New from Daniel Herbst (Assistant Professor of Economics at the University of Arizona) and Nathaniel Hendren (Harvard University):

'A better way to pay for college?'

There is a better way to fund undergraduate study, according to new research on the US.

03.09.2025 10:48 —

👍 2

🔁 1

💬 1

📌 0

Constructing new population-level linked administrative data to study households' access to credit in the US, from Trevor J. Bakker, Stefanie DeLuca, Eric A. English, James S. Fogel, Nathaniel Hendren, and Daniel Herbst https://www.nber.org/papers/w34053

25.07.2025 17:00 —

👍 12

🔁 3

💬 0

📌 0

Thanks @adegendre.bsky.social !

18.07.2025 22:48 —

👍 1

🔁 0

💬 0

📌 0

In case you missed it, @wsj.com dropped a bombshell this week.

I’m speaking, of course, about the recent feature on our working paper about credit access:

www.wsj.com/economy/cred...

18.07.2025 14:42 —

👍 3

🔁 1

💬 0

📌 0

NBER

The National Bureau of Economic Research (NBER) is a private, nonprofit, nonpartisan organization that facilitates cutting-edge investigation and analysis of major economic issues. It disseminates research findings to academics, public and private-sector decisionmakers, and the public by posting more than 1,200 working papers, and convening more than 120 scholarly conferences, each year.

Headquartered in Cambridge, MA, the NBER is a network of more than 1,700 economists who hold primary appointments at North American colleges and universities. These researchers are leaders in the field: 47 current or former NBER affiliates and board members have been awarded the Nobel Prize in Economics, and 13 have chaired the President’s Council of Economic Advisers.

The NBER is committed to making its content accessible to all. Address any concerns or requests for assistance to webaccessibility@nber.org. To request a video you are featured in be taken down, reach out to webmaster@nber.org.

15/ For more, check out...

The @oppinsights.bsky.social WP: opportunityinsights.org/paper/credi...

Our non-technical summary: opportunityinsights.org/wp-content/...

And watch Nathan present LIVE TODAY at 10:45AM ET in the @NBER.org SI Household Finance session!

www.youtube.com/@NBERvideos...

17.07.2025 13:17 —

👍 0

🔁 0

💬 0

📌 0

14/ In sum, our paper documents large differences in credit access by race, class, and hometown. These differences appear driven not by algorithmic bias or resource constraints but by early-life repayment that's rooted in childhood environments.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

13/ Why do childhood environments matter so much? Survey evidence points to several mechanisms, including differences in social capital, financial literacy, and informal credit networks. Future research might explore how early credit experiences are shaped through these channels.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

