Phenomenal opportunity for macroeconomists of all levels. Truly cannot recommend the Yale Budget Lab team enough. I've worked extremely closely with most of the people there, and their simultaneous dedication to accuracy and usefulness while ensuring the work environment is enjoyable is unmatched.

06.10.2025 14:20 — 👍 32 🔁 6 💬 1 📌 1

Hi all! We're still waiting on the official posting - but @budgetlab.bsky.social is looking for a new macro hire to add to our team! We're agnostic on level (Recent PhD, decades of experience, MA+ research experience, who knows?) - we care more about flexible thinking and curiosity

06.10.2025 14:09 — 👍 16 🔁 4 💬 1 📌 1

Full report here: budgetlab.yale.edu/r...

10/10

27.09.2025 00:05 — 👍 15 🔁 1 💬 0 📌 0

FISCAL EFFECTS: New 2025 tariffs raise $2.5 trillion over 2026-35 conventionally-scored and $2.0 trillion dynamically-scored.

9/10

27.09.2025 00:05 — 👍 9 🔁 0 💬 1 📌 0

COMMODITY PRICE EFFECTS: Consumers face particularly high increases in leather and clothing in the short-run: prices increase 36% for leather products (shoes and hand bags), 34% for apparel, and 21% for textiles.

8/10

27.09.2025 00:04 — 👍 10 🔁 1 💬 1 📌 0

DISTRIBUTIONAL EFFECTS: Tariffs are a regressive tax, especially in the short-run. The average annual cost to households in the first and top income deciles from all 2025 tariffs are $1,350 and $5,350 respectively in 2025$. The median cost is $2,000 per household.

7/10

27.09.2025 00:04 — 👍 10 🔁 1 💬 1 📌 1

GLOBAL EFFECTS: In the long-run, China real GDP is -0.3% smaller, about 3/4 of the effect to the US. The economies of Mexico, Canada, the EU, and the UK are all larger.

6/10

27.09.2025 00:04 — 👍 11 🔁 1 💬 1 📌 0

SECTORAL EFFECTS: In the long-run, tariffs present a trade-off. Total US manufacturing output expands by 2.7%, but advanced manufacturing shrinks by 4.2%. Moreover, the manufacturing gains are more than crowded out by other sectors: eg construction output contracts by 3.7%.

5/10

27.09.2025 00:04 — 👍 13 🔁 0 💬 1 📌 0

ECONOMIC/LABOR MARKET EFFECTS: US real GDP growth is -0.5pp lower over 2025 & -0.4pp lower over 2026. The level of US real GDP is persistently -0.4% smaller in the long-run. By the end of 2025, the unemployment rate is +0.3pp higher & employment is -490K lower.

4/10

27.09.2025 00:04 — 👍 12 🔁 1 💬 1 📌 0

PRICES: The price level rises by 1.7% in the short-run (2-3 yrs) from all 2025 tariffs, assuming the Federal Reserve looks through their price effects. This is the equivalent of a $2,400 average per-household loss of purchasing power in 2025$.

3/10

27.09.2025 00:04 — 👍 86 🔁 34 💬 2 📌 2

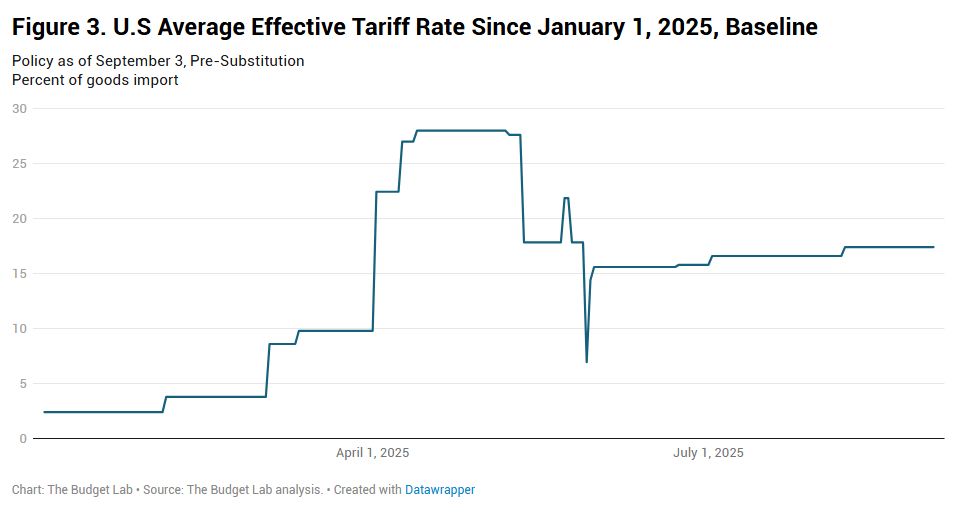

New @budgetlab.bsky.social tariff update out tonight, incorporating the heavy truck, furniture, and pharmaceutical tariffs announced by President Trump yesterday. Details are still sparse; we will update in the future as more specifics about the policy are published.

