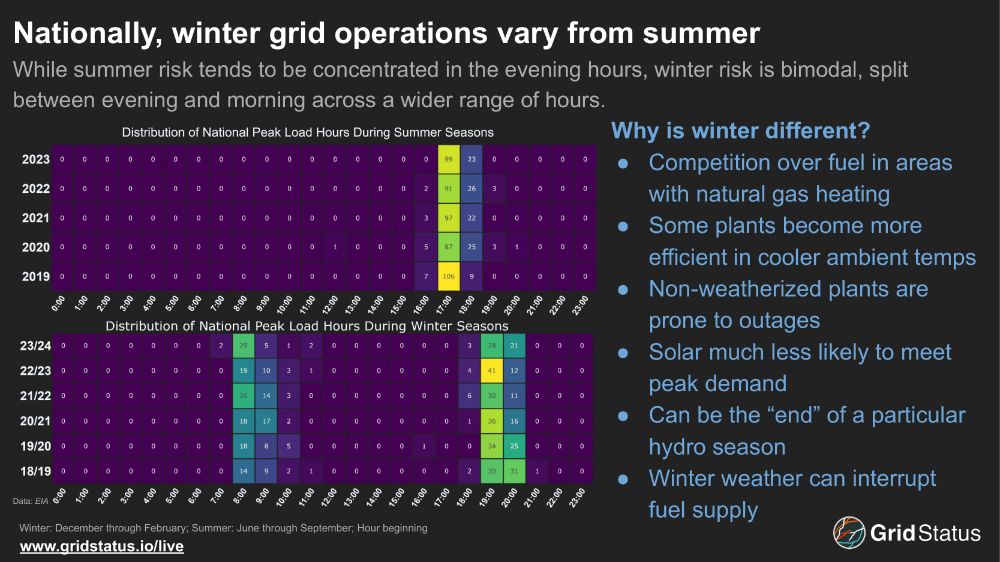

Nationally, winter grid operations vary from summer

While summer risk tends to be concentrated in the evening hours, winter risk is bimodal, split between evening and morning across a wider range of hours.

#energysky 🔌💡

20.12.2024 15:51 —

👍 22

🔁 8

💬 1

📌 2

Would be curious to discuss this more. Not clear to me if storage optimization issues should make us more confident about the need for energy-only markets or less confident about their viability.

20.12.2024 08:17 —

👍 0

🔁 0

💬 1

📌 0