🇺🇸 USA-börserna lockar igen, menar @aktierobban.bsky.social.

Mer i dagens Börsmorgon där vi också pratar räntebesked med Annika Winsth och @susannespector.bsky.social

#finanssky

Hela programmet:

PODD

podcasts.apple.com/se/podcast/e...

TV

di.se/ditv/borsmor...

20.03.2025 11:09 — 👍 4 🔁 2 💬 0 📌 0

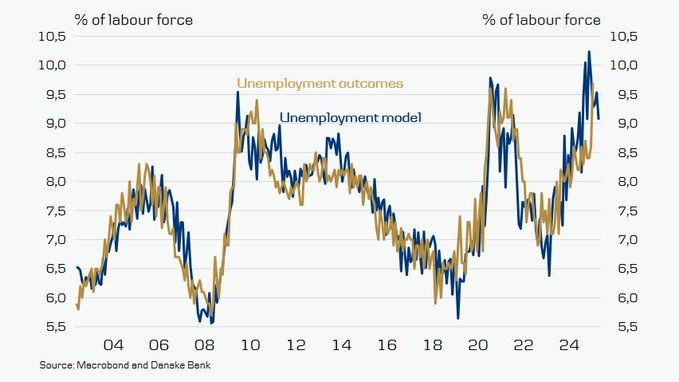

