@hussmanjp.bsky.social

15.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0Ludwig Von Mises

@ludwigvonmises.bsky.social

Tu ne cede malis, sed contra audentior ito (@NationsWealth in other place)

@ludwigvonmises.bsky.social

Tu ne cede malis, sed contra audentior ito (@NationsWealth in other place)

@hussmanjp.bsky.social

15.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

John, this reminded me accounting rule FAS-157 by the Financial Accounting Standards Board.

cc @hussmanjp.bsky.social

(Money, Bank Credit, and Economic Cycles, J. Huerta De Soto)

15.11.2025 10:58 — 👍 0 🔁 0 💬 0 📌 0

15.11.2025 10:58 — 👍 0 🔁 0 💬 0 📌 0

15.11.2025 10:58 — 👍 0 🔁 0 💬 1 📌 0

15.11.2025 10:58 — 👍 0 🔁 0 💬 1 📌 0

15.11.2025 10:58 — 👍 0 🔁 0 💬 1 📌 0

15.11.2025 10:58 — 👍 0 🔁 0 💬 1 📌 0

John, this reminded me accounting rule FAS-157 by the Financial Accounting Standards Board.

cc @hussmanjp.bsky.social

(Money, Bank Credit, and Economic Cycles, J. Huerta De Soto)

Let's see how far it drops, Prof

@hussmanjp.bsky.social

how did you come up with 78?

14.11.2025 06:29 — 👍 1 🔁 0 💬 0 📌 0

cc @hussmanjp.bsky.social

13.11.2025 13:42 — 👍 0 🔁 0 💬 0 📌 0John, this has nothing to do with your research and kindness. It's just me having too much of this endless bubble.

12.11.2025 12:25 — 👍 0 🔁 0 💬 0 📌 0

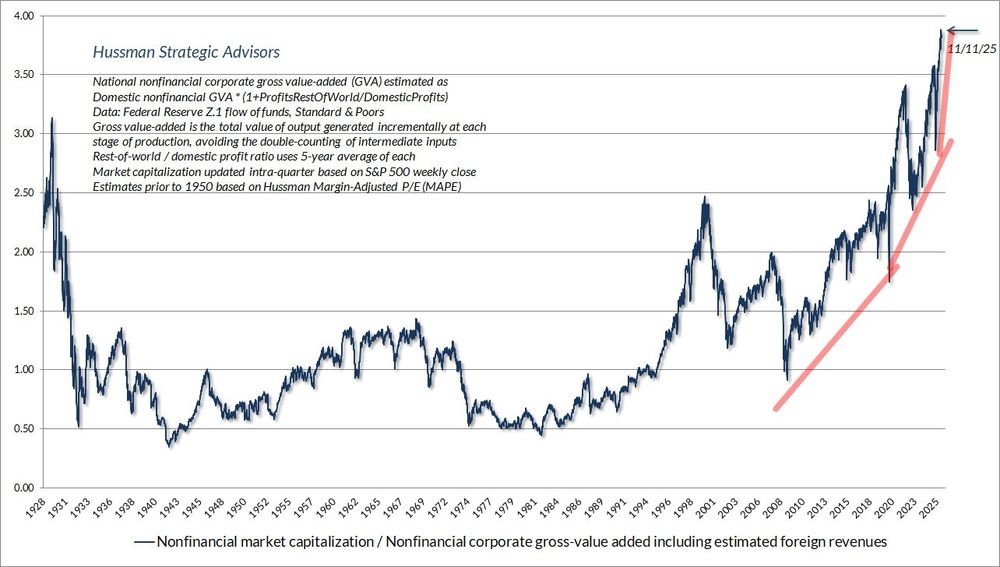

exponentially on a log scale. only the Fed could do it.

12.11.2025 09:47 — 👍 0 🔁 0 💬 0 📌 0

it will be another "buy the dip opportunity". We had so many in the last +10 years. Let's call it "The AI hiccup" ?

We've been trained as monkeys for decades to not fight the Fed & buy any dip.

QT is done now. Soon QE will be back. Brrr.. I know 'until investors are not risk adverse... yada yada'

The skyscraper curse. The cause is monetary expansion by central banks. The Fed in primis.

Source: Mises Institute share.google/pzHVCP4KO5JM...

ahahah

as Italian i want to be half as smart as derek and half as stilish

I'm tired of this bubble, John. I'm so tired of it.

@hussmanjp.bsky.social

even the weak bretton woods allow to restrict some monetary deranged policies. that being said, it was far from the honest gold standard.

09.11.2025 22:15 — 👍 0 🔁 0 💬 0 📌 0legend.

we all like to think we'd do the right thing but it sounds like this guy did

www.bbc.co.uk/news/article...

calpers too

lots of big boys coming out against it

Joshua's systems are flashing lights today

ps we are going to defcon 1

393

1.4 trillion company

oki doki...

The financial markets are raining duration.

03.11.2025 13:43 — 👍 12 🔁 1 💬 1 📌 0I cannot believe we had more than 10 years of these warning signs. Everything before GFC was quaint. Two years top in 2000. Asian Crisis and LTCM bail out and the Fed that cuts inducing a blow off top. It feels the same now. They are cutting into ATH and stopping QT.

02.11.2025 22:14 — 👍 2 🔁 0 💬 0 📌 0The bank lends $100 but it has only $10 as cash, $90 are IOUs. There are lots of IOU liabilities during an asset bubble, as the assets themselves are used as collateral to create new money to buy more assets.

30.10.2025 14:16 — 👍 1 🔁 0 💬 0 📌 0"With our broadest estimate of prospective S&P 500 10-year nominal total returns down to just 2.9%", 14 Oct 2013

ps we got 14% over 12-year

pps I'm convinced this bubble will end but I have been very wrong for a very long time too

cc @hussmanjp.bsky.social

www.hussmanfunds.com/wmc/wmc13101...

The stopped QT. This will not normilised any time soon. The way will be a sovereign debt crisis. Someday in the future.

@hussmanjp.bsky.social

What's the story of those dots? extreme valuation followed by poor results as expected

29.10.2025 17:44 — 👍 2 🔁 0 💬 0 📌 0John, did you try to calculate the density function of these dots? My guess is that the point (3.97, 5.5) is so far out on the right tail of the distribution to have a probability of 0.01% or 1-in-10,000 years event. We do not even have a dataset going back so much to cover it using only 100 years!

29.10.2025 17:09 — 👍 0 🔁 0 💬 1 📌 0but the incentive...the buydowns... the manufacturing machine...

28.10.2025 10:48 — 👍 1 🔁 0 💬 0 📌 0hmm can the ponzi exist with Mr Charles Ponzi?

27.10.2025 17:08 — 👍 0 🔁 0 💬 1 📌 0

Stop trying to sweeten the deal, Andrew. I'm already voting for Zohran!

26.10.2025 23:54 — 👍 16100 🔁 2437 💬 1292 📌 276