OTD in 2008, soon after I invaded Georgia, I was interviewed by Germany's biggest TV channel ARD in which I said I recognize all of Ukraine’s borders, including Crimea.

3 days later we claimed a “sphere of influence” that includes Ukraine.

28.08.2025 09:51 — 👍 651 🔁 177 💬 15 📌 12

#FIFACWC

13.07.2025 18:15 — 👍 2 🔁 0 💬 0 📌 0

@ernietedeschi.bsky.social Love the dinosaur on the background

01.07.2025 17:54 — 👍 0 🔁 0 💬 0 📌 0

Probably relatively better showing than the game vs Palmeiras. Brazilians should outnumber US-based PSG fans.

29.06.2025 14:24 — 👍 1 🔁 0 💬 0 📌 0

Hey Patrick. Appreciate all your commentary. Just wanted to add that ‘prices paid’ is not part of the calculation of the headline number.

02.05.2025 00:30 — 👍 1 🔁 0 💬 0 📌 0

Who’s the Fed official who has penciled in the same GDP growth forecast at 2.4%-2.5% for 2025-2027? At potential, no changes vs December.

Guesses welcome :)

20.03.2025 13:43 — 👍 1 🔁 0 💬 0 📌 0

Preliminary estimates of the January PCE inflation figures, which will probably change after the January PPI release on Thursday morning, currently project core PCE at around 0.36% (it was 0.50% one year earlier).

That would raise the 6-month annualized rate but lower the 12-month to 2.7%

12.02.2025 23:09 — 👍 17 🔁 3 💬 0 📌 0

100%

20.01.2025 13:45 — 👍 1 🔁 0 💬 0 📌 0

Post PPI & CPI reports, we look for core PCE inflation to stay largely in check at 0.20% m/m in December.

More importantly, core PCE inflation is expected to have averaged 0.19% m/m over the July-December period -already at spitting distance from the 2% target.

Governor Waller is onto something.

16.01.2025 15:46 — 👍 1 🔁 1 💬 0 📌 0

Mi momento ha llegado 💫

23.12.2024 14:08 — 👍 1 🔁 0 💬 0 📌 0

Mostly due to seasonality imo. The nsa data is tracking very closely the 2019 path (similar calendar year to 2024). Don’t think we should be concerned.

12.12.2024 14:11 — 👍 1 🔁 0 💬 0 📌 0

Following today’s PPI numbers, core PCE inflation is likely to print 0.14% m/m in Nov - lowest m/m gain in 2024 @nicktimiraos.bsky.social

Also, not concerned about claims. Today’s jump mostly due to seasonality. Tracking the 2019 nsa data very closely.

12.12.2024 14:09 — 👍 2 🔁 1 💬 0 📌 0

Economists who produce detailed inflation forecasts expect the November CPI to show that core prices rose about the same as in October, up 0.27% to hold the 12-month rate at 3.3%

The median forecast has headline CPI rising to 2.7% from 2.6%.

10.12.2024 02:56 — 👍 57 🔁 16 💬 4 📌 2

If you’re slightly concerned by this week’s increase in jobless claims, wait for the market reaction next week when it rises to ~240k :)

Mostly seasonal noise.

05.12.2024 13:45 — 👍 0 🔁 0 💬 0 📌 0

High Fed funds rate is transitory

25.11.2024 19:09 — 👍 0 🔁 0 💬 0 📌 0

The Chastening!

Oh no. I had no idea he passed away! RIP.

20.11.2024 22:58 — 👍 1 🔁 0 💬 0 📌 0

Paul Blustein’s book on the 2001 crisis is also a very good read :)

20.11.2024 22:48 — 👍 1 🔁 0 💬 1 📌 0

Fed in 2021: No liftoff until labor market conditions have reached levels consistent with maximum employment…

20.11.2024 18:42 — 👍 0 🔁 0 💬 0 📌 0

This consistent with the September dot plot. The two more hawkish Fed officials (likely Schmid himself and Bowman) see the terminal rate at just below 4%.

