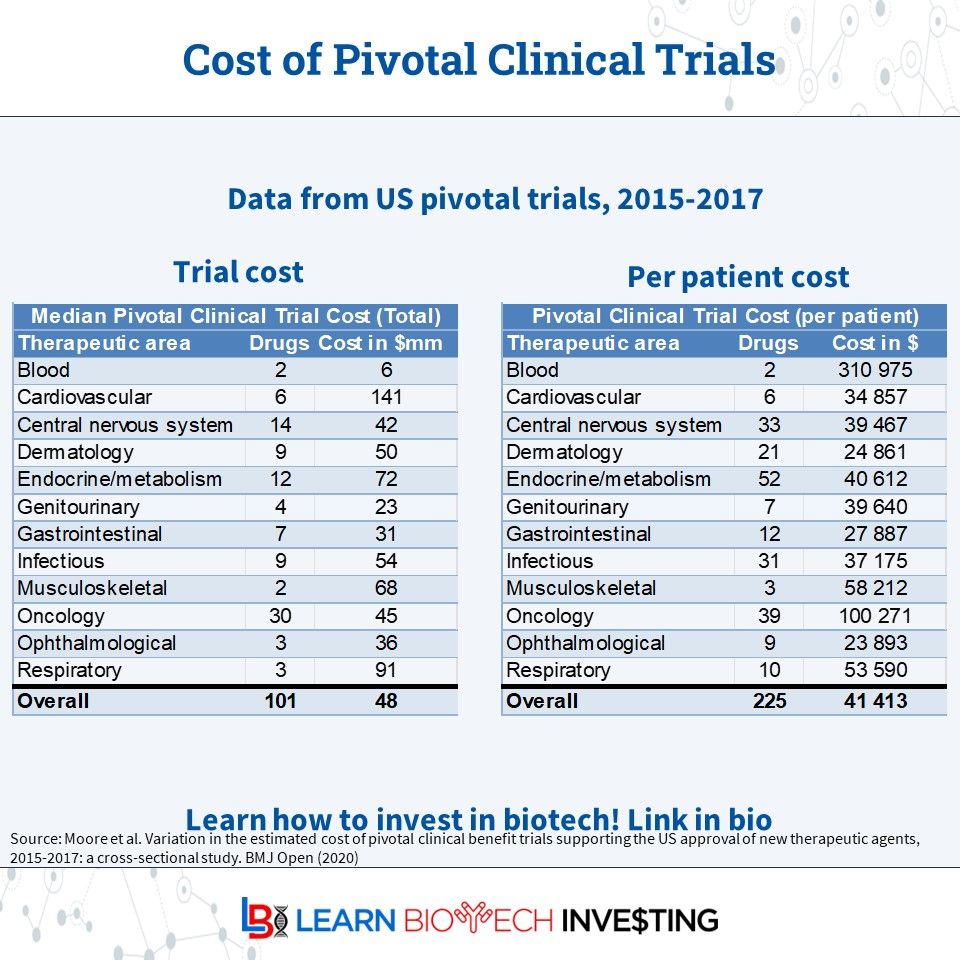

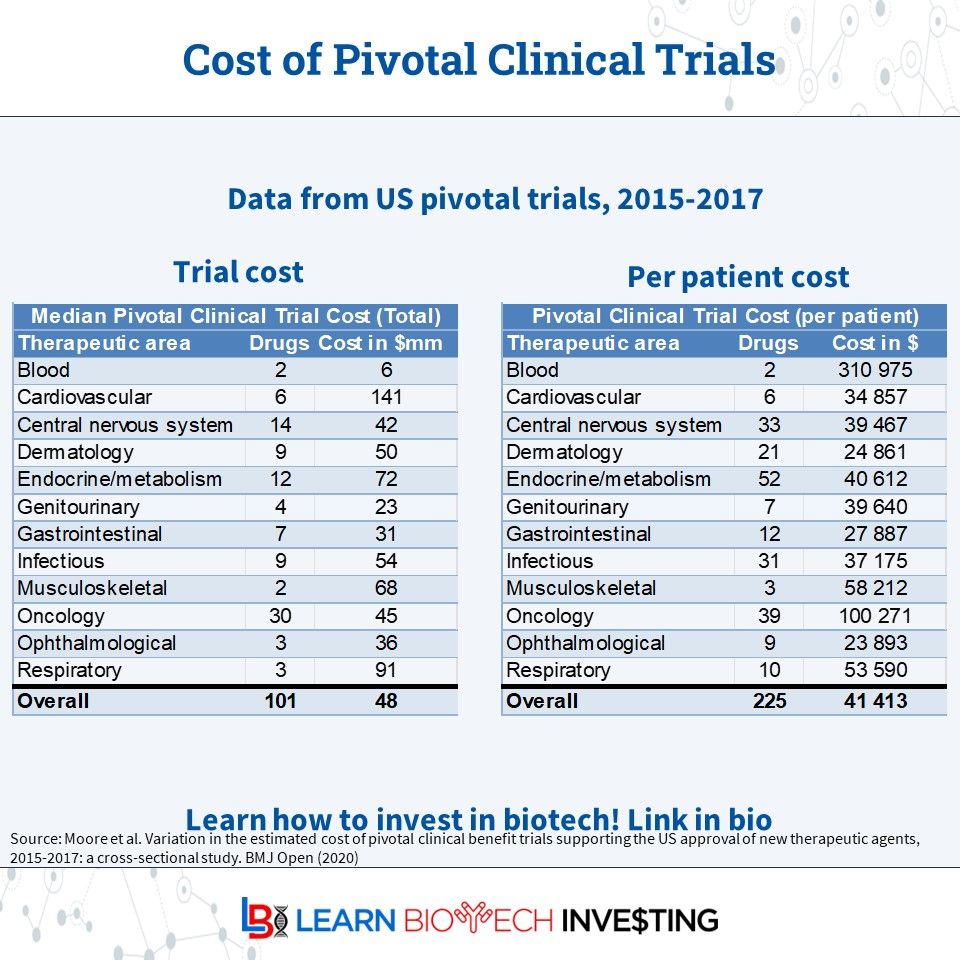

Here's some data for #investors when trying to benchmark the costs of pivotal clinical trials (2015-2017)

You can see it varies by Therapeutic Area

Remember, good clinical trials CANNOT be done on the cheap!

If anyone has updated numbers, please share!!!

#learnbiotechinvesting #BiotechPrometheus

07.12.2025 16:19 — 👍 0 🔁 0 💬 0 📌 0

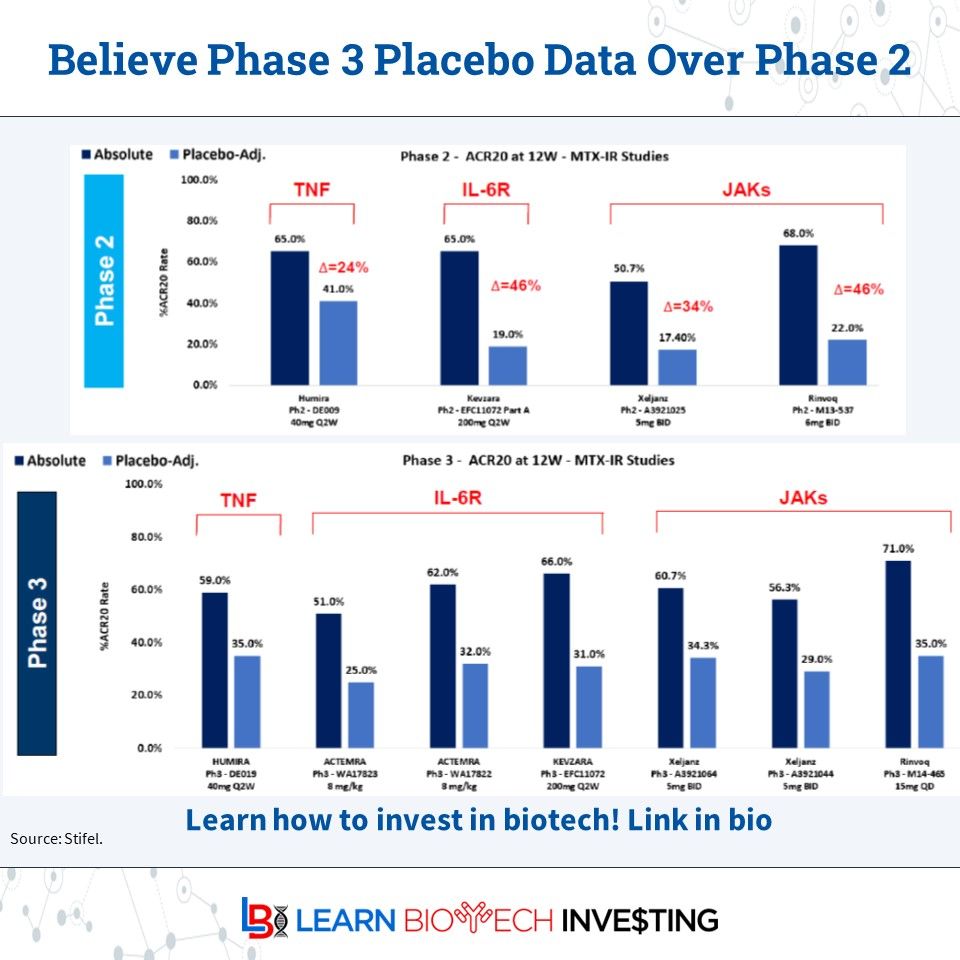

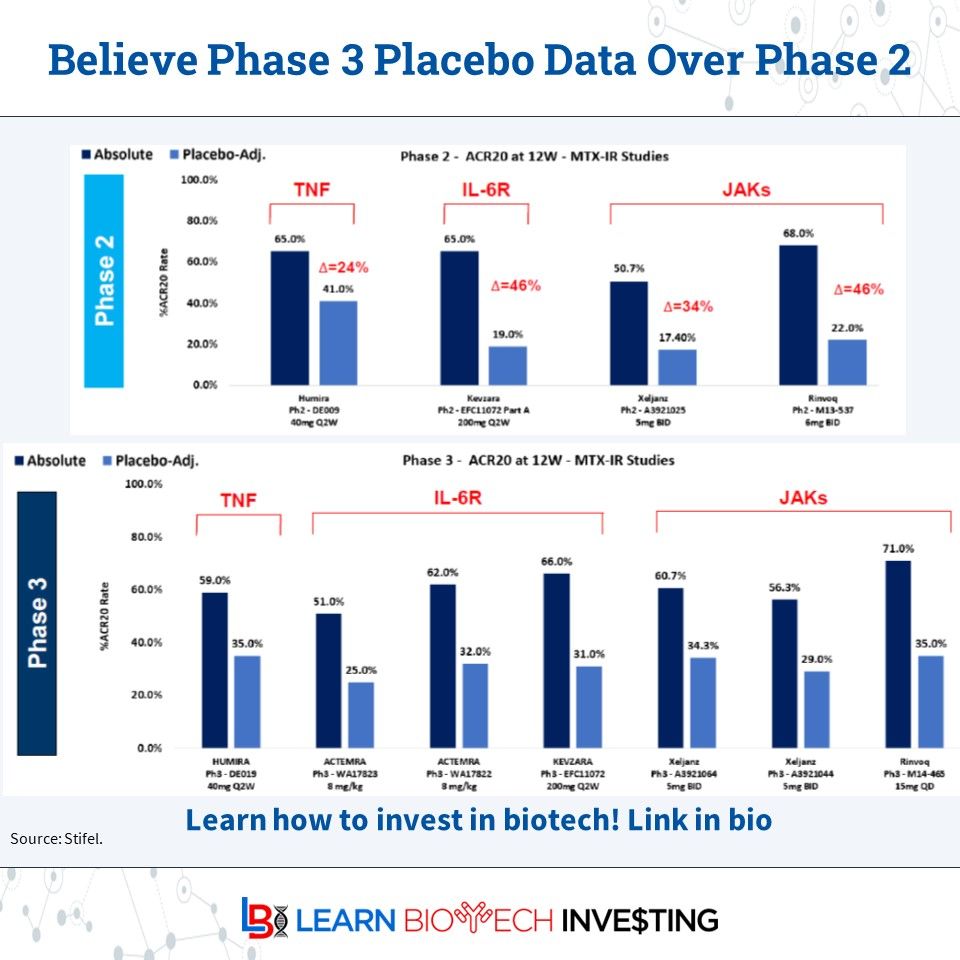

Another reason a P3 study can fail while a P2 was successful is that P2 placebo groups, with narrower eligibility criteria & fewer patients, often have more variable placebo-adjusted effects

