Has Mitt Romney been reading the @taxlawcenter.org Tealbook of options to broaden the tax base? www.nytimes.com/2025/12/19/o...

19.12.2025 15:42 — 👍 15 🔁 5 💬 1 📌 0@lilybatch.bsky.social

Kopple Family Professor, NYU Law. Faculty Director @taxlawcenter.org. Former Assistant Secretary for Tax Policy at Treasury; Deputy Director, National Economic Council; Chief Tax Counsel, Senate Finance Committee.

Has Mitt Romney been reading the @taxlawcenter.org Tealbook of options to broaden the tax base? www.nytimes.com/2025/12/19/o...

19.12.2025 15:42 — 👍 15 🔁 5 💬 1 📌 0THREAD:

GOP Senators say they're trying to scale back the SALT cap relief in the House bill. But could the approach to SALT in the Senate bill actually end up *more* generous & costly overall than the House bill? Do Senators – or does anyone – even know, despite the intense political focus on SALT?

24.06.2025 05:25 — 👍 0 🔁 0 💬 0 📌 0

24.06.2025 05:25 — 👍 0 🔁 0 💬 0 📌 0

24.06.2025 05:25 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:25 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:17 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:17 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:15 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:15 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:15 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:15 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:14 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:14 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:13 — 👍 0 🔁 0 💬 1 📌 0

