The latest inflation figures suggest the RBA have little choice but to hike rates. Otherwise, they'd have zero credibility as an inflation targeting central bank.

But it is concerning, particularly because we'd enter this hiking cycle with a softer job market and mediocre economy.

26.11.2025 01:24 — 👍 3 🔁 0 💬 2 📌 0

Australia's unemployment rate dropped to 4.3% in October, from 4.5% a month earlier.

The underemployment rate dropped to 5.7% - one of the lowest results this century.

That left the underutilisation rate at 10%, down from 10.4% in September #ausbiz #auspol

13.11.2025 00:40 — 👍 2 🔁 0 💬 0 📌 0

Australian employment increased 42k in October, which left employment up 160k this year.

That's around half the 325k gain we had over the January to October period last year #ausbiz #auspol

13.11.2025 00:35 — 👍 1 🔁 0 💬 0 📌 0

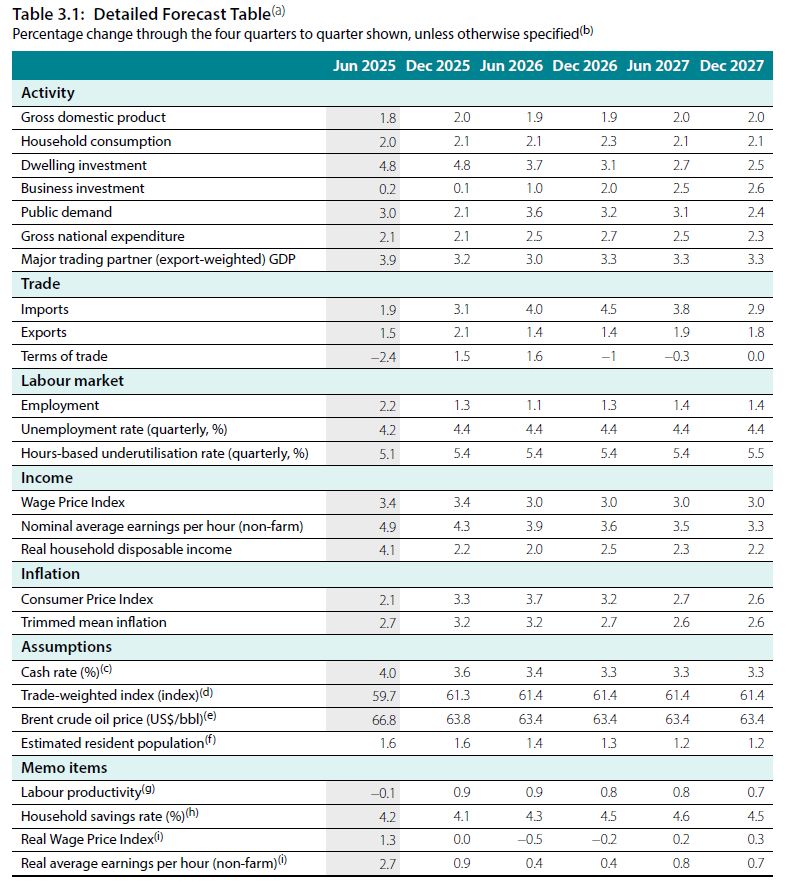

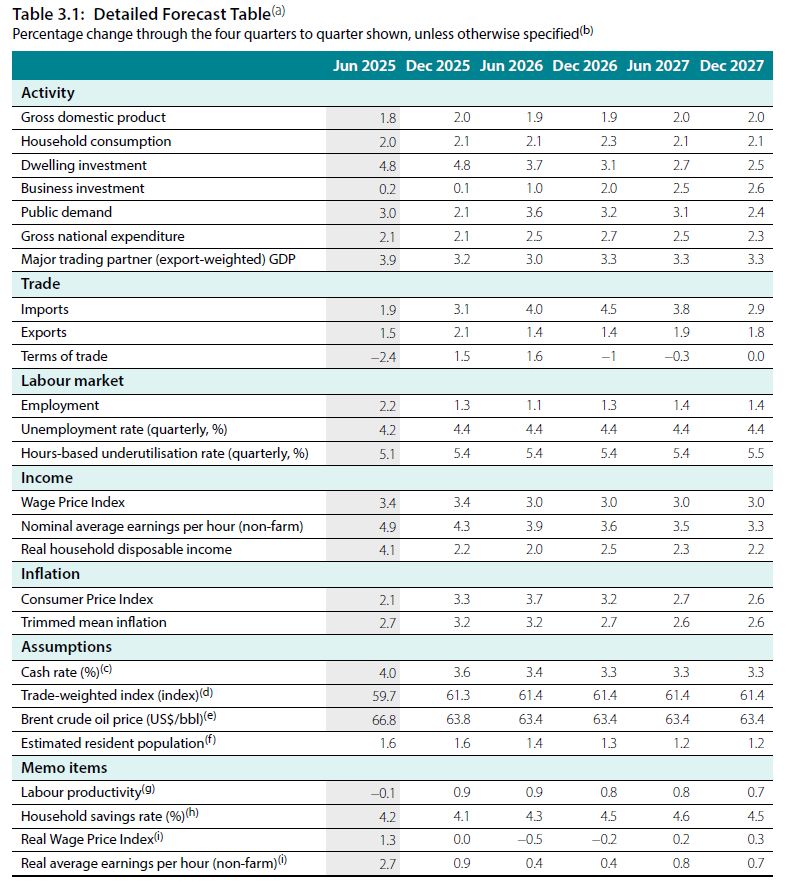

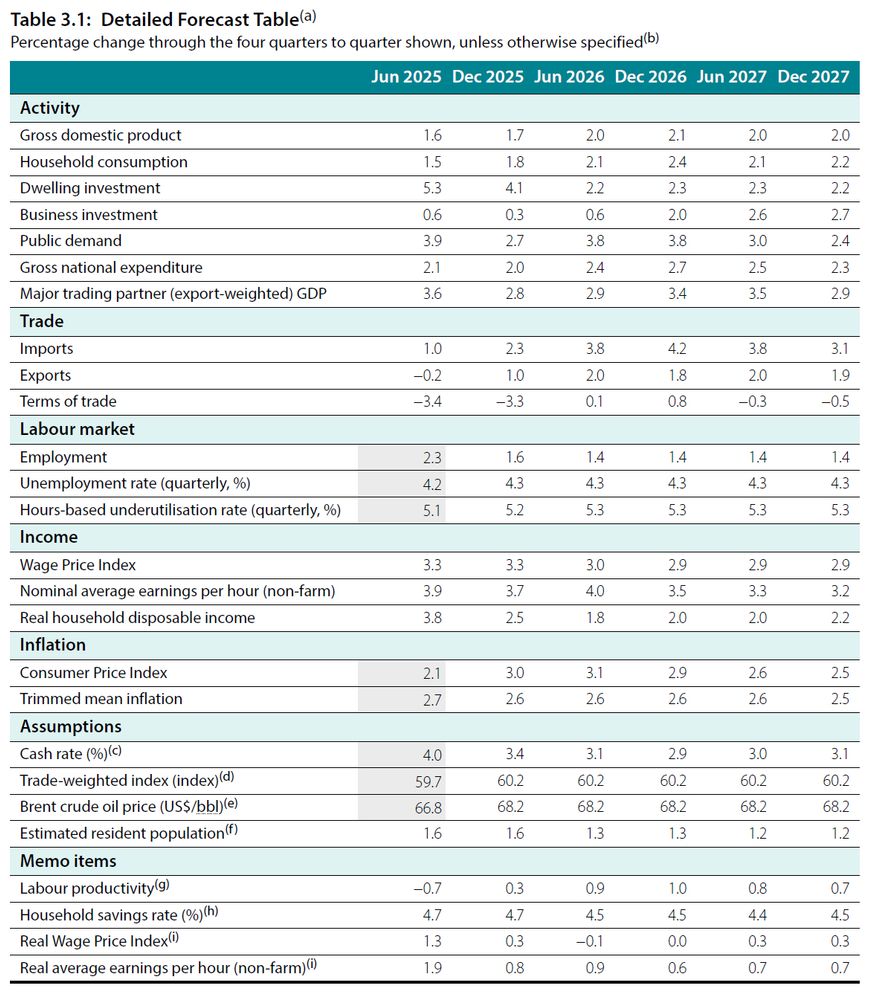

The latest forecasts from the RBA's Statement on Monetary Policy.

