My latest paper with Tam Bayoumi on the second China Shock is now out. Other commentators have been writing on this trend, but the IMF and professional forecasters still don’t see it. www.piie.com/publications...

23.02.2026 14:45 — 👍 1 🔁 2 💬 0 📌 0

My latest paper with Tam Bayoumi on the second China Shock is now out. Other commentators have been writing on this trend, but the IMF and professional forecasters still don’t see it. www.piie.com/publications...

23.02.2026 14:45 — 👍 1 🔁 2 💬 0 📌 0

Starting soon www.piie.com/events/2025/...

16.10.2025 12:43 — 👍 6 🔁 3 💬 0 📌 0

My article The New Economic Geography is out today in @foreignaffairs.com

Please read!

(Ungated link, suitable for sharing)

shared.outlook.inky.com/link?domain=...

My latest blog post with Steve Kamin explores the dilemma of the Fed’s next meeting. Markets expect a cut, but inflation expectations are rising. www.piie.com/blogs/realti...

19.08.2025 17:03 — 👍 2 🔁 0 💬 0 📌 0I’ll be working on that next month. First priority is to cut the budget deficit. Also get foreign countries to boost their domestic spending, including on US exports, in exchange for tariff reductions.

25.07.2025 02:05 — 👍 1 🔁 0 💬 1 📌 0

My latest with Tam Bayoumi on the real causes of the US trade deficit (not foreign tariffs or barriers) and why it is not sustainable. www.piie.com/publications...

09.07.2025 14:11 — 👍 6 🔁 3 💬 1 📌 0

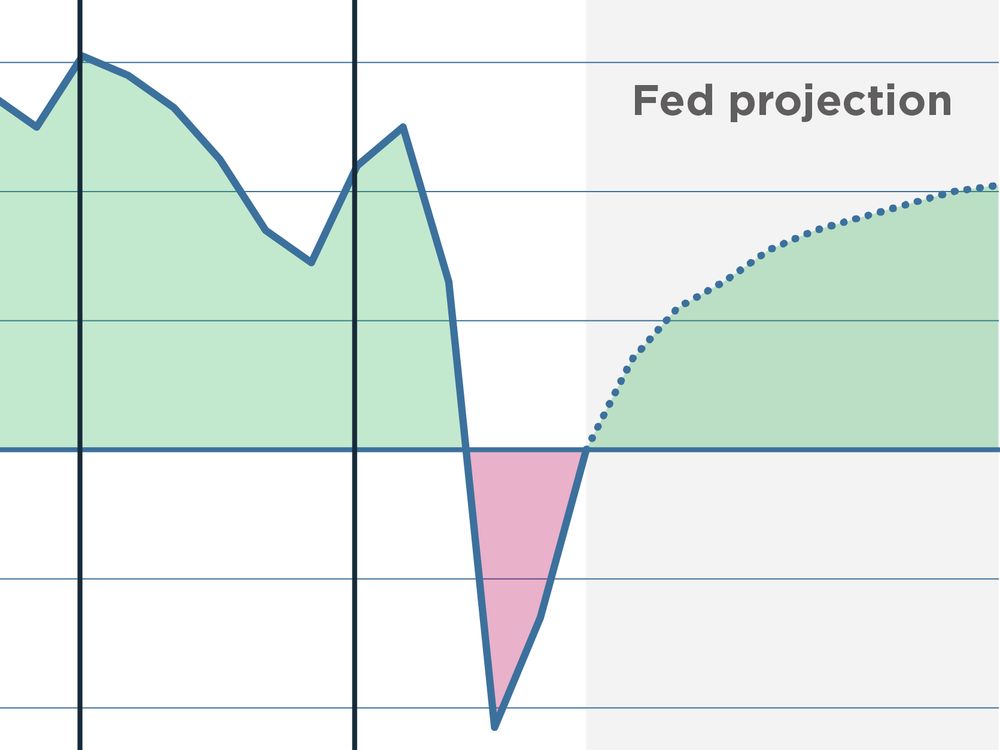

My colleague Asher Rose just posted a nice chart showing the Fed’s projected return to profitability after 3 years of losses. QE raises Fed profits and makes them more variable. www.piie.com/research/pii...

18.06.2025 16:52 — 👍 0 🔁 0 💬 0 📌 0This result holds up with dozens of different auxiliary variables to control for an array of possible omitted factors and in many different country samples.

30.04.2025 20:13 — 👍 1 🔁 0 💬 0 📌 0Surprising fact. The most important variable in explaining differences across countries in the rise of inflation under COVID is where inflation was decades earlier. This is true for both advanced and developing economies. Even true within the euro area!

30.04.2025 20:12 — 👍 0 🔁 0 💬 1 📌 0

My paper with Steve Kamin on long memory in COVID inflation is now on the PIIE website. www.piie.com/publications...

