While $SPX / $SPY closed down 5 of 6 days heading into today, it never closed in the bottom third of its intraday range. Always some optimism into the close. That may change today. Not looking strong so far...

05.02.2026 20:26 — 👍 2 🔁 0 💬 0 📌 0

Jan $VIX futures / options expiring Wed morning. Action could be interesting there over the next 24hrs.

20.01.2026 13:56 — 👍 1 🔁 0 💬 0 📌 0

Final reminder that the Quantifiable Edges Black Friday -> Cyber Monday sale ends in a few hours. Last chance to save until next Thanksgiving! quantifiableedges.com/subscribers/...

01.12.2025 21:16 — 👍 2 🔁 0 💬 0 📌 0

The Quantifiable Edges 2025 Black Friday sale was extended through Monday. Save on subscriptions and courses at the only sale of the year: quantifiableedges.com/subscribers/...

01.12.2025 00:09 — 👍 0 🔁 0 💬 0 📌 0

$SPX trying hard to close over 6840.20 and finish the month positive. Let's see...

28.11.2025 15:48 — 👍 1 🔁 0 💬 0 📌 0

Quantifiable Edges Black Friday sale is live: quantifiableedges.com/subscribers/... It's the only sale we've had since last Black Friday...so don't miss out!

28.11.2025 13:46 — 👍 0 🔁 0 💬 0 📌 0

If Mon & Tues close higher does that kill the Wed-Fri Thanksgiving bullish edge? Nope. I'll be discussing this study and more in tonight's letter. Also...Black Friday sale coming later this week so it might be a good time to take a free trial: quantifiableedges.com/subscribers/... $SPY $SPX

25.11.2025 20:22 — 👍 3 🔁 1 💬 0 📌 1

Yesterday I posted Thanksgiving week stats.Wed-Fri both have bullish tendencies. This is NOT a secret. In fact, it is an edge that is often front-run on Tuesday afternoon...I say this because 9 of last 10 Thanksgiving-week Tuesdays saw $SPY close in the top 1/2 of its intraday range. $SPX $STUDY

25.11.2025 14:43 — 👍 4 🔁 0 💬 0 📌 0

An updated look at Thanksgiving week stats: quantifiableedges.com/an-updated-l... $SPX $SPY $STUDY

24.11.2025 14:37 — 👍 3 🔁 0 💬 0 📌 0

Previous research of mine has shown 1) Friday is the least likely day of the week to see a bounce from an intermediate-term low, BUT 2) If $SPX does bounce, Friday is the most likely day to see short-term follow-through. $SPY

20.11.2025 20:47 — 👍 3 🔁 0 💬 0 📌 0

If the market closed right now, the Quantifiable Edges Capitulative Breadth Indicator (CBI) would finish at 7. Perking up, but not yet at the 10+ level I look for as a strong indication of a bounce. Lots of CBI research here: quantifiableedges.com/category/cbi/ $SPX $SPY #CBI

20.11.2025 19:08 — 👍 2 🔁 1 💬 0 📌 1

Podcast

"The Algorithmic Advantage" is the podcast and research newsletter of Algo Advantage. Check us out on YouTube!

Looking forward to joining Simon on the Algo Advantage podcast www.algoadvantage.io/podcast/ in the next week or so! Let @algo_advantage know if there is anything you want to hear us talk about.

14.11.2025 17:50 — 👍 2 🔁 0 💬 0 📌 0

Despite spike in $VIX the Nov-Dec futures are still slightly in contango. And rest of term structure looks orderly. Selloff not creating panic yet.

13.11.2025 20:45 — 👍 6 🔁 1 💬 0 📌 0

$NYSE volume is very light today. That is normal on days the stock market is open an the bond market is closed (Veteran's Day, Columbus Day). Don't make the mistake of reading into the low volume and thinking it is an indication of something more.

11.11.2025 18:29 — 👍 6 🔁 0 💬 0 📌 0

This is the 3rd day in a row that we are seeing $VIX and $VX futures rise along with $SPX. Unusual action.

23.09.2025 14:16 — 👍 4 🔁 0 💬 0 📌 0

A bunch of Fed Day studies to help you prep for tomorrow... quantifiableedges.com/category/fed...

