Haven't posted here in a while but figured I'd write a post to see if I should come back 😅

First longer form thing would be about an AI theory paper that I worked on that was inspired by crypto

14.04.2025 21:18 — 👍 5 🔁 0 💬 2 📌 0

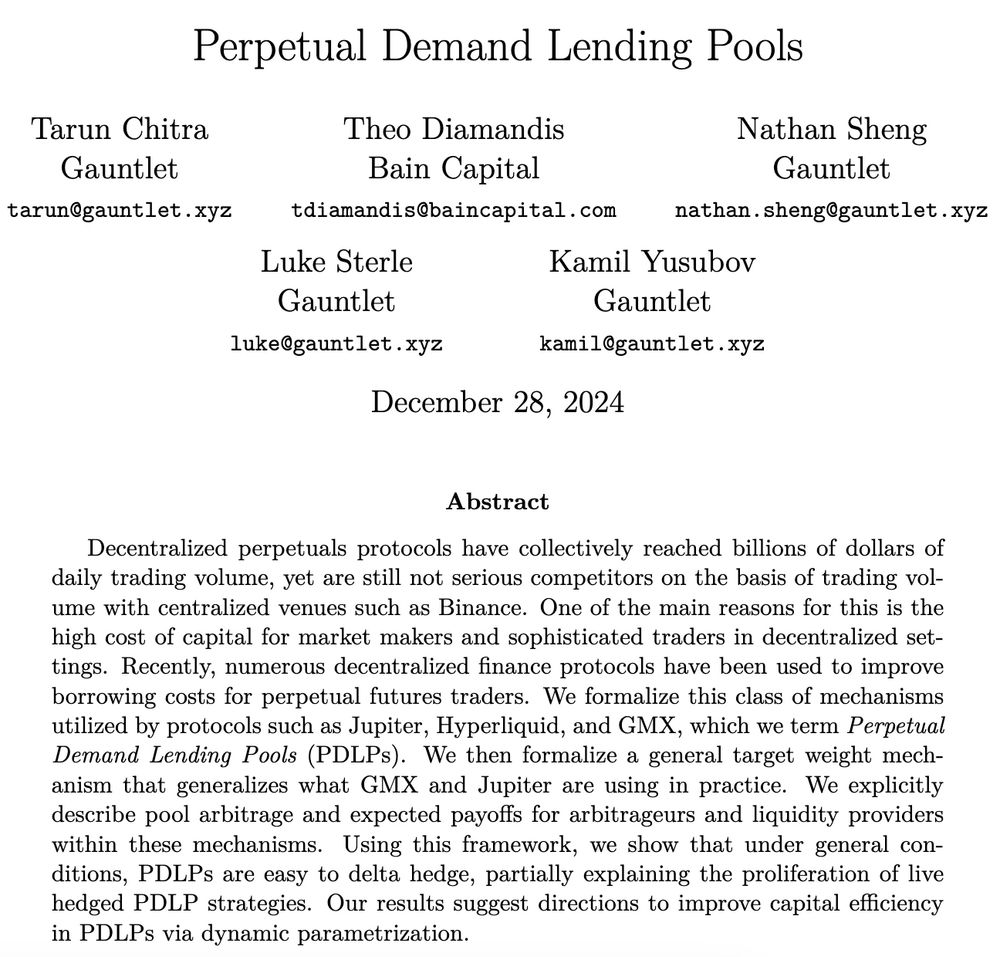

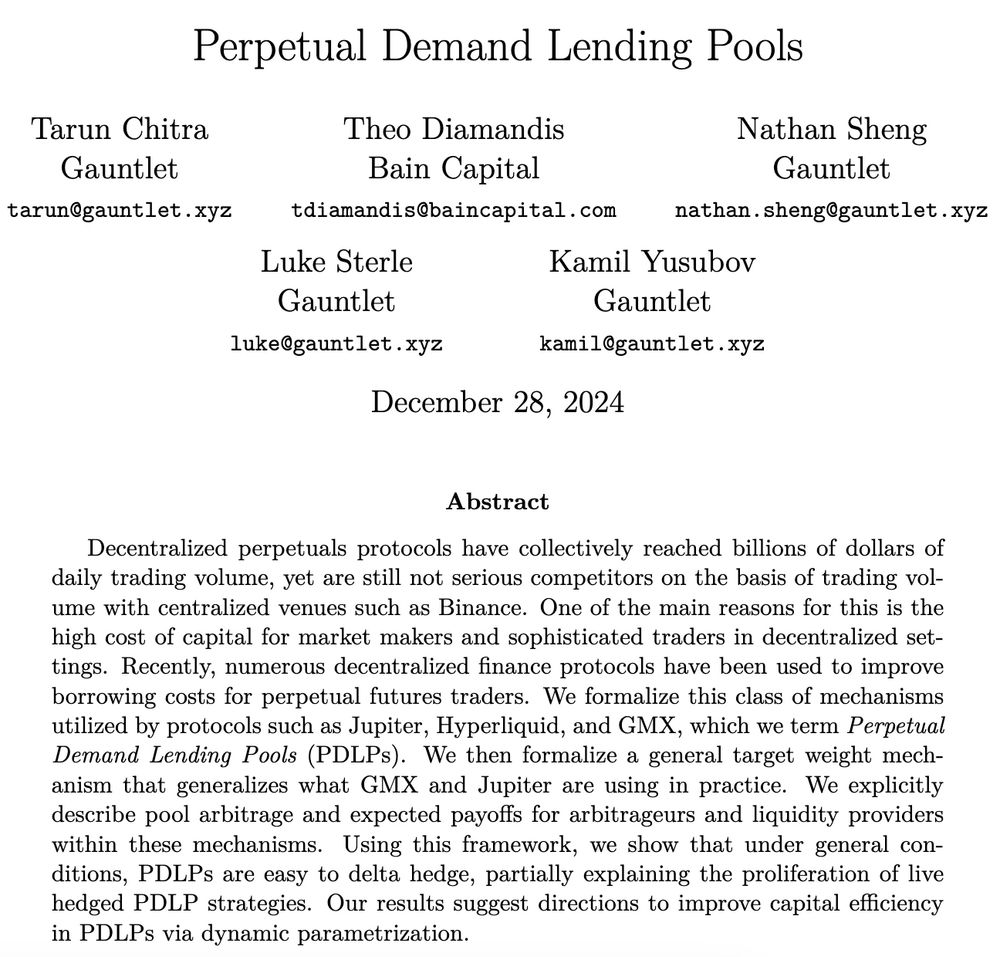

Maybe the most interesting DeFi research in recent years

01.01.2025 00:20 — 👍 5 🔁 2 💬 0 📌 0

Yeah their dynamic pricing helps.. but does not cover the worst case as we show in the paper (depends on the covariance structure of the pool assets)

28.12.2024 21:21 — 👍 2 🔁 0 💬 1 📌 0

As these pools grow, there are clearly ways that they can be improved and our paper provides a lot of directions to improve their efficiency

Hopefully this can push perpetuals DEX-CEX market share to over 15%!

28.12.2024 16:41 — 👍 4 🔁 0 💬 0 📌 0

From these arbitrage problems we show:

1. Optimal arbitrage is easy

2. Pools are easy to delta hedge

3. Choosing fees to make a healthy equilibrium between lenders and traders is possible

2) and 3) together explain the empirical observation that these pools are easier to hedge than CFMMs

28.12.2024 16:41 — 👍 3 🔁 0 💬 1 📌 0

In particular, we model these pools as “application specific lending protocols” where the borrowed asset can only be used for making trades

We write optimization problems that represent arbitrageurs trying to maximize yield by creating and redeeming LP shares, akin to interest rate arb

28.12.2024 16:41 — 👍 4 🔁 0 💬 1 📌 0

Looking at the code, these protocols seem very different from one another and it isn’t clear if there’s a single mechanism at play

In the paper, we formalize a model that encompasses *all* of these pools and construct a simple iterative model for how they function and what they payout

