Recently accepted by #QJE, “Who’s Afraid of the Minimum Wage? Measuring the Impacts on Independent Businesses Using Matched U.S. Tax Returns,” by Rao (@nirupama.bsky.social) and Risch: doi.org/10.1093/qje/...

24.12.2025 16:46 — 👍 19 🔁 13 💬 0 📌 6@mbengoa.bsky.social

Professor of International Economics at City University of New York (CUNY) & Univ of Johannesburg. On leave at Newcastle Univ. Business School. Senior Fellow at CIRANO. Former President International Trade & Finance Association www.martabengoa.com

Recently accepted by #QJE, “Who’s Afraid of the Minimum Wage? Measuring the Impacts on Independent Businesses Using Matched U.S. Tax Returns,” by Rao (@nirupama.bsky.social) and Risch: doi.org/10.1093/qje/...

24.12.2025 16:46 — 👍 19 🔁 13 💬 0 📌 6

It's easy to miss with so much noise around us, but we've continued an incredible streak of broad based real wage growth for a more extended period than we have for a long time. And wage growth still a bit higher for non-managerial workers (~80% or private workforce). www.bls.gov/opub/ted/202...

18.04.2025 00:25 — 👍 26 🔁 6 💬 1 📌 0

Featured in today’s @FT on the US-China tariff stand-off: Despite deep trade interdependence, the balance of risk tilts toward the US. Trade independence creates asymmetric risks & leverage Beijing holds: on.ft.com/4jx44DY #tariff #TradeWar #InternationalTrade #Economics

15.04.2025 14:38 — 👍 13 🔁 3 💬 0 📌 0

Featured in today’s @FT on the US-China tariff stand-off: Despite deep trade interdependence, the balance of risk tilts toward the US. Trade independence creates asymmetric risks & leverage Beijing holds: on.ft.com/4jx44DY #tariff #TradeWar #InternationalTrade #Economics

15.04.2025 14:38 — 👍 13 🔁 3 💬 0 📌 0

1/7 NEW: The hidden cost of America's trade war? A massive Treasury selloff that just added $4.68 billion to taxpayer debt burden. My latest analysis on how tariffs are silently inflating our national debt:

orfamerica.org/orf-america-...

7/7 The real danger: A feedback loop where tariffs → higher yields → bigger deficits → more borrowing → even higher yields. Markets are warning us, but is anyone in Washington listening?

14.04.2025 18:02 — 👍 6 🔁 2 💬 0 📌 06/7 This is mandatory spending—these higher interest costs automatically consume budget dollars for decades without any Congressional vote. Less money for infrastructure, healthcare, education.

14.04.2025 18:01 — 👍 3 🔁 2 💬 1 📌 05/7 Key irony: Countries like China and Japan are both targets of new tariffs AND major holders of US Treasuries. We're effectively antagonizing our largest creditors while asking them to keep financing our debt.

14.04.2025 18:01 — 👍 7 🔁 4 💬 1 📌 04/7 The math: 3-yr notes (+10.4 bps) = $181M more interest. 10-yr notes (+42.5 bps) = $1.66B more. 30-yr bonds (+43 bps) = $2.84B more. This is just from THREE DAYS of post-tariff market reaction.

14.04.2025 18:01 — 👍 2 🔁 1 💬 1 📌 03/7 Just this week's three Treasury auctions will cost taxpayers an extra $4.68B over the life of these securities due to higher yields. That's not a tariff on China—it's a stealth tax on future generations of Americans.

14.04.2025 18:01 — 👍 5 🔁 2 💬 1 📌 02/7 Markets deliver verdicts faster than economists. 10-yr Treasury yield surged from 4.01% to 4.51% in days after tariff announcements, while 30-yr bonds saw their biggest 3-day yield jump since 1982.

14.04.2025 18:00 — 👍 4 🔁 1 💬 1 📌 0

1/7 NEW: The hidden cost of America's trade war? A massive Treasury selloff that just added $4.68 billion to taxpayer debt burden. My latest analysis on how tariffs are silently inflating our national debt:

orfamerica.org/orf-america-...