16.09.2025 19:24 — 👍 2 🔁 0 💬 0 📌 0

Since the 9/11/2001 attacks and tragedy, September 11th has been a very strong day for the market. See study below, which will be included in tonight's subscriber letter. $SPX $SPY

11.09.2025 01:46 — 👍 9 🔁 0 💬 0 📌 1

The Reversal Tendency of Labor Day Week: quantifiableedges.com/the-reversal... $SPX $SPY $QUANT $STUDY #seasonality

01.09.2025 14:56 — 👍 5 🔁 0 💬 0 📌 0

First trading day of the month has generally been strong…except August. | Quantifiable Edges

First trading day of the month has generally been strong...except August: quantifiableedges.com/first-tradin... $SPX $SPY #seasonality $QUANT $STUDY

31.07.2025 19:38 — 👍 0 🔁 0 💬 0 📌 0

$SPX 21-day realized vol closing at lowest level (6.24) since July 2024. $VIX may seem low at 15, but it is almost 9 points above realized. Opportunities for real vol this week with earnings, $FED and jobs report. But if realized stays low through this, $VIX could be a good bit lower next week.

28.07.2025 20:01 — 👍 1 🔁 0 💬 0 📌 0

Also notable is that the edge basically plays out between Tues close and Wed announcement... quantifiableedges.com/why-waiting-... $SPX $SPY

28.07.2025 00:52 — 👍 1 🔁 0 💬 0 📌 0

$FED Day coming Wednesday. A few notes about Wed odds for you to prep as we approach... edge has been stronger with selling ahead of announcement. 3 examples: quantifiableedges.com/action-mon-t... and quantifiableedges.com/why-a-new-hi... and quantifiableedges.com/strong-selli...

28.07.2025 00:52 — 👍 1 🔁 0 💬 1 📌 1

I really liked this recent paper, by Tom Carlson. It presents a interesting approach to a Defense First strategy. papers.ssrn.com/sol3/papers.... $QUANT $STUDY

