Yet this is a third way in which the country can lead in AI. India's path may not be like America's or China's. But it could be no less consequential. (3/n)

www.economist.com/leaders/2025...

@shaileshchitnis.bsky.social

Business writer, The Economist. Interested in chips, pills and innovation. Recovering entrepreneur.

Yet this is a third way in which the country can lead in AI. India's path may not be like America's or China's. But it could be no less consequential. (3/n)

www.economist.com/leaders/2025...

As OpenAI, PerplexityAI, Google and more give away their products on the cheap, many are worried about what it means for India's tech sovereignty.

India will not make the fastest chips. It will not invent the latest AI models. (2/n)

The AI race between China and America has hidden an interesting trend: the boom in AI in India.

Indians have embraced AI in a scale not seen in other countries. Culturally too, the country seems more optimistic about its impact than in other countries. (1/n)

www.economist.com/asia/2025/09...

And, some personal reflections as someone who was in the trenches and is now writing about it. The greatest thing about this industry is how globalised, yet locally specialised it is. Resilience is good and needed. But the pendulum has swung too far. Time for some common sense.

22.08.2025 06:40 — 👍 0 🔁 0 💬 0 📌 0

Finally Tom Lee Devlin explains why America needs its allies in its chipmaking ambitions (5/n)

www.economist.com/leaders/2025...

Where does that leave Intel? Not in a very good place. I argue that Intel's best changce of success is to focus on the foundry. A foundry-only business would certainly be a gamble. But the longer it dithers, the lower the chance of success.(4/n)

www.economist.com/business/202...

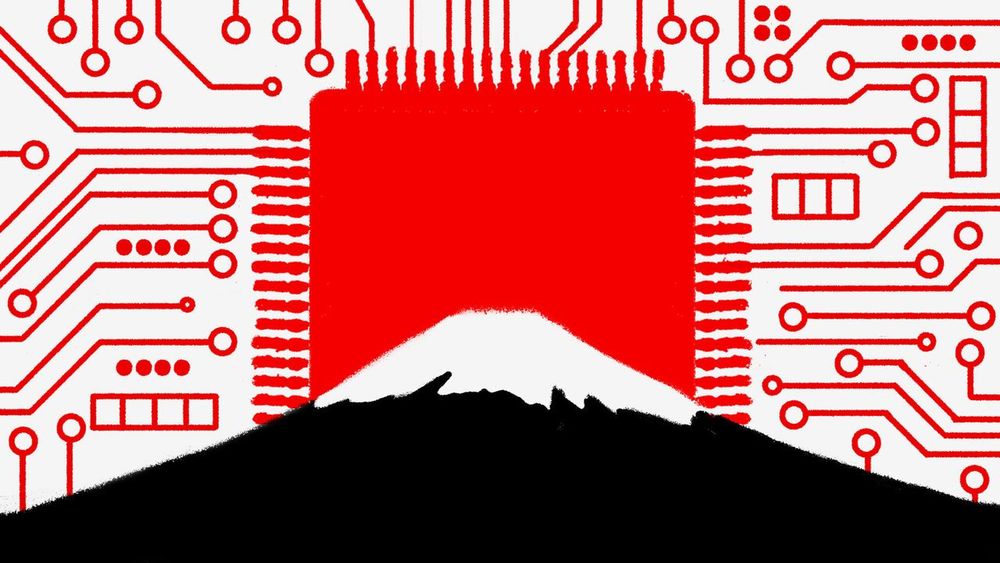

My colleague Noah Snider writes about Japan's resurgence as a chipmaking hub (3/n)

www.economist.com/asia/2025/08...

First up, I look at TSMC. The company at the heart of tech wars and AI. I argue that among all the challenges the company has faced - earthquakes, typhoons, threat of war - exporting its culture abroad may be the hardest (2/n)

www.economist.com/briefing/202...

There's just a lot happening with chips these days! Some time back it would have seemed wild that the US government could become the single largest shareholder of Intel. But here we are. This week's @economist.com

tries to make sense of it. (1/n)

#semiconductors #tsmc #intel

Here is a podcast on the company on @economist.com www.economist.com/podcasts/202...