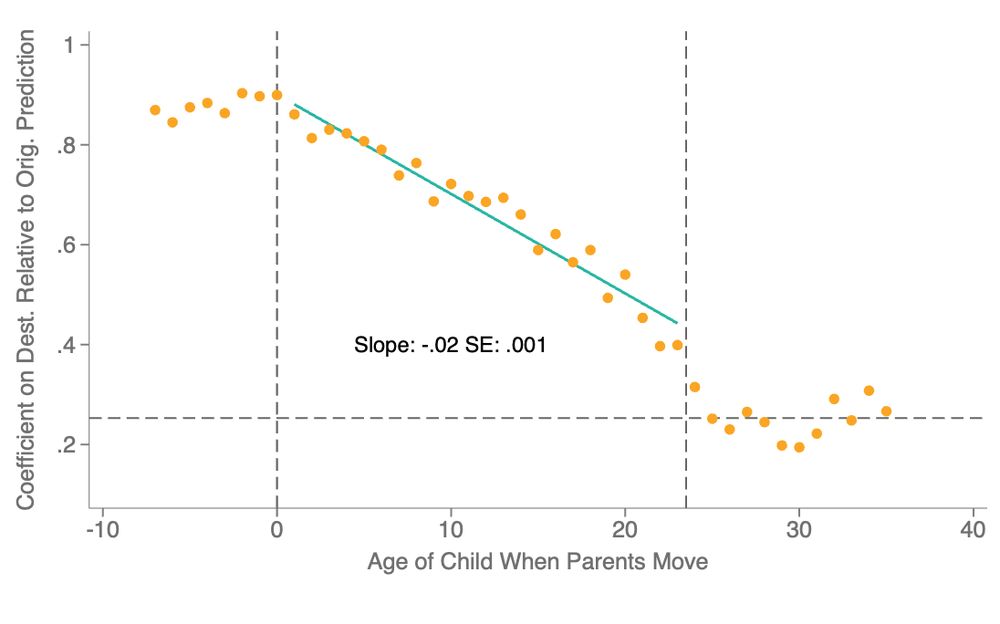

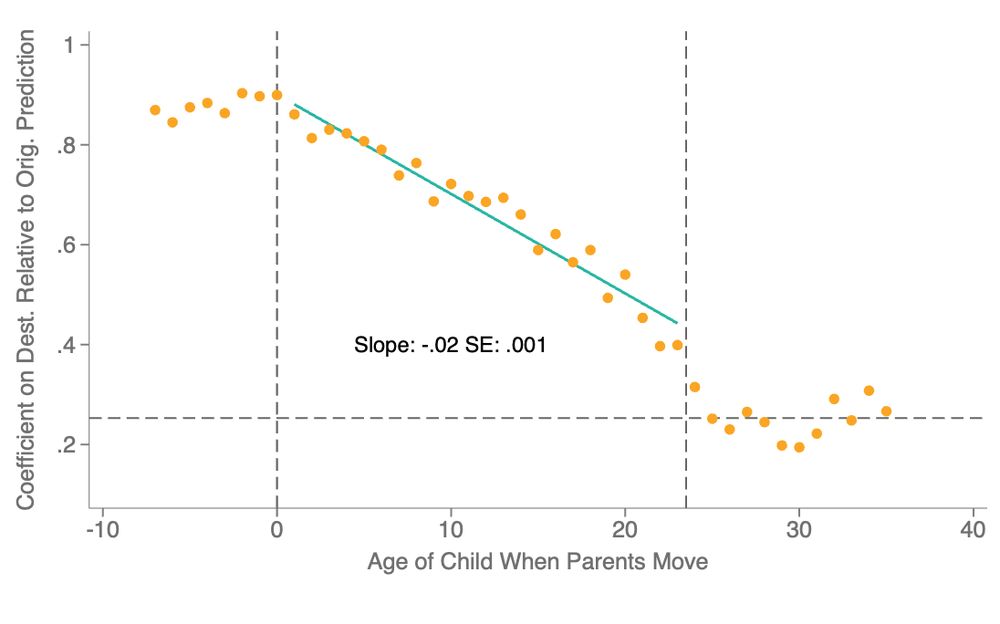

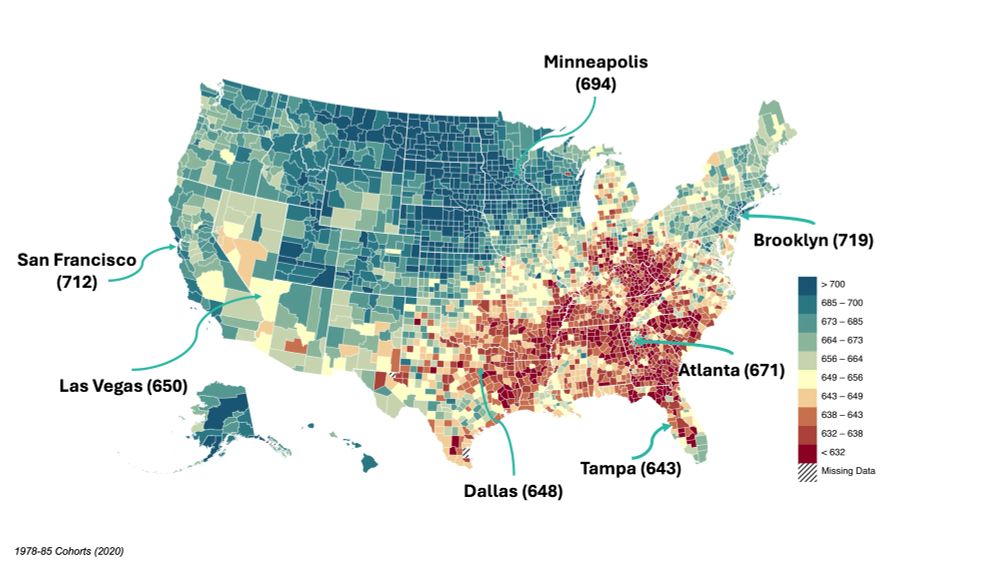

12/ We also find causal evidence place-based effects on repayment: using a mover's design, we find that childhood exposure to places with better repayment behaviors leads to lower delinquency rates in adulthood, even conditional on adult income.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