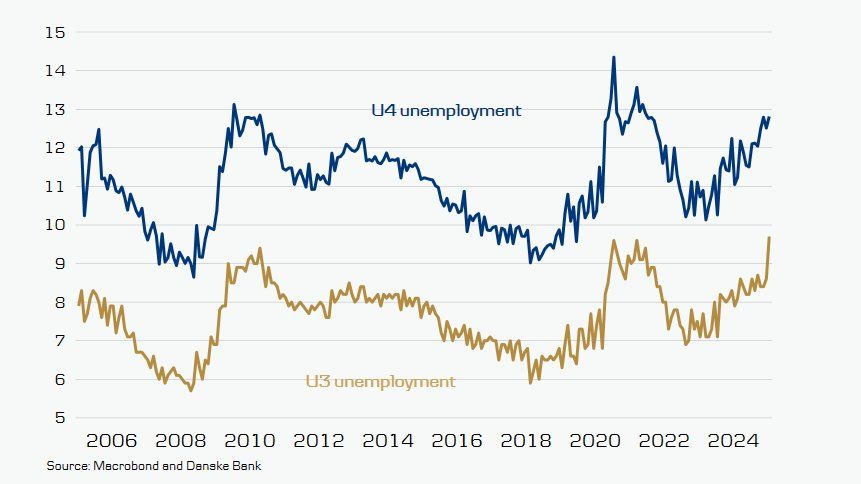

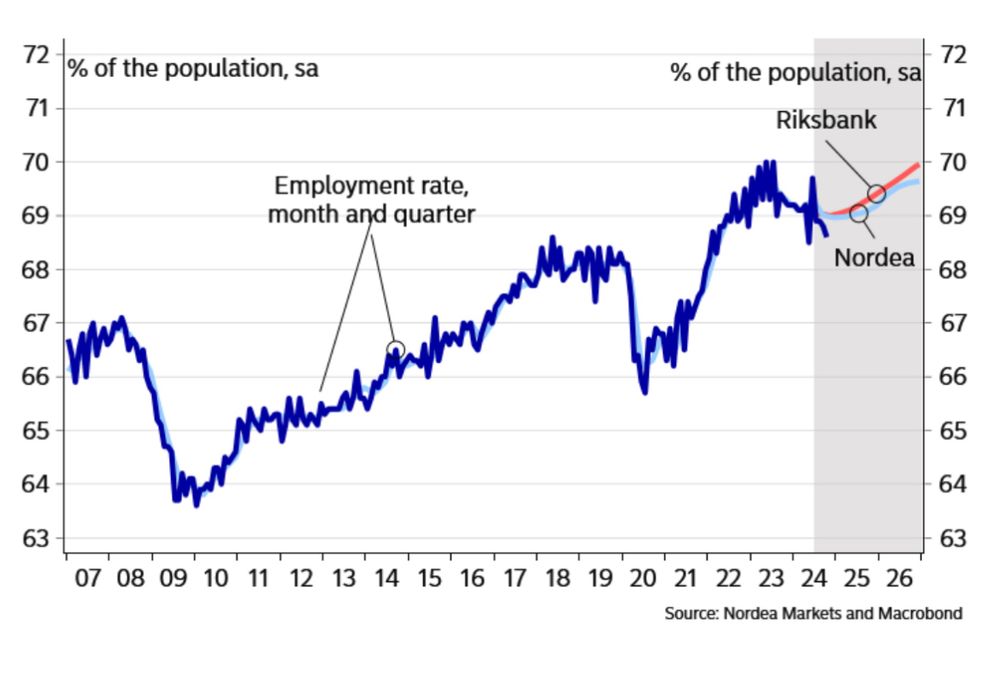

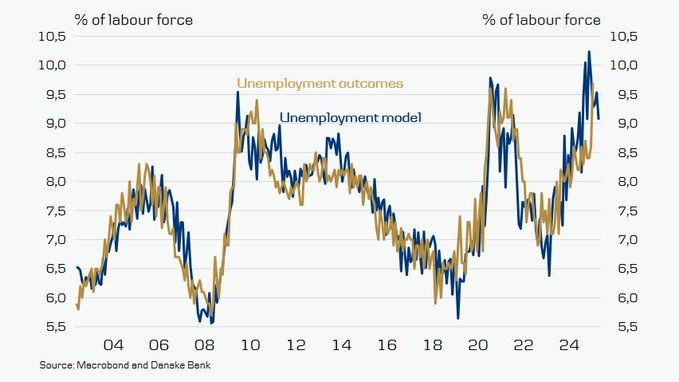

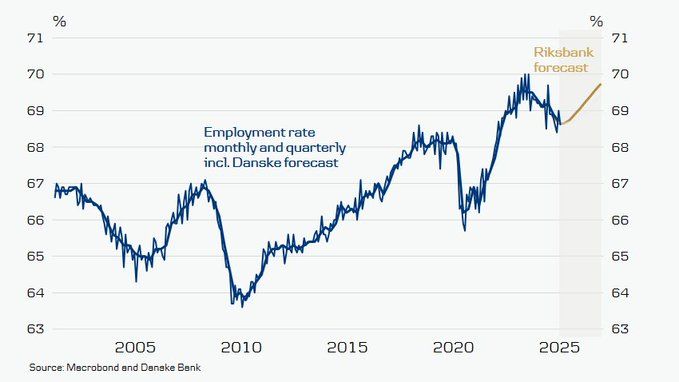

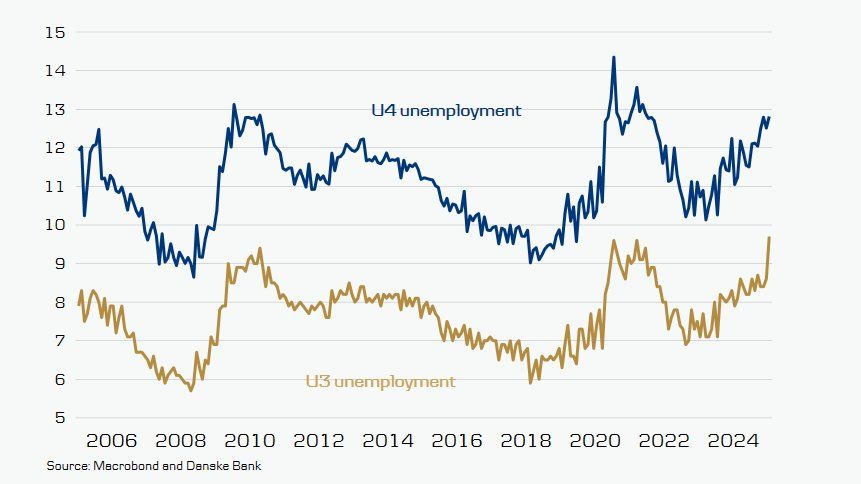

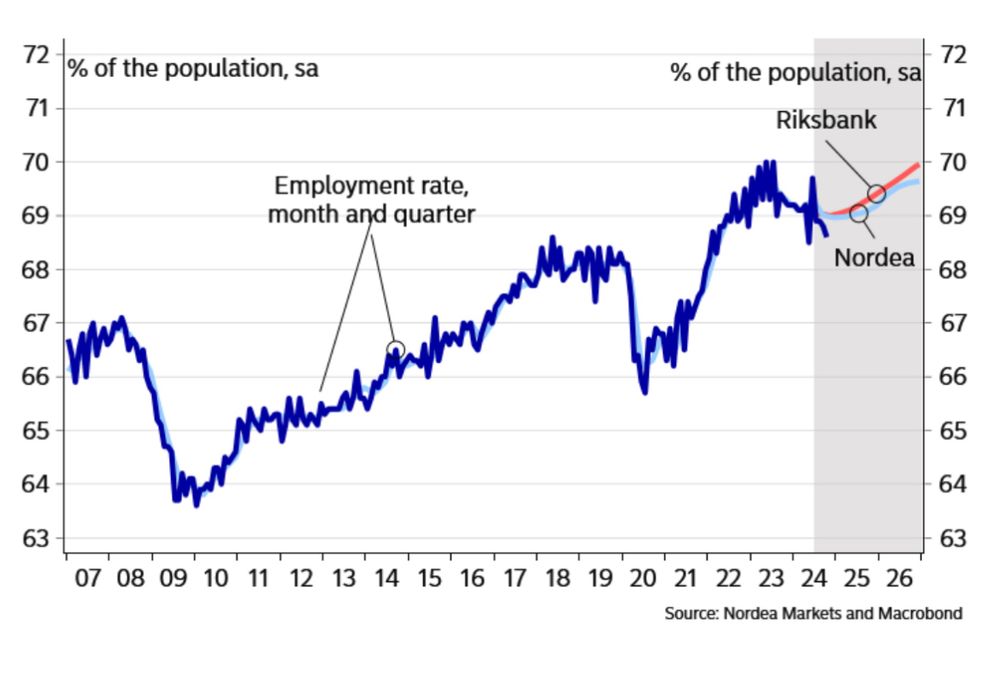

Overall takeaway is that the outcome should worry the Riksbank and is a clear indication that the labour market is weak.

