The U.S. Supreme Court kicked off a new term today. Every American with a bank account, credit card, mortgage loan, or any other financial product or service is impacted by—and has to care about—the Supreme Court’s decisions.

06.10.2025 21:12 — 👍 1 🔁 0 💬 1 📌 0

The SEC Must Not Kill The CAT | Better Markets

Introduction On May 6, 2010, nearly $1 trillion of stock market value was temporarily lost.[1] Some stocks inexplicably plummeted to $1 per share while others skyrocketed to more than $100,000 per sha...

13 years ago today, the SEC's rule requiring a consolidated audit trail (CAT) took effect. The CAT makes our securities markets safer and is an important tool for investor protection. But now, the SEC and its industry allies are trying to kill the CAT. bettermarkets.org/analysis/the...

01.10.2025 19:32 — 👍 1 🔁 0 💬 0 📌 0

Why Corporate America Is Caving to Trump

“It’s astonishing how spineless the masters of the universe and big bad billionaires really are. If they’re going to cravenly capitulate over the independence of the Fed, it’s pretty clear they will not stand up for anything.” -@denniskelleher.bsky.social @nytimes.com www.nytimes.com/2025/09/26/b...

26.09.2025 20:06 — 👍 0 🔁 0 💬 0 📌 0

![Groundhog Day

There is a tragic throughline running through this long-running script: financial industry leaders blow past legal guardrails, citing that their technological innovations cannot possibly be cabined in by outmoded rules created by a previous generation. Regulatory and law enforcement officials are under-resourced and out-gunned even at times when they have the best intentions for fulfilling the public interest. Other times, these officials are captured by the very industries they're tasked to police. In either case, industries are too often able to establish economic power through their noncompliance with existing law and translate it into political power to rewrite the rules to bless their business models. This noncompliance in the face of clear existing legal precedent creates the very "uncertainty" that the industry points to as a justification to change the law. And the final rhetorical move is to invoke international competitiveness, hoping to scare lawmakers into believing that a failure to bend the law to an industry's favor will harm U.S. industries, jobs and growth.

Crypto has memorized this script and is reading their lines in an Oscar-worthy performance to many policymakers. Congressional hearings bemoan the "legal uncertainty" caused by applying longstanding laws to arrangements that look a lot like pre-existing investment schemes but are digital or blockchain-based. Crypto industry petitions to federal agencies say that Great Depression-era laws "[prevent] market participants from leveraging the efficiencies new technology can offer."](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:32lvgu3krzhhw3h6k3pme72r/bafkreih6mirekxauy353h5w7jg2qg4cxkbf4lcl25dzqhiicoejnd2wkou@jpeg)

Groundhog Day

There is a tragic throughline running through this long-running script: financial industry leaders blow past legal guardrails, citing that their technological innovations cannot possibly be cabined in by outmoded rules created by a previous generation. Regulatory and law enforcement officials are under-resourced and out-gunned even at times when they have the best intentions for fulfilling the public interest. Other times, these officials are captured by the very industries they're tasked to police. In either case, industries are too often able to establish economic power through their noncompliance with existing law and translate it into political power to rewrite the rules to bless their business models. This noncompliance in the face of clear existing legal precedent creates the very "uncertainty" that the industry points to as a justification to change the law. And the final rhetorical move is to invoke international competitiveness, hoping to scare lawmakers into believing that a failure to bend the law to an industry's favor will harm U.S. industries, jobs and growth.

Crypto has memorized this script and is reading their lines in an Oscar-worthy performance to many policymakers. Congressional hearings bemoan the "legal uncertainty" caused by applying longstanding laws to arrangements that look a lot like pre-existing investment schemes but are digital or blockchain-based. Crypto industry petitions to federal agencies say that Great Depression-era laws "[prevent] market participants from leveraging the efficiencies new technology can offer."

Important explanation by @bettermarkets.bsky.social of how the crypto industry is reusing the same bogus “technological advancement” hype that Citigroup circa 1999 to gut key financial market protections.

Past is prologue. We should heed its lessons: bettermarkets.org/wp-content/u...

25.09.2025 19:44 — 👍 13 🔁 3 💬 0 📌 1

Jared Bernstein, Former Chair of the President’s Council of Economic Advisors, is closing out the State of Economic and Financial Policymaking Conference with a keynote address.

19.09.2025 20:29 — 👍 14 🔁 2 💬 1 📌 0

.jennifertaub.com, BMAAB Co-Chair & Prof. of Law, Wayne State University joins Anat Admati, Prof. of Finance and Economics, Stanford GSB; Hilary Allen, Prof., American University College of Law; and Patricia McCoy, Professor of Law, BC Law School to discuss financial "innovation & distortion."