Trimmed mean inflation revised higher (3.2% in Dec-25 compared to 2.6% previously).

Unemployment rate revised higher (4.4% in Dec-25 compared to 4.3% previously). This one seems too optimistic to me!

04.11.2025 03:42 — 👍 4 🔁 0 💬 0 📌 0

Australia's unemployment rate jumped to 4.5% in September, up from 4% at the end of last year.

And if you are wondering why it's because employment growth has slowed significantly. Up 116k from January to September this year, compared to 323k over the same period last year #ausbiz #auspol

16.10.2025 00:56 — 👍 4 🔁 3 💬 0 📌 1

Australia's unemployment rate jumped to 4.5% in September and now sits well above the RBA's forecast of 4.3% by year end.

16.10.2025 00:41 — 👍 2 🔁 1 💬 0 📌 0

The RBA would be foolish not to cut rates on Melbourne Cup day.

16.10.2025 00:38 — 👍 3 🔁 1 💬 0 📌 0

The unemployment rate might still be low at 4.2% but the labour market hasn't impressed this year.

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

26.09.2025 01:24 — 👍 4 🔁 6 💬 1 📌 0

The unemployment rate might still be low at 4.2% but the labour market hasn't impressed this year.

Employment is up just 103k this year, compared to +282k over the same period last year.

If that doesn't pick up soon, a spike in the unemployment rate is inevitable #ausbiz #auspol

26.09.2025 01:24 — 👍 4 🔁 6 💬 1 📌 0

In 2025 so far, Australian employment growth has been disappointing.

Through July:

2025: +113k

2024: +246k

2023: +265k

#ausbiz #auspol

14.08.2025 04:38 — 👍 1 🔁 1 💬 0 📌 0

Australia's participation rate was 67% in July and has been hovering around that rate in recent months.

Basically, it means that Australia's workforce is more diverse than it's ever been before in terms of gender, age, ethnicity and disability #ausbiz #auspol

14.08.2025 01:42 — 👍 6 🔁 0 💬 0 📌 1

Australia's unemployment rate dipped to 4.2% in July (from 4.3% in June) #ausbiz #auspol

14.08.2025 01:35 — 👍 1 🔁 0 💬 0 📌 0

Industry wage growth ranges from 5% in the utilities sector down to 2.6% in financial & insurance services. Nationally wages rose 3.4% over the past year, with most industries >3% #ausbiz

13.08.2025 01:41 — 👍 0 🔁 0 💬 0 📌 0

Adjusted for inflation, Australian wages are around 5.8% below their peak.

And based on the latest RBA forecasts - released yesterday - we aren't expecting any further improvement this year or next.

13.08.2025 01:35 — 👍 0 🔁 0 💬 0 📌 0

Australian wages rose by 0.8% in the June quarter and are 3.4% higher than a year ago.

By comparison, consumer prices have increased by 2% over the past year.

13.08.2025 01:35 — 👍 0 🔁 0 💬 1 📌 0

US merchandise imports surged in the March quarter - in anticipation of higher tariffs - and have since fallen sharply.

Interestingly, US merchandise imports are pretty much in line with 2024 levels; fewer imports from China but more from other countries.

12.08.2025 04:55 — 👍 1 🔁 0 💬 0 📌 0

China's merchandise exports to the US have declined, but China has managed to offset that with exports elsewhere.

12.08.2025 04:55 — 👍 1 🔁 0 💬 1 📌 0

According to the RBA's business liaison program, the biggest impediments to productivity growth are the regulatory environment, employee skills & availability and supply chain deficiencies.