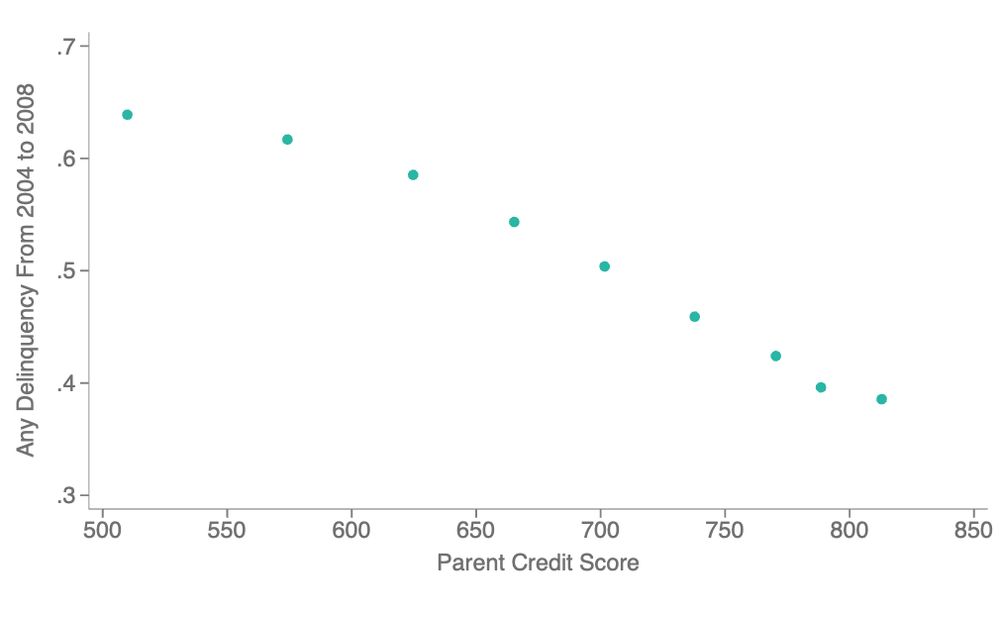

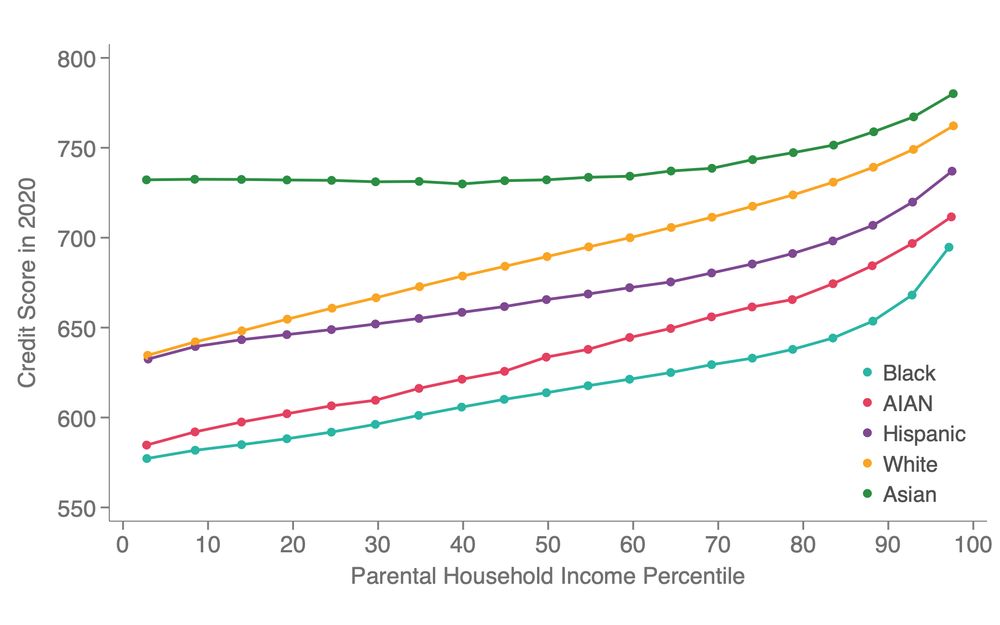

11/ Instead, we find that childhood factors play a role--the credit scores of your parents and childhood neighbors predict your later-life repayment, even conditional on income, wealth, and education.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

10/ Do differences in financial resources explain repayment gaps by race, class, and hometown? Not by much. Repayment gaps persist among individuals with the same income, wealth, marital status, job stability, and employer.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