Use Phase 3 data, often on drug labels, to make comparisons; They're more consistent

#learnbiotechinvesting

06.12.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

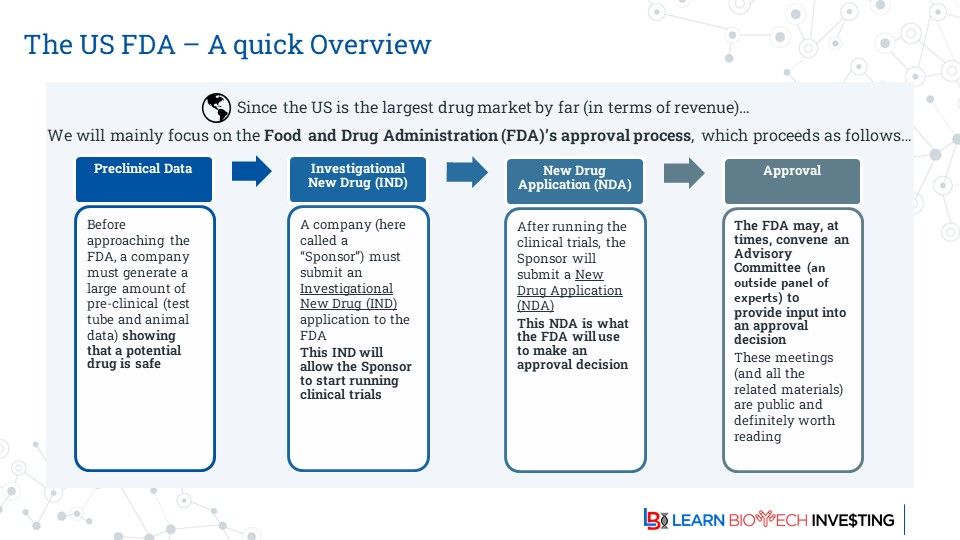

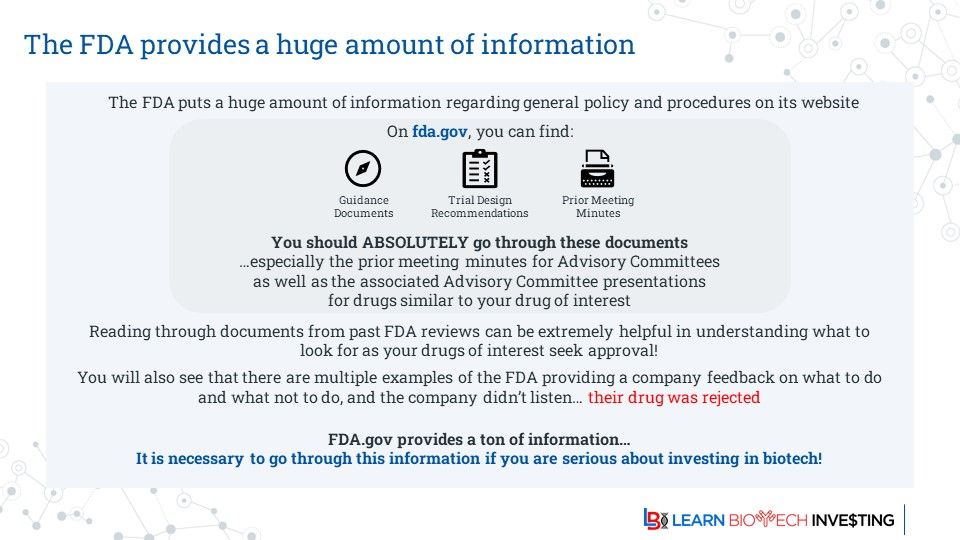

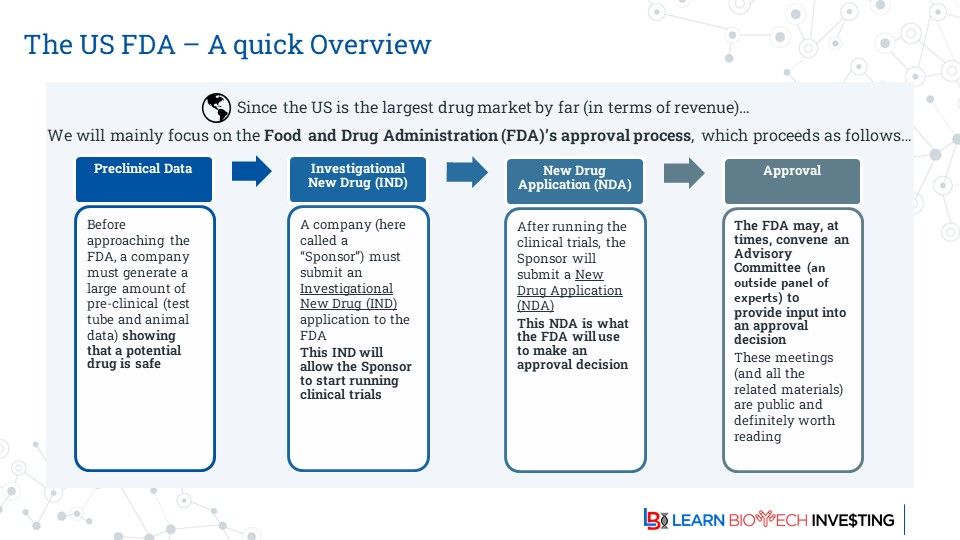

Investors should understand the #FDA regulatory process well. Here is a quick summary

At each step investors should ask themselves if the company is developing things in a way that will satisfy the FDA

Until a drug is approved the FDA is the most important decision maker

#BiotechPrometheus

05.12.2025 10:01 — 👍 0 🔁 0 💬 0 📌 0

Investors should note forecasters believe #ProbabilityOfSuccess across drug discovery will improve drastically (over 2x) versus existing success rates as AI-powered drugs go through the approval process

What do you think?

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

04.12.2025 11:00 — 👍 1 🔁 0 💬 0 📌 0

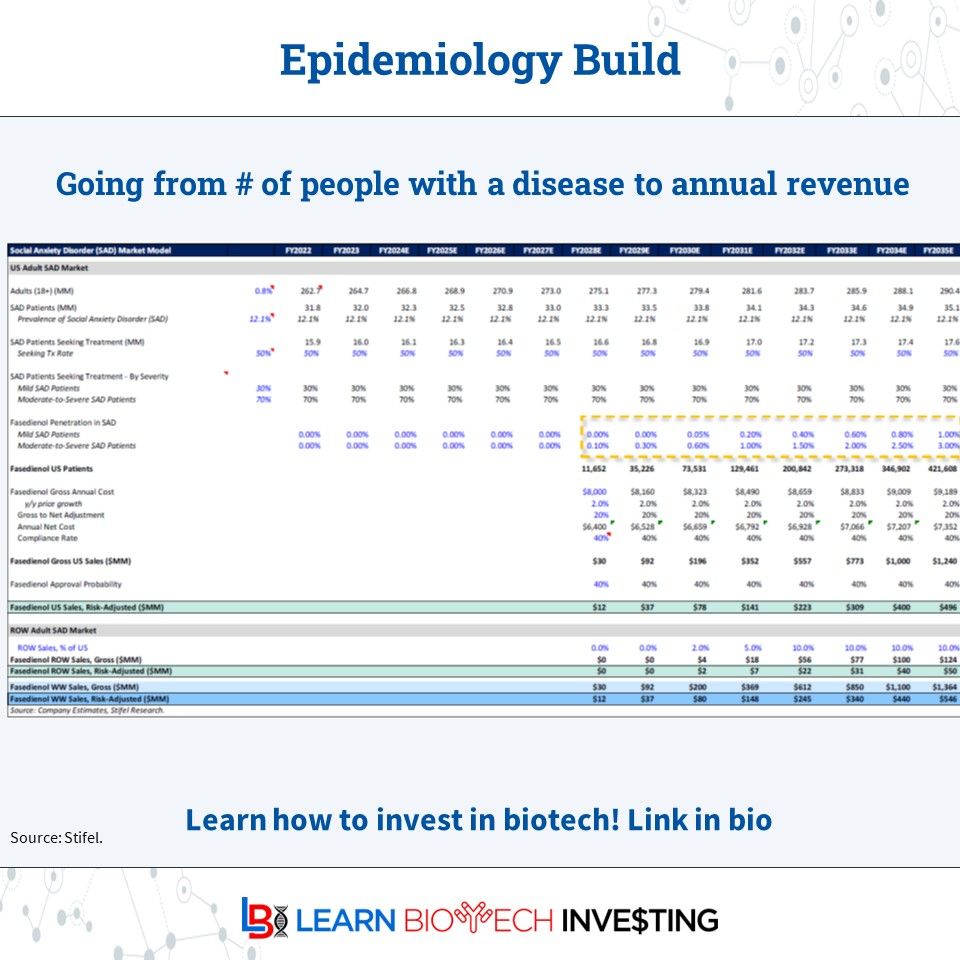

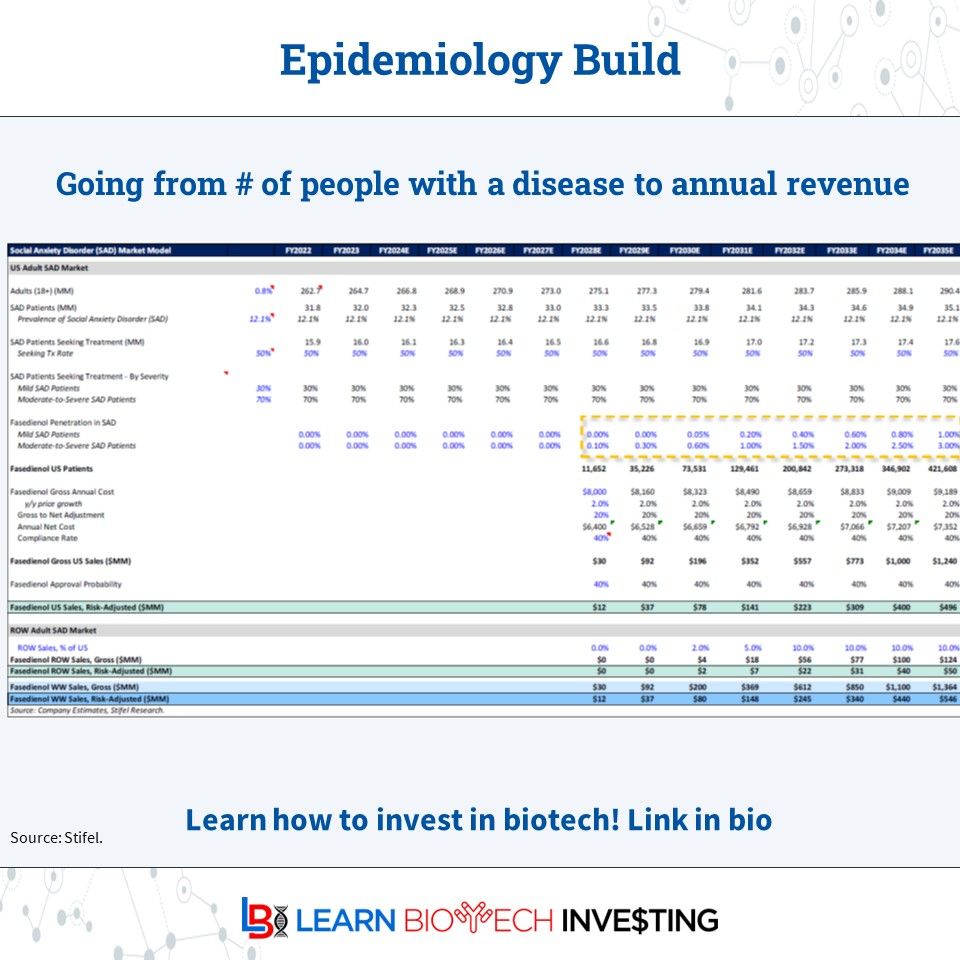

An important model for biotechs is an epidemiology build: an #epibuild

It takes a disease prevalence (or incidence) and turns it into annual revenue. This is what is plugged into other models

Here's an example:

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

02.12.2025 11:01 — 👍 0 🔁 0 💬 0 📌 0

A key factor in understanding how a biotech drug is reimbursed is assessing where it sits on the formulary (its position)

This is a drastic simplification but useful to know

Be aware of the perverse incentives #PBM

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

30.11.2025 14:10 — 👍 0 🔁 0 💬 0 📌 0

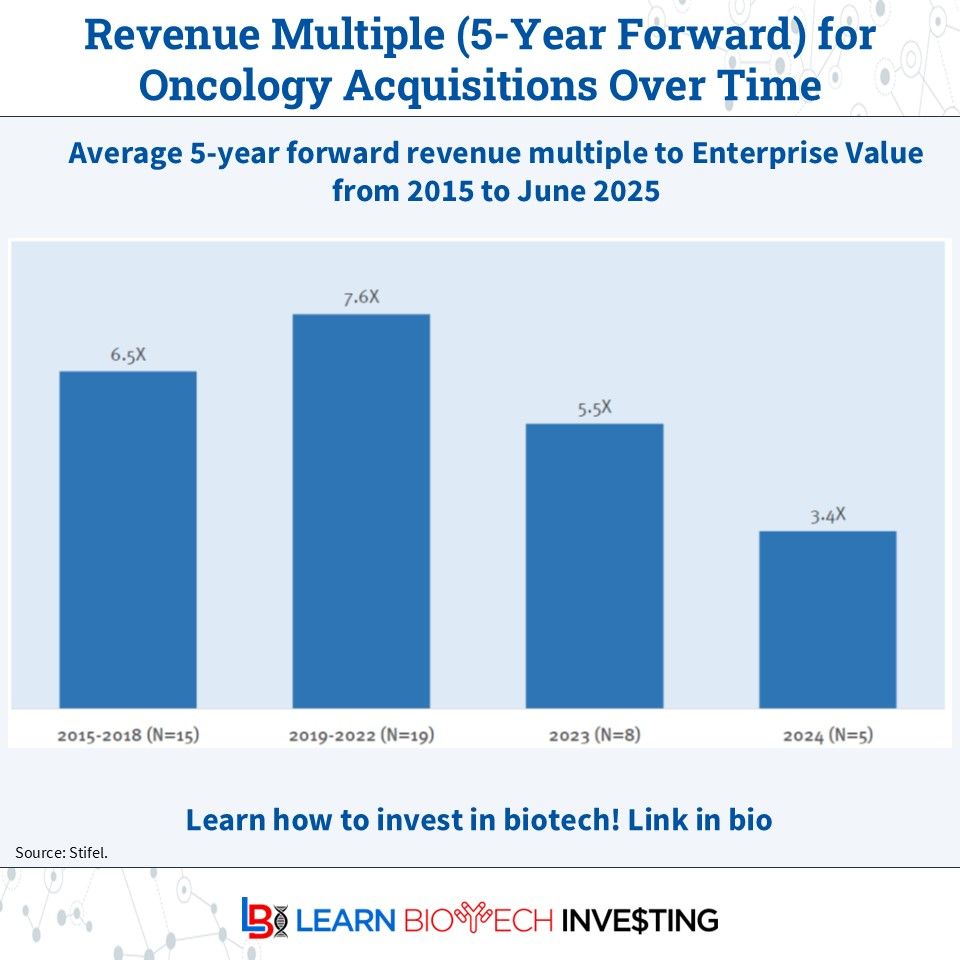

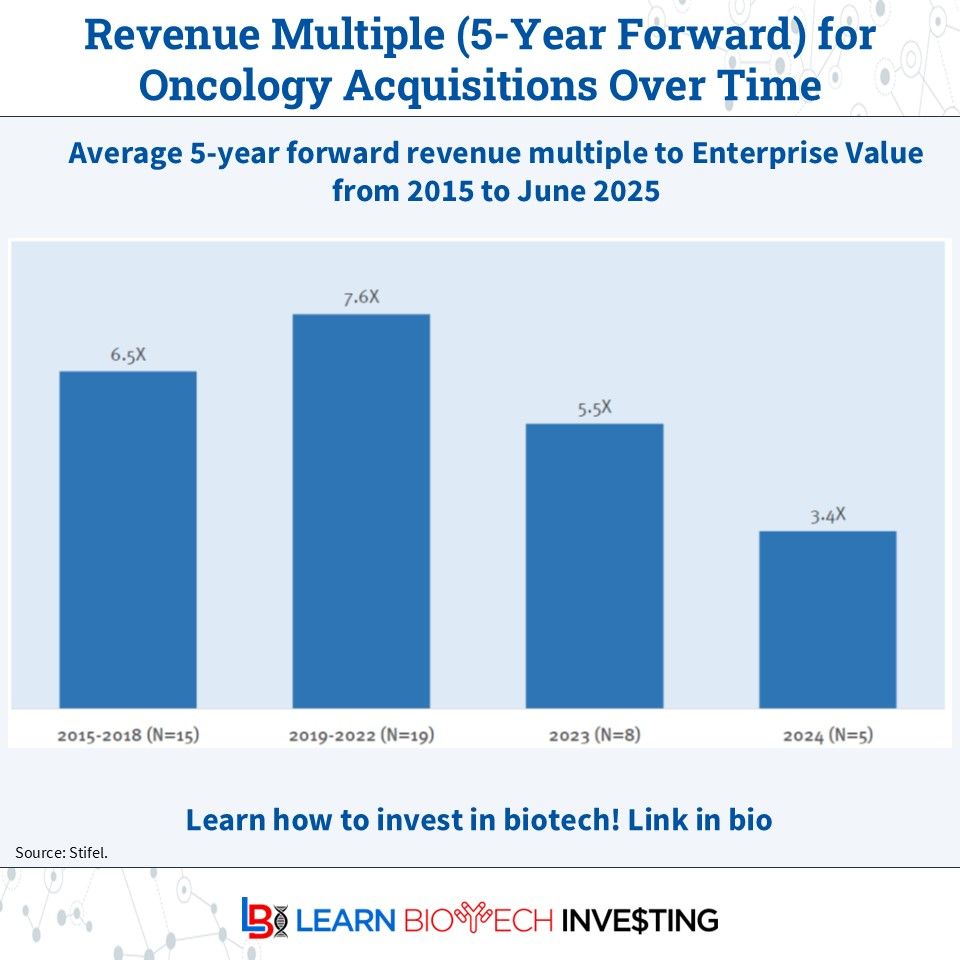

In #oncology #M&A higher 5-yr forward revenue multiples occur for earlier stage companies, though P3 is an exception

Recently multiples have declined reflecting lower valuations, later stage acquisitions, and smaller market opportunities

What are some other reasons?

#learnbiotechinvesting

29.11.2025 13:01 — 👍 0 🔁 0 💬 0 📌 0

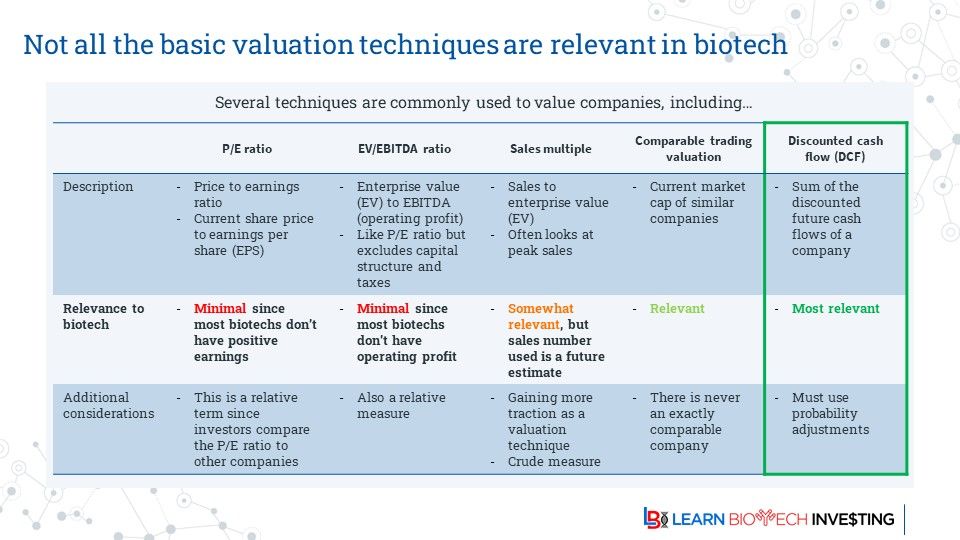

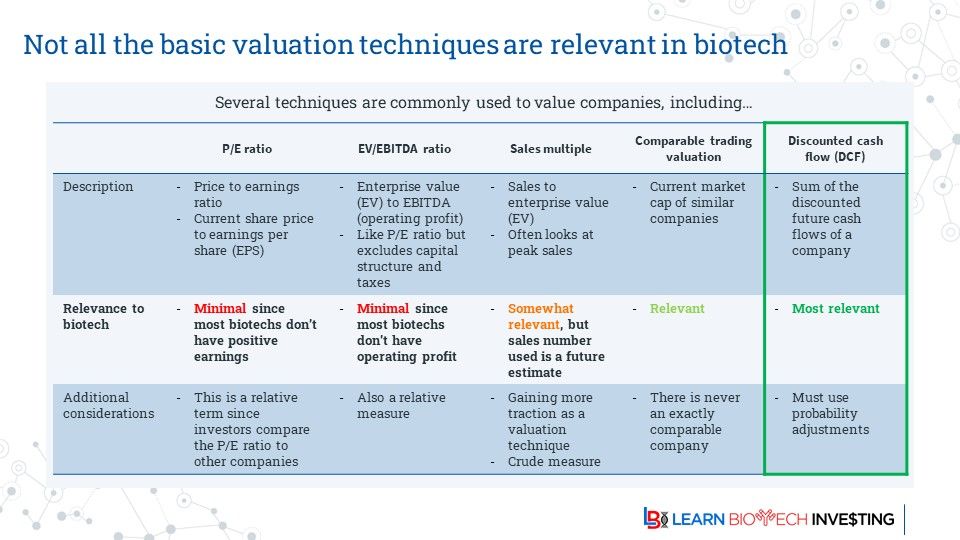

When thinking about valuing biotechs, especially those which are not yet profitable, a probability adjusted discounted cash flow model is perhaps the most important methodology

Though it too has drawbacks

#DCF #PoS #learnbiotechinvesting #biotech #investing #BiotechPrometheus

28.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

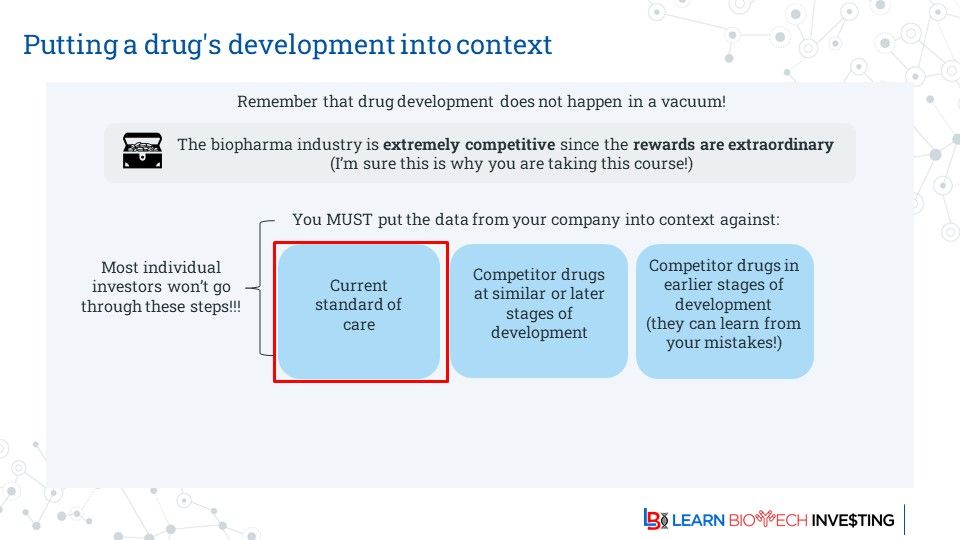

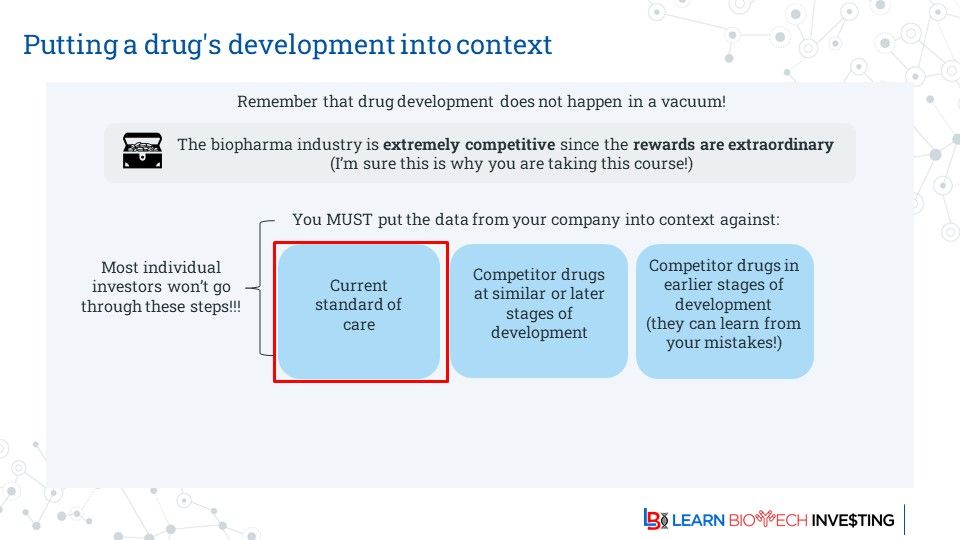

The context of the data matter. How does it stack up against the competition? Is there other competition?

