Home | Maha Rehman

I am very happy to share a new labour of love: my new website which is now live:

maharehman.github.io

Feedback welcome! Keeping it simple for clarity.

23.04.2025 21:31 — 👍 2 🔁 1 💬 0 📌 0

Home | Maha Rehman

I am very happy to share a new labour of love: my new website which is now live:

maharehman.github.io

Feedback welcome! Keeping it simple for clarity.

23.04.2025 21:31 — 👍 2 🔁 1 💬 0 📌 0

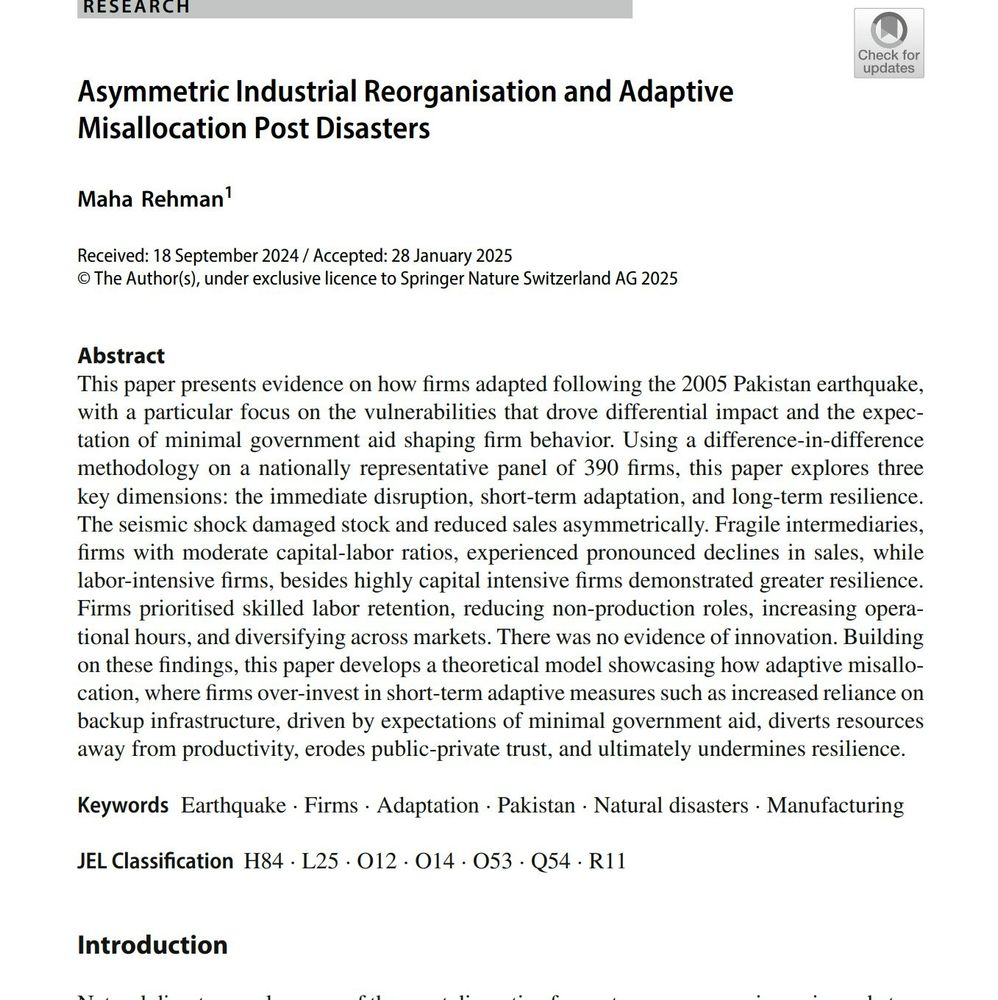

Policy predictability—not just aid—matters. Without credible, consistent public support, firms prioritise survival over productivity. In low-trust settings, adaptive misallocation becomes a structural barrier to recovery and long-term growth.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

Contrary to standard disaster economics, the problem is not moral hazard. Firms do not under-invest due to expected bailouts. Instead, they over-invest in short-term resilience precisely because they expect the state will not intervene.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