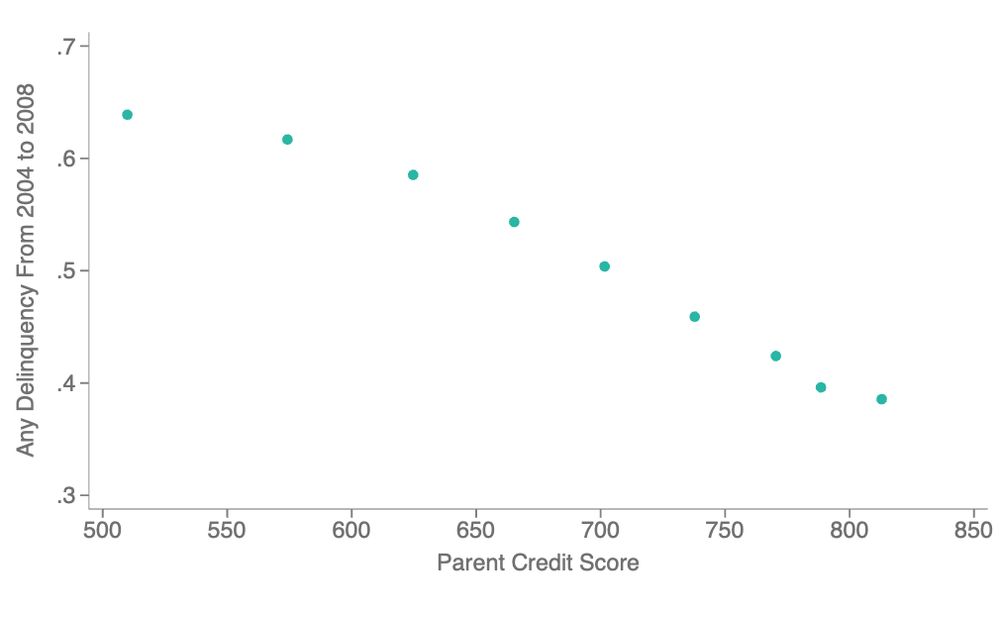

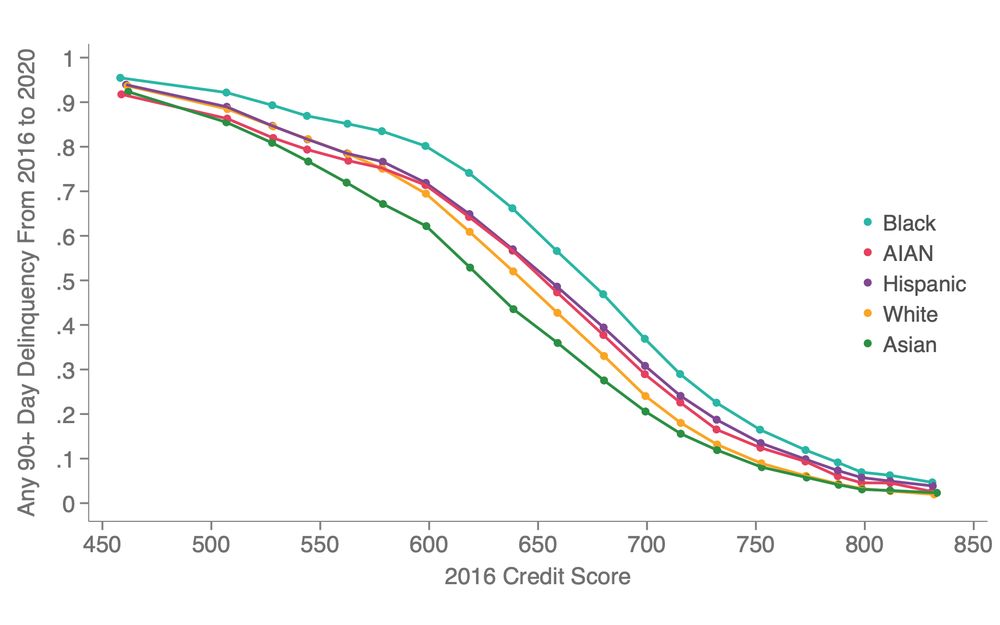

9/ Since credit scores predict future delinquency, the key to removing either type of bias and expanding credit access is to understand why some groups fall delinquent more often than others, especially in early adulthood.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

8/ But when it comes to *balance* bias, the answer is yes: among those who end up avoiding delinquency, Black individuals and those from low-income backgrounds received lower initial scores than other groups.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