19.11.2024 20:22 — 👍 1 🔁 0 💬 0 📌 0

In line with CPI seasonality!

18.11.2024 13:53 — 👍 0 🔁 0 💬 0 📌 0

Julia, you should convince Laura of joining as well! Love your and her takes. Hope all’s good.

16.11.2024 11:36 — 👍 1 🔁 0 💬 1 📌 0

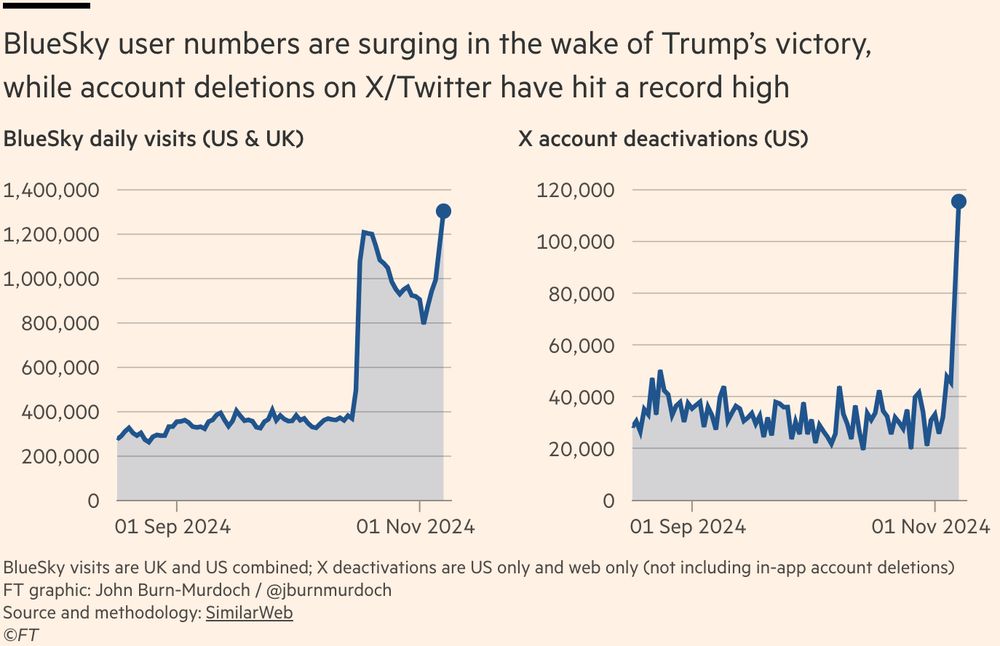

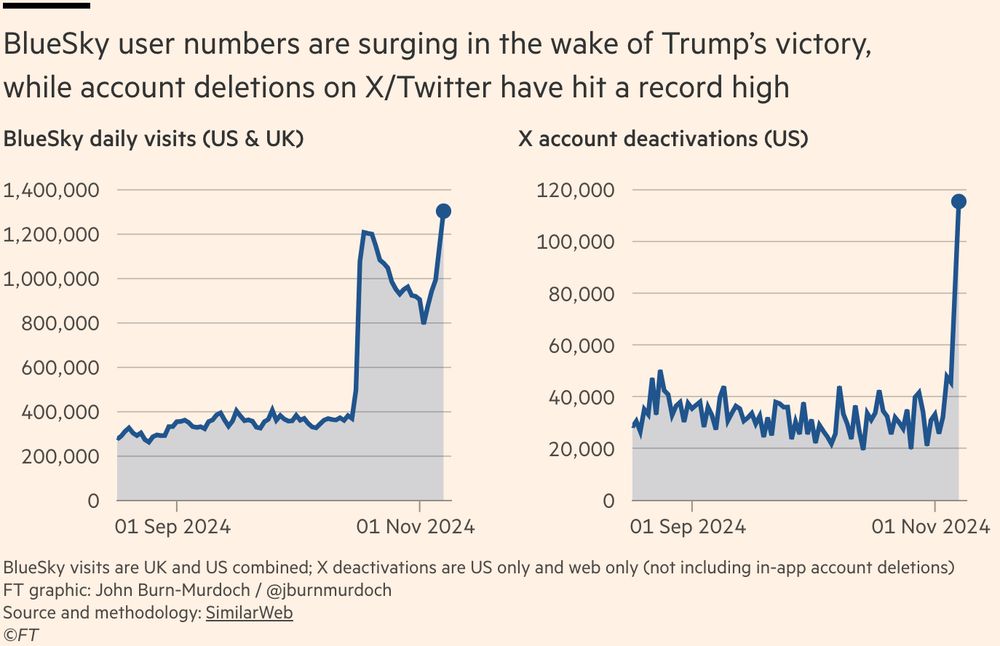

A tale of two platforms:

BlueSky user numbers have hit a new record high in recent days, while the number of people deleting their accounts on X/Twitter has rocketed 🚀

13.11.2024 11:21 — 👍 20418 🔁 4102 💬 460 📌 416

Following today’s CPI report we look for PCE prices to rise 0.22% m/m and 0.25% for the core in Oct. We will finalize our forecast after PPI data tomorrow.

Another 25bp rate reduction is still in the cards for December though Nov data (CPI/PCE, jobs) will have the last word.

#TDStrategy

13.11.2024 17:49 — 👍 2 🔁 0 💬 0 📌 0

Writer: The Atlantic, The Washington Post

https://www.obsoletedogma.com/

“Democracy is the theory that the common people know what they want and deserve to get it good and hard.” – H.L. Mencken

My blog in desuetude: https://epicureandealmaker.blogspot.com

Tweeting about tech and gabagool

Senior Fellow at @brookings.edu. Previously Chief Economist at IIF and Chief FX Strategist at Goldman Sachs.

founding partner @ MacroPolicy Perspectives, macroeconomist, inflation forecaster, Fed watcher, mom of 2

http://www.macropolicyperspectives.com

i write the data-driven politics newsletter Strength In Numbers: gelliottmorris.com/subscribe

wrote a book by the same name wwnorton.com/books/Strength-in-Numbers

polling averages at @fiftyplusone.news

formerly @ 538 & The Economist. email, don't DM, me