19.09.2025 19:47 — 👍 4 🔁 0 💬 0 📌 0

.@simonhrjohnson.bsky.social, Co-Chair, Better Markets Academic Advisory Board & MIT Prof. of Global Economics & Management discusses financial stability w/ Art Wilmarth, GW Prof Emeritus of Law & Gerald Epstein, UMass-Amherst Prof. of Economics & Founding Co-Dir., Political Economy Research Inst.

19.09.2025 18:18 — 👍 1 🔁 1 💬 0 📌 0

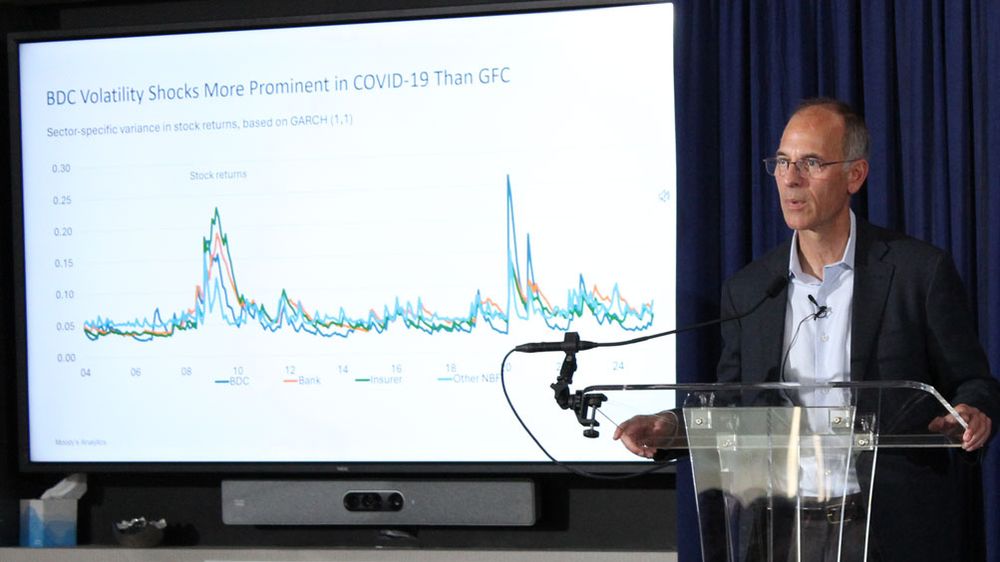

"The shape of the financial system has shifted from where it was in the Great Financial Crisis, from a bank-centric hub-and-spoke system with the banks in the middle and everyone else around the periphery to more of a web, with private credit more central in that web." - @markzandi.bsky.social

19.09.2025 17:36 — 👍 10 🔁 5 💬 0 📌 0

Antonio Weiss, Former Counselor to the Secretary of the United States Treasury and Partner, SSW Partners LP offers joint keynote on private credit and systemic risk with @markzandi.bsky.social, Chief Economist, Moody’s Analytics. Watch now: tinyurl.com/BMAAB2025

19.09.2025 17:14 — 👍 1 🔁 1 💬 1 📌 0

Better Markets COO and Policy Director @amandalfischer celebrates the impactful work of scholars within the Better Markets academic network, including Academic Advisory Board Co-Chair @baselinescene, awarded the 2024 Nobel Prize in Economics. tinyurl.com/BMAABAbout

19.09.2025 16:08 — 👍 2 🔁 1 💬 0 📌 0

Kate Judge, Co-Chair, Better Markets Academic Advisory Board & Columbia Law Prof. joins @jeremykress.bsky.social, Assoc. Professor U-M Business and Co-Faculty Dir. U-M Ctr on Finance, Law & Policy; @skandaamarnath.bsky.social, Exec. Dir. @employamerica.bsky.social to discuss what's next for the Fed.

19.09.2025 14:56 — 👍 4 🔁 3 💬 0 📌 0

Thomas Ferguson, Professor Emeritus, University of Massachusetts Boston, offers a research update on "Crypto's Political Economy." Follow along here: t.co/rz5QC1yzZC

19.09.2025 14:33 — 👍 5 🔁 2 💬 0 📌 0

Today's State of Economic & Financial Policymaking Conference is underway with a keynote address from SEC Commissioner Caroline Crenshaw. Tune in now! tinyurl.com/msukfkd4

19.09.2025 14:11 — 👍 1 🔁 1 💬 1 📌 0

This week! Join us on Friday, September 19 for the State of Economic & Financial Policymaking Conference, hosted by our Academic Advisory Board—bold ideas, expert panels. bettermarkets.org/analysis/bet...

16.09.2025 19:42 — 👍 0 🔁 0 💬 0 📌 1

One week away: the State of Economic & Financial Policymaking Conference. Hear panels and keynotes with bold ideas, expert insights, and collaborative dialogue on the future of economic and financial policymaking. Register here: bettermarkets.org/analysis/bet...

12.09.2025 19:57 — 👍 1 🔁 0 💬 0 📌 0

Create and share social media content anywhere, consistently.