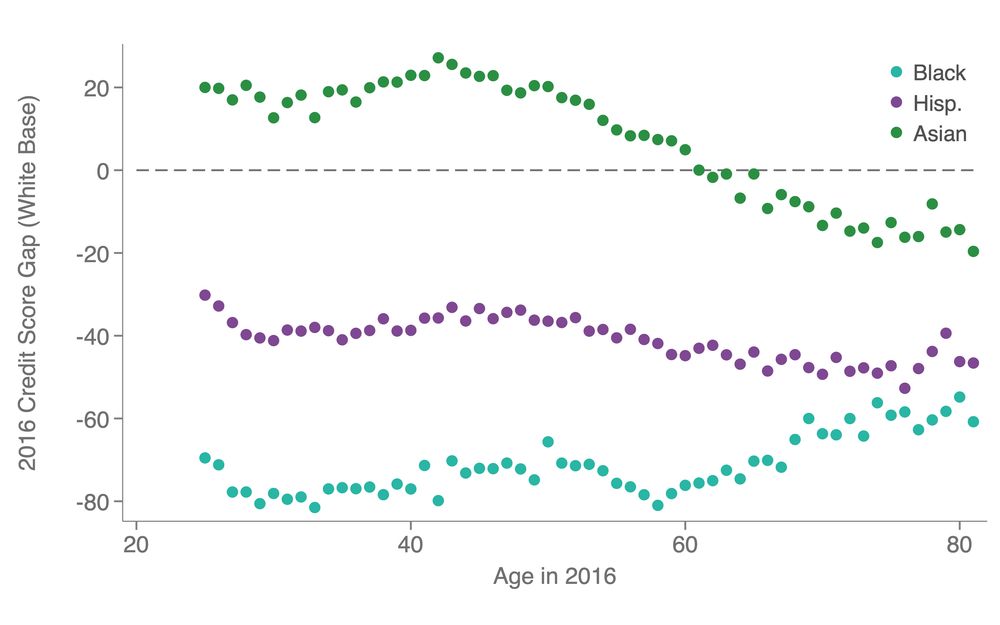

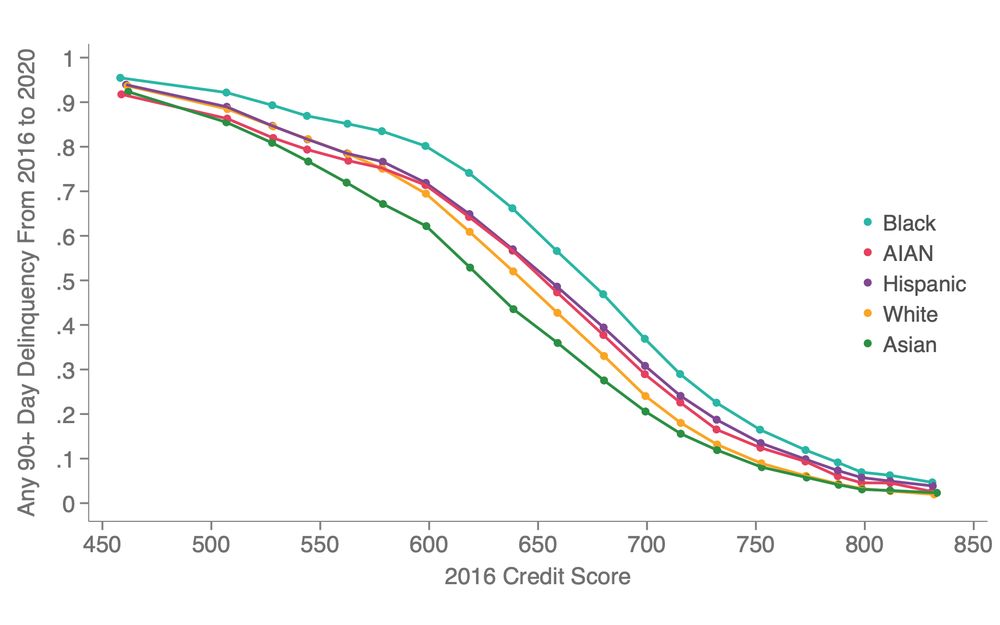

7/ When it comes to *calibration* bias, the answer is no: Among those with a given credit score, Black individuals or those from low-income backgrounds actually fall delinquent at higher rates than other groups. In other words, the credit-score gap understates the repayment gap.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