And yet the debate is dominated by tweaks to tax policy #auspol

12.08.2025 04:49 — 👍 5 🔁 2 💬 1 📌 0

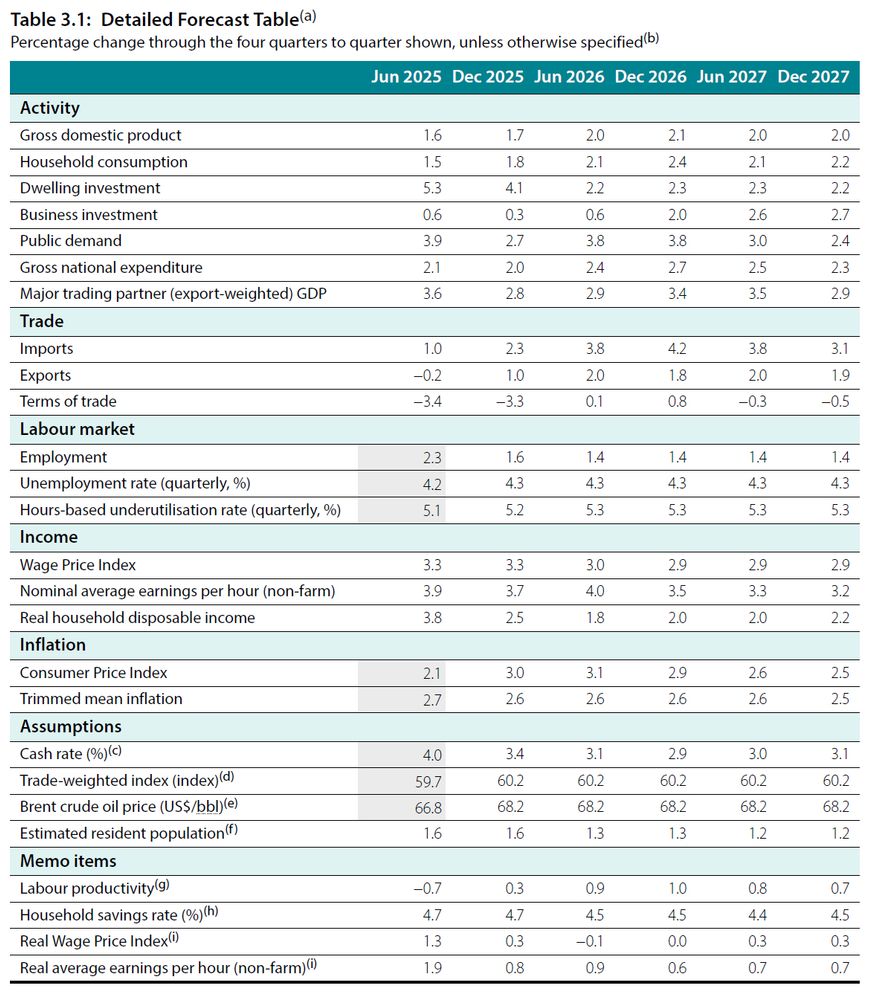

The latest economic forecasts from the RBA:

Unemployment and inflation forecasts unchanged from 3 months ago.

GDP growth 1.7% in Dec 2025 (vs 2.1% previously) and 2.1% in Dec 2026 (vs 2.2%).

Cash rate is assumed to drop to 2.9% in the Dec quarter next year, compared to 3.6% as of today #ausbiz

12.08.2025 04:40 — 👍 6 🔁 4 💬 0 📌 0

They made us wait six weeks, but the RBA finally delivered another rate cut.

The timing ultimately won't impact the economy in a meaningful way, but the failure to cut last month is still one of the weirder RBA decisions I've seen.

Massive comms blunder, hurt their credibility and for what?