This framework will help investors organise their thoughts

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

27.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

Investors must continually assess the ever-changing Standard of Care landscape. It could change and make a positive clinical result less relevant

Also keep an eye on the competition

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

26.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

Approved drugs can have a "black box" (aka boxed) warning, the highest safety-related warning that FDA can put on an approved drug

Usually applied to multiple drugs in the same class it can hamper revenue potential if alternatives exist

Investors should be aware

#learnbiotechinvesting

25.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

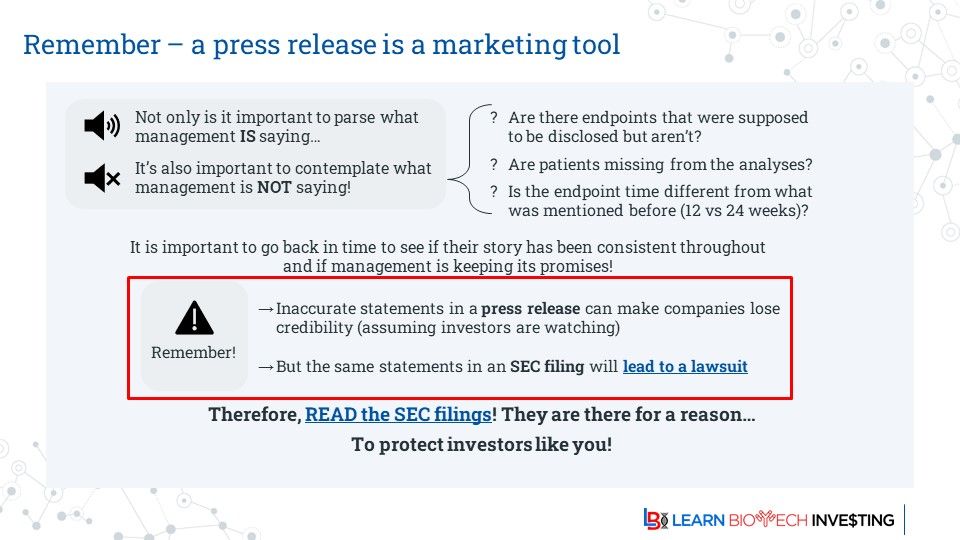

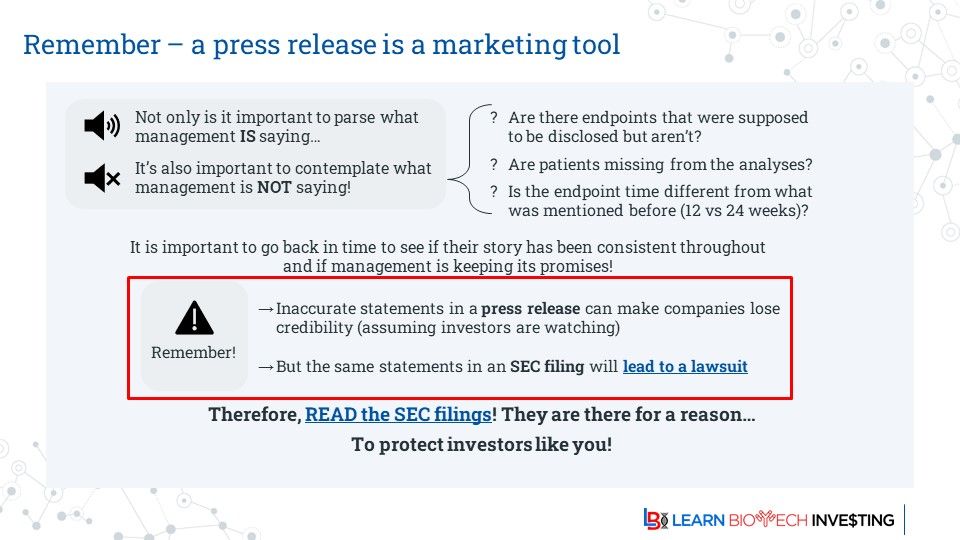

As we say here often: "A press release is a marketing document, an SEC filing is a legal document"

Read the SEC filings! They exist to help #investors! And they are freely available, often on the company website

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

24.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

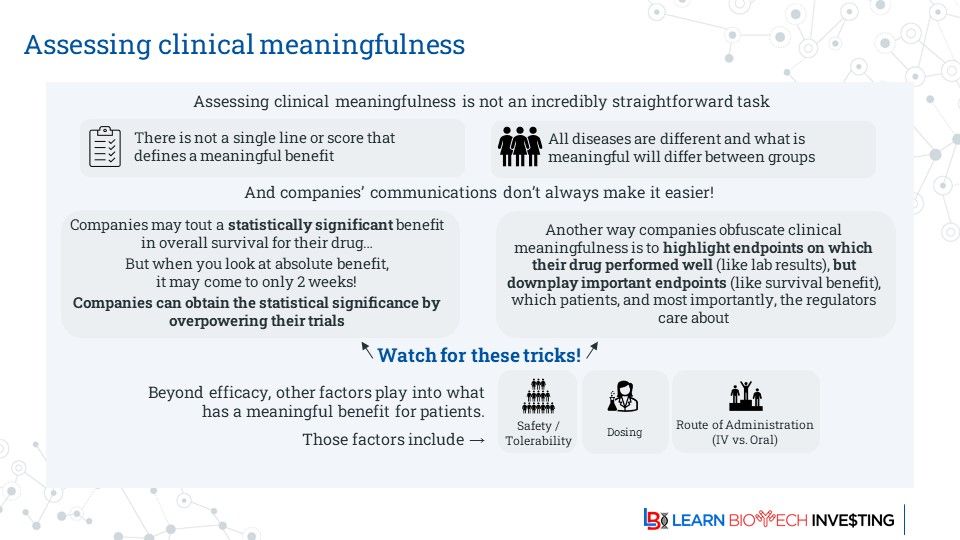

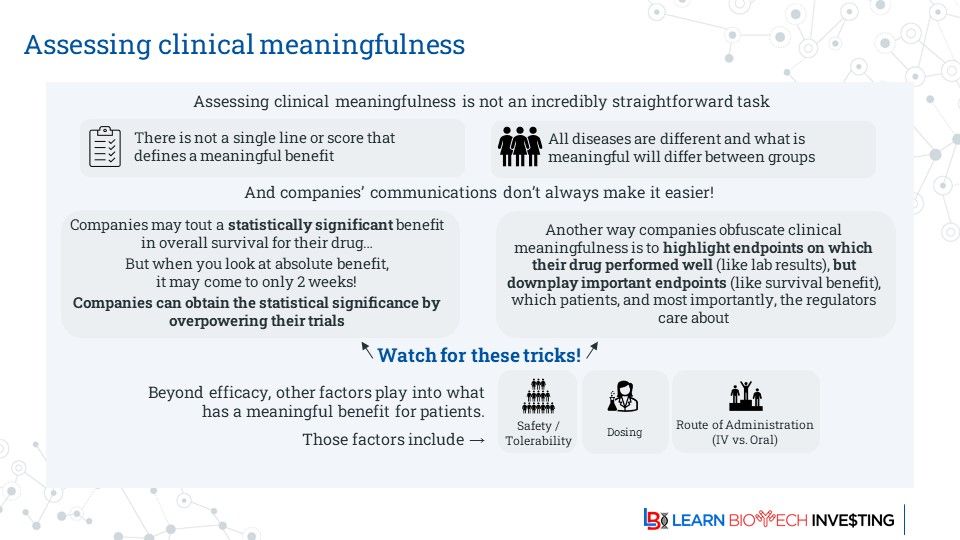

It's important for investors to assess the clinical meaningfulness of a result

A "positive" result sometimes isn't enough if it doesn't significantly change the treatment landscape. But this can be subjective