24.06.2025 05:13 — 👍 0 🔁 0 💬 1 📌 0

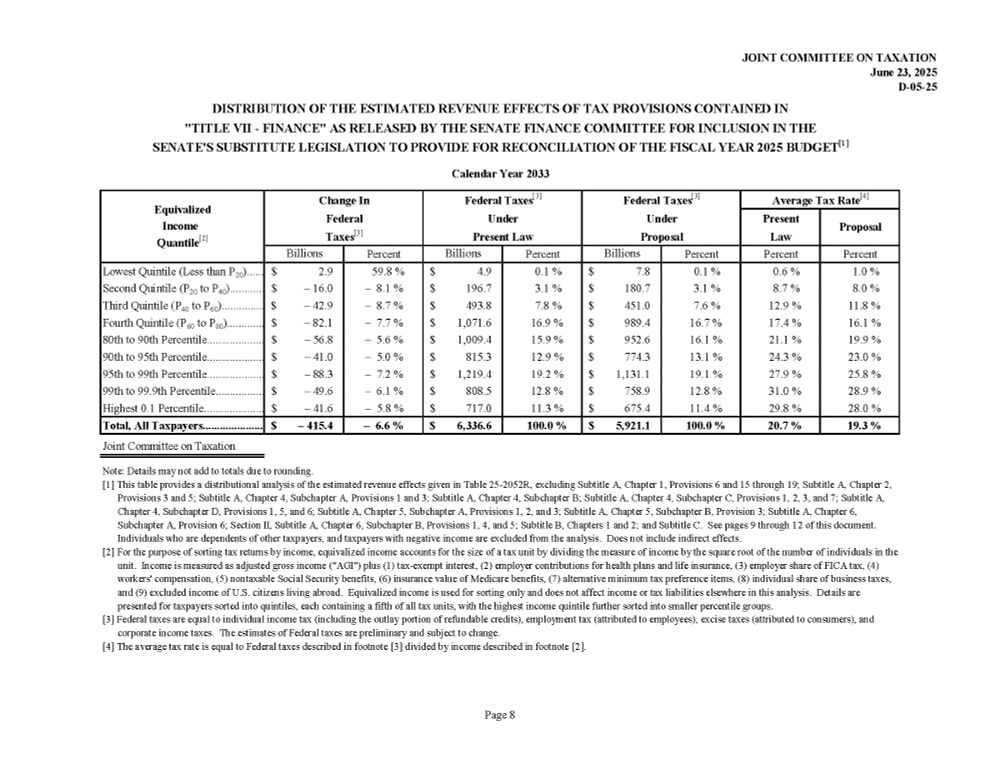

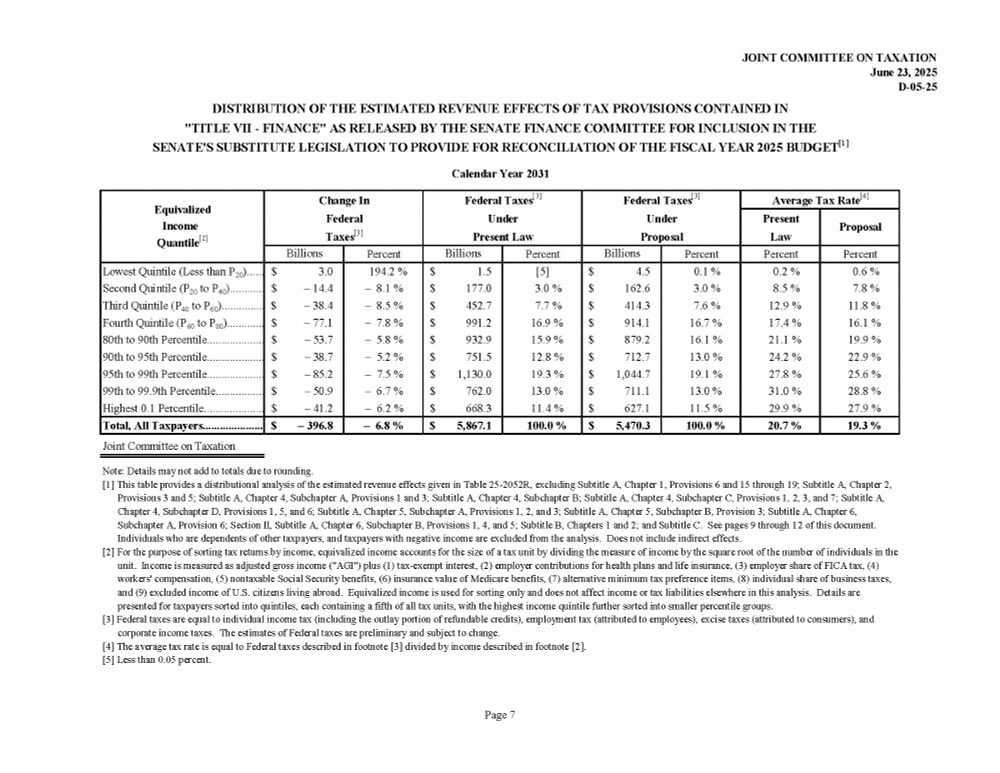

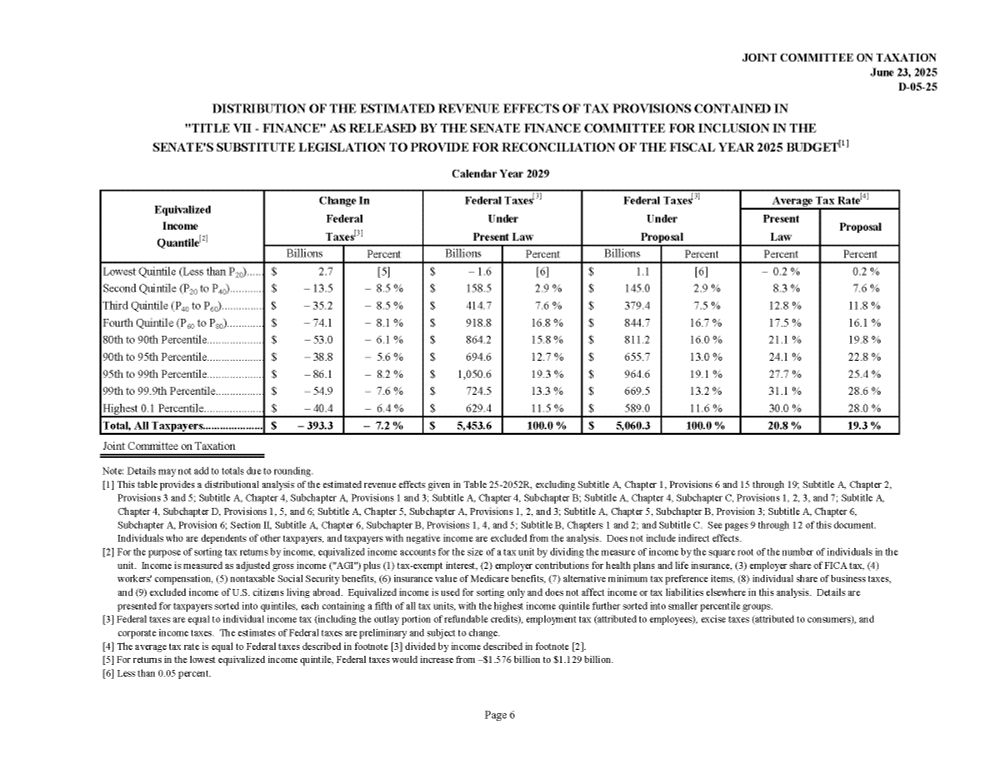

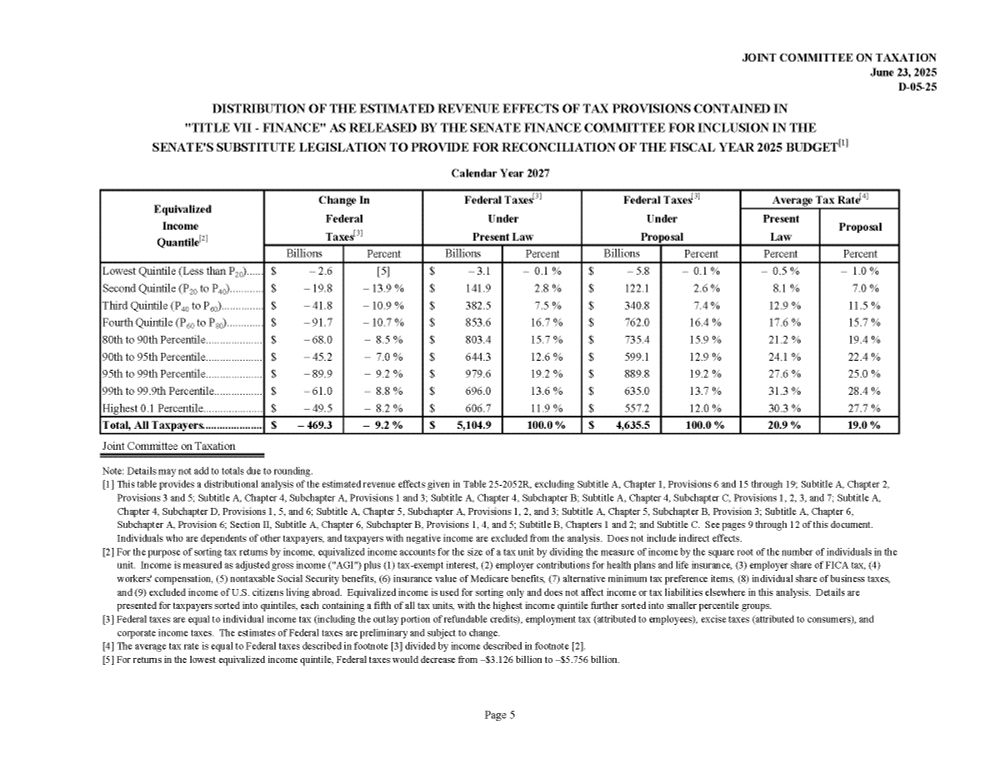

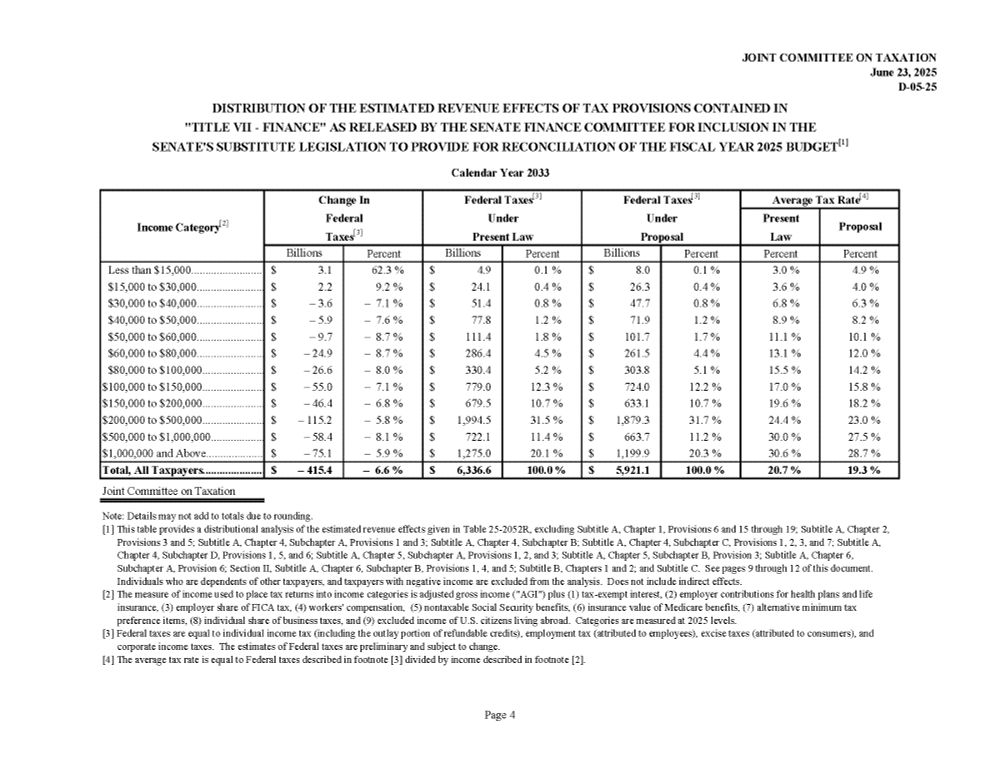

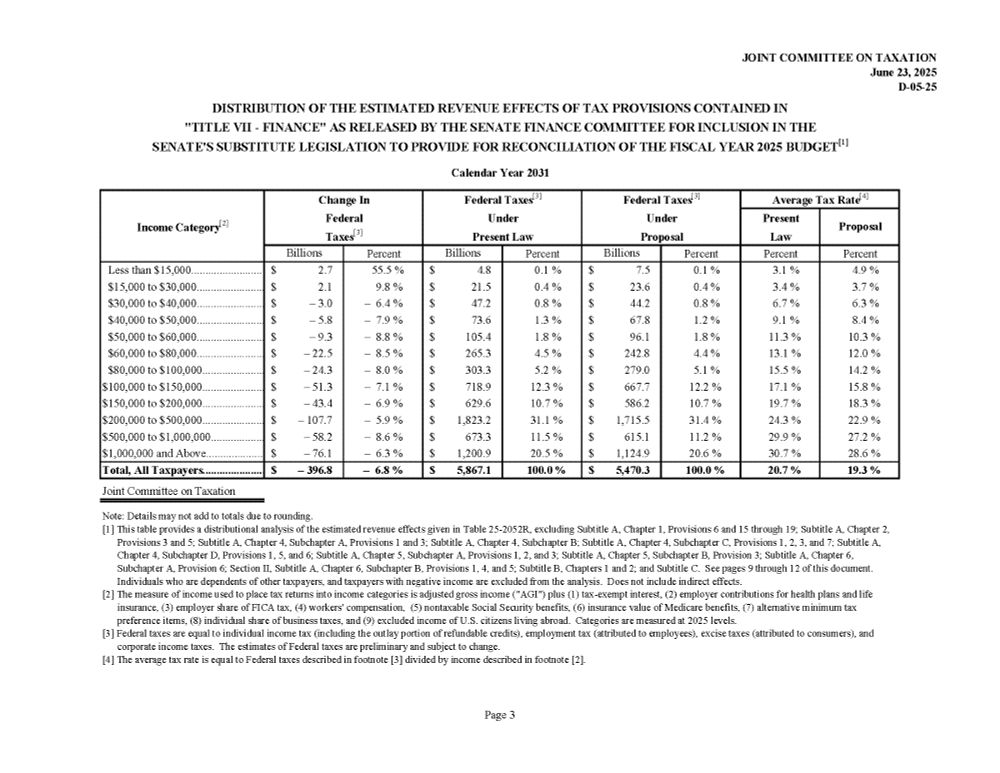

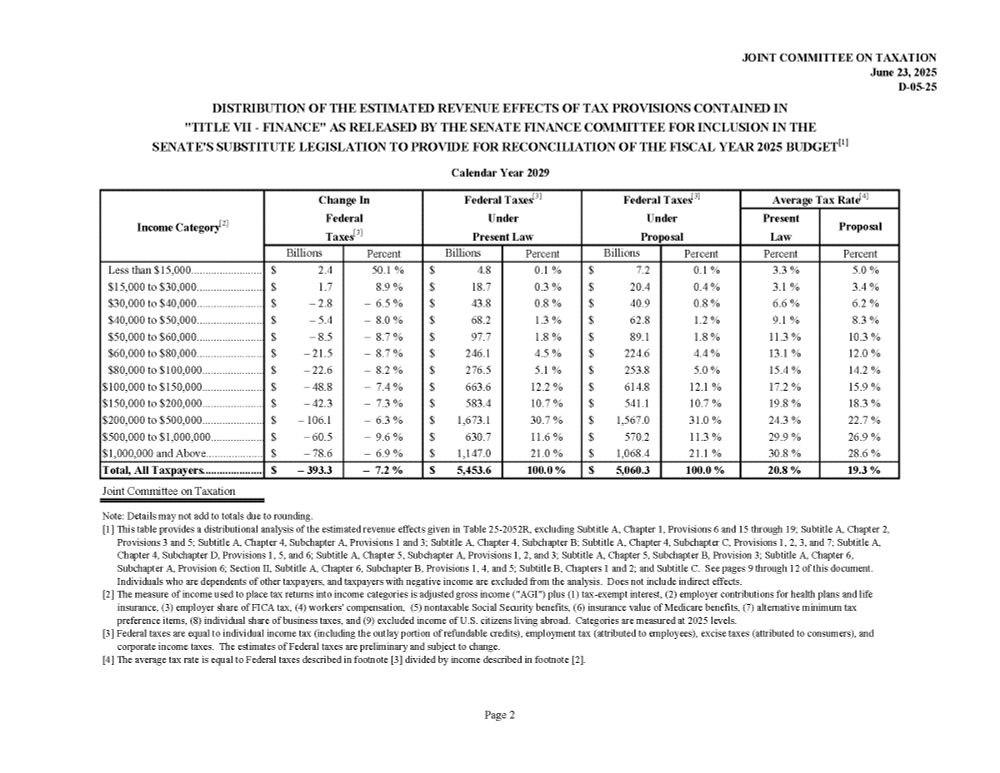

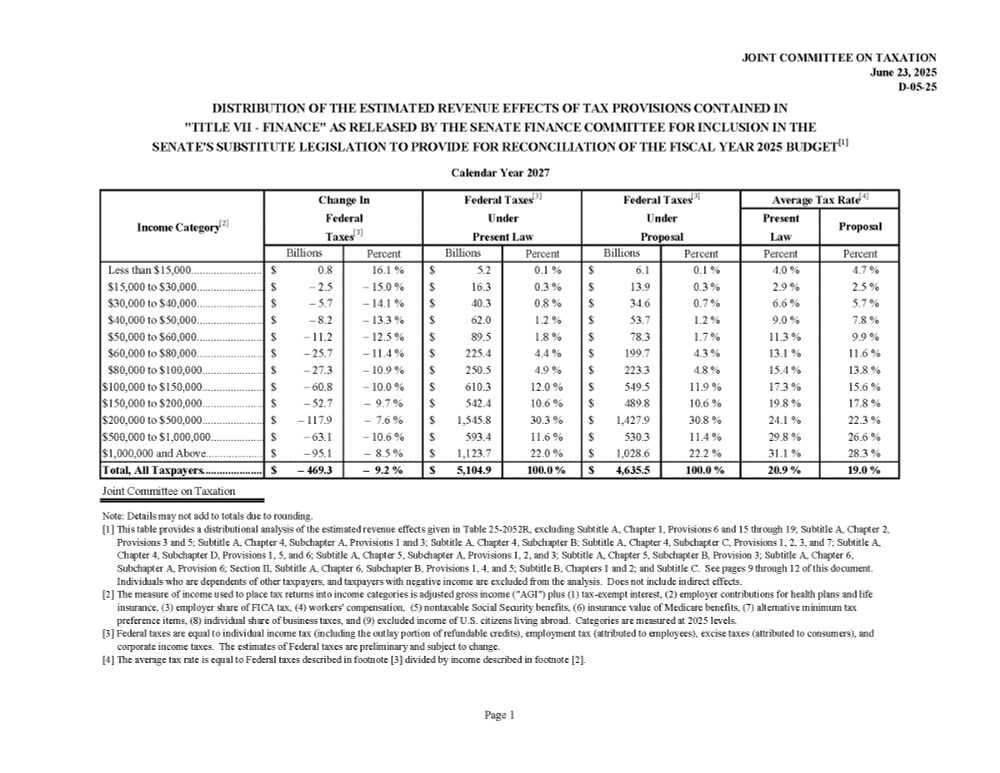