16.07.2025 12:59 — 👍 2 🔁 0 💬 0 📌 0

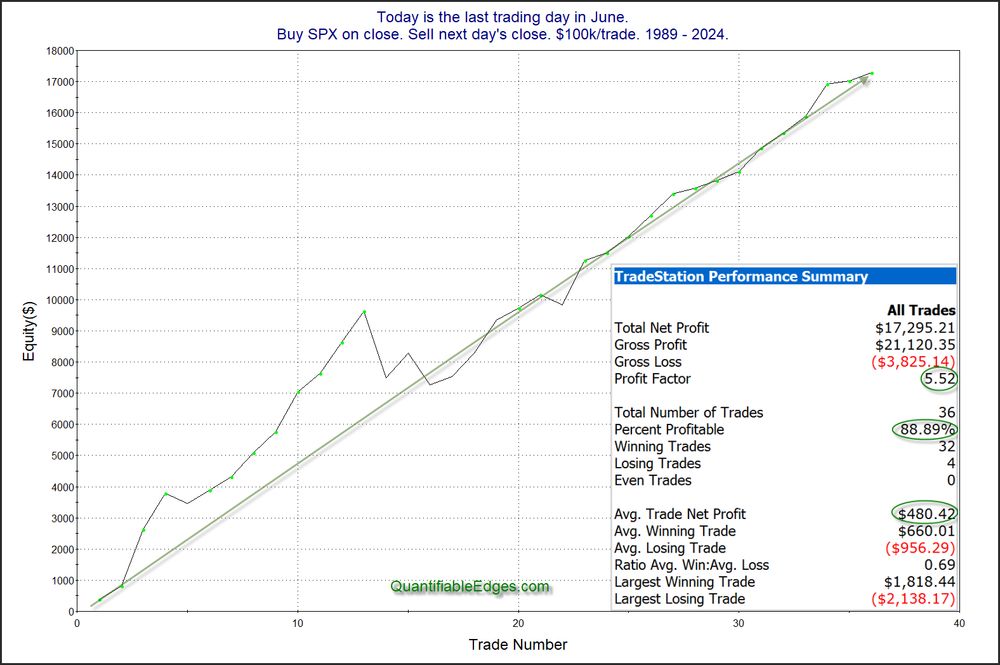

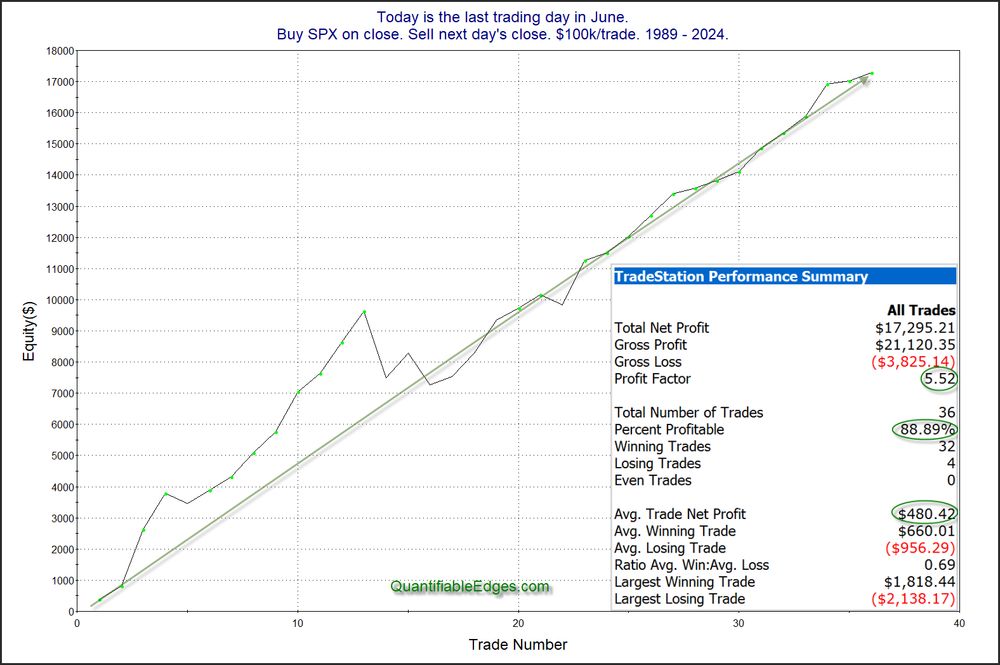

July has historically seen the best 1st day of any month. Performance from 1989 - 2024 can be seen in the attached chart. Note the last 14 years in a row have closed higher!

01.07.2025 12:30 — 👍 2 🔁 1 💬 1 📌 0

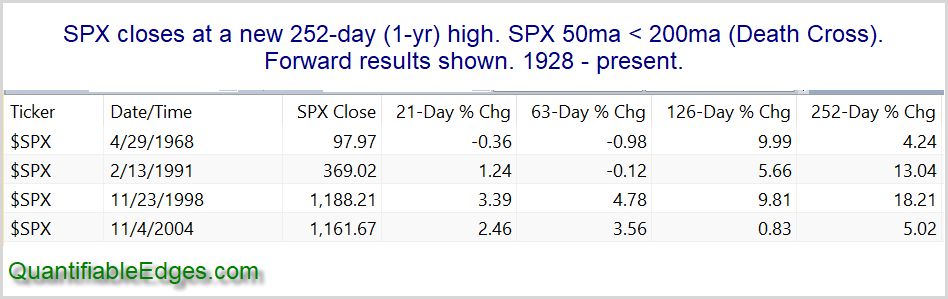

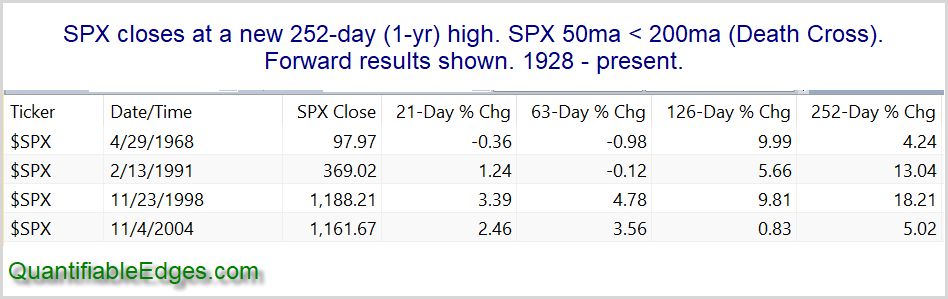

$SPX is very close to a new all-time high. Interestingly, the 50ma is still below the 200ma (Death Cross formation). It takes a sharp rally to accomplish that. I looked back and found only 4 previous instances where $SPX closed at a new high while Death Cross was still in effect. $SPY $QUANT $STUDY