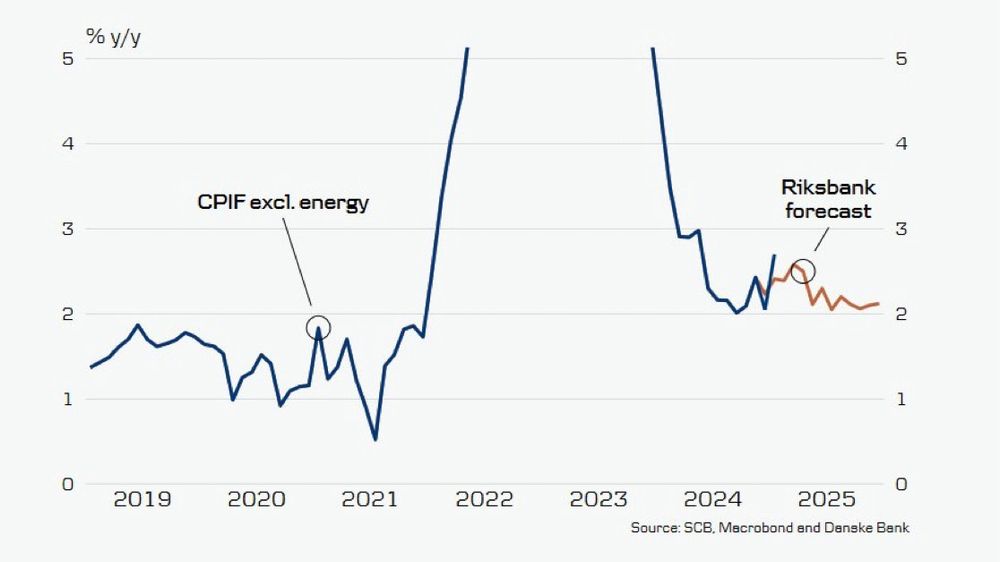

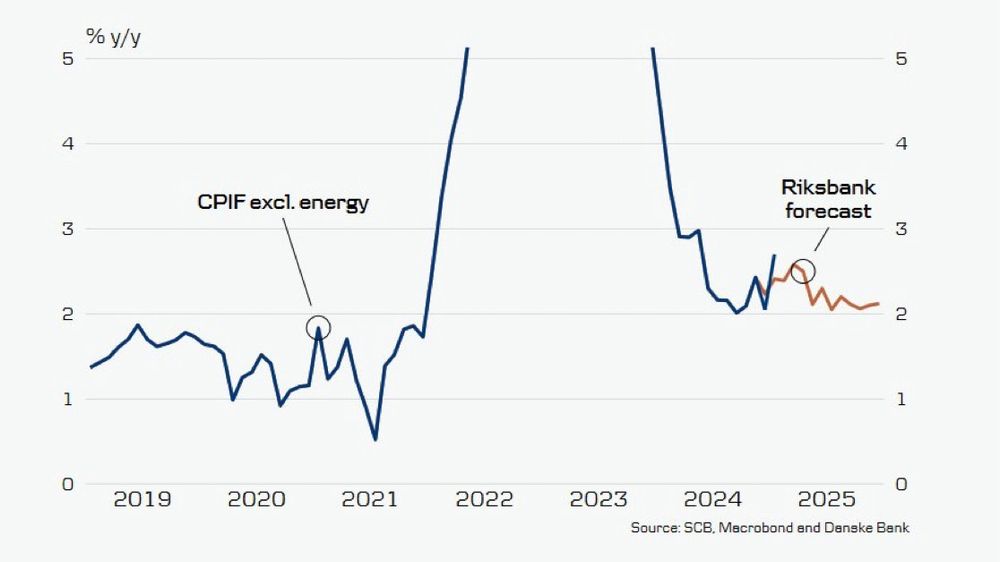

Inflation numbers out tomorrow will be more important, but it is clear that the Swedish economy needs more rate cuts.

17.02.2025 13:16 — 👍 2 🔁 0 💬 0 📌 0

The uptick in unemployment was unusually large and there is nothing that would warrant that kind of jump in January.

However, unemployment was likely underestimated in the fall due to many discouraged workers who now returned and the outcome in January was well in line with other indicators.

17.02.2025 13:16 — 👍 1 🔁 0 💬 1 📌 0

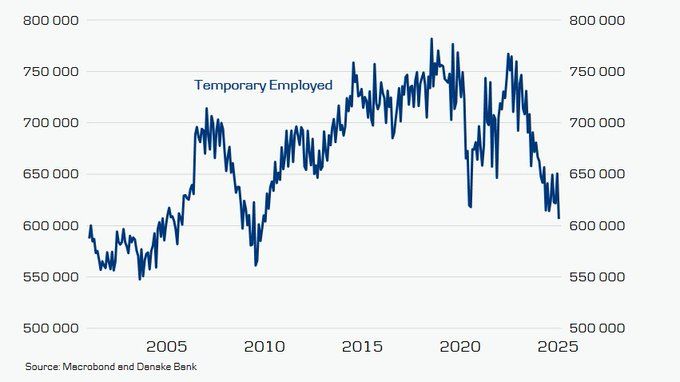

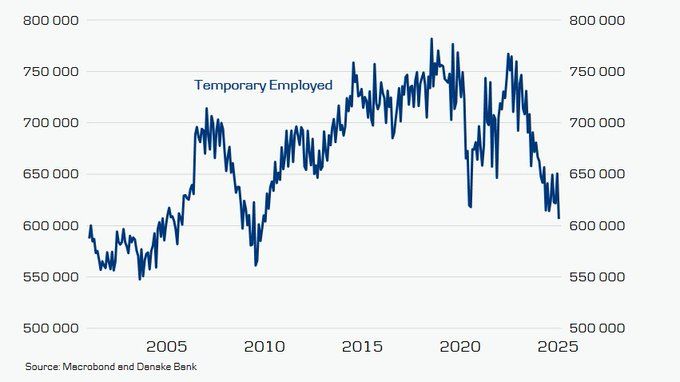

However, another worrying sign was that the number of temporary employed fell back in January.

17.02.2025 13:16 — 👍 0 🔁 0 💬 1 📌 0

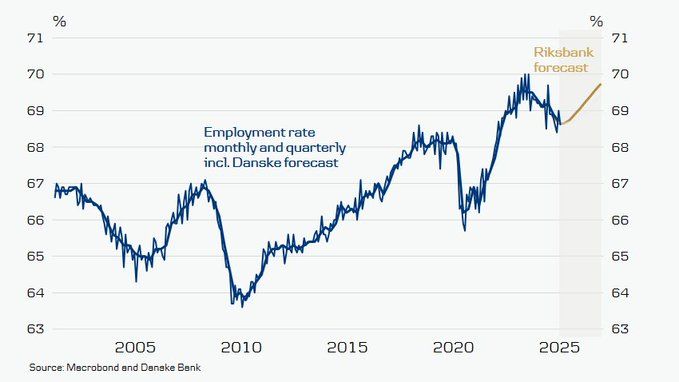

Not much drama in the employment numbers.