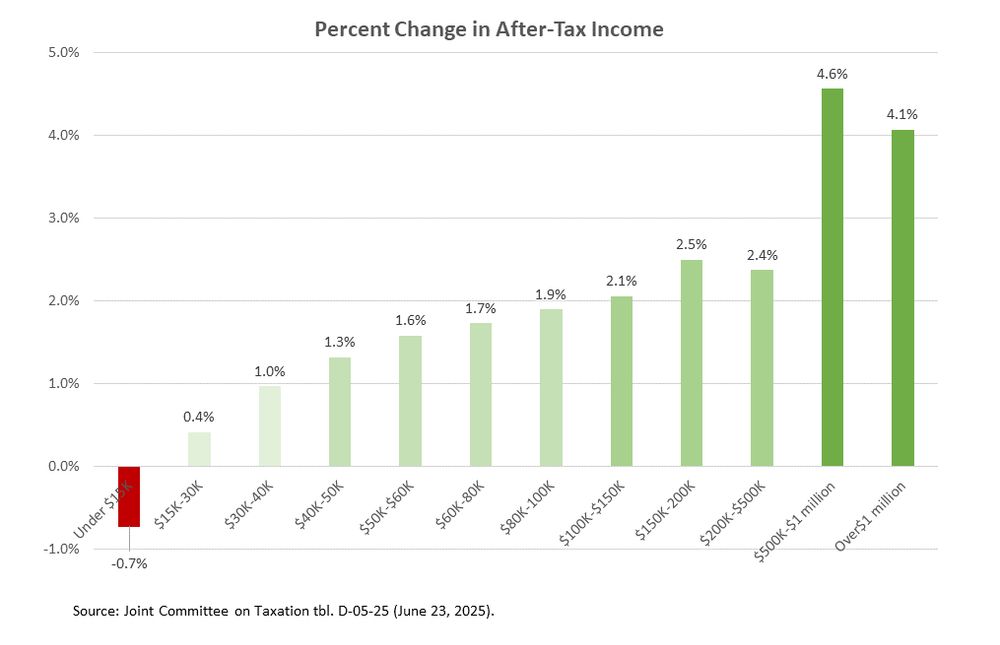

JCT tables follow. (Prior chart was for 2027 and calculated from JCT tables.) 2/

24.06.2025 05:13 — 👍 0 🔁 0 💬 1 📌 0

New JCT distributional estimates of proposed tax changes by the Senate Finance Committee. Compared to current law, the bill heavily skews benefits to the wealthy as a share of after-tax income. 1/

24.06.2025 04:52 — 👍 3 🔁 0 💬 2 📌 0Full recording of our discussion on risks to taxpayer privacy from DOGE & related efforts featuring Daniel Werfel, Lily Batchelder, Brandon DeBot, Elizabeth Laird, and David Padrino nyu.zoom.us/rec/share/IF...

03.06.2025 20:10 — 👍 3 🔁 2 💬 0 📌 1Looking forward to this discussion starting at 1:30 with Danny Werfel and cybersecurity, IT modernization, and tax policy experts!

03.06.2025 15:42 — 👍 1 🔁 0 💬 1 📌 0

On June 3, I'm moderating a panel for the @taxlawcenter.org on the privacy risks of unprecedented access / sharing of taxpayer data across government. We'll hear from Former IRS Commissioner Daniel Werfel plus Brandon DeBot, Elizabeth Laird & David Padrino. Please join! nyu.zoom.us/webinar/regi...

