Together, this suggests weakening competition and an increasing advantage of “superstar” firms.

It was a pleasure working on this project with Sara Calligaris, Chiara Criscuolo, @angrepp.bsky.social, and Olivero Pallanch.

Together, this suggests weakening competition and an increasing advantage of “superstar” firms.

It was a pleasure working on this project with Sara Calligaris, Chiara Criscuolo, @angrepp.bsky.social, and Olivero Pallanch.

📈 Leading business groups are expanding sales across product and country markets.

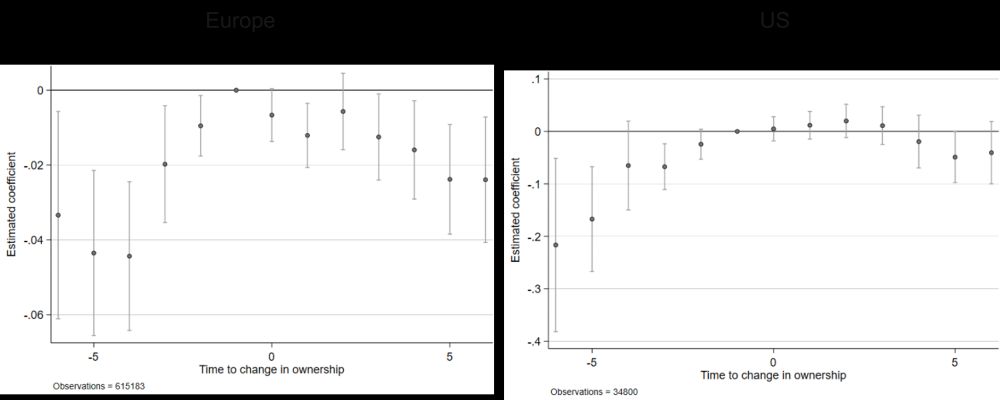

🏢 They use brand acquisitions to consolidate market positions and expand into new markets. But when brands are acquired, their sales seem to weaken compared with non-acquired brands.

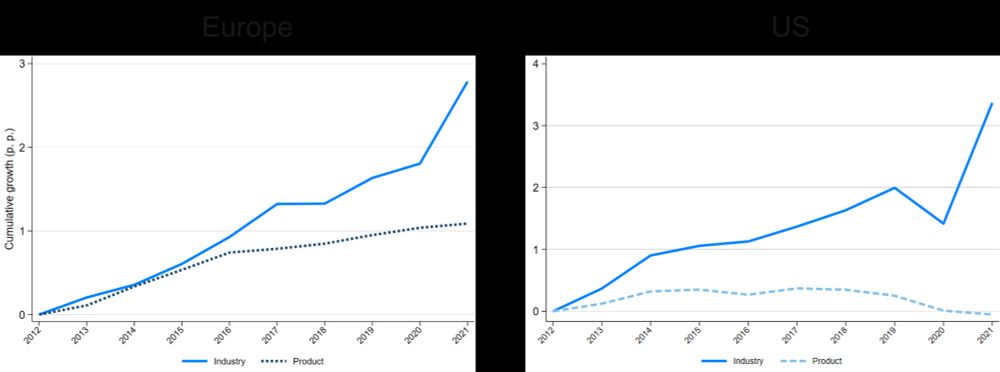

📈 Product concentration is 50% higher than industry concentration.

🌍 Both industry and product concentration have increased in Europe but not in the US, while business dynamism has declined in both.

Recent evidence shows rising concentration and declining business dynamism, suggesting weakening competition. However, these studies use industry-level data. Product markets are more relevant for welfare.

Key findings:

New @oecd-ocde.bsky.social @oecdinnovation.bsky.social paper on product market concentration and business dynamism! 📊

www.oecd.org/en/publicati....

A new way to measure (increasing) market concentration helps understanding of competition dynamics.

By Sara Calligaris, Chiara Criscuolo, @JoshDeLyon.bsky.social @AnGrepp.bsky.social and Oliviero Pallanch

cepr.org/voxeu/colum...

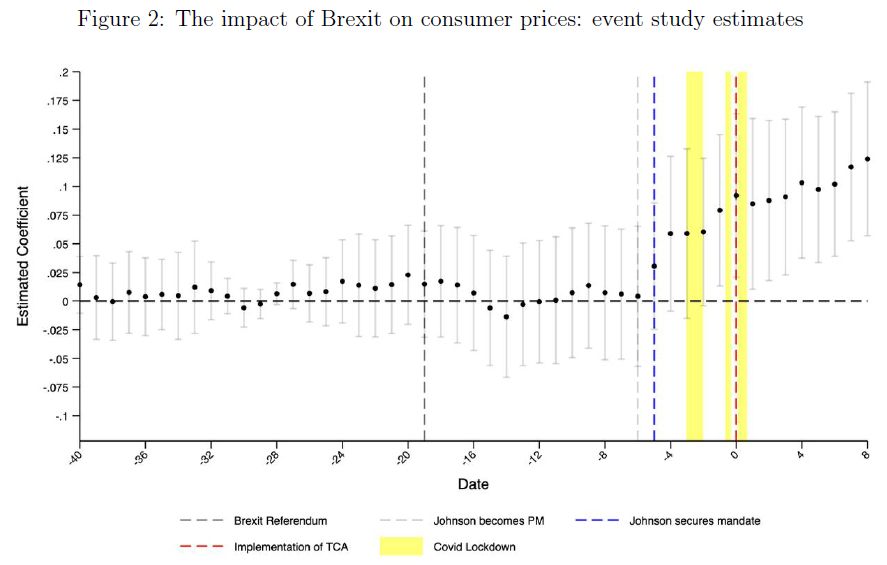

5 years ago today Britain left the EU. Between 2020-2023, Brexit drove up food prices by 4% a year on average.

Research from Jan David Bakker, @joshdelyon.bsky.social , @richarddavies.bsky.social and myself.

You can read the paper here: tinyurl.com/27vjakwa