28.12.2024 16:41 — 👍 3 🔁 0 💬 1 📌 0

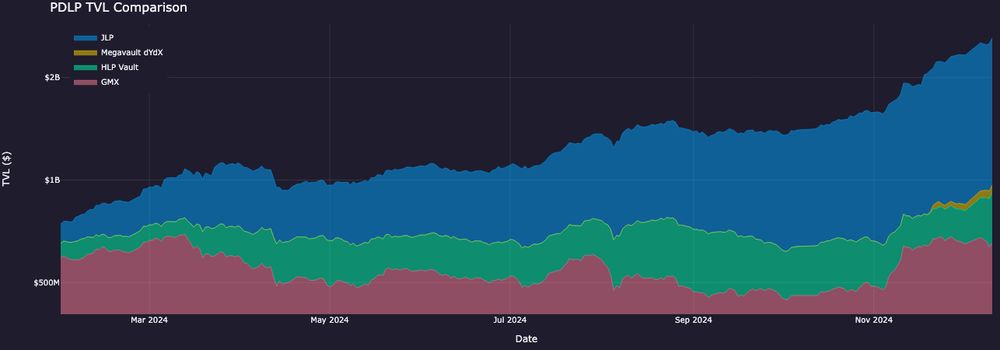

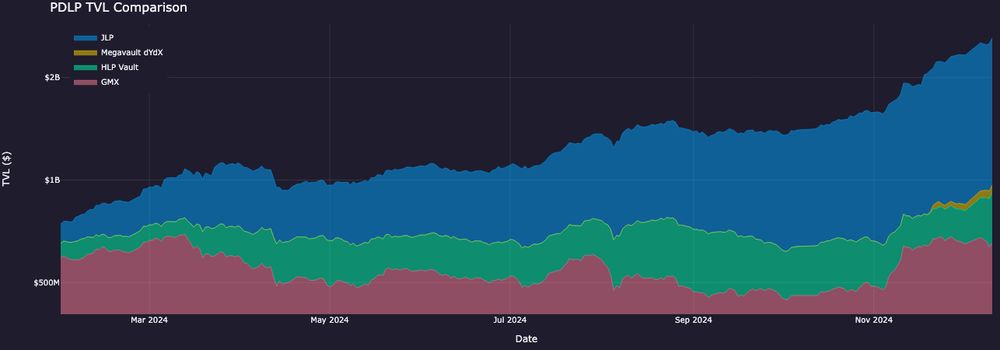

So how can DeFi compete? Since 2022 perpetual-specific lending pools — GMX’s GLP, Jupiter’s JLP, Hyperliquid’s HLP, dYdX MV— have found ways to offer MM loans via pooled products that resemble a combination of lending vaults and AMM pools

They’ve grown to >$2b, earning ~$750m in 2024 (37% yield!)

28.12.2024 16:41 — 👍 5 🔁 0 💬 1 📌 0

We start at this assumption: decentralized perps are used less as the cost of capital for strategic users and MMs is higher

CEXs often provide short term loans that can only be used on their exchange — a form of margin lending that improves capital efficiency and indirectly tightens spreads

28.12.2024 16:41 — 👍 3 🔁 0 💬 1 📌 0

Everyone on the X is too distracted with immigration, so I’m giving a sneak peek of some research here

Decentralized Perpetuals have long been the dream but they’ve been too capital inefficient

Many advances pushed DEX-CEX market share to >6% — but how are how are they related?

We answer this!

28.12.2024 16:41 — 👍 12 🔁 5 💬 3 📌 2

x.com

Paper: x.com/bremen79/sta...