31.05.2025 00:33 — 👍 6 🔁 1 💬 0 📌 0

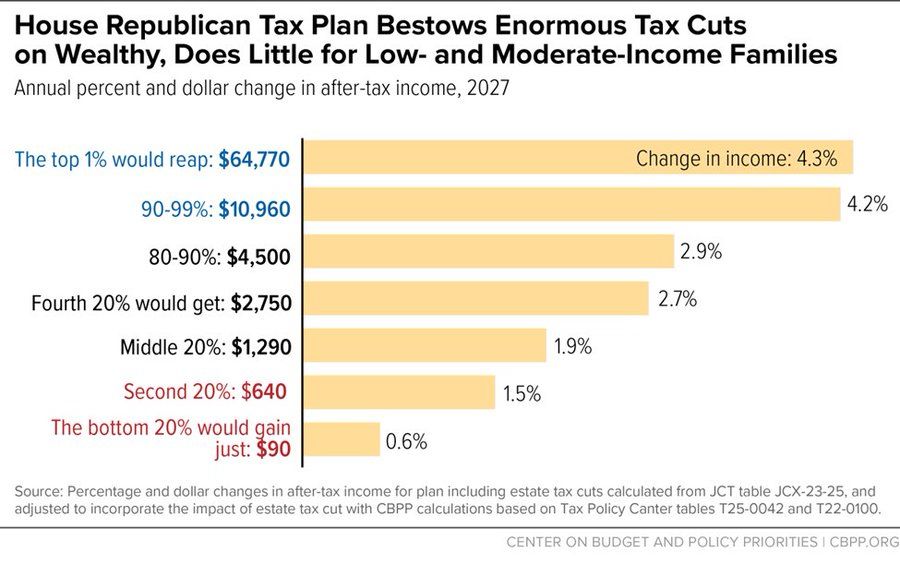

New @centeronbudget.bsky.social analysis of the draft GOP tax plan released yesterday:

Unsurprisingly, it provides enormous tax cuts for the wealthy—including an average annual $65k cut for the top 1%—while doing little for low- and moderate-income families in 2027 (and even less by 2029).

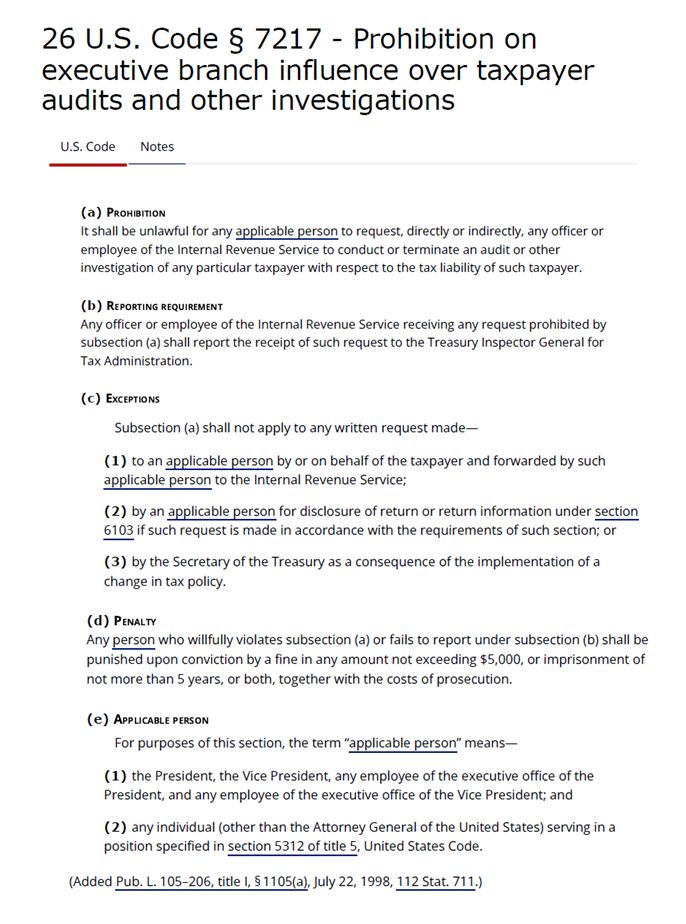

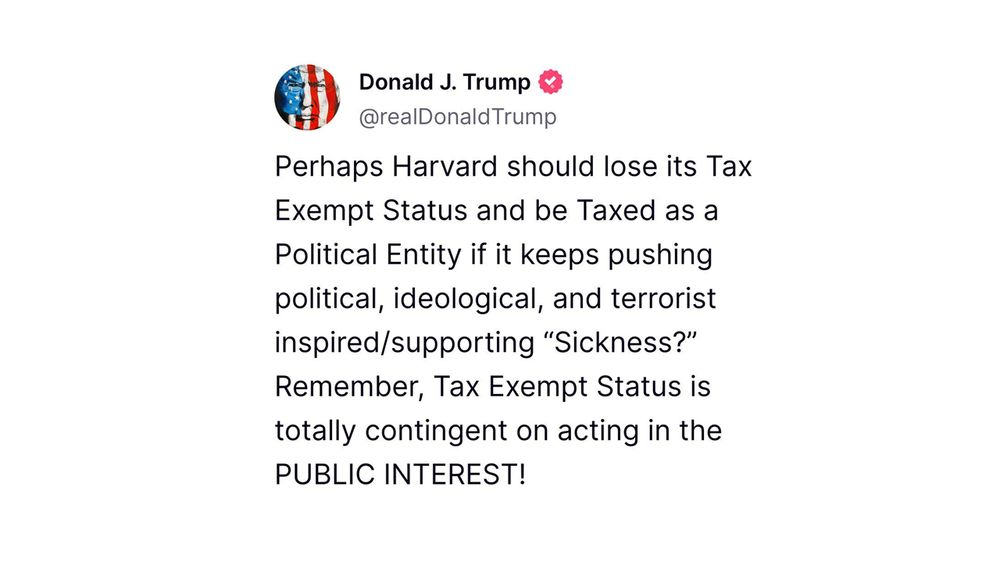

For more details on the law, see this Tax Law Center post. Overwhelming bipartisan majorities in Congress have enacted laws making it a crime for the President and his staff to request an audit or investigation of a particular taxpayer. 3/3 taxlawcenter.org/blog/irs-sta...