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

23.11.2025 13:00 — 👍 3 🔁 0 💬 0 📌 0

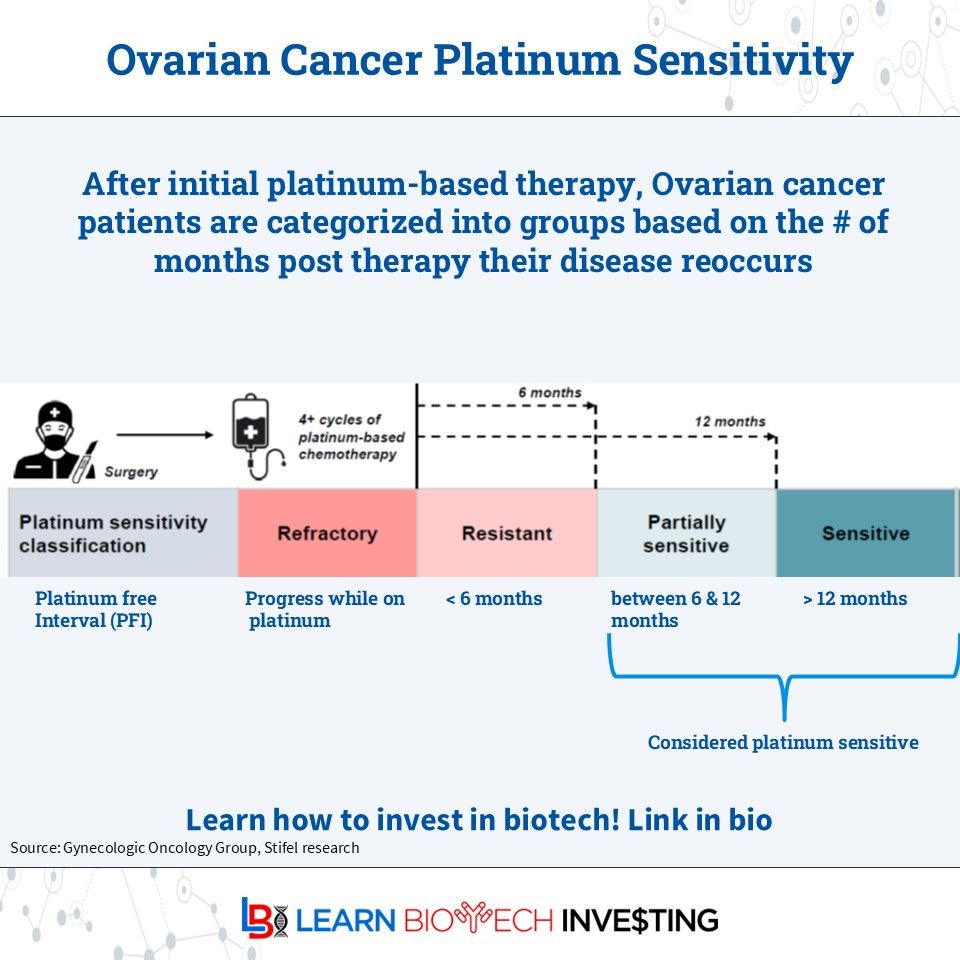

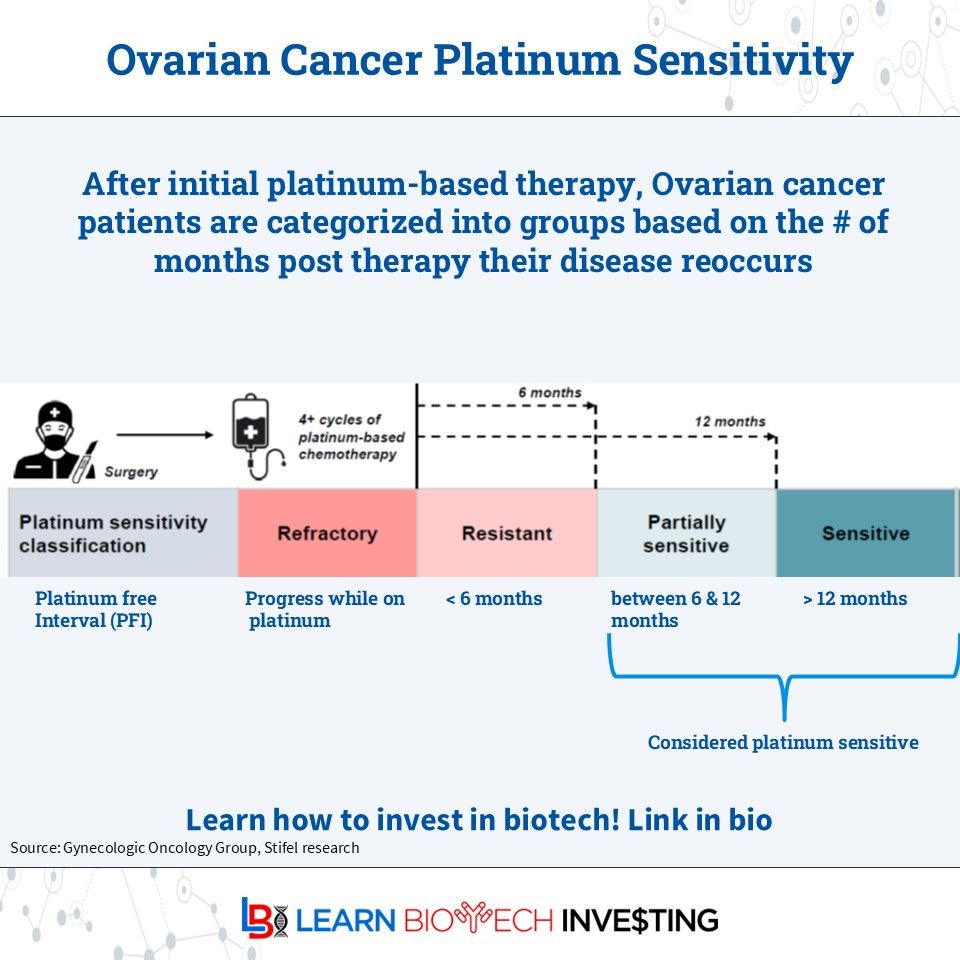

Defining patient populations matter for investors. Ovarian cancer patient recurrence to 2nd line platinum therapy is influenced by how long their tumor was controlled by 1st line therapy

Probability of response to 2L Pt is low for refractory (~0%) or resistant (~10%)

#learnbiotechinvesting

22.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

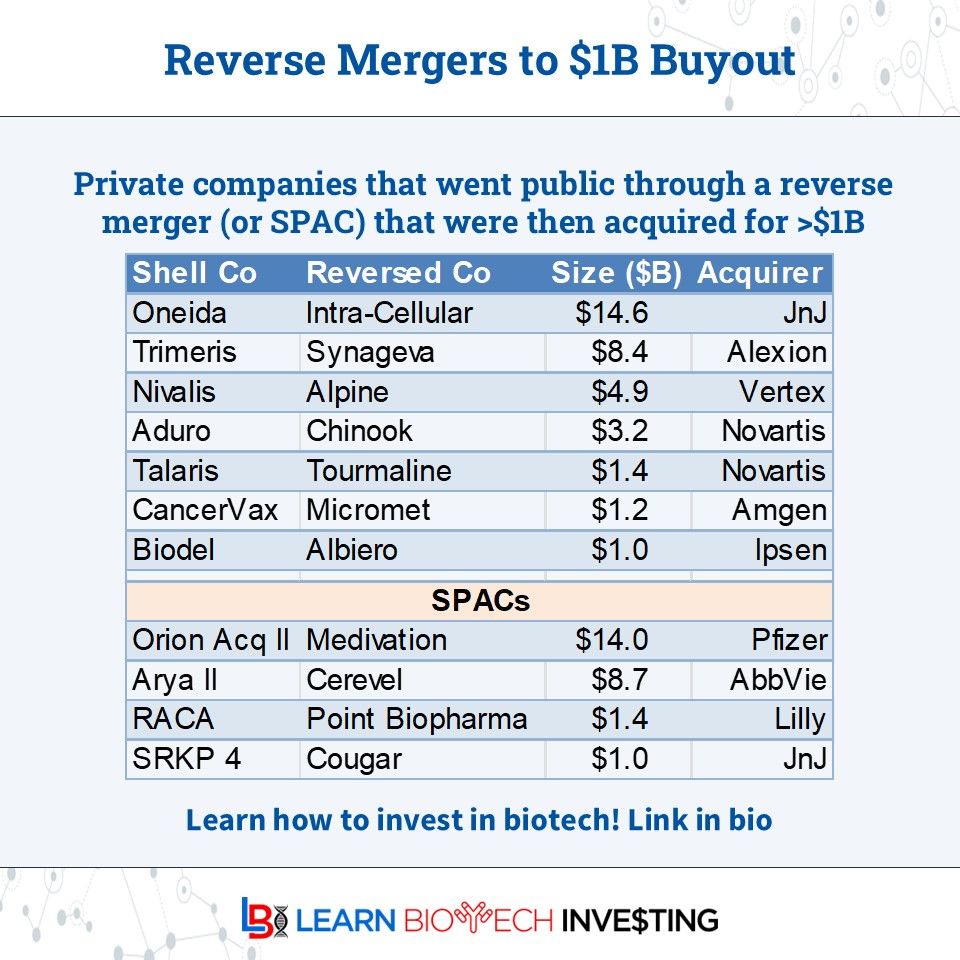

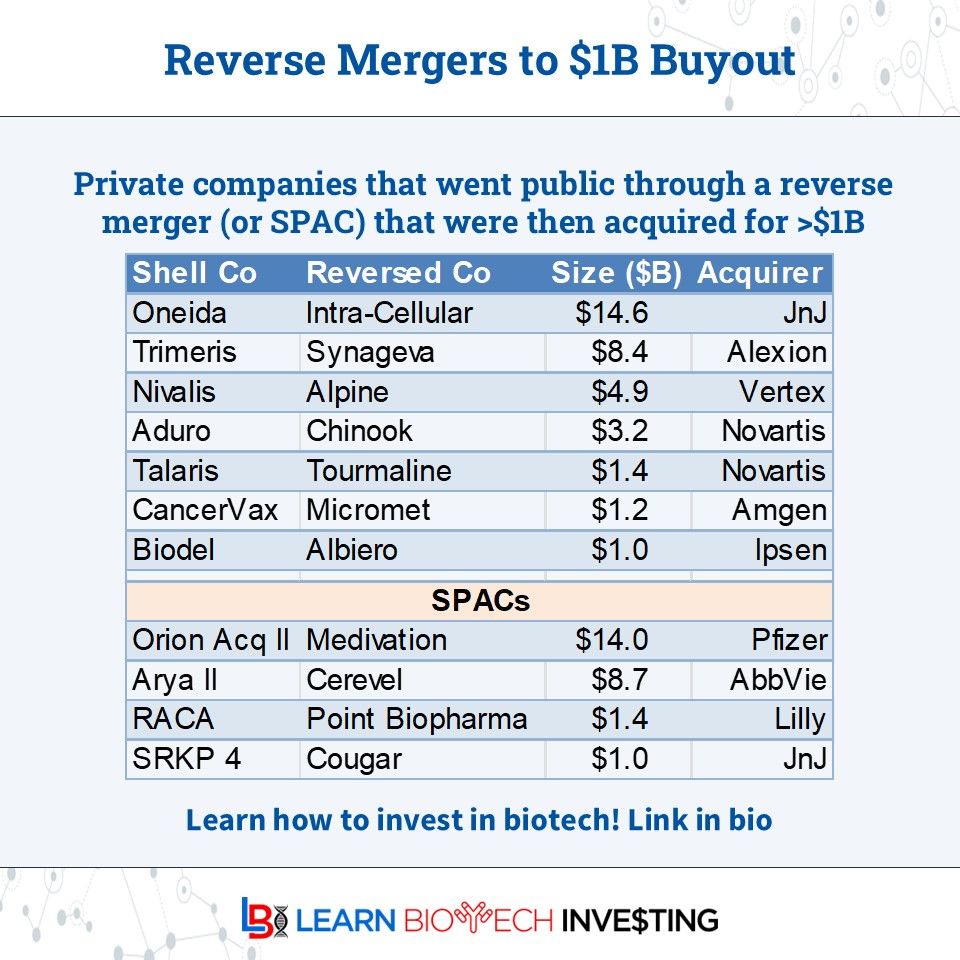

Sometimes a #reversemerger or #SPAC can result in a high value (>$1B) #biotech buyout. Both ways enable private companies to go public without an #IPO

Here's a selected list:

Any others I'm missing?

Who will be next?