03.12.2024 09:58 — 👍 0 🔁 0 💬 0 📌 0

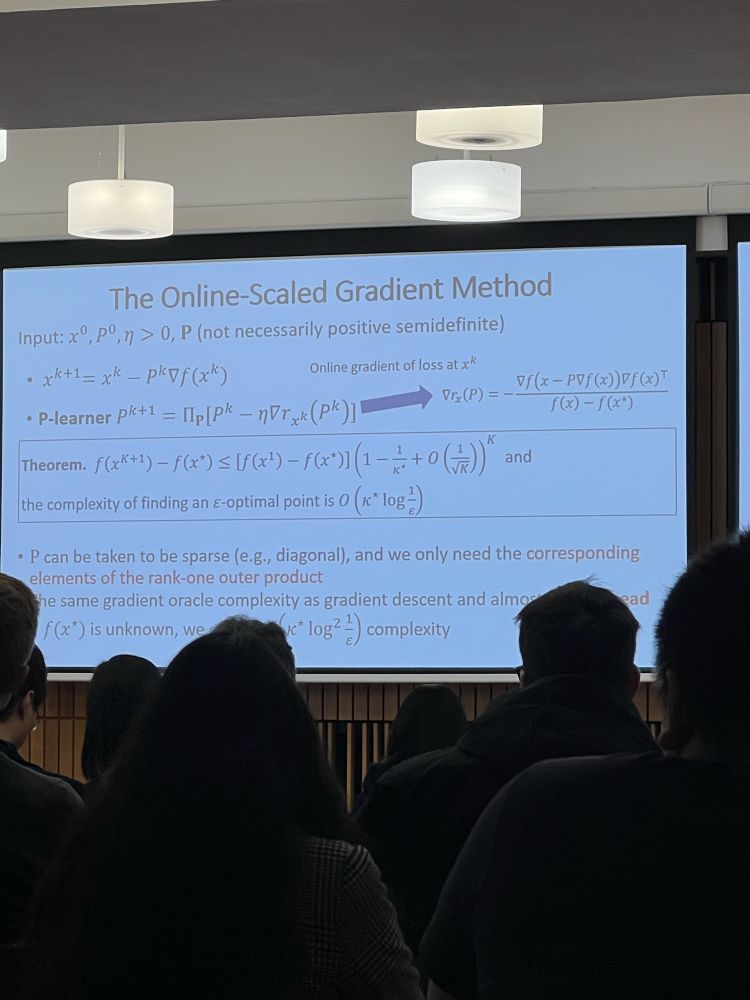

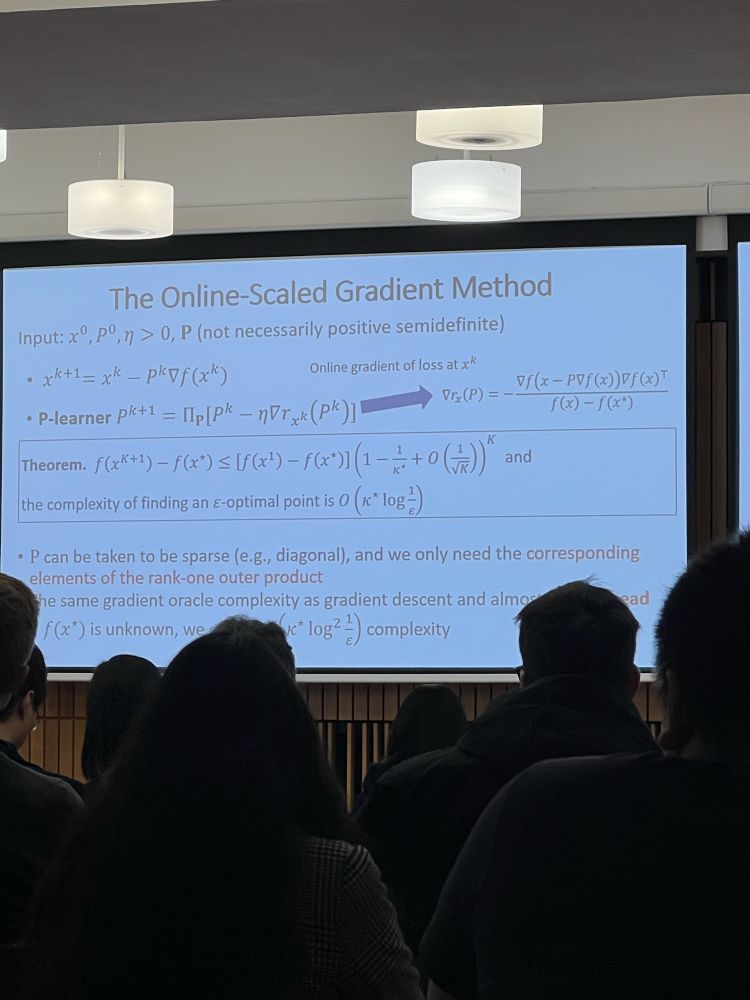

Basically, the condition number implied by the convex surrogate asymptotically approaches the optimal (like you see in Shampoo)

03.12.2024 09:56 — 👍 0 🔁 0 💬 1 📌 0

03.12.2024 09:55 — 👍 0 🔁 0 💬 1 📌 0

03.12.2024 09:55 — 👍 0 🔁 0 💬 1 📌 0

It’s a cool insight — these preconditioned gradient descent methods always seemed a little too magical in terms of constants and exponents — he showed there are convex surrogates that you’re actually minimizing and AM-GM gives you the exponents

03.12.2024 09:53 — 👍 0 🔁 0 💬 1 📌 0

Watching a talk by Yinyu Ye at WINE and being convinced Shampoo and all of these fancy preconditioning methods that are shilled on X are really just “gradient descent to approximate a sequence of online LPs”

03.12.2024 09:51 — 👍 1 🔁 0 💬 1 📌 0

Never been a worse year for people born in Delaware, going to go back to saying I’m from Philly

03.12.2024 00:55 — 👍 1 🔁 0 💬 1 📌 0

Quote from WINE 2024: “Ethereum is less decentralized than Cardano due to pooling [LSTs] but restaking might fix this”

lol? Their argument was based on a Shapley Value construction which seems likely to differ from proportional rules a lot

