Does it work for conservation ? Our proposal is best suited for re/afforestation. The economics of the conservation is very different & the flow benefits are smaller. Maybe w/ blended finance. 6/6

20.07.2025 12:53 — 👍 0 🔁 1 💬 0 📌 0

How does this differ from other emerging nature-shares proposals? We do not count on the marketable nature benefits (logging etc) to be enough to support demand. These slns may be ok to finance transitions to regenerative ag in the Global North, not for forests in the South. 5/6

20.07.2025 12:52 — 👍 0 🔁 1 💬 1 📌 0

Our proposal spurred interesting conversations. Is it Art. 6 compatible ? Yes. Countries could use the market to buy nature shares that deliver carbon dividends for their NDCs. How do you ensure a liquid secondary mkt? Using the info generated during the primary mkt (see paper for details). 4/6

20.07.2025 12:51 — 👍 0 🔁 1 💬 1 📌 0

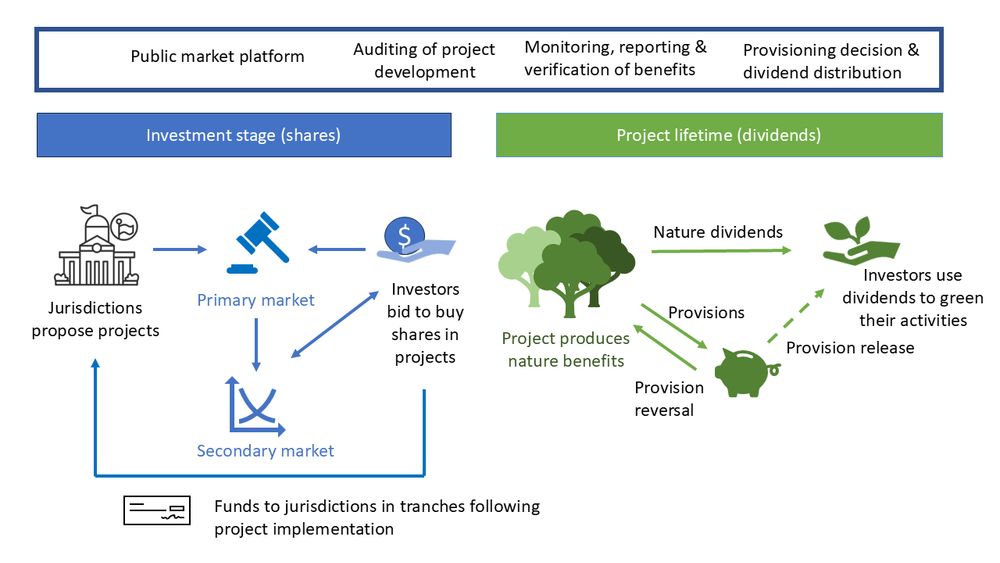

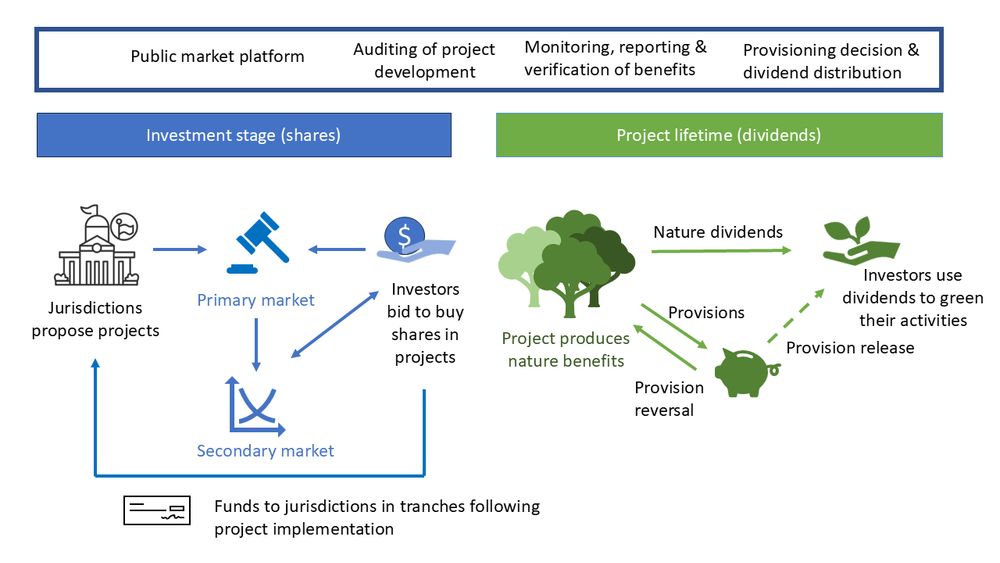

picture of proposed market design

Jurisdictions (rather than project developers) are on the supply side. A larger size reduces leakage, monitoring costs, risks, etc. To create demand, we consider a mandate on pension funds to be Paris-and Montreal-aligned. The carbon and biodiversity dividends reduce the funds’ footprint. 3/6

20.07.2025 12:51 — 👍 0 🔁 1 💬 1 📌 0

We propose to view nature as equity which generates carbon and biodiversity dividends. Viewing nature as a risky asset recognizes its impermanence. Using dividends to distribute its benefits = doing so prudently. But it requires to rethink the value of a market and how we create & support it. 2/6

20.07.2025 12:50 — 👍 1 🔁 1 💬 1 📌 0

I had the pleasure to work with Bea and Eric on scaling finance for forests in the Global South. Our starting point: the nature-based VCM is broken. Higher standards and better monitoring will not fix it. It can’t serve as a template for nature. Why? It can’t deal with nature’s impermanence. 🧵1/6