#learnbiotechinvesting #investing #BiotechPrometheus

21.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

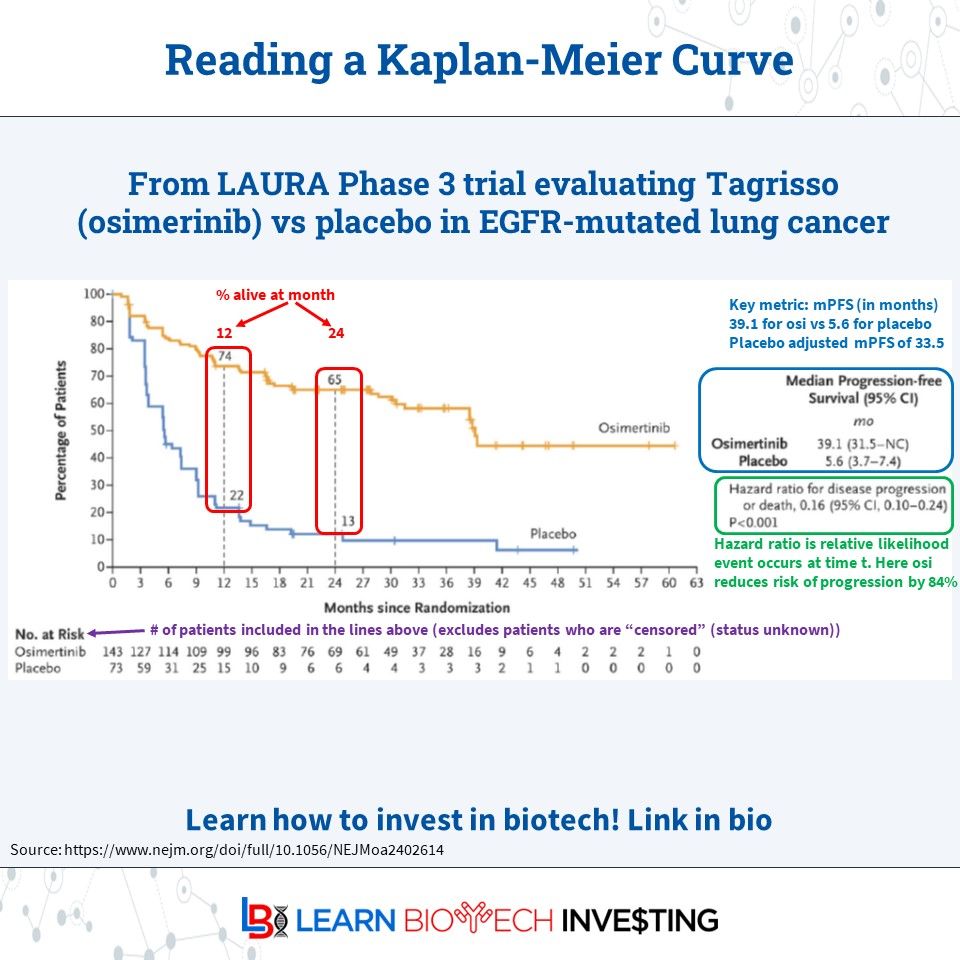

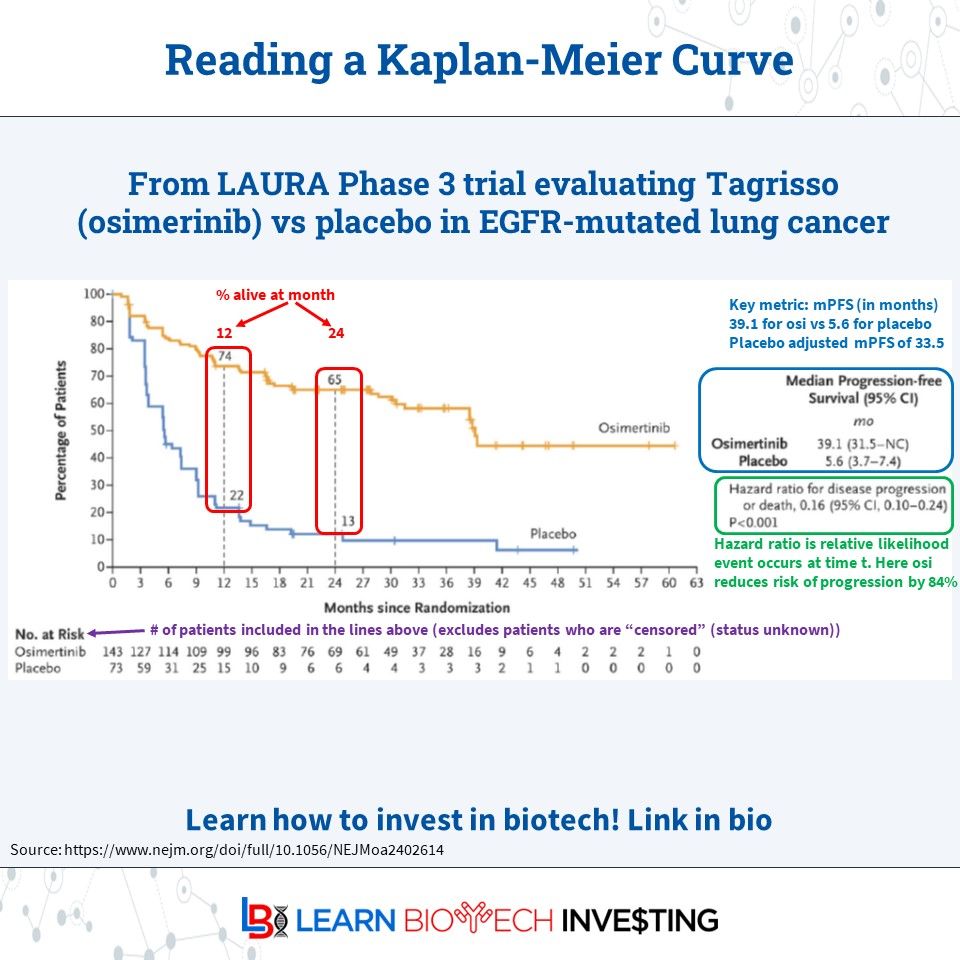

The #HazardRatio measures the effect of an intervention on an outcome of interest OVER TIME

Its an important metric for patients since it gives them a better understanding of the risk they face over time rather than when the median patient will progress or die

#learnbiotechinvesting

20.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

Here's an annotated #KaplanMeier curve to help investors know what information is being presented.

It covers #mPFS, 12 & 24-month survival, #HazardRatio, #atRisk.

These metrics give different views of a drug.

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

19.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

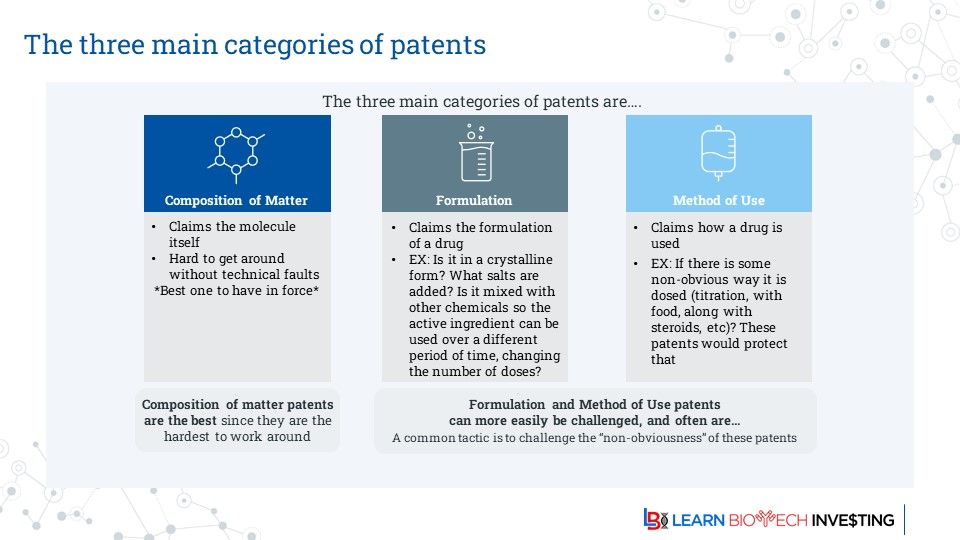

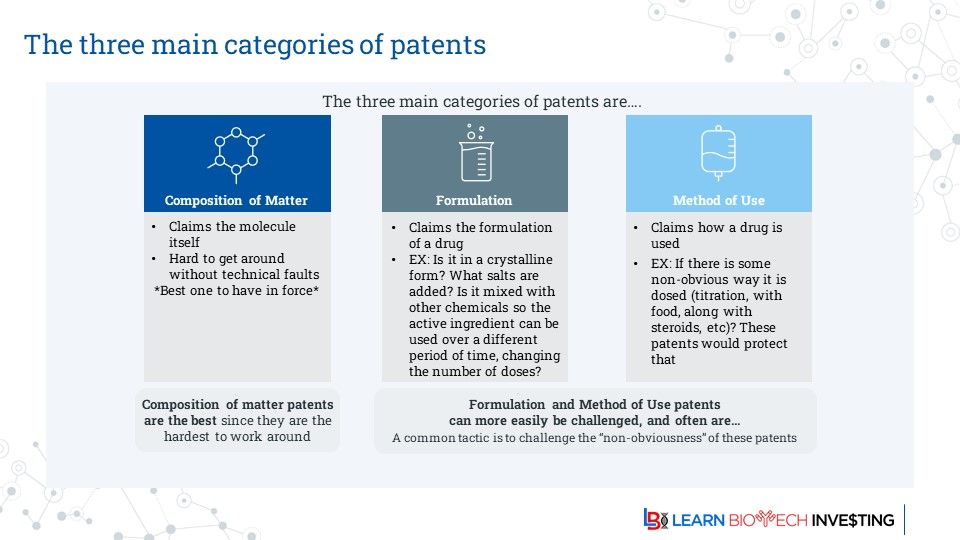

Investors must understand the patents which protect a drug. It's essential to determine the drug's revenue opportunity and therefore value

There are 3 main types, with composition of matter being the most important.

But remember that not all patents are equal; some are stronger than others

17.11.2025 11:00 — 👍 1 🔁 0 💬 0 📌 0

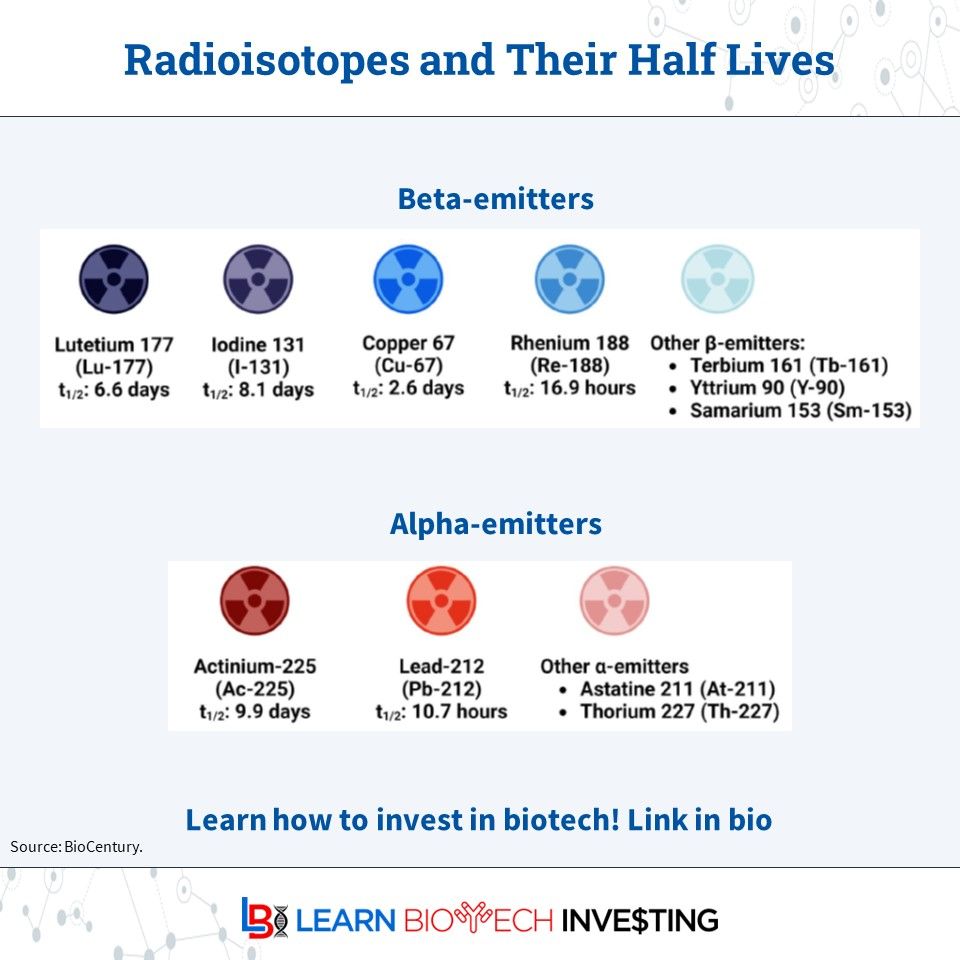

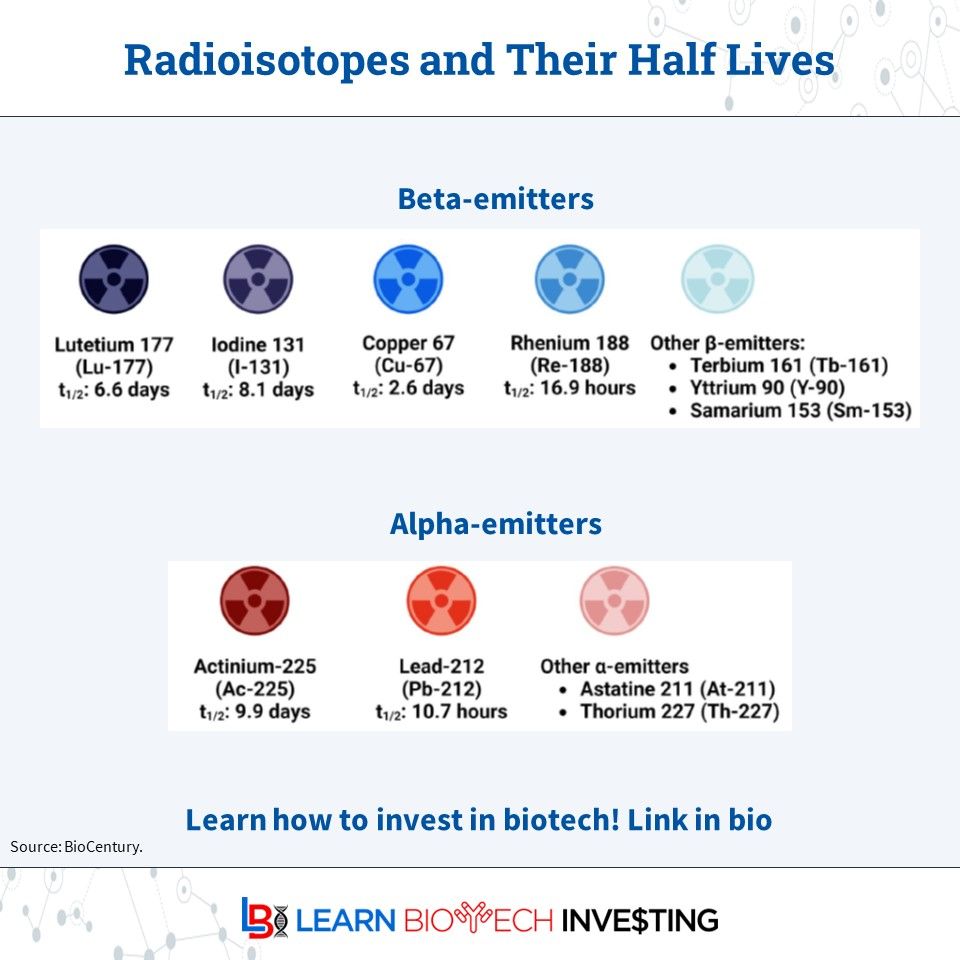

Investors should consider the half-life of various radio-isotopes used in radiotherapy