This creates a feedback loop: firm self-reliance lowers expectations of government support, which in turn reduces state pressure to intervene. The social contract weakens, and firms remain locked in low-growth, high-cost equilibrium.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

This resulted in adaptive misallocation—rational responses that were inefficient in aggregate. Firms absorbed high costs to survive but made few gains in productivity. Market exit was rare, and creative destruction failed to materialise.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

Firm responses varied by capital-labour intensity. Labour-intensive firms adapted with workforce flexibility. Capital-intensive firms relied on financial buffers. But “fragile intermediaries”—dependent on both labour and capital—faced the most severe output contractions.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

If it's true that future collection of Demographic and Health Survey (DHS) data "will cease," this would be a staggering loss to the global community. 1/6

www.science.org/content/arti...

06.02.2025 04:53 — 👍 26 🔁 26 💬 1 📌 6

Eid mubarak!

31.03.2025 14:27 — 👍 3 🔁 0 💬 1 📌 0

My new paper, now in print, examines how the 2005 Pakistan earthquake triggered asymmetric firm-level over-adaptation in response to policy uncertainty. (1/n)

Link: link.springer.com/article/10.1...

A thread follows:

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

Winter in Ithaca is majestic - notice nature's detailing in the grand icicles - but with spring around the corner, I almost miss the stillness and the comforting cold.

25.03.2025 13:51 — 👍 1 🔁 0 💬 0 📌 0

Thanks for reading!

24.03.2025 22:04 — 👍 0 🔁 0 💬 0 📌 0

Policy predictability—not just aid—matters. Without credible, consistent public support, firms prioritise survival over productivity. In low-trust settings, adaptive misallocation becomes a structural barrier to recovery and long-term growth.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

Contrary to standard disaster economics, the problem is not moral hazard. Firms do not under-invest due to expected bailouts. Instead, they over-invest in short-term resilience precisely because they expect the state will not intervene.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

This creates a feedback loop: firm self-reliance lowers expectations of government support, which in turn reduces state pressure to intervene. The social contract weakens, and firms remain locked in low-growth, high-cost equilibrium.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

A theoretical model captures this logic. Firms form expectations based on a stochastic policy environment. If government aid is persistently absent, firms expect minimal support and rationally divert investment toward self-provisioning.

24.03.2025 22:04 — 👍 0 🔁 0 💬 1 📌 0

This resulted in adaptive misallocation—rational responses that were inefficient in aggregate. Firms absorbed high costs to survive but made few gains in productivity. Market exit was rare, and creative destruction failed to materialise.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

Infrastructure collapse deepened firm vulnerability. Lacking state support, firms self-provisioned electricity and logistics. These defensive adaptations redirected resources away from capital deepening and technology adoption.

24.03.2025 22:04 — 👍 0 🔁 0 💬 1 📌 0

Firms focused on continuity: retaining skilled workers, shedding non-production roles, extending work hours, and diversifying markets. These adjustments occurred along the extensive margin. No evidence emerged of productivity-enhancing investment or innovation.

24.03.2025 22:04 — 👍 0 🔁 0 💬 1 📌 0

Firm responses varied by capital-labour intensity. Labour-intensive firms adapted with workforce flexibility. Capital-intensive firms relied on financial buffers. But “fragile intermediaries”—dependent on both labour and capital—faced the most severe output contractions.

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

My new paper, now in print, examines how the 2005 Pakistan earthquake triggered asymmetric firm-level over-adaptation in response to policy uncertainty. (1/n)

Link: link.springer.com/article/10.1...

A thread follows:

24.03.2025 22:04 — 👍 0 🔁 1 💬 1 📌 0

I am so excited for this extension to my current research agenda: How do firms in emerging economies, in this case Pakistan, react, respond and adapt in the aftermath of a natural disasters and climate change.

#climatesky

02.07.2024 09:35 — 👍 1 🔁 1 💬 0 📌 0

Congratulations

06.07.2024 17:03 — 👍 1 🔁 0 💬 1 📌 0

Confronting Climate Coloniality: Decolonizing Pathways for Climate Justice

This timely and urgent collection brings together cutting-edge interdisciplinary scholarship and ideas from around the world to present critical examinations of climate coloniality.