17.02.2025 13:16 — 👍 0 🔁 0 💬 1 📌 0

High unemployment out from Sweden this morning where the LFS unemployment unexpectedly rose to 9.7 percent.

A single month should always be interpreted with caution, but the overall picture is that individuals who exited the labour market during the autumn have now returned.

17.02.2025 13:16 — 👍 10 🔁 2 💬 1 📌 1

Clearly higher than expected inflation out of Sweden this morning. Flash core inflation at 2.7 percent – much higher than consensus and the Riksbank’s view. We will have to wait for the details, but taken at first glance this number puts doubt on further cuts from the Riksbank.

06.02.2025 09:12 — 👍 5 🔁 0 💬 0 📌 0

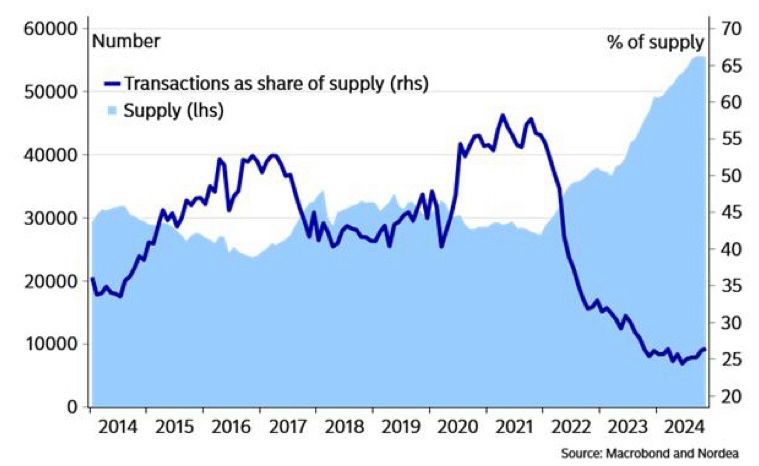

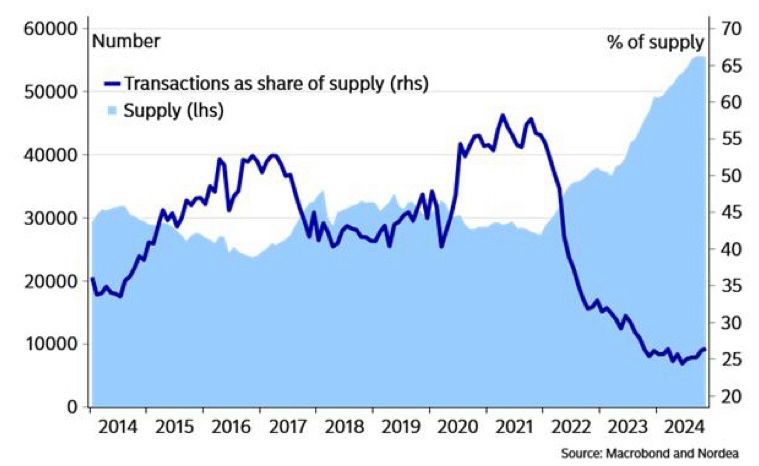

The Swedish housing market is picking up some momentum on the back of rate cuts. Prices are up, as well as transaction volumes. But the share of total supply of homes on the market that are sold are still low, which makes the upturn a bit shaky.

06.12.2024 11:55 — 👍 4 🔁 0 💬 0 📌 0

Revisiting a bad Beveridge curve take

And offering some hopefully better ones with medium confidence

Really interesting piece from @kevinrinz.bsky.social trying to reconcile the various (and to some degree conflicting) signals being sent by quits, openings and hires right now. #EconSky

kevinrinz.substack.com/p/revisiting...