12.08.2025 04:36 — 👍 5 🔁 0 💬 0 📌 0

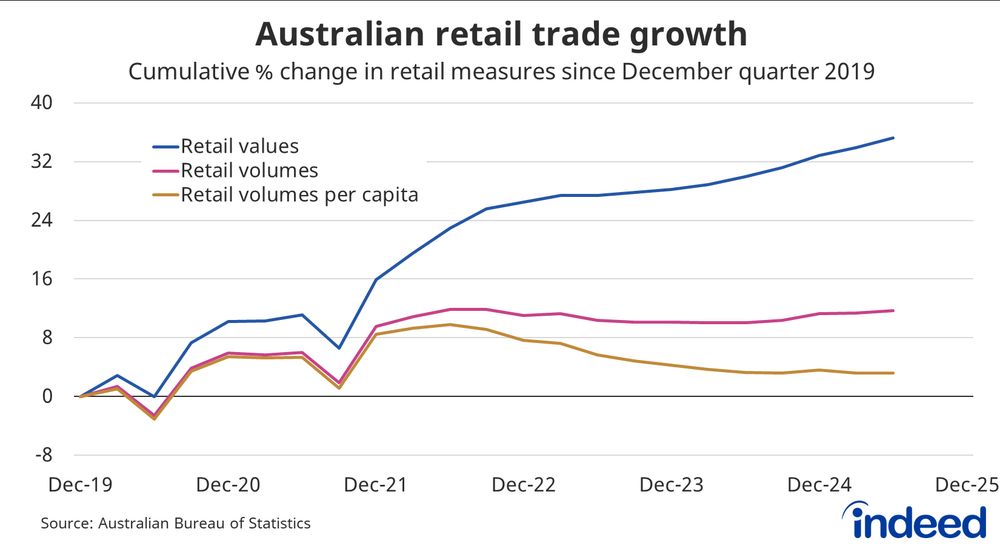

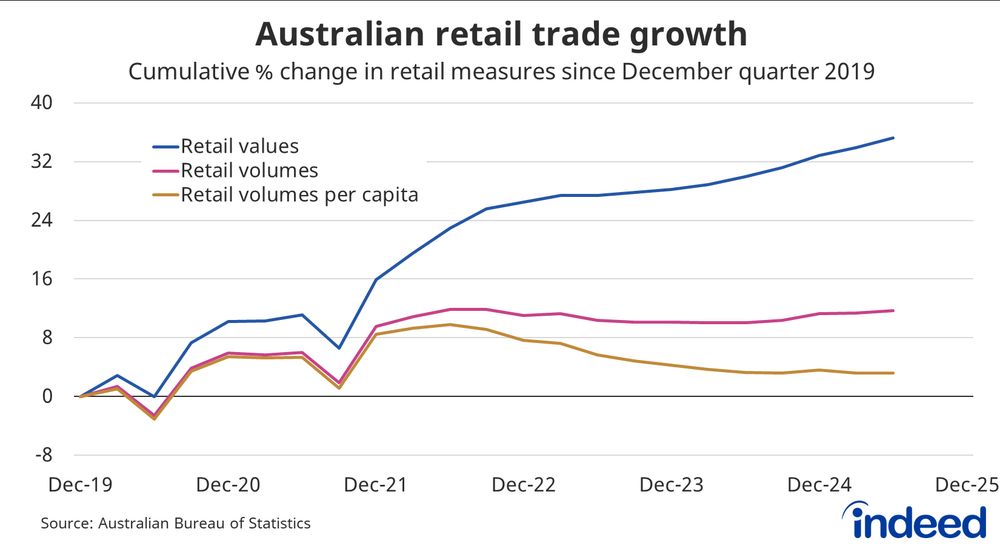

The volumes data accounts for price changes. So the gap between the blue and pink lines highlight the impact of prices.

31.07.2025 02:22 — 👍 0 🔁 0 💬 0 📌 0

Retail spending has increased 35% since the December quarter 2019.

But the volume of goods sold has been broadly unchanged in recent years, due to higher prices.

And volume per capita is almost 6% below its peak.

So we are spending more, but consuming less #ausbiz

31.07.2025 01:51 — 👍 3 🔁 4 💬 1 📌 0

The price of services rose by 3.3% over the past year, compared to a 1.1% rise in the price of goods.

That's a good sign that domestic price pressures have eased.

30.07.2025 01:44 — 👍 0 🔁 0 💬 0 📌 0

One of my favourite inflation graphs!

The RBA has achieved its inflation target over the past decade and they've achieved it by pretty consistently missing the target most years.

Undershooting in the years before the pandemic and then overshooting during the cost-of-living crisis.