30.04.2025 20:12 — 👍 2 🔁 2 💬 1 📌 0Finally, the President's ability to negotiate exceptions to the tariffs in exchange for financial or political support creates a threat to democracy and the rule of law that Congress should oppose. n/n

03.04.2025 13:09 — 👍 222 🔁 34 💬 4 📌 5The odds of a recession just went way up. That would reduce our trade deficit (unless the whole world goes into recession--a distinct possibility). Is that worth it? 4/n

03.04.2025 13:09 — 👍 126 🔁 8 💬 1 📌 1Even more importantly, tariffs are a horrible tool for this purpose. They will not reduce our trade deficit unless they persuade investors to dump US assets because our government is pursuing harmful policies. 3/n

03.04.2025 13:08 — 👍 144 🔁 13 💬 1 📌 1Second, overall trade surpluses are a better (but not perfect) indicator of foreign policies that contribute to the US trade deficit than bilateral surpluses. 2/n

03.04.2025 13:08 — 👍 124 🔁 9 💬 1 📌 0There is so much wrong with the new tariff policy, it is hard to begin. First of all, it makes no sense to tariff something we will never produce in the US. I don't see bananas and coffee on the exempted list. 1/n

03.04.2025 13:07 — 👍 356 🔁 71 💬 9 📌 10With reported US net international liabilities having reached an astonishing 90% of GDP, continued foreign borrowing (i.e., trade deficit) is not on a sustainable path.

01.04.2025 16:03 — 👍 1 🔁 0 💬 0 📌 0Back from March vacation. My take on a Mar-a-Lago Accord is included in this symposium with other observers. I focused my remarks on what I would like to see, not what is likely to happen (which is not much in the near term). international-economy.com/TIE_F24_Mara...

01.04.2025 16:02 — 👍 1 🔁 0 💬 1 📌 0

In case anyone wants to read more about the effects of tariffs! www.eurofinance.com/news/the-hid...

14.03.2025 14:17 — 👍 0 🔁 0 💬 0 📌 0Yesterday I discussed why tariffs will not reduce the US trade deficit. Today I show 2 policies that can do so and I link to the latest paper backing up these results in a more complete model. www.piie.com/research/pii...

25.02.2025 19:10 — 👍 2 🔁 3 💬 0 📌 0

Does it make sense to raise tariffs and cut interest rates now? No. www.voanews.com/a/trump-push...

13.02.2025 17:31 — 👍 2 🔁 0 💬 1 📌 0Argentina clearly has comparative advantage in agriculture. But we know from Lerner that barriers to imports are also barriers to exports. So the result you cite--loss of grain exports in favor of import-substituting products--is exactly as expected.

12.02.2025 20:02 — 👍 1 🔁 0 💬 0 📌 0I talk tariffs, trade deficits, and a lot more with @scclemons.bsky.social. t.co/5aT8g0WGSV

11.02.2025 20:12 — 👍 4 🔁 3 💬 0 📌 0I agree with Dani, but he omits the point that even he lists as Trump's first objective: to reduce the trade deficit. Tariffs do nothing for the deficit. I blogged that back in 2017 and a great 2019 IMF WP by Furceri, Hannan, Ostry, and Rose documents it convincingly. www.piie.com/blogs/trade-...

22.01.2025 19:21 — 👍 2 🔁 0 💬 0 📌 0It is something I have focused on a lot but often felt I was the only economist who did. Trying to increase net exports makes more sense when below potential at the zero bound than when at full employment.

22.01.2025 16:39 — 👍 2 🔁 0 💬 1 📌 0I described how and why to do this back in 2020. The fiscal deficit and the trade deficit are much larger now, making this advice all the more important. A weaker dollar can offset the drag on growth from budget cuts. n/n www.piie.com/publications...

21.01.2025 15:13 — 👍 0 🔁 0 💬 0 📌 0In 2021, Madi Sarsenbayev and I updated my earlier work showing that there are 2 main policies to shrink the trade deficit. They work well together. Reduce the fiscal deficit and push down the dollar. 3/n www.piie.com/publications...

21.01.2025 15:12 — 👍 1 🔁 0 💬 1 📌 0I pointed out 8 years ago that we know what causes trade deficits. I predicted Trump's tariffs would not reduce the trade deficit and I was right. The deficit continued to grow during his first term. 2/n www.piie.com/blogs/trade-...

21.01.2025 15:12 — 👍 0 🔁 0 💬 1 📌 0

On his first day in office, President Trump published a memo titled "America First Trade Policy." His first item of business, similar to 8 years ago, is to find out what causes our "trade deficits in goods". 1/n www.whitehouse.gov/presidential...

21.01.2025 15:09 — 👍 2 🔁 0 💬 2 📌 1My paper with Asher Rose on a 75 year perspective on COVID inflation is out. www.piie.com/publications...

17.01.2025 18:25 — 👍 0 🔁 0 💬 0 📌 0