6/ Are credit scores simply biased against Black individuals or those from low-income backgrounds? The answer depends on how you define "bias."

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

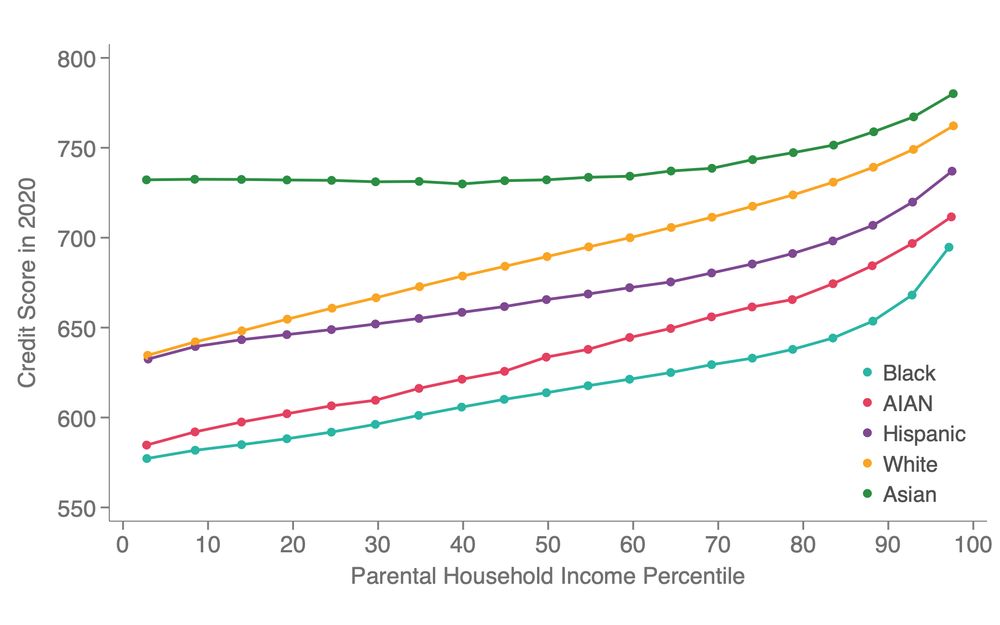

5/ These differences emerge at early ages and reflect real constraints on borrowing: groups with lower scores also have smaller credit balances, higher credit card utilization, and rely more on high-cost alternative financial products like payday loans.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