Econ nerd, Fed obsessive, Dodgers fan, recovering journalist (Ex-Econ Editor WaPo, WSJ), McKinsey alum, now Peterson Institute for International Economics VP Publishing, among other things. Opinions my own etc.

International macroeconomist. I specialize in exchange rates, trade balances, monetary policy, and inflation.

The Hamilton Project at @brookings.edu produces research and policy proposals on how to create a growing economy that benefits more Americans. www.hamiltonproject.org

Reporter and writer: https://fallows.substack.com/ and https://www.ourtownsfoundation.org/ One-time speechwriter, long-time pilot, longer-time husband of linguist/writer Deborah Fallows. Note same wristwatch in the two photos, more than 50 years apart.

Now on Bluesky! The original Drumpf on Twitter 2013-24. Named one of the best Trump parodies by Time, Wired, Mashable, etc. buymeacoffee.com/realdonaldrumpf and https://realdonaldrumpf.substack.com

Reginald Jones Senior Fellow @PIIE.com

@Trade--Talks.bsky.social Podcast host

Former State Department, White House, WTO, World Bank, Professor

I think about trade and policy. Probably too much

Me: www.chadpbown.com

Pod: www.tradetalkspodcast.com

Former US Congressman, Proud RINO, husband, and military man. Fighting the MAGA brain worms daily!

Adamkinzinger.komi.io

Adamkinzinger.substack.com

"You cannot escape the responsibility of tomorrow by evading it today.” – Abraham Lincoln 🏴☠️ | Home of #TheBreakdown and LP Podcast

In-depth, independent reporting to better understand the world, now on Bluesky. News tips? Share them here: http://nyti.ms/2FVHq9v

The fastest growing independent news network in the world. We cover breaking news, politics, law and more. We are unapologetically pro-democracy.