Key takeaway: short-run macroeconomic dynamics matter for climate outcomes.

The model offers a flexible framework to explore economy-ecology feedbacks - and to test policies for faster, more effective decarbonization.

Read it here: doi.org/10.1016/j.st...

09.06.2025 12:52 —

👍 0

🔁 0

💬 0

📌 0

🌍 The model is simulated using U.S. data.

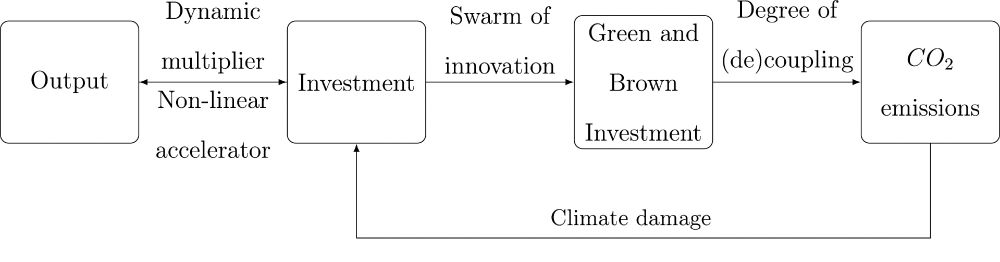

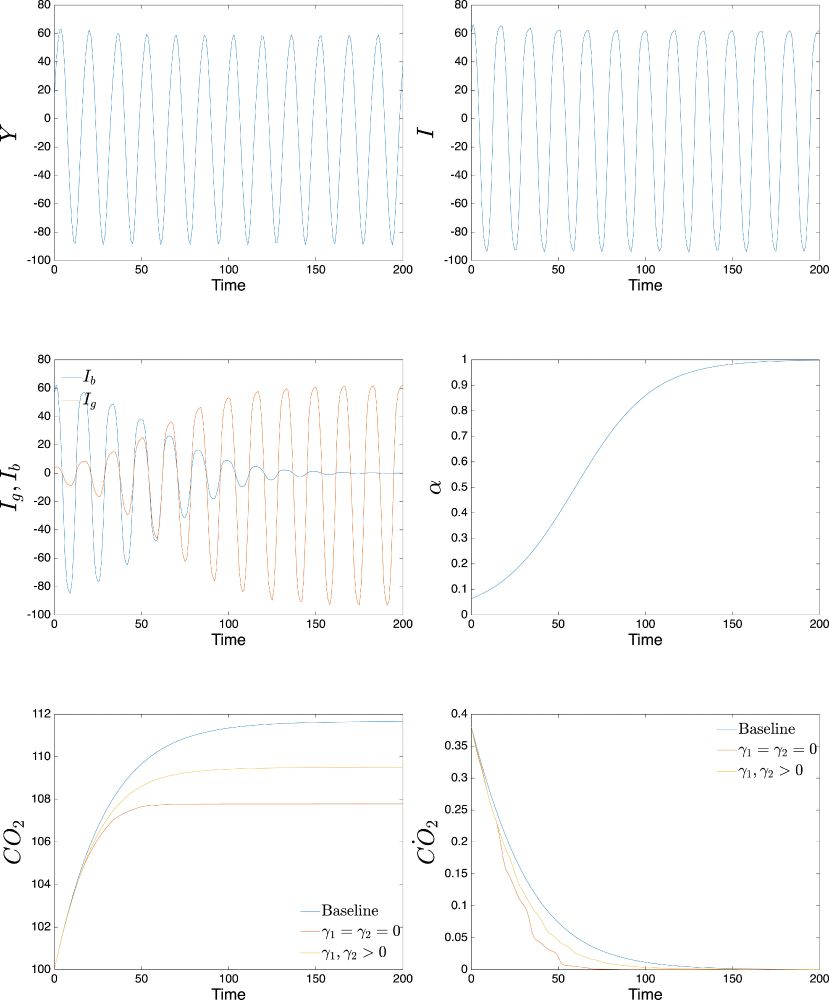

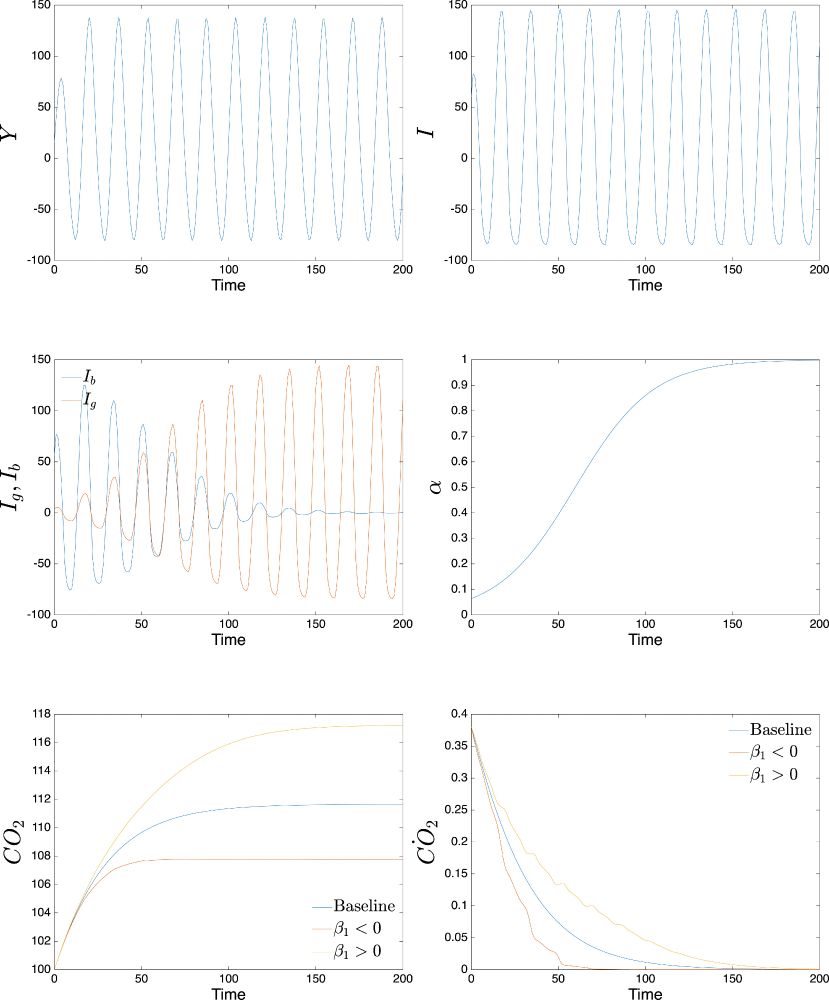

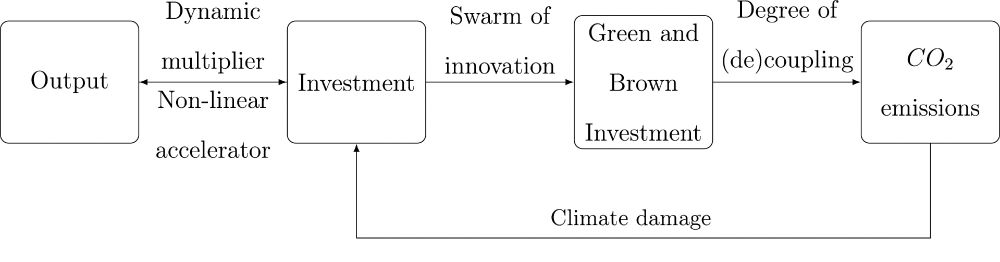

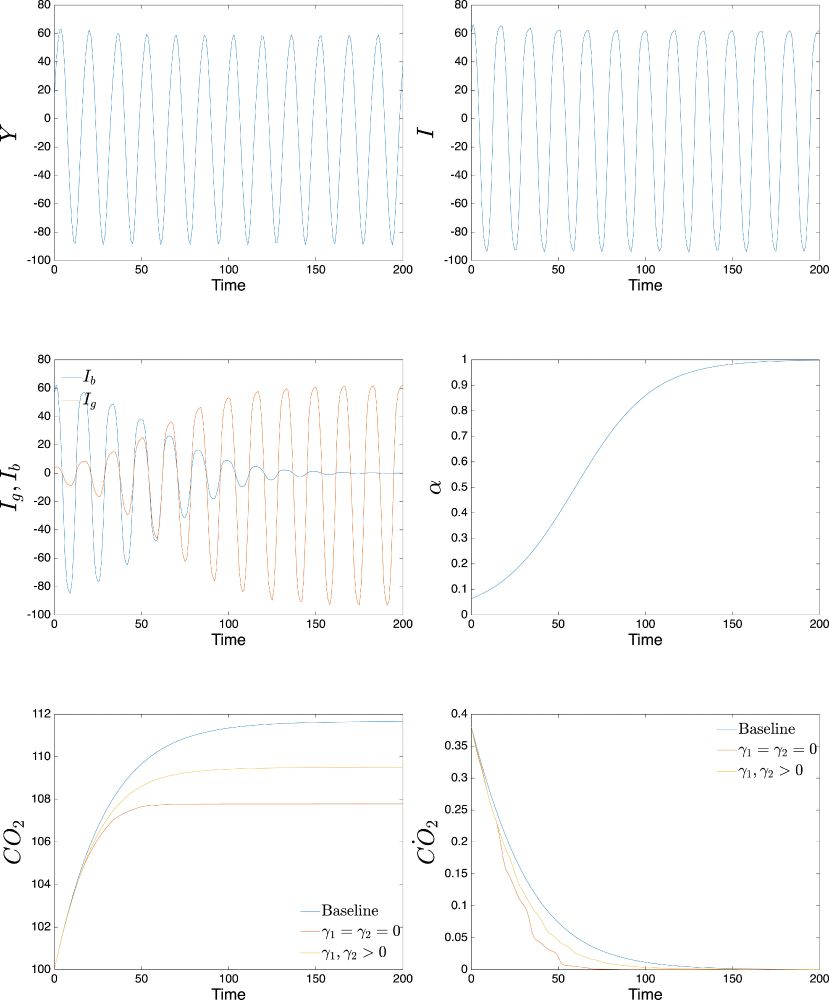

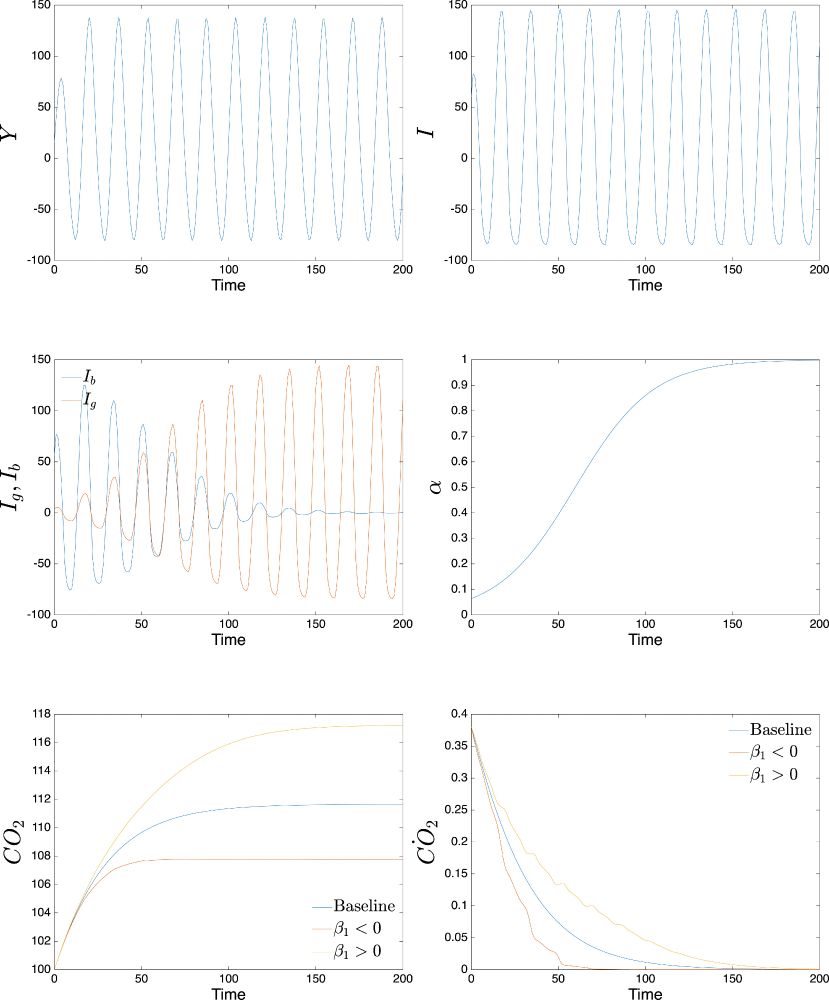

📉 When climate damages are introduced (e.g. via extreme events), they dampen booms and sharpen downturns, limiting the positive impact of the green transition.

5/

09.06.2025 12:52 —

👍 0

🔁 0

💬 1

📌 0