20.07.2025 12:49 — 👍 4 🔁 1 💬 1 📌 0

The global effort to combat climate change and biodiversity loss increasingly hinges on the choices made by emerging and developing economies. While advanced economies retain influence through emissions, trade, and technology, their relative share in global greenhouse gas emissions is declining. Rapid, inclusive, and low-carbon development pathways in countries like India, Indonesia, Brazil, South Africa, and especially China, are now pivotal. However, geopolitical tensions and waning leadership - particularly from the United States - threaten progress toward the goals set out in the Paris Agreement. To maintain momentum, this Policy Brief advocates for pragmatic “coalitions of the willing” that align climate, biodiversity, trade, and finance objectives. The European Union, with its leadership on climate policy and credibility in international negotiations, must spearhead these alliances, working closely with emerging markets to deliver systemic, cooperative solutions for a sustainable future.

New CEPR #PolicyInsight 144 Building coalitions for climate transition & nature restoration

@pisaniferry.bsky.social @wederdim.bsky.social & @jzettelmeyer.bsky.social advocate for pragmatic coalitions of the willing to align climate, biodiversity, trade & finance objectives.

cepr.org/publications...

18.07.2025 13:02 — 👍 5 🔁 1 💬 0 📌 0

In this Policy Insight, drawn from the 2025 Paris Report, the authors argue for a new approach to finance nature-based provision of carbon and biodiversity benefits: one that takes shares in projects as the main asset to be traded, rather than credits. In our mechanism, jurisdictions propose nature-positive large-scale projects. Investors buy shares in these projects. Shares do not affect land ownership but produce carbon and biodiversity dividends. Prices in the primary market are used to pin down investor preferences over project attributes and generate conversion rates for different projects in the secondary market, thereby fostering liquidity for investors. Compared to existing credit-based approaches, our mechanism accounts for the unavoidable non-permanence of forests and fosters long-term thinking for market participants. Additionally, our mechanism lowers transaction costs, encourages additionality, and reduces leakage. The Insight proposes several venues to support demand for this new market and discuss options available to adapt the mechanism to pure conservation projects, which are essential but less amenable to be turned into dividend-producing assets because they generate lower climate and biodiversity flow benefits.

New CEPR #PolicyInsight 145 Designing and scaling up nature-based markets

@estellecantillon.bsky.social, E Lambin & @wederdim.bsky.social describe a new approach to finance nature-based provision of carbon and biodiversity benefits through shares instead of credits.

cepr.org/publications...

#EconSky

18.07.2025 13:19 — 👍 3 🔁 1 💬 0 📌 1

The sound at Davos 25: high notes on tipping points (closer than we thought) and a constant undertone of Trump, Trump, Trump.

26.01.2025 17:33 — 👍 5 🔁 1 💬 1 📌 0

I'm an economist at Université Libre de Bruxelles, interested in market design, climate transition and sustainability. Posting mostly in EN but sometimes also in FR and NL. Webpage: https://ecantill.ulb.be/

Interested in economics, regulation, cycling, food, and dogs called Maynard.

Macro Prof @ Oxford Econ. Member of Ireland’s Fiscal Council and otherwise spend my work time thinking about central banks, communication and inventories!

Professor of Economics, University College Dublin. www.karlwhelan.com has research, teaching materials, stuff on the ECB and even a few old blog posts. Remember them? Currently doing research on betting and prediction markets and some macro things.

Stanford economist:

Professor of Political Economy; Business & Sustainability.

GSB, Doerr, NBER, CEPR, UiO, TSE, 3ERC.

https://www.gsb.stanford.edu/faculty-research/faculty/bard-harstad

Climate & environmental economics; micro; theory; institutions; trade

Economist @MonashWarwick

Project Leader @RF_Berlin

BWV227

Editor @EJ_RES

Associate Editor @QJEHarvard

First gen high school grad

Classical music and jazz enthusiast

Senior Fellow at Bruegel and at the Peterson Institute for International Economics

Chasing wealth and income, present and past, onshore and offshore.

https://gabriel-zucman.eu

https://www.taxobservatory.eu

Econ prof University of Zurich.

Faculty affiliate at JPAL, CEPR, CESifo.

Board member IIPF, Helvetas, GAIN.

#EconSky

Economics Professor at the Geneva Graduate Institute & the University of Lausanne, studying conflict, development & institutions. Leader of several expert groups on armed conflict. Associate Editor of the "Economic Journal". Author of "The Peace Formula".

President of DIW Berlin and Professor for Macroeconomics at Humboldt University.

Economist, author, and columnist for Die Zeit: https://www.zeit.de/serie/fratzschers-verteilungsfragen

Mitglied des Deutschen Bundestages | Stellv. Vorsitzender der CDU/CSU-Bundestagsfraktion für Auswärtiges & Verteidigung | Optimismus 🚀 Europa 🇪🇺 und Espresso ☕️

Süddeutsche Zeitung

It’s the economy, stupid

AW Phillips Professor of Economics at the LSE

DDG Macro, Forecasts, Research @BMWK

Professor of Finance @handels_sse @SHouseofFinance Research Fellow @ecgiorg @cepr_org Ph.D.@UCLAecon @uniBocconi alumna 🇪🇺🇮🇹

https://sites.google.com/site/mariassuntagiannetti/Home

Max(Micro in Macro) s.t. Tractable

Aggregate Demand w/ Heterogeneity/Inequality

Aggregate Supply w/ Entry/Variety

Monetary & Fiscal Policy

#EconSky

1st Gen

Prof. of Macro @ U. of Cambridge

https://sites.google.com/site/florinbilbiie/