Confronting Clim...

🚨My book is online!🚨

"Confronting Climate Coloniality: Decolonizing Pathways for Climate Justice"

This was a journey & labor of love to clarify what climate coloniality is & how to decolonize climate justice. Thanks to many for their support!

Details below.🧵

05.07.2024 17:03 — 👍 133 🔁 59 💬 5 📌 3

I am so excited for this extension to my current research agenda: How do firms in emerging economies, in this case Pakistan, react, respond and adapt in the aftermath of a natural disasters and climate change.

#climatesky

02.07.2024 09:35 — 👍 1 🔁 1 💬 0 📌 0

Fall in Ithaca!

09.10.2023 16:51 — 👍 0 🔁 1 💬 0 📌 0

Lovely!

23.11.2023 14:47 — 👍 1 🔁 0 💬 0 📌 0

Yes! I never thought of doing this when I taught a similar undergraduate class but will use it next time I do!

12.10.2023 02:03 — 👍 0 🔁 0 💬 0 📌 0

Greensky is so well organised!

The Development community should follow suite

11.10.2023 22:22 — 👍 2 🔁 0 💬 0 📌 0

Economist at Columbia University. Trade Diversion is a blog about trade & globalization.

www.tradediversion.net

Assistant Professor of Economics, UC Davis

Affiliates: CEGA, IDEAS Pakistan, UC IGCC, J-Pal

armanrezaee.com

unsolicited commentary on economics and the environment. Stanford prof, +co-founder AtlasAI

Prof at MIT working on misinformation/fake news, social media, polarization, intuition vs deliberation, cooperation, politics, and religion. (he/him)

https://davidrand-cooperation.com/

Econometrics professor and author. Dogs = 2, cats >= 10.

Explore groundbreaking news and research from PNAS, one of the world's most-cited scientific journals. Discover its sibling journal, @pnasnexus.org, both official journals of the National Academy of Sciences. Visit www.pnas.org for more info.

Professor at Carnegie Mellon University. Energy Affordability. Energy & Climate Justice. Climate Adaptation. Systems Modeling. CEO - Peoples Energy Analytics. Named a 2024 Science Defender

Acting Dean, LSE Global School of Sustainability, https://www.lse.ac.uk/global-school-of-sustainability

Seconded from Grantham Research Institute on Climate Change and the Environment, London School of Economics

Repost ≠ endorsement

Born @ 321 ppm CO2

Climate impacts and adaptation for nature and people. Senior Scientist @ Climate Impacts Group & Univ. Director @ NW Climate Adaptation Science Center, U of Washington. Surfer/paddler. Settler on Coast Salish land. She/her. Personal account - views mine.

Econ prof University of Zurich.

Faculty affiliate at JPAL, CEPR, CESifo.

Board member IIPF, Helvetas, GAIN.

#EconSky

Co-founder, Youth Impact

Academic Director, What Works Hub for Global Education

Blavatnik School of Government, University of Oxford

I am an Economist leveraging the assignment mechanism in the field to test theory and help non-profits, govts, and anyone who will listen! My goal is to (hopefully!) change the world for the better. My picture is with my son who makes me so proud daily.

Assistant Professor of Economics @ Johns Hopkins

IO, energy, environmental

https://jonathantelliott.com/

Runs Open Philanthropy’s Innovation Policy program. Creator of newthingsunderthesun.com, a living literature review about innovation. Website: mattsclancy.com.

immigrant, behavioral/experimental economics

mostly films, occasionally brains, games, and CCSC (Chinese Culinary Superiority Complex)

Professor in the Economics of Innovation and Public Value, University College London. Author: Entrepreneurial State, Value of Everything, Mission Economy, Big Con. Founding Director UCL Institute for Innovation & Public Purpose

www.marianamazzucato.com

Associate Professor, Yale Statistics & Data Science. Social networks, social and behavioral data, causal inference, mountains. https://jugander.github.io/