My take on today’s tariffs which represent strategic incoherence & dire economic consequences for the US & global economy in a highly unstable landscape #orfamerica

orfamerica.org/orf-america-...

My take on today’s tariffs which represent strategic incoherence & dire economic consequences for the US & global economy in a highly unstable landscape #orfamerica

orfamerica.org/orf-america-...

5/ Africa's trajectory remains uncertain, its vast reserves of rare minerals could be crucial in a reorganized global supply chain. Full implications of Trump's trade offensive remain to be seen, one thing appears certain: consequences will reverberate far beyond targeted nations

03.02.2025 20:54 — 👍 2 🔁 0 💬 0 📌 04/ Regional disparities in impact appear inevitable. Latam faces a potential 1.1% GDP reduction as Chinese demand will inevitably shrink, Southeast Asia could experience a manufacturing renaissance, with optimistic forecasts suggesting up to 2% GDP growth over the next five years

03.02.2025 20:54 — 👍 1 🔁 0 💬 1 📌 03/ It’ll lead to job losses in manufacturing, even as policy aims to protect domestic industry, creating the opposite effect intended. Might trigger a 2.1% contraction in international trade volumes. Perhaps most concerning for developing nations is 3.2% FDI decline (expected)

03.02.2025 20:54 — 👍 0 🔁 0 💬 1 📌 02/The policy raises significant questions about the United States’ reliability as a trading partner and ally. The arbitrary nature of the tariffs introduces a new element of uncertainty into business planning, potentially dampening investment in U.S.-oriented production capacity

03.02.2025 20:54 — 👍 0 🔁 0 💬 1 📌 01/ Policy shift is a major one, not going to reduce the bilateral trade deficits either as those depend on macroeconomic fundamentals (excess of investment over savings in the U.S. economy). Exchange rate of the United States will appreciate contributing to widening the deficit

03.02.2025 20:54 — 👍 0 🔁 0 💬 1 📌 0

My piece on Trump’s tariffs for ORF America. It explores the broad implications for the US and the developing world orfamerica.org/orf-america-...

03.02.2025 20:54 — 👍 4 🔁 2 💬 1 📌 0

NYFed paper: Trump's previous tariff announcements caused large declines in US stock market returns, and had a negative effect on the U.S. economy that is substantially larger than past estimates

libertystreeteconomics.newyorkfed.org/2024/12/usin...

Very happy to see this fully accepted and in press. A short thread coming. But first, thank you to all those who made this possible. To the JMCs out there this season: studies like this do not come from a vacuum, they stand on previous literatures and reflect invaluable comments from many people.

02.12.2024 13:40 — 👍 48 🔁 9 💬 1 📌 0Me! Please add me. Thanks

02.12.2024 15:03 — 👍 2 🔁 1 💬 0 📌 0No

27.11.2024 13:36 — 👍 0 🔁 0 💬 0 📌 0I'll be speaking at the 6th Workshop on the Economics and Politics of #Migration, May 22-23, 2025 here in Madrid. Leah Boustan will also be speaking. Submit your papers before Jan 26! tinyurl.com/y2cd98kk

21.11.2024 20:03 — 👍 17 🔁 6 💬 1 📌 0

🧵 New paper uses AI to map global production networks & study recent shifts in global trade: "AI-Generated Production Networks" by @trfetzer.com @econopete.bsky.social @prashantgarg.bsky.social and Bennet Feld.

18.11.2024 16:22 — 👍 58 🔁 21 💬 2 📌 9

Alejandro Graziano presented "International Trade, Market Concentration and Welfare". The paper highlights how changes in competition and concentration influence consumer welfare and trade outcomes.

19.11.2024 11:21 — 👍 2 🔁 1 💬 0 📌 0

In our new paper we introduce a novel global production network leveraging quite refined AI retrieval augmented generation techniques. We believe this data is particularly suitable to study the economic repercussions of escalating global trade tensions.