21.11.2024 16:05 — 👍 28 🔁 8 💬 1 📌 2

Best two Econ books that are both fun to read and give you new insights, and that I recommend to all are:

1. Yellen: The Trailblazing Economist Who Navigated an Era of Upheaval by Jon Hilsenrath

2. Trillion Dollar Triage by @nicktimiraos.bsky.social

03.12.2024 05:56 — 👍 1 🔁 0 💬 0 📌 0

YouTube video by Sveriges riksbank

Frukostseminarium om neutral ränta med vice riksbankschef Anna Seim

The Riksbank’s new assessment of the nominal neutral rate is an interval between 1.5 to 3 percent.

Full seminar (in Swedish): m.youtube.com/watch?v=5dn2...

26.11.2024 07:58 — 👍 3 🔁 0 💬 0 📌 0

Since when did Black Friday last like a month? Tell me you have no pricing power anymore without...

25.11.2024 22:49 — 👍 20 🔁 2 💬 6 📌 0

Very interesting, thanks!

25.11.2024 14:48 — 👍 1 🔁 0 💬 0 📌 0

I agree and it’s a bit at odds with the Beveridge curve framework as well where you have new vacancies and the unemployment rate at the same time but if you do a very simple optimal lead/lag you seem to end up with the six month lead for the macro variables.

25.11.2024 12:41 — 👍 1 🔁 0 💬 1 📌 0

Yes, the unemployment rate and the employment growth, the variables that most people care about. In a strict sense, new vacancies are of course a big part of the labor market so that was perhaps a bit unclear.