It has implications for manufacturing, ligand residence time, and dosing frequency

Beta-emitters (esp Lu-177) are more common due to approved infrastructure, but alpha-emitters (esp Ac-225) are growing fast

16.11.2025 22:08 — 👍 0 🔁 0 💬 0 📌 0

Intellectual property #IP & probability of success #POS are unique to biotech valuations

Investors must embrace these facets of biotech if they want to be successful

Note that assumptions around both may differ

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

15.11.2025 12:00 — 👍 0 🔁 0 💬 0 📌 0

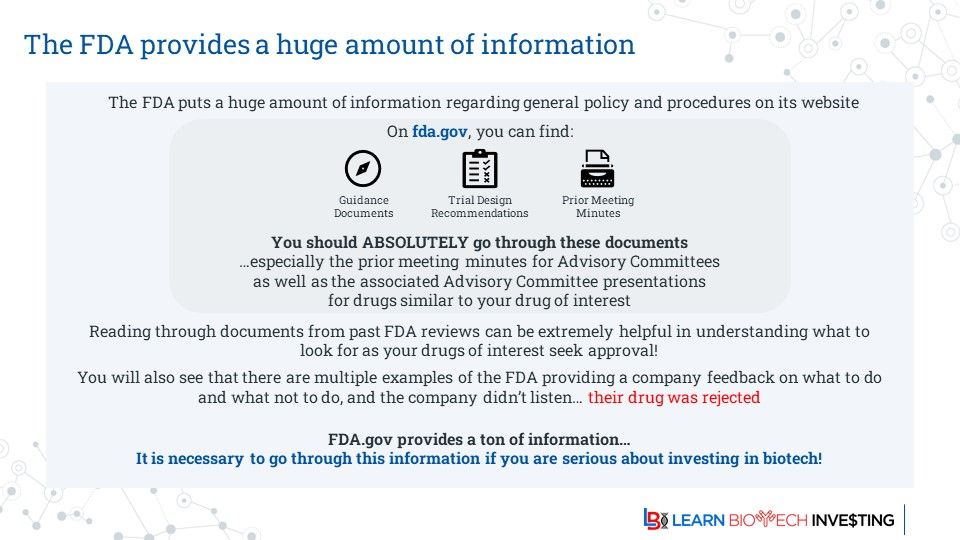

Investors, remember that the FDA puts out a wealth of information about drug candidates ahead of a potential approval

A serious investor MUST read these!

They are the ultimate arbiter for approval in the US

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

14.11.2025 11:01 — 👍 0 🔁 0 💬 0 📌 0

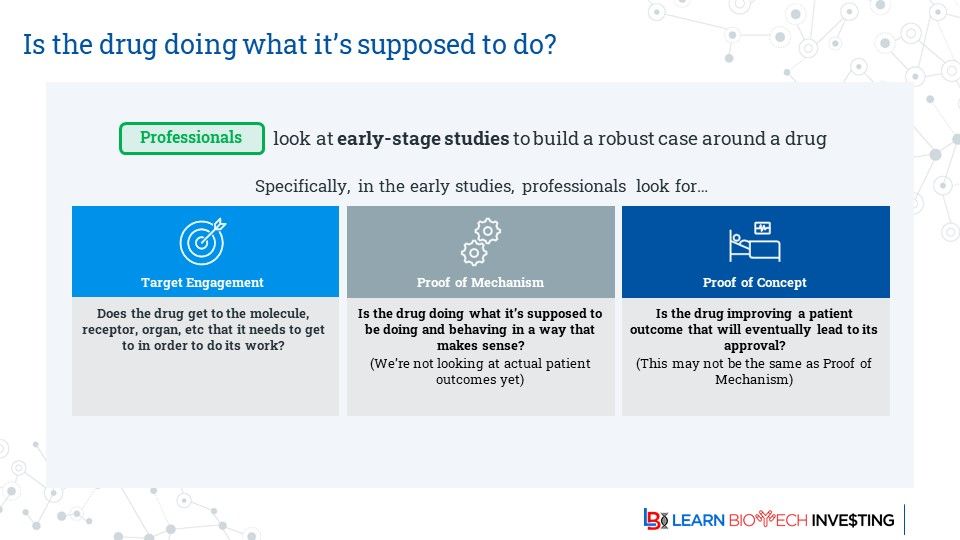

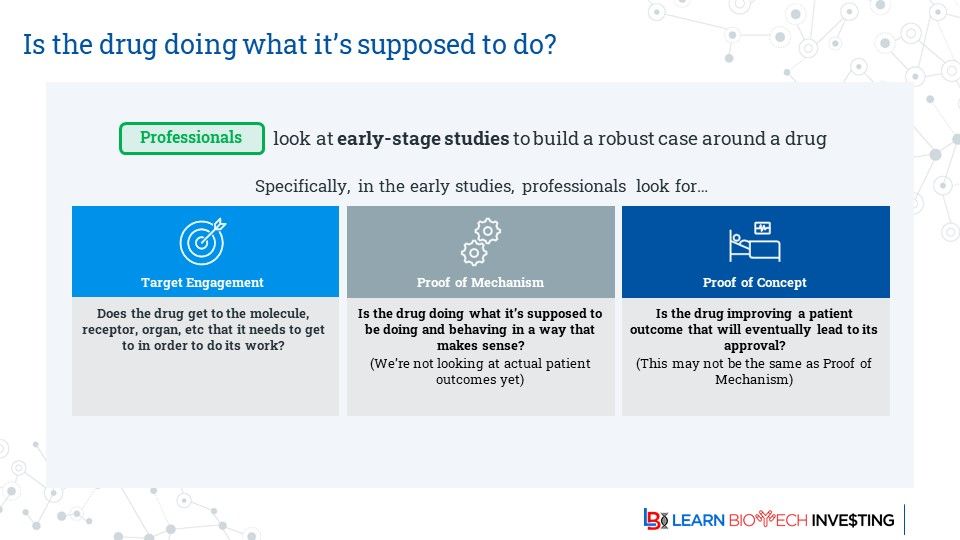

Investors should take an unbiased view of data and not only listen to management. Ask yourself: Is the drug doing what it's supposed to do?

Look for: target engagement, proof of mechanism, and proof of concept

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

13.11.2025 11:01 — 👍 0 🔁 0 💬 0 📌 0

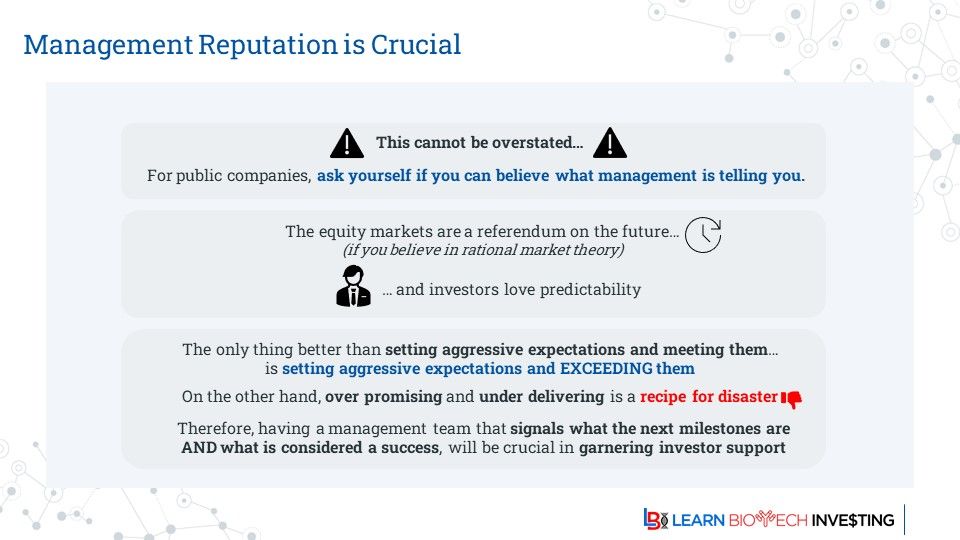

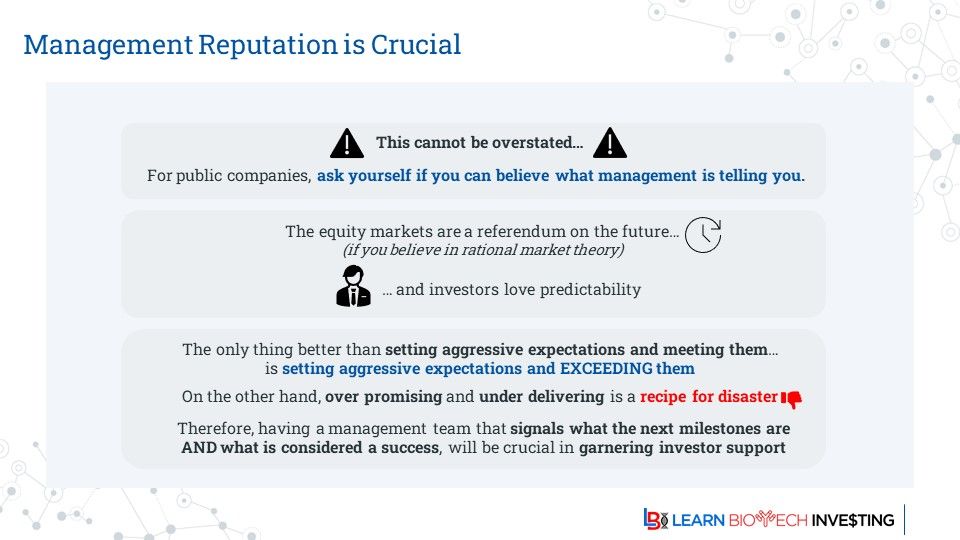

A key variable for investors is management reputation

A lot that happens inside a company that is critical for success is outside of public view

Investors must ask themselves if they believe management is giving an accurate assessment, both good & bad

#learnbiotechinvesting #BiotechPrometheus

10.11.2025 12:00 — 👍 0 🔁 0 💬 0 📌 0

Investors will often see ORR quoted or displayed for oncology clinical trial results for solid tumors

Here's what the CRs/PRs/SDs mean at a high level

These are assessed on scans

I'm using RECIST v1.1 definitions

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

07.11.2025 11:01 — 👍 0 🔁 0 💬 0 📌 0

Intellectual property #IP & probability of success #POS are unique to biotech valuations

Investors must embrace these facets of biotech if they want to be successful

Note that assumptions around both may differ

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

06.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

Pharma has varying levels of success developing drugs. That's a boon for biotech

Here are the biopharma companies ranked by likelihood of first approval (LoA%) from 2006-2022

$AMGN, $NVO, #Eisai top the list

$GSK, #Astellas, $ABBV are at the bottom

#learnbiotechinvesting #BiotechPrometheus

04.11.2025 11:00 — 👍 1 🔁 0 💬 0 📌 0

Incorporating Probability of Success (PoS) is a unique aspect of #biotech valuation investors must be aware of.

It tries to factor development risk into revenue and cost assumptions.