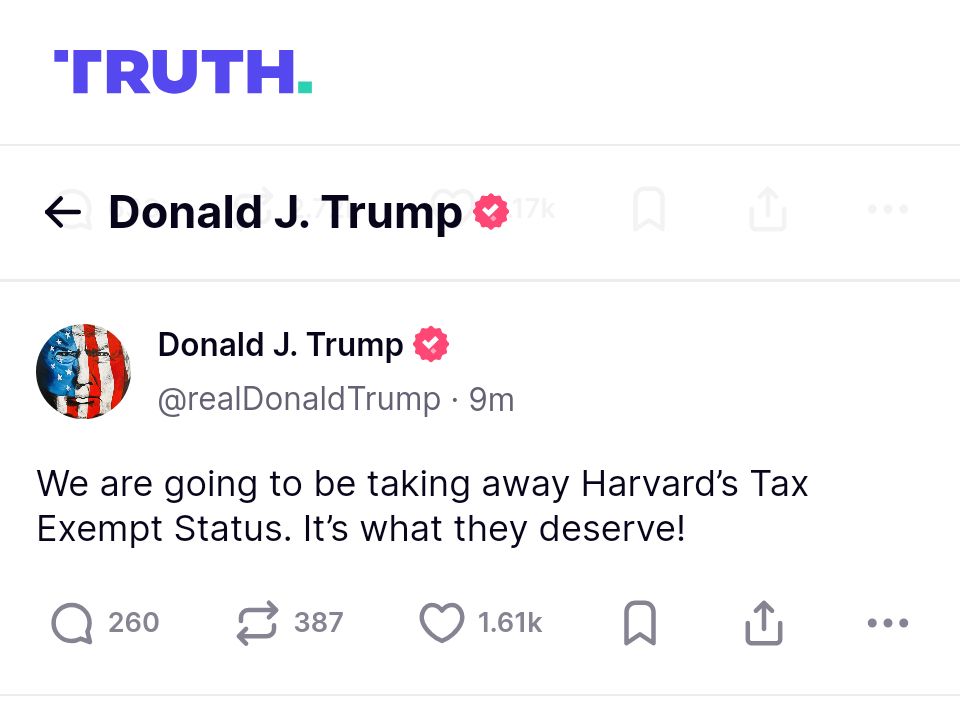

02.05.2025 16:10 — 👍 243 🔁 44 💬 1 📌 1If the President can announce that he is revoking the tax-exempt status of a charity, we have crossed a rubicon that has no clear end. What will stop him or any President from weaponizing the IRS to intimidate any political opponent or group he dislikes into silence? 2/3

02.05.2025 16:10 — 👍 473 🔁 87 💬 8 📌 3

The President just effectively signed a statement that he is committing a crime, violating a criminal statute enacted with overwhelming bipartisan majorities (it passed 96-2 in the Senate). Here is the law and his post. 1/3

02.05.2025 16:10 — 👍 2160 🔁 717 💬 74 📌 39

Harvard may not be at the top of most people’s list of favorite charitable causes, but if the President’s and WH's unlawful interference in IRS actions regarding specific TPs and charities isn’t stopped, it means he or any president can come for your church or community group.

22.04.2025 14:06 — 👍 16 🔁 7 💬 1 📌 0This violate the law (which was passed by a vote of 96-2 in the Senate in 1998) that makes it a crime for the President and his political advisors to directly or indirectly interfere in IRS audits or investigations. 11/11 medium.com/@taxlawcente...

20.04.2025 16:35 — 👍 10 🔁 2 💬 0 📌 0

Now R lawmakers are silent when the President – the most political actor of all! – is pressuring the IRS to revoke the tax exempt status of nonprofits he doesn’t like. 10/