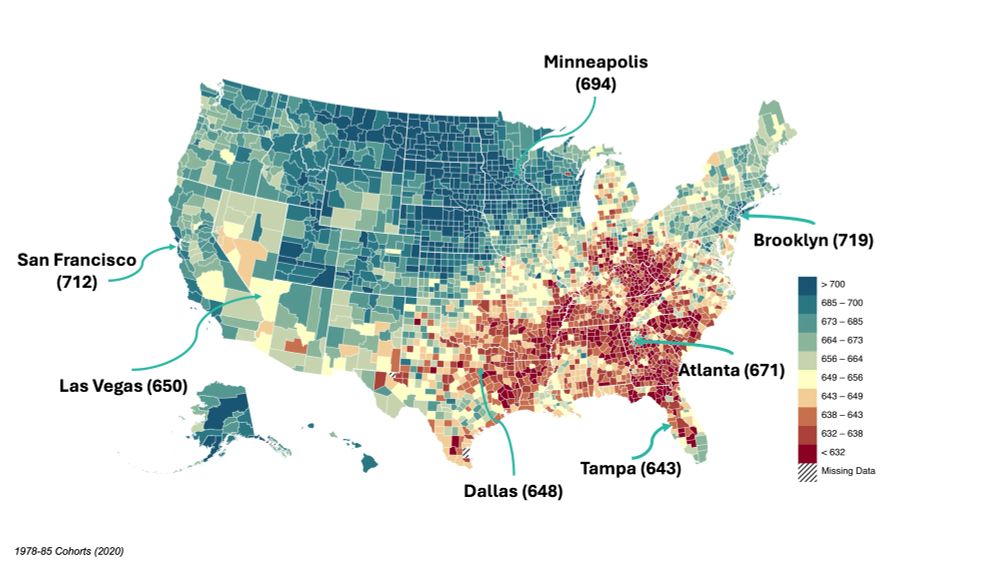

4/ We also see large differences by hometown. For example, by the time they're adults, low-income White children from Brooklyn, NY have 90-point higher average credit scores than low-income White children from Indianapolis.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

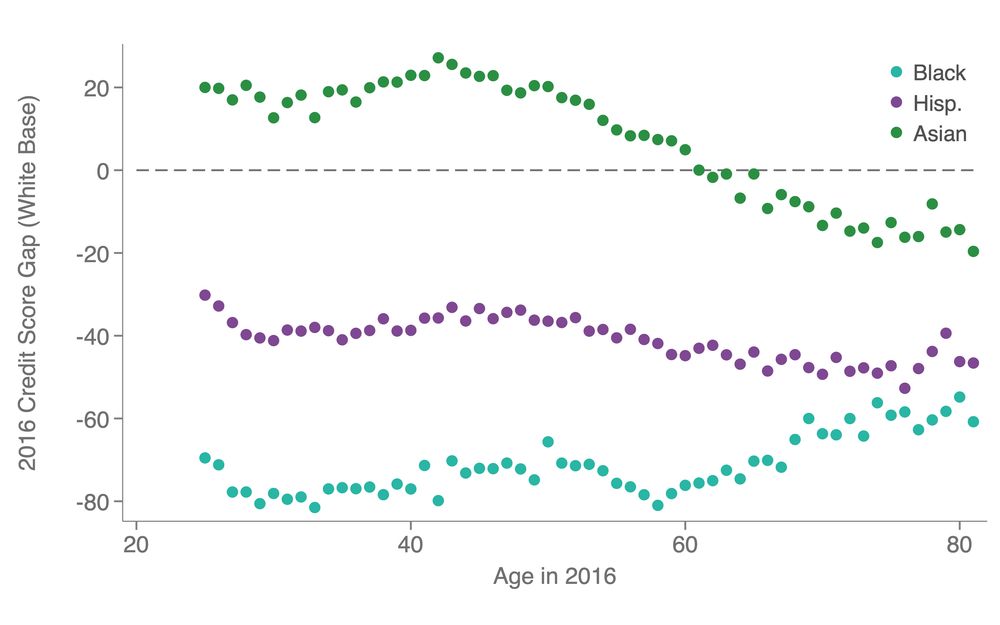

3/ Black individuals and those born to low-income parents have much lower credit scores than other groups. For example, Black individuals from the 90th pctile of parent income have similar average credit scores as White individuals from the 25th pctile.