30.07.2025 01:40 — 👍 1 🔁 1 💬 0 📌 0

But when you consider the overall economic environment, recent labour market figures, ongoing weakness in GDP and, of course, geopolitical and economic uncertainty, I think it's clear what they should do.

30.07.2025 01:37 — 👍 0 🔁 0 💬 0 📌 0

Trimmed mean inflation - the RBA's preferred inflation measure - has increased by 2.7% over the past year.

The result is slightly stronger than the RBA's forecasts from May, but it should dip towards 2.5% next quarter.

Is that sufficient for the RBA to cut rates? Perhaps not on its own.

30.07.2025 01:37 — 👍 1 🔁 0 💬 2 📌 0

In June:

Unemployment rate: 4.3% (from 4.1% in May)

Underemployment rate: 6.0% (from 5.9%)

Underutilisation rate: 10.3% (from 10%)

#ausbiz #auspol

17.07.2025 01:37 — 👍 3 🔁 4 💬 0 📌 0

Australia's unemployment rate jumped to 4.3% in June - reaching its highest level since November 2021 - which is perhaps a surprise given that most forward-looking measures of labour demand remain healthy #ausbiz #auspol

17.07.2025 01:35 — 👍 3 🔁 0 💬 0 📌 0

It feels like a decision made by an inexperienced governor and an inexperienced board. The RBA lost a tonne of economic talent during the 'reforms' and they may have been valuable when trying to navigate a complex economic environment.

08.07.2025 05:15 — 👍 4 🔁 1 💬 1 📌 0

Just a bizarre decision by the RBA.

They've backed themselves into a corner tying the decision so closely with the quarterly inflation figures. Particularly in an economic environment where backward-looking economic data has rightfully taken a backseat to geopolitical & economic uncertainty.

08.07.2025 05:15 — 👍 18 🔁 7 💬 1 📌 0

Political economy, industry policy, foreign policy, globalisation, debt/housing etc, art, cartoons, fiction, succulents, Australian rules ...

Economist @BYU Econ working on labor and behavioral topics.

Research affiliate at NBER, JPAL, IZA, LEO.

https://sites.google.com/view/olgastoddard

Scribbler and data journalist. https://joshnicholas.com

The guy from The Week on Wednesday podcast who works with unions, boards and other folk to try and make the world a better place.

Canberra bureau chief for The West Australian

Reader in Economics (from August 1) at QBS. Recovering journal editor. Perhaps best known - if at all- for writing about De Lorean? Fan of Bangor FC and low brow cinema.

Personal Account. Director of Economics, The Budget Lab at Yale University. Former Chief Economist, White House Council of Economic Advisers.

Professor of Business and Society at UTS Business School, Sydney, Australia. Writes on business and democracy, economic injustice and dissensus politics. Ops mine!

Journalist 👑 Stuff The British Stole (ABC/CBC) 🧠 Mastermind (SBS) 🎨 Framed (SBS) 🏫 School That Tried To End Racism (ABC) 🥜 NutJobs 🌶 It Burns (Audible)

Audience Editor @australia.theguardian.com. Previously digital editor Quest Newspapers, engagement editor Courier Mail, online news editor 7News Brisbane and more. Social media, journalism, analytics, audience engagement, etc. All the digital news things

Media correspondent at Capital Brief

Treasurer of Australia, Labor MP for Rankin, proudly Logan, QLD born & bred.

Authorised by J. Chalmers, ALP, Logan Central.

Tech reporter, The Australian Financial Review | email: a.mcguire@afr.com.au| COYS

North Asia Correspondent - The Australian Financial Review

Based in Tokyo.

Professional services editor at The Australian Financial Review

Banking reporter @ The Information in NYC

☏/Telegram/WhatsApp/Signal 347 864 0601

Former national correspondent at The Australian Financial Review and roustabout for The Australian newspaper

Columnist at the Australian Financial Review

owner: Aviation Gin - Mint Mobile - Maximum Effort - Wrexham AFC

Bodybuilder. Conan. Terminator. Former Governor. I killed the Predator. I told you I’d be back. Join my positive corner of the internet - Arnold’s Pump Club.