25.11.2024 12:25 — 👍 1 🔁 0 💬 1 📌 0

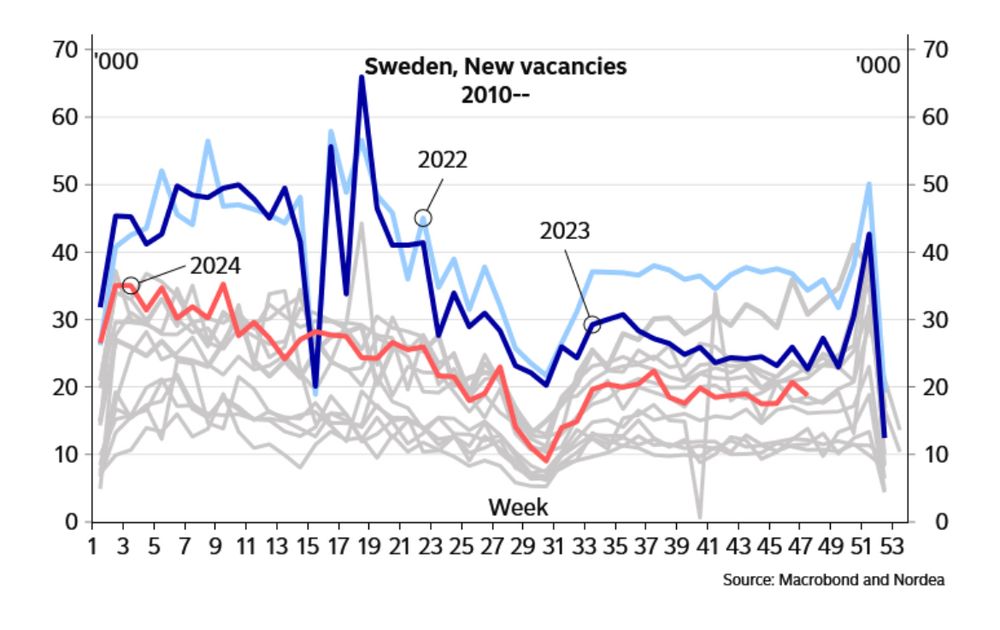

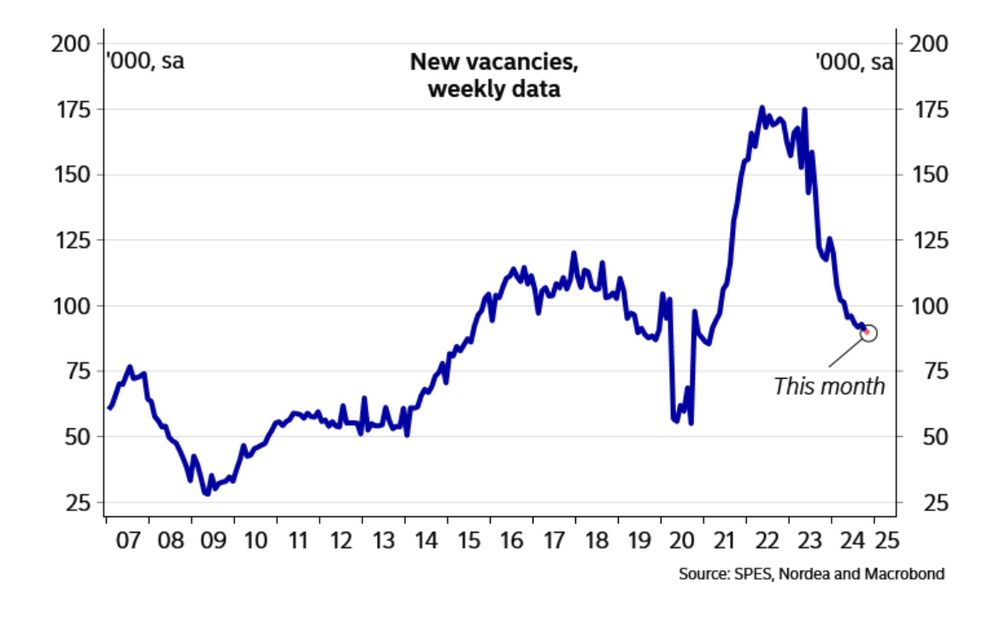

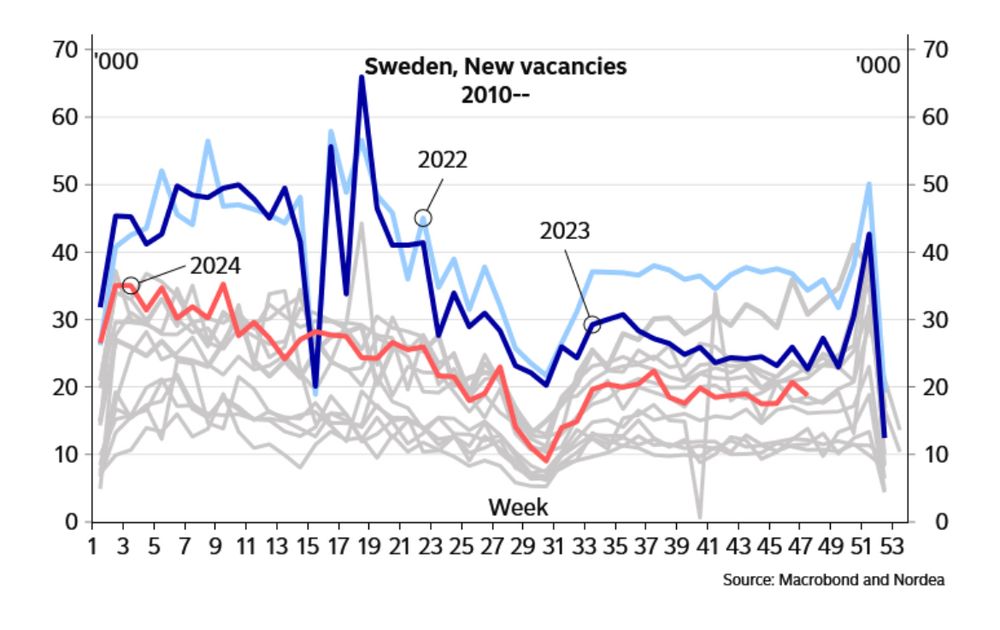

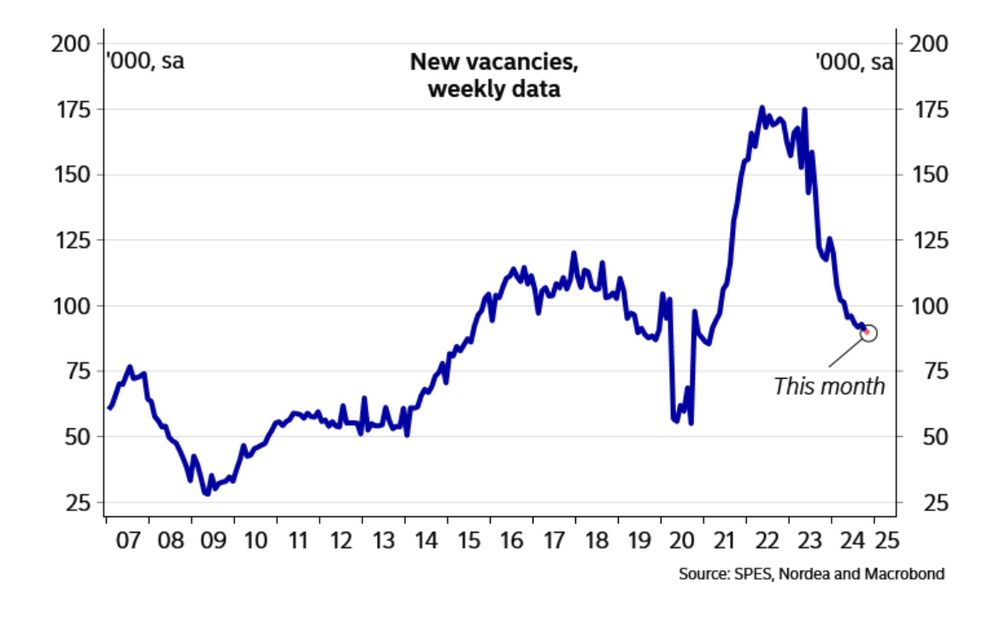

New vacancies typically lead

the labor market by 6 months. The fact that we do not yet see a clear turnaround in demand for labor suggests that forecasts of recovery early next year may be too optimistic.

25.11.2024 11:52 — 👍 2 🔁 0 💬 1 📌 0

👋

22.11.2024 18:18 — 👍 1 🔁 0 💬 0 📌 0

Despite the fact that the Riksbank has cut interest rates by 125 basis points this year, there are no signs that demand for labor is about to gear up.

The weekly statistics so far in November show that new job vacancies remain subdued.

18.11.2024 12:11 — 👍 1 🔁 0 💬 0 📌 0

The Swedish labor market continued to weaken in October.

▫️Employment declined by 0.2% and the employment rate fell further

▫️ The unemployment rate also declined to 8.4% due to a drop in the labor force by 0.5% over the month

▫️ Weaker than forecast and underscores the risks to the expected recovery