Thanks to @birdyword.bsky.social @ethanywu.bsky.social Chris Miller and Jon Y

TSMC is still coming to terms with all the attention and its role as a centre point of tech wars (3/n)

25.07.2025 08:27 — 👍 0 🔁 0 💬 1 📌 0The T in TSMC is a big part of its culture. While a lot of focus of governments in onshoring chip manufacturing has been on subsidies and incentives, there has been less appreciation of how much process, talent and culture matter in leading-edge chip manufacturing. (2/n)

25.07.2025 08:27 — 👍 0 🔁 0 💬 1 📌 0Last week I was in Taiwan as part of a profile on TSMC (coming soon!), a company now worth over $1trn. As an ex-chip designer, it was like a pilgrimage, visiting a country where "CoWoS" is not something only geeks know about. A few thoughts (1/n).

25.07.2025 08:27 — 👍 1 🔁 0 💬 1 📌 0

Between 2017–2024, just 5% of Indian VC funding went to deep tech.

By contrast, Chinese startups poured billions into AI, EVs, and semiconductors in one year alone.

Universities fare little better.

India ranks 3rd in publication volume, but no Indian university ranks in the global top 100 for science.

Academic research rarely turns into marketable innovation.

India’s firms are reluctant to invest.

Even its most profitable companies spend just 0.3% of sales on R&D.

In the US, that figure is 8.8%. In China, 2.1%.

R&D spending tells the story:

🔴 India: 0.7% of GDP

🔴 China: 2.4%

🔴 US: 3.6%

Among the world’s 2,000 biggest R&D spenders, only 15 are Indian.

In 2024, India attracted just $1.2bn in private AI investment.

The US got $109bn.

Austria and Sweden each got more than India.

Not one Indian AI model ranks among the global top 200.

India is a digital powerhouse—but not yet a technological one.

It leads the world in app downloads, digital payments, and ChatGPT usage.

But when it comes to building foundational tech, it lags far behind.

A thread based on two pieces in this week's

@economist.com

Interesting stat from JP Morgan. Cost of making an iPhone in India is only 2% more than in China.Most of the value is in individual components that are made by other firms (chips, display) the labour intensive assembly is at par. The harder part is recreating Apple's China supply chain in India.

14.05.2025 11:03 — 👍 2 🔁 0 💬 0 📌 0

Finally pharma is just 10% of total U.S. healthcare spending. Hospital care and services make up nearly half.

www.economist.com/business/202...

🏭 Even if drugs are made in the U.S., the patents and profits often sit abroad for tax reasons. And that is a big part of price in a branded drug (4/n)

14.05.2025 05:57 — 👍 0 🔁 0 💬 1 📌 0📉 Linking U.S. drug prices to those in other countries (the “Most Favoured Nation” idea) won’t lower prices much for Americans. Companies might just raise prices elsewhere or stop selling in some markets (3/n)

14.05.2025 05:57 — 👍 0 🔁 0 💬 1 📌 0💊 Generic drugs are make up 90% of prescriptions in the U.S. and they are cheaper than in other rich countries (2/n)

14.05.2025 05:57 — 👍 1 🔁 0 💬 1 📌 0

President Trump's latest order wants to set drug prices based on other countries. Seems a good idea, But In this week's @economist.com I argue that the fix proposed by Trump will not work. And it will probably leave patients worse off. (1/n)

14.05.2025 05:57 — 👍 3 🔁 0 💬 1 📌 0

Read the full story here: www.economist.com/business/202...

07.05.2025 08:41 — 👍 0 🔁 1 💬 0 📌 0👉 U.S. enforcement is stretched: one officer covers all of South-East Asia

👉 Ideas like a “kill switch” are really bad

👉 I am sympathetic to Nvidia's view that these controls are not the right way to beat China, innovation is.

👉 Chinese firms lease restricted chips through offshore data centres, especially in Malaysia

👉 Singapore, with few actual chip end-users, is now Nvidia’s second-biggest market

👉 Smugglers route chips via third countries using doctored paperwork and front companies