02.12.2024 11:36 — 👍 3 🔁 0 💬 1 📌 0

I did later lol

01.12.2024 19:53 — 👍 0 🔁 0 💬 0 📌 0

Now this has to be the wildest VC shade story of all time

29.11.2024 02:58 — 👍 12 🔁 1 💬 2 📌 0

Yeah; I agree that lumping a lot of groups into “CS” was probably too broad 😅

24.11.2024 17:28 — 👍 0 🔁 0 💬 0 📌 0

This is why the comparison to DeFi is incredulous to me — in DeFi the game theoretic mechanisms involved usually tie the token to the success / usage of the protocol

24.11.2024 17:22 — 👍 1 🔁 0 💬 1 📌 0

DeSci isn’t even a good enough narrative (imo) to be cohesive enough to support a grant program — how do you decide how to allocate across fields? The NSF but decentralized and with no accountability seems worse than EU funding agencies

24.11.2024 17:05 — 👍 2 🔁 0 💬 1 📌 0

There is hope for the peer review improvements

There is not hope for “hurr durr let’s do an AlphaFold token to fund research”

24.11.2024 16:53 — 👍 2 🔁 0 💬 1 📌 0

There are processes that can be reformed (peer review, grants, etc.) without question

But without any form of accountability on the part of the recipient, this turns into the usual crypto grant grift game (c.f. OP governance)

24.11.2024 16:51 — 👍 4 🔁 0 💬 1 📌 0

There is no inherent reason in DeSci not to spam marginal or even fake results (think: bioarXiv Covid slop data science around March 2020) in order to get rewards as opposed to making multi year bets that improve knowledge

Perpetuals traders telling you otherwise are purely self motivated

24.11.2024 16:50 — 👍 5 🔁 1 💬 0 📌 0

The talent gap in DeSci between people who make scientific progress and people creating projects feels like something that grows exponentially

In DeFi, the product getting better got better talent to join and the gap shrunk

Don’t get clowned by influencers

24.11.2024 16:47 — 👍 7 🔁 1 💬 1 📌 0

“DeSci is like DeFi in 2019”

lol, one has close to attribution and still gets exploited (i.e. MEV) whereas the other has adverse selection built in (only grad students who can’t seem to get any citation success seem to want to start DeSci coins)

24.11.2024 16:45 — 👍 4 🔁 1 💬 2 📌 0

Bluesky is a safe space for me to say that DeSci is mainly a scam, don’t get caught by influenzas who are pumping a coin yet can’t tell you what an orbital is

24.11.2024 16:43 — 👍 18 🔁 2 💬 4 📌 1

😂

24.11.2024 16:28 — 👍 1 🔁 0 💬 0 📌 0

Rejoining Bluesky after a year off and my day 1 observation is:

- Math, Econ, Physics people have moved here en masse

- CS, AI, crypto, finance people have not

24.11.2024 16:22 — 👍 15 🔁 0 💬 5 📌 0

Waitress turned Congresswoman for the Bronx and Queens. Grassroots elected, small-dollar supported. A better world is possible.

ocasiocortez.com

Investigative journalism in the public interest. Headlines and (sometimes literal) receipts.

Send us tips: propublica.org/tips

ML Research @ Apple.

Understanding deep learning (generalization, calibration, diffusion, etc).

preetum.nakkiran.org

Privacy and zero-knowledge propaganda at Aztec

Professor, Stanford University, Statistics and Mathematics. Opinions are my own.

Theoretical computer science ftw

Crypto journalist 🎧 Host @unchained_pod 📚 Author, The Cryptopians 👇🏻 sign up for my 💌 http://unchainedcrypto.substack.com. Ads: sponsorships@unchainedcrypto.com

Vol PM (energy vol), PhD in math. Causing myself stress is my superpower.

Robust Incentives Group @ Ethereum Foundation

This will made house my random thoughts

Assistant professor (of mathematics) at the University of Toronto. Algebraic geometry, number theory, forever distracted and confused, etc. He/him.

Quant/dev/trading, enjoy Rust, FPGA hacking, and more

founder https://yagi.fi + protocol https://aera.finance | talk about web3/crypto + bluesky | ex mckinsey ⚡️

economics and computer science professor at Northwestern

bengolub.net

social and economic networks

originally from Ukraine

I love James Harden & I write about abortioneveryday.com / kyliewrites.net

Free Palestine

03.12.2024 09:55 — 👍 0 🔁 0 💬 1 📌 0

03.12.2024 09:55 — 👍 0 🔁 0 💬 1 📌 0