A man presenting to an audience, gesturing as he explains his topic to the engaged group of listeners.

We are delighted to share that @ucdlibrary.bsky.social have ingested a new collection into the Repository - Democracy Challenged, an @erc.europa.eu funded project led by @aidanregan.bsky.social.

Find out more: dri.ie/news/new-col...

03.07.2025 12:01 — 👍 6 🔁 1 💬 0 📌 0

Reminder: Today at 4pm CET (3pm Irish time) @aidanregan.bsky.social will moderate this virtual session for the 2025 @sasemeeting.bsky.social conference.

02.07.2025 08:10 — 👍 1 🔁 0 💬 0 📌 0

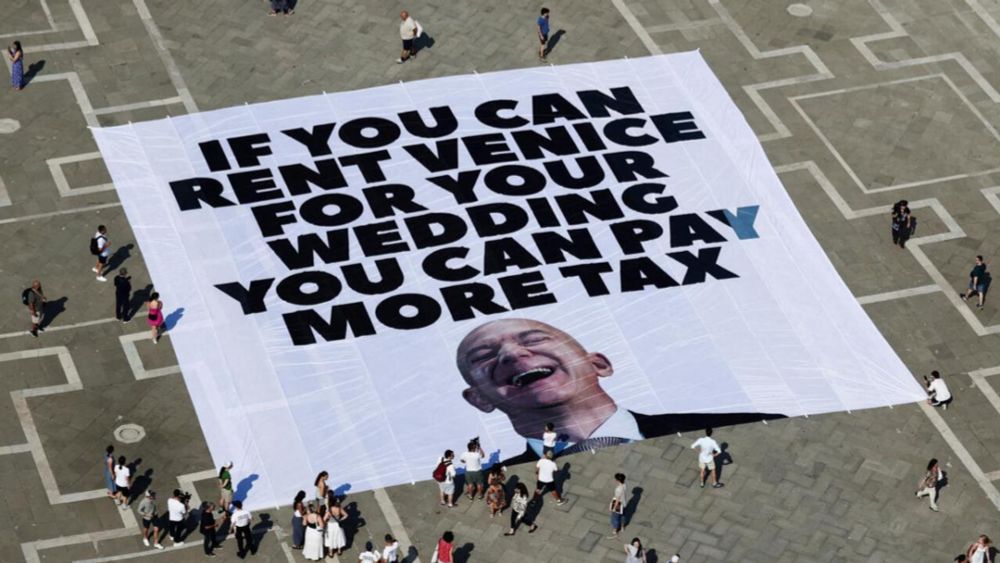

How Ireland became the Saudi Arabia of siphoned-off global profits

The Emerald petro-state is riding high off tech and pharma—for now

Recent the @economist.com piece highlights insights from @aidanregan.bsky.social on Ireland's multinational profits vs. real economic activity.

Worth reading both:

Economist article 👉 tinyurl.com/yv9r2wk3

Aidan’s post 👉 tinyurl.com/347b4mhw

13.06.2025 13:24 — 👍 2 🔁 0 💬 0 📌 0

Save the date! @aidanregan.bsky.social will moderate a round table discussion at this year's @sasemeeting.bsky.social conference. Participation is possible online.

05.06.2025 09:51 — 👍 3 🔁 2 💬 0 📌 0

The Digital Repository of Ireland (DRI) is a CoreTrustSeal-certified digital repository, or online archive, for the long-term preservation of Ireland's social and cultural digital legacy. Explore the Repository: https://repository.dri.ie/

The Society for the Advancement of Socio-Economics (SASE), founded by Amitai Etzioni in 1989, is an international, interdisciplinary organization with members across 50 countries.

2026 Conference in Bordeaux 🇫🇷

Das Wissenschaftszentrum Berlin für Sozialforschung untersucht den gesellschaftlichen Wandel. Es postet das Kommunikationsteam. http://wisskomm.social/@WZB_Berlin

Husband, dad, metal head, economist.

periodic posting on political economy issues, mostly charts, some shirts, weekly kittens. Sic semper tyrannis.

States vs Markets 5th edition now out: https://www.bloomsbury.com/9781350458369

Ireland correspondent Financial Times - all things N&S. Transplanted from Latam. All views own etc

Assistant Prof and Ad Astra Fellow working on taxation, inequality, international econ in UCD School of Economics, formerly ETH Zurich.

Professor at EHESS & PSE

Co-Director, World Inequality Lab

inequalitylab.world | WID.world

http://piketty.pse.ens.fr/

Illuminating the debate through data-driven research #inequalitydata✨

Hosting the World Inequality Database🌐 https://wid.world/

https://inequalitylab.world/en/

Associate Professor @ucddublin.bsky.social • party competition, public opinion, political communication, computational social science • Maintainer @irishpollingind.bsky.social • Executive Committee Member @yai.ie

muellerstefan.net

Global tax politics, economic sociology, political economy, equality. Department of Sociology, Maynooth University, Ireland

Ireland's leading law school

Interdisciplinary research and teaching hub for policy, practice and equality l RT is not an endorsement.

Professor of International Relations at UCD Dublin; Dundrum Methodist Church; Royal Irish Academy; Azure Forum, IDSA and Gym Dad. Mix of Mayo, Kerry, West Virginia and suburban Maryland.

Prof of Accounting & Society at Uni of Sheffield; Head of Subject Group; Director of CRAFiC & The Audit Reform Lab; veteran soulboy.

Chasing wealth and income, present and past, onshore and offshore.

https://gabriel-zucman.eu

https://www.taxobservatory.eu

Independent research lab focusing on #taxation, corporate tax avoidance, tax evasion, and solutions to these issues. Directed by @gabrielzucman.bsky.social

Learn more: https://linktr.ee/taxobservatory

This is only a placeholder account. For updates on our work visit https://skatteforsk.no/ or https://www.linkedin.com/company/skatteforsk/

Want to contact us? Our e-mail is: skatteforsk@nmbu.no