20.11.2024 17:00 — 👍 2 🔁 1 💬 0 📌 0

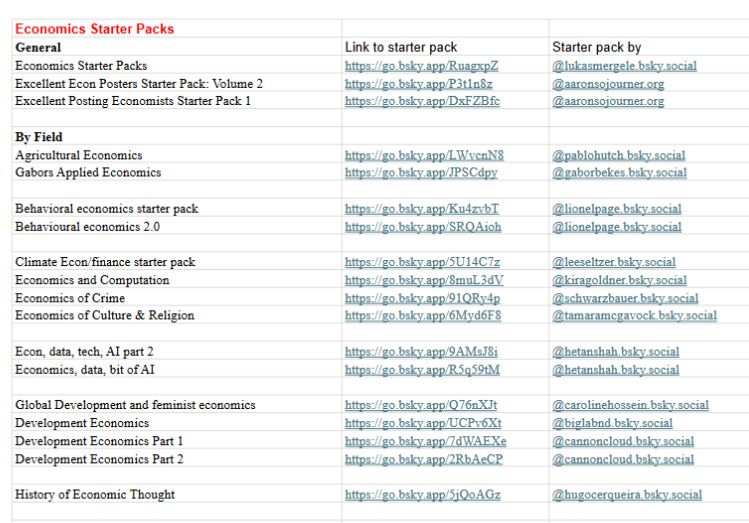

Hi #EconSky,

Not sure if the Starter Pack party's over, but I've made an Econ Starter Pack of Starter Packs! 😄

It's a work in progress, so I may have missed some. Let me know if there's anything to add—DMs are open!

Thanks for support @economista.bsky.social!

docs.google.com/spreadsheets...

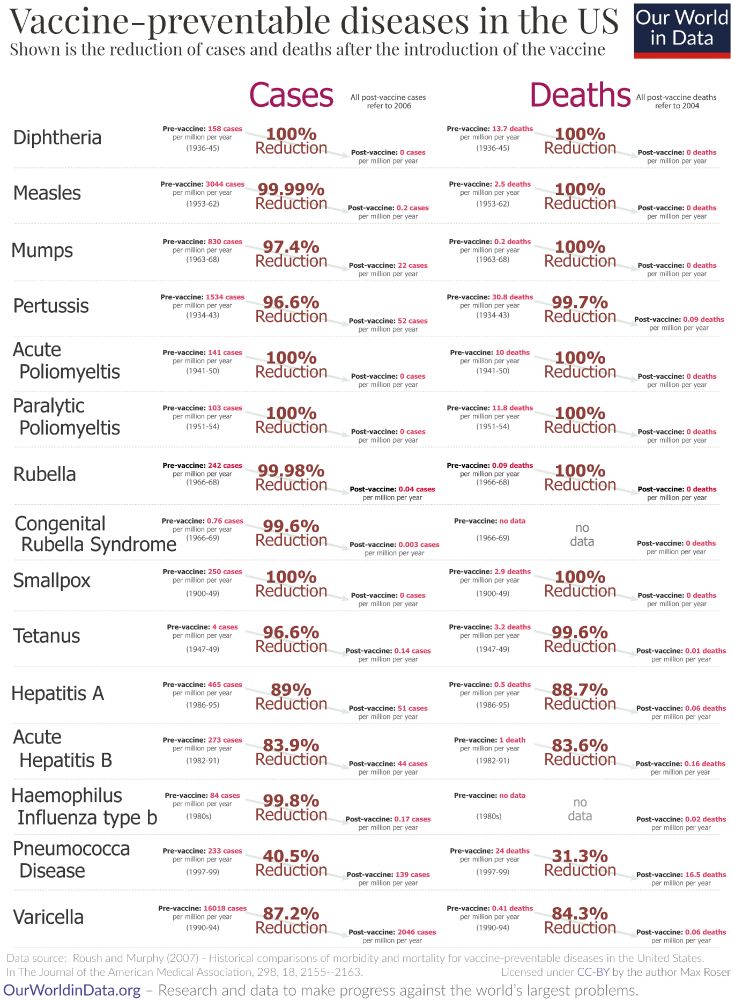

Many infectious diseases are so rare today that it is easy to forget how very common they were before the introduction of vaccines.

My chart presents an overview of the change in the US.