In brief...

1/10

27.09.2025 00:04 — 👍 51 🔁 14 💬 2 📌 3

The preliminary benchmark revision of -911K amounts to -0.6% to March 2025 payroll employment. Combined with 2-month revisions, recent total revisions are big but hardly unprecedented, & smoothed over the business cycle the payroll survey has gotten more accurate over time.

09.09.2025 14:01 — 👍 65 🔁 24 💬 1 📌 1

The larger-than-usual downward revision last month was in large part driven by a negative skew in the job growth distribution among late reporting firms. That’s unusual, but it’s happened before when the pace of job growth slows rapidly. This print is more evidence that was the case

05.09.2025 12:42 — 👍 385 🔁 140 💬 9 📌 10

Full report here: budgetlab.yale.edu/r...

12/12

04.09.2025 19:16 — 👍 8 🔁 0 💬 1 📌 0

3. The long-run hit to US real GDP levels is now only -0.1%, but there is still an outsized negative effect on advanced manufacturing (due to the remaining 232 tariffs).

4. The effective tariff rate would be 6.8%, still the highest since 1969.

11/12

04.09.2025 19:16 — 👍 10 🔁 0 💬 1 📌 0

But what if the IEEPA tariffs were both 1) overturned, & 2) not replaced? We show a "No IEEPA" scenario assuming a SCOTUS decision in June 2026. A few highlights:

1. IEEPA tariffs make up ~70% of the 2025 tariffs to date.

2. Revenues shrink to $700B over 2026-2035.

10/12

04.09.2025 19:16 — 👍 6 🔁 0 💬 1 📌 0

All tariffs to date in 2025 raise $2.4 trillion over 2026-35, with $454 billion in negative dynamic revenue effects, bringing dynamic revenues to $2.0 trillion.

9/12

04.09.2025 19:16 — 👍 7 🔁 0 💬 1 📌 0

Canada cessation of most retaliation significantly eases the economic burden they bear relative to our prior estimates: long-run Canadian real GDP is now 0.1% higher. China’s economy is -0.3% smaller, nearly 3/4 as large as the hit to the US.

8/12

04.09.2025 19:16 — 👍 9 🔁 1 💬 1 📌 0

In the long-run, tariffs present a trade-off. US manufacturing output expands by 2.7%, but these gains are more than crowded out by other sectors: construction output contracts by 3.8% and mining declines by 1.6%.

7/12

04.09.2025 19:16 — 👍 8 🔁 0 💬 1 📌 0

US real GDP growth over 2025 & 2026 is 0.5pp & 0.4pp lower respectively from all 2025 tariffs. In the long-run, the US economy is persistently 0.4% smaller, the equivalent of $120B annually in 2024$.

The unemployment rate rises 0.3pp by the end of 2025, & 0.7pp by end-2026.

6/12

04.09.2025 19:15 — 👍 10 🔁 0 💬 2 📌 1

The 2025 tariffs disproportionately affect clothing and textiles, with consumers facing 37% higher shoe prices and 35% higher apparel prices in the short-run. Shoes and apparel prices stay 13% higher in the long-run.

5/12

04.09.2025 19:15 — 👍 10 🔁 2 💬 1 📌 0

Tariffs are a regressive tax, especially in the short-run. The short-run burden on 1st decile households (as a % of income) is >3x that of the top decile (-3.5% versus -1.0%). The average annual cost to the 1st & top decile are $1,300 & $5,200 respectively; median is $2,000.

4/12

04.09.2025 19:15 — 👍 13 🔁 3 💬 1 📌 0

The price level from all 2025 tariffs rises by 1.7% in the short-run under our all-tariff baseline, an average per-household income loss of $2,300 in 2025$. The post-substitution price increase settles at 1.4%, a $1,900 loss per household.

3/12

04.09.2025 19:15 — 👍 8 🔁 1 💬 1 📌 1

New @budgetlab.bsky.social tariff analysis incorporating all tariffs through Sept 3. This is a major update. We:

• incorporate higher assumptions about Canada & Mexico tariff-free import shares;

• show 2 scenarios: all tariffs & no IEEPA tariffs after Jun 2026.