20.04.2025 16:35 — 👍 5 🔁 3 💬 1 📌 0

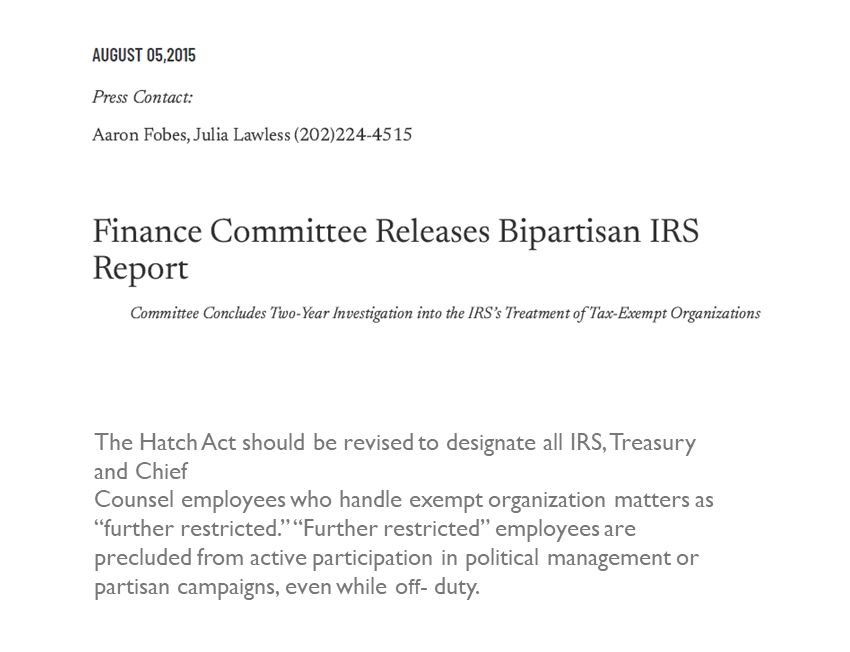

One of the recommendations from the bipartisan Senate Finance Committee report was that *anyone* with influence over whether and how tax exempts are reviewed and audited should be precluded from participating in political work, even when off-duty. 9/

20.04.2025 16:34 — 👍 4 🔁 1 💬 1 📌 0

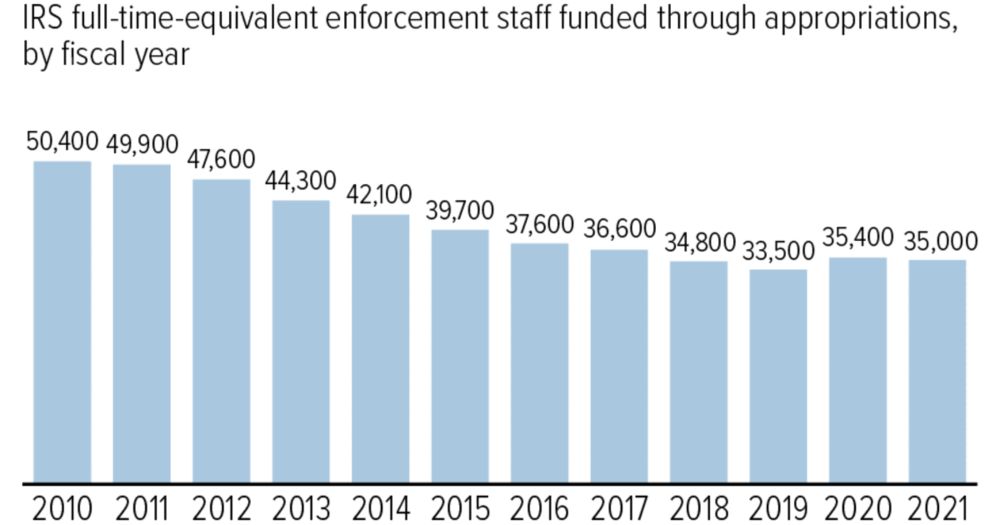

The IRS was defunded for a decade to a large extent in response. 8/ www.cbpp.org/charts/budge...

20.04.2025 16:34 — 👍 3 🔁 1 💬 1 📌 0Despite the fact that it is not crazy (except as a political matter) to select applications for tax exempt status for review about whether they intend to abide by lobbying limits if their name includes terms associated with electioneering, 7/

20.04.2025 16:34 — 👍 3 🔁 0 💬 1 📌 0Despite the fact that these weren’t even audits but rather keywords were used in triaging applications for tax-exempt status, 6/

20.04.2025 16:34 — 👍 2 🔁 0 💬 1 📌 0Despite the fact that there was no evidence of interference by political appointees (let alone the WH or President!), despite the fact that the IRS voluntarily disclosed this information without prompting, 5/

20.04.2025 16:33 — 👍 3 🔁 0 💬 1 📌 0The (R-appointed) Inspector General for Tax Administration and the bipartisan Senate Finance Committee report found that the IRS had also used liberal-coded keywords like “progressive” and “Occupy” to identify tax exempts for audit. 4/ www.tigta.gov/sites/defaul...

20.04.2025 16:33 — 👍 3 🔁 0 💬 1 📌 0

Rs and Ds on a *bipartisan* basis launched a multiyear investigation into the matter. 3/ www.finance.senate.gov/release/fina...

20.04.2025 16:33 — 👍 4 🔁 0 💬 1 📌 0In 2013, a nonpartisan career IRS official publicly shared that the IRS had selected some tax exempts for review about whether they were violating lobbying limits based on keywords like “Tea Party.” A firestorm ensued. 2/

20.04.2025 16:33 — 👍 5 🔁 0 💬 1 📌 0

The silence from Republican lawmakers re: Trump’s suggestions that IRS audit specific tax exempt orgs is deafening. Here’s a short history of how Rs and Ds responded to prior IRS reviews of tax exempts when *no* political appointees, let alone the President, were interfering. 1/

20.04.2025 16:32 — 👍 29 🔁 16 💬 3 📌 1