26.06.2025 15:35 — 👍 2 🔁 1 💬 0 📌 0

One interesting aspect of Monday's action was how large the rally was compared to the recent range. $SPX moved from a 10-day low close on Fri to closing > 10ma. Only 10th time since 1961. Previous 9 showed no short-term edge. (Basically coinflip next few days.) Still interesting to me. $SPY $STUDY

23.06.2025 21:29 — 👍 5 🔁 0 💬 0 📌 0

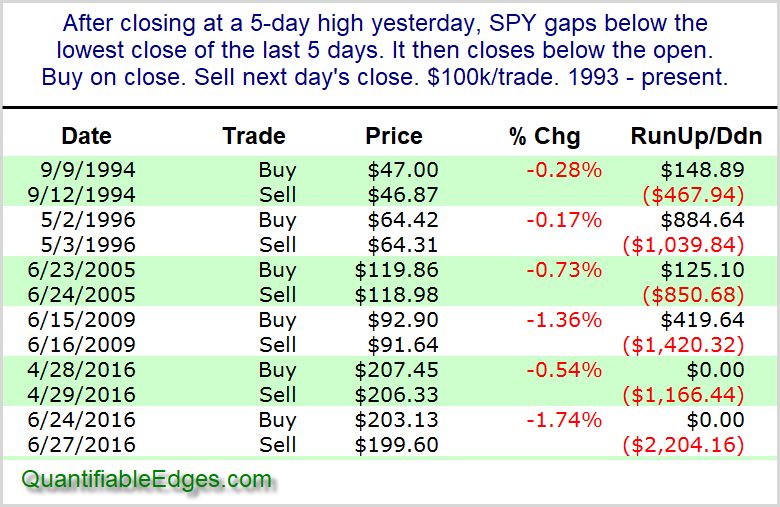

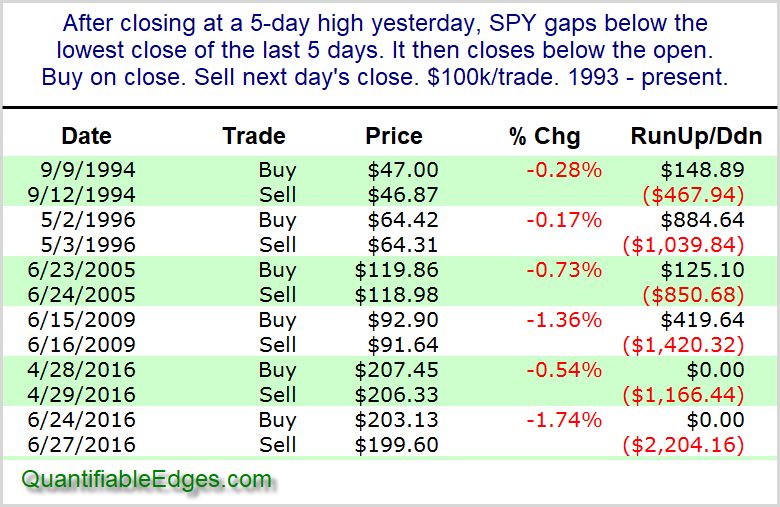

Here's an interesting little study that popped up while I was doing my research this weekend... $SPY $SPX $QUANT $STUDY

15.06.2025 16:06 — 👍 2 🔁 1 💬 1 📌 0

Husband, father, Chief U.S. Economist, @sghmacro, @uoregon economist, Tim Duy's Fed Watch, former columnist for @bopinion

🤓 Your resident market nerd 💙 Author of OptimistiCallie 👉 https://www.optimisticallie.com/subscribe

The Sentimentrader Advantage: Over 20 years of exclusive, data-driven insights and unrivaled market sentiment tools.

Website: sentimentrader.com

X: x.com/sentimentrader

LinkedIn: linkedin.com/company/sentimentrader

YouTube: youtube.com/SentimenTrader

Retired institutional market analyst (1964-2016)

Former: UBS Securities, Asia Ex-Pat, McKinsey, Mayor of Mill Valley, Finance Twitter. Fan of causal relationships, behavioral finance and the Quad Dipsea.

Full time trader and venture capitalist trying to find where all the traders went

I write a daily column for https://pro.thestreet.com/author/helene-meisler on the markets. Worked at Cowen, GS, Cargill. Former Asian Expat: S'pore & Shanghai. Tennis fan. Love to cook.

official Bluesky account (check username👆)

Bugs, feature requests, feedback: support@bsky.app