In brief...

1/12

04.09.2025 19:15 — 👍 58 🔁 20 💬 2 📌 1

Full @budgetlab.bsky.social report here: budgetlab.yale.edu/r...

13/13

03.09.2025 13:52 — 👍 9 🔁 3 💬 0 📌 0

INDUSTRIAL PRODUCTION. Industrial production is volatile, but industrial output in tariff-sensitive industries has risen sharply year-to-date by 3.5%, returning to early-2024 levels after a late-2024 decline.

12/13

03.09.2025 13:52 — 👍 7 🔁 0 💬 1 📌 0

FEDERAL RESERVE POLICY. Many factors beyond tariffs are affecting Fed policy expectations. The Fed itself has signaled one less cut in 2026 than it forecast last Dec, but markets expect meaningfully lower interest rates by the end of 2026 than they previously thought.

11/13

03.09.2025 13:52 — 👍 8 🔁 0 💬 1 📌 0

THE LABOR MARKET: Tariff-sensitive employment has grown so far in 2025, albeit by less than pre-2025 trend would have suggested; the difference is not significant. Tariff-sensitive manufacturing employment has fallen slightly YTD, the same pace as overall manufacturing.

10/13

03.09.2025 13:52 — 👍 9 🔁 0 💬 1 📌 0

Covering policymaking, economics, and financial markets for Barron’s. matt.peterson@dowjones.com

mattpeterson.me

Adventure game aficionado with a foul mouth.

YouTube: youtube.com/spacequesthistorian

PeerTube: spectra.video/c/spacequesthistorian

Twitch: twitch.tv/spacequesthistorian

Mastodon: dosgame.club/@sqhistorian

26+ years at @CNBC and @NBCNews / @WSJ alum / board member, NY City Center & Sag Harbor Cinema

Poster of posts. Comparative politics, memes, and the occasional update about my ducks. Bluesky's premier advocate for Bushidoliberalism 🫡 🗡️⛩️

Designs (mostly) inspired by and derived from 19th century political Americana at 👁 wideawakes.army 👁

Endowed chair of the Tocqueville-Rand Freedom Enterprise Markets Innovation Center. Bound but not protected, I lie but I do not pretend. 🚰 🏗

Former Assistant Treasury Secretary for Economic Policy (acting) / Chief Treasury Economist, 2023-25. Before that: BlackRock investor, Obama CEA. Fan of inclusive growth and promoting American innovation.

Pro-Black, prolife, racial justice, religious liberty, Carmelite, Catholic,The Gloria Purvis Podcast

Economist.

Atkinson Fellow on the Future of Workers

https://atkinsonfoundation.ca/atkinson-fellows/atkinson-fellow-on-the-future-of-workers/

Contributing Columnist for the Toronto Star https://www.thestar.com/

Mostly #cdnecon #CareEconomy #Inequality

The Budget Lab at Yale is a non-partisan policy research center dedicated to providing in-depth analysis of federal proposals for the American economy.

Climbing, skiing, rates’ musing economist

Economist, UNCG PhD, "serial millennial myth debunker," labor, housing and time use researcher, AU adjunct prof. Views are my own and not any employer's.

I'm the radio guy from Capitol Hill whose voice don't work right. I write the 'Regular Order' newsletter and have covered Congress since the Reagan Administration. Sign up for more at http://jamiedupree.substack.com

Ezra Klein’s tweets, articles, clips and podcasts on bluesky.

Just thinks we should stop spending trillions on tax breaks for the rich.

Campaign Director at Families Over Billionaires. Senior Policy Fellow at Washington Center for Equitable Growth.

Formerly: OMB, Senate Budget, Senate HELP, Groundwork, CAP.

MSNBC anchor/co-host of The Weekend: Primetime, Sat/Sun 6-9pm. Fmrly WashPost syndicated op-ed columnist. Currently on parental leave.

Econ, politics, immigration, tax, etc. + occasional theater nerdery.

Political science professor, academic dean, writer, podcaster, shaker of hands with Mel Brooks — you know, the usual kinks.

Economics and other interesting stuff

Automated feed of https://www.noahpinion.blog/, discover more at @blogsky.venki.dev

Writer on economic policy, bureaucracy, household finances, and the human relationship with animals, among other stuff, at The Atlantic. Ping me on annie@theatlantic.com and annielowrey.25 on Signal.

Committee for a Responsible Federal Budget, University of California DC.

Berlin bureau chief, the New York Times.