15.11.2024 10:46 — 👍 1 🔁 0 💬 0 📌 0

Avdankad ekonomijournalist

Programledare & redaktör EFN | Endast mina privata tankar, inget ska ses som råd

#finanstwitter

@efntv.bsky.social

efn.se

Endast här för #finanstwitter. 😉

Lever på knäckebröd samt min avkastning.

Må portföljen växa exceptionellt!

Kan få för mig att skriva om prisstatistik.

Jobbar med omvärldsanalys o nyheter o så | Ena halvan av podcasten Marknaden

Co-founder and head of Kunskapsverket. Economist, optimist, curious.

Pratar gärna aktier och investeringar, diskuterar också gärna vår omvärld. Välkommen hit !

Aktieanalytiker som följer Hälsovårdssektorn. Jobbat på medtechbolag och gått i skolan (ekonom, doktorererat i kemi, kurser på KI etc).

Grundare av Murgata Equity Research.

https://www.youtube.com/@MurgataER?sub_confirmation=1

Jurist & ekonom | Boktips & aktiemarknadsrätt

LL.M. ’26 at Cornell Law School

PhD in Political Science • Assistant Professor, University College Dublin @ucdpolitics.bsky.social • Climate Change, Conflict, Migration, Computational Social Science • Researcher with @peacerep.bsky.social • https://www.elisadamico.net/

Analyserar bostadspolitik och bostadsmarknad, vilket lär avspeglas i inlägg. Känner mig dock inte begränsad av det utan kommer min vana trogen att oombedd leverera åsikter om både det ena o det andra. Åsikterna är mina, ingen annans. Självskattat liberal.

Money and politics, monetary integration in the EU, with a focus on France and Italy, at the SWP think tank in Berlin.

PhD in economics, College of Europe (Natolin) Alumnus

Views expressed are my own

Passionate about human rights, liberal democracy, freedom of press & freedom of speech. Pro-EU. Oslo, Norway/Noreg

Economist at the Swedish Institute for Social Research. www.annasandberg.nu

The real jbouie. Columnist for the New York Times Opinion section. Co-host of the Unclear and Present Danger podcast. b-boy-bouiebaisse on TikTok. jbouienyt on Twitch. National program director of the CHUM Group.

Send me your mutual aid requests.

Politisk kommentator i Expressen sedan 2019. Before that most other things.