Built with 💙 by a global, remote team.

⬇️ Learn more about Buffer & Bluesky

https://buffer.com/bluesky

Director of Banking Policy at Better Markets

Law professor & author of BIG DIRTY MONEY and OTHER PEOPLE’S HOUSES

Host of LIVE morning news show https://www.youtube.com/@jentaub

pragmatic, progressive, multidisciplinary creative, data scientist & full stack dev. occasional avid beach goer.

🔗 https://marko.tech 🏠 https://startyparty.dev

VP, Financial Services @ CFRA Washington Analysis. Longtime DC finreg and econ policy guy; history buff, tortured MN sports fan, Fargo native. #Timberwolves; opinions my own

Personal account. Run Revolving Door Project (@revolvingdoordc.bsky.social) & co-manage my son's athletic career. https://revolvingdoorproject.substack.com

We post the main Bluesky trending topics in the world every 30 minutes. There are usage tips in the pinned post. @terraprotege.bsky.social 🌱🌎

💪 💪🏾💪🏻 💙 💚 ♥️ 🗽🦅🌏 ✊🔥🇺🇸

Now more than ever, civil servants need your support. No matter your political views, we all depend on their dedication and hard work every day.

savecivilservice.org to

SUPPORT AND REP THE CAUSE

#DrainTheDOGE #SaveCivilService

Financial Opinion Editor at the FT. I have views. A spotter of things in markets, companies, world affairs. Also interested in food and climbing.

"Minds are like parachutes-they only function when open."

T Dewar.

Joined BSky 01/07/24

Liberal Progressive #Resist

Equality. LGBTQ & Women rights, Justice reform, Married, ✝️TEC!

No Bio, No Post = No Follow

🚫MAGA 🚫Porn 🚫DM's https://discord.gg/zeGbxVtX

📎Twitter refugee #StandWithUkraine 🇺🇦Lover of Democracy;🏳️🌈 Ally; BLM ✊🏽 ; #girlmom x 2; MND (PLS) caregiver to my hubby

Keeper Of Flame For Democracy!

My wife is a breast cancer survivor.

He/Him 🔷 Politics 🔷 News

Defanged by weaponized block lists.

Help share posts for me?

http://McSpocky.blue

Starter Pack: https://bsky.app/profile/mcspocky.bsky.social/post/3lgtkoekcok2u

The Freedom Writers Collaborative is a multi-state Indivisible Group and a grass roots operation providing messaging and social media content inspired by our progressive allies.

https://freedomwriterscollaborative.org

The voice of progressives in Congress since 1991. Fighting for working families over corporate interests. Advancing racial and social justice. Working for peace. ✊

We are a group of journalists & scholars in policy & economics working at the vanguard of antimonopoly to achieve victories that empower everyone. Learn more: openmarketsinstitute.org

Big ideas for consumer justice and power in New York. Subscribe at empirewatch.substack.com. It's free!

Federal worker just trying to do my job for the American people. Member of @nteu335.bsky.social.

The climate crisis is here and your money is likely funding it. Check your bank and discover sustainable options with our simple tools: http://bank.green.

Labor econ @upjohninstitute.bsky.social & @IZA.org. Formerly senior economist for labor at White House CEA, UMinn prof, union organizer, bike courier, house painter, dishwasher... Minneapolis. Views mine.

aaronsojourner.org

Be kind • Work hard • Have fun

Consumer, environmental, economic and social justice advocate. Day job is Programs Director, Advocacy at Consumer Reports. My posts are my own.

![Groundhog Day

There is a tragic throughline running through this long-running script: financial industry leaders blow past legal guardrails, citing that their technological innovations cannot possibly be cabined in by outmoded rules created by a previous generation. Regulatory and law enforcement officials are under-resourced and out-gunned even at times when they have the best intentions for fulfilling the public interest. Other times, these officials are captured by the very industries they're tasked to police. In either case, industries are too often able to establish economic power through their noncompliance with existing law and translate it into political power to rewrite the rules to bless their business models. This noncompliance in the face of clear existing legal precedent creates the very "uncertainty" that the industry points to as a justification to change the law. And the final rhetorical move is to invoke international competitiveness, hoping to scare lawmakers into believing that a failure to bend the law to an industry's favor will harm U.S. industries, jobs and growth.

Crypto has memorized this script and is reading their lines in an Oscar-worthy performance to many policymakers. Congressional hearings bemoan the "legal uncertainty" caused by applying longstanding laws to arrangements that look a lot like pre-existing investment schemes but are digital or blockchain-based. Crypto industry petitions to federal agencies say that Great Depression-era laws "[prevent] market participants from leveraging the efficiencies new technology can offer."](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:32lvgu3krzhhw3h6k3pme72r/bafkreih6mirekxauy353h5w7jg2qg4cxkbf4lcl25dzqhiicoejnd2wkou@jpeg)