🔧 The model allows for both coupling and decoupling between GDP and emissions, capturing dynamics observed in advanced vs. emerging economies.

4/

09.06.2025 12:52 —

👍 0

🔁 0

💬 1

📌 0

🟢 Green investment can be either emissions-reducing or emissions-enhancing, depending on timing, scale, and the interaction with business cycle and emission dynamics.

3/

09.06.2025 12:52 —

👍 0

🔁 0

💬 1

📌 0

The paper builds on Goodwin’s 1951 business cycle model, modeling the transition from brown to green investment as a logistic diffusion process.

This allows to explore the procyclical behavior of emissions and the conditions for (de)coupling.

2/

09.06.2025 12:52 —

👍 0

🔁 0

💬 1

📌 0

What are the effects of transitioning to green investment on business cycles and CO₂ emissions?

Most climate-economic models focus on long-run dynamics.

This paper tackles a missing link: the short-run interaction between green investment, emissions, and business cycles.

1/

09.06.2025 12:52 —

👍 0

🔁 0

💬 1

📌 0

📢📢 New Publication 📢📢

"Reduction of CO₂ emissions, climate damage and the persistence of business cycles: A model of (de)coupling"

📘 Structural Change and Economic Dynamics @SCEDjournal

🔗 sciencedirect.com/science/arti... (OPEN ACCESS)

A thread below 🧵

09.06.2025 12:52 —

👍 1

🔁 0

💬 1

📌 0

Solar (photovoltaic) panel prices have declined from $130.7 per watt in 1975 to 0.31$ today (-99.8%).

08.06.2025 10:40 —

👍 14

🔁 7

💬 1

📌 0

The result?

A trend-cum-cycle model where fluctuations persist endogenously, while long-run growth remains demand-led.

This bridges business cycle theory with supermultiplier models! 🔄📈

#MacroEcon #BusinessCycles #EconomicGrowth

3/3

03.06.2025 08:12 —

👍 0

🔁 0

💬 0

📌 0

The paper deals with the question of how to reconcile short-run cycles with long-run growth in a unified framework.

I develop a model showing how investment-driven cycles can work alongside autonomous demand-led growth.

2/3

03.06.2025 08:12 —

👍 0

🔁 0

💬 1

📌 0

🚨 Open access publication alert (AND FIRST POST ON BLUESKY)! 🚨

🧵 Excited to share my new paper just published in Metroeconomica:

“Kaldor, Hicks and Goodwin Meet the Supermultiplier: On Growth Cycles and Autonomous Demand”

🔗 doi.org/10.1111/meca...

1/3

03.06.2025 08:12 —

👍 1

🔁 1

💬 1

📌 0

Wood and biofuel still lead renewable energy production in the US today, not solar or wind—is featured in today’s Chartbook Top Link. Visit the link in the comment for more insights.

11.04.2025 19:30 —

👍 31

🔁 3

💬 3

📌 0