Here is a table of PoS values:

#learnbiotechinvesting #investing #BiotechPrometheus

03.11.2025 11:00 — 👍 0 🔁 0 💬 0 📌 0

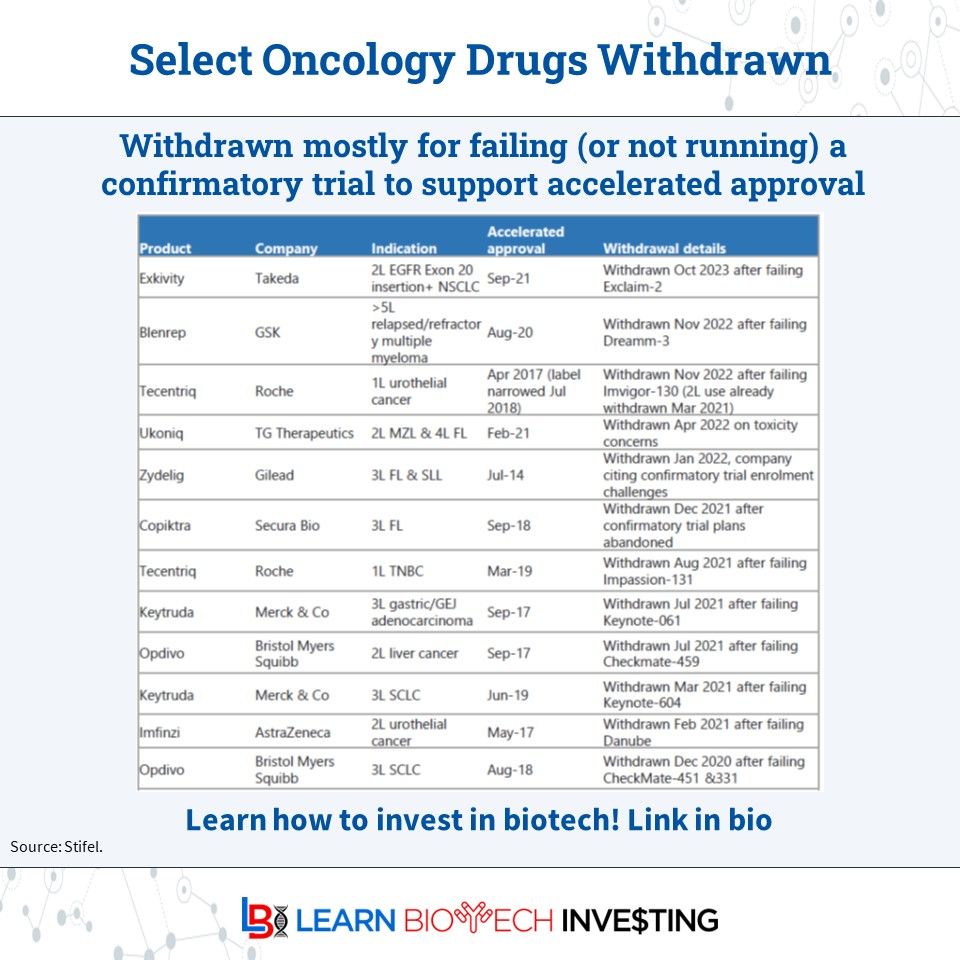

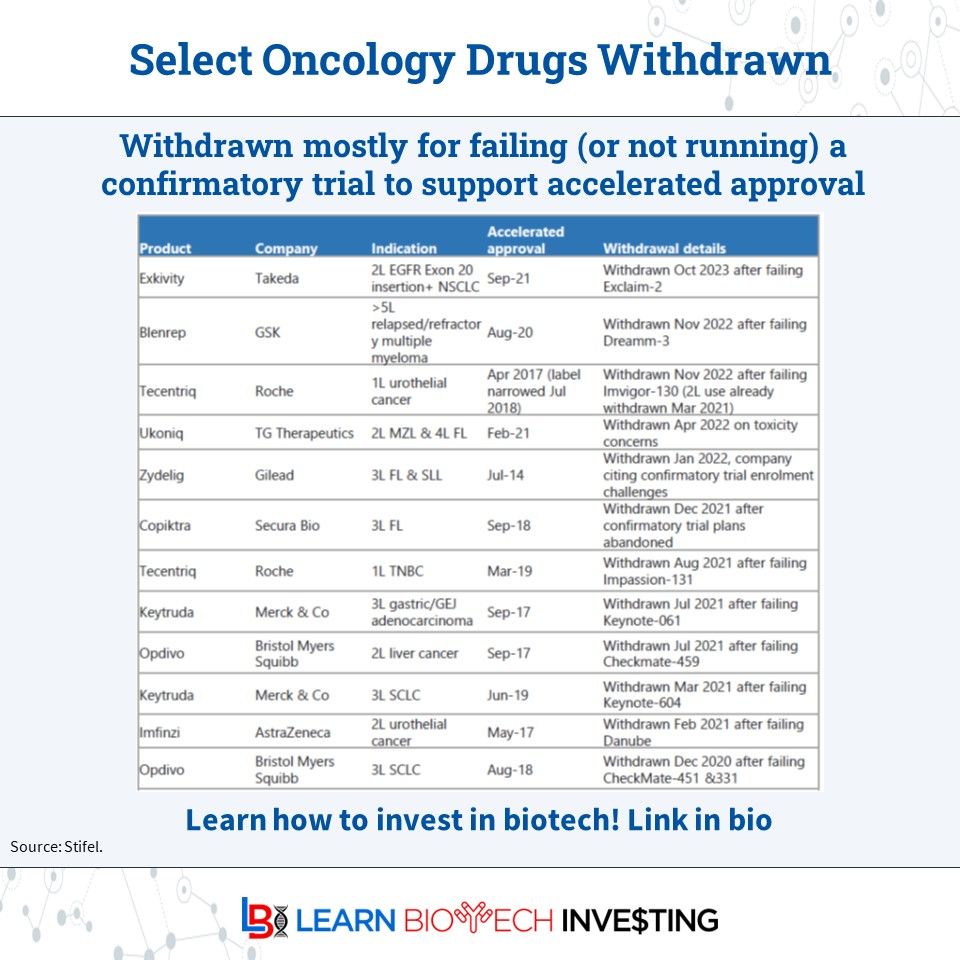

Investors should keep in mind that a drug on the market after an accelerated approval can later be withdrawn if the confirmatory study doesn't show favorable risk/benefit on an approvable endpoint

Here are recent oncology examples but it also happens in other TAs (women's health)

02.11.2025 13:00 — 👍 0 🔁 0 💬 0 📌 0

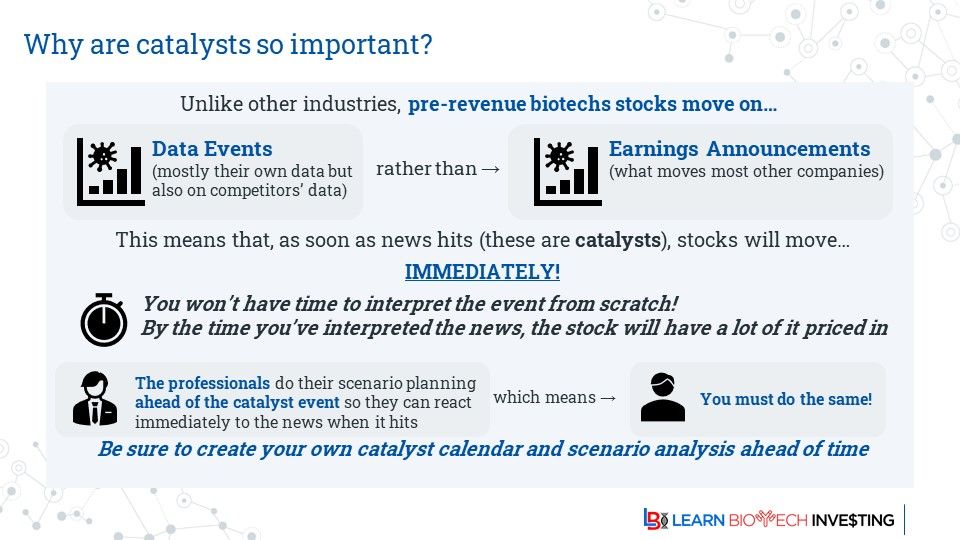

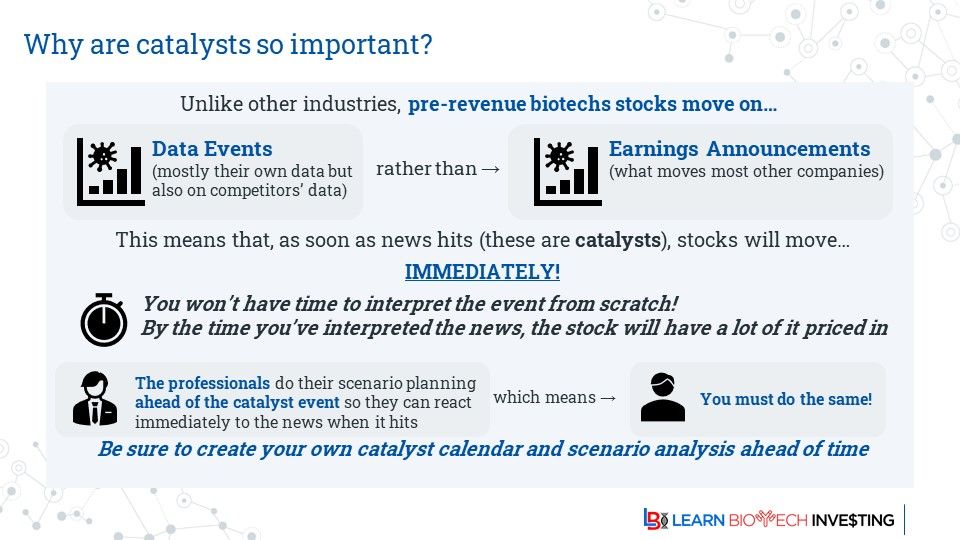

Investors should know WHAT will move a stock & WHEN, especially in biotech with the outsized moves. Build your catalyst calendar ahead of time.

You won't have time to thoughtfully analyze the data when it hits

#learnbiotechinvesting #biotech #investing #BiotechPrometheus

31.10.2025 10:01 — 👍 0 🔁 0 💬 0 📌 0

Join a bleeding-heart liberal and compulsive speculator rambling about saving the world with win-win games at nonzerosum.games!

Follow for investing humor, memes, and sarcasm. It’s not that serious

Skeet about markets and political corruption

Discord: http://bit.ly/3Bf2pNJ

Links: http://bit.ly/3V8D6Gb

Get $50-$5000 to trade: http://bit.ly/4ayctTD

aka Dirk Haussecker. Biotech enthusiast with expertise in sequence-directed therapeutics (RNAi, ASO, ADAR, CRISPR...) enjoying drug development and trying to make a buck along the way.

Diligently working towards the infinite replacement organ paradigm.

Building Robots That Help People Learn Things Quicker

Biotech investor. Virologist. Author: The Great American Drug Deal. Founder: No Patient Left Behind. Healthcare reform advocate. Daughter says I’m cool 75% of the time; son says 100%.

Resistance fighter for Democracy. It will not be easy, but we will emerge stronger and defeat fascism.

Physicist and Professor at a university in Chicago.

Black holes, quantum gravity, cosmology.

Rocky Top. Tar Heel.

Reposts are spooky action at a distance.

My views, not my employer's.

https://jacobi.luc.edu

Head of Sci/cofounder at futurehouse.org. Prof of chem eng at UofR (on sabbatical). Automating science with AI and robots in biology. Corvid enthusiast

Reporter at STAT. The Harry Kane of biotech. Dog ❤️er. Polk Award winner. Said one analyst: The likes of Adam Feuerstein attack viciously.

I don’t check this account often. Founder & CEO of www.SeaportTx.com developing new medicines for neuropsychiatric disorders. Co-founder Karuna Tx (KarXt/Cobenfy now at BMS). Founding CEO & Senior Advisor PureTech. Co founder/host @BiotechCH. Board of BIO

Scientist, entrepreneur, ex-biopharm exec, former FM radio jock, lifelong hockey fan, aspiring guitar player and mixologist, #immigrant. CEO, Arrakis Therapeutics and a variety of other things. https://www.michaelgilman.net/disclosures/

Medicinal chemist / chemical biologist, author of “In the Pipeline” at http://science.org/blogs/pipeline. derekb.lowe@gmail.com and on Signal at Dblowe.18

All opinions are mine; I don’t speak for my employer in any way.

official Bluesky account (check username👆)

Bugs, feature requests, feedback: support@bsky.app