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

2/ Whether buying a home, building wealth, or managing sudden expenses, affordable credit can be a powerful tool for upward mobility. But our data show how access to this tool is limited for many groups.

Consider credit scores—a metric lenders use to judge creditworthiness...

17.07.2025 13:17 —

👍 0

🔁 0

💬 1

📌 0

1/ New working paper with Trevor Bakker, @stefanie-deluca.bsky.social, Eric English, Jamie Fogel, and Nathan Hendren: We use newly linked Census, IRS, and credit bureau data to explore differences in credit access by race, class, and hometown.

djh1202.github.io/website/cre...

🧵...

17.07.2025 13:17 —

👍 19

🔁 8

💬 2

📌 3

Thanks!

And thanks for the thoughtful feedback! The comments are much appreciated :)

12.12.2024 05:23 —

👍 0

🔁 0

💬 0

📌 0

Yeah it would add cost and complicate recruitment (which mentions the piece-rate option). At the time, I didn't think an hourly conrol group would be worth the trouble because I thought the highest wage offers would get close to complete take-up. In hindsight it might have been a good idea!

12.12.2024 05:21 —

👍 1

🔁 0

💬 0

📌 0

You're absolutely right--there are a variety of factors apart from moral hazard and adverse selection that influence payment schemes. I mention monitoring costs, but I should delve into behavioral mechanisms like Falk & Kosfeld as well. There's a lot of great work I'm building on here.

12.12.2024 05:20 —

👍 2

🔁 0

💬 0

📌 0

I'd love to add other dimensions of variation, but unfortunately cost is a very real constraint right now. I'm definitely looking to things like this in the future if those constraints are lifted!

12.12.2024 05:19 —

👍 1

🔁 0

💬 0

📌 0

Yeah, I tried to make it as generalizable as possible—participants don't know they're in an experiment, data-entry required in many jobs, etc. But I can't claim my estimates would extrapolate different tasks or labor markets (in fairness, neither can most other studies of labor productivity.)

12.12.2024 05:19 —

👍 1

🔁 0

💬 1

📌 0

Thanks Peter!

12.12.2024 00:08 —

👍 1

🔁 0

💬 0

📌 0

Check out my website to read the full paper and reach out with feedback. I've had a ton of fun working on this paper and I'm eager to hear your thoughts!

www.danjherbst.com

(end)

11.12.2024 16:06 —

👍 1

🔁 0

💬 0

📌 0

Bottom line: For workers with uncertain output, fixed wages provide implicit insurance compared to self-employment or piece rates. But like any insurance, they are prone moral hazard and adverse selection. Smart policy can correct for these distortions to improve welfare.

14/n

11.12.2024 15:36 —

👍 1

🔁 0

💬 1

📌 0

The policy implications don't stop there. Employment classification rules, portable benefits programs, and even the minimum wage could be designed to help mitigate the market inefficiences associated with moral hazard and adverse selection in labor contracts.

13/n

11.12.2024 15:36 —

👍 0

🔁 0

💬 1

📌 0

Example: Remember when both presidential candidates promised to eliminate taxes on tips? My analysis makes the case for the *opposite* policy—more taxes on tips can raise government revenue while promoting hourly wages, reversing some of the welfare loss from adverse selection.

12/n

11.12.2024 15:36 —

👍 6

🔁 1

💬 1

📌 0

How can the government respond? A variety of policies could improve welfare by promoting insurance-like provisions in labor contracts. To quantify these benefits, I calculate the marginal values of public funds (MVPFs) for a range of wage-based taxes and subsidies.

11/n

11.12.2024 15:36 —

👍 0

🔁 0

💬 1

📌 0